Professional Documents

Culture Documents

Negotiable Instrument Case Number 7 (BASILISCO, JALEFAYE)

Uploaded by

jalefaye abapoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Negotiable Instrument Case Number 7 (BASILISCO, JALEFAYE)

Uploaded by

jalefaye abapoCopyright:

Available Formats

Philippine Bank of Commerce V. Jose M.

Aruego (1961)

FACTS:

Jose Aruego obtained a credit accommodation from the Philippine Bank of Commerce to

facilitate the payment of printing of “World Current Events”, the periodical he is publishing.

Thus, for every printing of the periodical, the printer, Encal Press and Photo Engraving, collected

the cost of printing by drawing a draft against the plaintiff, said draft being sent later to the

defendant for acceptance. As an added security for the payment of the amounts advanced to

Encal Press and Photo-Engraving, the plaintiff bank also required defendant Aruego to execute a

trust receipt in favor of said bank wherein said defendant undertook to hold in trust for plaintiff

the periodicals and to sell the same with the promise to turn over to the plaintiff the proceeds of

the sale of said publication to answer for the payment of all obligations arising from the draft.

The Philippine Bank of Commerce instituted an action to recover the cost of printing of the

latter’s periodical (P35,000 with daily interest and commission for every 30 days) based on their

22 transactions. Aruego however argues that he signed the supposed bills of exchange in a

representative capacity as the President of the Philippine Education Foundation Company; that

his liability is only secondarily; and that he was signing only as an accommodation party to add

to the security of the bank. Lower courts: Ordered Aruego to pay PBC, declaring him in default.

ISSUE:

Whether/not Aruego can be held liable by the petitioner bank.

Whether/not Aruego is primarily and personally liable for the drafts.

HELD:

YES. Aruego is liable to the petitioner.

Section 20 of the Negotiable Instruments Law provides: "Where the instrument contains or a

person adds to his signature words indicating that he signs for or on behalf of a principal or in a

representative capacity, he is not liable on the instrument if he was duly authorized; but the mere

addition of words describing him as an agent or as filing a representative character, without

disclosing his principal, does not exempt him from personal liability." An inspection of the drafts

accepted by the defendant shows that nowhere has he disclosed that he was signing as a

representative of the Philippine Education Foundation Company. He merely signed as follows:

"JOSE ARUEGO (Acceptor) (SGD) JOSE ARGUEGO”.

YES. Aruego is primarily and personally liable for the drafts. An accommodation party is one

who has signed the instrument as maker, drawer, endorser, without receiving value therefor and

for the purpose of lending his name to some other person. Under the Negotiable Instruments

Law, a bill of exchange is an unconditional order in writing addressed by one person to another,

signed by the person giving it, requiring the person to whom it is addressed to pay on demand or

at a fixed or determinable future time a sum certain in money to order or to bearer. As long as a

commercial paper conforms with the definition of a bill of exchange, that paper is considered a

bill of exchange. The nature of acceptance is important only in the determination of the kind of

liabilities of the parties involved, but not in the determination of whether a commercial paper is a

bill of exchange or not.

You might also like

- Phil Bank of Commerce V AruegoDocument2 pagesPhil Bank of Commerce V AruegoGuevarra RemNo ratings yet

- PBCOM v. Aruego (Case Digest)Document2 pagesPBCOM v. Aruego (Case Digest)Carlo UsmanNo ratings yet

- PHILIPPINE BANK OF COMMERCE VsDocument1 pagePHILIPPINE BANK OF COMMERCE VsJan Aldrin AfosNo ratings yet

- Philippine Bank of Commerce VsDocument1 pagePhilippine Bank of Commerce VsJan Aldrin AfosNo ratings yet

- The Philippine Bank of Commerce V. Aruego 102 SCRA 530: IndebtednessDocument1 pageThe Philippine Bank of Commerce V. Aruego 102 SCRA 530: IndebtednessClar NapaNo ratings yet

- Philippine Bank of Commerce v. AruegoDocument1 pagePhilippine Bank of Commerce v. AruegoPre PacionelaNo ratings yet

