Professional Documents

Culture Documents

1 6948 245269

Uploaded by

Aimen UsmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 6948 245269

Uploaded by

Aimen UsmanCopyright:

Available Formats

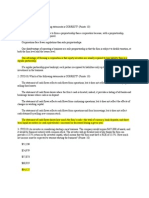

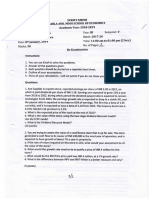

Lahore School of Economics

Adv Corp Finance. Winter 2021. Quiz 1.

Your Name:______________________________________ ID:___________________

Please circle T or F

1. Expected sales for the next year is 100 and net profits are10% of sales. Co gives half of its net profits

as cash dividends. You would conclude that increase in RE would be 5 T

2. TA/Sales ratio is 0.4; Spontaneous CL /Sales ratio is 0.1; NI/sales ratio is 0.05; and dividend payout

ratio is 0.2. Last year’s sales (S0) was 100. You would conclude sustainable growth rate of sales of this

Co is 15.38% T

3. Constant growth rate is another name for sustainable growth rate F

4. Sustainable growth rate of a business is equal to its ROE if its “d” is zero F

5. Net profit Margin on sales, total asset turnover, financial leverage, number of shares outstanding and

spontaneous CL to Sales ratio must be held constant at the level of previous year only then constant

growth rate can be calculated as ROE (1 - d) F

6. Beginning of 2020 RE was 100, during 2020 NI was 40 and company gave cash dividends of 30 to

shareholders. No stock dividends (bonus shares) were given during 2020. You would conclude ending

RE in the balance sheet made on the last day of 2020 was 110 T

7. Beginning of 2020 OE was 100, during 2020 NI was 40. Company issued shares worth 50 during 2020

but repurchased no shares. Co paid cash dividends of 5 during 2020 to its shareholders. You would

conclude Ending OE on the last day of 2020 was 185 T

8. Beginning Inventory in a Co was 100, purchases of inventory during the year were 50 an Ending

Inventory was 130. You would conclude CGS for the year was 20 T

9. TFN (total funds needed) were estimated 10. Net profit for the next year is projected 10 and cash

dividends as 5. Increase in spontaneously CL are expected to be 3 . You would conclude IGF (internally

generated funds) are expected to be 8. You would further conclude that Co would experience EFN

(external funds needed) of 2 T

10. If Co is growing at constant growth rate then it needs no external equity financing by issuing new

shares ; but it may need to take bank loan to raise debt financing. On the other hand when Co is growing

at sustainable growth rate it needs neither external equity financing by issuing new shares nor does it

need external debt financing by taking bank loan T

You might also like

- Handout 2Document2 pagesHandout 2Eric PerryNo ratings yet

- Practice Questions On Financial Planning and Corporate ValuationDocument6 pagesPractice Questions On Financial Planning and Corporate ValuationsimraNo ratings yet

- Chap3 QuizDocument10 pagesChap3 Quizharrisfb100% (2)

- Paper LBODocument2 pagesPaper LBOAljon Del Rosario0% (1)

- AFN ProbDocument3 pagesAFN ProbAli The Banner MakerNo ratings yet

- Lecture 6 & 7Document17 pagesLecture 6 & 7Yumna AzharNo ratings yet

- Merger & Acquisitions AssignmentDocument21 pagesMerger & Acquisitions AssignmentSuraj PrakashNo ratings yet

- Assignment 1Document1 pageAssignment 1Muhammad UmarNo ratings yet

- MT SampleDocument3 pagesMT Samplechingyho100% (1)

- CA FINAL SFM - NOV 2012 Question PAPERDocument8 pagesCA FINAL SFM - NOV 2012 Question PAPERPravinn_MahajanNo ratings yet

- FAUE InterpretationDocument4 pagesFAUE InterpretationAnkit PatidarNo ratings yet

- Wall Street Prep Premium Exam Flashcards QuizletDocument1 pageWall Street Prep Premium Exam Flashcards QuizletRaghadNo ratings yet

- Bilgin Demir: Financial Statement & Security Analysis Case StudyDocument20 pagesBilgin Demir: Financial Statement & Security Analysis Case StudyadiscriNo ratings yet

- 2 Lecture 4 and 5 Contant GDocument21 pages2 Lecture 4 and 5 Contant GNaveed SheikhNo ratings yet

- Exercise Stock ValuationDocument2 pagesExercise Stock ValuationUmair ShekhaniNo ratings yet

- CasesDocument18 pagesCasesparmendra_singh25No ratings yet

- HW2 CF1 Spring 2013Document3 pagesHW2 CF1 Spring 2013impurewolfNo ratings yet

- Fi515 Test 2Document4 pagesFi515 Test 2joannapsmith33No ratings yet

- Free Cash Flow Question No.1: For Exam PreparationDocument16 pagesFree Cash Flow Question No.1: For Exam PreparationNAFEES NASRUDDIN PATELNo ratings yet

