Professional Documents

Culture Documents

Dipesh Jain - CFC Assignment 2 Revised

Dipesh Jain - CFC Assignment 2 Revised

Uploaded by

Dipesh JainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dipesh Jain - CFC Assignment 2 Revised

Dipesh Jain - CFC Assignment 2 Revised

Uploaded by

Dipesh JainCopyright:

Available Formats

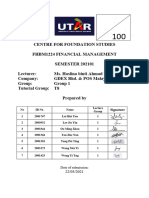

Dipesh Jain Title Page

Fundamental Stock Valuation Case

Case & Homework Assignment

Master of Business Administration & Engineering

Dipesh Jain

-

Matriculation number: s0581383

Date:

Berlin, 05.11.2021

Guided By:

Prof. Dr. Thomas Rachfall

Fundamental Stock Valuation Case Ⅰ

Dipesh Jain Abstract

ABSTRACT

Fundamental analysis is a method of determining a stocks real or fair market value. With the

help of fundamental analysis, we can search for stocks that are currently trading at higher or

lower than their real value. Key fundamental indicators such as PE ratio, PB ratio, Earnings per

share and the Dividend yield are used to carry out the fundamental analysis. This assignment

evaluates these ratios of 4 top companies in global market along with carrying out their

benchmarking to identify the best-in-class company.

Keywords: Fundamental Metrics, Overvalued, Undervalued, Peer, Earnings momentum.

Fundamental Stock Valuation Case IⅠ

Dipesh Jain List of Abbreviations

LIST OF ABBREVIATIONS

PE Ratio: Price to Earnings ratio

PB Ratio: Price to Book Ratio

EPS: Earnings per share

EM: Earnings Momentum

ROI: Return on Investments

Fundamental Stock Valuation Case IIⅠ

Dipesh Jain List of Figures

LIST OF FIGURES

Figure 1 Benchmarking based on ROI and ROS 1

Figure 2 ROS 2017-2020 / 2022 Forecast 1

Figure 3 Benchmarking based on ROI and ROS 1

Figure 4 Valuation/ Earnings Momentum Matrix 2

Figure 5 VIACOM Stock Chart 3

Figure 6 Walt Disney Stock Chart 3

Figure 7 AT&T Stock Chart 3

Fundamental Stock Valuation Case IV

Dipesh Jain Index of Formulas

INDEX OF FORMULAS

𝑀𝑎𝑟𝑘𝑒𝑡 𝑉𝑎𝑙𝑢𝑒 𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

1. 𝑃𝑟𝑖𝑐𝑒 𝑡𝑜 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑟𝑎𝑡𝑖𝑜 =

𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝑀𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒 𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

2. 𝑃𝑟𝑖𝑐𝑒 𝑡𝑜 𝐵𝑜𝑜𝑘 𝑟𝑎𝑡𝑖𝑜 =

𝐵𝑜𝑜𝑘 𝑣𝑎𝑙𝑢𝑒 𝑝𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝑝𝑟𝑒𝑓𝑓𝑒𝑟𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠

3. 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 =

𝐸𝑛𝑑 𝑜𝑓 𝑝𝑒𝑟𝑖𝑜𝑑 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠ℎ𝑎𝑟𝑒 𝑜𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

