Professional Documents

Culture Documents

Assignment 2 - Suggested Answers

Uploaded by

Mark James GarzonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2 - Suggested Answers

Uploaded by

Mark James GarzonCopyright:

Available Formats

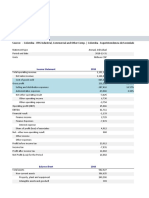

PROBLEM 4

Friendships Co.

Statement of Financial Position

December 31, 20x1

Current assets Notes

Cash 4 4,240,975

Trade and other receivables 5 8,998,130

Financial assets at fair value through profit or loss 2,834,079

Inventories 6 22,117,615

Prepayments and other current assets 7 1,159,345 39,350,144

Noncurrent assets

Property and equipment 8 12,370,960

Loans receivable 9 8,592,522

Financial assets at fair value through other comprehensive income 987,234

Investment in associate 1,290,347

Deferred tax asset 1,092,387 24,333,450

Total assets 63,683,594

Current liabilities

Trade and other payables 10 18,269,269

Income tax payable 721,346

Provision for warranty obligations 432,187 19,422,802

Deferred tax liability 918,732

Total liabilities 20,341,534

Shareholders' equity

Ordinary share capital 20,000,000

Share premium 6,000,000

Retained earnings 11 16,344,664

Other components of equity 12 997,396 43,342,060

Total liabilities and shareholders' equity 63,683,594

Friendships Co.

Notes to the Financial Statements (excerpts)

As of and for the Year Ended December 31, 20x1

Note 4 Cash on hand 62,350

Cash in bank - BPI (Savings) 1,720,500

Cash in bank - BPI (Current) 1,890,234

Cash in bank - BDO (Current) 567,891

Cash 4,240,975

Note 5 Accounts receivable - net

Accounts receivable 8,341,689

Less: Allowance for doubtful accounts ( 347,182) 7,994,507

Advances to employees 57,610

Interest receivable 946,013

Trade and other receivables 8,998,130

Note 6 Raw materials inventory 1,237,398

Work in process inventory 7,987,908

Finished goods inventory 12,892,309

Inventories 22,117,615

Note 7 Prepaid income tax 234,125

Prepaid supplies 890,239

Advances to suppliers 34,981

Prepayments and other current assets 1,159,345

Note 8 Land Building Equipment Total

Cost 8,980,751.00 3,419,877.00 917,387 13,318,015

Less: Accumulated depreciation - ( 712,930.00) ( 234,125) ( 947,055)

Property and equipment, net 8,980,751.00 2,706,947.00 683,262 12,370,960

Note 9 Loans receivable 9,827,341

Less: Unearned interest income ( 1,234,819)

Loans receivable, net 8,592,522

Note 10 Accounts payable 9,071,239

Accrued liabilities 889,712

Loans payable

Loans payable, face amount 8,000,000

Discount on loans payable ( 746,252) 7,253,748

Interest payable 341,782

Deferred credits 712,788

Trade and other payables 18,269,269

Note 11 Retained earnings - unrestricted 15,144,664

Retained earnings - appropriated 1,200,000

Retained earnings 16,344,664

Note 12 Revaluation surplus 873,984

Unrealized gains on equity securities - FVOCI 123,412

Other components of equity 997,396

1 Mare Co. 3-5. Mint Corp. 6 Mont Inc.

Cash 70,000 3 Earnings from long-term contracts 6,680,000 Net assets, unadjusted 875,000

Accounts receivable Less: Costs and expenses ( 5,180,000) Adjustments:

Trade accounts 96,000 Profit before tax 1,500,000 Treasury share ( 24,000)

Allowance for doubtful accounts ( 2,000) 94,000 Income tax expense (30%) ( 450,000) 851,000

Inventories Profit for the year 1,050,000

Unadjusted 60,000 Add: Retained earnings, unappropriated, beginning of year 900,000

Goods out on consignment Retained earnings, unappropriated, end of year 1,950,000

(P26,000 / 130%) 20,000 80,000 Retained earnings, restricted for note payable 160,000

Current assets 244,000 Retained earnings, December 31, 20x3 2,110,000

2 Mill Co. Adjustment to record income tax expense:

Accounts payable 15,000 Income tax expense 450,000

Bonds payable, due 20x4 Prepaid taxes 450,000

Face amount 25,000

Discount on bonds payable ( 3,000) 22,000 4 Noncurrent liabilities

Dividends payable 8,000 Note payable - noncurrent 1,620,000

Current liabilities 45,000

5 Cash 600,000

Accounts receivable 3,500,000

Cost in excess of billings on long-term contracts - net 900,000

Current assets 5,000,000

You might also like

- Requirement 1: BALANCE SHEETDocument3 pagesRequirement 1: BALANCE SHEETAnnabeth BrionNo ratings yet