- Personal Notes: Business Finance 19-10-2020 Types of Business Categories 1. Sole ProprietorshipDocument18 pagesPersonal Notes: Business Finance 19-10-2020 Types of Business Categories 1. Sole ProprietorshipHijab ZaidiNo ratings yet

- Lbo Model PreparationDocument3 pagesLbo Model PreparationMus Chrifi100% (1)

- AFM Assignment (2019)Document9 pagesAFM Assignment (2019)Videhi BajajNo ratings yet

- Fin515 Week 4 ExamDocument5 pagesFin515 Week 4 ExamNatasha DeclanNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementMiconNo ratings yet

- Final ReportDocument46 pagesFinal ReportAndrew GilmanNo ratings yet

- Weekly Market Commentary 02-14-12Document3 pagesWeekly Market Commentary 02-14-12monarchadvisorygroupNo ratings yet

- Forecasting Financial Statements NotesDocument20 pagesForecasting Financial Statements NotesUzzaam HaiderNo ratings yet

- Financial Analysis Ratio Analysis of The Shifa International HospitalDocument4 pagesFinancial Analysis Ratio Analysis of The Shifa International HospitalNaheed AdeelNo ratings yet

- Finance Pq1Document33 pagesFinance Pq1pakhok3No ratings yet

- BUS 635 Quiz3 Sum15 AnswersDocument5 pagesBUS 635 Quiz3 Sum15 AnswershnoamanNo ratings yet

- 9-Case Study - Financial Forecasts and Crystal Balldoc1outof2Document2 pages9-Case Study - Financial Forecasts and Crystal Balldoc1outof2Sylvain BlanchardNo ratings yet

- Financial Analysis - ITC - AsimBhawsinghka PDFDocument13 pagesFinancial Analysis - ITC - AsimBhawsinghka PDFAsim BhawsinghkaNo ratings yet

- ExplanationDocument4 pagesExplanationKousik GangulyNo ratings yet

- Valuation: Future Growth and Cash FlowsDocument12 pagesValuation: Future Growth and Cash FlowsAnshik BansalNo ratings yet

- Fsa Assignment - Web - MRFDocument31 pagesFsa Assignment - Web - MRFNipu KurupNo ratings yet

- Additional Funds Needed MasDocument22 pagesAdditional Funds Needed MasWilmer Mateo Bernardo100% (1)

- IBF FinalDocument2 pagesIBF FinalRaja UsamaNo ratings yet

- Cffinalb SPR 11Document10 pagesCffinalb SPR 11Arun PrabuNo ratings yet

- Du PontDocument8 pagesDu PontTên Hay ThếNo ratings yet

- Corporate Finance ReExamDocument5 pagesCorporate Finance ReExamNAITIK SHAHNo ratings yet

- Practice Test MidtermDocument6 pagesPractice Test Midtermzm05280No ratings yet

- ExamView - Homework CH 4Document9 pagesExamView - Homework CH 4Brooke LevertonNo ratings yet

- Case No. 1 BWFM5013Document8 pagesCase No. 1 BWFM5013Shashi Kumar NairNo ratings yet

- FIN 370 Final Exam 30 Questions With AnswersDocument11 pagesFIN 370 Final Exam 30 Questions With Answersassignmentsehelp0% (1)

- Jatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghDocument18 pagesJatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghJatin JoharNo ratings yet

- FIN 370 Final Exam - AssignmentDocument11 pagesFIN 370 Final Exam - AssignmentstudentehelpNo ratings yet

- 00-Text-Ch3 Additional Problems UpdatedDocument6 pages00-Text-Ch3 Additional Problems Updatedzombies_meNo ratings yet

- FDGFDSGDFGDocument3 pagesFDGFDSGDFGJesus Colin CampuzanoNo ratings yet

- How To Value Stocks - Part 1Document6 pagesHow To Value Stocks - Part 1vurublog100% (1)

- Accounting Ratio AnalysisDocument5 pagesAccounting Ratio AnalysisSaloni LohiaNo ratings yet

- Cairn India Financial InfoDocument4 pagesCairn India Financial Infohirenchavla93No ratings yet

- ExamDocument2 pagesExamALBERT CRUZNo ratings yet

- Fortnightly: Ipca LabDocument5 pagesFortnightly: Ipca Labbinoy666No ratings yet

- Assignment 7 FinanceDocument3 pagesAssignment 7 FinanceAhmedNo ratings yet

- BV 2019 Revision QuestionsDocument2 pagesBV 2019 Revision QuestionsFadzir AmirNo ratings yet

- Exam Three FIN 4310.004Document4 pagesExam Three FIN 4310.004An KouNo ratings yet

- Santa’s Bringing Closed-End Funds for Christmas: Financial Freedom, #216From EverandSanta’s Bringing Closed-End Funds for Christmas: Financial Freedom, #216No ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet