Professional Documents

Culture Documents

PT Merdeka Battery Materials TBK

PT Merdeka Battery Materials TBK

Uploaded by

Otniel SimopiarefOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PT Merdeka Battery Materials TBK

PT Merdeka Battery Materials TBK

Uploaded by

Otniel SimopiarefCopyright:

Available Formats

PT Merdeka Battery Materials Tbk

Registered No. S-03093/BEI.PP1/04-2023

Quarterly Report: June 2023

PT Merdeka Battery Materials Tbk (“MBMA” or “the Company”) is

PT Merdeka Battery

pleased to report on its June 2023 quarterly activities.

Materials Tbk

IDX code: MBMA MBMA aims to become a leading, vertically integrated, global battery

As at 30 June 2023 materials company. The Company holds a portfolio of high-quality assets

in the battery materials value chain located in Central Sulawesi and

Capital Structure Southeast Sulawesi, Indonesia. Since completing a series of acquisitions

(1 August 2023) in 2022, MBMA has made significant progress in expanding and

Shares outstanding: developing its downstream business along the battery value chain.

107,995,419,900

shares MBMA completed its Initial Public Offering (“IPO”) on the Indonesia Stock

Share price: IDR 745 Exchange (“IDX”) during the quarter. The IPO, priced at IDR795 per share,

Market capitalisation: was well supported by domestic and foreign institutional investors, regional

$5.3 billion sovereign wealth fund and strategic investors. A total of 11.6 billion new

shares were issued representing IDR9.2 trillion in new capital and

Cash and Debt approximately 10.7% of the total outstanding shares.

Cash: $328 million

Bank debt: $289 million MBMA, together with its strategic partners Tsingshan Group, CATL and

Huayou, is well positioned to deliver its long-term strategy of maximising

Board of the value of its assets by pursuing downstream expansion projects to

Commissioners produce materials critical to support the fast-growing electric vehicle value

Winato Kartono chain.

(President)

Michael W.P. MBMA consists of the following key assets:

Soeryadjaya

• Sulawesi Cahaya Mineral Mine (“SCM Mine”)

Hasan Fawzi

• Rotary Kiln-Electric Furnace Smelters (“RKEF Smelters”)

(Independent)

• Nickel Matte Converter (“Nickel Matte”)

Board of Directors • Acid Iron Metal Project (“AIM Project”)

Devin Antonio Ridwan

MBMA also has several significant, downstream growth projects including

(President)

High Pressure Acid Leach (“HPAL”) facilities that will be developed in

Jason Laurence Greive

MBMA’s own Indonesia Konawe Industrial Park (“IKIP”), along with other

(Vice President)

assets that support the overall nickel processing chain.

Titien Supeno

Andrew Phillip Starkey Major developments during the quarter include:

Registered Office • First production of nickel matte, following the acquisition of a high-

Treasury Tower, 69th grade nickel matte converter;

Floor, District 8 SCBD • The successful commissioning of a third RKEF plant, ZHN, which will

Lot. 28 more than double MBMA's NPI production;

Jl. Jend. Sudirman Kav. • The commencement of commissioning activities of Huayou’s HPAL

52-53, Senayan,

feed preparation plant within the SCM Mine concession area which will

Kebayoran Baru,

allow large scale mining activities to commence;

South Jakarta 12190

• Continued development of the AIM Project and SCM Mine haul road;

and

Tel: +62 21 3952 5581

Fax: +62 21 3952 5582 • Advancement of HPAL feasibility work, with detailed engineering and

construction expected to commence shortly after feasibility work

completion.

MBMA adheres to the highest safety standards, and we are pleased to

report No Lost Time Injury (“LTI”) occurred during the quarter at our

operations. Total manhour without LTI is 7,510,743 at the end of the

quarter.

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 1 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

SCM Mine

Resource: SCM Mine is regarded as one of the world’s largest resources in terms of contained nickel

with approximately 13.8 million tonnes of nickel and 1.0 million tonnes of cobalt 1. The SCM Mine will

supply saprolite ore to MBMA’s RKEF Smelters (CSID, BSID and ZHN), located at the Indonesia

Morowali Industrial Park (“IMIP”), and supply limonite ore to HPAL plants at both IMIP and IKIP.

Mining: Mining activities continue to ramp up on site. Total material mined was 944,212 wmt, comprising

waste, limonite ore and saprolite ore with material movement of 312,743 wmt, 390,436 wmt and 241,033

wmt, respectively. The actual mining contractor cost incurred in 1H 2023 was approximately $4.2/wmt

ore mined.

Total ending stockpiles at the end of the quarter is set out below:

Table 1: SCM Mine Stockpiles at the end of the quarter

Ore Type Ore (wmt) Ni Grade (%)

Limonite ore 1,988,687 1.24%

Saprolite ore 907,552 1.83%

Total 2,896,239 1.41%

Haul road: MBMA is currently upgrading the haul road from the mine site to IMIP to improve access

and allow the efficient delivery of saprolite ore from the SCM Mine to the RKEF Smelters. The

earthworks are being managed by PT Merdeka Mining Servis (“MMS”) and significant progress has

been made with 9.5 million cubic meters of material movement (representing 98% completion) at the

end of the quarter. MBMA will continue to upgrade the haul road with the aim of achieving a 9% grade

by early Q3 2023, which will allow the transport of saprolite ore to begin. As of the end of the quarter,

approximately $77.5 million has been invested on the haul road upgrade with a further investment of

$8.2 million expected to complete the upgrade.

Once the haul road reaches a 9% grade, MBMA will commence the hauling of saprolite ore to its RKEF

Smelters at IMIP. Trial ore haulage is underway and commenced after the end of the quarter.

1

SCM Mineral Resource: JORC prepared by AMC Consultants Pty Ltd issued in May 2022. Total resource of 1.9 billion wmt at

1.22% Ni containing 13.8Mt of nickel and at 0.09% Co containing 1.0Mt of cobalt

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 2 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

Figure 1: Haul road connecting SCM Mine to IMIP

Other construction: MBMA continues to improve site infrastructure to support mining operations,

including developing several mine site roads, ore haulage, fuel storage, bailey bridge and camp

facilities. These construction activities are supported by both the MMS and MBMA project teams. MBMA

is also monitoring the Huayou Feed Preparation Plant (“FPP”) construction project taking place inside

the SCM Mine concession area. The FPP is nearing completion and Huayou has begun commissioning

of the FPP. Huayou is also installing a slurry pipeline from the FPP to the PT Huayue Nickel Cobalt

HPAL plant (“HNC”) at IMIP. The FPP and slurry pipeline will allow the SCM Mine to supply limonite

feed required by HNC. These construction projects are expected to be completed by the end of 2023,

allowing the transport and sale of limonite ore from the SCM Mine to begin.

Figure 2: Ore haulage facility warehouse

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 3 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

Exploration: Resource definition drilling activities are currently focusing on the Delta Sierra (“DS”) and

Bravo Romeo 2&3 (“BR 2&3”) areas, with 304 diamond drill holes completed for 8,178 meters during

the quarter. The infill drilling program used 15 drill diamond drill rigs with drill holes completed on a 50

meters grid drill spacing. Drilling is continuing with approximately 20,000 meters planned for the

remainder of 2023.

During the quarter, initial surface exploration commenced in the Papa Bravo (“PB”) North and BR 2&3

South area. This program is following up on the distribution of ultramafic rocks based on regional

geology maps, looking for extensions of nickel laterite deposits within the SCM Mine concession area.

Figure 3: SCM Mine concession area showing resource definition drilling completed in Q2 2023

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 4 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

RKEF Smelters

Overview: MBMA has three RKEF Smelters within IMIP. BSID and CSID each have a nameplate

capacity of 19,000 tonnes of nickel in NPI per annum and have been operating successfully since early

2020. A third smelter (ZHN) has successfully completed commissioning of all four lines during the

quarter and has an expected nameplate capacity of 50,000 tonnes of nickel in NPI per annum.

Operating outlook: Each of BSID and CSID are expected to produce 18,000 – 20,000 tonnes of nickel

in NPI at an AISC of $13,000 – 15,000/t for 2023.

ZHN is expected to produce 21,000 – 25,000 tonnes of nickel in NPI for this year following its

commissioning during the quarter.

Production: During the quarter, BSID and CSID processed 1.01 million wmt of ore at a grade of 1.70%

to produce a combined 9,725 tonnes of nickel in NPI. The combined AISC for BSID and CSID for the

quarter was $13,470/t. In June 2023, ZHN produced 2,145 tonnes of nickel in NPI at an AISC of

$13,406/t. Production cost is expected to decline as ZHN completes commissioning and moves into

steady state production. Combined nickel in NPI production for the quarter was 11,870 tonnes at an

AISC of $13,459/t.

Operating costs decreased by 16% compared to last quarter, primarily attributed to a lower price for

nickel ore, electricity generation costs and smelting costs. One of the major cost components is nickel

ore, the price of which varies depending on the international nickel price. MBMA will be self-sustaining

and less exposed to the ore price fluctuations following commencement of saprolite hauling activities

from SCM Mine.

Average realised NPI price for the quarter was $14,123/t.

Figure 4: ZHN RKEF Smelter

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 5 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

Nickel Matte

Overview: On 31 May 2023, the Company completed the acquisition of a 60% interest in PT Huaneng

Metal Industry (“HNMI”) with the remaining 40% interest held by Tsingshan Group. HNMI is a high-

grade nickel matte conversion facility located in IMIP and has been in steady state production since

2022. HNMI processes low-grade nickel matte (“LGNM”) produced by RKEF smelters, reducing the iron

content and resulting in a high-grade nickel matte (“HGNM”) product containing more than 70% nickel.

Historically, HNMI has sustained an average annual production rate of 50,000 tonnes of nickel in nickel

matte. This acquisition allows MBMA to deliver immediate, incremental cash flow and capture additional

profit margin from producing and selling nickel matte, a key feedstock for battery precursors and Class

1 nickel.

Figure 5: HNMI converter Figure 6: HGNM product

Production: HNMI produced 14,379 tonnes of nickel in nickel matte at an AISC of $15,954/t for the

quarter. HGNM production for June 2023 was 4,438 tonnes of nickel in nickel matte, at an AISC of

$15,524/t. Most of the operating cost is attributable to the purchase of LGNM at $14,916/t. The balance

of the costs consists of materials, electricity, labour and sustaining capital.

HNMI has an agreement to purchase LGNM at the prevailing NPI price plus a small margin. As a large-

scale producer of NPI, MBMA is naturally hedged against the cost of LGNM. MBMA continues to

evaluate the conversion of its existing RKEF Smelters to produce LGNM and supply HNMI directly.

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 6 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

AIM Project

Summary: Construction is nearing completion with engineering, procurement and construction

reaching 91.6% at the end of the quarter. With the completion of original engineering design scope,

MBMA’s focus is shifting from design centric to construction and operational readiness.

Merdeka Tsingshan Indonesia Joint Venture (“JV”): PT Merdeka Copper Gold Tbk (“MDKA”),

Tsingshan Group and their respective affiliates signed a JV agreement to develop the AIM Project in

February 2021. The AIM Project will process pyrite ore from MDKA’s wholly owned Wetar copper mine

(“Wetar”). PT Merdeka Tsingshan Indonesia (“MTI”), a JV company, was established in March 2021.

MBMA (through its subsidiary, PT Batutua Pelita Investama) owns an 80% interest and Tsingshan Group

(through its affiliate) owns the remaining 20%.

JV overview: The AIM Project will purchase high-grade pyrite ore from Wetar under a long-term supply

agreement. The ore, containing copper, gold, silver and zinc will be transported by barge from Wetar to

IMIP.

The AIM plant is designed to treat the pyrite ore from Wetar at a nominal rate of 1,060,000 tonnes per

year. The plant will produce sulphuric acid, saturated steam, iron ore pellets, sponge copper, lead-zinc

hydroxides, gold and silver doré. Significant growth in acid demand is expected as additional HPAL

plants are planned to be constructed in Indonesia.

Construction progress: The AIM Project successfully achieved 10,874,177 LTI free manhours to date.

MBMA is shifting to operational readiness and conducted a workshop on commissioning risk

assessment with key safety, operational and construction personnels. Key concerns were registered

and will be reviewed and updated monthly. MMS is realigning resources, with emphasis on the

concentrator being ready for commissioning. Operational readiness is another key active area with

spares, consumables and first fill procurement on-going. Project documentation preparation, such as

operating manuals, control philosophies and standard operating procedures is progressing to schedule.

Construction progress reached 85.7%. The pyrite plant is the first operational area, and the project team

is focusing on the area to ensure a smooth transition to operation. The work has shifted from civil and

structural installation to mechanical, piping, and electrical installation. Around all project areas, ongoing

critical equipment installation consists of chain grate, rotary kiln, and iron pellet cooler. Electrical

installations continue with cable supports, lighting, local and equipment control panels.

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 7 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

Figure 7: Construction progress of AIM Project

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 8 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

Other Key Developments

HPAL facilities: On 16 March 2023, MBMA entered into a Memorandum of Understanding (“MoU”) with

Brunp CATL regarding the development of an HPAL plant to produce Mixed Hydroxide Precipitate

(“MHP”). The first phase of MBMA’s HPAL strategy is to develop 120ktpa of nickel in MHP production

capacity split into two 60ktpa tranches. MBMA will own a 66% economic interest in the first 60ktpa

tranche (“HPAL 1a”), with 34% owned by Brunp CATL. Feasibility work is advancing, with detailed

engineering and construction expected to commence shortly after the completion of the feasibility work.

Commissioning is expected within 24 months from the commencement of construction. The MoU

remains subject to definitive documentation and approvals.

MBMA is in discussions with other potential JV partners regarding other HPAL joint ventures.

IKIP: IKIP is a joint venture between MBMA (32%) and Tsingshan Group (68%) to develop an industrial

park, focusing on HPAL processing technology for battery materials within the SCM Mine concession

area. IKIP is now processing land conversion into approximately 3,800 Ha non-forest area for the

Konawe Industrial Estate on behalf of PT Indonesia Konawe Industrial Park, covering an area of

approximately 3,500 Ha. Furthermore, MBMA is progressing with the revision of AMDAL and other

required permits and licenses.

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 9 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

Sustainability & Environment, Social and Governance Planning

Sustainability

Finalisation of the 2022 MBMA Sustainability Report

MBMA has issued the 2022 Sustainability Report and submitted it to the Financial Services Authority

(“OJK”) and Indonesia Stock Exchange (“IDX”). The report emphasises MBMA's environmental, social,

and governance (“ESG”) initiatives and performance, as well as MBMA’s contribution to the Sustainable

Development Goals (“SDGs”). It provides a comprehensive overview of MBMA's efforts to integrate

sustainable practices into its operations, including environmental stewardship, occupational health and

safety, employee welfare, community engagement, human rights, and sustainability governance.

The Sustainability Report has been developed in accordance with GRI Standards 2021 and national

regulations. The national regulations that were used as a reference for preparing this report are OJK

Regulation No. 51/POJK.03/2017 regarding Sustainable Finance and Financial Services Authority

Circular Letter (SEOJK) No. 16/SEOJK.04/2021.

The report underwent a thorough review to ensure accuracy, transparency, and alignment with MBMA's

sustainability objectives. Multiple departments from MBMA collaborated to assess content and validate

data accuracy to ensure compliance with reporting standards and regulations. By submitting the report

to the OJK and IDX, MBMA demonstrates its commitment to transparency, accountability, and

responsible business practices. Moreover, it aims to share its sustainability accomplishments and plans

with stakeholders and the wider public, fostering greater awareness and engagement in sustainable

practices.

MBMA Sustainability Roadmap

The MBMA sustainability team is working on further developing MBMA's sustainability roadmap, which

includes frameworks, governance, policies, and procedures. These elements will shape MBMA's

Sustainability approach and influence external agencies' ratings, such as MSCI and Sustainalytics.

These external ratings are increasingly important for investors (providing access to capital) and end

users (original equipment manufacturers/OEMs), making them crucial for MBMA's growth ambitions.

Furthermore, MBMA's roadmap aims to align its sustainability approach with international standards,

particularly the GRI Standards 2021, while ensuring full compliance with the national OJK regulation

No. 51/2017 requirement.

Environmental

Biodiversity Management Plan for PT Sulawesi Cahaya Mineral (“SCM”)

As stated in MBMA's environmental policy, MBMA is committed to consistently implementing effective

environmental management practices while reducing and restoring environmental impacts throughout

its operations. Specifically, MBMA is dedicated to protecting and preserving biodiversity, responsibly

utilising water resources, and incorporating rehabilitation into its operational cycle.

As part of the efforts to preserve biodiversity, MBMA has completed a biodiversity management plan

(“BMP”) with the assistance of external biodiversity experts. The BMP's objective is to guide the

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 10 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

conservation, enhancement, and management of biodiversity within and adjacent to the site, while

allowing for development, restoration, and aftercare management to proceed.

The development of the BMP is based on the existence of biodiversity value within the project area and

its surrounding environment, as well as the local community's reliance on the utilization of existing

biodiversity. Furthermore, the BMP is an essential part of MBMA’s efforts to demonstrate compliance

with specific international standards related to mining activities, including the requirements from the

International Council on Mining and Metals (“ICMM”) under Principle 7 - Conservation of Biodiversity

and the Initiative for Responsible Mining Assurance (“IRMA”) Environmental Responsibility

Requirement, Chapter 4.6 - Biodiversity, Ecosystem Services, and Protected Areas.

Social and Governance

Health and Safety

At the end of the quarter, MBMA's year-to-date safety performance, as measured by the Total

Recordable Injury Frequency Rate (“TRIFR”), was 0.92, compared to the 2022 end-of-year (EOY) result

of 1.31. There were no Lost Time Injuries (LTIs) during this quarter, resulting in a 2023 year-to-date LTI

Frequency Rate of 0.09, as opposed to the 2022 EOY rate of 0.00.

Figure 8: Incident Rolling Frequency Rates (incident per million man-hours worked)

Additionally, effective, and efficient traffic management development and implementation have

continued during the quarter. This includes carrying out a trial of installing fatigue detection cameras on

haul truck units in the SCM Mine area to prevent accidents caused by operators' fatigue. Furthermore,

the critical risk management program is being developed at MBMA.

Cultural Heritage Management Plan of SCM

MBMA has completed cultural heritage management plan (“CHMP”) with the support of a third party,

Hasanudin University. The CHMP presents a comprehensive strategy for SCM to manage the cultural

heritage impacted by its mining activities, following heritage preservation procedures.

At its core, the CHMP includes mitigation and management measures that adhere to national laws and

international best practices for heritage preservation. As a guide, the CHMP will aid SCM in upholding

its commitment to safeguarding cultural heritage within the mining concession area and its

surroundings.

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 11 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

Appendix 1: Finance and Corporate

Cash and Cash Equivalents: As of 30 June 2023, cash and cash equivalents were $328 million.

Debt:

MBMA Senior Loan

MBMA entered into a $300 million loan with ING and Barclays on 19 May 2022 (“MBMA Senior Loan”).

The loan had an applicable interest rate of 4.25% per annum plus SOFR with final maturity date on 30

September 2026.

In Q3 2022, PT Merdeka Copper Gold Tbk (“MDKA”) provided debt funding of $225 million to MBMA to

partially repay the MBMA Senior Loan.

MBMA fully repaid its outstanding principal loan of $225 million to MDKA and $75 million to ING on 18

April 2023 from IPO proceeds.

MTI Facility Agreement

MTI entered into a $260 million term loan facility (“MTI Term Loan”) and IDR430 billion (equivalent to

$29 million) of MTI VAT funding facility (“MTI VAT Facility”) on 31 August 2022. MTI Term Loan has a

final maturity date of August 2027 with applicable margin of:

i. Offshore lenders: 3.75% per annum plus SOFR; and

ii. Onshore lenders: 3.95% per annum plus SOFR.

MTI VAT Facility has an applicable margin of 3.50% per annum plus JIBOR with a final maturity in

August 2026. As of 30 June 2023, MTI has fully drawn the $260 million MTI Term Loan and the IDR430

billion MTI VAT Facility.

MBMA Shareholder Loan

MBMA entered into a $175 million shareholder loan agreement with MDKA on 22 May 2022. This loan

has a maturity date of 25 May 2025 with an applicable margin of 4.60% per annum plus SOFR.

The outstanding balance of this shareholder loan as of 30 June 2023 was $75 million.

MTI Shareholder Loans

MTI entered into a $50 million Project Expansion Facility Agreement with MDKA on 29 July 2022 to fund

the development of a copper cathode plant in AIM Project. The interest rate for this facility is 5.26% per

annum plus SOFR with a maturity date on the later of (i) 5 (five) years after the signing of the agreement;

and (ii) the date falling 5 (five) business days after the final maturity date as defined in the MTI Term

Loan, or such later date agreed in writing by the parties. As of 30 June 2023, MTI had drawn $20 million

from this facility.

MTI also entered into a $60 million Parent Support Facility Agreement with MDKA on 23 August 2022

to fund the overall development of AIM Project. The interest rate for this facility is 5.26% per annum

plus SOFR with a maturity date on the later of (i) 5 (five) years after the signing of the agreement; and

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 12 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

(ii) the date falling 5 (five) business days after the final maturity date as defined in the MTI Term Loan,

or such later date agreed in writing by the parties. As of 30 June 2023, MTI has fully drawn this facility.

On 14 June 2023, MTI, MBMA and MDKA signed a Partial Novation and Amendment Agreement to

partially assign and transfer of $30 million the Parent Support Facility Agreement to MBMA.

The outstanding balance of both MTI loan from MDKA on 30 June 2023 was $50 million.

ZHN Shareholder Funding

ZHN has a shareholder loan from both its shareholders, MBMA and Tsingshan Group, in proportion to

each respective shareholder. The interest rate for both facilities is 4.75% per annum plus SOFR.

The outstanding balance of this shareholder loan on 30 June 2023 was $105 million to each of

Tsingshan Group and MBMA.

Sales: During the quarter, 11,053 tonnes of nickel in NPI were sold from CSID and BSID at an average

price of $14,123/t for total revenue of $156.1 million. NPI produced by ZHN in Q2 2023 is expected to

be sold in Q3 2023.

HNMI sold 13,225 tonnes of nickel in nickel matte at an average price of $16,648/t for total revenue of

$220.2 million during the quarter. The acquisition of HNMI was completed in June 2023 resulting in

MBMA recognising HGNM revenue of $52.9 million2 reflecting sales of 3,036 tonnes of nickel in nickel

matte at an average price of $17,423/t.

Table 2: MBMA Sales YTD 2023

Product Product Sold (t Ni) Average Sales Price ($/t) $ million

Q1 2023

NPI 8,170 17,470 142.7

Q2 2023

NPI 11,053 14,123 156.1

HGNM 3,036 17,423 52.9

Total 351.7

Capital Structure: Total issued and paid-up capital of MBMA is 107,995,419,900 shares.

Shareholders No. of shares %

PT Merdeka Energi Nusantara (99.99% owned by MDKA) 53,778,976,600 49.8

Thohir Group 11,967,190,000 11.1

Huayong International (HK) Limited (Huayou Cobalt) 8,149,060,000 7.5

Winato Kartono 6,796,280,000 6.3

Total Major Shareholders 80,691,506,600 74.7

Others (less than 5%) 27,303,913,300 25.3

Total Issued Shares 107,995,419,900 100.0

2

Includes cobalt credits of 38 tonnes with total amount of US$681k

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 13 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

Quarterly Report: June 2023

For further information, please contact:

Investor Relations

Treasury Tower 69th Floor

District 8 SCBD Lot. 28

Jl. Jend. Sudirman Kav. 52-53,

Senayan, Kebayoran Baru,

South Jakarta 12190

E: investor.relations@merdekabattery.com

ABOUT PT MERDEKA BATTERY MATERIALS TBK

PT Merdeka Battery Materials Tbk (IDX: MBMA) (“MBMA” or the “Company”) holds a portfolio of

high-quality businesses in the strategic mineral and electric vehicle (“EV”) battery value chain located

in Indonesia. MBMA aims to establish itself as a leading, vertically integrated company to support the

clean energy transition.

