Professional Documents

Culture Documents

SECOND DEMAND For Jury Trial and Zoccali First Amended Objections Responses and Affirmative Defenses

Uploaded by

MammaBear1230 ratings0% found this document useful (0 votes)

22 views12 pagesSECOND DEMAND FOR TRIAL BY JURY by DEFENDANT ZOCCALI (ProSe)'s FIRST AMENDED OBJECTIONS/RESPONSES AND AFFIRMATIVE DEFENSES TO PLAINTIFF’S COMPLAINT FILED IN CHESTER COUNTY, PA

1st Affirmative Defense - Lack of Standing

2nd Affirmative Defense - Failure to Comply with Legal Obligations

3rd Affirmative Defense - Statute of Limitations

4th Affirmative Defense - Lack of Capacity to Sue

5th Affirmative Defense - Failure to Join Necessary Parties

6th Affirmative Defense - Improper Verification

Original Title

SECOND DEMAND for Jury Trial and Zoccali First Amended Objections Responses and Affirmative Defenses

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSECOND DEMAND FOR TRIAL BY JURY by DEFENDANT ZOCCALI (ProSe)'s FIRST AMENDED OBJECTIONS/RESPONSES AND AFFIRMATIVE DEFENSES TO PLAINTIFF’S COMPLAINT FILED IN CHESTER COUNTY, PA

1st Affirmative Defense - Lack of Standing

2nd Affirmative Defense - Failure to Comply with Legal Obligations

3rd Affirmative Defense - Statute of Limitations

4th Affirmative Defense - Lack of Capacity to Sue

5th Affirmative Defense - Failure to Join Necessary Parties

6th Affirmative Defense - Improper Verification

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views12 pagesSECOND DEMAND For Jury Trial and Zoccali First Amended Objections Responses and Affirmative Defenses

Uploaded by

MammaBear123SECOND DEMAND FOR TRIAL BY JURY by DEFENDANT ZOCCALI (ProSe)'s FIRST AMENDED OBJECTIONS/RESPONSES AND AFFIRMATIVE DEFENSES TO PLAINTIFF’S COMPLAINT FILED IN CHESTER COUNTY, PA

1st Affirmative Defense - Lack of Standing

2nd Affirmative Defense - Failure to Comply with Legal Obligations

3rd Affirmative Defense - Statute of Limitations

4th Affirmative Defense - Lack of Capacity to Sue

5th Affirmative Defense - Failure to Join Necessary Parties

6th Affirmative Defense - Improper Verification

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

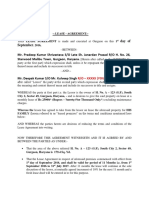

Filed and Attested by

COURT OF COMMON PLEAS PROTHONOTARY

31 Jul 2023 10:48 PM

C. Luna-Valente

CHESTER COUNTY

HSBC BANK USA, NATIONAL

ASSOCIATION, AS TRUSTEE FOR

CIVIL ACTION

DEUTSCHE ALT-B SECURITIES

MORTGAGE LOAN TRUST, SERIES No. 2022-07728-RC

2006-AB2

Plaintiff(s), SECOND DEMAND FOR TRIAL

v. BY JURY

CYNTHIA ZOCCALI, DEFENDANT ZOCCALI’S FIRST

AMENDED OBJECTIONS AND

Defendant

AFFIRMATIVE

DEFENSES/RESPONSES TO

PLAINTIFF’S COMPLAINT

SECOND DEMAND FOR TRIAL BY JURY

DEFENDANT ZOCCALI’S FIRST AMENDED

OBJECTIONS/RESPONSES

AND AFFIRMATIVE DEFENSES TO PLAINTIFF’S COMPLAINT

To the Honorable Court, and all interested parties:

Defendant, Zoccali, hereby submits the following objections and affirmative

defenses to Plaintiff’s Complaint as follows:

First Affirmative Defense

(Lack of Standing)

Plaintiff lacks standing to bring this foreclosure action as they did not

receive any valid rights or obligations from AMERICAN BROKERS

CONDUIT, a non-existent entity.

First Amended Objections and Affirmative Defenses Page 1 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

Second Affirmative Defense

(Failure to Comply with Legal Obligations)

Plaintiff failed to provide a necessary Act 91 Notice prior to initiating this

foreclosure action, a requirement under Pennsylvania law.

Third Affirmative Defense

(Statute of Limitations)

Plaintiff’s action is barred by the applicable statute of limitations as the

lawsuit was filed more than four years after the last payment was made to a

party with legal, equitable or contractual rights, title, or interests, to be paid.

AMERICAN BROKERS CONDUIT and/or Plaintiff’s failed to give legally

mandated notice of alleged ‘acquisition’ of rights directly from AMERICAN

BROKERS CONDUIT, which had to occur on or before the August 6, 2007,

U.S. Bankruptcy Court proceeding in Delaware.

Zoccali alleges tolling of any statute of limitation(s) on Zoccali’s part, as

there has been no bona fide party from 2007 to the alleged ‘assignment’ in

2015, to have been ‘paid’ by Zoccali; or that any valid entity has sought nor

successfully acquired Zoccali’s strict knowledge, consent and authorization

to engage in financial transaction without strict disclosure and notice of who

or what exactly Zoccali was, had been or is now being coerced into paying,

again, when it is apparent AMERICAN BROKERS CONDUIT, legally

defunct by the 2007 AHM bankruptcy proceeding when AHM was acquired

in 2010 by

Which means any remittances of money was not to AMERICAN BROKERS

CONDUIT nor any known or disclosed party, which means Plaintiff's,

claims of a ‘2015’ alleged assignment by AMERICAN BROKERS

CONDUIT was over 7 years ago with no legal notices or disclosures within

30 days of any sale, transfer, or conveyance of AMERICAN BROKERS

CONDUIT’s purported ‘mortgage.’ Rendering the ‘destination’ of every

single financial submission of Zoccali’s money was not being directed to

any bona fide entity, at least none disclosed to Zoccali, if Zoccali’s alleged

co-principal never provided Zoccali with any disclosures or notices of any

sales, transfers or conveyances, then no party absent legal compliance of

statutory duties and conditions precedent in the alleged “AMERICAN

First Amended Objections and Affirmative Defenses Page 2 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

BROKERS CONDUIT” mortgage were ever met, thus AMERICAN

BROKERS CONDUIT and not Zoccali, breached a ‘contract’ if one ever

legally existed to be ‘enforced’ sold, transferred, conveyed, securitized,

collateralization Zoccali’s subject real property ownership title.

Fourth Affirmative Defense

(Lack of Capacity to Sue)

Plaintiffs lack the capacity to sue as they are not registered to do business

in the Commonwealth of Pennsylvania.

Fifth Affirmative Defense

(Failure to Join Necessary Parties)

Plaintiff failed to name all necessary parties with a bona fide legal interest

in the subject matter of this lawsuit. Interests that must be supported by

legal evidence of lawfully existing, and enforceable, timely ‘documents.’

The Chester Co. Recorder of Deeds does not reflect any bona fide party

having complied with any terms or conditions within the AMERICAN

BROKERS CONDUIT ‘mortgage’ or known of, agreed to, or consented by

both principals, not just AMERICAN BROKERS CONDUIT.

Sixth Affirmative Defense

(Improper Verification)

The Complaint is improperly verified by an individual with no legal authority

or first-hand knowledge of the alleged facts.

Commonwealth of Pennsylvania rules regarding verification of pleadings

pursuant to Pennsylvania Rules of Civil Procedure, Rule 1024, state that

every pleading containing an averment of fact not appearing of record in

the action or containing a denial of fact shall be verified on oath or

affirmation.

The verification must state that the averments of fact are true and correct to

the best of the verifier’s knowledge, information, and belief and that any

false statements are subject to penalties of perjury.

First Amended Objections and Affirmative Defenses Page 3 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

The alleged ‘verification’ is not by one with first-hand personal knowledge

or information on behalf of the alleged ‘assignor’ being American Brokers

Conduit – who has been legally defunct since 2007. There is no record of

AMERICAN BROKERS CONDUIT having sold, transferred, assigned, or

conveyed any of AMERICAN BROKERS CONDUIT’s interest in the

AMERICAN BROKERS CONDUIT (alleged) ‘mortgage’ nor evidence

AMERICAN BROKERS CONDUIT transferred rights to enforce the

AMERICAN BROKERS CONDUIT ‘note’ by endorsement to PHH Mortgage

Corporation in 2006 as PHH Mortgage Corporation was acquired by The

Blackstone Group/GECC/Pearl and Jade, on March 15, 2007.

Therefore, rights to the “AMERICAN BROKERS CONDUIT” alleged

financial product were acquired by the Blackstone/GE/Pearl/Jade entities,

per the March 15, 2007, agreements.

PHH Mortgage Corporation also, was never licensed in the Commonwealth

of Pennsylvania to engage in any ‘real estate’ transactions involving real

property situated in the Commonwealth of Pennsylvania until February 14,

2009. Which was after the AHM 2007 Bankruptcy. Which PHH Mortgage

Corporation was not a party to either AMERICAN BROKERS CONDUIT or

AHM and had no legal nexus to the AHM bankruptcy estate of August 6,

2007.

Or PHH Mortgage Corporation failed to give any legally mandated notices

or disclosures of 2006 transactions involving the AMERICAN BROKERS

CONDUIT ‘mortgage’ and/or ‘note’ which had to be noticed to Zoccali

within 30 days of any sales, transfers or conveyances that were required to

be recorded within 90 days.

Zoccali, to date has never received any legal notices or disclosures of any

involvement with PHH Mortgage Corporation, Blackstone Group, et al., or

Freddie Mac having acquired any legal, equitable or a contractual rights,

title or interests in the AMERICAN BROKERS CONDUIT or Zoccali’s sole

and separate legal ownership title in the subject real property evidenced by

a Grant Deed of March 2006.

Nor has this Court been provided with any verifiable bona fide legal

evidence of any ‘perfected’ chains of title, commencing with AMERICAN

BROKERS CONDUIT in 2006-2007; but no time thereafter when

First Amended Objections and Affirmative Defenses Page 4 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

AMERICAN BROKERS CONDUIT/AHM ‘assets’ became property of the

bankruptcy estate in 2007.

The following are raised and preserved by Zoccali as genuine issues of

material facts and/or laws that have not or cannot be disputed in this action

with evidentiary proof, hearings, and discovery, especially of the alleged

“verification” by "Franci Boothney, as “Contract Management Coordinator”

for PHH Mortgage Corporation when PHH Mortgage Corporation is not a

Plaintiff nor 'serviced' on September 20, 2022, a MBS ‘trust’ or ‘trustee’ or

‘bank’ acting as a ‘trustee.’

“Felix Rodriquez” as “Contract Management Coordinator” for PHH

Mortgage Corporation, not a party to the lawsuit or named as any bona fide

real party in interest, or having any legal, equitable or contractual nexus to

Plaintiff's on April 13, 2023, as ‘verified’:

History:

“American Brokers Conduit’ was a division of American Home Mortgage

Holdings, Inc. (AHMHI) which became known as American Home Mortgage

Investment Corp. (AHMIC) in 2003, the new parent company of American

Home Mortgage, when it became a REIT company.

On August 2, 2007, American Home Mortgage and all divisions, closed.

On August 6, 2007, American Home Mortgage filed for Chapter 11

bankruptcy protection in Delaware with all of American Home Mortgage’s

assets sold off.

On September 25, 2007, Michael Strauss, Chief Executive Officer for

American Home Mortgage Investment Corp. and its subsidiaries, American

Home Mortgage Corp., and American Home Mortgage Servicing, Inc.,

American Brokers Conduit, entered into an Asset Purchase Agreement with

AH Mortgage Acquisition Co., Inc. (the "Stalking Horse"), an entity newly

formed by WL Ross & Company, LLC, for the sale of the Company's

mortgage servicing assets and mortgage servicing platform.

In October 2010, Billionaire Wilbur Ross’s mortgage company, the same

named entity in this case, American Home Mortgage Servicing Inc.

(AHMSI), faced lawsuits by attorneys general, sued by homeowners who

First Amended Objections and Affirmative Defenses Page 5 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

accused AHMSI of using tactics that lead to improper and illegal taking of

properties in foreclosures.

On October 25, 2020, a lawsuit was filed in a Texas federal court on behalf

of homeowners with mortgages serviced by American Home going back to

2006. American Home’s “illegal, unfair and deceptive business practices

victimized borrowers” across the U.S., according to the complaint.

Billionaire Wilbur Ross’s American Home Mortgage Servicing Inc. faced

lawsuits by attorneys general for using tactics that lead to improper

foreclosures.

PHH Mortgage Corporation was also in many federal court actions for

using tactics to lead to improper foreclosures by, among others, 49 state

attorneys general, including Commonwealth of Pennsylvania’s Attorney

General Josh Shapiro, who executed final orders against PHH Mortgage

Corporation in 2017, charging him with duties to monitor and supervise

PHH Mortgage Corporation from engaging in the same conduct and

actions, in this subject case against Zoccali. It was after AG Shapiro’s

announcement in 2017 of the PHH Mortgage Corporation’s nationwide

indictment, at the same time the U.S. Dept. of Justice ex rel; Bozzelli v

PHH Mortgage Corporation criminal indictment was filed for same

violations and wrongdoing. Zoccali was among those ‘victimized by PHH

Mortgage Corporation, and despite 10 years of known civil and criminal

wrongdoing by PHH Mortgage Corporation, which affects 33,000

Pennsylvanians, PHH Mortgage Corporation continues to engage in false

and fraudulent misrepresentations and judicial proceedings in its own

name, when PHH Mortgage Corporation never held any legal, equitable or

a contractual rights, title, or interest in Zoccali’s subject real property

ownership title.

PHH Mortgage Corporation has been indicted since 2001 for accounting,

banking, and servicing fraud first under its former name “Cendant

Corporation” then under its own name PHH Mortgage Corporation, again in

2017, including CFPB v PHH Mortgage Corporation; in addition to lawsuits

in every state of the nation. While Zoccali, has never broken a law, has no

‘rap sheet’ never been indicted, served prison terms, or paid $6 billion in

fines (2001) or $74 million to resolve violations of the False Claims Act

involving Freddie Mac, U.S. Government. Yet PHH Mortgage Corporation

First Amended Objections and Affirmative Defenses Page 6 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

continues to be allowed to engage protracted, false, and felonious lawsuits

against millions of Americans; begging the question, who were recipients of

$6,074,000,000 paid since 2001? It certainly wasn’t Zoccali. In fact,

Zoccali endeavored to pay-off in full and wind down but could never

ascertain who or what exactly she had been paying, must less ‘wiring’ over

a digital database sum in excess of $180,000.

Which Zoccali further begs, who exactly in this legal scenario was/is to

have the legal authority and standing to cancel the original AMERICAN

BROKERS CONDUIT note and release the original AMERICAN BROKERS

CONDUIT mortgage if it has been legally defunct since August 2007; and

no cognizable party exists to stand in AMERICAN BROKERS CONDUIT’s

shoes; so who is legally as proven by operation of law, to take a penny

from Zoccali, if they have never been conferred any legal, equitable or

contractual rights, title or interest beginning 2007 before AMERICAN

BROKERS CONDUIT became defunct? These queries must be the

subject of Plaintiff’s lawsuit and addressed under the judicial scrutiny of this

Honorable Court.

It is therefore incumbent upon this Court to invoke judicial scrutiny into

Zoccali’s first amended objections and affirmative defenses.

Background:

The entity was formed by affiliates of WL Ross & Co. LLC in November

2007 for the purpose of acquiring the servicing assets of American Home

Mortgage Investment Corp., American Home Mortgage Corp., and

American Home Mortgage Servicing Inc. in the bankruptcy liquidation.

American Home Mortgage Servicing Inc. changed its name to Homeward

Residential Holdings, Inc. in February 2012.

In October 2012, Ocwen announced plans to buy Homeward Residential

Holdings, Inc. from WL Ross & Co. for $750 million. The acquisition was

finalized on Dec.27, 2012.

In 2010, American Home Mortgage Servicing, Inc. (AHMSI), was created to

service loans originated by AHMIC and all its divisions – AHMSI – and not

PHH Mortgage Corporation - serviced its own ‘loans’ which were sold to

Wilbur Ross & Company. The truthful and accurate details as to why, how,

and when exactly PHH Mortgage Corporation became a ‘servicer’ remains

First Amended Objections and Affirmative Defenses Page 7 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

to be determined in discovery and evidentiary proceedings. Unless and

until discovery and evidentiary proceedings forthcoming, neither Zoccali nor

this Honorable Court will know.

Which therefore warrants an accurate, legal disclosure of all sales,

transfers, and conveyances of the original AMERICAN BROKERS

CONDUIT ‘mortgage and note’ that were required under Commonwealth of

Pennsylvania laws to have been memorialized by recordation in the

Chester Co. Recorder of Deeds within recording laws which were

applicable in 2006-2010 as all sales, transfers and conveyances must be

recorded within 90 days of any sale, transfer or conveyance of real property

situated in the Commonwealth of Pennsylvania.

Since PHH Mortgage Corporation could not legally engage in any real

estate transactions in Commonwealth of Pennsylvania before February 14,

2009, PHH was not a lawfully permitted ‘servicer’ of Zoccali’s real property

ownership title or any alleged ‘security interests’ as none existed post-2007

bankruptcy, and no evidence any party from March 2006 to the alleged

2015 ‘assignment from AMERICAN BROKERS CONDUIT to the Plaintiff

‘trust’ engaged in any proper, lawful or enforceable sales, transfers or

conveyances of the AMERICAN BROKERS CONDUIT ‘mortgage or note’

at any time between 2006 and alleged 2015 ‘assignment’ by AMERICAN

BROKERS CONDUIT who has been legally defunct for 16 years since

2007 could not have possibly or legally ‘assigned’ or ‘transferred’ rights to

enforce AMERICAN BROKERS CONDUIT’s mortgage or note, if no

evidence exists from March 2006, to and including, a May 26, 2015

‘assignment’ Plaintiff’s rely on to support this lawsuit which Zoccali asserts

is neither legal or truthful; but false and fraudulent misrepresentations

made to this Court for the sole purpose of relying on a forged, counterfeit

‘assignment’ in AMERICAN BROKERS CONDUIT’s name, as nothing but a

litigation tool to engage in the illegal and improper taking of property.

Actions Zoccali alleges are in actuality at the behest of the U.S.

Government on behalf of Freddie Mac who was taken into the U.S.

Government’s conservatorship on or around September 4, 2008.

Whereunder Zoccali alleges with confidence Plaintiffs are not being candid

with Zoccali or this Honorable Court, as to who or what exactly the law firm

First Amended Objections and Affirmative Defenses Page 8 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

actually ‘represents’ and carrying out this action in unethical and illegal

premises.

Zoccali will provide evidence in the form of an example of GSE’s 1998

communications and agreements with law firms participating in the

Government Sponsored Enterprise’s Retained Attorney Network and

Servicing Guide acknowledging that legacy agreements apply in cases like

this one.

Zoccali, therefore, as an affirmative defense regarding no bona fide real

party is party to this lawsuit, asserts under what interest does the United

States have (or has had) in Zoccali’s home loan and/or any aspects of the

purported AMERICAN BROKERS CONDUIT home loan and alleged

security instruments strictly in the name of American Brokers Conduit

thereto.

In this case, American citizens, like Zoccali and her family of minor

children, are threatened with being knowingly and intentionally as

unconstitutional, evicted from their homes as a result of unconstitutional

acts and omissions by the governments of the United States and

Commonwealth of Pennsylvania. While ignoring the legal duties and

mandatory compliances required of Plaintiff or Plaintiff’s in this case. There

is no clear or definitive claim or who or what exactly this law firm, has a

legal representation contract with or who it actually represents being

shielded, using felonious documents as litigation tools and this Court as a

‘debt collection’ agency without conferring requisite subject-matter (in rem),

personam, procedural, prudential, and/or substantive jurisdiction to preside

over Zoccali’s ownership title to real property as in rem, nor Zoccali as in

personam.

Zoccali has challenged the allegations of PHH Mortgage Corporation

having any legal nexus, which Zoccali brings to this Court’s attention,

Plaintiff/Plaintiffs have knowingly and intentionally dropped statements that

they represent PHH Mortgage Corporation as their ‘client.’ But have not

moved for leave of this Court or permission to dismiss PHH Mortgage

Corporation.

It must be clearly delineated as to who or what exactly is accusing Zoccali

of some wrongdoing and must be subject to judicial scrutiny into this matter

as this Court’s legal authority and jurisdiction is also contingent upon

First Amended Objections and Affirmative Defenses Page 9 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

Plaintiff’s bona fide real party interests which cannot confer or invoke this

Court’s authority if Plaintiff ‘trustee’ does not itself have any justiciable

‘injuries’ that can be traced to any act or omission on Zoccali’s part. Or that

any legal nexus ever existed directly with Zoccali so as to hold her

accountable for any alleged ‘losses’ which Zoccali alleges having no legal

nexus or possible means of having any nexus to a ‘mortgage-backed

securities trust’ could in any way be the fault of Zoccali.

Nor can any Plaintiff prove they ‘paid’ consideration to AMERICAN

BROKERS CONDUIT to step into the ‘shoes’ of AMERICAN BROKERS

CONDUIT at or before August 2007.

Zoccali reminds this Honorable Court and Plaintiff(s) that since the

origination of the subject real property AMERICAN BROKERS CONDUIT

transaction in 2006, was in fact, a U.S. Government GSE ‘transaction’

purchased by Freddie Mac (March 2006), then in 2008 under the

Emergency Economic Stabilization Act the U.S. Government paid out to

these Plaintiff(s) and other financial entities, $700B in Troubled Asset Relief

Program funds.

There is no record of any of the above cited actions that legally warranted

memorialization and recordation of all identities, actions and/or transactions

that transpired involving the subject real property AMERICAN BROKERS

CONDUIT mortgage and note, to demonstrate a legally existing and

lawfully enforceable ‘chain’ of events creating a ‘perfected’ interest held by

any party, much less Plaintiff in this case.

There is no disclosure to Zoccali, or this Honorable Court, who both have a

right to know, what and who exactly is appearing before this Court, and to

explain what happened to alleged ‘mortgage’ they relied on regarding

American Brokers Conduit which was a division of AHMIC that has been

legally defunct since 2007. AMERICAN BROKERS CONDUIT could and

did not exist post-2007 bankruptcy proceedings.

Plaintiff's must, therefore, be required to engage in discovery and

evidentiary hearings to prove up their claims, including prove up by

evidence, any divestiture by Wilbur Ross & Company’s of rights and

interests in AHMIC a/k/a AHMSI to every Plaintiff in this case.

First Amended Objections and Affirmative Defenses Page 10 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

There is no evidence Ross et al. assigned or transferred any rights

acquired under the 2007 bankruptcy of the 2007 legally-defunct American

Brokers Conduit.

Plaintiff's must, therefore, prove up their claims of being bona fide

assignees of AMERICAN BROKERS CONDUIT’s ‘mortgage’ in 2015, and

evidence AMERICAN BROKERS CONDUIT ‘transferred’ rights to enforce

AMERICAN BROKERS CONDUIT’s ‘note’ by direct endorsement by

AMERICAN BROKERS CONDUIT in 2015 or any other time – 8 years after

AMERICAN BROKERS CONDUIT or its parent, ceased to exist or when

property of a federal bankruptcy estate’s competent legal control and

jurisdiction over AMERICAN BROKERS CONDUIT.

First Amended Objections and Affirmative Defenses Page 11 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

Zoccali reserves the right to amend and add additional defenses as

discovery proceeds and more information comes to light.

Zoccali by this statement raises, and preserves, genuine issues of material

facts and laws regarding this Court may not have been conferred

prerequisite subject-matter (in rem), personam, procedural, prudential,

and/or substantive jurisdiction, and that no party had Article III

constitutional standing or legal authority to bring this action.

Zoccali reserves the right to demand trial by jury as to all facts so triable.

Respectfully Submitted,

By:/s/ Cynthia Zoccali

Cynthia Zoccali

118 Meredith Drive

Spring City, PA 19475

Email: cynthiazoccali@gmail.com

(484) 336-3236

First Amended Objections and Affirmative Defenses Page 12 of 12

2022-07728-RC – July 31, 2023

2022-07728-RC

You might also like

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- Post Motion To VacateDocument22 pagesPost Motion To Vacatepeny7100% (3)

- Brief of Defendant in Opposition of Plaintiff'S Amended Complaint and BriefDocument11 pagesBrief of Defendant in Opposition of Plaintiff'S Amended Complaint and BriefMammaBear123No ratings yet

- Tom Chan AnswerDocument7 pagesTom Chan AnswerDreloc1604No ratings yet

- Webster MTDDocument18 pagesWebster MTDStopGovt WasteNo ratings yet

- Strickland, Response, Objection and Memo.Document9 pagesStrickland, Response, Objection and Memo.Ron HouchinsNo ratings yet

- Celizena Julme Vilamar Julme in The Circuit Court of The 17Document5 pagesCelizena Julme Vilamar Julme in The Circuit Court of The 17Richarnellia-RichieRichBattiest-CollinsNo ratings yet

- In The Court of Appeals of Ohio Second Appellate DivisionDocument20 pagesIn The Court of Appeals of Ohio Second Appellate DivisionJohn ReedNo ratings yet

- Sample Motion2QuashDocument7 pagesSample Motion2QuashTodd Wetzelberger100% (2)

- Compiled & Updated By: Reynaldo Dalisay JR., Marianne Serrano (The Poypis')Document15 pagesCompiled & Updated By: Reynaldo Dalisay JR., Marianne Serrano (The Poypis')Johndale de los SantosNo ratings yet

- Defendant's Summary Process AnswerDocument175 pagesDefendant's Summary Process AnswerBobNo ratings yet

- FRAUD Upon The Court Motion - BOA V Julme-FL Case#CACE09-21933-051 - 2010-09-29 PDFDocument30 pagesFRAUD Upon The Court Motion - BOA V Julme-FL Case#CACE09-21933-051 - 2010-09-29 PDFStar Gazon100% (2)

- Motion Vacate Judgment - Fraud On Court-Request Evidentiary HearingDocument30 pagesMotion Vacate Judgment - Fraud On Court-Request Evidentiary Hearingwinstons2311100% (2)

- Motion To Dismiss Sample 3Document12 pagesMotion To Dismiss Sample 3Randall Lemani100% (1)

- BB&T First Motion To DismissDocument15 pagesBB&T First Motion To DismissSean G. DeVriesNo ratings yet

- DW RJB WCP Mot2Document9 pagesDW RJB WCP Mot2Daniel T. WarrenNo ratings yet

- Yap Versus Siao - Appellee's Brief1Document84 pagesYap Versus Siao - Appellee's Brief1Bayani Sevilla AtupNo ratings yet

- Answer Objection To MSJDocument17 pagesAnswer Objection To MSJrichk7No ratings yet

- Defendant Motion For Summary JudgmentDocument7 pagesDefendant Motion For Summary Judgmentwinstons23110% (1)

- G.R. No. 115678Document5 pagesG.R. No. 115678Graile Dela CruzNo ratings yet

- Opposition To Demurrer-SampleDocument10 pagesOpposition To Demurrer-SampleRobert McKeeNo ratings yet

- Motion To Dismiss Sample 3Document13 pagesMotion To Dismiss Sample 3winprose89% (27)

- Awesome Debt Validation LetterDocument27 pagesAwesome Debt Validation Letterbalestrery85% (55)

- Motion To Dismiss For Fraud 2Document10 pagesMotion To Dismiss For Fraud 2Howard H. Ellzey100% (1)

- Laurelwood FileDocument19 pagesLaurelwood Filethe kingfishNo ratings yet

- Reply To Opposition Cme ReadyDocument7 pagesReply To Opposition Cme ReadyDavid T Saint AlbansNo ratings yet

- Motion To Dismiss and Other DocumentsDocument13 pagesMotion To Dismiss and Other DocumentsBINGE TV EXCLUSIVENo ratings yet

- Petitioner Respondents. Ramos & Sibal For Petitioner. Oliver O. Lozano For Private RespondentDocument8 pagesPetitioner Respondents. Ramos & Sibal For Petitioner. Oliver O. Lozano For Private RespondentZarahNo ratings yet

- Bais Yaakov of Spring Valley v. ACT, Inc., 1st Cir. (2015)Document21 pagesBais Yaakov of Spring Valley v. ACT, Inc., 1st Cir. (2015)Scribd Government DocsNo ratings yet

- Petition For Declaratory Judgment - TemplateDocument220 pagesPetition For Declaratory Judgment - Templateextemporaneous89% (9)

- Provrem III.I Case DigestsDocument5 pagesProvrem III.I Case DigestsKim EcarmaNo ratings yet

- Maste ModifiedDocument4 pagesMaste ModifiedBond HolderNo ratings yet

- Sostenes Pena v. HSBC Bank USA, 4th Cir. (2015)Document6 pagesSostenes Pena v. HSBC Bank USA, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Siok Ping Tang VS Subic BayDocument3 pagesSiok Ping Tang VS Subic Bayfermo ii ramos100% (1)

- Hearing Begins Wednesday in Florida Redistricting Map LawsuitDocument8 pagesHearing Begins Wednesday in Florida Redistricting Map LawsuitSarah GlennNo ratings yet

- Connecticut v. Doehr, 501 U.S. 1 (1991)Document26 pagesConnecticut v. Doehr, 501 U.S. 1 (1991)Scribd Government DocsNo ratings yet

- Demand For Trial by JuryDocument31 pagesDemand For Trial by JuryJudicial_Fraud0% (1)

- United States Court of Appeals, Eighth CircuitDocument8 pagesUnited States Court of Appeals, Eighth CircuitScribd Government DocsNo ratings yet

- Answer and Counterclaim - (If Being Sued)Document6 pagesAnswer and Counterclaim - (If Being Sued)Jacqueline Graham0% (1)

- Cabanting vs. BPI FamilyDocument9 pagesCabanting vs. BPI FamilyDexter CircaNo ratings yet

- ANSWERAFFIRMDocument6 pagesANSWERAFFIRMMatthew Weidner100% (1)

- PBCom vs. Court of Appeals, G.R. Nos. 115678 & 119723, 23 February 2001Document6 pagesPBCom vs. Court of Appeals, G.R. Nos. 115678 & 119723, 23 February 2001Christopher ArellanoNo ratings yet

- Amended Motion To DismissDocument5 pagesAmended Motion To DismissStephanie MathusaNo ratings yet

- 15 Arguments Against Incarceration For Child SupportDocument284 pages15 Arguments Against Incarceration For Child Supportextemporaneous91% (11)

- Motion To Dismiss - Capacity US Bank - PITA NoA Cost BondDocument16 pagesMotion To Dismiss - Capacity US Bank - PITA NoA Cost Bondwinstons2311100% (2)

- Duvaz Corporation vs. Export and Industry Bank (163011) 523 SCRA 405 (2007)Document12 pagesDuvaz Corporation vs. Export and Industry Bank (163011) 523 SCRA 405 (2007)Joe PoNo ratings yet

- Credit Card Case - Answer To The ComplaintDocument5 pagesCredit Card Case - Answer To The ComplaintRGARRASINo ratings yet

- Truth Affidavit Regarding Right To TravelDocument344 pagesTruth Affidavit Regarding Right To Travelextemporaneous100% (45)

- Motion To Dismiss - AllongeDocument14 pagesMotion To Dismiss - Allongewinstons2311100% (7)

- Motion To StrikeDocument8 pagesMotion To Strikeanon_410533234No ratings yet

- The Art of Recusing a Judge - With Ultimate Loopholes and a Sample Motion to RecuseFrom EverandThe Art of Recusing a Judge - With Ultimate Loopholes and a Sample Motion to RecuseRating: 5 out of 5 stars5/5 (5)

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionFrom EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNo ratings yet

- Sample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimFrom EverandSample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimRating: 5 out of 5 stars5/5 (21)

- Petition for Certiorari: Denied Without Opinion Patent Case 93-1413From EverandPetition for Certiorari: Denied Without Opinion Patent Case 93-1413No ratings yet

- The Book of Writs - With Sample Writs of Quo Warranto, Habeas Corpus, Mandamus, Certiorari, and ProhibitionFrom EverandThe Book of Writs - With Sample Writs of Quo Warranto, Habeas Corpus, Mandamus, Certiorari, and ProhibitionRating: 5 out of 5 stars5/5 (9)

- Defendants First Amended Objections and Affirmative Defenses 2022 07728 RC 7 31 23Document12 pagesDefendants First Amended Objections and Affirmative Defenses 2022 07728 RC 7 31 23MammaBear123No ratings yet

- Foreign Bank HSBC & Dominion Voting Machines - Patents 8195505 - 9870666 - 9710988Document78 pagesForeign Bank HSBC & Dominion Voting Machines - Patents 8195505 - 9870666 - 9710988MammaBear123No ratings yet

- 916 HSBC Corporate Assignments On File in Chester County PA As of 01/04/23.Document66 pages916 HSBC Corporate Assignments On File in Chester County PA As of 01/04/23.MammaBear123No ratings yet

- Foreign Bank HSBC & Dominion Voting Machines - Patents 8844813 - 8913737 - 9202113Document114 pagesForeign Bank HSBC & Dominion Voting Machines - Patents 8844813 - 8913737 - 9202113MammaBear123No ratings yet

- 916 HSBC Corporate Assignments On File in Chester County PA As of 01/04/23.Document66 pages916 HSBC Corporate Assignments On File in Chester County PA As of 01/04/23.MammaBear123No ratings yet

- 1,378 Deutsche Bank Corporate Assignments On File in Chester County PA As of 01.04.23Document108 pages1,378 Deutsche Bank Corporate Assignments On File in Chester County PA As of 01.04.23MammaBear123No ratings yet

- MERS TrademarkDocument14 pagesMERS TrademarkMammaBear123No ratings yet

- Mers, Inc. Membership List of 5,566 Members As of May 22, 2016Document133 pagesMers, Inc. Membership List of 5,566 Members As of May 22, 2016Emanuel McCray100% (1)

- Imploded LendersDocument8 pagesImploded LendersMammaBear123No ratings yet

- MERSTrademark 1 2Document8 pagesMERSTrademark 1 2MammaBear123No ratings yet

- Ocwen/PHH/ NewRez - Zoccali Exhibit Outline - Zoccali Motion To Intervene - 2:20-cv-00864-CFK - Eastern District of PADocument2 pagesOcwen/PHH/ NewRez - Zoccali Exhibit Outline - Zoccali Motion To Intervene - 2:20-cv-00864-CFK - Eastern District of PAMammaBear123No ratings yet

- Exhibit 10 - Zoccali Motion To Intervene 11.24.20 - 2:20-cv-00864-CFK - Eastern District of PADocument30 pagesExhibit 10 - Zoccali Motion To Intervene 11.24.20 - 2:20-cv-00864-CFK - Eastern District of PAMammaBear123No ratings yet

- Exhibit 5 - Zoccali Motion To Intervene 11.24.20 - 2:20-cv-00864-CFK - Eastern District of PADocument24 pagesExhibit 5 - Zoccali Motion To Intervene 11.24.20 - 2:20-cv-00864-CFK - Eastern District of PAMammaBear123No ratings yet

- Ocwen/PHH/ NewRez - Zoccali Intervene 11.24.20 - 2:20-cv-00864-CFK - Eastern District of PADocument28 pagesOcwen/PHH/ NewRez - Zoccali Intervene 11.24.20 - 2:20-cv-00864-CFK - Eastern District of PAMammaBear123100% (1)

- 11 7 12 0204 62337 Bates 619 To1654 Pleading Created by Zach Coughlin Vol 2 SBN Violates SCR 105 (2) (C) With Index OptDocument1,036 pages11 7 12 0204 62337 Bates 619 To1654 Pleading Created by Zach Coughlin Vol 2 SBN Violates SCR 105 (2) (C) With Index OptNevadaGadflyNo ratings yet

- Neypes V CA Case DigestDocument7 pagesNeypes V CA Case DigestIvan Montealegre ConchasNo ratings yet

- Civ Pro II - NotesDocument4 pagesCiv Pro II - NotesLouray JeanNo ratings yet

- COA Cases (Consti 1)Document3 pagesCOA Cases (Consti 1)Dee LMNo ratings yet

- 11 J.L. & Health 195Document19 pages11 J.L. & Health 195djranneyNo ratings yet

- IPC - II - Amogh Mittal - 18223Document18 pagesIPC - II - Amogh Mittal - 1822318223 AMOGH MITTALNo ratings yet

- Combined Undertaking For Change of MappingDocument4 pagesCombined Undertaking For Change of MappingUllas DivakaranNo ratings yet

- Prevention PrincipleDocument14 pagesPrevention PrincipleHweh Tze GohNo ratings yet

- Imperial v. Jaucian PDFDocument19 pagesImperial v. Jaucian PDFMarkAnthonyAlonzoTorresNo ratings yet

- Adult Tattoo Consent Form PDFDocument2 pagesAdult Tattoo Consent Form PDFRyan ShmeraNo ratings yet

- Republic of The Philippines Regional Trial Court Fourth Judicial Region Branch 22 Imus, CaviteDocument5 pagesRepublic of The Philippines Regional Trial Court Fourth Judicial Region Branch 22 Imus, CaviteMark RyeNo ratings yet

- S&P AgreementDocument2 pagesS&P AgreementrasfixNo ratings yet

- M - Criticisms Against The Courts Judges JusticesDocument38 pagesM - Criticisms Against The Courts Judges JusticessigfridmonteNo ratings yet

- Oil & Natural Gas Corporation LTD vs. Western Geco International LTDDocument5 pagesOil & Natural Gas Corporation LTD vs. Western Geco International LTDSharvi Dua100% (1)

- Assignment DigestDocument23 pagesAssignment Digestmuton20No ratings yet

- The Importance of Learning Legal English For LawyersDocument8 pagesThe Importance of Learning Legal English For LawyersSyed Gulfam AhmadNo ratings yet

- A Prenuptial AgreementDocument4 pagesA Prenuptial AgreementBonny Mariela Marquina LeonNo ratings yet

- Legal Ethics Week 9Document14 pagesLegal Ethics Week 9Sharmaine Alisa BasinangNo ratings yet

- Data Privacy ActDocument18 pagesData Privacy ActAnna Ayson-VegafriaNo ratings yet

- Mendoza and Enriquez vs. de Guzman, 52 Phil. 164, No. 28721 October 5, 1928 (Builder in Bad Faith)Document8 pagesMendoza and Enriquez vs. de Guzman, 52 Phil. 164, No. 28721 October 5, 1928 (Builder in Bad Faith)Alexiss Mace JuradoNo ratings yet

- Fair Debt Collection Practices Act: BackgroundDocument7 pagesFair Debt Collection Practices Act: BackgroundWilson GrahamNo ratings yet

- Civil Case 92 of 2008Document6 pagesCivil Case 92 of 2008majoNo ratings yet

- Song Fo - Company vs. Hawaiian Philippine Co.Document10 pagesSong Fo - Company vs. Hawaiian Philippine Co.Jacob FerrerNo ratings yet

- PERSONS Case Digests (Mallion Vs Alcantara - Garcia Vs Sangil)Document52 pagesPERSONS Case Digests (Mallion Vs Alcantara - Garcia Vs Sangil)Harry Peter100% (2)

- Due DiligenceDocument51 pagesDue DiligenceDeepali ParmarNo ratings yet

- Prov Rem Case DigestDocument3 pagesProv Rem Case DigestJune ReighNo ratings yet

- NTC v. Hamoy, Jr. (Reassignment) 2009Document7 pagesNTC v. Hamoy, Jr. (Reassignment) 2009Dael GerongNo ratings yet

- Lease Agreement - A 123 (GF)Document5 pagesLease Agreement - A 123 (GF)deeNo ratings yet

- Recent UK Construction Law CasesDocument11 pagesRecent UK Construction Law CasesNadnos WolfriderNo ratings yet

- Remedial Law Case Digests (Week 4) : AmendmentsDocument17 pagesRemedial Law Case Digests (Week 4) : AmendmentsLydie Ron BonacuaNo ratings yet