Professional Documents

Culture Documents

SSE 107 Macroeconomics SG 5

Uploaded by

Aila Erika EgrosCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSE 107 Macroeconomics SG 5

Uploaded by

Aila Erika EgrosCopyright:

Available Formats

FM-AA-CIA-15 Rev.

0 10-July-2020

Study Guide in (Course Code and Course Title) Module No._5_

SSE 107 - Macroeconomics

STUDY GUIDE FOR MODULE NO. 5

National Income Accounting

MODULE OVERVIEW

Module Outline

A. Approaches to National Income Accounting

1. Income Approach

2. Expenditure Approach

3. Industrial Origin Approach

B. Gross National Product (GNP) Accounting: Meaning, Purpose and Limitations

C. GNP vs. Gross Domestic Product (GDP)

D. Money GNP vs. Real GNP

Introduction

National income accounting provides us the measurement of aggregate economic activity as well as a

useful perspective on the way the economy works.

This particular module discusses the different approaches to national income accounting. It also deals

with a discussion of the GNP and GDP giving emphasis on their purposes and limitations. Money GNP and

Real GNP will be further discussed focusing on computing/calculating their values for a more elaborated

interpretation and analysis of these topics.

MODULE LEARNING OBJECTIVES

At the end of the module, students are expected to:

1. explain the important role of national income accounting to the national economy;

2. differentiate between GNP and GDP; and Money GNP and Real GNP;

3. calculate Real GNP and Money GNP; and

4. explain each of the three approaches to national income accounting.

LEARNING CONTENTS (title of the subsection)

Approaches to National Income Accounting

Though there is no perfect way of estimating national output and income, an economy nonetheless still

utilizes the national income system because of its role to national economy and government, viz:

1. National income accounting system permits us to measure the level of production in the economy at

some point in time and explain why it is at that level.

2. By comparing national income accounts over a number of years, we can track the long-run course of

the economy and see whether it has grown, been steady or stagnated.

3. Information supplied by national income accounts provides a basis for formulating and applying public

policies to improve the performance of the economy.

National Income is a measure of the money value of the total flow of goods and services produced in an

economy over a specified period of time. It consists of the following:

1. Wage or salary – those generated by labor

2. Interest – those generated by lenders of funds

3. Rent – those generated by owners of real estate

4. Profit – those generated by the entrepreneurs

5. Net factor – income from abroad

PANGASINAN STATE UNIVERSITY 1

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No._5_

Approaches to National Income Estimation

1. Industrial Origin Approach (or Value Added Approach). It measures the national income by

determining the sum of the market value of the total production of all the major industries comprising the

economy. The major industries consist of the following:

a. agriculture, fisheries and forestry

b. industrial sector

c. service sector

PANGASINAN STATE UNIVERSITY 2

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No._5_

2. Product Approach (or Expenditure approach). It involves calculating the sum of all expenditures on

final goods. These are the expenditures of the end-users of the output produced in a given year. The end-

users are the households, business firms, the government and the rest of the population. This can be

summarized as follows:

GNP = C + I + G + (X – M) where:

GNP = Gross National Product

C = Personal Consumption Expenditure

I = Gross Domestic Capital Formation

G = Government Consumption Expenditure

X = Exports

M = Imports

PANGASINAN STATE UNIVERSITY 3

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No._5_

3. Factor Income Approach. An approach where the total amount of earnings of the owners of economic

resources (land, labor, capital, entrepreneur) are aggregated into a single amount with the objective of

determining the national income.

LEARNING ACTIVITY 1

A. Direction: Identify in WHAT APPROACH the following items are used: EXPENDITURE or INCOME or

INDUSTRIAL ORIGIN.

___________________________ 1. General Government Consumption Expenditures

___________________________ 2. Exports of Goods

___________________________ 3. Household Economic Income

___________________________ 4. Net Foreign Factor Income

___________________________ 5. Government earnings from enterprises

___________________________ 6. Personal entrepreneurial profits

___________________________ 7. Service Sector contribution

___________________________ 8. Corporate Profits

___________________________ 9. Gross Domestic Capital Formation

___________________________ 10. Indirect Taxes

PANGASINAN STATE UNIVERSITY 4

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No._5_

B. Identify in WHAT EXPENDITURES the following items are classified: Personal Consumption Expenditure

(C) or Gross Domestic Capital Formation (I) or Government Consumption Expenditure (G).

