Professional Documents

Culture Documents

Piermont Personal Banking Accounts - 1.20.2022

Uploaded by

MarkOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Piermont Personal Banking Accounts - 1.20.2022

Uploaded by

MarkCopyright:

Available Formats

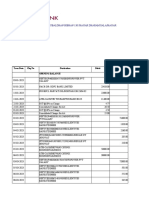

Piermont Personal Banking Accounts

Piermont Bank offers a variety of deposit account options for all personal banking needs.

BASIC CHECKING SIMPLY INTEREST SIMPLY MONEY MARKET SAVINGS CERTIFICATE OF DEPOSIT

CHECKING

Ideal for basic checking Interest-bearing checking High yield variable interest Keeping your money safe Flexible terms with

Key Features needs with low transaction with ease of access to funds rates and continue to grow predetermined interest rates1

activities

Interest No Yes Yes, variable interest rates1 Yes, variable interest rates1 Yes, terms from 3-60 months

$3.00 $25.00; $25.00; $25.00 N/A

Monthly Service Fee waived with minimum waived with minimum waived with minimum of

average balance of $1,000 average balance of $1,000 $1,000

Minimum Opening Balance No minimum $1,000 $1,000 $1,000 $25,000

Visa Debit Card Yes Yes Yes No No

Access to Online & Mobile Yes Yes Yes Yes Yes

Banking

Unlimited deposits Convenient bill pay via online Unlimited deposits Unlimited deposits

banking

12 withdrawals2 per month Maximum six debit Maximum six debit

allowed at no additional No transaction restriction transactions per monthly transactions per monthly

Additional Details3 charge. There is a $ 0.50 statement cycle by check, statement cycle by check,

charge for each check No transaction fees4 debit card, online banking debit card, online banking

/withdrawal thereafter. or electronic transfer or or electronic transfer or

payment to a third party payment to a third party

1

Interest rates vary, check with your Piermont Bank relationship manager on the most up to date interest rates offered.

2

Withdrawals include checks, ATM withdrawals and purchases using a debit card associated with the account.

3

See fee schedule for additional details on fees, as applicable

4

Transaction fees defined as checks, deposit tickets, deposit items, ACH received debits or credits.

You might also like

- Checking Account and Savings Account ChartDocument2 pagesChecking Account and Savings Account ChartMichelle StubbsNo ratings yet

- Deposit ProductsDocument14 pagesDeposit ProductssupportNo ratings yet

- Bank Exploration Julia GleasonDocument3 pagesBank Exploration Julia Gleasonapi-439614932No ratings yet

- Vio Fee AAD PrivacyDocument17 pagesVio Fee AAD PrivacyChimezie GregNo ratings yet

- UK Types of Bank Accounts PDFDocument2 pagesUK Types of Bank Accounts PDFAilénVillalbaNo ratings yet

- ServePayGo Summary of FeesDocument4 pagesServePayGo Summary of Feeshersheyschwartz1No ratings yet

- Easy Checking SnapshotDocument2 pagesEasy Checking SnapshotsupportNo ratings yet

- Terms Basic Checking PDFDocument2 pagesTerms Basic Checking PDFMilton DavidsonNo ratings yet

- Tarrif Guide SeptemberDocument1 pageTarrif Guide Septemberfaisal_ahsan7919No ratings yet

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Document4 pagesYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanNo ratings yet

- Elite Gold NCDocument2 pagesElite Gold NCAakash AgarwalNo ratings yet

- Interest RatesDocument1 pageInterest RateskushNo ratings yet

- Financial Products Role CardsDocument1 pageFinancial Products Role CardsMuriel VegaNo ratings yet

- Account Access Services: Internet BankingDocument7 pagesAccount Access Services: Internet BankingUmair RNNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDocument2 pagesOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleNo ratings yet

- Bennett - Daniel BUS 219 Survey Example BU701 Survey Sheet 10-2-2020Document3 pagesBennett - Daniel BUS 219 Survey Example BU701 Survey Sheet 10-2-2020Jamie ProvinoNo ratings yet

- PDA Account Disclosure BookletDocument34 pagesPDA Account Disclosure BookletJo niggathugslifeNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- Credit CardsDocument5 pagesCredit CardsCemitoXNo ratings yet

- Key-Facts-Statement-Signature-Priority-Account UBLDocument4 pagesKey-Facts-Statement-Signature-Priority-Account UBLMuhammadDanialNo ratings yet

- Bankciwamb Bank PH Pds Fast Plus AccountDocument6 pagesBankciwamb Bank PH Pds Fast Plus AccountChuckie TajorNo ratings yet

- Business-Bank-Account MetroDocument3 pagesBusiness-Bank-Account Metroussef oblivion0% (1)

- Offer Confirmation LetterDocument2 pagesOffer Confirmation Letterwjf69rnj8dNo ratings yet

- An Indian Online Payment Gateway SolutionDocument5 pagesAn Indian Online Payment Gateway SolutionAbhinav SrivastavaNo ratings yet

- MyMoBiz Account Pricing Guide 2023Document6 pagesMyMoBiz Account Pricing Guide 2023gadlampumeNo ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- Personal Pricing GuideDocument7 pagesPersonal Pricing GuideAar RageediNo ratings yet

- Everyday Credit Card Keyfacts DocumentDocument10 pagesEveryday Credit Card Keyfacts Documentnoddieedwards260373No ratings yet

- Banking ServicesDocument11 pagesBanking ServicesSwarna GuptaNo ratings yet

- BofA CoreChecking en ADADocument2 pagesBofA CoreChecking en ADAFrank TilemanNo ratings yet

- Habibmetro BankDocument18 pagesHabibmetro Bankfoqia nishatNo ratings yet

- Lecture 6 - Managing Your CreditDocument47 pagesLecture 6 - Managing Your CreditHiền NguyễnNo ratings yet

- Fees and limitsغزاليDocument5 pagesFees and limitsغزاليdiego maradonianNo ratings yet

- Crédit Agricole Sud Rhone Alpes - CGB-2024-PART-WEBDocument48 pagesCrédit Agricole Sud Rhone Alpes - CGB-2024-PART-WEBseeplanet69No ratings yet

- Transaction Savings Terms and ConditionsDocument41 pagesTransaction Savings Terms and Conditionsmatt luiNo ratings yet

- FNB Pricing Guide BusinessBanking 2018-2019Document20 pagesFNB Pricing Guide BusinessBanking 2018-2019Kriopas N HamukotoNo ratings yet

- Schedule of Benefits & Charges RBL Aspire Banking: (Individual) (Entity)Document2 pagesSchedule of Benefits & Charges RBL Aspire Banking: (Individual) (Entity)Badri ShaikhNo ratings yet

- 3services Provided by BanksDocument26 pages3services Provided by BanksZarreen ModakNo ratings yet

- PT CAP BasicBankingDocument3 pagesPT CAP BasicBankingRayan PaulNo ratings yet

- Wellsfargo Business Choice Checking FeesDocument3 pagesWellsfargo Business Choice Checking FeesMike HartNo ratings yet

- Everyday Saver BarclaysDocument1 pageEveryday Saver BarclaysantonyNo ratings yet

- What Is This Product About?Document6 pagesWhat Is This Product About?Franco BegnadenNo ratings yet

- The Rajastan Co-Operative BankDocument12 pagesThe Rajastan Co-Operative Bankjini03No ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Discovery Bank Platinum Credit Card Fees 2022Document1 pageDiscovery Bank Platinum Credit Card Fees 2022CornelVermaakNo ratings yet

- Chase Bank Account Rules and Regulations 12-31-08Document34 pagesChase Bank Account Rules and Regulations 12-31-08wps013100% (1)

- Premium Banking: Schedule of ChargesDocument6 pagesPremium Banking: Schedule of Chargestanvir kabirNo ratings yet

- HSBC Premier Savings Terms & Charges Disclosure: EligibilityDocument3 pagesHSBC Premier Savings Terms & Charges Disclosure: EligibilityAndi PrabowoNo ratings yet

- CreditDocument5 pagesCreditSarees online shoppingNo ratings yet

- The Discovery Gold Transaction Account PDFDocument6 pagesThe Discovery Gold Transaction Account PDFJoshNo ratings yet

- Business Bonus Account v79.0Document3 pagesBusiness Bonus Account v79.0prabeshmanNo ratings yet

- Metrobank Business Account SummaryDocument3 pagesMetrobank Business Account SummaryJack ChardwoodNo ratings yet

- Debitcardfeeschedule PDFDocument1 pageDebitcardfeeschedule PDFkimberly GillingsNo ratings yet

- Send Money To Argentina Money Transfer To Argentina - Wise, Formerly TransferWiseDocument1 pageSend Money To Argentina Money Transfer To Argentina - Wise, Formerly TransferWiseSergio KieskiewiczNo ratings yet

- First National Bank Tanzania: Personal and Business Banking Pricing GuideDocument31 pagesFirst National Bank Tanzania: Personal and Business Banking Pricing GuideCharity Charles NgusaNo ratings yet

- ANZ Fees Charges Retail enDocument1 pageANZ Fees Charges Retail enWiwa PerwataNo ratings yet

- 2396510-14-8EN - r1 - Service Information and Procedures Class MDocument2,072 pages2396510-14-8EN - r1 - Service Information and Procedures Class MJuan Bautista PradoNo ratings yet

- Shelly Cashman Series Microsoft Office 365 Excel 2016 Comprehensive 1st Edition Freund Solutions ManualDocument5 pagesShelly Cashman Series Microsoft Office 365 Excel 2016 Comprehensive 1st Edition Freund Solutions Manualjuanlucerofdqegwntai100% (10)

- NauseaDocument12 pagesNauseakazakom100% (2)

- MSDS Leadframe (16 Items)Document8 pagesMSDS Leadframe (16 Items)bennisg8No ratings yet

- Calendar of Activities A.Y. 2015-2016: 12 Independence Day (Regular Holiday)Document3 pagesCalendar of Activities A.Y. 2015-2016: 12 Independence Day (Regular Holiday)Beny TawanNo ratings yet

- PretestDocument8 pagesPretestAlmonte Aira LynNo ratings yet

- Bassoon (FAGOT) : See AlsoDocument36 pagesBassoon (FAGOT) : See Alsocarlos tarancón0% (1)

- Mossbauer SpectrosDocument7 pagesMossbauer SpectroscyrimathewNo ratings yet

- Citrus Information Kit-Update: Reprint - Information Current in 1998Document53 pagesCitrus Information Kit-Update: Reprint - Information Current in 1998hamsa sewakNo ratings yet

- Storage-Tanks Titik Berat PDFDocument72 pagesStorage-Tanks Titik Berat PDF'viki Art100% (1)

- PV Power To Methane: Draft Assignment 2Document13 pagesPV Power To Methane: Draft Assignment 2Ardiansyah ARNo ratings yet

- Monster Hunter: World - Canteen IngredientsDocument5 pagesMonster Hunter: World - Canteen IngredientsSong HoeNo ratings yet

- Technical Rockwell Automation FactoryTalk HistorianDocument6 pagesTechnical Rockwell Automation FactoryTalk HistorianAmit MishraNo ratings yet

- DIY Toolkit Arabic Web VersionDocument168 pagesDIY Toolkit Arabic Web VersionAyda AlshamsiNo ratings yet

- XXXX96 01 01 2023to28 08 2023Document18 pagesXXXX96 01 01 2023to28 08 2023dabu choudharyNo ratings yet

- School Activity Calendar - Millsberry SchoolDocument2 pagesSchool Activity Calendar - Millsberry SchoolSushil DahalNo ratings yet

- Adigwe J. C.: ATBU, Journal of Science, Technology & Education (JOSTE) Vol. 3 (1), January, 2015 ISSN: 2277-0011Document16 pagesAdigwe J. C.: ATBU, Journal of Science, Technology & Education (JOSTE) Vol. 3 (1), January, 2015 ISSN: 2277-0011AnnyNo ratings yet

- Gold Loan Application FormDocument7 pagesGold Loan Application FormMahesh PittalaNo ratings yet

- Design of Purlins: Try 75mm X 100mm: Case 1Document12 pagesDesign of Purlins: Try 75mm X 100mm: Case 1Pamela Joanne Falo AndradeNo ratings yet

- Lord of The Flies - Chapter Comprehension QuestionsDocument19 pagesLord of The Flies - Chapter Comprehension Questionsjosh johnsyNo ratings yet

- Training Design SprintDocument11 pagesTraining Design Sprintardi wiantoNo ratings yet

- The Limits of The Sectarian Narrative in YemenDocument19 pagesThe Limits of The Sectarian Narrative in Yemenهادي قبيسيNo ratings yet

- Grua Grove 530e 2 Manual de PartesDocument713 pagesGrua Grove 530e 2 Manual de PartesGustavo100% (7)

- Chapter 5 IppDocument24 pagesChapter 5 IppRoseann EnriquezNo ratings yet

- SANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabDocument2 pagesSANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabsantonuNo ratings yet

- (Bruno Bettelheim) Symbolic Wounds Puberty RitesDocument196 pages(Bruno Bettelheim) Symbolic Wounds Puberty RitesAmbrose66No ratings yet

- Zillah P. Curato: ObjectiveDocument1 pageZillah P. Curato: ObjectiveZillah CuratoNo ratings yet

- Sips 1328Document64 pagesSips 1328Jean Claude De AldánNo ratings yet

- GST RATE LIST - pdf-3Document6 pagesGST RATE LIST - pdf-3Niteesh KumarNo ratings yet

- Entrepreneurial MotivationDocument18 pagesEntrepreneurial MotivationRagavendra RagsNo ratings yet