𝐸𝐵𝐼𝑇

4. 𝑅𝑂𝐼% = ∗ 100

𝑇𝑜𝑡𝑎𝑙 𝐵𝑜𝑜𝑘 𝐶𝑎𝑝𝑖𝑡𝑎𝑙

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑃𝑟𝑜𝑓𝑖𝑡/𝐸𝐵𝐼𝑇

5. 𝑅𝑂𝑆 =

𝑁𝑒𝑡 𝑠𝑎𝑙𝑒𝑠

Fundamental Stock Valuation Case V

Dipesh Jain Table of Contents

TABLE OF CONTENTS

ABSTRACT………………………………………………………………………………….. Ⅱ

LIST OF ABBREVIATIONS.……………………………………………………………….. ⅡI

LIST OF FIGURES…………………………………………………………………………...IV

INDEX OF FORMULAS……………………………………………………………………...V

TABLE OF CONTENTS……………………………………………………………….…….VI

INTRODUCTION...……………………………………………………………….….……... 01

OBJECTIVES……………………………...……………………...………………….............01

METHODOLOGY…………….….……………………………………………………......... 01

3.1. ROI & ROS…………………………………………………………………………….01

3.2. FUNDAMENTAL METRICS ANALYSIS……………………………………………02

3.3. CHART ANALYSIS…………………………………………………………………...03

2. PEER GROUP…………………………………………………………………………... 04

3. CONCLUSION…………………………………………………………………………. 04

REFERENCES……………………………………………………………………………....VII

Fundamental Stock Valuation Case VI

Dipesh Jain Homework

1. Introduction

Evaluating a company’s financial background with the purpose to invest is always intriguing.

However, one cannot just judge a company on assumptions or rumors. The proper way to

examine the past financial records/balance sheets of the company and its current performance

in the market as compared to its peers, so as to predict the future growth of the company is

called the Fundamental Analysis. This process is not only limited to the company’s financials

but also with the general economic scenario, the industry’s growth and fall, along with the

company’s organizational structure and management.

2. Objectives

In this report, fundamental analysis of 4 companies – Viacom, Sab miller, Walt Disney, and

AT&T has been carried out to determine which stock needs to be bought and which stock

needs to sold or kept on hold or observe. After the evaluation, a peer company has to be found

out which is considered to be undervalued on the market.

3. Methodology

3.1. ROI & ROS

ROI & ROS for the year 2017-2020 have been calculated as per the given formulas.

Figure 1 ROI 2017-2020 / 2022 Forecast

Figure 2 ROS 2017-2020 / 2022 Forecast

Figure 3 Benchmarking based on ROI and ROS

Fundamental Stock Valuation Case 1

Dipesh Jain Homework

Financials of the above companies have all been affected by the Covid 19 pandemic. It was due

to an external factor and not because there was something wrong in the company. Hence

forecasting based on the year 2020 is difficult as some companies faced tremendous loss such

as the entertainment industry (Walt Disney), because of the closed attractions, theme parks,

delayed shootings, etc. But now everything is starting to get back to normal and the companies

may also return to their financial stabilities as in the previous years. Hence forecasting based

on just last 4 years of data would be inaccurate. However as per the assignment, based on the

data we found that Viacom is the best-in-class company based on its ROI and Sab Miller is the

Worst in class.

3.2. Fundamental Metrics Analysis

Figure 4 Valuation/ Earnings Momentum Matrix

We can see that by putting all the companies in the Valuation/Earnings momentum matrix, we

can derive that AT&T is the share to Buy, Walt Disney is the share to Hold, Viacom is the

share to Observe, and Sab Miller is the share to Sell.

Also, we can observe that earnings momentum of Walt Disney was quite unusual between the

second and third quarter. It is due the Covid-19 situations and the restrictions place on the

company by the government during this crisis.

Fundamental Stock Valuation Case 2

Dipesh Jain Homework

3.3. Chart Analysis

SAB Miller plc was a British multinational brewing and beverage company headquartered in

Woking, England on the outskirts of London until 10 October 2016 when it was acquired by

Anheuser-Busch InBev. Hence Stock price chart of Sab Miller is now unavailable.

Viacom (VIAC) had steep drop in share prices in April after which the price has slowly but

consistently moving in downward trends.

Figure 5 VIACOM Stock Chart

Walt Disney (DIS) has been trying to stay above the 170 mark thus forming a descending

triangle pattern. Price is currently at the support and may give a breakout in the coming

sessions.

Figure 6 Walt Disney Stock Chart

AT&T (T) is showing a downward trend continuously since June 2021. However, it looks

like the stock has been oversold which led to decrease in its share price and may thus bounce

back in a few sessions.

Figure 7 AT&T Stock Chart

Fundamental Stock Valuation Case 3

Dipesh Jain Homework

4. Peer Group

According to my research, the company Discovery listed on the American stock exchange

(Tik: DISCK), is an undervalued company compared to Walt Disney.

Discovery has a PE ratio of 9.06 as on November 3rd, 2021. It also has a PB ratio of just 0.92

and thus have a tendency to at least reach 1.0. It also has a Price to Cash Flow ratio of 7.48

which is less and indicates the potential for cash flow generation.

