Professional Documents

Culture Documents

Assignment On International Trade

Uploaded by

Mark James Garzon0 ratings0% found this document useful (0 votes)

15 views3 pagesOriginal Title

ASSIGNMENT ON INTERNATIONAL TRADE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views3 pagesAssignment On International Trade

Uploaded by

Mark James GarzonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

FINANCIAL MARKETS LEARNING GUIDE

INTERNATIONAL TRADE & THE CURRENCY

EXCHANGE MARKET

OBJECTIVES:

At the end of the topic, the student is expected to be able to:

a. Describe how international payments are made

b. Describe the nature of foreign exchange markets

c. Discuss the effect of exchange rates on international trade and explain

arbitrage and exchange quotations

1. Read Chapter 6 of the book INTRODUCTION TO FINANCE By. Melicher and

Norton (130-157).

2. Watch the following videos:

a. International Trade animation by Wian Guse.

April 15, 2016

https://www.youtube.com/watch?v=aemiFHJXrHI

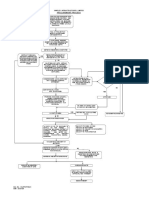

b. Letter of Credit Process!Explained LC Transaction with Flow Chart By

Logistics Youtuber-IINO San. Nov. 21, 2020.

https://www.youtube.com/watch?v=OLOvu_K7gYg

c. Letters of Credit-What is a letter of credit (Trade finance Global LC Guide)

by Trade Finance Global. October 23, 2016.

https://www.youtube.com/watch?v=9bZwWuiw8hQ

d. Imports, Exports, and Exchange Rates: Crash course Economics # 15

CrashCourse. November 21, 2015

https://www.youtube.com/watch?v=geoe-6NBy10

3. Answer the following review questions and exercises:

A. THEORY. Choose 5 questions to answer (5 points each)

1. What is the purpose of an international monetary system?

2. What are currency or foreign exchange markets? How are exchange rates

quoted?

3. Describe the various ways by which an exporter may finance an

international shipment of goods. How may commercial banks assist the

exporter in collecting drafts?

4. How do importers protect themselves against improper delivery of goods

when they are required to make payment as they place an order?

5. Describe the process by which an importing firm may substitute the credit

of its bank for its own credit in financing international transactions.

6. How may a bank protect itself after having issued a commercial letter of

credit on behalf of a customer?

7. Describe the costs involved in connection with financing exports through

banker’s acceptances.

8. Commercial letters of credit, traveller’s letters of credit, and traveller’s

checks all play an important role in international finance. Distinguish

among these three types of instruments.

B. CASES/PROBLEMS

1. Assume, as the loan officer of a commercial bank, that one of your

customers has asked for a commercial letter of credit to enable his firm to

import a supply of well-known French wines. This customer has a long

record of commercial success, yet has large outstanding debts to other

creditors. In what way might you accommodate the customer and at the

same time protect your bank?

2. As an importer of merchandise you depend on the sale of the

merchandise for funds to make payment. Although customary terms of

sale are 90 days for this type of merchandise, you are not well-known to

foreign suppliers because of your recent entry into business. Furthermore,

your suppliers require almost immediate payment to meet their own

expenses of operations. How might the banking systems of the exporter

and importer accommodate your situation?

3. Assume you are the international vice president of a small U.S.-based

manufacturing corporation. You are trying to expand your business in

several developing countries. You are also aware that some business

practices are considered to be “acceptable” in these countries but not

necessarily in the United States. How would you react to the following

situations?

a. You met yesterday with a government official from one of the

countries in which you would like to make sales. He said that he

could speed up the process for acquiring the necessary licenses for

conducting business in his country if you would pay him for his

time and eff ort. What would you do?

b. You are trying to make a major sale of your firm’s products to

the government of a foreign country. You have identified the key

decision maker. You are considering offering the official a monetary

payment if she would recommend buying your firm’s products.

What would you do?

c. Your fi rm has a local office in a developing country where you

are trying to increase business opportunities. Representatives from

a local crime syndicate have approached you and have offered to

provide “local security” in exchange for a monthly payment to

them. What would you do?

Reference:

Melicher, R. W. & Norton, E. A. (2017). Introduction to Finance. Wiley.