- PBCom Vs Aruego NEGO DigestDocument2 pagesPBCom Vs Aruego NEGO DigestMary LouiseNo ratings yet

- Philippine Bank of Commerce v. Aruego (G.R. Nos. L-25836-37. January 31, 1981)Document2 pagesPhilippine Bank of Commerce v. Aruego (G.R. Nos. L-25836-37. January 31, 1981)Thoughts and More ThoughtsNo ratings yet

- Phil. Bank of Commerce v. AruegoDocument1 pagePhil. Bank of Commerce v. AruegoReymart-Vin MagulianoNo ratings yet

- Philippine Bank of Commerce v. Jose AruegoDocument2 pagesPhilippine Bank of Commerce v. Jose AruegoKatrina PerezNo ratings yet

- Garcia Vs LlamasDocument2 pagesGarcia Vs LlamasKling King100% (2)

- PHILIPPINE BANK OF COMMERCE VsDocument3 pagesPHILIPPINE BANK OF COMMERCE VsRaiza SunggayNo ratings yet

- PBCOM v. Aruego - DigestDocument1 pagePBCOM v. Aruego - DigestMirabel VidalNo ratings yet

- (Nego) (PBC v. Aruego)Document3 pages(Nego) (PBC v. Aruego)Alyanna ApacibleNo ratings yet

- PBC V AruegoDocument2 pagesPBC V AruegoVianca MiguelNo ratings yet

- Nego Week 3 Case DigestDocument53 pagesNego Week 3 Case DigestKarlo Marco Cleto100% (1)

- The Philippine Bank of Commerce, PlaintiffDocument8 pagesThe Philippine Bank of Commerce, PlaintiffEfeiluj CuencaNo ratings yet

- THE PHILIPPINE BANK OF COMMERCE, Plaintiff-Appellee, vs. JOSE M. ARUEGO, Defendant-AppellantDocument1 pageTHE PHILIPPINE BANK OF COMMERCE, Plaintiff-Appellee, vs. JOSE M. ARUEGO, Defendant-AppellantAdrian HilarioNo ratings yet

- Regfra Notes (Finals)Document21 pagesRegfra Notes (Finals)Janeth ManalangNo ratings yet

- 2nd Set ReviewerDocument8 pages2nd Set ReviewerRegieReyAgustinNo ratings yet

- Digest 3Document24 pagesDigest 3Kathlene JaoNo ratings yet

- Nego CasesDocument22 pagesNego CasesLisa GarciaNo ratings yet

- Phil Bank of CommerceDocument1 pagePhil Bank of CommerceApple PanganibanNo ratings yet

- 16Document56 pages16Diana BaganganNo ratings yet

- Section 20 - NIL Case DigestDocument12 pagesSection 20 - NIL Case DigestCML100% (1)

- PBCOM Vs AruegoDocument1 pagePBCOM Vs AruegoGeorge AlmedaNo ratings yet

- Section 20Document2 pagesSection 20einel dcNo ratings yet

- Nego Case Digests June 10, 2013 Pineda V. Dela RamaDocument6 pagesNego Case Digests June 10, 2013 Pineda V. Dela RamaChic PabalanNo ratings yet

- Case Digest - PBC Vs Aruedo, G.R. L-25836-38Document2 pagesCase Digest - PBC Vs Aruedo, G.R. L-25836-38J Yasser PascubilloNo ratings yet

- Negotiable Instruments Law DoctrinesDocument21 pagesNegotiable Instruments Law DoctrinesMarc Daniel MolinaNo ratings yet

- Dev't Bank of Rizal Vs Sima WeiDocument7 pagesDev't Bank of Rizal Vs Sima WeiAlpheus Shem ROJASNo ratings yet

- 06 Allied Banking Corporation V CADocument2 pages06 Allied Banking Corporation V CAYPENo ratings yet

- Digests 1Document21 pagesDigests 1Kathlene JaoNo ratings yet

- NEGO Gr. 2 - Baggay, Bernadas, Blancaver - Republic Planters Bank Vs Court of AppealsDocument3 pagesNEGO Gr. 2 - Baggay, Bernadas, Blancaver - Republic Planters Bank Vs Court of AppealsBiBi JumpolNo ratings yet

