Professional Documents

Culture Documents

Mountain Company CFS Problem

Uploaded by

Bryan NograOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mountain Company CFS Problem

Uploaded by

Bryan NograCopyright:

Available Formats

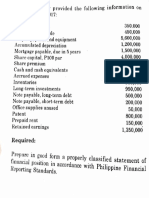

Mountain Company provided the following information:

2014 2013

Cash and cash equivalents 5,600,000 7,400,000

Accounts receivable 3,000,000 3,500,000

Inventory 8,000,000 6,500,000

Prepaid expenses 400,000 600,000

Property, plant and equipment 55,000,000 42,000,000

Accumulated depreciation (20,000,000) (16,000,000)

Accounts payable 6,000,000 9,500,000

Accrued expenses 1,500,000 500,000

Note payable - bank (current) 2,000,000 5,000,000

Note payable-bank (noncurrent) 10,000,000 -

Ordinary share capital 30,000,000 30,000,000

Retained earnings 2,500,000 ( 1,000,000)

Cash needed to purchase new equipment was raised by borrowing from the bank with a

long-term note.

Equipment costing P2,000,000 and carrying amount of PI,500,000 was sold for PI,800,000.

The entity paid a cash dividend of P3,000,000 in 2014.

Retained Earnings

Beg

Net loss Net Income

Cash Dividend

End

Retained Earnings

1,000,000

6,500,000 net income

3,000,000

2,500,000

You might also like

- Chapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Document38 pagesChapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Asi Cas Jav0% (1)

- PPEDocument30 pagesPPEJohn Kenneth AlicawayNo ratings yet

- Financial Accounting and Reporting Test BankDocument30 pagesFinancial Accounting and Reporting Test BankMiku Lendio78% (9)

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Quiz - 4B UpdatesDocument7 pagesQuiz - 4B UpdatesAngelo HilomaNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Cash Flow Online April 6 2024 For StudentsDocument5 pagesCash Flow Online April 6 2024 For Studentsraven.jumaoas.eNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- Financial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionDocument29 pagesFinancial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionBernadette PalermoNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- FAR Test BankDocument24 pagesFAR Test BankMaryjel17No ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Quiz - Single EntryDocument2 pagesQuiz - Single EntryGloria BeltranNo ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Financial Accounting and Reporting Final ExaminationDocument13 pagesFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- (Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Document2 pages(Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Irene ArantxaNo ratings yet

- 162 003Document4 pages162 003Angelli LamiqueNo ratings yet

- FABM 2 ProjectDocument14 pagesFABM 2 ProjectMilanie Rose Mendoza 11- ABMNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Activity Part 1 Prepartion of Financial StatementsDocument4 pagesActivity Part 1 Prepartion of Financial Statementsjrmsu-3No ratings yet

- Pembahasan Genap ACT Genap 2020 19 MarDocument12 pagesPembahasan Genap ACT Genap 2020 19 MarSoca NarendraNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- Cfas Pfa 01Document194 pagesCfas Pfa 01Kimberly Claire Atienza100% (1)

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- ACCTGREV1 - 009.1 Statement of Cash Flows Part 1Document1 pageACCTGREV1 - 009.1 Statement of Cash Flows Part 1Jeremiah David0% (1)

- Seatwork Far3Document3 pagesSeatwork Far3Mansour HamjaNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Chapter 1Document20 pagesChapter 1Coursehero PremiumNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- Review Problems AnswersDocument4 pagesReview Problems AnswersFranchette Yvonne JulianNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementROHIT SHANo ratings yet

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- Acctg 100C 25 PDFDocument2 pagesAcctg 100C 25 PDFQuid DamityNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- Statement of Cash FlowDocument2 pagesStatement of Cash FlowHaidee Flavier Sabido100% (1)

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- Cashflow Statement-Class Practice 1Document2 pagesCashflow Statement-Class Practice 1AnikaNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet