Professional Documents

Culture Documents

Foreign Currency History

Foreign Currency History

Uploaded by

Elle VernezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foreign Currency History

Foreign Currency History

Uploaded by

Elle VernezCopyright:

Available Formats

Philippines Representative Office

The process for obtaining a license to transact business from the Philippines SEC to

operate a Foreign Company Representative Office in the Philippines is similar to that of the

Foreign Company Branch Office.

The required annual minimal inward remittance of funds for a Foreign Representative

Office as working capital is US$ 30,000.00 as opposed to a one time minimum remittance

of US$200,000.00 of a Foreign Branch Office as mandated by the SEC regulations. Every

year the parent company must remit at least US$ 30,000.00 to cover operating expenses.

A Representative Office of a foreign corporation may not derive income from its

operations in the Philippines. All of its operating costs must be covered by transfer of funds

from the parent company. Usual activities allowed are dealing with the clients of the parent

company, dissemination of information, promotion of company products and quality control

of products for export. It is forbidden to offer services to 3rd parties.

A Representative Office does not pay income taxes as none of its income is derived

from the Philippines and is not qualified to apply for tax incentives with

the BOI or PEZA authorities.

Dayanan Philippines Business Consultants will assist you with the setup and registration of

your business with the relevant government agencies for a quick opening of a

representative office in Philippines.

Philippines Representative Office Requirements

1 – Application Form

2 – Name Verification Slip (A name search will be done at the SEC to determine if the

corporate name

You might also like

- Registration of A Representative OfficeDocument2 pagesRegistration of A Representative OfficeGlory PerezNo ratings yet

- Foreign Corporations in The PhilippinesDocument3 pagesForeign Corporations in The PhilippinesRyan BalladaresNo ratings yet

- Business Registration RequirementsDocument17 pagesBusiness Registration RequirementsBeverlyNo ratings yet

- Representative OfficeDocument4 pagesRepresentative OfficeAbee TiponesNo ratings yet

- Legal M e M o R A N D U MDocument3 pagesLegal M e M o R A N D U MmyrahjNo ratings yet

- Foreign CorporationDocument8 pagesForeign CorporationRomNo ratings yet

- Discussion Paper On Representative Office As An Investment VehicleDocument5 pagesDiscussion Paper On Representative Office As An Investment VehicleMIKHAEL MEDRANONo ratings yet

- Domestic Corporations (Subsidiary)Document3 pagesDomestic Corporations (Subsidiary)Coco LocoNo ratings yet

- Regional Operating Headquarters (ROHQ) Shall Mean A Foreign Business Entity Which IsDocument5 pagesRegional Operating Headquarters (ROHQ) Shall Mean A Foreign Business Entity Which IsDaryl Jacob Bigay0% (1)

- Register A Branch Office in The PhilippinesDocument4 pagesRegister A Branch Office in The PhilippinesAudrey De GuzmanNo ratings yet

- Rohq DetailsDocument4 pagesRohq DetailsEumell Alexis PaleNo ratings yet

- Branch Vs Subsidiary (TAX)Document4 pagesBranch Vs Subsidiary (TAX)pokeball001No ratings yet

- Business Process Outsourcing GuideDocument6 pagesBusiness Process Outsourcing GuideLester PaulinoNo ratings yet

- Branch V Subsidiary CorporationDocument4 pagesBranch V Subsidiary CorporationKristian AguilarNo ratings yet

- Local Subsidiary - DC: Being Subject To Philippine Law Requirements On Corporate Structure. Like All StockDocument20 pagesLocal Subsidiary - DC: Being Subject To Philippine Law Requirements On Corporate Structure. Like All Stockred gynNo ratings yet

- Lecture Notes - Atty Steve Part 1Document9 pagesLecture Notes - Atty Steve Part 1Tesia MandaloNo ratings yet

- Choosing The Appropriate Mode For Foreign Corporations To Do Business in The Philippines (By DivinaLaw)Document9 pagesChoosing The Appropriate Mode For Foreign Corporations To Do Business in The Philippines (By DivinaLaw)JarwikNo ratings yet

