Professional Documents

Culture Documents

BAM 127 Day 12 - TG

Uploaded by

Paulo BelenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BAM 127 Day 12 - TG

Uploaded by

Paulo BelenCopyright:

Available Formats

BAM 1: Income Taxation for BA

Teachers’ Guide Module #12

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

Lesson title: Introduction to Regular Income Tax Materials:

Lesson Objectives: Text book:

At the end of this module, I should be able to: Income Taxation by Rex

1. Summarize the scope of Regular Income Tax and its Banggawan

model; and

2. Discuss the scope and classifications of Gross Income. References:

www.bir.gov.ph/

A. LESSON PREVIEW/REVIEW

Review (5 mins)

In your own words, discuss the taxability of gains in dealings of the following properties:

1. Ordinary Asset

2. Movable / Personal - Capital Asset

3. Immovable / Real – Capital Asset

Activity 1- What I know Chart (3 mins)

Try answering the questions below by writing your ideas under the first column What I Know. It’s

okay if you write key words or phrases that you think are related to the questions.

What I Know Questions: What I Learned

1. What are the coverage of

Regular Income Tax?

This document is the property of PHINMA EDUCATION

BAM 1: Income Taxation for BA

Teachers’ Guide Module #12

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

2. What are the different

classifications of Gross Income

B. MAIN LESSON

Activity 2 – Content Notes

LO 1: Summarize the scope of Regular Income Tax and its model

CHARACTERISTICS OF REGULAR INCOME TAX

1. General 4. Creditable Withholding Tax

2. Net Income Tax 5. Progressive or Proportional

3. Annual Tax

General

The regular income tax applies to all items of income except those that are subject to final tax.

Capital gains tax, and special tax regimes.

Net Income Taxation

The regular tax is an imposition on residual profits or gains after deductions for expenses and

personal exemptions allowable by law.

Annual Income Tax

The regular income tax applies on yearly profits or gains. The gross income and expenses of the

taxpayer are measured using the accounting methods adopted by the taxpayer and are reported

to the government over the accounting period selected by the taxpayer.

Creditable Withholding Tax

Most items of regular income are subject to creditable withholding tax (CWT).

Progressive or Proportional Tax

The NIRC imposes a progressive tax on the taxable income of individuals while it imposes a flat or

This document is the property of PHINMA EDUCATION

BAM 1: Income Taxation for BA

Teachers’ Guide Module #12

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

proportional tax of 30% upon the taxable income of corporations

This document is the property of PHINMA EDUCATION

BAM 1: Income Taxation for BA

Teachers’ Guide Module #12

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

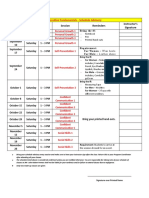

Regular Income Tax Table for Individuals

REGULAR INCOME TAX MODEL

Gross Income xx

Less: Allowable Deductions xx

Taxable Income xx

LO 1: Discuss the scope and classifications of Gross Income.

GROSS INCOME – All income from whatever sources.

Gross Income, for purposes of computing RIT, is all income from whatever sources (1) not subject to Final

Tax; (2) not subject to CGT; and (3) not exempt (Exclusion of Gross Income).

Classification of Gross Income

1. Compensation Income – Employee-Employer relationship

2. Business or Professional Income – Selling of goods or services

3. Other Taxable Income – Neither Compensation nor Business or Professional Income.

Employees

Source(s) of Income Payment of Tax Income Tax Return

1. Purely Compensation Income Substituted Filing No need to file an ITR

personally

This document is the property of PHINMA EDUCATION

BAM 1: Income Taxation for BA

Teachers’ Guide Module #12

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

2. W/ Other Taxable Income Need to file an ITR – Annual – BIR Form 1700

Consolidated Income

3. w/ Business or Professional Need to file an ITR – Quarterly and Annual – 1701

Income Consolidated Income

Note: Substituted Filing may only be availed by Pure compensation Income earners. The latter may relieve from

the obligation to file an annual ITR. Provided further that the latter has: (1) no other taxable Income; (2) no

other employer; and (3) Income Tax Withheld was correct.

Business or Professional Income

Source(s) of Income Payment of Tax Income Tax Return

1. Pure Business or ITR Quarterly & Annually BIR Form 1701A – May use

Professional Income 8% Optional Income Tax or

Regular Income Tax.

2. Mixed Income Earners ITR Quarterly & Annually BIR Form 1701

Note: The 8% Income Tax shall be in lieu of (1) Progressive Tax; and (2) 3% Progressive Tax.

Activity 3: Skill-building Activities

Let’s practice! After completing each exercise, you may refer to the Key to Corrections for feedback. Try to

complete each exercise before looking at the feedback.

Exercise 1 : True or False

__________1. There are two types of regular income tax: proportional income tax for corporations and

progressive income tax for individuals.

__________2. NRA-NETB and NRFCs are also subject to regular income tax.

__________3. All taxpayers are subject to final tax.

__________4. Taxable income is synonymous to net income.

__________5. For all taxpayers, taxable income means the pertinent items of gross income not subject to

capital gains tax and final tax less allowable deductions.

__________6. All taxpayers are subject to regular income tax.

This document is the property of PHINMA EDUCATION

BAM 1: Income Taxation for BA

Teachers’ Guide Module #12

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

__________7. Employed taxpayers can claim expenses from their employment as deductions against their

compensation income.

__________8. Items of gross income subject to final tax and capital gains tax are excluded in gross income

subject to regular income tax.

__________9. The P250,000 income tax exemption for individuals is designed to be in lieu of their personal

and business expenses.

__________10. Non-taxable compensation are items of compensation that are excluded against gross

income.

ACTIVITY 4: What I know Chart – Part 2 (3 mins)

It’s time to answer the “what I learned” column in the What I Know chart in Activity 1.

ACTIVITY 5: ‘Check for understanding

Exercise 1: In your own words, enumerate and discuss the different characteristics of Regular Income

Tax.

________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

Exercise 2: Problem Solving – Provide your solutions.

1. ABC earned a compensation income of P120,000 and a net income from business of P300,000. He also

earned P8,000 prizes from a dancing competition and P45,000 royalties from his musical composition.

ABC has P200,000 personal expenses. Compute the taxable income.

2. In 2020, CDE earned P450,000 compensation income but incurred P120,000 net loss in his business.

What is his taxable income assuming she incurred personal expenses of P100,000?

This document is the property of PHINMA EDUCATION

BAM 1: Income Taxation for BA

Teachers’ Guide Module #12

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

3. FGH, had the following data in 2020:

Compute the taxable income and the tax due if FGH is a resident citizen.

4. In the immediately preceding problem, compute the taxable income and the tax due if FGH is a NRA-

ETB.

C. LESSON WRAP-UP

You’ve finish another module, Congratulations! Shade the number of the module that you finished to track your

accomplishment.

Did you have challenges learning the concepts in this module? If none, which parts of the module helped you

learn the concepts?

____________________________________________________________________________________________________________________

____________________________________________________________________________________________

Some question/s I want to ask my teacher about this module is/are:

____________________________________________________________________________________________________________________

____________________________________________________________________________________________

Key to Corrections:

This document is the property of PHINMA EDUCATION

BAM 1: Income Taxation for BA

Teachers’ Guide Module #12

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

True or False

1. True

2. False

3. False

4. False

5. True

6. True

7. False

8. True

9. False

10. True

Problem Solving

1. P 465,000

2. P 450,000

3. P 4,480,000; P 1,283, 600

4. P 2,000,000; P 490,000

This document is the property of PHINMA EDUCATION

You might also like

- Finance Policies and Procedures Manual - TEMPLATE PDFDocument60 pagesFinance Policies and Procedures Manual - TEMPLATE PDFIPFC CochinNo ratings yet

- Income Taxation - Tabag & Garcia Income Taxation - Tabag & GarciaDocument34 pagesIncome Taxation - Tabag & Garcia Income Taxation - Tabag & GarciaShaira Villaflor100% (20)

- 7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestDocument2 pages7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestHarleneNo ratings yet

- Finance Policies and Procedures Manual - TEMPLATEDocument60 pagesFinance Policies and Procedures Manual - TEMPLATEHassan Liquat100% (2)

- Fabm2: Quarter 1 Module 2 New Normal ABM For Grade 12Document16 pagesFabm2: Quarter 1 Module 2 New Normal ABM For Grade 12Nonilon RoblesNo ratings yet

- TRAIN Law Lecture by Dr. Lim PDFDocument12 pagesTRAIN Law Lecture by Dr. Lim PDFAnonymous 8SUSyvGc3d100% (1)

- Develop Understanding of TaxationDocument31 pagesDevelop Understanding of TaxationAshenafi Abdurkadir100% (2)

- ABM-FABM2-12 - Q1 - W2 - Mod2 Online PDFDocument8 pagesABM-FABM2-12 - Q1 - W2 - Mod2 Online PDFchristine100% (1)

- Sworn Declaration of SalesDocument1 pageSworn Declaration of SalesPaulo BelenNo ratings yet

