Professional Documents

Culture Documents

Accounting Flow

Accounting Flow

Uploaded by

Shakhir Mohun0 ratings0% found this document useful (0 votes)

5 views13 pagesOriginal Title

Accounting_Flow

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views13 pagesAccounting Flow

Accounting Flow

Uploaded by

Shakhir MohunCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 13

Accounting Flow and Related Information

Author: Navin Gadidala, PM & Strategy-Leasing

Introduction:

Lease Accounting (FLA) a new product on Oracle Cloud which is bundled with Oracle Financials. This paper captures the

accounting flows for all accounting events seeded by Oracle till 21.C.

Lease Accounting supports Multi-GAAP and using this feature, customers can comply with multiple accounting standard-

IFRS1 and USGAAP-ASC 42 in Primary and Secondary Ledgers as per their choice.

Lease Accounting supports Multi-Currency distinguishing between Monetary/Non-Monetary items.

Accounting Events

Till 21.C, FLA has the below mentioned accounting events/classes seeded. Please go through the below table:

S.No Accounting Event Explanation

Lease Booking event generates ROU, Lease Liability and Reserve if needed. This

accounting event is generated when the Lease Status moves to 'Active' and Lease

a Lease Booking Version Status moves to 'Finalized.

Lease Version Status moves to 'Finalized' when 'Attach Lease Details Report' is

clicked as a final step in Lease Activation.

This process generates Lease Interest and Lease Amortization Expenses for each of

b Lease Expense the periods. 'Process Lease Accounting' ESS generates the transactions for the Lease

Expenses

Lease Revision accounting event is generated whenever an amendment is finalized.

Scope Increase/Scope No change/Scope Decrease will cause Lease Revision events.

c Lease Revision Only for Scope Decrease, gain/loss is generated. Users can also update Lease

Payments and this will cause Lease Revision.

Early option exercise will also lead to Lease Revision.(21A and 21B)

Lease Payment Compliance payments with Lease Liability checkbox when approved, generates

d Lease Payment Approval Accounting Event(21.B). With this event, Lease Liability

Approvals

balance is brought down.

Added in 21C. Lease/Asset Termination generates this event. Even exercise of

Termination option leads to this accounting event. ROU/Liability balances on the

e Lease Termination termination date are rolled off with the difference getting posted into Gain/Loss.

Accounting is also generated for an 'Expired' lease when the Process Lease

Accounting for Lease Expiration is run. This closes out the balances in Right of Use

and Accumulated Amortization account.

Default Accounts

Default Accounts can be provided on the Payment Templates. When a payment is created out of payment templates,

these accounts flow to the lease and from lease to Subledger Accounting engine on the cloud for transaction accounting.

Following Default Accounts are provided:

a. Right of Use—ROU account. Mandatory for Lease Booking

b. Lease Liability—Lease Liability account. Mandatory for Lease Booking

c. Reserve---Reserve is used whenever ROU amount is not same as Lease Liability amount

d. Interest Expense- Interest Expense account is needed to capture interest expense accrual in IFRS1 , and it is

included into Lease Expense in ASC 42. Mandatory for IFRS1

e. Amortization Expense- Amortization Expense (equivalent of Depreciation Charge) account is needed to capture

Amortization Expense accrual in IFRS1 , and it is included into Lease Expense in ASC 42. Mandatory for ASC 42.

f. Accumulated Amortization: Amortization Expense is piled up into this account. Mandatory account for Lease

Expense accounting event.

g. Lease Expense- ASC 42 Lease Expense Account. Mandatory account for ASC 42.

h. Non-Compliance Expense- Charge account for the non-compliance expense (no liability/ROU checkboxes). This

account is used on non-compliance invoices on the expense distribution when it reaches AP. Mandatory account if

AP setup does not have ‘Expense’ account defined in setups.

i. Payables Clearing: For Compliance payments, this account is used as offset for creating temporary AP Liability

charge. This is a mandatory account for Lease Payments Approval event

j. Payables Liability- AP Liability which is used on the credit side of AP Invoice. FLA send this account on the invoices

which are sourced from it. If AP setup does not have this account, then this account needs to be necessarily defined

on Payment.

k. Gain/Loss: For all Terminations and Scope Decrease Amendments, FLA calculates gain/loss

l. Forex Gain/Loss: This account is used during ‘Revision’ transactions for revaluation of ‘ROU’ for forex transactions.

FLA’s default accounting is being captured below for each of the accounting standards and users can override this through

SLA configuration if there is a need to do that.

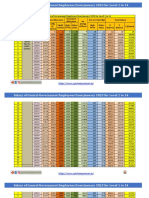

IFRS16

ROU(Yes), Liability(Yes) ROU(Yes), Liability(No) ROU(No), Liability(Yes) ROU(No), Liability(No)

Event( Dr Cr Dr Cr Dr Cr Dr Cr

Booking ROU Lease Liability ROU Reserve Reserve Lease No No Accounting

Liability Accounting

Accruals (Periodical Amortization Accumulated Amortization Accumulated Interest Lease No No Accounting

Expenses) Expense Amortization Expense Amortization Expense Liability Accounting

Interest

Expense Lease Liability

Payment Approval Lease AP Clearing No No Lease AP Clearing No No Accounting

Liability Accounting Accounting Liability Accounting

AP Invoice AP Clearing AP Liability Reserve AP Liability AP Clearing AP Liability Non AP Liability

Compliance

Expense

Revision - Remeasurement ROU Lease Liability ROU Reserve Reserve Lease No No Accounting

Liability Accounting

Revision - Reduction Lease ROU Loss ROU Lease Gain No No Accounting

(Scope Decrease) Liability Liability Accounting

Loss (If Loss) Gain (If Gain)

Termination Lease ROU Loss ROU Lease Gain No No Accounting

Liability Liability Accounting

Loss (If Loss) Gain (If Gain)

Lease Accumulated ROU Accumulated ROU No No No No Accounting

Expiration(Termination Amortization Amortization Accounting Accounting Accounting

Event)

Option Cancellation Lease ROU Loss ROU Lease Gain No No Accounting

Liability Liability Accounting

Loss (If Loss) Gain (If Gain)

Option Exercise ROU Lease Liability ROU Reserve Reserve Lease No No Accounting

Liability Accounting

Lease ROU Loss ROU Lease Gain No No Accounting

Liability Liability Accounting

Loss (If Loss) Gain (If Gain)

For ASC 42, the below accounting is derived:

ASC842

Flags ROU(Yes), Liability(Yes) ROU(Yes), Liability(No) ROU(No), Liability(Yes) ROU(No), Liability(No)

Event Dr Cr Dr Cr Dr Cr Dr Cr

Booking ROU Lease Liability ROU Reserve Reserve Lease Liability No Accounting No

Accounting

Accruals(Periodical Expenses) Lease Expense Accumulated Lease Expense Accumulated Lease Lease Liability No Accounting No

Amortization Amortization Expense Accounting

Lease Expense Lease Liability

Payment Approval(FLA) Lease Liability AP Clearing No No Lease AP Clearing No Accounting No

Accounting Accounting Liability Accounting

AP Invoice AP Clearing AP Liability Reserve AP Liability AP Clearing AP Liability Non AP Liability

Compliance

Expense

Revision - Remeasurement ROU Lease Liability ROU Reserve Reserve Lease Liability No Accounting No

Accounting

Revision - Reduction (Scope Lease Liability ROU Loss ROU Lease Gain No Accounting No

Decrease) Liability Accounting

Loss(If Loss) Gain(If Gain)

Termination Lease Liability ROU Loss ROU Lease Gain No Accounting No

Liability Accounting

Loss (If Loss) Gain (If Gain)