- Bank Guarantees in International TradeDocument4 pagesBank Guarantees in International TradeMohammad Shahjahan SiddiquiNo ratings yet

- Ang Vs Associated Bank E. Accomodation PartyDocument4 pagesAng Vs Associated Bank E. Accomodation Partydnel13No ratings yet

- LABOR LAW 1 Lesson 3Document31 pagesLABOR LAW 1 Lesson 3Henrick YsonNo ratings yet

- Arcellana - PBC V Aruego (d2017)Document1 pageArcellana - PBC V Aruego (d2017)huhah303No ratings yet

- Case Digest NilDocument10 pagesCase Digest NilMarc AcostaNo ratings yet

- Ang Vs Associated BankDocument4 pagesAng Vs Associated Bankmarkhan18No ratings yet

- Jose Velasco v. Tan Liuan CoDocument2 pagesJose Velasco v. Tan Liuan Codyosa100% (2)

- Rodriguez v. Court of AppealsDocument7 pagesRodriguez v. Court of AppealsCassie GacottNo ratings yet

- 29 Licaros v. GatmaitanDocument12 pages29 Licaros v. GatmaitanApa MendozaNo ratings yet

- Agency Reviewer Doc Jim NotesDocument13 pagesAgency Reviewer Doc Jim NotesNA Nanorac JDNo ratings yet

- Gonzales V PCIBDocument36 pagesGonzales V PCIBHeidiNo ratings yet

- Guaranty & Suretyship - CasesDocument361 pagesGuaranty & Suretyship - CasesClarice Joy Sj100% (1)

- Francisco vs. CA - 319 SCRA 354, GR 116320Document9 pagesFrancisco vs. CA - 319 SCRA 354, GR 116320Krister VallenteNo ratings yet

- Pointers in Mercantile Law 2017Document30 pagesPointers in Mercantile Law 2017Grace MagnayeNo ratings yet

- Lica RosDocument14 pagesLica RosXyrus BucaoNo ratings yet

- Negotiable Law DoctrinesDocument22 pagesNegotiable Law DoctrineswichupinunoNo ratings yet

- Republic Planters Bank Vs CADocument2 pagesRepublic Planters Bank Vs CAMohammad Yusof Mauna MacalandapNo ratings yet

- Nego Notes Ni RodelDocument41 pagesNego Notes Ni RodelMandaragat GeronimoNo ratings yet

- 23 Ang v. Associated BankDocument4 pages23 Ang v. Associated BankJanno SangalangNo ratings yet

- Sbec - Final ExercisesDocument7 pagesSbec - Final ExercisesJULLIE CARMELLE H. CHATTONo ratings yet

- Tupaz - IV - v. - Court - of - Appeals20210423-12-J4sv5Document14 pagesTupaz - IV - v. - Court - of - Appeals20210423-12-J4sv5Maddison YuNo ratings yet

- Negotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 162 of 190Document1 pageNegotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 162 of 190Christian Lemuel Tangunan TanNo ratings yet

- Legal Ethics Digest Case No 43 To 56Document10 pagesLegal Ethics Digest Case No 43 To 56jm_marshalNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- Arguments FinalDocument9 pagesArguments Finaljalefaye abapoNo ratings yet

- GLOBAL MIN-MET - Control of Documents (2) - For MergeDocument7 pagesGLOBAL MIN-MET - Control of Documents (2) - For Mergejalefaye abapoNo ratings yet

- Document Development Monitoring SheetDocument1 pageDocument Development Monitoring Sheetjalefaye abapoNo ratings yet

- Deed of Sale SuvDocument2 pagesDeed of Sale Suvjalefaye abapoNo ratings yet

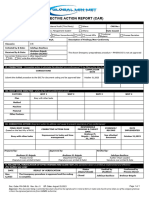

- CAR 2 Brigz FinalDocument2 pagesCAR 2 Brigz Finaljalefaye abapoNo ratings yet

- Risk and Opportunity ManagementDocument6 pagesRisk and Opportunity Managementjalefaye abapoNo ratings yet