- FABM 1 Week 3 4Document20 pagesFABM 1 Week 3 4RD Suarez67% (6)

- SFP for Grade 12Document18 pagesSFP for Grade 12Jose John Vocal82% (51)

- Clearance Form: Department /project Clearing Officer Remarks DateDocument1 pageClearance Form: Department /project Clearing Officer Remarks DateElence CorpNo ratings yet

- FABM2 Q2 Mod13Document29 pagesFABM2 Q2 Mod13Fretty Mae Abubo100% (3)

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- ABM-FABM2 12 - Q1 - W2 - Mod2Document16 pagesABM-FABM2 12 - Q1 - W2 - Mod2Jose John Vocal83% (18)

- Financial Crisis Prevention MeasuresDocument3 pagesFinancial Crisis Prevention MeasuresFergus Gerodias100% (4)

- Fabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueDocument21 pagesFabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueFlordilyn DichonNo ratings yet

- RR 12-99 Rules On Assessments PDFDocument19 pagesRR 12-99 Rules On Assessments PDFJeremeh PenarejoNo ratings yet

- Jay - Kashyap@vedanta - Co.in F16Document8 pagesJay - Kashyap@vedanta - Co.in F16Jay kashyapNo ratings yet

- Ch. 1 Introduction To TaxationDocument14 pagesCh. 1 Introduction To TaxationYousef M. Aqel100% (1)

- Pat - CodalDocument33 pagesPat - CodalLeyy De GuzmanNo ratings yet

- Quarter 2 - Module 3 General MathematicsDocument8 pagesQuarter 2 - Module 3 General MathematicsKristine Alcordo100% (1)

- Lesson Plan in Bookkeeping For DemoDocument6 pagesLesson Plan in Bookkeeping For DemoChristine Garcia Rafael88% (26)

- Taxation Law ProjectDocument26 pagesTaxation Law Projectshekhar singhNo ratings yet

- (FABM 2) Interactive Module Week 2Document12 pages(FABM 2) Interactive Module Week 2Krisha FernandezNo ratings yet

- BAM 127 Day 8 - TGDocument9 pagesBAM 127 Day 8 - TGPaulo BelenNo ratings yet

- BAM 127 Day 3 - TGDocument14 pagesBAM 127 Day 3 - TGPaulo BelenNo ratings yet

- BAM 127 Day 11 - TGDocument8 pagesBAM 127 Day 11 - TGPaulo BelenNo ratings yet

- BAM 127 Day 5 - TGDocument6 pagesBAM 127 Day 5 - TGPaulo BelenNo ratings yet

- BAM 127 Day 7 - TGDocument11 pagesBAM 127 Day 7 - TGPaulo BelenNo ratings yet

- PHI 002 ENG 188 Module 10 and 11 PAS 34 Interim Financial ReportingDocument10 pagesPHI 002 ENG 188 Module 10 and 11 PAS 34 Interim Financial Reportinggenonashley56No ratings yet

- BAM 127 Day 1 - TGDocument7 pagesBAM 127 Day 1 - TGPaulo BelenNo ratings yet

- BAM 127 Day 4 - TGDocument11 pagesBAM 127 Day 4 - TGPaulo BelenNo ratings yet

- Bam031 Sas 14 PDFDocument6 pagesBam031 Sas 14 PDFIan Eldrick Dela CruzNo ratings yet

- Lesson Title: Revenue Recognition - Consignment AccountingDocument8 pagesLesson Title: Revenue Recognition - Consignment AccountingFeedback Or BawiNo ratings yet

- PHI 002 ENG 188 Module 13 SAS Cash Basis To Accrual Basis of Accounting IntroductionDocument6 pagesPHI 002 ENG 188 Module 13 SAS Cash Basis To Accrual Basis of Accounting Introductiongenonashley56No ratings yet

- Acc 106 - Sas - 2Document9 pagesAcc 106 - Sas - 2Rodmar SumugatNo ratings yet

- Draft Fabm1 Module 5Document8 pagesDraft Fabm1 Module 5Abegail AlegreNo ratings yet

- 3LQ - Econ9Document1 page3LQ - Econ9Camille WuNo ratings yet

- Acc 118 Mod 3Document8 pagesAcc 118 Mod 3Rona Amor MundaNo ratings yet

- BAM 127 Day 6 - TGDocument10 pagesBAM 127 Day 6 - TGPaulo BelenNo ratings yet

- ENTREP 9: Business Law and Taxation With Laws Affecting Micro, Small and Medium Enterprises Module Content - Midterm Lesson 5 To 7: Module 5 To 7Document3 pagesENTREP 9: Business Law and Taxation With Laws Affecting Micro, Small and Medium Enterprises Module Content - Midterm Lesson 5 To 7: Module 5 To 7hazelouitom98No ratings yet

- FABM2 Mod2Document27 pagesFABM2 Mod2Angelo PeraltaNo ratings yet

- Att.jugrVbrav8WVoP4LjXc2zAyrBqtieCX8Xk4KARBcVWsDocument2 pagesAtt.jugrVbrav8WVoP4LjXc2zAyrBqtieCX8Xk4KARBcVWsMillicent AlmueteNo ratings yet

- Accounting Mod1Document16 pagesAccounting Mod1Rojane L. AlcantaraNo ratings yet

- Tanauan Institute Senior High Fundamentals WorkbookDocument8 pagesTanauan Institute Senior High Fundamentals WorkbookHanna CaraigNo ratings yet

- Business and Management 2: Fundamentals of AccountancyDocument11 pagesBusiness and Management 2: Fundamentals of AccountancyZed MercyNo ratings yet

- GenebraDocument13 pagesGenebraHans Pierre AlfonsoNo ratings yet

- Accounting concepts and principles matching testDocument1 pageAccounting concepts and principles matching testFlorante De LeonNo ratings yet

- Public FinanceDocument3 pagesPublic FinanceJorge LabanteNo ratings yet

- Q2las4 1Document9 pagesQ2las4 1Justine BuenaventuraNo ratings yet

- Lesson Title: Most Essential Learning Competencies (Melcs)Document9 pagesLesson Title: Most Essential Learning Competencies (Melcs)Maria Lutgarda TumbagaNo ratings yet

- FABM2 Module 2. Statement of Comprehensive IncomeDocument13 pagesFABM2 Module 2. Statement of Comprehensive IncomeSITTIE RAYMAH ABDULLAHNo ratings yet

- Sas#3-Acc 111Document10 pagesSas#3-Acc 111Christine Nicole BacoNo ratings yet

- Acctg1 Module 4Document19 pagesAcctg1 Module 4ignaciorojhieannpelayoNo ratings yet

- IIANHS LASformatDocument7 pagesIIANHS LASformatDystral CliffNo ratings yet

- DAVO Senior High: Future & Present Values of Simple & General AnnuitiesDocument8 pagesDAVO Senior High: Future & Present Values of Simple & General AnnuitiesKristine AlcordoNo ratings yet

- TaxssdakcnsaDocument164 pagesTaxssdakcnsaLouisse Marie CatipayNo ratings yet

- Acc 103 Sas-24Document22 pagesAcc 103 Sas-24bakdbdkNo ratings yet

- Government Economic Objectives and Policies: Textbook, Chapter 26 (PG 317-328)Document10 pagesGovernment Economic Objectives and Policies: Textbook, Chapter 26 (PG 317-328)Vincent ChurchillNo ratings yet

- Worksheet FABM2 Q1 M2 1 SCI Single StepDocument3 pagesWorksheet FABM2 Q1 M2 1 SCI Single StepMarjun AbogNo ratings yet

- Manual 3 Federal Accounting System Chapter 11. Monthly ReportsDocument38 pagesManual 3 Federal Accounting System Chapter 11. Monthly ReportsalemayehuNo ratings yet

- FABM2 Quarter 1 Module and WorksheetsDocument27 pagesFABM2 Quarter 1 Module and WorksheetsHeart polvos100% (1)

- Accounting Business & Management 2 Grade 12: Summative Test No. 2Document2 pagesAccounting Business & Management 2 Grade 12: Summative Test No. 2bimbo serrotNo ratings yet

- Ch.1 Introduction To TaxationDocument14 pagesCh.1 Introduction To TaxationhzughiarrNo ratings yet

- SSE 107 Macroeconomics SG 5Document8 pagesSSE 107 Macroeconomics SG 5Aila Erika EgrosNo ratings yet

- Are Those That Do Not Have Future Tax Consequences. Temporary DifferencesDocument4 pagesAre Those That Do Not Have Future Tax Consequences. Temporary DifferencesAryan LeeNo ratings yet

- Sworn Declaration of SalesDocument4 pagesSworn Declaration of SalesPaulo BelenNo ratings yet

- APPLICATIONDocument2 pagesAPPLICATIONPaulo BelenNo ratings yet

- BAM 127 Day 1 - TGDocument7 pagesBAM 127 Day 1 - TGPaulo BelenNo ratings yet

- Sauce Matter's Appliance and Item ListDocument1 pageSauce Matter's Appliance and Item ListPaulo BelenNo ratings yet