Also, Verizon can be called an undervalued compared when compared to Viacom and AT&T.

It has a PE ratio of 9.86 and a price to cash flow ratio of 9.59.

5. Conclusion

After performing the fundamental analysis for all the four companies, we can see that AT&T is

the best stock to buy right now and Viacom is good to invest in the future.

But after comparing the financial performance benchmarking with the results of the

fundamental metrics, I found that AT&T isn’t the best-in-class company but instead its Viacom.

I think that the Covid 19 pandemic may have affected the fundamental analysis as the

company’s financials were fluctuating in that particular year. So, fundamental analysis has to

be carried out on large number of past data and cannot be used to forecast the financials of the

company with just 3 years of data and during the times of such a pandemic. However, based on

past data and calculated ROI/ROS, Viacom seems a better choice for investment.

Hence, I would like to invest in VIACOM

Fundamental Stock Valuation Case 4

Dipesh Jain References

REFERENCES

https://www.macrotrends.net/

https://www.tradingview.com/

https://www.wsj.com/

Fundamental Stock Valuation Case VI

You might also like

- Focus Questions For Laura MartinDocument10 pagesFocus Questions For Laura MartinEyiram Adanu100% (2)

- Top 75 KPIs For Human Resources DepartmentDocument9 pagesTop 75 KPIs For Human Resources DepartmentAlexxyaNo ratings yet

- Magkano Ba Ang Magpadesign NG Plano Sa ArkitektoDocument2 pagesMagkano Ba Ang Magpadesign NG Plano Sa ArkitektoPaul Ni�o DechosNo ratings yet

- Financial Statements Analysis Case StudyDocument17 pagesFinancial Statements Analysis Case StudychrisNo ratings yet

- Focus Questions For Laura MartinDocument10 pagesFocus Questions For Laura MartinAgnik DuttaNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysistimbulmanaluNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisRizka HendrawanNo ratings yet

- Assignment 1. Gucci CaseDocument8 pagesAssignment 1. Gucci Caseafif12No ratings yet

- Assessment Formal AssessmentDocument8 pagesAssessment Formal Assessmentashish100% (1)

- Dipesh Jain - CFC Assignment 5Document14 pagesDipesh Jain - CFC Assignment 5Dipesh JainNo ratings yet

- Dipesh Jain - CFC Assignment 1Document9 pagesDipesh Jain - CFC Assignment 1Dipesh JainNo ratings yet

- Ratio Analysis: A Study On Financial Performance of Tata MotorsDocument7 pagesRatio Analysis: A Study On Financial Performance of Tata MotorsKapil AroraNo ratings yet

- Valuation of Startups: Click To Edit Master Title StyleDocument25 pagesValuation of Startups: Click To Edit Master Title Stylevinay dugar100% (1)

- Anderson Autoparts Dividend PolicyDocument8 pagesAnderson Autoparts Dividend PolicyEthan Law100% (1)

- Week 2 FINA2207Document31 pagesWeek 2 FINA2207blythe shengNo ratings yet

- A Guide To Understanding Stock ScreenersDocument7 pagesA Guide To Understanding Stock ScreenerssubbaraokommuriNo ratings yet

- Ebay Inc.: Case Analysis ofDocument8 pagesEbay Inc.: Case Analysis ofmokshgoyal2597No ratings yet

- Oil & Gas Modeling: - Quiz Questions: Module 3 - Valuation and Simplified NAV ModelDocument20 pagesOil & Gas Modeling: - Quiz Questions: Module 3 - Valuation and Simplified NAV ModelManish JhaNo ratings yet

- Ch13 Wiley Plus Wk3Document58 pagesCh13 Wiley Plus Wk3Prakash VaidhyanathanNo ratings yet

- Ip RelVal01Document3 pagesIp RelVal01Liew Chee KiongNo ratings yet

- Fundamental AnalysisDocument52 pagesFundamental Analysisrahairi100% (5)

- Trading Smart With Fundamental AnalysisDocument51 pagesTrading Smart With Fundamental Analysisjihad jamarei100% (1)

- BPCLDocument8 pagesBPCLvipin chahal100% (1)

- Basic Fundamental AnalysisDocument5 pagesBasic Fundamental AnalysisDeepal DhamejaNo ratings yet

- Fundamental Analysis (IT Sector)Document44 pagesFundamental Analysis (IT Sector)Sehejmeet Singh NandaNo ratings yet

- Chapter One Financial Objectives-Review of F9 KnowledgeDocument17 pagesChapter One Financial Objectives-Review of F9 Knowledgekuttan1000100% (1)

- Fundamental AnalysisDocument15 pagesFundamental AnalysisGagan VibhuNo ratings yet

- Assignment 3 2021Document5 pagesAssignment 3 2021Zahra HussainNo ratings yet

- Project On Foreign Exchange MarketDocument72 pagesProject On Foreign Exchange MarketDishant YadavNo ratings yet

- IM Assignment4Document5 pagesIM Assignment4Sanket AndhareNo ratings yet

- FM - 1 To 3Document169 pagesFM - 1 To 3FCA Zaid Travel VlogsNo ratings yet

- Other Stock NotesDocument13 pagesOther Stock NotesManish GuptaNo ratings yet

- 01 DAIS Question Module 03 Finance HANDOUT 933680800790651Document5 pages01 DAIS Question Module 03 Finance HANDOUT 933680800790651ronny nyagakaNo ratings yet

- Va02 12pdDocument35 pagesVa02 12pdridwanbudiman2000No ratings yet

- Determinants of Firm Value in Kenya: Case of Commercial Banks Listed at The Nairobi Securities ExchangeDocument14 pagesDeterminants of Firm Value in Kenya: Case of Commercial Banks Listed at The Nairobi Securities Exchangeanon_828393156No ratings yet

- Equity ResearchDocument7 pagesEquity Researchmohammadhamza563No ratings yet

- ExampleDocument25 pagesExampleshun zhə.No ratings yet

- Absolute PE of StocksDocument13 pagesAbsolute PE of StocksJeet SinghNo ratings yet

- Learn Practise and Profit From InvestingDocument43 pagesLearn Practise and Profit From Investingvipinkala1No ratings yet

- Apple ReportDocument21 pagesApple Reportapi-555390406No ratings yet

- How To Perform Stock Research Using Fundamental AnalysisDocument5 pagesHow To Perform Stock Research Using Fundamental AnalysisSreenath NaniNo ratings yet

- GPF 1 Lec 2Document20 pagesGPF 1 Lec 2Habiba HishamNo ratings yet

- Financial Decision Making QP April 2021Document4 pagesFinancial Decision Making QP April 2021Nihar ShahNo ratings yet

- What Is Equity AnalysisDocument4 pagesWhat Is Equity AnalysisShiva Kumar MahadevappaNo ratings yet

- PE Ratio FMDocument2 pagesPE Ratio FMAbhilash ShuklaNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisNic AurthurNo ratings yet

- 1900cccc74252345 Nike Case AnalysisDocument9 pages1900cccc74252345 Nike Case AnalysistimbulmanaluNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisOktoNo ratings yet

- Nike Case Analysis PDFDocument9 pagesNike Case Analysis PDFSrishti PandeyNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisKwame Obeng SikaNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case Analysisshamayita sahaNo ratings yet

- Nike Case Solution PDFDocument9 pagesNike Case Solution PDFKunal KumarNo ratings yet

- 2022 ICM Part 7Document49 pages2022 ICM Part 7amkamo99No ratings yet

- What Drives Your Return On EquityDocument1 pageWhat Drives Your Return On Equitysilverjade03No ratings yet

- Balancing ROIC and Growth To Build ValueDocument8 pagesBalancing ROIC and Growth To Build ValueLuis Daniel Napa TorresNo ratings yet

- An Introduction To Fundamental Analysis: Jason O Bryan 19 September 2006Document23 pagesAn Introduction To Fundamental Analysis: Jason O Bryan 19 September 2006Saumil ShahNo ratings yet

- The Home DepotDocument7 pagesThe Home DepotWawire WycliffeNo ratings yet

- Brixton Et Al - AQR Q1 2022 Capital Market AssumptionsDocument17 pagesBrixton Et Al - AQR Q1 2022 Capital Market AssumptionsStephen LinNo ratings yet

- Financial PlanningDocument24 pagesFinancial PlanningDayaan ANo ratings yet

- Equity ResearchDocument7 pagesEquity Researchmohammadhamza563No ratings yet

- CH 04Document53 pagesCH 04Nirupa DudhatraNo ratings yet

- Rishabh Goyal - Investment ManagementDocument9 pagesRishabh Goyal - Investment ManagementRishabh GoyalNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Customs Administrative Order TemplateDocument6 pagesCustoms Administrative Order TemplateAlthea AcasNo ratings yet

- Quiz No. 2: Bachelor of Science in Information TechnologyDocument4 pagesQuiz No. 2: Bachelor of Science in Information TechnologyshihanNo ratings yet

- Chapter 01 Introduction To Managerial Decision ModelingDocument14 pagesChapter 01 Introduction To Managerial Decision ModelingRhea Joy C. MoralesNo ratings yet

- Change Management-An Unending Micro and Macro Minuet: Mariela K. Farhi-ZimmermanDocument11 pagesChange Management-An Unending Micro and Macro Minuet: Mariela K. Farhi-ZimmermanChinmayJoshiNo ratings yet

- Sridhar P - Notes On PMP (Formulas)Document5 pagesSridhar P - Notes On PMP (Formulas)KARTHIK145No ratings yet

- Dwnload Full Financial Accounting and Reporting A Global Perspective 5th Edition Stolowy Test Bank PDFDocument36 pagesDwnload Full Financial Accounting and Reporting A Global Perspective 5th Edition Stolowy Test Bank PDFkrossenflorrie355100% (15)

- Accounting 2Document157 pagesAccounting 2Christian Terens AblangNo ratings yet

- Resume - Brian AndersonDocument2 pagesResume - Brian AndersonBrian AndersonNo ratings yet

- Pricing in Indian RailwayDocument10 pagesPricing in Indian RailwayAnurag SinghNo ratings yet

- The Polish Cosmetic IndustryDocument20 pagesThe Polish Cosmetic IndustryBasil Fletcher100% (1)

- Work Sheet in Accounting 1Document8 pagesWork Sheet in Accounting 1Nancy AtentarNo ratings yet

- Econ PDFDocument36 pagesEcon PDFRicahbel Cabanlit SasamNo ratings yet

- Bon Chon in PhilippinesDocument4 pagesBon Chon in Philippinesmargie giloNo ratings yet

- Finite Math Final ProjectDocument14 pagesFinite Math Final Projectapi-396001914No ratings yet

- APC SG BrochureDocument14 pagesAPC SG BrochureVaruni RanavirageNo ratings yet

- Workmen of Dimakuchi Tea Estate Vs The ManagementDocument10 pagesWorkmen of Dimakuchi Tea Estate Vs The Managementboohoo19150% (2)

- Impact of Political Instability On Pakistan Stock MarketDocument6 pagesImpact of Political Instability On Pakistan Stock MarketSardar AftabNo ratings yet

- HoyleDocument5 pagesHoyleJose Matalo100% (2)

- EP 1110-1-8 Vo9 PDFDocument501 pagesEP 1110-1-8 Vo9 PDFyodiumhchltNo ratings yet

- WebSphere For Dummies (Handout)Document35 pagesWebSphere For Dummies (Handout)Anonymous BOOmZGNo ratings yet

- PGBM03 LC MayDocument3 pagesPGBM03 LC MayWaqas CheemaNo ratings yet

- 1 Introduction To EntreprenuershipDocument16 pages1 Introduction To EntreprenuershipKyla RodriguezaNo ratings yet

- Module 1.1 - Introduction-ELECDocument17 pagesModule 1.1 - Introduction-ELECheromiki316100% (1)

- Modern Machine Shop 262180-MAR 2014Document228 pagesModern Machine Shop 262180-MAR 20141mmahoneyNo ratings yet

- Pinto pm5 Inppt 03Document31 pagesPinto pm5 Inppt 03Gabriel Korletey0% (1)

- Business Development Strategy: A Case Study at The Largest Commercial Printing Company in MalaysiaDocument3 pagesBusiness Development Strategy: A Case Study at The Largest Commercial Printing Company in MalaysiaInternational Journal of Innovative Science and Research Technology100% (2)