You might also like

- How to Get a Business Loan for Commercial Real Estate: 2012 EditionFrom EverandHow to Get a Business Loan for Commercial Real Estate: 2012 EditionNo ratings yet

- Answers To End of Chapter Questions: 1. Banker's AcceptancesDocument3 pagesAnswers To End of Chapter Questions: 1. Banker's AcceptancesNgan NguyenNo ratings yet

- International Finance A SR Jwhe3pDocument11 pagesInternational Finance A SR Jwhe3pRajni KumariNo ratings yet

- Č Boss 2iDocument12 pagesČ Boss 2iVenkateshNo ratings yet

- EXIM Test Paper2Document4 pagesEXIM Test Paper2Karthikeya PrathipatiNo ratings yet

- Chapter 1 Running Your Own MNCDocument4 pagesChapter 1 Running Your Own MNCMotasem adnan0% (1)

- Cash Is King: Maintain Liquidity, Build Capital, and Prepare Your Business for Every OpportunityFrom EverandCash Is King: Maintain Liquidity, Build Capital, and Prepare Your Business for Every OpportunityNo ratings yet

- Strategic Fixed Income Investing: An Insider's Perspective on Bond Markets, Analysis, and Portfolio ManagementFrom EverandStrategic Fixed Income Investing: An Insider's Perspective on Bond Markets, Analysis, and Portfolio ManagementNo ratings yet

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- The Food Truck Handbook: Start, Grow, and Succeed in the Mobile Food BusinessFrom EverandThe Food Truck Handbook: Start, Grow, and Succeed in the Mobile Food BusinessRating: 5 out of 5 stars5/5 (1)

- BFSI Training Manual - PDF - 20230810 - 164502 - 0000Document136 pagesBFSI Training Manual - PDF - 20230810 - 164502 - 0000deepak643aNo ratings yet

- Financial Markets Tutorial and Self Study Questions All TopicsDocument17 pagesFinancial Markets Tutorial and Self Study Questions All TopicsTan Nguyen100% (1)

- Investing in Fixed Income Securities: Understanding the Bond MarketFrom EverandInvesting in Fixed Income Securities: Understanding the Bond MarketNo ratings yet

- Managing Concentrated Stock Wealth: An Advisor's Guide to Building Customized SolutionsFrom EverandManaging Concentrated Stock Wealth: An Advisor's Guide to Building Customized SolutionsNo ratings yet

- Ravshan Suyunov Final EnterpreneurshipDocument5 pagesRavshan Suyunov Final EnterpreneurshipzazaNo ratings yet

- Equity Crowdfunding for Investors: A Guide to Risks, Returns, Regulations, Funding Portals, Due Diligence, and Deal TermsFrom EverandEquity Crowdfunding for Investors: A Guide to Risks, Returns, Regulations, Funding Portals, Due Diligence, and Deal TermsNo ratings yet

- Export to Explode Cash Flow and Profits: Creating New Streams of Business in Asia, Africa and the Americas with Little InvestmentFrom EverandExport to Explode Cash Flow and Profits: Creating New Streams of Business in Asia, Africa and the Americas with Little InvestmentNo ratings yet

- Section 2 - CH 1 - Part 2Document11 pagesSection 2 - CH 1 - Part 2Jehan OsamaNo ratings yet

- Guide international finance examDocument12 pagesGuide international finance examHernanNo ratings yet

- FGM OBJESSAY CompiledDocument20 pagesFGM OBJESSAY CompiledPatience AkpanNo ratings yet

- DSIMS IB Question BankDocument3 pagesDSIMS IB Question BankpravinbulbuleNo ratings yet

- My First Step to a Successful Credit Score for Teens and BeginnersFrom EverandMy First Step to a Successful Credit Score for Teens and BeginnersNo ratings yet

- Dwnload Full International-Financial-Management-13th-Edition-Madura-Solutions-Manual PDFDocument27 pagesDwnload Full International-Financial-Management-13th-Edition-Madura-Solutions-Manual PDFashero2eford100% (10)

- International Financial Management PPT Chap 1Document16 pagesInternational Financial Management PPT Chap 1serge folegweNo ratings yet

- Managed Futures for Institutional Investors: Analysis and Portfolio ConstructionFrom EverandManaged Futures for Institutional Investors: Analysis and Portfolio ConstructionNo ratings yet

- Middle Market M & A: Handbook for Investment Banking and Business ConsultingFrom EverandMiddle Market M & A: Handbook for Investment Banking and Business ConsultingRating: 4 out of 5 stars4/5 (1)

