Professional Documents

Culture Documents

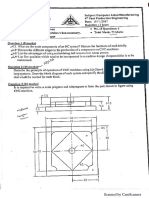

2016 q6

Uploaded by

abdullah 3mar abou reashaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2016 q6

Uploaded by

abdullah 3mar abou reashaCopyright:

Available Formats

12/18/22, 6:54 AM Loading..

Please find below the image of excel sheet attached for detailed calculations and formulas used to

derive these calculations :

Consider Alternatives x

Initial Investment = @ 200,000 ( Cash Outflow) at Year 3

Now we will first find out the Expected cash flow at each year 4, 5 & 6

For e.g at Year 4, Expected Cash Flow = Probability x Cash Flow = 0.7 * 50000 + 0.3 * 40000 = $47,000

Similarly calculate Cash flow at Year 5 and Year 6. Year 5 = 0.7 * 50000 + 0.3 * 30000 = $ 44,000

Year 6 = 0.7 * 50000 + 0.3 * 20000 = $ 41,000

Now next step is to discount this Cash Flow at year 4,5 & 6 to the time we have to consider the

alternative i.e Year 3. This net cash flow is then substracted from the investment at Year 3 which would

result in Expected NPV

Expected NPV of Alternative x = -200,000 + 47,000 / (1.15^1) + 44,000 / (1.15^2) + 41,000 / (1.15^3)

= $ -98,902

Similarly,

Expected NPV of Alternative y = -75,000 + 30,000 / (1.15^1) + 34,500 / (1.15^2) + 39,000 / (1.15^3)

= $ 2,817

Expected NPV of Alternative x = -350,000 + 124,000 / (1.15^1) + 110,000 / (1.15^2) + 96,000 /

(1.15^3) = $ -98,902

As Expected NPV of Alternative y is positive and largest , decision y should be selected.

https://creativeworks.lol/malaysia-desperately-needs-new-economic-story/ 1/1

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Time Value of MoneyDocument55 pagesTime Value of MoneySayoni GhoshNo ratings yet

- Net Present Value and Other Investment Criteria: Solutions To Questions and ProblemsDocument4 pagesNet Present Value and Other Investment Criteria: Solutions To Questions and Problemsabraha gebruNo ratings yet

- Tutorial 4 AnwersDocument6 pagesTutorial 4 AnwersSyuhaidah Binti Aziz ZudinNo ratings yet

- Project Appraisal Techniques Payback, ARR & NPVDocument3 pagesProject Appraisal Techniques Payback, ARR & NPVqari saibNo ratings yet

- Week 5-Chapter 6 Discounted Cash Flow ValuationDocument70 pagesWeek 5-Chapter 6 Discounted Cash Flow ValuationOkura TsukikoNo ratings yet

- FM - 3Document14 pagesFM - 3akesingsNo ratings yet

- General Math Activity SheetsDocument60 pagesGeneral Math Activity Sheetslui yangyangNo ratings yet

- Solution For Homework Week4Document11 pagesSolution For Homework Week4jibberish yoNo ratings yet

- CAPITAL BUDGETING NotesDocument74 pagesCAPITAL BUDGETING NotesMahek RawatNo ratings yet

- Time Value of MoneyDocument33 pagesTime Value of MoneySayantan HalderNo ratings yet

- Basic 5Document2 pagesBasic 5Venky DNo ratings yet

- Present Value Calculations for Retirement PlanningDocument38 pagesPresent Value Calculations for Retirement Planningmarjannaseri77100% (1)

- Capital BudgetingDocument74 pagesCapital BudgetingAaryan RastogiNo ratings yet

- Topic 3 8 Investment AppraisalDocument20 pagesTopic 3 8 Investment AppraisalEren BarlasNo ratings yet

- Chapter 3 - Cash Flow, Interest and EquivalenceDocument9 pagesChapter 3 - Cash Flow, Interest and EquivalenceSandipNo ratings yet

- Future Value of MoneyDocument11 pagesFuture Value of Moneyaymanmomani2111No ratings yet

- Philippine School of Business Administration - PSBA ManilaDocument12 pagesPhilippine School of Business Administration - PSBA ManilaephraimNo ratings yet

- Chap 002Document63 pagesChap 002محمد عقابنةNo ratings yet

- CHAPTER 6 Module Financial ManagementDocument23 pagesCHAPTER 6 Module Financial Managementgiezel francoNo ratings yet

- Erick BusFin 073455Document12 pagesErick BusFin 073455ErickNo ratings yet

- Project Appraisal TechniquesDocument11 pagesProject Appraisal TechniquesChristineNo ratings yet

- MATH 15-W7-NET PRESENT VALUE (NPV) - Nov.26,2021Document34 pagesMATH 15-W7-NET PRESENT VALUE (NPV) - Nov.26,2021Romel BernardoNo ratings yet

- Equivalence CalculationsDocument2 pagesEquivalence Calculationsmiang.gabriel0928No ratings yet

- 5.2 Discounted Cash Flows, Internal Rate of Return, ROI. Feb 8-12. 2Document13 pages5.2 Discounted Cash Flows, Internal Rate of Return, ROI. Feb 8-12. 2John GarciaNo ratings yet

- Welcome: Selestian AugustinoDocument24 pagesWelcome: Selestian AugustinoDane Chybo TzNo ratings yet

- HKUST Financial Calculator Workshop 2024-02Document34 pagesHKUST Financial Calculator Workshop 2024-02LincolnNo ratings yet

- Feasibility ReportDocument4 pagesFeasibility ReportfranceivycadionocanaNo ratings yet

- Tugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Document5 pagesTugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Maulana IkhsanNo ratings yet

- DP 2 Lecture 3.8 and Onwards (Delievered 26th Sep 2022)Document14 pagesDP 2 Lecture 3.8 and Onwards (Delievered 26th Sep 2022)MMN LegendNo ratings yet

- Examples GradientsDocument5 pagesExamples GradientsRhean Mikee AbneNo ratings yet

- Calculation Part-Financial ManagementDocument5 pagesCalculation Part-Financial ManagementAshwini shenolkarNo ratings yet

- The Time Value of Money (Chapter 4)Document33 pagesThe Time Value of Money (Chapter 4)falak zehraNo ratings yet

- Middle East Technical University Civil Engineering Department basic conceptsDocument33 pagesMiddle East Technical University Civil Engineering Department basic conceptsCenk BudayanNo ratings yet

- Chapter 6 Math of FinanceDocument10 pagesChapter 6 Math of FinanceEmmanuel Santos IINo ratings yet

- Finance Chapter4 AnswersDocument4 pagesFinance Chapter4 AnswersyumnaNo ratings yet

- A. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueDocument30 pagesA. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueAfroz AlamNo ratings yet

- Discount Rate Formula Excel TemplateDocument7 pagesDiscount Rate Formula Excel TemplateJaspreet GillNo ratings yet

- Capital Budgeting Examples - SolutionsDocument11 pagesCapital Budgeting Examples - Solutionsanik islamNo ratings yet

- 2 Time Value of MoneyDocument22 pages2 Time Value of MoneyRitu JainNo ratings yet

- 109_2_____________________________.pdfDocument3 pages109_2_____________________________.pdf112205013No ratings yet

- Chap 6 Notes To Accompany The PP TransparenciesDocument8 pagesChap 6 Notes To Accompany The PP TransparenciesChantal AouadNo ratings yet

- PFP Unit 1 Time Value of MoneyDocument40 pagesPFP Unit 1 Time Value of MoneyAnkit KumarNo ratings yet

- Compound Interest Calculations and Financial AnalysisDocument6 pagesCompound Interest Calculations and Financial AnalysisSheikh Roshnee 1731695No ratings yet

- A Cash Flow Diagram Is Simply A Graphical Representation of Cash Flows Drawn On A Time ScaleDocument39 pagesA Cash Flow Diagram Is Simply A Graphical Representation of Cash Flows Drawn On A Time ScaleBolocon, Harvey Jon DelfinNo ratings yet

- CASH FLOW DIAGRAMDocument39 pagesCASH FLOW DIAGRAMBolocon, Harvey Jon DelfinNo ratings yet

- Capital BudgitingDocument37 pagesCapital BudgitingDr.Surajit DasNo ratings yet

- Calculate Project ROI FactorsDocument4 pagesCalculate Project ROI FactorsCarlos H AngelNo ratings yet

- Exercises Week 3 FinanceDocument11 pagesExercises Week 3 FinancebNo ratings yet

- Ch06 Discounted Cash Flow ValuationDocument45 pagesCh06 Discounted Cash Flow Valuation마늘빵파스타No ratings yet

- Decision Recognizing Risks: Topic 5Document24 pagesDecision Recognizing Risks: Topic 5Jayson Dela Cruz OmictinNo ratings yet

- Capital Budgeting-Theory Sid911Document11 pagesCapital Budgeting-Theory Sid911Siddhesh BridNo ratings yet

- UNIT - 4-2 - Gursamey....Document27 pagesUNIT - 4-2 - Gursamey....demeketeme2013No ratings yet

- Capital Budgeting: Year Cash FlowDocument5 pagesCapital Budgeting: Year Cash FlowNaeem Uddin100% (3)

- Techniques of Capital Budgeting SumsDocument15 pagesTechniques of Capital Budgeting Sumshardika jadavNo ratings yet

- Lecture 3 Answers 2Document7 pagesLecture 3 Answers 2Thắng ThôngNo ratings yet

- CHAPTER 6 Module Financial ManagementDocument20 pagesCHAPTER 6 Module Financial ManagementAdoree RamosNo ratings yet

- DCF Analysis ExplainedDocument12 pagesDCF Analysis Explainedaymanmomani2111No ratings yet

- Capital Budgeting: Overview: Multiperiod Decision-MakingDocument3 pagesCapital Budgeting: Overview: Multiperiod Decision-MakingckalechaNo ratings yet

- Busi 2401 Week 2 (CH 6)Document48 pagesBusi 2401 Week 2 (CH 6)Jason LeeNo ratings yet

- نسخة من Final - ExamDocument2 pagesنسخة من Final - Examabdullah 3mar abou reashaNo ratings yet

- Revision Questions 2222Document13 pagesRevision Questions 2222abdullah 3mar abou reashaNo ratings yet

- Value EngineeringDocument7 pagesValue Engineeringabdullah 3mar abou reashaNo ratings yet

- LEC3 Lubrication 2021Document19 pagesLEC3 Lubrication 2021abdullah 3mar abou reashaNo ratings yet

- مسألة ٤Document5 pagesمسألة ٤abdullah 3mar abou reashaNo ratings yet

- Lecture 002 - PLCDocument6 pagesLecture 002 - PLCabdullah 3mar abou reashaNo ratings yet

- Sheet 2 MRPDocument5 pagesSheet 2 MRPabdullah 3mar abou reashaNo ratings yet

- Scan Doc by CamScannerDocument1 pageScan Doc by CamScannerabdullah 3mar abou reashaNo ratings yet

- مسألة ٣Document7 pagesمسألة ٣abdullah 3mar abou reashaNo ratings yet

- Advanced Automatic ControlDocument26 pagesAdvanced Automatic Controlabdullah 3mar abou reashaNo ratings yet

- حل الميد تيرم cncDocument2 pagesحل الميد تيرم cncabdullah 3mar abou reashaNo ratings yet

- Karnaugh MapsDocument10 pagesKarnaugh Mapsabdullah 3mar abou reashaNo ratings yet

- Introduction to Statistics Chapter Exploring Data, Samples & PopulationsDocument24 pagesIntroduction to Statistics Chapter Exploring Data, Samples & Populationsabdullah 3mar abou reashaNo ratings yet

- Final 2017Document3 pagesFinal 2017abdullah 3mar abou reashaNo ratings yet

- CH 3Document14 pagesCH 3abdullah 3mar abou reashaNo ratings yet

- A Review On Fabrication & Characterization of Hybrid Aluminium Metal Matrix CompositeDocument6 pagesA Review On Fabrication & Characterization of Hybrid Aluminium Metal Matrix Compositeabdullah 3mar abou reashaNo ratings yet

- محاضرة العداداتDocument3 pagesمحاضرة العداداتabdullah 3mar abou reashaNo ratings yet

- CNC QuestionsDocument1 pageCNC Questionsabdullah 3mar abou reashaNo ratings yet

- Sliding Wear Properties of A Composite of Aluminum 2024 Powder Reinforced With Heat Treatment and Silicon CarbideDocument12 pagesSliding Wear Properties of A Composite of Aluminum 2024 Powder Reinforced With Heat Treatment and Silicon Carbideabdullah 3mar abou reashaNo ratings yet

- First Page PDFDocument1 pageFirst Page PDFabdullah 3mar abou reashaNo ratings yet

- Al2O3/SiC particle reinforced aluminium composites dry sliding wearDocument10 pagesAl2O3/SiC particle reinforced aluminium composites dry sliding wearabdullah 3mar abou reashaNo ratings yet

- Invoice 1109Document1 pageInvoice 1109abdullah 3mar abou reashaNo ratings yet

- Lecture 004 - PLCDocument2 pagesLecture 004 - PLCabdullah 3mar abou reashaNo ratings yet

- تطبيقات عملية PDFDocument30 pagesتطبيقات عملية PDFMohamed YahyaNo ratings yet

- Chapter (5) Di Fsidl Dsidls T Design of Spindles and Spindle SupportsDocument16 pagesChapter (5) Di Fsidl Dsidls T Design of Spindles and Spindle Supportsabdullah 3mar abou reashaNo ratings yet

- Invoice 1109Document1 pageInvoice 1109abdullah 3mar abou reashaNo ratings yet

- Wear and Friction Properties of Epoxy-Polyamide Blend Nanocomposites Reinforced by MwcntsDocument7 pagesWear and Friction Properties of Epoxy-Polyamide Blend Nanocomposites Reinforced by Mwcntsabdullah 3mar abou reashaNo ratings yet

- ISO 90012015checklist - tcm14 57745 PDFDocument25 pagesISO 90012015checklist - tcm14 57745 PDFDaniela Muñoz SaldiasNo ratings yet

- Chapter 7 - Lathes - Metal Arts PressDocument8 pagesChapter 7 - Lathes - Metal Arts Pressabdullah 3mar abou reashaNo ratings yet