Lease Expiration(Termination Accumulated ROU Accumulated ROU No No No Accounting No

Event) Amortization Amortization Accounting Accounting Accounting

Option Cancellation Lease Liability ROU Loss ROU Lease Gain No Accounting No

Liability Accounting

Loss (If Loss) Gain (If Gain)

Option Exercise ROU Lease Liability ROU Reserve Reserve Lease Liability No Accounting No

Accounting

Lease Liability ROU Loss ROU Lease Gain No Accounting No

Liability Accounting

Loss (If Loss) Gain (If Gain)

Notes:

1 All the above mentioned accounting gets reversed in case the amounts are negative

2 The above accounting is for events that are solutioned till end of 21.C

3 Numbers in Forex currency are first accounted in entered currency and then converted to Functional currency

R le of Con e ion o F nc ional C enc o he han U e Ra e T pe

a Right of Use and Liability are initially converted using Forex Rates on Lease Amortization Start Date

b For migrated leases, ROU balances are converted using user provided rate

c Interest Expense is converted using period end date

d Amortization Expense is converted using initial ROU rate or if there is an amendment, using the Rate on

Amendment Commencement Rate from amendment date and onwards

e Payment Invoice processing uses rate on Invoice Due Date

f Outstanding unamortized ROU is revalued to latest Forex rate during every amendment with the

difference hitting Forex Gain/Loss

g During most of the amendments, expenses accrued and accounted for periods greater than amendment

commencement date are reversed and recreated. Hence accounting is reversed and recreated accordingly.

h All expenses are transaction dated as period end date and Accounting Date is the transaction date or first

day of next open period

4 ASC 42 follows IFRS if the lease classification is Finance

Accounting Events

All the above accounting events are seeded and added to ‘Standard Accrual’ accounting method by Oracle. If you are using

a custom ‘Accounting Method’ you will need to add each of these accounting classes to your Accounting Method following

by activation of the accounting method and finally run ‘Update Subledger Accounting Options’ process with Lease

Accounting as parameter.

Navigation: Setup and Maintainence Manage Accounting Methods Set Scope to Lease Accounting Your Custom

Accounting Method Add Accounting Classes as shown in this screenshots:

Select your Accounting Method:

Add each of these Accounting Event Classes and Rule Set as below and then activate.

Please do not forget to run ‘Update Subledger Accounting Options’ ESS with Lease Accounting as parameter finally as

shown below:

In case you have Secondary ledger, please perform this action as well:

You might also like

- General LedgerDocument2 pagesGeneral LedgerAbhi AbhiNo ratings yet

- Multi Period AccountingDocument67 pagesMulti Period AccountingRajendra Pilluda100% (1)

- Oracle Leasing Solution To IFRS16 ASC842Document72 pagesOracle Leasing Solution To IFRS16 ASC842Satya Raya100% (1)

- Business Plan Template Excel FreeDocument13 pagesBusiness Plan Template Excel FreeShreya More75% (8)

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- AGIS OverviewDocument9 pagesAGIS OverviewRupak SinghNo ratings yet

- 7) Fusion Accounting Hub For Insurance Premium - External SourceDocument18 pages7) Fusion Accounting Hub For Insurance Premium - External Sourcekeerthi_fcmaNo ratings yet

- MF SlaDocument33 pagesMF SlaMihai Fildan100% (1)

- Oracle Lease and Finance Management PDFDocument51 pagesOracle Lease and Finance Management PDFAhmed AbozeadNo ratings yet

- Fusion Fa SlaDocument41 pagesFusion Fa SlaVemula Durgaprasad100% (2)

- Oracle FA QuestionnaireDocument12 pagesOracle FA QuestionnaireInderjeet SinghNo ratings yet

- Secondary Tracking SegmentDocument5 pagesSecondary Tracking Segmentrsririshi100% (1)

- Document 1061798.1 CalendarDocument7 pagesDocument 1061798.1 CalendarRedrouthu JayaprakashNo ratings yet

- Certain Tables Used For Reporting On Budgetary Control Are Not Listed in The Online Documentation For Oracle Fusion General Ledger Cloud Service PDFDocument2 pagesCertain Tables Used For Reporting On Budgetary Control Are Not Listed in The Online Documentation For Oracle Fusion General Ledger Cloud Service PDFBhavikNo ratings yet

- AP AR Netting OracleDocument3 pagesAP AR Netting Oracleiam_ritehereNo ratings yet

- FA Period CloseDocument2 pagesFA Period CloseIBT InfotechNo ratings yet

- Fusion Accounting Hub Reporting Cloud Anil Patil Blog PDFDocument64 pagesFusion Accounting Hub Reporting Cloud Anil Patil Blog PDFRaveen KumarNo ratings yet

- Introduction To Cash Management: Rohit DaswaniDocument39 pagesIntroduction To Cash Management: Rohit DaswaniRohit DaswaniNo ratings yet

- R12 Unaccounted Transactions Sweep Program in APDocument2 pagesR12 Unaccounted Transactions Sweep Program in APalf12alf100% (1)

- AP Profile OptionsDocument7 pagesAP Profile OptionsMina SamehNo ratings yet

- Operational Analysis Questionnaire Accounts Payable: Author: Creation Date: Last Updated: R12 StatusDocument12 pagesOperational Analysis Questionnaire Accounts Payable: Author: Creation Date: Last Updated: R12 StatusShamika MevanNo ratings yet

- Oracle Payables Holds: Summary of Invoice Hold NamesDocument12 pagesOracle Payables Holds: Summary of Invoice Hold NamesjrparidaNo ratings yet

- Fusion Financials JournalApprovals GLDocument40 pagesFusion Financials JournalApprovals GLSrinivasa Rao AsuruNo ratings yet

- BR100Document23 pagesBR100AnshuanupamNo ratings yet

- Expenses ActivitiesDocument38 pagesExpenses ActivitiesDhanesh DhamanaskarNo ratings yet

- VAT in Oracle EBSDocument8 pagesVAT in Oracle EBSAbhishek IyerNo ratings yet

- Oracle R12 Fixed Assets Changes From 11iDocument29 pagesOracle R12 Fixed Assets Changes From 11isanjayapps100% (1)

- Oracle Fusion Accounting Hub Calculation Engine FahDocument4 pagesOracle Fusion Accounting Hub Calculation Engine FahSaurabh ModiNo ratings yet

- How Many Key Flexfields Are There in Oracle Financials?Document93 pagesHow Many Key Flexfields Are There in Oracle Financials?priyanka joshiNo ratings yet

- Using Budgetary Control For 2018Document2 pagesUsing Budgetary Control For 2018BhavikNo ratings yet

- Fah For Oaug 16jul15Document43 pagesFah For Oaug 16jul15zeeshan78No ratings yet

- Erptree Receipt Write OffDocument18 pagesErptree Receipt Write OffsureshNo ratings yet

- Application: Account Receivables Title: Deposit Transaction: OracleDocument20 pagesApplication: Account Receivables Title: Deposit Transaction: OraclesureshNo ratings yet

- Accounts Receivable - CRPDocument35 pagesAccounts Receivable - CRPmaddiboinaNo ratings yet

- Period Close (CM) 12Document5 pagesPeriod Close (CM) 12jabar aliNo ratings yet

- General Ledger Interview Questions in R12Document9 pagesGeneral Ledger Interview Questions in R12jeedNo ratings yet

- Budget in OracleDocument21 pagesBudget in Oracleoracleapps R12No ratings yet

- Fixed Assets: Internal & ConfidentialDocument93 pagesFixed Assets: Internal & Confidentialahmed_1233No ratings yet

- Oracle General Ledger (GL) Interview Questions and Answers (FAQs)Document13 pagesOracle General Ledger (GL) Interview Questions and Answers (FAQs)C Nu100% (1)