MBMA’s portfolio includes one of the world’s largest nickel resources containing approximately 13.8

million tonnes of nickel and 1.0 million tonnes of cobalt, three operating RKEF smelters with a total

nameplate capacity of 88,000 tonnes of nickel in NPI per annum, a high-grade nickel matte conversion

facility located within IMIP with an average annual production of 50,000 tonnes of nickel in nickel matte,

the Acid Iron Metal (“AIM”) Project which will produce acid and steam for use in high pressure acid

leach (“HPAL”) plants, in addition to producing other metals such as copper, gold and iron. MBMA is

also developing substantial HPAL processing facilities at the Indonesia Konawe Industrial Park (“IKIP”),

a battery materials-focused industrial estate located within SCM Mine concession area. It is intended

that the first phase of the HPAL plant will be a 120,000tpa operation (nickel equivalent) split into two

60,000tpa tranches.

MBMA is supported by prominent Indonesian group, among others: Provident Capital Group, Saratoga

Investama Group and Thohir Group who have an established and proven track records in successfully

identifying, building and operating multiple private and publicly listed and unlisted companies across

diverse industries in Indonesia.

PT Merdeka Battery Materials Tbk (IDX: MBMA) Page 14 of 14

All figures are denominated in US Dollars and represents unaudited numbers, unless otherwise stated

You might also like

- MemoireDocument74 pagesMemoireRafik Dra100% (1)

- Handbook on Battery Energy Storage SystemFrom EverandHandbook on Battery Energy Storage SystemRating: 4.5 out of 5 stars4.5/5 (2)

- Introduction to Petroleum Process SafetyFrom EverandIntroduction to Petroleum Process SafetyRating: 3 out of 5 stars3/5 (2)

- Laser Processing of Materials in Japan: Research, Development and ApplicationsFrom EverandLaser Processing of Materials in Japan: Research, Development and ApplicationsNo ratings yet

- 07 - Eletronica Embarcada MotoresDocument24 pages07 - Eletronica Embarcada MotoresJeferson SantosNo ratings yet

- Knowledge and Power: Lessons from ADB Energy ProjectsFrom EverandKnowledge and Power: Lessons from ADB Energy ProjectsNo ratings yet

- Basin Evolution and Petroleum Prospectivity of the Continental Margins of IndiaFrom EverandBasin Evolution and Petroleum Prospectivity of the Continental Margins of IndiaNo ratings yet

- Carbon Capture, Utilization, and Storage Game Changers in Asia and the Pacific: 2022 Compendium of Technologies and EnablersFrom EverandCarbon Capture, Utilization, and Storage Game Changers in Asia and the Pacific: 2022 Compendium of Technologies and EnablersNo ratings yet

- Integrated Sand Management For Effective Hydrocarbon Flow AssuranceFrom EverandIntegrated Sand Management For Effective Hydrocarbon Flow AssuranceNo ratings yet

- Osh Induction Program in Enhancing Safety Awareness Amongst Fabrication Workers in Brooke Dockyard, Kuching, SarawakFrom EverandOsh Induction Program in Enhancing Safety Awareness Amongst Fabrication Workers in Brooke Dockyard, Kuching, SarawakRating: 5 out of 5 stars5/5 (1)

- Next Generation Batteries: Realization of High Energy Density Rechargeable BatteriesFrom EverandNext Generation Batteries: Realization of High Energy Density Rechargeable BatteriesKiyoshi KanamuraNo ratings yet

- Token Ring Technology ReportFrom EverandToken Ring Technology ReportNo ratings yet

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesFrom EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesNo ratings yet

- Guidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Molecular Beam Epitaxy: Materials and Applications for Electronics and OptoelectronicsFrom EverandMolecular Beam Epitaxy: Materials and Applications for Electronics and OptoelectronicsHajime AsahiNo ratings yet

- Nanotechnology Commercialization: Manufacturing Processes and ProductsFrom EverandNanotechnology Commercialization: Manufacturing Processes and ProductsNo ratings yet

- How Better Regulation Can Shape the Future of Indonesia's Electricity SectorFrom EverandHow Better Regulation Can Shape the Future of Indonesia's Electricity SectorNo ratings yet