- Emis Soriana IndicesDocument11 pagesEmis Soriana IndicesRamiro Gallo Diaz GonzalezNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Optiva Inc. Q2 2022 Financial Statements FinalDocument19 pagesOptiva Inc. Q2 2022 Financial Statements FinaldivyaNo ratings yet

- Base de Datos Quala y ColombinaDocument16 pagesBase de Datos Quala y ColombinaSARETH VIVIANA CABANA SANCHEZNo ratings yet

- Supplementary Accounting Statement ECPLDocument15 pagesSupplementary Accounting Statement ECPLdeepNo ratings yet

- EvergrandeDocument5 pagesEvergrandeTrần QuyênNo ratings yet

- Tobias Co. Problem AssignmentDocument2 pagesTobias Co. Problem AssignmentMiss MegzzNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at June 30, 2022 For The Year Ended June 30, 2022Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at June 30, 2022 For The Year Ended June 30, 2022Saljook AslamNo ratings yet

- Financial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016Document5 pagesFinancial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016SSDNo ratings yet

- Accounting Information System HomeWork 1 Jazan UniversityDocument7 pagesAccounting Information System HomeWork 1 Jazan Universityabdullah.masmaliNo ratings yet

- FS InRetail Consumer Q4'21Document48 pagesFS InRetail Consumer Q4'21Jose LumbrerasNo ratings yet

- Ar-18 8Document5 pagesAr-18 8jawad anwarNo ratings yet

- 2018 Annual ReportDocument4 pages2018 Annual ReportAbs PangaderNo ratings yet

- Expressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDocument5 pagesExpressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDishant KhanejaNo ratings yet

- Restatements Due To PPA of The Monsanto Acquisition PDFDocument8 pagesRestatements Due To PPA of The Monsanto Acquisition PDFAlvin LaquiNo ratings yet

- Cash and Cash Equivalents 6 1,060,000 Trade and Other Receivables 7 1,770,000 Inventories 1,200,000 Held For Trading Securities 800,000Document12 pagesCash and Cash Equivalents 6 1,060,000 Trade and Other Receivables 7 1,770,000 Inventories 1,200,000 Held For Trading Securities 800,000Hazel Kaye EspelitaNo ratings yet

- Bajaj Finserv Ltd. (India) : SourceDocument5 pagesBajaj Finserv Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Greenko Investment Company - Financial Statements 2017-18Document93 pagesGreenko Investment Company - Financial Statements 2017-18DSddsNo ratings yet

- Star ReportsDocument38 pagesStar ReportsAnnisa DewiNo ratings yet

- Consolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Document45 pagesConsolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Fernando SeminarioNo ratings yet

- CIB Separate Financial Statements Mar 2022 EnglishDocument29 pagesCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechNo ratings yet

- PJSC Lukoil: 31 December 2020Document53 pagesPJSC Lukoil: 31 December 2020Vincze EugeneNo ratings yet

- Statement August 31 2020Document30 pagesStatement August 31 2020NicolasNo ratings yet

- Leverage RatioDocument3 pagesLeverage RatioRahul PrasadNo ratings yet

- StateHouse Holdings Inc - Form Interim Financial Statements (Nov-22-2022)Document60 pagesStateHouse Holdings Inc - Form Interim Financial Statements (Nov-22-2022)ScridbyNo ratings yet

- Berger Paints Bangladesh Limited Statement of Financial PositionDocument8 pagesBerger Paints Bangladesh Limited Statement of Financial PositionrrashadattNo ratings yet

- Nib Q4 2012Document77 pagesNib Q4 2012MUHAMMAD IQBALNo ratings yet

- Preparing FSDocument7 pagesPreparing FSJohn AlbateraNo ratings yet

- Consolidated Balance Sheet Metapower International, IncDocument12 pagesConsolidated Balance Sheet Metapower International, IncJha YaNo ratings yet

- Walgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassDocument7 pagesWalgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassHiếu Nguyễn Minh HoàngNo ratings yet

- Samsung RatiosDocument11 pagesSamsung RatiosjunaidNo ratings yet

- Five Below 2018 Financial StatementsDocument4 pagesFive Below 2018 Financial StatementsElie GergesNo ratings yet

