Professional Documents

Culture Documents

74.2 Notes - 2 MANUF

74.2 Notes - 2 MANUF

Uploaded by

SLUNGILE MKHONTOOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

74.2 Notes - 2 MANUF

74.2 Notes - 2 MANUF

Uploaded by

SLUNGILE MKHONTOCopyright:

Available Formats

LESSON

GRADE 11

WEEK 23 - Lesson 2 of 16 74

MANUFACTURING

REVISION GRADE 10 - WORKSHEET 3

FIXED & VARIABLE COSTS

Variable costs These costs increase when the factory produces more products

VC and decrease when the factory produces less products.

Costs that change depending on number of units produced.

Example: Raw materials

This means that the costs will change depending on the number of

desks produced. One piece of wood will be needed for 1 desk

therefore 2 pieces of wood will be needed for two desks.

Therefore, the variable cost depends on the number of goods

produced.

There are other variable costs but we need to remember that

Direct material costs and Direct labour costs are always variable

costs.

Fixed costs These costs do not change even if the quantities produced by the

FC factory increase or decrease.

Fixed costs are the opposite of variable costs. Most overhead

costs are considered to be fixed costs as they do not change in

relation to the number of items produced.

Example: Rent

We will pay the same amount of rent for the premises no matter

how many items we produce. Even if we do not produce one unit,

the rent still remains the same amount.

74 Accounting Grade 11 - CAPS 1

BASELINE ACTIVITY 4

REQUIRED

REFER TO ACTIVITY 1

Now classify the costs by making a tick in the appropriate columns. There may be more

than one tick.

Work done Direct Indirect Fixed Variable

by person costs costs costs costs

Factory worker

making the tables

Cleaner

Security guard

Foreman

Person looking

after the stock

BASELINE ACTIVITY 5

FIXED / VARIABLE COSTS

REQUIRED

Classify the costs by making a tick in the appropriate columns.

Fixed Variable

Cost costs costs

Rent

Raw material cost

Electricity

Insurance

Indirect labour costs

Depreciation

Cleaning materials

Indirect material costs

NOTE: There is a fixed monthly charge that needs to be paid for electricity even if no

electricity is used. The electricity consumption cost will thereafter fluctuate (increase or

decrease) according to the quantities produced.

74 Accounting Grade 11 - CAPS 2

SELLING AND DISTRIBUTION COSTS

These are costs of selling the finished goods (e.g. advertising, sales commission).

These are variable costs.

ADMINISTRATIVE COSTS

This is the cost of running the office where the administration and accounting is done.

These are fixed costs.

PRIME COSTS

Direct raw material cost xxxxx

+ Direct labour cost xxxxx

= Primary cost XXXX

WORK IN PROCESS

In a manufacturing business there are at any point in time products at various stages of

completion – “partly completed”.

These unfinished products are called Work in Process.

74 Accounting Grade 11 - CAPS 3

ANSWERS

74

BASELINE ACTIVITY 4

Work done Direct Indirect Fixed Variable

by person costs costs costs costs

Factory worker X

making the tables X (not fixed –

there can be

overtime)

Cleaner X X

Security guard X X

Foreman X X

Person looking

after the stock X X

BASELINE ACTIVITY 5

Fixed Variable

Cost costs costs

Rent X

Raw material cost X

Electricity X

Insurance X

Indirect labour costs X

Depreciation X

Cleaning materials X

Indirect material costs X

74 Accounting Grade 11 - CAPS 4

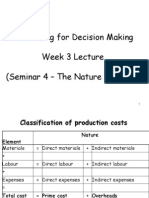

CHALKBOARD SUMMARY / TRANSPARENCY

Direct raw materials + Direct labour costs

Primary Costs

Factory overheads

Indirect materials

Indirect labour Other costs

that cannot be

directly

allocated to

production

Total Production Costs

74 Accounting Grade 11 - CAPS 5

You might also like

- Homework 5Document3 pagesHomework 5Kevin0% (3)

- Acccob3 HW2Document18 pagesAcccob3 HW2Aaron HuangNo ratings yet

- Strategic Marketing 1st Edition Mooradian Test BankDocument9 pagesStrategic Marketing 1st Edition Mooradian Test Bankmeganfloresyfwemzsrdp100% (15)

- Supply Chain Strategy Analysis of The Benetton CaseDocument6 pagesSupply Chain Strategy Analysis of The Benetton CasebizaczkiNo ratings yet

- Marginal Costing & Absorption CostingDocument56 pagesMarginal Costing & Absorption CostingHoàng Phương ThảoNo ratings yet

- Chapter 2 EOQ MODELDocument24 pagesChapter 2 EOQ MODELHamdan Hassin100% (2)

- Research Report On Strategies of Amul and SarasDocument84 pagesResearch Report On Strategies of Amul and Sarasswatigupta8880% (5)

- Chapter 2 Cost ClassificationsDocument18 pagesChapter 2 Cost Classificationsmarizemeyer2No ratings yet

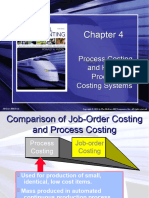

- Chapter No.04 - Process Costing and Hybrid Product-Costing SystemsDocument39 pagesChapter No.04 - Process Costing and Hybrid Product-Costing SystemsWali NoorzadNo ratings yet

- Akb Bab4Document37 pagesAkb Bab4MulyaniNo ratings yet

- Hilton 11e Chap004 PPT-STUDocument42 pagesHilton 11e Chap004 PPT-STULạnh LùngNo ratings yet

- Process Costing and Hybrid Product-Costing SystemsDocument38 pagesProcess Costing and Hybrid Product-Costing SystemsZia UddinNo ratings yet

- Hilton Chapter 4 Prerecorded LectureDocument12 pagesHilton Chapter 4 Prerecorded Lecturesunq hccnNo ratings yet

- Chap4 (E)Document47 pagesChap4 (E)Kiên Lê TrungNo ratings yet

- Process Costing and Hybrid Product-Costing Systems: Mcgraw-Hill/IrwinDocument44 pagesProcess Costing and Hybrid Product-Costing Systems: Mcgraw-Hill/Irwinsunanda mNo ratings yet

- Chap004 7e EditedDocument47 pagesChap004 7e EditedfarahNo ratings yet

- Cost - Terms Concepts and ClassificationsDocument17 pagesCost - Terms Concepts and ClassificationsSwap WerdNo ratings yet

- (Revised) Week 13 - ReviewDocument94 pages(Revised) Week 13 - ReviewCheuk Ling SoNo ratings yet

- Hilton Chapter 3 Live Adobe ConnectDocument13 pagesHilton Chapter 3 Live Adobe ConnectaksNo ratings yet

- Hilton Chapter 4 Live Adobe ConnectDocument15 pagesHilton Chapter 4 Live Adobe ConnectJaved ImranNo ratings yet

- Absorption Costing Vs Variable CostingDocument20 pagesAbsorption Costing Vs Variable CostingMa. Alene MagdaraogNo ratings yet

- Chaitra B Chaitra C MDocument28 pagesChaitra B Chaitra C MChaitra MuralidharaNo ratings yet

- Cost Terminologies and ClassficationsDocument51 pagesCost Terminologies and ClassficationsLim Jie XiNo ratings yet

- NOTE CHAPTER 9 - Absorption Costing & Marginal CostingDocument18 pagesNOTE CHAPTER 9 - Absorption Costing & Marginal CostingNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- 07 Module 03 AVC PDFDocument12 pages07 Module 03 AVC PDFMarriah Izzabelle Suarez RamadaNo ratings yet

- Inventory Costing: Chapter NineDocument39 pagesInventory Costing: Chapter NineDio VinosaNo ratings yet

- Cost Term, Concept and ClassificationsDocument28 pagesCost Term, Concept and ClassificationskumarNo ratings yet

- Costman Variable CostingDocument2 pagesCostman Variable CostingJeremi BernardoNo ratings yet

- Ma1 PDFDocument65 pagesMa1 PDFĐức TrầnNo ratings yet

- Cost TutorialDocument26 pagesCost TutorialedrianclydeNo ratings yet

- AF3112 Management Accounting 2: Process CostingDocument66 pagesAF3112 Management Accounting 2: Process Costing行歌No ratings yet

- Cost Accounting ReviewerDocument7 pagesCost Accounting Reviewerjaninasachadelacruz0119No ratings yet

- Cost Accountingpractical 2021-22 PDFDocument42 pagesCost Accountingpractical 2021-22 PDFSora 1211100% (1)

- Cost Concepts: Ilene D. Padilla Cpa, MbaDocument53 pagesCost Concepts: Ilene D. Padilla Cpa, Mbaharley_quinn11No ratings yet

- Process Costing and Hybrid Product-Costing SystemsDocument17 pagesProcess Costing and Hybrid Product-Costing SystemsWailNo ratings yet

- ACT121 - Topic 5Document5 pagesACT121 - Topic 5Juan FrivaldoNo ratings yet

- Chapter 4 OverheadDocument21 pagesChapter 4 OverheadMUHAMMAD ZAIM HAMZI MUHAMMAD ZINNo ratings yet

- Absorption and Variable CostingDocument2 pagesAbsorption and Variable CostingFelimar CalaNo ratings yet

- IWB Chapter 5 - Marginal and Absorption CostingDocument28 pagesIWB Chapter 5 - Marginal and Absorption Costingjulioruiz891No ratings yet

- Acc GR 11 T4 Week 1&2 Manuftring Costs ENGDocument4 pagesAcc GR 11 T4 Week 1&2 Manuftring Costs ENGsihlemooi3No ratings yet

- Variable Costing: A Tool For Management: Chapter SevenDocument37 pagesVariable Costing: A Tool For Management: Chapter SevenJavier TsangNo ratings yet

- Cost Terms, Concepts, and ClassificationsDocument22 pagesCost Terms, Concepts, and ClassificationsKi xxiNo ratings yet

- Session - 4&5 (A) : Product CostingDocument38 pagesSession - 4&5 (A) : Product CostingAnkitShettyNo ratings yet

- Cost and Cost Behavior IntroductionDocument1 pageCost and Cost Behavior IntroductionArvin BeduralNo ratings yet

- Accounting For Decision Making Week 3 Lecture (Seminar 4 - The Nature of Costs)Document51 pagesAccounting For Decision Making Week 3 Lecture (Seminar 4 - The Nature of Costs)nwcbenny337No ratings yet

- ReviewDocument68 pagesReviewHồng Phạm Thị ÁnhNo ratings yet

- (Cpar2017) Mas-8205 (Product Costing) PDFDocument12 pages(Cpar2017) Mas-8205 (Product Costing) PDFSusan Esteban Espartero50% (2)

- Ronald Hilton Chapter 3Document25 pagesRonald Hilton Chapter 3Difen L HaradiniNo ratings yet

- SCM Unit 4 Variable and Absorption CostingDocument9 pagesSCM Unit 4 Variable and Absorption CostingMargie Garcia LausaNo ratings yet

- Mas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsDocument3 pagesMas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsClyde RamosNo ratings yet

- Chap 004Document15 pagesChap 004Ahmad Restu FauziNo ratings yet

- Lecture 2 Cost Terms, Concepts and ClassificationDocument34 pagesLecture 2 Cost Terms, Concepts and ClassificationTgrh TgrhNo ratings yet

- Absorption and Variable Costing: Types of Product Costing MethodDocument2 pagesAbsorption and Variable Costing: Types of Product Costing MethodKuya ANo ratings yet

- Cost Terms, Concepts, and ClassificationDocument27 pagesCost Terms, Concepts, and ClassificationParadise VillageNo ratings yet

- Segment Reporting and Performance EvaluationDocument23 pagesSegment Reporting and Performance EvaluationiqbalrzzNo ratings yet

- Direct Costing2Document11 pagesDirect Costing2Lamtiur LidiaqNo ratings yet

- Chapter 4: Type of Cost: Direct Costs (Prime Costs) Indirect Costs (Overheads)Document8 pagesChapter 4: Type of Cost: Direct Costs (Prime Costs) Indirect Costs (Overheads)Claudia WongNo ratings yet

- Week 2-Basic Cost ManagementDocument21 pagesWeek 2-Basic Cost ManagementRichard Oliver CortezNo ratings yet

- PGP-CMA-Cost Fundamentals PDFDocument53 pagesPGP-CMA-Cost Fundamentals PDFRiturajPaulNo ratings yet

- Topic 6 - Process CostingDocument7 pagesTopic 6 - Process CostingMuhammad Alif100% (1)

- Act 202 Chapter 2Document52 pagesAct 202 Chapter 2Shaon KhanNo ratings yet

- Manufacturing Cost AcctgDocument6 pagesManufacturing Cost AcctgDivine Nicole Sabit AguirreNo ratings yet

- MPA 602: Cost and Managerial Accounting: Cost Accounting Methods - Job Order Costing, ABC, Process CostingDocument81 pagesMPA 602: Cost and Managerial Accounting: Cost Accounting Methods - Job Order Costing, ABC, Process CostingMd. ZakariaNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Chapter 5 - 6 - Inventory Accounting and ValuationDocument61 pagesChapter 5 - 6 - Inventory Accounting and ValuationNaeemullah baig100% (1)

- Larson17ceV1 SM CH04Document153 pagesLarson17ceV1 SM CH04AdedoyinNo ratings yet

- Financial Regulation and Capital Adequacy: Arthur Centonze FIN644 - Slides 6Document45 pagesFinancial Regulation and Capital Adequacy: Arthur Centonze FIN644 - Slides 6Robert LongoNo ratings yet

- Holcim - HDFC SecuritiesDocument7 pagesHolcim - HDFC SecuritiessachinoakNo ratings yet

- Shri Mahila Griha Udyog Lijjat PapadDocument86 pagesShri Mahila Griha Udyog Lijjat PapadpRiNcE DuDhAtRa60% (5)

- SCM Assignment - Mid - Term - JOCKEYDocument13 pagesSCM Assignment - Mid - Term - JOCKEYPOORNENDUKRISHNA RAONo ratings yet

- CRM NotesDocument32 pagesCRM NotesHari KrishnanNo ratings yet

- Entrep12 - Q2 - M6 - 4MS of Production and Business ModelDocument25 pagesEntrep12 - Q2 - M6 - 4MS of Production and Business ModelRose Marie D TupasNo ratings yet

- Blue DartDocument2 pagesBlue DartPushkar AshtekarNo ratings yet

- Economics Question PaperDocument3 pagesEconomics Question Papershehzad MandrawalaNo ratings yet

- Chap 4Document7 pagesChap 4Christine Joy OriginalNo ratings yet

- The Impact of Rebranding On Guest Satisfaction and Financial PerfDocument57 pagesThe Impact of Rebranding On Guest Satisfaction and Financial PerfNguyen VyNo ratings yet

- Mocha Feelings CompanyDocument11 pagesMocha Feelings CompanyTunelyNo ratings yet

- Assignment 3 Wida Widiawati 19AKJ 194020034Document8 pagesAssignment 3 Wida Widiawati 19AKJ 194020034wida widiawatiNo ratings yet

- Glossary of Terms: Acpl A-Ifrs Asic ASX Barrel (Per Barrel) or BBL Biofuels MarketingDocument1 pageGlossary of Terms: Acpl A-Ifrs Asic ASX Barrel (Per Barrel) or BBL Biofuels MarketingDanny DukeranNo ratings yet

- The State of Social Enterprise in Malaysia British Council Low ResDocument114 pagesThe State of Social Enterprise in Malaysia British Council Low ResRichard T. PetersonNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamJollibee JollibeeeNo ratings yet

- Tapal DanedarDocument15 pagesTapal DanedarAli Raza100% (1)

- Company Performance - Comuicare in Afaceri in Limba EnglezaDocument10 pagesCompany Performance - Comuicare in Afaceri in Limba EnglezaMincu IulianNo ratings yet

- Retailer Supplier PartnershipDocument12 pagesRetailer Supplier PartnershipSanjeev Bishnoi100% (1)

- SapolioDocument7 pagesSapolioJuan Diego Vasquez BeraunNo ratings yet

- What Is Your Criteria For Selecting A Brand in Terms of Value and WhyDocument3 pagesWhat Is Your Criteria For Selecting A Brand in Terms of Value and WhyMadan JhaNo ratings yet

- PDF Sales Force Management Leadership Innovation Technology 12Th Edition Mark W Johnston Ebook Full ChapterDocument53 pagesPDF Sales Force Management Leadership Innovation Technology 12Th Edition Mark W Johnston Ebook Full Chaptercharity.robichaux234100% (1)

- Anu Ujin Bat Erdene CV Resume PDFDocument1 pageAnu Ujin Bat Erdene CV Resume PDFAnuUjin BatErdeneNo ratings yet

- DD Termsheet-2Document2 pagesDD Termsheet-2Operation BluepayNo ratings yet