Professional Documents

Culture Documents

1crc-Ace 1stpb - Far

1crc-Ace 1stpb - Far

Uploaded by

ace0 ratings0% found this document useful (0 votes)

2 views14 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views14 pages1crc-Ace 1stpb - Far

1crc-Ace 1stpb - Far

Uploaded by

aceCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 14

—

FINANCIAL ACCOUNTING & REPORTING OCTOBER 2017 BATCH

FIRST PRE-BOARD EXAMINATION gg EE? fy August 3, 2017 10:30AM ~ 1:00PM

INSTRUCTIONS: Select the correct answer for each of the following questions, Mark only one answer for each

item by writing a VERTICAL LINE corresponding to the letter of your choice on the answer sheet provided.

STRICTLY NO ERASURES ALLOWED. Use Pencil No. 1 ot No. 2 only.

1. Which of the following statements about Philippine GAAP is (are) false?

L The Philippine Interpretatiohs Committee issuances are an indication that the IFRSs are principles-

based.

TI, The Securities and’ Exchange Commission (SEC) allows miér6 entities to use cash basis of accounting.

111, All reporting enterprises entities in the Philippines including regulated entities are required to follow

full Philippine Financial Reporting Standards (PFRSs) in the preparation of financial statements.

T only - b. Il only ¢. and Tl only @. 1,1 and 11

al Framework has the highest level of authority in financial accounting and tepotting

Philippines +, p

Financial Accounting Standgrds applies to all reporting enterprises, whether publicly

-small and medium-sized entities

Interpretations Committee (PIC) assists the FRSC and the public it serves. by

entities are required to apply the PERS for SMEs in Philippine financial reporting?

"Novelty Store with total assets of P 300 M and total liabilities of P 160 M

Company with total assets of P 420 M and total liabilities of P 195 M

‘Capistrano, Tarlac, with toral assets of P 300 M and total liabilities of P120 M

is food. Itis in the process of issuing securities in a domestic stock exchange.

ational Accounting Standards Board is to

is which regulate the financial accounting and reporting of multinational

ind of accounting is (are) true?

esigned is exactly the same as that which the accounting

sion in the current millenninm is the uniform adoption of

‘countries of the world, |

worldwide would have the advantage of comparability

tion of financial information, . _

&RC-ACE: FAR - 1" Pre board October 2017 Batch Page 2 of 12

4. Crafted the Implementing Rules and Regulations (IRR) of the Philippine Accountancy Act of 2004.

7. Which of the following statements about “due process” in accounting standatd setting and the ‘Conceptual

Framework Is true?

1, AICPA professionals are given the opportunity to participate in the standard-setting process

Tl The FRSC, the Board of Accountancy, the Philippine Institute of Certified Public Accountants

patticipate in the due process of accounting standard-setting, as approving and endorsing bodies, with

the Professional Regulation Commission as the final signing authority

MH, Accounting standards become implementable only after it has been published in the PRC Official

Gazette

‘The Conceptual Framework constitute the accounting laws of the accountancy profession and

Sad. provisions will be meted corresponding sanctions by the regulatory bodies

d I are trac ¢, I, Mand IV ere true

a di All statements are true

journal system of recording transactions and events is an application of which of the

financial reporting?

¢. Timeliness

¢. Completeness

global phenomenon is the primary factor that accelerated what is known as

‘nancial reporting standards

onal education standatds

‘meet three criteria for recognition. Which of the following selected business

i that ate presented to you by its management in 2017 will qualify as an

signed on December 28, 2016 for P1,000,000 worth of merchandise

‘under terms 2/10, n/30

ellable lease contract for the use of a building with « useful life of 50

except

in the choice of the appropriate fair matket value to be

A. asset acquired through a non-reciprocal transfer

in the Sinancial statements through ratios and trend

on of financial condition and operating results

he analysis & recognition of accountable events

se aed

hs

TERCACEPAR - 1" Pre board Oetobor 2017 Batch oe

14. Which TWO of the following areas of an accountant? work are not part of financial accounting?

1) Reporting on parent and subsidiary selationships and transactions

2) Reporting on installment aales and long-term constmiction contracts

3) Reporting on profitability trends as well as ratios and measurements

4) Reporting on the faimess’of presentation of finaticial position and performance of am entity in

conformity with GAAP,

a. (1) and (2) b.@) and (4) c. () and@) d @ and @)

45. The basic financial statements, according the PAS 1, include all of the following except

a. Statement of Changes in Financial Position. —¢. ‘Statement of Comprehensive Income

. Statement of changes in financial position ~ ‘d. Statement of Changes in Equity

16, Which of the following statements about financial statements is (ate) incorrect?

© hefishow the teslts Of the stewardship of management for the resources entrusted to it by the capital

er te

| They are the primary responsibility of both management and the external auditor after audit,

[They are prepared aa oor ie dicted to the common information needs of wide

‘tange of statement users. |

f. The financial statements prepared by banks, cooperatives and insurance companies should comply ist

“ith repulitory accounting principles before they should comply with generally accepted accounting

principles of the accountancy profession.

¢. Statements I, I and IV

, Statements II, III and TV

‘of the following statements about financial accounting it incor?

os ee bbe prepared by a certified public accountant.

fal accounting is a social science that can be infinenced by changes in the legal, political and

business environments.

stated in any language or dialect of a geographical jurisdiction.

linfotmation useful to users can be displayed on the face of the basic financial

© Statements I and IIT only

4, Statements III end IV only

F acquisition of asset and measurement base is (are) property and logically

Measurement base

4, Fair value

2, Net realizable value

3. Equivalent cash price

€-2 and 3 only a.1,2and3

ments may be made with the greatest degree of objectivity

c. Appraised value of land at year-end

end“ d._ Net Income

4s GAAP and the qualitative objectives most applied?

¢ Joumnalizing and preparing closing entries

Preparing the financial stacements

- accounting cycle is true?

the debit account from the journal to the ledger

sheet and income statement accounts, of in some tare

OREAGE:FAR - 1 Pre board October 2017 Batch Page 4 of 12

A&, Mixed accounts should be split into theic real and nominal elements.

a. Berots discovered at the end of the Period should be corrected in order ro generate mote reliable

| Bnancial reports

25. The following six adjusting entries were recorded by RNQ Coxp. at the end of the fiscal yen

(1) Bank service charge 500 () Wages expense 50,000

“Cash 500 Wages payable 50,000

@) Unearned rent 7,400 ©) Advertising expense 6,000

Rent revenue Propaid advertising 6,000

7,400

~ @) Bad debts expense 18,000 (© Prepaid rent 12,000

Allowance for bad debts 18,000 Rent expense 12,000

fotiinal cntties which should be appropriately reversed, which of the six

de reverse?

Paw «

should be reversed

fing statements does not pertain directly to the Going-Concetn assumption of

ei

nd liabilities should be classified in the statement of financial position as to “current” or “non

@ the ability of aa entity to operate as a going concer, such as a troubled-debt restructuring

‘should be disclosed in the notes to financial statements

‘and expenses should be recognized as these events occur, even if cash is not yet received or

pega

the Accrual assumption is related to the Going Concern assumption

G. Comparability

H. Freedom from error

I, Completeness

« E,G,H

d. C,D,EandF

conceptual framework includes a cost-benefit consteaint.

‘benefit constraint?

Je greater than the costs of providing it

n cost to users of the information

aze not always evident or measurable, but must be considered,

in decision by helping users form

‘or confirm /correct prior expectations

ial information is free from bias and

sare of significant information

financial statements, the

at times because of cost

y. GRG-AGE:FAR - 1" Pre board Cciober 2017 Batch Page 5 of 12

29. Eexpensing the cost of an inexpensive waste receptacle which has a useful life of 3 years is

% A Violation of the definition of an asset

, Is an application of cost / benefit constraint

Ts an application of the time period assumption

@. Is a violation of the expense recognition principle of systematic and rational allocation

ee we the following statements about the concept of measurement ot valuation in Accounting és (are)

rue?

GAAP, as a general nile, the primary basis of measurement of assets upon acquisition is

instances when assets are initially measured on the basis of fair value.

tion of assets and liabilities in the balance sheet are a mixture of costs and values.

IPRS, under no citcumstances is price-level accounting acceptable as an alternative

Fin accounting in present-day GAAP.

C.1, 1, and I only

D. 1,11, [land IV

“the 2017 trial balance, Rome Company's accountant committed the following errors

BP iid cent account amounting to P4,000; understatement of the inventory account by

of the sales account by P1,500; accounts receivables totaling to P123,000 was

‘balance as P213,000; accounts payable totaling to P153,000 was included as P135,000;

ds payable was included as a credit cather than as a debit, P1,500; Revenue expenditures of

capitalized to furniture and fixtures.

n the debit and ctedit amounts in Rome Company's trial balance is

+b. P26,000 c. P7500 d, P27,500

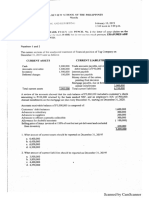

taken from Pa

$ Company's adjusted trial balance; except for its land and building

Inventory 300,000

Paris, capital °F 420,000

Prepaid supplies 11,000

Rent revenue © 11,500

Salaries expense 75,000

Sales f 800,000

Sales returns and allowances 23,000

Unearned rent income 35,000

Utilities expense 45,000

, the credit total would amount to

e P1,561,000 d. P953,000

ages during the current year

Increase

(Decrease)

Accounts payable P 80,000 —

Bonds payable (100,000) *

~~ Discount on bonds payable (10,000) ~

Common stock 420,000

‘Premium on common stock 60,000.

30,000

d declaration of P50,000,

aed. Pam - VY FreboardOctober 2017 Batch Page 6 of 12

‘Use the following information for numbers 34 and 35 i

On April 12, 2017, upon the receipt of the March 2017 bank statement, the accountant of Salzburg Company

‘prepared the following bank reconciliation dated March 31; 2017 and immediately recorded the approptiate

adjusting entry.

Balance per bank statement, March 31, 2017 P 980,000

Add: Deposit in transit

— Error in recording check No.125412 (P45,000 instead of P54,000)

Service €Harges for March

Hy

45,000

P 15,000

2,000

15,500 32,500

arch 31, 2017 P 292.500

ted total receipts of P265,000 and total disbursements d€ P215,000 for April 2017.

§ 8 of Match 31, 2017 cleated the bank on April 2017. However, the bank, in April 2017

alzburg Company P20,000 for a check that was supposed to be against the account of

iarges for April 2017 was P1,200. Deposits in transit amounted to P42,000

ading amounted tg P33,000 as of April 2017.

fo the cash in bank account is

©. P272,500 4. P257,000

jursements) to the cash in bank account is

_-b. P209,700 ©. 220,300 4. P2i1,300

ish in Bank items as of December 31, 2017 included the following items:

checking account P 1,500,000

g 1,200,000.

account (per bank statement) 1,450,000

P 4,150,000

to the above-mentioned components is as follows:

in relation to the BDO checking account

ated on December 28, 2017 in the amount of P45,000 remains at hand

‘on December 29, 2017 in the amount of P30,000 dated January 2, 2018 was

2017 /

ten and dated on December 30, 2017 in the amount of P25,000 was picked up

uthas remained outstanding until January 4, 2018

ma to Savannah Company's BPI checking accounts

P 1,450,000

230.000)

P 1,200,000

count #10002 was due to a check for P300,000 dated January 2, 2018

ber 29, 2017,

BPI checking account #10001 for P100,000 in

to withdrawal

‘the MBTC checking account, deposit in transit at

December 31, 2006, P60,000; service charge for

"7 CRC-AGE: FAR - 1" Pre board October 2017 Batch eet

37. The

total amount of income to be recognized in 2017 in relation to the above-mentioned transaction is

oo b. 176,639 c. 163,871 4. 123,570

iB ated value of the note to be presented in the December 31, 2018 balance sheet is

000 b. 533,836 c. 519,536 d. 476,639

39. Venice Company reported the following items as part of cash and cash equivalents

d commercial papers P* 300,000

cates of Indebtedness 350,000

|Bank Treasury bills, maturing on January 31, 2017 + 450,000

acquired three months from its maturity date of Januaty 31,2017 + 600,000

acquired 2 years ago, maturing on Januaty 31, 2017 800,000

from cash and cash equivalents is

b. P1,700,000_, <, 1,900,000 d. P1,100,000

2017, Prague Company sold its goods costing P400,000 to Budapest Company. Prague

ns a mark-up of 30% on cost. Budapest Company issued a promissory note that provides

al installments that will yield 12%. The fizst installment would be made at the end of the

‘the last on December 31, 2021. Prague Company uses the calendar year for reporting

ae

Lb. 110,964 128,797 d. 144,253

if that follows is available ftom the general ledger, cash in bank ~ BPI and the bank statement

iy for the month of August 2017:

August 31, P250,000

‘bank in August including interest of P2,500, P62,500

eginning of August, P47,650, at the end of August, P68,450

00; for August, P1,400

August P27,000; at the end of August P32,900

spany’s accountant in recording check No 12345 for P16,000 was

IB for P1,250 was recorded as P12,500

gent by Masterdam Company for P28,000 was reconded against

= BPIis

<. 203,200 ad. 209,500

2018. On December 31, 2018, prior to the preparation of the

torals were P890,000 and P520,000 respectively, Further

9,000 loan to Kyoto Company. ‘The loan calls for interest

e it, gpr>

year property insurance which it recorded initially

23450

1 which was recorded inital under the eapplieson

Ue

‘year commencing on June 1,

2 hang

saps

CREAACE: FAR - 1" Pre board October 2017 Batch Page 8 of 12

44 Dating the year, Maldives Company, in its tial balance reported revenues of P130,000 and expenses of

before adjustments for the following items: P20,000 which was collected in advance, recorded

~ initally as a lability was earned by yearend; P10,000 of rentals initially recorded under prepaid rent expires by

Yearend; P8,000 unrecorded and uncollected services rendered to customers; and P3,500 employees salaries

ineurted by yearend, remains unrecorded and unpaid. After the adjusting and closing entries have been

* posted, the balance of the Income Summary account is

Pe b. P48,500 ©. P50,000 4. P64,500

showed the following information related to the accounts receivable in order to estimate

‘use of the aging, ‘The credit period of the company is 30 days on the average.

Amount,

(4,000,000 © ve

| 1,500,000 *!:

1,000,000 « , t }

500,000

200,000 1

100,000 ¥

ce, Buttercup has the following percent of collectibility:

ts which are overdue for less than 30 days 96%

which are overdue 31 — 60 days 90%

which are overdue 61-90 days 715%

which are overdue 91 — 120 days 55%

ts which are overdue 121 — 150 days 35%

1 ate overdue for over 150 days 5%

accounts receivable?

ce. P6,385,000 d. P6,860,000

Accounts receivable under the allowance method since the start of

of bad debts ‘previously wiitren off were credited to the

to the allowance account were made. Clover Company's usual

[accounts was P260,000 at Januacy 1, 2017. During 2047, credit

doubtful accounts were made at 2% of credit sales, P180,000 of

ts previously written off amounted to P30,000.

November 2017 and an aging of accounts recélvable was

A summary of the aging is as follows:

Balance in Each Estimated %

Each Category Uncollectible

2,280,000 2%

‘ 420008 . 15%

2017 7

i 1 Pre board October 2017 Batch dune” Page 9 of 12

Us the ilasing for items number 49 - 50

On January 1, 2017, Forget Me Not Company sold equipment with a carrying amount of P4,800,000 in

exchange for a 6,000,000 noninterest bearing note due January 1, 2020. There was no established exchange

‘Puce for the equipment, The prevailing rate of interest for a ote OF this type on January 1, 2017 was 10%. The

tesent value of 1 at 10% for three periods is 0.75. i

49. Taterest income reposted Forget Me Not Company's 2017 income statement is

a. 90,000 As. 450,000 c. 500,000 d. 600,000

50. Gain (loss) on sale of equipment is

«. 1,200,000 4. 2,700,000

ed from Orchid Company a P20,000, 8%, 5-year note that required five equal

°P5,009. The note was discounted to yield a 9% rate to Heather. At the date of

t recorded the note at its present value of P19,485. # ‘

bby Heather over the life of this note is 6

Bb. P5560 ©. P8,000 4. P9,000

2017, ‘Company engaged in the following tansactions.

ed a P750,000, six-month loan from NFL Bank, discounted at 12%. The company pledged

{000 of accounts teceivable as security for the loan.

| 21,000,000 of receivable without recourse on 2 non-notification basis with Mimosa Company.

Company charged a factoring fee of 2% of the'amount of receivables factored and withheld 10%

the financing of receivables

1,585,000 1,578,000

‘of the receivables

4. 1,576,000

cc. 120,000 4. 185,000.

cing facilitated a P1,000,000, 8% loan. Interest is receivable at the end

to be received at the end of five years. At the end of 2017, the first

dias the borrower is experiencing financial difficulties. The borrower

‘The payment of all interest for 5 years shall be deferred until the end

the principal payment shall be reduced to P500,000, The PV of 1 at 8%

hhas been recognized in 2017 in connection with the loan.

31, 2017 is

. 338,500 418,500

E Go. had an unadjusted credit balance of P1,000 in its allowance for

‘of Red Vélvet’s trade accounts receivable at that date revealed the

Amount Estimated uncollectible

60,000! 5% ;

4000 10%

2000 1,400

¢ as allowance for uncollectible accounts in its March 34, 2017 balance

4. P3,000

FAR - 1" Pre board October 2017 Batch Page 10 of 12

57. Canying value of the note receivable as of December 31, 2016 is

a, P 450,780 (BP 495,858 c. P 545,444 @. P.600,000

Use the allowing information jor numbers 58-59

‘On December 31, 2018 Cookies ‘n Cream. Company factors P450,000 of its receivables to Vanilla Company

ay ona zi recourse basis. The agreement includes a factoring fee of 8% and a 10% holdback both based on

the holdback account at 10% of the uncollected receivables and will make

oe Company at the end of each month for any excess. Cookies ‘n Cream

an Allowance for Doubtful Accounts for these receivables of P12,000.

by Cookies ‘n Cream Company from the factoring

‘b. 369,960 c. 372,600 4, 377,100

the factoring of the receivables

“be 32,000 c.

Toma ot

1uses a periodic inventory system and a fiscal year ending September 30. On September

reported inventory on hand costing P 980,000. During the fiscal year en

0 , Java ‘Chip recorded purchases of P 5,700,000. A physical count on September 30, 2017

costing P 1,260,000 were on hand. The following material events occurred between

35,040

d. 44,000

ring 276; 000 was received and recorded on September 29. The goods atrived

the goods FOB destination on September

0 was xeceived and recorded on September 28. The supplier shipped the

eptember 26. The receiving report indicates that Java Chip received the

‘Feported in Java Chip’s income statement for the fiscal year ending

-e= P 5,424,000 @. 5,241,000

ported in Java Chip’s balance sheet at September 30, 2017 should be

0 cP 1,536,000 4. 1,719,000

#t which it purchases from various supplicrs. The trial balance on

15,000,000

4,000,000

9,300,000

400,000 « Hi

Total

“cost

1,200,000

1,950,000

2,800,000

-a

CEARAR - 1*Preboard October 2017 Batch Page 11 of 12

63, On April 30, 2017 fed sea

: , 2017, a fire damaged the i i vd fre

* edace a ¢ office of Cinnamon Company. The following were gathere e

oe Teoetrable 960,000 Sales 3,600,000

wentory — January 1 1,880,000 Purchases 1,680,000

Accounts payable 950,000

Additional information: i

* An examination of the April bank statement and canceled checks revealed checks written during the

P il 1-308 follows:

240,000

80,000

A 160,000

ppetiod amounted to P440,000 consisting of collections

‘refund from a vendor for merchandise returned in Apsil.

4 indebtedness of P1,040,000 at April 30. Customers owed another P60,000 that

red. Of the acknowledged indebtedness, 40,000 may prove uncollectible.

th suppliers zevesled untecotded obligations at April 30, of P540,000 for Apa

including P100,000 for shipments in transit on that date.

rate is 40%, t

St of P260,000 was salvaged and sold for P140,000. The balance of the inventory was @

from customers with the

. 1,300,000 c. 1,340,000 a. 1,440,000

mel Company shipped to a customer merchandise with selling price of P75,000,

oint Selling price is 125% of cost was recorded in January 2018 when the check

ry was detetmined by physical count on December 31, 2017.

¢. Overstated by P75,000

d, Correctly stated

vi for the current year.

oy == + -*90,000 units @P7.00 »

— ® 75000 units @ P8.00

Ro) © 120,000 units @ P8.50

s of maw materials to work in process during the year.

50,000 units @ P14.00

3,100,000

2,950,000

48,000 units @ P15.00

‘assuming that Vanilla Company uses the FIFO cost flow

8,235,000 d- 8,280,000

t value method to value inventory. Data regarding the

1 Pre board October 2017 Batch Page 12 of 12

ory on hand December 31, 2017 for Blueberry Company is P950,000. The following Were not

in this inventory amount: :

‘goods in transit, shipped FOB destination, invoice price P30,000 which included freight charge

‘held on consignment by Blueberry Company at a sales price of P28,000 which includes sales

ion of 20% of the sales price.

ods Sold to Hazelnut Company, FOB destisation, invoiced for P18,500 which includes P1,000 freight

€ to deliver the goods, Goods are in transit. The entity’s selling price is 40% of cost.

‘goods in transit, terms FOB shipping point, invoice price P50,000, freight cost, P2,500.

ut on consignment to Butter Company, sales price P35,000, shipping cost of P2,000.

st of the inventory on December 31, 2017 is,

5 b. 1,042,000 c. 1,043,000 d. 1,073,000

ought a 10-hectare Innd in Paranaque to be improved, subdivided into lots and eventually

of the land was P5,800,000. Taxes and documentation expenses on the transfer to the

) PB0,000. The lots were classified as follows.

ot Number Selling price Total clearing

of lots perlot cost

10 100,000 None

20 80,000 100,000

40 70,000 300,000

. 50 60,000 00,000

Gost of Class CL lots under the relative sales value method is

1,220,000 ¢, 1,276,000 d. 1,700,000

was licensed to Jelly Company for royalties of 15% of sales of the

‘payable semi-annually on March 15 for sales in July-December of the prior

in January-June of the same year. Espresso Company received the

March 15. Sey 15

10,000 15,000

12,000 17,000

for July-December 2017 is P60,000

< P38,000 a. P41,000

P38,000 d. P41,000

cRe --

The Professional CPA |

Main: 3F C. Vilaroman Bldg, 873 P. Campa St. co

(02) 735 8901 / 735 9031 / 0922

‘email add: crc_ace@yahoo.<

Baguio

Rude! Blea. V; Lower Mabini cor Diego Siang, Baguio ity (074) 442-1440

FIRST PRE-BOARD EXAMINATION 7/0922-8499196

SUGGESTED ANSWERS

defo

REGULATORY FRAMEWORK

FOR BUSINESS TRANSACTIONS

6B ot 7 3

a7 D

2 C

2a — A cE

The Professional CPA Review School

\illaroman Bldg. £73 P. Campa St. cor Espans, Sampaloc, Manila

(Go) 735 6901 J 735 9031 / 0922 861 0191

‘emall add: 1c_ace@yatioo.com

Davao

3/F GCAM Bldg. Monteverde St. Davao City

(074) 442-1440

(G82) 285-8805 / 0925-7272223,

FINANCIAL AGCTG &

REPORTING

OCTOBER 2017 BATCH

ADVANCED

FINANCIAL & REPORTING

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PRTC1PB TaxationDocument12 pagesPRTC1PB TaxationaceNo ratings yet

- Afar Concept Review Notes Part 2Document16 pagesAfar Concept Review Notes Part 2aceNo ratings yet

- Tax 311 p3 Accounting MethodsDocument7 pagesTax 311 p3 Accounting MethodsaceNo ratings yet

- Ic Res PrelimDocument8 pagesIc Res PrelimaceNo ratings yet

- At0105fraud Error and Non Compliancepdf PDF FreeDocument12 pagesAt0105fraud Error and Non Compliancepdf PDF FreeaceNo ratings yet

- At 01 Practice and Regulation of The Accountancy Profession1Document17 pagesAt 01 Practice and Regulation of The Accountancy Profession1ace100% (1)

- REO With Theories AnwerDocument21 pagesREO With Theories AnweraceNo ratings yet

- Illustrative Quizzers Code of EthicsDocument6 pagesIllustrative Quizzers Code of EthicsaceNo ratings yet

- Transaction Cycle ReviewerDocument20 pagesTransaction Cycle RevieweraceNo ratings yet

- AT 14 Information Technologypdf - 160935913Document6 pagesAT 14 Information Technologypdf - 160935913aceNo ratings yet

- Establishin Board Comittees 2Document35 pagesEstablishin Board Comittees 2aceNo ratings yet

- 03 Debt Restructuring and Lessee Accounting (FOR RELEASE)Document2 pages03 Debt Restructuring and Lessee Accounting (FOR RELEASE)aceNo ratings yet

- 03 Fundamentals of Assurance Services - CompressDocument10 pages03 Fundamentals of Assurance Services - CompressaceNo ratings yet

- SMC Related Party Transactions Committee Charter 10 Aug 2017Document5 pagesSMC Related Party Transactions Committee Charter 10 Aug 2017aceNo ratings yet

- Quiz No. 2 Answer Key 3Document3 pagesQuiz No. 2 Answer Key 3aceNo ratings yet

- Capitalizing On Global and Regional IntegrationDocument34 pagesCapitalizing On Global and Regional IntegrationaceNo ratings yet

- fae10439-b6b4-4aba-8186-2e4cba8f5b42Document15 pagesfae10439-b6b4-4aba-8186-2e4cba8f5b42aceNo ratings yet

- The Goodness of A Moral Act Is Assessed Based On Three ConditionsDocument1 pageThe Goodness of A Moral Act Is Assessed Based On Three ConditionsaceNo ratings yet

- ACC314 A31 ProblemsDocument12 pagesACC314 A31 ProblemsaceNo ratings yet

- Audit Chapter 6Document30 pagesAudit Chapter 6aceNo ratings yet

- Group-Government AccountingDocument125 pagesGroup-Government AccountingaceNo ratings yet

- Cpar 85 1st Preboards FarDocument14 pagesCpar 85 1st Preboards FaraceNo ratings yet

- AIS Midterm Reviewer AnswersDocument26 pagesAIS Midterm Reviewer AnswersaceNo ratings yet

- Ais Prelim Reviewer.Document38 pagesAis Prelim Reviewer.aceNo ratings yet

- MACC 224 Narrative ReportDocument3 pagesMACC 224 Narrative ReportaceNo ratings yet

- Ais Final Reviewer, Perfect CutieDocument10 pagesAis Final Reviewer, Perfect CutieaceNo ratings yet

- Group 2 Paris To Berlin ReportDocument13 pagesGroup 2 Paris To Berlin ReportaceNo ratings yet

- LESSON-7 THE-MATS Group3 Villanueva Hijos Dayao Gumaos PDFDocument2 pagesLESSON-7 THE-MATS Group3 Villanueva Hijos Dayao Gumaos PDFaceNo ratings yet

- José Protasio Rizal Mercado y Alonso RealondaDocument1 pageJosé Protasio Rizal Mercado y Alonso RealondaaceNo ratings yet

- G3 - Noli Published in Berlin CompressedDocument27 pagesG3 - Noli Published in Berlin CompressedaceNo ratings yet