- Specific Considerations in the Assessment of the Status of the National Nuclear Infrastructure for a New Research Reactor ProgrammeFrom EverandSpecific Considerations in the Assessment of the Status of the National Nuclear Infrastructure for a New Research Reactor ProgrammeNo ratings yet

- Review and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportFrom EverandReview and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportNo ratings yet

- Motor Truck Logging Methods Engineering Experiment Station Series, Bulletin No. 12From EverandMotor Truck Logging Methods Engineering Experiment Station Series, Bulletin No. 12No ratings yet

- The Ocean-Energy Economy: A Multifunctional ApproachFrom EverandThe Ocean-Energy Economy: A Multifunctional ApproachNo ratings yet

- Initiating Nuclear Power Programmes: Responsibilities and Capabilities of Owners and OperatorsFrom EverandInitiating Nuclear Power Programmes: Responsibilities and Capabilities of Owners and OperatorsNo ratings yet

- EU China Energy Magazine 2023 April Issue: 2023, #3From EverandEU China Energy Magazine 2023 April Issue: 2023, #3No ratings yet

- Review of Configuration of the Greater Mekong Subregion Economic CorridorsFrom EverandReview of Configuration of the Greater Mekong Subregion Economic CorridorsNo ratings yet

- Abstraksi Nomor 28Document3 pagesAbstraksi Nomor 28Jeremy SidaurukNo ratings yet

- Studi Case - Ded Rumah Eco LivingDocument40 pagesStudi Case - Ded Rumah Eco LivingJeremy SidaurukNo ratings yet

- BA Draft Survey HEP 1Document4 pagesBA Draft Survey HEP 1Jeremy SidaurukNo ratings yet

- Design and Development A Multi-Portable Lift Platform Trolleys For The Large Warehouses and Markets 1Document38 pagesDesign and Development A Multi-Portable Lift Platform Trolleys For The Large Warehouses and Markets 1Jeremy SidaurukNo ratings yet

- ISO 17025 Certificate BCCDocument1 pageISO 17025 Certificate BCCJeremy SidaurukNo ratings yet

- Urutan SementaraDocument18 pagesUrutan SementaraJeremy SidaurukNo ratings yet

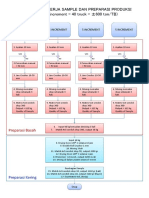

- Flowchart PreparasiDocument3 pagesFlowchart PreparasiJeremy SidaurukNo ratings yet

- Offering Letter Fajar NurDocument2 pagesOffering Letter Fajar NurJeremy SidaurukNo ratings yet

- Scanned DocumentsDocument1 pageScanned DocumentsJeremy SidaurukNo ratings yet

- Contoh Surat Perjanjian Kerja Kontrak FH UIIDocument8 pagesContoh Surat Perjanjian Kerja Kontrak FH UIIJeremy SidaurukNo ratings yet

- FRM - HRD.002 Penilaian Karyawan 4 SKILLDocument1 pageFRM - HRD.002 Penilaian Karyawan 4 SKILLJeremy SidaurukNo ratings yet

- Evaluasi DT DesemberDocument1 pageEvaluasi DT DesemberJeremy SidaurukNo ratings yet

- Bg. Princess Sofia 3005 (08-22-2022 17.04)Document1 pageBg. Princess Sofia 3005 (08-22-2022 17.04)Jeremy SidaurukNo ratings yet

- Logo Tamiya MarkusDocument1 pageLogo Tamiya MarkusJeremy SidaurukNo ratings yet

- Triple Eight Energy, PT Nomor 540.15.iup - Desdm.bup-2010 OpDocument7 pagesTriple Eight Energy, PT Nomor 540.15.iup - Desdm.bup-2010 OpJeremy SidaurukNo ratings yet

- 21 September 2022Document3 pages21 September 2022Jeremy SidaurukNo ratings yet

- Logo Tamiya MarkusDocument1 pageLogo Tamiya MarkusJeremy SidaurukNo ratings yet

- Billing Statement 1Document1 pageBilling Statement 1Jeremy SidaurukNo ratings yet

- MD Mobil 850 PrioritasDocument2 pagesMD Mobil 850 PrioritasJeremy SidaurukNo ratings yet

- Peta IUP PT. SUMBAR CALSIUM PRATAMADocument1 pagePeta IUP PT. SUMBAR CALSIUM PRATAMAJeremy Sidauruk0% (1)

- Certificate of Analysis - Certified Reference Material: Certipur Calcium CarbonateDocument2 pagesCertificate of Analysis - Certified Reference Material: Certipur Calcium CarbonateJeremy SidaurukNo ratings yet

- Tujuan Dan Manfaat Training POP PertambanganDocument2 pagesTujuan Dan Manfaat Training POP PertambanganJeremy SidaurukNo ratings yet

- Diagram Kerja Sample Dan Preparasi ProduDocument1 pageDiagram Kerja Sample Dan Preparasi ProduJeremy SidaurukNo ratings yet

- Dokumen - Tips Import Data Koordinat MinescapeDocument6 pagesDokumen - Tips Import Data Koordinat MinescapeJeremy SidaurukNo ratings yet

- Achmad Rojichan Maftuchul ArifDocument153 pagesAchmad Rojichan Maftuchul ArifJeremy SidaurukNo ratings yet

- Automação em Um Sistema de Abastecimento de Água - Análise de Dados OperacionaisDocument10 pagesAutomação em Um Sistema de Abastecimento de Água - Análise de Dados OperacionaisHeloisa DiasNo ratings yet

- HPM 10KW 96V TestDocument1 pageHPM 10KW 96V TestAnderson Ricardo PradoNo ratings yet

- 2.-RUBRICA Energías RenovablesDocument1 page2.-RUBRICA Energías RenovablesHéctor Alexis González SoriaNo ratings yet

- Wiring Diagram Drive Control (FR)Document7 pagesWiring Diagram Drive Control (FR)Heru PurwantoNo ratings yet

- Genius Store Sac... (Matematica Basica .) Grupo 7Document13 pagesGenius Store Sac... (Matematica Basica .) Grupo 7n00332646No ratings yet

- 4ta Sesion de Ejercicios - Electro - 2021-IIDocument10 pages4ta Sesion de Ejercicios - Electro - 2021-IIWitney Yurany QUEMBA PACANCHIQUENo ratings yet

- Evs Unit 2 Environmental PollutionDocument105 pagesEvs Unit 2 Environmental PollutionlyrixxopediaNo ratings yet

- Clarification-1 Anwar IspatDocument42 pagesClarification-1 Anwar IspatPranoy BaruaNo ratings yet

- ViscosidadDocument11 pagesViscosidadVanessa CastroNo ratings yet

- Chaudiere-Serpentins Babcock WansonDocument2 pagesChaudiere-Serpentins Babcock WansonzakariaNo ratings yet

- 1,4D HDi DVTD (8HZ) 68CHDocument183 pages1,4D HDi DVTD (8HZ) 68CHAlexNo ratings yet

- 5 Exercicios Transm Calor ConvecçaoDocument5 pages5 Exercicios Transm Calor ConvecçaoALEX PESSOA PIMENTELNo ratings yet

- SISTEMAS DE SECAGEM - Secador de MinérioDocument9 pagesSISTEMAS DE SECAGEM - Secador de MinériocafacioNo ratings yet

- APONTAMENTOS DE CIRCUITOS ELÉCTRICOS - Aula 03,04,05 e 06.Document13 pagesAPONTAMENTOS DE CIRCUITOS ELÉCTRICOS - Aula 03,04,05 e 06.Edvânio ÉrdnaNo ratings yet

- Check List Montacargas.Document4 pagesCheck List Montacargas.Miguel G. FigueroaNo ratings yet

- Parthan SL 680: Fully Synthetic Gear OilDocument2 pagesParthan SL 680: Fully Synthetic Gear OilprimnnitNo ratings yet

- MEPC 1 Circ 736 Rev 2Document12 pagesMEPC 1 Circ 736 Rev 2Markus SitanggangNo ratings yet

- Cap 13 Filtración Multiple Etapas. FinalDocument41 pagesCap 13 Filtración Multiple Etapas. FinalNicol Paola Muñoz ZuñigaNo ratings yet

- 7.service ManualDocument7 pages7.service ManualOrlando MantillaNo ratings yet

- Problemas PropuestosDocument3 pagesProblemas PropuestosNicolas Ignacio Aliaga MachucaNo ratings yet

- 09B 26 00 A3 Sheet 01Document1 page09B 26 00 A3 Sheet 01Leonardo PereiraNo ratings yet

- Copia de ConducciónDocument14 pagesCopia de Conducciónalex123No ratings yet

- UT 2 La MotosierraDocument30 pagesUT 2 La MotosierraSusan AlexandreNo ratings yet

- Service Manual: Inverter PairDocument144 pagesService Manual: Inverter PairhansgutmeierNo ratings yet

- Moment VectorDocument9 pagesMoment VectorGlen GulayNo ratings yet

- 6.3 Using Conductors & Insulators in Electrical Appliances.Document27 pages6.3 Using Conductors & Insulators in Electrical Appliances.ZOZO CHOUCAIRNo ratings yet

- Laleska Llanos - EPIAM - Trabajo Unidad IDocument12 pagesLaleska Llanos - EPIAM - Trabajo Unidad ILaleska LlanosNo ratings yet

- Rocket Propulsion Prof. K. Ramamurthi Department of Mechanical Engineering Indian Institute of Technology, MadrasDocument25 pagesRocket Propulsion Prof. K. Ramamurthi Department of Mechanical Engineering Indian Institute of Technology, MadrasMohd TauqeerNo ratings yet