- Real Estate Investing QuickStart Guide: The Simplified Beginner’s Guide to Successfully Securing Financing, Closing Your First Deal, and Building Wealth Through Real EstateFrom EverandReal Estate Investing QuickStart Guide: The Simplified Beginner’s Guide to Successfully Securing Financing, Closing Your First Deal, and Building Wealth Through Real EstateRating: 5 out of 5 stars5/5 (1)

- Get Your Business Funded: Creative Methods for Getting the Money You NeedFrom EverandGet Your Business Funded: Creative Methods for Getting the Money You NeedNo ratings yet

- (123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Document10 pages(123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Công MinhNo ratings yet

- Getting Started as a Commercial Mortgage Broker: How to Get to a Six-Figure Salary in 12 MonthsFrom EverandGetting Started as a Commercial Mortgage Broker: How to Get to a Six-Figure Salary in 12 MonthsRating: 5 out of 5 stars5/5 (3)

- Critical Discussion Questions and AnswersDocument3 pagesCritical Discussion Questions and AnswersHoàng LongNo ratings yet

- Answer 1: The Companies Intending To Go International Have To Carefully ConsiderDocument6 pagesAnswer 1: The Companies Intending To Go International Have To Carefully ConsiderSolve AssignmentNo ratings yet

- Gujranwala Institute of Management Studies, GujranwalaDocument8 pagesGujranwala Institute of Management Studies, GujranwalaAnam KhanNo ratings yet

- Module 2 (FINE-6)Document4 pagesModule 2 (FINE-6)John Mark GabrielNo ratings yet

- Real Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksFrom EverandReal Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksNo ratings yet

- Global Recession, Pawnshops, Collection Strategies, Hyundai Credit CardDocument2 pagesGlobal Recession, Pawnshops, Collection Strategies, Hyundai Credit CardMaricar TabadaNo ratings yet

- IB QUESTIONNAIRE W ANSWERSDocument8 pagesIB QUESTIONNAIRE W ANSWERSKarissa Jun MustachoNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- The Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesFrom EverandThe Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesNo ratings yet

- Benefits and Risks of International TradeDocument11 pagesBenefits and Risks of International TradeK58 NGUYEN THI THUY LINHNo ratings yet

- Chapter 20Document7 pagesChapter 20Sowparnika BalasubramaniamNo ratings yet

- Bachelor of Business Administration-BBA: Semester 5 BB0024 - Introduction To International Marketing Assignment (60 Marks)Document7 pagesBachelor of Business Administration-BBA: Semester 5 BB0024 - Introduction To International Marketing Assignment (60 Marks)Devlean BhowalNo ratings yet

- Interest Rate Markets: A Practical Approach to Fixed IncomeFrom EverandInterest Rate Markets: A Practical Approach to Fixed IncomeRating: 4 out of 5 stars4/5 (2)

- FINC/ECON 3240 - International Finance Homework SolutionsDocument34 pagesFINC/ECON 3240 - International Finance Homework SolutionsRichard WestNo ratings yet

- Import Business: A Guide on Starting Up Your Own Import BusinessFrom EverandImport Business: A Guide on Starting Up Your Own Import BusinessRating: 4 out of 5 stars4/5 (1)

- Trillion Dollar Economists: How Economists and Their Ideas have Transformed BusinessFrom EverandTrillion Dollar Economists: How Economists and Their Ideas have Transformed BusinessRating: 4 out of 5 stars4/5 (1)

- Exercise SolutionsDocument114 pagesExercise SolutionsCarolyn ImaniNo ratings yet

- Setting Up Wholly Foreign Owned Enterprises in ChinaFrom EverandSetting Up Wholly Foreign Owned Enterprises in ChinaNo ratings yet

- Friendships Co. Financial Position StatementDocument3 pagesFriendships Co. Financial Position StatementMark James GarzonNo ratings yet

- Module 2A - Hardware Component - The Input UnitDocument11 pagesModule 2A - Hardware Component - The Input UnitMark James GarzonNo ratings yet

- Local Media5224693240533058014Document1 pageLocal Media5224693240533058014Mark James GarzonNo ratings yet

- Determinants of Economic DevelopmentDocument5 pagesDeterminants of Economic DevelopmentMark James GarzonNo ratings yet

- AE4a - Mind Challenges (Module 4-7)Document6 pagesAE4a - Mind Challenges (Module 4-7)Mark James GarzonNo ratings yet