__________1. Pension payments to GSIS retirees

__________ 2. Computer machine of Banco De Oro

__________ 3. Your mother’s transportation expenses

__________ 4. Stock of new cars of Mitsubishi Philippines

__________ 5. Repair of South Expressway

__________ 6. Your snack purchases at the restaurant

__________ 7. Salaries of public school teachers

__________ 8. New disco lights and audio equipment at SSD Disco

__________ 9. Construction of flyovers at Roxas Blvd.

__________ 10. Food requirement of your family

LEARNING CONTENTS (title of the subsection)

Gross National Product (GNP) Accounting: Meaning, Purpose and Limitations

Gross National Product (GNP) refers to the market value of all the final goods and services

produced by nationals or citizens of a country in one year. This includes production within and outside of the

country under consideration. Gross Domestic Product (GDP) on the other hand refers to the total market

value of all final goods and services produced within the territories of a country in one year.

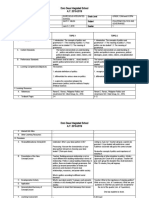

A clearer distinction between the two is illustrated Table 1.

Table 1 - GNP vs. GDP

GNP Production within the Philippines by Production within the Philippines by

Philippine Nationals Foreign Nationals

GDP Production within the Philippines by Production outside the Philippines by

Philippine Nationals Philippine Nationals

Functions of GNP

Gross National Product has the following functions, namely:

1. GNP reflects the value of the economy’s production.

2. GNP figures show the structure of production according to end use and factor contribution.

3. GNP accounting serves as a barometer of aggregate activities in the economy.

The main use of GNP measurement is that it affords a quantitative measure of economic performance. It

serves as indicator of the overall performance of the economy.

PANGASINAN STATE UNIVERSITY 5

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No._5_

Limitations of GNP

While GNP has useful functions such as measurement of national economic performance as well as a

tool in both government and business planning, it also has several limitations, viz:

1. GNP does not show the allocation of goods and services among the members of the society.

2. GNP accounting is understated since not all goods and services are accounted for. Some goods do not

pass through the market system.

3. Double counting. In some instances, not only are the finals goods added in the GNP but intermediate

goods as well which are supposedly excluded.

4. The evils of economic growth like pollution, congestion and dirty environment are not reflected in the

GNP.

5. It only measures the quantity of goods and services but not the quality.

6. Incomes or products from illegal sources are not included in the GNP.

MONEY GNP vs. REAL GNP

Money GNP is the value of GNP at current price or market price. It is obtained by multiplying the

number of final products and services by prevailing market prices.

It is expressed as P x Q = GNP.

Table 2 shows the value of Money GNP calculated using the above formula.

Table 2 – Money GNP

Year Quantity Price GNP

1 100 P10 P1,000

2 100 P20 P2,000

3 100 P30 P3,000

4 100 P40 P4,000

5 100 P50 P5,000

Based from the table, the GNP accounts appear to progressively increase since year 1. To conclude

therefore that the national economy has been improving because of increasing GNP is wrong. Take note that

quantity remains the same from year 1 to year 5. So, there is no increase in the number of final products

produced within the last five years.

Real GNP on the other hand is the value of GNP in terms of the number of goods and services

produced.

It is calculated making use of the following formulas:

Real GNP = Money GNP X 100

Price Index

Price Index = Price in a given year x 100

Price in Base year

PANGASINAN STATE UNIVERSITY 6

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No._5_

Table 3 shows the value of Real GNP using the above formulas.

Table 3 - Real GNP (or Adjusted GNP)

(Year 3 = Base Year)

Year Quantity Price Price Index GNP Real GNP

1 100 P10 33.33 P1,000 P3,000

2 100 P20 66.67 P2,000 P3,000

3 100 P30 100 P3,000 P3,000.00

4 100 P40 133.33 P4,000 P3,000

5 100 P50 166.67 P5,000 P3,000

Considering Year 3 as the base year, the Price Index of the base year is:

Price Index = P30 x 100 = 100%

P30

Price Index for Year 1 = P10 x 100 = 33%

P30

Price Index for Year 2 = P20 x 100 = 66%

P30

LEARNING ACTIVITY 2

Direction: Solve for the Price Index and Real GNP.

Real GNP (or Adjusted GNP)

(Year 2 = Base Year)

YEA QUANTITY PRICE PRICE GNP REAL GNP

R INDEX

1 200 P30 6,000

2 200 P60 12,000

3 200 P90 18,000

4 200 P120 24,000

5 200 P150 30,000

SUMMARY

The three approaches to national income accounting dealt with how the performance of an economy in

producing goods and services can be measured. Said approaches revolved around the circular flow of goods,

services and money. The circular flow of goods, services and money shows the transactions and movements

of commodities from one sector to another and the income generated by all these economic transactions;

hence, one can measure the economic performance of a country by analysing the different components of the

circular flow.

PANGASINAN STATE UNIVERSITY 7

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No._5_

Gross Domestic Product is the total market value of all final goods and services produced in an economy

over a period of one year. It excludes production abroad by Philippine businesses and overseas Filipino

workers. Gross National Product, on the other hand, is the total market value of all final goods and services

produced by a nation’s residents regardless of where they are located.

GNP has its shortcomings or limitations but in spite of this, GNP accounting can still be a barometer of

aggregate activities in the economy through time.

REFERENCES

A. BOOKS

De Guzman, Rachele D., et al. (2013). General Economics, Taxation and Agrarian Reform. Meycuayan City,

Bulacan. IPM Publishing.

Medina, Roberto G. (2003). Principles of Economics. Manila. Rex Book Store.

Nebres (2008). Economics: Concepts, Theories and Applications. Mandaluyong City: National Book Store.

Pagoso, Cristobal M. et al. (1996) Introductory Economics. Manila: Rex Book Store.

Viray, et al. (2011). Macroeconomics Simplified. Mandaluyong City: National Book Store.

B. ONLINE SOURCES

https://www.britannica.com/topic/national-income-accounting

https://corporatefinanceinstitute.com/resources/knowledge/economics/national-income-accounting/

https://www.investopedia.com/ask/answers/030415/what-functional-difference-between-gdp-and-gnp.asp

https://www.investopedia.com/terms/g/gnp.asp

https://www.thebalance.com/gross-national-income-4020738

PANGASINAN STATE UNIVERSITY 8

You might also like

- David Clarence Complete Transcript of The 08Document61 pagesDavid Clarence Complete Transcript of The 08Pri95% (22)

- POLGOV - Study Guide 1st and 2nd QTRDocument61 pagesPOLGOV - Study Guide 1st and 2nd QTRVein NoahNo ratings yet

- Philippine Politics and Governance - AY 2020 - 2021Document129 pagesPhilippine Politics and Governance - AY 2020 - 2021bb JisooNo ratings yet

- Lesson Plan in Diss Defining Social ScieDocument5 pagesLesson Plan in Diss Defining Social SciePryamn JoefNo ratings yet

- Lesson 1 RPH Handouts AUGUST 10 14 2020Document11 pagesLesson 1 RPH Handouts AUGUST 10 14 2020Lee DuquiatanNo ratings yet

- Lesson 2 - Understanding Culture and SocietyDocument19 pagesLesson 2 - Understanding Culture and SocietyJamesel VillaruzNo ratings yet

- Chapter A Starting Point For The Understanding of Culture Society and PoliticsDocument34 pagesChapter A Starting Point For The Understanding of Culture Society and PoliticsMarie SinongcoNo ratings yet

- SOCIAL SCIENCE - AnthropologyDocument45 pagesSOCIAL SCIENCE - AnthropologyStella MonicaNo ratings yet

- PPT1Document37 pagesPPT1Joeyen LaynoNo ratings yet

- Ucsp Lesson 2Document31 pagesUcsp Lesson 2Billy JamesNo ratings yet

- DLPDocument5 pagesDLPAbegail AlcoberNo ratings yet

- Understanding Culture Society and PoliticsDocument27 pagesUnderstanding Culture Society and PoliticsBona MeladNo ratings yet

- Joseph - FILIPINO VALUE SYSTEMS IN BUSINESSDocument29 pagesJoseph - FILIPINO VALUE SYSTEMS IN BUSINESSKAudy MacasùsiNo ratings yet

- IntroPhilo - Q1 - Mod4 - The Human Person in Their EnvironmentDocument27 pagesIntroPhilo - Q1 - Mod4 - The Human Person in Their EnvironmentRey Ann RubioNo ratings yet

- NITI Directory 161219Document39 pagesNITI Directory 161219neohorizonsNo ratings yet

- PPG 11Document20 pagesPPG 11John very simbajonNo ratings yet

- Bachelor of Secondary Education Major in Social StudiesDocument4 pagesBachelor of Secondary Education Major in Social StudiesChristine Joy MarcelNo ratings yet

- SSE 101foundation of Social StudiesDocument2 pagesSSE 101foundation of Social StudiesEdwin SamisNo ratings yet

- Ucsp11 q2 Mod8 Globalinequality v1Document23 pagesUcsp11 q2 Mod8 Globalinequality v1Thinthin AraqueNo ratings yet

- UCSP W4 JermiesoteroDocument20 pagesUCSP W4 JermiesoteroChristopher Luigi RodriguezNo ratings yet

- UCSP 1 F-DomeDocument20 pagesUCSP 1 F-DomeAl Cheeno Anonuevo100% (1)

- Module 2 W2 3POLGOVDocument14 pagesModule 2 W2 3POLGOVAlyssa SarmientoNo ratings yet

- Effective Instructional StrategiesDocument19 pagesEffective Instructional StrategiesSheryl Ann Tumacder DionicioNo ratings yet

- Division Araling Panlipunan Tools: Parts of A Whole, Emerging Patterns, Causes and Consequences of TrendsDocument12 pagesDivision Araling Panlipunan Tools: Parts of A Whole, Emerging Patterns, Causes and Consequences of TrendsNestor MoresNo ratings yet

- Syllabus Soc AnthroDocument2 pagesSyllabus Soc AnthroKen ChiaNo ratings yet

- TNCT Q1 M1 Ver2 Differences-of-Trends-and-FadsDocument23 pagesTNCT Q1 M1 Ver2 Differences-of-Trends-and-FadsShianne Dancee CorpuzNo ratings yet

- Course OutlineDocument2 pagesCourse OutlineArnel L. Jabagat82% (28)

- Education and Social DevelopmentDocument30 pagesEducation and Social DevelopmentMichelleAlejandroNo ratings yet

- 2019 National on-The-Spot Skills Exhibition On Population Development (PopDev) Implementing GuidelinesDocument9 pages2019 National on-The-Spot Skills Exhibition On Population Development (PopDev) Implementing GuidelinesEmily Ebreo BaculiNo ratings yet

- Ppg-Module 7 PDFDocument16 pagesPpg-Module 7 PDFNoemi Ruth Carrasco MesanaNo ratings yet

- Ucsp 1ST SlidesDocument17 pagesUcsp 1ST SlidesBangi, Jamby M.100% (1)

- Shs Humss Ucsp Module-5Document54 pagesShs Humss Ucsp Module-5Eric EscobarNo ratings yet

- Cesc 12 - Q1 - M18Document13 pagesCesc 12 - Q1 - M18jayson babaranNo ratings yet

- Ucsp Content Analysis Summative TestsDocument2 pagesUcsp Content Analysis Summative TestsPiven James SarongNo ratings yet

- 2017.02.09 BSSE CatalogueDocument12 pages2017.02.09 BSSE CatalogueAnonymous BBs1xxk96VNo ratings yet

- Department of Education: Republic of The PhilippinesDocument14 pagesDepartment of Education: Republic of The PhilippinesjoelNo ratings yet

- DIASS Module 1Document11 pagesDIASS Module 1Edison MontemayorNo ratings yet

- Discipline and Ideas in The Social SciencesDocument26 pagesDiscipline and Ideas in The Social SciencesAnthony GorospeNo ratings yet

- Nature, Goals and Perspective inDocument29 pagesNature, Goals and Perspective inHope ArazaNo ratings yet

- Entrepreneurship (Q3) : Ma. Luisa D. Cabanig, LPTDocument50 pagesEntrepreneurship (Q3) : Ma. Luisa D. Cabanig, LPTMikey Abril GarciaNo ratings yet

- 2nd Summative Test (Week 3-4)Document5 pages2nd Summative Test (Week 3-4)gayNo ratings yet

- Recognizing The Importance of Teaching Social Sciences in Philippine Schools1Document35 pagesRecognizing The Importance of Teaching Social Sciences in Philippine Schools1Ramie SenarosaNo ratings yet

- SHS Core Understanding Culture Society and PolitiDocument8 pagesSHS Core Understanding Culture Society and PolitiNerriza VinzeNo ratings yet

- SOC116 SyllabusDocument9 pagesSOC116 SyllabusMark Serrano100% (1)

- Handouts DissDocument8 pagesHandouts DissNoralyn GutierrezNo ratings yet

- Introduction To The Philosophy of Human Person Module 8-Week 8Document9 pagesIntroduction To The Philosophy of Human Person Module 8-Week 8Mariel Lopez - MadrideoNo ratings yet

- Class Program S.Y. 2019-2020: Caloocan Sur Elementary SchoolDocument1 pageClass Program S.Y. 2019-2020: Caloocan Sur Elementary SchoolShikinah Glory PadillaNo ratings yet

- Disciplines and Ideas in The Social DLPDocument158 pagesDisciplines and Ideas in The Social DLPJade MillanteNo ratings yet

- DLL DORO PoliticsDocument8 pagesDLL DORO PoliticsGa MusaNo ratings yet

- UCSP Module 8 SummaryDocument8 pagesUCSP Module 8 SummaryJudy May BaroaNo ratings yet

- TNCT in The 21st CenturyDocument19 pagesTNCT in The 21st CenturyJean Brailee - SombritoNo ratings yet

- Lesson Plan Joanna RoseDocument4 pagesLesson Plan Joanna RoseJoanna Rose LandichoNo ratings yet

- UCSP Notes 1st GradingDocument30 pagesUCSP Notes 1st GradingKhassie B. GrandeNo ratings yet

- CHAPTER 1 HandoutsDocument3 pagesCHAPTER 1 Handoutsvince madroneroNo ratings yet

- Philippine Politics and Governance 1Document45 pagesPhilippine Politics and Governance 1Khen Eros NarcisoNo ratings yet

- Emphasis of Social StudiesDocument12 pagesEmphasis of Social StudiesDan GregoriousNo ratings yet

- PPG Q2 Week5Document3 pagesPPG Q2 Week5ferdzjoseph05.rrNo ratings yet

- Foundation of Social Studies (SSED-113)Document23 pagesFoundation of Social Studies (SSED-113)Via OctosoNo ratings yet

- Implementation of Senior High School Work Immersion Classroom and Field - TABAMODocument8 pagesImplementation of Senior High School Work Immersion Classroom and Field - TABAMOAj Comon TabamoNo ratings yet

- Department of Economics Nizam Collee (Autonomous) Osmania University, Hyderabad Undergraduate (B.A) Syllabus With Effect From The Batch 2010-201 1Document9 pagesDepartment of Economics Nizam Collee (Autonomous) Osmania University, Hyderabad Undergraduate (B.A) Syllabus With Effect From The Batch 2010-201 1Mad MadhaviNo ratings yet

- Rubric PresentationDocument1 pageRubric PresentationJm McCallNo ratings yet

- The Good Life: Study Guide For Module No. 7Document4 pagesThe Good Life: Study Guide For Module No. 7Maylene CalicdanNo ratings yet