- Budget: Planning Budget: in This Planning Budget We Just Plan The Expenditures But There Will Not Be AnyDocument20 pagesBudget: Planning Budget: in This Planning Budget We Just Plan The Expenditures But There Will Not Be AnybiswalsNo ratings yet

- GL Requirement QuestionnaireDocument3 pagesGL Requirement QuestionnaireSandip GhoshNo ratings yet

- General Ledger Accounting CycleDocument4 pagesGeneral Ledger Accounting CycleSrinadh MaramNo ratings yet

- Encumbrance Accounting - Setup and UsageDocument15 pagesEncumbrance Accounting - Setup and Usageniza2000inNo ratings yet

- Application Account Payables Title: Retainage Invoice: OracleDocument24 pagesApplication Account Payables Title: Retainage Invoice: OraclesureshNo ratings yet

- Encumbrance Accounting, Budgetary Accounting and Budgetary ControlDocument33 pagesEncumbrance Accounting, Budgetary Accounting and Budgetary ControlasdfNo ratings yet

- Oracle-Fusion-Tax - Analysis PDFDocument43 pagesOracle-Fusion-Tax - Analysis PDFRaveen Kumar100% (1)

- Assign Security in Fusion ERPDocument18 pagesAssign Security in Fusion ERPKaviraj MathNo ratings yet

- R12Projects White Paper Part IIDocument137 pagesR12Projects White Paper Part IIrahuldisyNo ratings yet

- Oracel Eb-Suite With FAH An Overview v3Document26 pagesOracel Eb-Suite With FAH An Overview v3Kaviraj MathNo ratings yet

- Consolidations GLDocument50 pagesConsolidations GLNikhil YadavNo ratings yet

- Oracle AGIS - IntercompanyDocument8 pagesOracle AGIS - IntercompanyAmitNo ratings yet

- Oracle AR QuestionnaireDocument5 pagesOracle AR Questionnairesridhar_eNo ratings yet

- GL PPT Basic For Oracle AppsDocument81 pagesGL PPT Basic For Oracle AppsPhanendra KumarNo ratings yet

- E-Mail - Print - PDFDocument87 pagesE-Mail - Print - PDFabadrhNo ratings yet

- SLA TechnicalDocument20 pagesSLA TechnicalRanjita08No ratings yet

- EBT Implementation ConsiderationsDocument45 pagesEBT Implementation ConsiderationsTarun JainNo ratings yet

- Functional PayablesDocument78 pagesFunctional PayablesSekhar AppsNo ratings yet

- Harinath - Oracle Apps Finance FunctionalDocument4 pagesHarinath - Oracle Apps Finance FunctionalAnuNo ratings yet

- Fixed Asset User Guide OracleDocument36 pagesFixed Asset User Guide OracleBilal MaqsoodNo ratings yet

- FSG WhitepaperDocument83 pagesFSG WhitepaperWalter Spinelli100% (1)

- Oracle Fusion Applications The Ultimate Step-By-Step GuideFrom EverandOracle Fusion Applications The Ultimate Step-By-Step GuideNo ratings yet

- Using The Control Budget Filter To Determine The Control Budgets For TransactionsDocument2 pagesUsing The Control Budget Filter To Determine The Control Budgets For TransactionsBhavikNo ratings yet

- Using Budgetary Control For 2018Document2 pagesUsing Budgetary Control For 2018BhavikNo ratings yet

- Cannot Change The Status of Control Budget Control Budget From Not Ready For Use - Redefining PDFDocument2 pagesCannot Change The Status of Control Budget Control Budget From Not Ready For Use - Redefining PDFBhavikNo ratings yet

- Control Budget Performed To Accounts Not Setup For Budgetary ControlDocument2 pagesControl Budget Performed To Accounts Not Setup For Budgetary ControlBhavikNo ratings yet

- Control Budget Naming Standards For Essbase Doc ID 1987481.1 PDFDocument3 pagesControl Budget Naming Standards For Essbase Doc ID 1987481.1 PDFBhavikNo ratings yet

- Socrative Quiz - Week 4 (With Solution)Document3 pagesSocrative Quiz - Week 4 (With Solution)jenny kimNo ratings yet

- Worksheet ProblemDocument4 pagesWorksheet Problemusernames358No ratings yet

- STRATEGIC COSTMan QUIZ 3Document5 pagesSTRATEGIC COSTMan QUIZ 3StephannieArreolaNo ratings yet

- Heritage Foods CaseDocument14 pagesHeritage Foods CasePriya DurejaNo ratings yet

- Keac 211Document38 pagesKeac 211vichmegaNo ratings yet

- Manual of Cost Accounting in The Ordnance and Ordnance Equipment Factories Section - I General ObjectsDocument73 pagesManual of Cost Accounting in The Ordnance and Ordnance Equipment Factories Section - I General ObjectsSachin PatelNo ratings yet

- Chapter 04 Modern Advanced AccountingDocument31 pagesChapter 04 Modern Advanced AccountingPhoebe Lim81% (21)

- GaneshDocument1 pageGaneshganeshtambre747No ratings yet

- Vardhan 1Document12 pagesVardhan 1DHYAN PATELNo ratings yet

- Salary From January 2023 With 42% DA by GE NewsDocument22 pagesSalary From January 2023 With 42% DA by GE NewsAditya Prasad MishraNo ratings yet

- Aditya FactsetDocument4 pagesAditya FactsetAditya KattaNo ratings yet

- Meteorology Today An Introduction To Weather Climate and The Environment 2nd Edition Ahrens Test BankDocument36 pagesMeteorology Today An Introduction To Weather Climate and The Environment 2nd Edition Ahrens Test Banksaturnagamivphdh100% (26)

- Triune Technologies: General Ledger (GL)Document26 pagesTriune Technologies: General Ledger (GL)Saq IbNo ratings yet

- Accounting-Chapter 3Document53 pagesAccounting-Chapter 3Maisha Uddin100% (1)

- Develop and Understand TaxationDocument26 pagesDevelop and Understand TaxationNigussie BerhanuNo ratings yet

- DFSA Form PDFDocument2 pagesDFSA Form PDFvalerieNo ratings yet

- Truck Stop Business PlanDocument37 pagesTruck Stop Business PlanZUZANI MATHIYANo ratings yet

- 2nd Quiz Midterm Acctg12Document3 pages2nd Quiz Midterm Acctg12Erma Caseñas50% (2)

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Unit 5 Yew Tree Business Centre - Draft Rent Deposit Deed v1 09.02.2016Document10 pagesUnit 5 Yew Tree Business Centre - Draft Rent Deposit Deed v1 09.02.2016Jamie ThomasNo ratings yet

- Business PlanDocument20 pagesBusiness PlanAbhishek VishwakarmaNo ratings yet

- Examples of Trading and Profit and Loss Account and Balance SheetDocument5 pagesExamples of Trading and Profit and Loss Account and Balance SheetSaad Arshad Mughal83% (6)

- Sanlam Kenya PLC - Audited Financial Statements For The Period Ended 31-Dec-2023Document2 pagesSanlam Kenya PLC - Audited Financial Statements For The Period Ended 31-Dec-2023Denis KibetNo ratings yet

- MOADocument18 pagesMOANicah AcojonNo ratings yet

- Fundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manual 1Document36 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manual 1toddvaldezamzxfwnrtq100% (27)

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- POA Exercise AnswersDocument90 pagesPOA Exercise AnswersEmily Tan50% (2)

- Exercises On Acc Eqn - 26 QuesDocument12 pagesExercises On Acc Eqn - 26 QuesNeelu AggrawalNo ratings yet