- SCM-Module 3B-PPT-01Document47 pagesSCM-Module 3B-PPT-01arkmaniNo ratings yet

- Annex 4: Inventory of Third-Party ContentsDocument3 pagesAnnex 4: Inventory of Third-Party ContentsAlbert BallesterosNo ratings yet

- ENTREPRENEURSHIP 5 C'SDocument9 pagesENTREPRENEURSHIP 5 C'Skhizar naseemNo ratings yet

- FINANCIAL SYSTEMS AND MARKETS CHAPTER 1Document67 pagesFINANCIAL SYSTEMS AND MARKETS CHAPTER 1Gabrielle Anne MagsanocNo ratings yet

- Accounting & Marketing Students ListDocument9 pagesAccounting & Marketing Students ListJustine Brylle DomantayNo ratings yet

- Private Placement Memorandum Template 07Document38 pagesPrivate Placement Memorandum Template 07charliep8100% (1)

- Msme NdaDocument3 pagesMsme NdaXuena ouNo ratings yet

- Philippines Urban Land Reform Act of 1975Document6 pagesPhilippines Urban Land Reform Act of 1975Wendell MaunahanNo ratings yet

- RE: POLICY #: A13267806PLA NAME OF INSURED: Ossilien ThimotDocument1 pageRE: POLICY #: A13267806PLA NAME OF INSURED: Ossilien ThimotAndre SenabNo ratings yet

- Presentation on Puma Brand Life CycleDocument24 pagesPresentation on Puma Brand Life Cyclenicks1988No ratings yet

- China GroupDocument28 pagesChina GroupAndrew OrbetaNo ratings yet

- MGN 313Document10 pagesMGN 313Ketsia MukalayNo ratings yet

- Gross Income and Net IncomeDocument2 pagesGross Income and Net IncomeJasmine PeraltaNo ratings yet

- The Expenditure Cycle 2Document12 pagesThe Expenditure Cycle 2Princess Nicole Posadas OniaNo ratings yet

- Sgs Ss Smls Pipe HNSSDDocument18 pagesSgs Ss Smls Pipe HNSSDNandha KumarNo ratings yet

- Value-Based Metrics: Foundations and Practice: June 2000Document3 pagesValue-Based Metrics: Foundations and Practice: June 2000abdelmutalabNo ratings yet

- Hotel Industry Report Provides Insights on Growth, Costs, and FinancialsDocument12 pagesHotel Industry Report Provides Insights on Growth, Costs, and FinancialssparasavediNo ratings yet

- Unit 2 Marketing ResearchDocument6 pagesUnit 2 Marketing ResearchDr Priyanka TripathyNo ratings yet

- Bailment: Sanjay BangDocument31 pagesBailment: Sanjay BangBTS x ARMYNo ratings yet

- Guyana Trade Unions Act SummaryDocument18 pagesGuyana Trade Unions Act SummaryAaliyahNo ratings yet

- BCA-3rd-Sem-2022-23 (1) - 231123 - 060059Document12 pagesBCA-3rd-Sem-2022-23 (1) - 231123 - 060059satya.bhatia123456No ratings yet

- Rich Dad Poor Dad EbookDocument220 pagesRich Dad Poor Dad EbookBrute1989No ratings yet

- Prospectus 2016 07 19Document199 pagesProspectus 2016 07 19Nicolas GrossNo ratings yet

- Term PaperDocument20 pagesTerm PaperTanvir Mahmood KamalNo ratings yet

- New 1Document6 pagesNew 1Teddy Parker da SilvaNo ratings yet

- Social Science All in One (Preli)Document363 pagesSocial Science All in One (Preli)Safa AbcNo ratings yet

- 15.1 Shopping On Instagram PDFDocument6 pages15.1 Shopping On Instagram PDFMuhammad FaisalNo ratings yet

- Pilatus PC-12 Assembly Line: Industrialization, Manufacturing and Process ImprovementDocument8 pagesPilatus PC-12 Assembly Line: Industrialization, Manufacturing and Process ImprovementTGTrindadeNo ratings yet

- 27 Flow Chart For Procurement Process Rev1Document1 page27 Flow Chart For Procurement Process Rev1Prasanta ParidaNo ratings yet

- Case Study For Junior Assistant Brand Manager (Pot Noodle) & CMI AMDocument5 pagesCase Study For Junior Assistant Brand Manager (Pot Noodle) & CMI AMBlissKedNo ratings yet