- Science, Tenchnology, and Nation-Building: Study Guide For Module No. 4Document16 pagesScience, Tenchnology, and Nation-Building: Study Guide For Module No. 4Maylene CalicdanNo ratings yet

- Module 1 - 7Document43 pagesModule 1 - 7Aila Erika EgrosNo ratings yet

- Human Flourishing in Progress and De-Development: Study Guide For Module No. 6Document3 pagesHuman Flourishing in Progress and De-Development: Study Guide For Module No. 6Maylene CalicdanNo ratings yet

- PROF ED 105 Foundation of Inclusive and Special EducationCOURSE SYLLABUS VMRG 1Document2 pagesPROF ED 105 Foundation of Inclusive and Special EducationCOURSE SYLLABUS VMRG 1Aila Erika EgrosNo ratings yet

- Activity 3 Worksheet SummaryDocument2 pagesActivity 3 Worksheet SummaryAila Erika EgrosNo ratings yet

- Technology As A Way of Revealing: Study Guide For Module No. 5Document4 pagesTechnology As A Way of Revealing: Study Guide For Module No. 5Maylene CalicdanNo ratings yet

- Ge6 Study Guide 3Document6 pagesGe6 Study Guide 3PammieNo ratings yet

- SSE 107 Macroeconomics SG 4Document10 pagesSSE 107 Macroeconomics SG 4Aila Erika EgrosNo ratings yet

- Historical Antecedents of Science and Technology: Study Guide For Module No. 2Document12 pagesHistorical Antecedents of Science and Technology: Study Guide For Module No. 2Maylene CalicdanNo ratings yet

- Sse115 M5Document5 pagesSse115 M5Aila Erika EgrosNo ratings yet

- Introduction To Science, Technology, and Society: Study Guide For Module No. 1Document5 pagesIntroduction To Science, Technology, and Society: Study Guide For Module No. 1Maylene CalicdanNo ratings yet

- SSE 107 Macroeconomics SG 3Document4 pagesSSE 107 Macroeconomics SG 3Aila Erika EgrosNo ratings yet

- SSE 107 Macroeconomics SG 1Document6 pagesSSE 107 Macroeconomics SG 1Aila Erika EgrosNo ratings yet

- Sse115 M3Document9 pagesSse115 M3Aila Erika EgrosNo ratings yet

- Sse115 M2Document10 pagesSse115 M2Aila Erika EgrosNo ratings yet

- Sse 106 SG 5Document12 pagesSse 106 SG 5Aila Erika EgrosNo ratings yet

- Study Guide For Module No. 2: Economic TheoryDocument5 pagesStudy Guide For Module No. 2: Economic TheoryAila Erika EgrosNo ratings yet

- Sse115 M1Document6 pagesSse115 M1Aila Erika EgrosNo ratings yet

- Sse115 M4Document6 pagesSse115 M4Aila Erika EgrosNo ratings yet

- Study Guide For Module No. 3Document7 pagesStudy Guide For Module No. 3Aila Erika EgrosNo ratings yet

- Sse 106 SG 4Document8 pagesSse 106 SG 4Aila Erika EgrosNo ratings yet

- Study Guide For Module No. 1Document5 pagesStudy Guide For Module No. 1Aila Erika EgrosNo ratings yet

- (460-19E) Mohd Rokis Mohd Ghulan v. Cekal Teguh SDN BHD & Anor & Another AppealsDocument4 pages(460-19E) Mohd Rokis Mohd Ghulan v. Cekal Teguh SDN BHD & Anor & Another AppealsJonardi DianaNo ratings yet

- Stanley Ford Makes Mountains Out of Molehills He Can DoDocument1 pageStanley Ford Makes Mountains Out of Molehills He Can Dotrilocksp Singh0% (1)

- Milimani Elc 13th March 2024Document10 pagesMilimani Elc 13th March 2024Benson GakaNo ratings yet

- MD Uzzal HossainDocument4 pagesMD Uzzal HossainMD Omor FarukNo ratings yet

- Final Distributor Communication PMGKY PDFDocument7 pagesFinal Distributor Communication PMGKY PDFravendra patelNo ratings yet