- MenuDocument7 pagesMenuPaulo BelenNo ratings yet

- Business Permit Details for Food Stalls in Phinma HallDocument1 pageBusiness Permit Details for Food Stalls in Phinma HallPaulo BelenNo ratings yet

- Executive Fundamentals Schedule AdvisoryDocument1 pageExecutive Fundamentals Schedule AdvisoryPaulo BelenNo ratings yet

- 2 ND Finals TOSDocument4 pages2 ND Finals TOSPaulo BelenNo ratings yet

- Cash Monitoring and Sales MonitoringDocument29 pagesCash Monitoring and Sales MonitoringPaulo BelenNo ratings yet

- Automatic ScoresheetDocument4 pagesAutomatic ScoresheetPaulo BelenNo ratings yet

- 2020 Sales SLSPDocument2 pages2020 Sales SLSPPaulo BelenNo ratings yet

- 2019 and 2020 Purchases SLSPDocument6 pages2019 and 2020 Purchases SLSPPaulo BelenNo ratings yet

- 2021 Income ComputationsDocument7 pages2021 Income ComputationsPaulo BelenNo ratings yet

- 2021 Income ComputationsDocument7 pages2021 Income ComputationsPaulo BelenNo ratings yet

- 2019 Sales SLSPDocument2 pages2019 Sales SLSPPaulo BelenNo ratings yet

- 8531 1uniDocument18 pages8531 1uniMs AimaNo ratings yet

- Fillable Bir Form 1701 2013 Version FillableDocument12 pagesFillable Bir Form 1701 2013 Version FillableCJNo ratings yet

- Law of TaxationDocument13 pagesLaw of TaxationRameshNadarNo ratings yet

- Solved in Each of The Following Cases Discuss How The TaxpayersDocument1 pageSolved in Each of The Following Cases Discuss How The TaxpayersAnbu jaromiaNo ratings yet

- Unit 7Document32 pagesUnit 7fitsumNo ratings yet

- Introduction To Income TaxationDocument3 pagesIntroduction To Income TaxationescrowNo ratings yet

- 130 Inspirational Quotes About TaxesDocument16 pages130 Inspirational Quotes About TaxesYash RankaNo ratings yet

- Gourishankar - BihaniDocument5 pagesGourishankar - BihaniSunny MittalNo ratings yet

- Tan vs. Del RosarioDocument1 pageTan vs. Del RosarioFaustina del RosarioNo ratings yet

- South African Airways v. CIR PDFDocument8 pagesSouth African Airways v. CIR PDFsbce14No ratings yet

- Reduced Increased Increase Means: The Article Reduction TheDocument1 pageReduced Increased Increase Means: The Article Reduction TherickmortyNo ratings yet

- Office of The Inland Revenue and Customs (South), Karachi: Director General AuditDocument14 pagesOffice of The Inland Revenue and Customs (South), Karachi: Director General AuditHamid AliNo ratings yet

- CIR vs. Algue Inc. Taxation CaseDocument5 pagesCIR vs. Algue Inc. Taxation CaseNiña ArmadaNo ratings yet

- MATRIX 2-Tax-RevDocument18 pagesMATRIX 2-Tax-RevJepoy FranciscoNo ratings yet

- Allowable DeductionsDocument15 pagesAllowable DeductionsEloisa Venice TinsayNo ratings yet

- Intermediate Accounting IFRS 4e - 2021 (Donald E. Kieso 2021-1047-1089Document43 pagesIntermediate Accounting IFRS 4e - 2021 (Donald E. Kieso 2021-1047-1089FINNA HABIBATUSNo ratings yet

- IR Act No 10 (E) 2006 (Consolidation 2015)Document319 pagesIR Act No 10 (E) 2006 (Consolidation 2015)Nirmalee WeerasingheNo ratings yet

- Tax Calculator (Salaried Person) : Monthly SalaryDocument5 pagesTax Calculator (Salaried Person) : Monthly SalarySheeraz Ahmed MemonNo ratings yet

- Corporate Income TaxDocument12 pagesCorporate Income Taxrevilo ordinarioNo ratings yet

- Tax 1 PDFDocument12 pagesTax 1 PDFhotgirlsummerNo ratings yet

- Revised Syllabus-Individual Income Taxation Atty. Ma. Victoria A. VillaluzDocument2 pagesRevised Syllabus-Individual Income Taxation Atty. Ma. Victoria A. VillaluzAlfonso DimlaNo ratings yet

- Digest Bir Ruling 30-00, 19-01Document3 pagesDigest Bir Ruling 30-00, 19-01Jonathan Ocampo BajetaNo ratings yet