Professional Documents

Culture Documents

Theory of Capital Structure

Uploaded by

Alamin Rahman JuwelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Theory of Capital Structure

Uploaded by

Alamin Rahman JuwelCopyright:

Available Formats

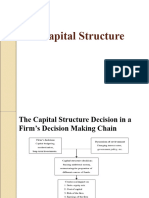

CAPITAL STRUCTURE

Capital is the major part of all kinds of business activities, which are decided by the

size, and nature of the business concern. Capital may be raised with the help of various

sources. If the company maintains proper and adequate level of capital, it will earn

high profit and they can provide more dividends to its shareholders.

Meaning of Capital Structure

The term capital structure refers to the relationship between the various long-term

source financing such as equity capital, preference share capital and debt capital.

Deciding the suitable capital structure is the important decision of the financial

management because it is closely related to the value of the firm.

OPTIMUM CAPITAL STRUCTURE

Optimum capital structure is the capital structure at which the weighted average cost

of capital is minimum and thereby the value of the firm is maximum.

Optimum capital structure may be defined as the capital structure or combination of

debt and equity that leads to the maximum value of the firm.

Decision of capital structure aims at the following two important objectives:

1. Maximize the value of the firm.

2. Minimize the overall cost of capital.

Capital structure pattern varies from company to company and the availability of

finance. Normally the following forms of capital structure are popular in practice.

• Equity shares only.

• Equity and preference shares only.

• Equity and Debentures only.

• Equity shares, preference shares and debentures.

CAPITAL STRUCTURE THEORIES

There are two major theories explaining the relationship between capital structure,

cost of capital and value of the firm.

1. Traditional Approach

2. Modern Approach

Traditional Approach

It is the mix of Net Income approach and Net Operating Income approach. Hence, it is

also called as intermediate approach. According to the traditional approach, mix of

debt and equity capital can increase the value of the firm by reducing overall cost of

capital up to certain level of debt.

With Best Wishes: Abhishek Chouhan Page 1

B.Com., M.Com.(Accounting), NET (Commerce)

Assumptions

Capital structure theories are based on certain assumption to analysis in a single and

convenient manner:

• There are only two sources of funds used by a firm; debt and shares.

• The firm pays 100% of its earning as dividend.

• The total assets are given and do not change.

• The total finance remains constant.

• The operating profits (EBIT) are not expected to grow.

• The business risk remains constant.

• The firm has a perpetual life.

• The investors behave rationally.

Net Income (NI) Approach

Net income approach suggested by the Durand. According to this approach, the capital

structure decision is relevant to the valuation of the firm. In other words, a change in

the capital structure leads to a corresponding change in the overall cost of capital as

well as the total value of the firm.

According to this approach, use more debt finance to reduce the overall cost of capital

and increase the value of firm.

Net income approach is based on the following three important assumptions:

1. There are no corporate taxes.

2. The cost debt is less than the cost of equity.

3. The use of debt does not change the risk perception of the investor.

Net Operating Income (NOI) Approach

Another modern theory of capital structure, suggested by Durand. This is just the

opposite to the Net Income approach. According to this approach, Capital Structure

decision is irrelevant to the valuation of the firm. The market value of the firm is not

at all affected by the capital structure changes.

According to this approach, the change in capital structure will not lead to any change

in the total value of the firm and market price of shares as well as the overall cost of

capital.

NOI approach is based on the following important assumptions;

1. The overall cost of capital remains constant,

2. There are no corporate taxes.

With Best Wishes: Abhishek Chouhan Page 1

B.Com., M.Com.(Accounting), NET (Commerce)

Modigliani and Miller Approach

Modigliani and Miller approach states that the financing decision of a firm does not

affect the market value of a firm in a perfect capital market. In other words MM

approach maintains that the average cost of capital does not change with change in

the debt weighted equity mix or capital structures of the firm.

Modigliani and Miller approach is based on the following important assumptions:

• There is a perfect capital market.

• There are no retained earnings.

• There are no corporate taxes.

• The investors act rationally.

• The dividend payout ratio is 100%.

• The business consists of the same level of business risk.

With Best Wishes: Abhishek Chouhan Page 1

B.Com., M.Com.(Accounting), NET (Commerce)

You might also like

- Capital Structure and Dividend PolicyDocument25 pagesCapital Structure and Dividend PolicySarah Mae SudayanNo ratings yet

- Accounting for Partnership LiquidationDocument11 pagesAccounting for Partnership LiquidationMary Angeline Lopez100% (2)

- Optimal Capital Structure for Maximum Firm ValueDocument26 pagesOptimal Capital Structure for Maximum Firm ValueHimani DubeyNo ratings yet

- Zahid NazDocument29 pagesZahid NazMSA100% (1)

- NFJPIA Mock Board 2016 - AuditingDocument8 pagesNFJPIA Mock Board 2016 - AuditingClareng Anne100% (1)

- Hypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDDocument25 pagesHypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDlovels_agrawal6313No ratings yet

- CH 5Document10 pagesCH 5malo baNo ratings yet

- Capital StructureDocument4 pagesCapital StructureAdeem Ashrafi100% (2)

- Project Appraisal: Department of Economics Email: Tel. 0832-2580207 (O) 08879506995 (M)Document32 pagesProject Appraisal: Department of Economics Email: Tel. 0832-2580207 (O) 08879506995 (M)rajpd28No ratings yet

- FM Capital StructureDocument5 pagesFM Capital Structuremugojulius671No ratings yet

- UNIT 3 CAPITAL STRUCTURE THEORIES 2 and 3 Topic New123Document4 pagesUNIT 3 CAPITAL STRUCTURE THEORIES 2 and 3 Topic New123Rahul Ameen 1818No ratings yet

- Capital Structure DecisionDocument12 pagesCapital Structure Decisionchaterji_aNo ratings yet

- Capital Structure DecisionDocument12 pagesCapital Structure Decisionchaterji_aNo ratings yet

- Capital Structure Unit 2Document14 pagesCapital Structure Unit 2Jia MakhijaNo ratings yet

- Capital Structure Planning: Unit: 3Document46 pagesCapital Structure Planning: Unit: 3Shaifali ChauhanNo ratings yet

- Capital Structure TheoriesDocument13 pagesCapital Structure TheoriesAfnan Ahmad JarwarNo ratings yet

- AJAY KUMAR GARG INSTITUTE OF MANAGEMENT CAPITAL STRUCTUREDocument28 pagesAJAY KUMAR GARG INSTITUTE OF MANAGEMENT CAPITAL STRUCTURESimmi KhuranaNo ratings yet

- Mba NotesDocument12 pagesMba NotesSrishtiNo ratings yet

- FM S5 Capitalstructure TheoriesDocument36 pagesFM S5 Capitalstructure TheoriesSunny RajoraNo ratings yet

- Optimal Capital Structure and Cost ComponentsDocument12 pagesOptimal Capital Structure and Cost ComponentsBhartiNo ratings yet

- Financial Management: 1st Theory of Capital StructureDocument7 pagesFinancial Management: 1st Theory of Capital StructureYash AgarwalNo ratings yet

- Presentation of Capital BudgetingDocument45 pagesPresentation of Capital BudgetingIsmail UmerNo ratings yet

- Capital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmDocument11 pagesCapital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmArun NairNo ratings yet

- Unit IVDocument48 pagesUnit IVGhar AjaNo ratings yet

- Capital StructureDocument55 pagesCapital Structurekartik avhadNo ratings yet

- FM Sheet 4 (JUHI RAJWANI)Document8 pagesFM Sheet 4 (JUHI RAJWANI)Mukesh SinghNo ratings yet

- Capital StructureDocument23 pagesCapital StructureDrishti BhushanNo ratings yet

- Capital StructureDocument14 pagesCapital StructureArul Dass0% (1)

- QLesson 3 Capital StructureDocument63 pagesQLesson 3 Capital StructureSay SayNo ratings yet

- Unit 7 Capital StructureDocument12 pagesUnit 7 Capital StructurepnkgoudNo ratings yet

- Capital StructureDocument9 pagesCapital StructureRavi TejaNo ratings yet

- Finance Decisions ExplainedDocument70 pagesFinance Decisions ExplainedFara HameedNo ratings yet

- Corporate FinanceDocument18 pagesCorporate FinanceNishakdasNo ratings yet

- FM Unit 3Document22 pagesFM Unit 3Krishnapriya S MeenuNo ratings yet

- Unit II, Chapter 4Document33 pagesUnit II, Chapter 4abhikini93No ratings yet

- Unit IVDocument48 pagesUnit IVGhar AjaNo ratings yet

- Capital Structure and Firm ValueDocument39 pagesCapital Structure and Firm ValueIndrajeet KoleNo ratings yet

- FM-Cap. Structure COCDocument24 pagesFM-Cap. Structure COCshagun.2224mba1003No ratings yet

- Capital Structure - Trda... and MMDocument18 pagesCapital Structure - Trda... and MMMazhar Farid ChishtiNo ratings yet

- Capital Stucture: Compiled To Fulfill The Duties of Marketing Management CoursesDocument8 pagesCapital Stucture: Compiled To Fulfill The Duties of Marketing Management Coursesizzah mariamiNo ratings yet

- Capital Structure Definition and FactorsDocument15 pagesCapital Structure Definition and FactorsPriyanka SharmaNo ratings yet

- 8779 - AssignmentDocument7 pages8779 - AssignmentOmkar BhujbalNo ratings yet

- Unit 5 Capital Structure - TheoriesDocument39 pagesUnit 5 Capital Structure - Theoriesvishal kumarNo ratings yet

- Adv FMDocument32 pagesAdv FMsarath cmNo ratings yet

- Advance Financial ManagementDocument62 pagesAdvance Financial ManagementKaneNo ratings yet

- FM AssignmentDocument16 pagesFM AssignmentSarvagya GuptaNo ratings yet

- Financial Accounting HighlightsDocument74 pagesFinancial Accounting HighlightsSourav paulNo ratings yet

- Mco 07Document45 pagesMco 07Damn GoodNo ratings yet

- UNIT - 4 CAPITALs - TreDocument20 pagesUNIT - 4 CAPITALs - Treetebark h/michaleNo ratings yet

- Module Iv Capital Structure÷nd DecisionsDocument37 pagesModule Iv Capital Structure÷nd DecisionsMidhun George VargheseNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalBabar AdeebNo ratings yet

- Capital Structure and Firm ValueDocument33 pagesCapital Structure and Firm Valuemanish9890No ratings yet

- Capital Structure Theory: Amit Deshmukh Kuldeep KumbharDocument9 pagesCapital Structure Theory: Amit Deshmukh Kuldeep KumbharAmit DeshmukhNo ratings yet

- Theories of Capital StructueDocument7 pagesTheories of Capital StructueDhruva Kumar K R 1910146No ratings yet

- CF Assignment - Capital Structure - FreshDocument3 pagesCF Assignment - Capital Structure - Freshganesh gowthamNo ratings yet

- Capital Structure Theory and PolicyDocument11 pagesCapital Structure Theory and PolicypreetiNo ratings yet

- Capital Structure (1)Document18 pagesCapital Structure (1)Maulik VasaniNo ratings yet

- Advanced Financial ManagementDocument23 pagesAdvanced Financial ManagementDhaval Lagwankar75% (4)

- Decision Areas in Financial ManagementDocument15 pagesDecision Areas in Financial ManagementSana Moid100% (3)

- Unit IV Financing DecisionsDocument44 pagesUnit IV Financing DecisionsmswjpNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Forensic+ MLDocument4 pagesForensic+ MLAlamin Rahman JuwelNo ratings yet

- scipg,+Journal+manager,+JABFR 2020 9 (2) 50 56Document7 pagesscipg,+Journal+manager,+JABFR 2020 9 (2) 50 56Alamin Rahman JuwelNo ratings yet

- Assignment 2021Document1 pageAssignment 2021Alamin Rahman JuwelNo ratings yet

- Defining Plagiarism The Plagiarism SpectrumDocument12 pagesDefining Plagiarism The Plagiarism SpectrumAlamin Rahman JuwelNo ratings yet

- The Basic Terms I Need To KnowDocument1 pageThe Basic Terms I Need To KnowAlamin Rahman JuwelNo ratings yet

- Business Plan For (Your Business Name Here)Document4 pagesBusiness Plan For (Your Business Name Here)Alamin Rahman JuwelNo ratings yet

- Dux Company Statement of Cash Flows for 2021 (indirect methodDocument6 pagesDux Company Statement of Cash Flows for 2021 (indirect methodJuliana CaroNo ratings yet

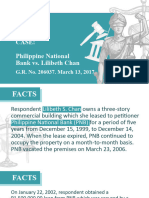

- Philippine National Bank vs Lilibeth ChanDocument14 pagesPhilippine National Bank vs Lilibeth ChanJoatham GenovisNo ratings yet

- Nature Description: PT Telekomunikasi Selular and Its Subsidiaries Trial Balance July 31, 2019Document102 pagesNature Description: PT Telekomunikasi Selular and Its Subsidiaries Trial Balance July 31, 2019Agniyyy TNo ratings yet

- Soa 1700471159825Document5 pagesSoa 1700471159825grv50215No ratings yet

- ch12 BaruDocument28 pagesch12 BaruIrvan Syafiq NurhabibieNo ratings yet

- 11 Ib SL Quiz1Document3 pages11 Ib SL Quiz1Haluk Bulut0% (1)

- Monthly Free Acupuncture Treatment Camp HighlightsDocument21 pagesMonthly Free Acupuncture Treatment Camp HighlightsShripadNo ratings yet

- Daily Derivative Report 27 January 2016: NiftyDocument4 pagesDaily Derivative Report 27 January 2016: NiftyAyesha ShaikhNo ratings yet

- 21 Republic Vs de GUzman PDFDocument22 pages21 Republic Vs de GUzman PDFShivaNo ratings yet

- Palileo v. CosioDocument4 pagesPalileo v. CosioHency TanbengcoNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- Bonus Loan FormDocument2 pagesBonus Loan FormPATCOMC CooperativeNo ratings yet

- Tax Quick Reviewer - Edward Arriba PDFDocument70 pagesTax Quick Reviewer - Edward Arriba PDFDanpatz GarciaNo ratings yet

- It S Lit E30 Tiffany Aliche Submix 041621 LDocument10 pagesIt S Lit E30 Tiffany Aliche Submix 041621 LGMG EditorialNo ratings yet

- NBFC Sector ReportDocument8 pagesNBFC Sector Reportpawankaul82No ratings yet

- CapstoneDocument29 pagesCapstonelajjo1230% (1)

- Rural Bank vs Courts of Appeals Loan Fraud CaseDocument1 pageRural Bank vs Courts of Appeals Loan Fraud CaseMarianne Hope VillasNo ratings yet

- ABMF3184 AssignmentDocument10 pagesABMF3184 AssignmentChristyNo ratings yet

- Transfer of Property ACT, 1882: PreliminaryDocument13 pagesTransfer of Property ACT, 1882: PreliminaryIam MirzaNo ratings yet

- Financial analysis techniquesDocument22 pagesFinancial analysis techniquesChristian Jake RespicioNo ratings yet

- Week 4 Money Market and Inter Bank Call Loan by LCLEJARDEDocument24 pagesWeek 4 Money Market and Inter Bank Call Loan by LCLEJARDEErica CadagoNo ratings yet

- MKTG101 - Principles of Marketing Assignment Collapse of Thomas Cook Group PLCDocument6 pagesMKTG101 - Principles of Marketing Assignment Collapse of Thomas Cook Group PLCSaharsh SinghalNo ratings yet

- 1.Management-Financial Literacy of Himachal Pradesh-Karan GuptaDocument14 pages1.Management-Financial Literacy of Himachal Pradesh-Karan GuptaImpact JournalsNo ratings yet

- Acc407 Quiz 1 Introduction To Accounting (Question)Document7 pagesAcc407 Quiz 1 Introduction To Accounting (Question)Tuan AinnurNo ratings yet

- Polypropylene Woven Bags Manufacturing UnitDocument23 pagesPolypropylene Woven Bags Manufacturing UnitIjaz AhmadNo ratings yet

- XXXX Sap Implementation Project Exercise Book: FI110-Enterprise Controlling - ConsolidationDocument18 pagesXXXX Sap Implementation Project Exercise Book: FI110-Enterprise Controlling - ConsolidationShyam JaganathNo ratings yet

- IC Generic Purchase Order Template 9181Document3 pagesIC Generic Purchase Order Template 9181DipeshNo ratings yet