- Chapter-2 - activity-DIMACULANGAN, DANICADocument3 pagesChapter-2 - activity-DIMACULANGAN, DANICAdanica dimaculanganNo ratings yet

- "I Know of No Other Instrument So Potenti Ally Powerful and Full of Social Purpose As The Co-Operati Ve Movement" - Smt. Indira GandhiDocument15 pages"I Know of No Other Instrument So Potenti Ally Powerful and Full of Social Purpose As The Co-Operati Ve Movement" - Smt. Indira GandhiDeepak Singh ChauhanNo ratings yet

- Book 1Document12 pagesBook 1Bahtije SylajNo ratings yet

- TEC ADD-NBO-ADD - EliasDocument2 pagesTEC ADD-NBO-ADD - EliasObo KeroNo ratings yet

- Background Report On: Anthony KahaleDocument32 pagesBackground Report On: Anthony KahaleTina Martinez100% (1)

- Advantages and Disadvantages of Joint VentureDocument4 pagesAdvantages and Disadvantages of Joint VentureRahmat HidayatNo ratings yet

- 02.financial Times - March.30.2023Document24 pages02.financial Times - March.30.2023fuyukawiNo ratings yet

- Cortar GST CertificateDocument3 pagesCortar GST CertificatevirajNo ratings yet

- Foundation Modules For Engineering (2012)Document4 pagesFoundation Modules For Engineering (2012)Sia MarkNo ratings yet

- CLC033 - 4 Contract Format - Structure DOD E-Biz - Line Item StructureDocument31 pagesCLC033 - 4 Contract Format - Structure DOD E-Biz - Line Item Structuresuasponte2No ratings yet

- English Speaking Test Part 1 2 Paper 3 SPM 2021Document2 pagesEnglish Speaking Test Part 1 2 Paper 3 SPM 2021linNo ratings yet

- India S Coal Story Subhomoy Bhattacharjee 2017 Annas Archive Libgenrs NF 3207598Document287 pagesIndia S Coal Story Subhomoy Bhattacharjee 2017 Annas Archive Libgenrs NF 3207598Prashanth BangaloreNo ratings yet

- 2020 IESF Membership Questionnaire - Associate MembershipDocument8 pages2020 IESF Membership Questionnaire - Associate Membershipzeeeryx_293154639No ratings yet

- Evolution of The Local Governments in The PhilippinesDocument6 pagesEvolution of The Local Governments in The PhilippinesRonn Briane AtudNo ratings yet

- Blue Cross Appeal 2022 10 05Document18 pagesBlue Cross Appeal 2022 10 05Jakob EmersonNo ratings yet

- Bs Na en 1992 3 2006Document10 pagesBs Na en 1992 3 2006Amrut BhattNo ratings yet

- Wallstreetjournaleurope 20170905 TheWallStreetJournal-EuropeDocument20 pagesWallstreetjournaleurope 20170905 TheWallStreetJournal-EuropestefanoNo ratings yet

- Model Pontaj Ianuarie 2023Document2 pagesModel Pontaj Ianuarie 2023Daianca MarcovNo ratings yet

- EO Cooperative Developemnt OfficerDocument3 pagesEO Cooperative Developemnt Officerdexnarrido100% (1)

- Doe Tap Sirim 240722Document4 pagesDoe Tap Sirim 240722khairil mohdNo ratings yet

- HPCL Price List Eff-01st Feb 2021Document1 pageHPCL Price List Eff-01st Feb 2021aee lweNo ratings yet

- Income Tax (Costs of Renovation and Refurbishment of Business Premise) (Amendment) Rules 2021Document5 pagesIncome Tax (Costs of Renovation and Refurbishment of Business Premise) (Amendment) Rules 2021Naqib AhmadNo ratings yet

- Bravo Bravissimo Project Call Art. 1 - IntroductionDocument4 pagesBravo Bravissimo Project Call Art. 1 - IntroductionMilica PopovićNo ratings yet