- CIR Vs ShinkoDocument3 pagesCIR Vs ShinkoEllaine BernardinoNo ratings yet

- Important Information - Foreign Business in PHDocument4 pagesImportant Information - Foreign Business in PHGraze IsidroNo ratings yet

- 3 Tax Deductible Expenses With Limitations in PhilippinesDocument2 pages3 Tax Deductible Expenses With Limitations in PhilippinesChristine Bobis100% (1)

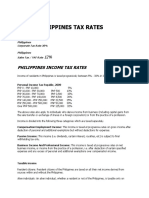

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesJL GEN0% (1)

- Income and TaxationDocument37 pagesIncome and TaxationStephanie Mharie EugenioNo ratings yet

- Philippines Income Tax RatesDocument6 pagesPhilippines Income Tax RatesKristina AngelieNo ratings yet

- Philippine Corporate TaxDocument3 pagesPhilippine Corporate TaxRaymond FaeldoñaNo ratings yet

- Company Formation in SingaporeDocument7 pagesCompany Formation in SingaporeShah AlamNo ratings yet

- Categories of Income and Tax RatesDocument5 pagesCategories of Income and Tax RatesRonel CacheroNo ratings yet

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesRonel CacheroNo ratings yet

- Week 16 and 17 Tax Incentives and BMBEDocument28 pagesWeek 16 and 17 Tax Incentives and BMBEwatanabe200412No ratings yet

- Corporate Taxes in The PhilippinesDocument2 pagesCorporate Taxes in The PhilippinesAike SadjailNo ratings yet

- Corporate Income Taxation-Special CorporationDocument24 pagesCorporate Income Taxation-Special CorporationXyla Marie EstorNo ratings yet

- Organizational ManagementDocument19 pagesOrganizational ManagementJulius San JoseNo ratings yet

- PWC NotesDocument2 pagesPWC NotesDave Mar IdnayNo ratings yet

- 05b Concept of Taxable IncomeDocument36 pages05b Concept of Taxable IncomeGolden ChildNo ratings yet

- Human Resources ManagemenentDocument8 pagesHuman Resources Managemenentalana blessila galloNo ratings yet

- 02A Income Taxes: Clwtaxn de La Salle UniversityDocument46 pages02A Income Taxes: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- Regular Income TaxationDocument2 pagesRegular Income TaxationAlyza CaculitanNo ratings yet

- Legal Documents You Need To Run A Business in Philippines SEC Registration DTI Registration Mayor's Business PermitDocument2 pagesLegal Documents You Need To Run A Business in Philippines SEC Registration DTI Registration Mayor's Business PermitblessingNo ratings yet

- Indonesia: in Case of Branches of Foreign Companies, TheDocument2 pagesIndonesia: in Case of Branches of Foreign Companies, TheVioni HanifaNo ratings yet

- Different Kinds of Taxes in The PhilippinesDocument4 pagesDifferent Kinds of Taxes in The PhilippinesJUDADRIEL MADRIDANONo ratings yet

- 2013 - Thinking Beyond Borders: PhilippinesDocument4 pages2013 - Thinking Beyond Borders: PhilippinesherleprasNo ratings yet

- FABM 2 Module 4 Income and Business TaxationDocument19 pagesFABM 2 Module 4 Income and Business TaxationOkim MikoNo ratings yet

- Bustax Chap 3 QuizDocument3 pagesBustax Chap 3 QuizTeam Mindanao100% (1)

- 3.2 Business Profit TaxDocument49 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- Taxation For Professional Services: TopicDocument35 pagesTaxation For Professional Services: TopicLANCENo ratings yet

- Philippines TaxDocument3 pagesPhilippines TaxerickjaoNo ratings yet

- Corporate TaxesDocument6 pagesCorporate TaxesfranNo ratings yet

- CIR v. Shinko Electric Industries Co. LTDDocument2 pagesCIR v. Shinko Electric Industries Co. LTDMarien MontecalvoNo ratings yet

- March BIR RulingsDocument13 pagesMarch BIR Rulingscarlee014No ratings yet

- Tax-on-Individuals PhilippinesDocument21 pagesTax-on-Individuals PhilippinesMaria Regina Javier100% (2)

- From An Employee To A SelfDocument3 pagesFrom An Employee To A SelfChristine BobisNo ratings yet

- Types of Business EnterpriseDocument2 pagesTypes of Business EnterprisealperenogluNo ratings yet

- Guide To Setting Up A Company in The PhilippinesDocument11 pagesGuide To Setting Up A Company in The PhilippinesNestieNo ratings yet

- Admas University: Learning GuideDocument19 pagesAdmas University: Learning Guidebirhanu sintayehuNo ratings yet

- A Guide To Taxation in The PhilippinesDocument5 pagesA Guide To Taxation in The PhilippinesNathaniel MartinezNo ratings yet

- Canvas Activity 2Document10 pagesCanvas Activity 2Micol VillaflorNo ratings yet

- Tax Guide For Professionals BIRDocument8 pagesTax Guide For Professionals BIRPY CaunanNo ratings yet

- Aquitani HistoryDocument3 pagesAquitani HistoryElle VernezNo ratings yet

- Auditing HistoryDocument2 pagesAuditing HistoryElle VernezNo ratings yet

- Ambiani HistoryDocument1 pageAmbiani HistoryElle VernezNo ratings yet

- Belgae HistoryDocument5 pagesBelgae HistoryElle VernezNo ratings yet

- Cross HistoryDocument3 pagesCross HistoryElle VernezNo ratings yet

- Spiral Galaxy HistoryDocument2 pagesSpiral Galaxy HistoryElle VernezNo ratings yet

- Investment of Money HistoryDocument2 pagesInvestment of Money HistoryElle VernezNo ratings yet

- Service Cooperative HistoryDocument1 pageService Cooperative HistoryElle VernezNo ratings yet

- Generational Wealth HistoryDocument1 pageGenerational Wealth HistoryElle VernezNo ratings yet

- Binary Star HistoryDocument1 pageBinary Star HistoryElle VernezNo ratings yet

- Newton HistoryDocument1 pageNewton HistoryElle VernezNo ratings yet

- Milky Way HistoryDocument1 pageMilky Way HistoryElle VernezNo ratings yet

- Taurus HistoryDocument1 pageTaurus HistoryElle VernezNo ratings yet

- Astrophysic HistoryDocument1 pageAstrophysic HistoryElle VernezNo ratings yet

- Sol Q5Document5 pagesSol Q5Elle VernezNo ratings yet

- Monkeypox HistoryDocument3 pagesMonkeypox HistoryElle VernezNo ratings yet

- Nicolas Copernicus HistoryDocument2 pagesNicolas Copernicus HistoryElle VernezNo ratings yet

- Stellar HistoryDocument2 pagesStellar HistoryElle VernezNo ratings yet

- Problem 4 6. Materials in RIP, Beg (45,000-21,000) 24,000Document1 pageProblem 4 6. Materials in RIP, Beg (45,000-21,000) 24,000Elle VernezNo ratings yet

- Quizzer Final SET B PDFDocument9 pagesQuizzer Final SET B PDFElle VernezNo ratings yet

- Pangasinan People HistoryDocument3 pagesPangasinan People HistoryElle VernezNo ratings yet

- Problem 1Document6 pagesProblem 1Elle VernezNo ratings yet

- Current Ratio : 365 DaysDocument2 pagesCurrent Ratio : 365 DaysElle VernezNo ratings yet

- Conceptual With Correct AnswersDocument5 pagesConceptual With Correct AnswersElle Vernez0% (2)

- 7.0 Capital Gains TaxationDocument23 pages7.0 Capital Gains TaxationElle VernezNo ratings yet

- Regular Income Tax: (As Amended by TRAIN LAW)Document32 pagesRegular Income Tax: (As Amended by TRAIN LAW)Elle VernezNo ratings yet