- Samorita Hospital (Last 6 Month Financial Report)Document11 pagesSamorita Hospital (Last 6 Month Financial Report)Stalwart sheikhNo ratings yet

- Numinus FS Q1 Nov 30, 2022 FINALDocument26 pagesNuminus FS Q1 Nov 30, 2022 FINALNdjfncnNo ratings yet

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksNo ratings yet

- Aritzia Inc. Q1 2021 FSDocument25 pagesAritzia Inc. Q1 2021 FSKevin GitauNo ratings yet

- CompleteDocument17 pagesCompletesanket patilNo ratings yet

- Pak Elektron Limited: Condensed Interim Consolidated Balance Sheet AS AT MARCH 31, 2017Document9 pagesPak Elektron Limited: Condensed Interim Consolidated Balance Sheet AS AT MARCH 31, 2017Imran Abdul AzizNo ratings yet

- Wipro Ltd. (India) : SourceDocument6 pagesWipro Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Adani Ports & Special Economic Zone Ltd. (India) : SourceDocument9 pagesAdani Ports & Special Economic Zone Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Consolidated Balance Sheet As at June 30, 2021: AssetsDocument2 pagesConsolidated Balance Sheet As at June 30, 2021: Assetsshannia dcostaNo ratings yet

- Espresso Software Financial Statements and Supplementary DataDocument38 pagesEspresso Software Financial Statements and Supplementary DataAnwar AshrafNo ratings yet

- 2022 - Consolidated Financial StatementsDocument7 pages2022 - Consolidated Financial StatementscaarunjiNo ratings yet

- Financial Position of The STCDocument13 pagesFinancial Position of The STCSalwa AlbalawiNo ratings yet

- Ratio AnalysisDocument15 pagesRatio AnalysisNSTJ HouseNo ratings yet

- MOD Technical Proposal 1.0Document23 pagesMOD Technical Proposal 1.0Scott TigerNo ratings yet

- Coal India Ltd. (India) : SourceDocument6 pagesCoal India Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Final Financial Reporting AssessmentDocument23 pagesFinal Financial Reporting Assessmentapi-413236814No ratings yet

- 2020 - GATI - Gatron Industries Limited-55-56Document2 pages2020 - GATI - Gatron Industries Limited-55-56Muhammad Noman MehboobNo ratings yet

- FS - InRetail Consumer - Q4'22Document50 pagesFS - InRetail Consumer - Q4'22joseacasieteuwuNo ratings yet

- Trident, Inc. Consolidated Balance Sheets: Execonline - Mastering Finance FundamentalsDocument3 pagesTrident, Inc. Consolidated Balance Sheets: Execonline - Mastering Finance Fundamentalschemicalchouhan9303No ratings yet

- Dec 2023 Financials UpdatedDocument102 pagesDec 2023 Financials Updatedpraveenramesh058No ratings yet

- 2023 Half Year Balance SheetDocument2 pages2023 Half Year Balance SheetsrishtiladdhaNo ratings yet

- Ultratech Cement Ltd. (India) : SourceDocument6 pagesUltratech Cement Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Scotiabank Peru Financial Statements - 2018Document80 pagesScotiabank Peru Financial Statements - 2018Juan CalfunNo ratings yet

- Balance SheetDocument1 pageBalance SheetAmmar YasinNo ratings yet

- Karora FS Q1 2021Document16 pagesKarora FS Q1 2021Predrag MarkovicNo ratings yet

- Module 2A - Hardware Component - The Input UnitDocument11 pagesModule 2A - Hardware Component - The Input UnitMark James GarzonNo ratings yet

- Local Media5224693240533058014Document1 pageLocal Media5224693240533058014Mark James GarzonNo ratings yet

- Assignment On International TradeDocument3 pagesAssignment On International TradeMark James GarzonNo ratings yet

- Module 3 (Part 1) : Determinants of Economic Development, Problems and Development StrategiesDocument5 pagesModule 3 (Part 1) : Determinants of Economic Development, Problems and Development StrategiesMark James GarzonNo ratings yet

- AE4a - Mind Challenges (Module 4-7)Document6 pagesAE4a - Mind Challenges (Module 4-7)Mark James GarzonNo ratings yet

- RFBT Preweek (B44)Document16 pagesRFBT Preweek (B44)LeiNo ratings yet

- Press Release-Edelteq Holdings BerhadDocument2 pagesPress Release-Edelteq Holdings BerhadMohd Faizal Mohd IbrahimNo ratings yet

- Proposal NSDCDocument2 pagesProposal NSDCDheeraj SaxenaNo ratings yet

- Chapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013Document32 pagesChapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013melsun007No ratings yet

- Rent Receipt Generator Online - House Rent ReceiptDocument5 pagesRent Receipt Generator Online - House Rent ReceiptManish GhadgeNo ratings yet

- 43860-Sec105-Ethics and Sustainability CaseDocument5 pages43860-Sec105-Ethics and Sustainability Caselj420139435No ratings yet

- Module 1 - Lesson 2 - Taxable Net Gift and Computation of Donor's Tax DueDocument6 pagesModule 1 - Lesson 2 - Taxable Net Gift and Computation of Donor's Tax Dueohmyme sungjaeNo ratings yet

- Management and Financial Accounting: (Assignment-2)Document10 pagesManagement and Financial Accounting: (Assignment-2)kashish Agarwal100% (1)

- Rochester FFDocument40 pagesRochester FFThomas Dayton CressmanNo ratings yet

- Frequently Asked Questions - Maybank Visa DebitDocument4 pagesFrequently Asked Questions - Maybank Visa DebitholaNo ratings yet

- Annual Report BDP 2016Document130 pagesAnnual Report BDP 2016Zahra Putri PratamaNo ratings yet

- 021119-Life Certificate Physical Format PDFDocument2 pages021119-Life Certificate Physical Format PDFEr Karan RajNo ratings yet

- United Coconut Planters Bank v. Sps BelusoDocument2 pagesUnited Coconut Planters Bank v. Sps Belusod2015member100% (1)

- Break-Even Point NotesDocument3 pagesBreak-Even Point NotesMinu Mary Jolly100% (1)

- Atlas Resources Annual Report 2013 Company Profile Arii Indonesia Investments PDFDocument214 pagesAtlas Resources Annual Report 2013 Company Profile Arii Indonesia Investments PDFHenri MuqorobiNo ratings yet

- Wachtell, Lipton, Rosen Katz: New - York, New York 10173Document11 pagesWachtell, Lipton, Rosen Katz: New - York, New York 10173Matthew Russell LeeNo ratings yet

- CV TemplatesDocument3 pagesCV TemplatesMd Shohag AliNo ratings yet

- International Flow of FundsDocument72 pagesInternational Flow of FundsBilal sattiNo ratings yet

- Test Bank Ques - 5Document4 pagesTest Bank Ques - 5MahfuzulNo ratings yet

- Kuis NPV Vs IRR (CH 5 and 6)Document4 pagesKuis NPV Vs IRR (CH 5 and 6)Imelda HotmariaNo ratings yet

- CFO ProgrammeDocument7 pagesCFO ProgrammeAnish ShahNo ratings yet

- MBA-Financial and Management AccountingDocument331 pagesMBA-Financial and Management AccountingMahoKukhianidze0% (1)

- All EXam Data - RevisedDocument108 pagesAll EXam Data - RevisedTesfaye Belaye100% (2)

- Application of JhimpirDocument194 pagesApplication of Jhimpirjaved765No ratings yet

- CTA Case Phil Am Life V CTA and CommissionerDocument4 pagesCTA Case Phil Am Life V CTA and Commissionersaintkarri100% (3)

- General Form No 58 (A) TreasDocument1 pageGeneral Form No 58 (A) TreasJEAN M. BUAL100% (1)

- Finacle Friendly A Handbook On CbsDocument289 pagesFinacle Friendly A Handbook On CbsS. Allen78% (23)

- Branches of AccountingDocument3 pagesBranches of AccountingMie HuntersNo ratings yet

- Module 2 Conceptual FrameworkDocument49 pagesModule 2 Conceptual FrameworkNicole ConcepcionNo ratings yet

- The Coming Reset of The International Monetary SystemDocument1 pageThe Coming Reset of The International Monetary SystemEliezer Ben Iejeskel100% (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Your First CFO: The Accounting Cure for Small Business OwnersFrom EverandYour First CFO: The Accounting Cure for Small Business OwnersRating: 4 out of 5 stars4/5 (2)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!From EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Rating: 4.5 out of 5 stars4.5/5 (8)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitFrom EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitRating: 4.5 out of 5 stars4.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackFrom EverandThe Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackRating: 1 out of 5 stars1/5 (1)

- Excel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsFrom EverandExcel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- Accounting All-in-One For Dummies, with Online PracticeFrom EverandAccounting All-in-One For Dummies, with Online PracticeRating: 3 out of 5 stars3/5 (1)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)