- Global Min-Met - r431 Rev14 Environmental Aspects and Ohs Hazards Identification Assessment and ControlDocument6 pagesGlobal Min-Met - r431 Rev14 Environmental Aspects and Ohs Hazards Identification Assessment and Controljalefaye abapoNo ratings yet

- Real Estate MortgageDocument3 pagesReal Estate Mortgagejalefaye abapoNo ratings yet

- GLOBAL MIN-MET - Compliance - Obligations - and - Evaluation - ISO - 14001 - 2015 - As - of - May - 2020 - JBAS456Document4 pagesGLOBAL MIN-MET - Compliance - Obligations - and - Evaluation - ISO - 14001 - 2015 - As - of - May - 2020 - JBAS456jalefaye abapoNo ratings yet

- GLOBAL MIN-MET - AAS-01, Hiring and RecruitmentDocument7 pagesGLOBAL MIN-MET - AAS-01, Hiring and Recruitmentjalefaye abapoNo ratings yet

- PM - Control of DocumentsDocument7 pagesPM - Control of Documentsjalefaye abapoNo ratings yet

- Board Reso FinalDocument2 pagesBoard Reso Finaljalefaye abapoNo ratings yet

- GLOBAL MIN-MET - Control of Documents (2) - For MergeDocument7 pagesGLOBAL MIN-MET - Control of Documents (2) - For Mergejalefaye abapoNo ratings yet

- Rule 57 Prelim AttachmentDocument6 pagesRule 57 Prelim Attachmentjalefaye abapoNo ratings yet

- Case Number 23Document7 pagesCase Number 23jalefaye abapoNo ratings yet

- GLOBAL MIN-MET - EMS-L2-008 r00 Procedure On Emergency Preparedness and ResponseDocument18 pagesGLOBAL MIN-MET - EMS-L2-008 r00 Procedure On Emergency Preparedness and Responsejalefaye abapoNo ratings yet

- Credit Case Abalysis 14 (Basilisco, Jalefaye)Document1 pageCredit Case Abalysis 14 (Basilisco, Jalefaye)jalefaye abapoNo ratings yet

- Case Number 16Document9 pagesCase Number 16jalefaye abapoNo ratings yet

- Case Number 16Document9 pagesCase Number 16jalefaye abapoNo ratings yet

- Credit Case Analysis 13 (Basilisco, Jalefaye)Document1 pageCredit Case Analysis 13 (Basilisco, Jalefaye)jalefaye abapoNo ratings yet

- UsuryDocument1 pageUsuryjalefaye abapoNo ratings yet

- GLOBAL MIN-MET - AAS-02, Training and DevelopmentDocument5 pagesGLOBAL MIN-MET - AAS-02, Training and Developmentjalefaye abapoNo ratings yet

- GLOBAL MIN-MET - Control of Documents (2) - For MergeDocument7 pagesGLOBAL MIN-MET - Control of Documents (2) - For Mergejalefaye abapoNo ratings yet

- Document Development Monitoring SheetDocument1 pageDocument Development Monitoring Sheetjalefaye abapoNo ratings yet

- GLOBAL MIN-MET - EMS-L2-004 r00 Procedure On Compliance ObligationDocument3 pagesGLOBAL MIN-MET - EMS-L2-004 r00 Procedure On Compliance Obligationjalefaye abapoNo ratings yet

- GLOBAL MIN-MET - Compliance - Obligations - and - Evaluation - ISO - 14001 - 2015 - As - of - May - 2020 - JBAS456Document4 pagesGLOBAL MIN-MET - Compliance - Obligations - and - Evaluation - ISO - 14001 - 2015 - As - of - May - 2020 - JBAS456jalefaye abapoNo ratings yet

- GLOBAL MIN-MET - AAS-01, Hiring and RecruitmentDocument7 pagesGLOBAL MIN-MET - AAS-01, Hiring and Recruitmentjalefaye abapoNo ratings yet

- GLOBAL MIN-MET - EMS-L4-034 r00 Drill Scenario-TemplateDocument1 pageGLOBAL MIN-MET - EMS-L4-034 r00 Drill Scenario-Templatejalefaye abapoNo ratings yet

