Professional Documents

Culture Documents

Taxing High-Fat Food

Uploaded by

Kira L. MorrisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxing High-Fat Food

Uploaded by

Kira L. MorrisCopyright:

Available Formats

1) Taxing high-fat foods would be a way to reduce heart disease?

– I do not agree with this

statement.

2) Taxing high-fat foods would be a way to offset the treatment of heart disease related illness? – I

do not agree with this statement.

3) Taxing high-fat foods could be used for public education. – I agree with this statement.

About 34% or more of Americans are obese, according to the U.S. Centers for Disease Control and

Prevention. The goal of the tax of high-fat foods is to curb sales of unhealthy food and decrease

overconsumption, which may help to prevent diseases like hypertension or diabetes (1). “One U.S. study

reviewed by Mytton and his colleagues found a 35% tax on sugar-sweetened drinks — $0.45 per drink —

led to a 26% decline in sales. Based on their analysis of modeling studies, they concluded a 20% tax on

sugary drinks in the U.S. would reduce obesity levels by 3.5% — from 33.5% to 30% among adults. A

similar tax in the U.K. could cut up to 2,700 heart disease deaths a year” (2). It does seem like a good

idea, but what people aren’t realizing is that these foods aren’t the only factor in heart related issues.

Exercise plays a big part too, and it’s the person’s choice whether to do this or not. So even if the food

culprit was to be taxed or not, the issue will most likely remain. “Exercise burns calories. The more you

exercise, the easier it is to keep your weight under control. But remember that exercise is not a free pass

to eat everything in sight! To burn 100 calories, most people need to walk or run about one mile (3).”

Bad habits like not exercising or choosing to eat large amounts of unhealthy food is completely up to the

person, so taxing may not even work. The only thing these taxes may end up doing is cause issues for

low income families that just want a snack every now and then. Besides, it is shown that over the years

the price of healthy foods have gone up while unhealthy prices drop, so the prices themselves are

encouraging bad habits to begin with. Instead of taxing, researchers suggest that there should be public

health campaigns that focus on the reasons for poor dietary choices as opposed to making a marginal

change in the diets of everyone (4).

If they wanted to educate people, their first step would have to be decreasing the prices of healthy food.

Once a tax of high-fat foods would be put in place, I’ll admit it may drive people to make slight changes

in their habits simply to save money. Food industries appear incapable of marketing healthier foods.

Their mission is not public health but profit, so they’ll continue to sell the health-damaging food that’s

most profitable, until the market or another force skews things otherwise (5). If the taxes are placed on

these high-fat foods, the profit margin for these industries may shift, leading to more healthy foods

being produced. People do need to be educated to eat a bit more of these healthy foods and only enjoy

the unhealthy stuff in moderation. If not, the only outcome will be a lot of upset people still buying the

unhealthy foods regardless of the taxes and losing money while increasing obesity rates. All in all, I do

think it’ll take more than just a tax to fix these issues, but it might educate people to change their habits

a bit.

Works Cited:

1. http://abcnews.go.com/Health/Wellness/fat-tax-lower-obesity/story?id=16353067

2. http://healthland.time.com/2012/05/16/study-a-20-fat-tax-would-improve-public-health/

3. http://www.acsm.org/access-public-information/articles/2012/01/19/obesity-and-exercise

4. http://medicalxpress.com/news/2011-11-obesity-fat-tax.html

5. http://www.nytimes.com/2011/07/24/opinion/sunday/24bittman.html?pagewanted=all&_r=0

You might also like

- FinalDocument8 pagesFinalapi-246754759No ratings yet

- Persuasive EssayDocument9 pagesPersuasive Essayv_murrayNo ratings yet

- CEA EssayDocument2 pagesCEA EssaykrzyslubowsNo ratings yet

- Assessment Task - 5 (B) ObesityDocument8 pagesAssessment Task - 5 (B) ObesityAnmol PreetNo ratings yet

- First in Asia: Fat TaxDocument8 pagesFirst in Asia: Fat TaxPauline DangaranNo ratings yet

- Fat Tax Literature ReviewDocument8 pagesFat Tax Literature Reviewafmabzmoniomdc100% (1)

- Final Draft Reseach Paper MohammedfakhrooDocument7 pagesFinal Draft Reseach Paper Mohammedfakhrooapi-620593044No ratings yet

- Cae Essay Example 2Document1 pageCae Essay Example 2Mitzi GonzálezNo ratings yet

- Obesity in America Final ProductDocument6 pagesObesity in America Final Productapi-302662040No ratings yet

- Government Intervention Will Not Solve Our Obesity ProblemDocument4 pagesGovernment Intervention Will Not Solve Our Obesity ProblemJulian BeardNo ratings yet

- Obesity statistics and causes: Understanding the obesity epidemicDocument4 pagesObesity statistics and causes: Understanding the obesity epidemicBryan Andrés AnguloNo ratings yet

- EgyptDocument4 pagesEgyptMohamed MamdouhNo ratings yet

- Copy of Copy of Copy of Eportfolio Assignment Research Essay Revised Draft 3 2Document5 pagesCopy of Copy of Copy of Eportfolio Assignment Research Essay Revised Draft 3 2api-558922829No ratings yet

- MCRPDocument6 pagesMCRPapi-303005501No ratings yet

- Research Paper Social Issues Rough DraftDocument6 pagesResearch Paper Social Issues Rough DraftMatty 0331No ratings yet

- Running Head: U.S Government Against ObesityDocument4 pagesRunning Head: U.S Government Against ObesityRenato GonçalvesNo ratings yet

- Should Governments Tax Unhealthy Foods and DrinksDocument2 pagesShould Governments Tax Unhealthy Foods and DrinksLê Phú ThắngNo ratings yet

- Research Paper Social Issues Rough DraftDocument6 pagesResearch Paper Social Issues Rough DraftMatty 0331No ratings yet

- Sugary DrinksDocument4 pagesSugary DrinksJun YuNo ratings yet

- Health Policy AnalysisDocument13 pagesHealth Policy AnalysisJordan SusaNo ratings yet

- ATIP N-12 Final Information Transfer (1) - 1Document164 pagesATIP N-12 Final Information Transfer (1) - 1tessavanderhartNo ratings yet

- ObesityDocument6 pagesObesityErick MwangiNo ratings yet

- Sugar Added BeveragesDocument2 pagesSugar Added BeveragesPatyMaldonadoNo ratings yet

- Writing Project 3-5Document10 pagesWriting Project 3-5api-456365943No ratings yet

- Luther 1Document12 pagesLuther 1api-339280867No ratings yet

- The World's Expanding Waistline: Diet by Command?Document3 pagesThe World's Expanding Waistline: Diet by Command?KIET DO50% (2)

- Obesity ProjectDocument10 pagesObesity Projectapi-385383966No ratings yet

- Food Restaurants ObesityDocument2 pagesFood Restaurants ObesityParmvir SinghNo ratings yet

- Research Techniques-Final DraftDocument8 pagesResearch Techniques-Final Draftapi-315741707No ratings yet

- 4 Govalla EssayDocument11 pages4 Govalla EssayNina GovallaNo ratings yet

- Fast Food Tax Opinion EssayDocument2 pagesFast Food Tax Opinion EssayfrozenglxNo ratings yet

- EssayDocument7 pagesEssayRuzellNo ratings yet

- Argument EssayDocument6 pagesArgument Essayapi-246731403No ratings yet

- Article 1 - Fast Food AdsDocument3 pagesArticle 1 - Fast Food AdsMuhd AmmarhafizNo ratings yet

- User's Guide to Good Fats and Bad Fats: Learn the Difference Between Fats That Make You Well and Fats That Make You SickFrom EverandUser's Guide to Good Fats and Bad Fats: Learn the Difference Between Fats That Make You Well and Fats That Make You SickNo ratings yet

- The Fifth ElementDocument36 pagesThe Fifth ElementBert HernandezNo ratings yet

- Oumh 2103 English For Science and Technical Purposes 770516036401001Document22 pagesOumh 2103 English For Science and Technical Purposes 770516036401001danial_77No ratings yet

- It Is Noticeable That Consuming Fast Food On A Prolonged Basis Will Develop Various DiseasesDocument1 pageIt Is Noticeable That Consuming Fast Food On A Prolonged Basis Will Develop Various DiseasesDũng BùiNo ratings yet

- Tax on Fast Food DisagreeDocument1 pageTax on Fast Food Disagreedhruv patelNo ratings yet

- Defining Overweight and ObesityDocument22 pagesDefining Overweight and ObesityDr Nurul NabilahNo ratings yet

- Obesity EffectDocument2 pagesObesity EffectDaisy Joy BarangganNo ratings yet

- Some People Think That The Government Has The Duty To Ensure Its Citizens Have A Healthy Diet, While Others Argue It Is The Responsibility of Each IndividualDocument1 pageSome People Think That The Government Has The Duty To Ensure Its Citizens Have A Healthy Diet, While Others Argue It Is The Responsibility of Each IndividualQuỳnh NhậtNo ratings yet

- International Childhood Obesity Prevention StrategiesDocument12 pagesInternational Childhood Obesity Prevention StrategiesMarkNo ratings yet

- Understanding Obesity: A New Hope For Weight Loss and Escaping Food AddictionFrom EverandUnderstanding Obesity: A New Hope For Weight Loss and Escaping Food AddictionRating: 1 out of 5 stars1/5 (1)

- Ge MoocDocument4 pagesGe MoocJonathan Gabriel VillicanaNo ratings yet

- Stasis GridDocument13 pagesStasis Gridapi-317522041No ratings yet

- OBESITY AND EATING DISORDERS: CAUSES, TREATMENT, AND GOALSDocument66 pagesOBESITY AND EATING DISORDERS: CAUSES, TREATMENT, AND GOALSVivian LajaraNo ratings yet

- Food: EssayDocument4 pagesFood: EssayDerek D LimNo ratings yet

- Obesity Research Paper IntroductionDocument4 pagesObesity Research Paper Introductionafnkcjxisddxil100% (1)

- Task2 6 O (2.01)Document1 pageTask2 6 O (2.01)Li kevinNo ratings yet

- Creating A Healthier AmericaDocument11 pagesCreating A Healthier Americaapi-329347866No ratings yet

- Obesity Essay (Essay)Document5 pagesObesity Essay (Essay)Johnathan LebiasNo ratings yet

- Obesity in America Research PaperDocument5 pagesObesity in America Research Paperjrcrefvhf100% (1)

- Fat Shame Hand OutDocument23 pagesFat Shame Hand Outpizdacristi40No ratings yet

- Help Sheet For Week 4Document5 pagesHelp Sheet For Week 4Kira L. MorrisNo ratings yet

- Essay 1Document4 pagesEssay 1Kira L. MorrisNo ratings yet

- Scientific Method ExampleDocument1 pageScientific Method ExampleKira L. MorrisNo ratings yet

- Preeclampsia ResearchDocument1 pagePreeclampsia ResearchKira L. MorrisNo ratings yet

- Immune DefensesDocument1 pageImmune DefensesKira L. MorrisNo ratings yet

- The ImpermissiconDocument255 pagesThe ImpermissiconKira L. MorrisNo ratings yet

- Anorexia Nervosa InfographicDocument1 pageAnorexia Nervosa Infographicapi-518183280No ratings yet

- Betaine HCL Digestive Enzymes: Kefir The Gut Health ProtocolDocument2 pagesBetaine HCL Digestive Enzymes: Kefir The Gut Health ProtocolNico Pop100% (1)

- Whole Wheat Flour - Atta Sandwich Bread Recipe, 100% Whole Wheat AttaDocument2 pagesWhole Wheat Flour - Atta Sandwich Bread Recipe, 100% Whole Wheat AttaTarun SharmaNo ratings yet

- Capstone Presentation 2020Document12 pagesCapstone Presentation 2020api-539629427No ratings yet

- Food DistributionDocument2 pagesFood DistributionNgo PartnerNo ratings yet

- HKII 18 19 - Anh - LOP 9Document2 pagesHKII 18 19 - Anh - LOP 9phuongliendn0304No ratings yet

- PENILAIN TENGAH SEMESTER BAHASA INGGRISDocument6 pagesPENILAIN TENGAH SEMESTER BAHASA INGGRISdiazfandyNo ratings yet

- Eating Disorders (Barlow and Durand - Pp. 269 - 295)Document27 pagesEating Disorders (Barlow and Durand - Pp. 269 - 295)Monina JonesNo ratings yet

- Formulating With Quantum 5000 PDFDocument4 pagesFormulating With Quantum 5000 PDFTiger WaspNo ratings yet

- MNT For HIV AIDS - 2023Document29 pagesMNT For HIV AIDS - 2023PDD SAN MEDANNo ratings yet

- Drug Induced Nutrient DepletionDocument2 pagesDrug Induced Nutrient DepletionMila ZainNo ratings yet

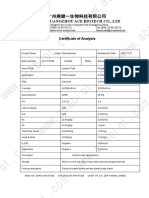

- COA of Konjac GlucomannanDocument1 pageCOA of Konjac GlucomannanPan EmmaNo ratings yet

- Normal Diagnostic and Laboratory Findings/ Nutritional Health of Pregnant WomenDocument8 pagesNormal Diagnostic and Laboratory Findings/ Nutritional Health of Pregnant WomenArianna Jasmine MabungaNo ratings yet

- Lesson 3 Notes Keto MasterclassDocument7 pagesLesson 3 Notes Keto Masterclass2readNo ratings yet

- Soal AKSi-KISIDocument20 pagesSoal AKSi-KISISTEBI Al RosyidNo ratings yet

- Life of PiDocument1 pageLife of PiHector bartleyNo ratings yet

- (English) Timothy Goes To School - Timothy Goes To School - Yoko - Ep.1 (DownSub - Com)Document18 pages(English) Timothy Goes To School - Timothy Goes To School - Yoko - Ep.1 (DownSub - Com)Diem DXNo ratings yet

- Poster Utt Research Symposium 2019 - YoghurtDocument1 pagePoster Utt Research Symposium 2019 - Yoghurtjessel83No ratings yet

- Paper 1 - SET ADocument16 pagesPaper 1 - SET AZUBAIDAH BINTI JAMALUDDIN MoeNo ratings yet

- 04 D.S.penaranda Research in Biofloc at University of ValenciaDocument22 pages04 D.S.penaranda Research in Biofloc at University of ValenciaMayank VaitiNo ratings yet

- Nutrition For Healthy Living 4th Edition Schiff Solutions ManualDocument12 pagesNutrition For Healthy Living 4th Edition Schiff Solutions Manualnathanmelanie53f18f100% (26)

- Basic English Pronouns, Prepositions and Connectors PracticeDocument3 pagesBasic English Pronouns, Prepositions and Connectors PracticeYo Soy VidelNo ratings yet

- Weight Monitoring FormDocument1 pageWeight Monitoring FormChristopher Torres50% (2)

- This Following Text Is For Questions 1 and 2Document17 pagesThis Following Text Is For Questions 1 and 2Ani BungaNo ratings yet

- Hydroponics Fodder Factory RsaDocument40 pagesHydroponics Fodder Factory RsaJose Castanedo100% (1)

- CSR 05 - Emotional HowlDocument129 pagesCSR 05 - Emotional Howlnatsu sajaNo ratings yet

- Lifelong Vitality BrochureDocument24 pagesLifelong Vitality BrochureJosefina LarreateguiNo ratings yet

- Chitin Extraction From InsectsDocument60 pagesChitin Extraction From Insectsshruthishree gandhiNo ratings yet

- PQCNC 2023 Nutrition in PregnancyDocument12 pagesPQCNC 2023 Nutrition in PregnancykcochranNo ratings yet

- Dozova NAD+ Vitamin Supplement Supports Healthy Aging, Energy - Sehetna-EgDocument4 pagesDozova NAD+ Vitamin Supplement Supports Healthy Aging, Energy - Sehetna-EgaliNo ratings yet