- GLOBAL MIN-MET - EMS-L2-004 r00 Procedure On Compliance ObligationDocument3 pagesGLOBAL MIN-MET - EMS-L2-004 r00 Procedure On Compliance Obligationjalefaye abapoNo ratings yet

- DeclarationDocument1 pageDeclarationjalefaye abapoNo ratings yet

- Internal Revenue Manual - 1.33Document13 pagesInternal Revenue Manual - 1.33purpelNo ratings yet

- Unit-5 Receivables ManagementDocument26 pagesUnit-5 Receivables ManagementSarthak MattaNo ratings yet

- Notes in Tax On IndividualsDocument4 pagesNotes in Tax On IndividualsPaula BatulanNo ratings yet

- Dollar Heg DADocument233 pagesDollar Heg DASimon WuNo ratings yet

- Final Project Report of Summer Internship (VK)Document56 pagesFinal Project Report of Summer Internship (VK)Vikas Kumar PatelNo ratings yet

- Financial ManagementDocument11 pagesFinancial ManagementRuel VillanuevaNo ratings yet

- Entrepreneurial Finance - Luisa AlemanyDocument648 pagesEntrepreneurial Finance - Luisa Alemanytea.liuyudanNo ratings yet

- ICICI Pru Signature Online BrochureDocument30 pagesICICI Pru Signature Online Brochuremyhomemitv2uNo ratings yet

- LO3 ProblemsDocument11 pagesLO3 ProblemsKayla SheltonNo ratings yet

- PBCom V CA, G.R. No. 118552, February 5, 1996Document6 pagesPBCom V CA, G.R. No. 118552, February 5, 1996ademarNo ratings yet

- Ceekay Daikin Ltd.Document39 pagesCeekay Daikin Ltd.TAHER3555No ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument3 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsMarc Eric RedondoNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Time Value of MoneyDocument22 pagesTime Value of Moneyshubham abrolNo ratings yet

- Introduction AdvertisingDocument82 pagesIntroduction AdvertisingselbalNo ratings yet

- Module 5 - Interests Formula and RatesDocument14 pagesModule 5 - Interests Formula and RatesHazel NantesNo ratings yet

- 3 - Valuation of Equity Shares - Assignment (26-04-19)Document4 pages3 - Valuation of Equity Shares - Assignment (26-04-19)AakashNo ratings yet

- Mutual Funds - IntroductionDocument9 pagesMutual Funds - IntroductionMd Zainuddin IbrahimNo ratings yet

- A Guide To The Stock Exchange For Beginners - Part 2 PDFDocument5 pagesA Guide To The Stock Exchange For Beginners - Part 2 PDFAnil Yadavrao GaikwadNo ratings yet

- Notes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The NotesDocument5 pagesNotes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The Notesjake doinogNo ratings yet

- Untitled SpreadsheetDocument12 pagesUntitled SpreadsheetNoble JonesNo ratings yet

- PA Sample MCQs 2Document15 pagesPA Sample MCQs 2ANH PHẠM QUỲNHNo ratings yet

- SYBAF Project Guidelines: 1) AuditingDocument6 pagesSYBAF Project Guidelines: 1) AuditingBhavya RatadiaNo ratings yet

- Partnership PDFDocument1 pagePartnership PDFAoiNo ratings yet

- REAL ESTATE MORTGAGE-CalubayanDocument5 pagesREAL ESTATE MORTGAGE-CalubayanChristopher JuniarNo ratings yet

- Assignment On International TradeDocument3 pagesAssignment On International TradeMark James GarzonNo ratings yet

- SEC 204 Status ReportDocument17 pagesSEC 204 Status Reportthe kingfishNo ratings yet

- 3.2 Mathematics of RetailingDocument10 pages3.2 Mathematics of RetailingharizNo ratings yet

- Ap COSTSDocument4 pagesAp COSTSferNo ratings yet

- 4 Hoi and RobinDocument7 pages4 Hoi and RobinelizabetaangelovaNo ratings yet