Professional Documents

Culture Documents

Journal of Economics, Finance and Management Studies

Uploaded by

Danica DiamanteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Journal of Economics, Finance and Management Studies

Uploaded by

Danica DiamanteCopyright:

Available Formats

Journal of Economics, Finance and Management Studies

ISSN (print): 2644-0490, ISSN (online): 2644-0504

Volume 06 Issue 07 July 2023

Article DOI: 10.47191/jefms/v6-i7-32, Impact Factor: 7.144

Page No: 3290-3296

The Influence of Tax Policies on Investment Decisions and

Business Development of Micro, Small, and Medium-Sized

Enterprises (MSMEs) and its Implications for Economic Growth

in Indonesia

Anna Sofia Atichasari1, Asep Marfu2

1

Department of Accounting, Faculty of Economics and Business, Syekh-Yusuf Islamic University, Indonesia

2

Banten General Regional Hospital, Serang, Indonesia

ABSTRACT: This study investigates the relationship between tax policies, investment decisions, business growth, and economic

growth in Micro, Small, and Medium-Sized Enterprises (MSMEs). The purpose is to examine the influence of tax policies on

investment decisions and business development and their implications for economic growth. Using a quantitative strategy based

on a survey research design, data were collected from a sample of MSMEs. The findings indicate that favorable tax policies

positively influence MSMEs' investment decisions and business growth. Policymakers should design tax policies that incentivize

investment and business growth, while MSMEs should strategically leverage favorable tax policies to drive growth and

competitiveness. The study's limitations include its regional focus and reliance on self-reported data. Future research should take

longitudinal studies and contextual factors into account. Overall, the study provides policymakers and MSMEs with insights for

promoting sustainable growth and development in the MSMEs sector, resulting in favorable economic outcomes.

KEYWORDS: Tax policies, investment decisions, business development, economic growth

INTRODUCTION

Any country's principal goal should be to achieve long-term economic growth (Al-Qudah et al., 2022). In Indonesia, the micro,

small, and medium-sized enterprise (MSMEs) sector is critical to generating economic growth, creating job opportunities, and

eliminating economic inequities (Prasetyo, 2020). On the other hand, MSMEs frequently need help developing their operations,

including restricted access to financing, technology, and other resources (Rizos et al., 2016). Tax policy can be a deciding element

in investment decisions and business development in attempts to encourage the growth and sustainability of MSMEs (Islam &

Wahab, 2021). Tax laws that are well-designed and supportive can create incentives for MSMEs to boost their investments in

product development, market expansion, and competitiveness (Hidayati & Rachman, 2021). In contrast, fair and costly tax laws

can stymie MSMEs and reduce their willingness to expand and grow (Werekoh, 2022).

However, research on the impact of tax laws on MSMEs' investment decisions and business development, as well as their

consequences for economic growth, needs to be more extensive in Indonesia. As a result, a better understanding of this

relationship must influence policy revisions that align with Indonesian MSMEs' demands and features (Annisa & Mahendrawathi,

2019). A deeper understanding of how tax policies influence investment decisions and the development of MSMEs in Indonesia is

critical to achieving sustainable and inclusive economic growth (Prasetyo & Kistanti, 2020; Surya et al., 2021; Susan, 2020). This

research will give significant insights to the government, regulators, and other stakeholders in formulating tax policies that assist

MSME growth while driving general economic growth.

Thus, research on the impact of tax policies on MSMEs' investment decisions and business development and their

implications for economic growth will provide a more comprehensive understanding and a solid foundation for developing

sustainable and inclusive MSMEs policies in Indonesia. There needs to be more literature on the impact of tax policies on

investment decisions and company development in Indonesian micro, small, and medium-sized enterprises (MSMEs). There need

to be more thorough studies that precisely explore the relationship between tax policies and their implications for MSMEs' long-

term economic growth. The current research frequently focuses on larger firms or broad tax policies, with little regard for MSMEs'

JEFMS, Volume 06 Issue 07 July 2023 www.ijefm.co.in Page 3290

The Influence of Tax Policies on Investment Decisions and Business Development of Micro, Small, and Medium-

Sized Enterprises (MSMEs) and its Implications for Economic Growth in Indonesia

special issues and features. As a result, there needs to be more study gap in understanding how tax policies may successfully

support the growth and development of MSMEs while contributing to Indonesia's long-term economic growth.

This study seeks to address a research gap by concentrating on the impact of tax laws on investment decisions and business

development of MSMEs in Indonesia and their implications for long-term economic growth. This research will provide insights into

the effectiveness of tax policies in supporting MSME growth and their contribution to the broader economy by examining the

unique demands and problems MSMEs face. The study will also examine specific tax breaks and regulations that apply to MSMEs

and investigate their impact on investment decisions and business development. The research is unique because it focuses on

MSMEs and the Indonesian environment. It gives useful insights for policymakers, regulators, and stakeholders in establishing tax

policies that promote MSME growth and contribute to long-term economic development.

LITERATURE REVIEW

Tax policy can have a large influence on investment decisions (Bialowolski & Weziak-Bialowolska, 2014). Favorable tax laws, such

as tax breaks for capital expenditures, may motivate businesses to invest in productive resources, innovation, and growth (Zahra

& Wright, 2016). These measures minimize the tax burden while increasing after-tax gains on investing, making it more appealing

(Evers et al., 2015). Unfavorable tax policies, on the other hand, such as high tax rates or complicated requirements for compliance,

may prevent enterprises from making major investments (Lawless, 2013). In turn, investment decisions generate economic growth

by increasing capital accumulation, enhancing productivity, and expanding economic activity (Chijioke & Amadi, 2019). Business

development is critical to driving economic prosperity (Ribeiro-Soriano, 2017). Businesses that expand create jobs raise income

levels, and contribute to an economy's output of products and services (Chen et al., 2021). Shahbaz et al. (2016) assess that

business development increased consumption, investment, and exports result from business expansion, which are important

economic growth drivers. Furthermore, company development promotes innovation, technology adoption, and knowledge

transfer, which are critical for long-term economic success. Tax policies directly impact economic growth by influencing investment

decisions and business development (Kim et al., 2022; Mdanat et al., 2018; Vedia-Jerez & Chasco, 2016). Favorable tax laws can

boost investment, entrepreneurship, and innovation, increasing corporate activity and economic expansion (Zahra & Wright,

2016). In addition, Mazzola (2021) assert that tax policies help to job creation, income generation, and overall economic growth

by providing incentives for business development. Taxation, investment decisions, business development, and economic growth

are all intertwined. Favorable tax policies that stimulate investment and business development can help to boost economic growth

by promoting investment, increasing productivity, generating job opportunities, and supporting innovation. Policymakers must

devise tax policies that balance generating revenue and encouraging investment and business development, ensuring long-term

economic growth and prosperity (Raihan et al., 2022). Based on the previous description, the hypotheses proposed for this study

are as follows:

H1: A significant relationship between tax policies and investment decisions in MSMEs.

H2: A significant relationship between tax policies and business development in MSMEs.

H3: A significant relationship exists between tax policies and economic growth in MSMEs.

H4: A significant relationship exists between investment decisions and economic growth in MSMEs.

H5: A significant relationship exists between business development and economic growth in MSMEs.

H6: Investment decisions mediate the relationship between tax policies and economic growth in MSMEs.

H7: Business development mediates the relationship between tax policies and economic growth in MSMEs.

METHODOLOGY

This study will use the quantitative approach, employing a survey research design. Data will be gathered using questionnaires from

respondents representing Tangerang City's micro, small, and medium-sized enterprises (MSMEs). The questionnaire will be created

with variables such as tax policy, investment decisions, business development, and economic growth in mind. The questionnaire

will be structured to assess respondents' perceptions of these variables on a Likert scale of 1 to 7. The research sample will be

chosen with care, considering differences in MSMEs' size and performance levels. Data will be gathered by email and WhatsApp

and analyzed using descriptive statistics and path analysis. The research findings will contribute to a better understanding of the

relationship between tax policies, investment decisions, business development, and economic growth in Indonesian MSMEs.

Furthermore, the research can help to build long-term policies and corporate practices in the sector.

JEFMS, Volume 06 Issue 07 July 2023 www.ijefm.co.in Page 3291

The Influence of Tax Policies on Investment Decisions and Business Development of Micro, Small, and Medium-

Sized Enterprises (MSMEs) and its Implications for Economic Growth in Indonesia

FINDINGS AND DISCUSSION

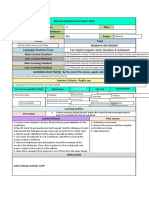

The indicators were evaluated using the convergent approach and external loading factor values. A loading factor of 0.50-0.70 is

deemed suitable for early exploratory research. All indicators in this investigation had loading values more than 0.70, indicating

strong convergent validity. The discriminant validity of each latent factor was assessed by comparing the square root of the average

variance extracted (AVE) with the model's correlation coefficients. This evaluation assesses whether the variables can differ across

various groups. The findings supported discriminant validity. In the last step, composite reliability was also tested to ascertain the

dependability of the variable indicators. The results were judged reliable when both the composite reliability and Cronbach's alpha

were more than 0.70. Composite reliability assesses the dependability of the variable indicators. The indicators were determined

to be reliable in this investigation since both composite reliability and Cronbach's alpha exceeded the 0.70 criterion. According to

the findings refers in Table 1, the indicators utilized in the study had good convergent validity, discriminant validity, and reliability.

These findings confirm the measurement model's robustness and validity in the investigation (Chin, 2010).

Table 1. Explanatory data result

Construct Items Outer Cronbach's rho_A CR AVE

Loading Alpha

Tax Policies TXPOL1=High tax rates are imposed on 0.945 0.943 0.955 0.963 0.897

enterprises

TXPO2=Government-provided tax incentives 0.968

encourage business development

TXPO3=The tax compliance requirements 0.927

imposed on businesses are onerous and intricate

Investment INDEC1=Our company has allocated substantial 0.875 0.728 0.726 0.848 0.652

Decisions capital expenditure funds

INDEC2=We have made significant investments in 0.828

research and development

INDEC3=Our company has invested in the 0.711

expansion into new markets

Business BUSDV1=Our company has broadened its 0.823 0.788 0.868 0.859 0.671

Development product or service offerings

BUSDV2=We continually seek new market entry 0.805

and market presence opportunities

BUSDV3=Customer acquisition and retention are 0.829

critical considerations for our company

Economic ECGRW1=Our company's revenue has increased 0.926 0.888 0.89 0.931 0.82

Growth significantly

ECGRW2=We have generated a significant 0.831

number of employments within our company

ECGRW3=Our company has maintained constant 0.955

profitability

JEFMS, Volume 06 Issue 07 July 2023 www.ijefm.co.in Page 3292

The Influence of Tax Policies on Investment Decisions and Business Development of Micro, Small, and Medium-

Sized Enterprises (MSMEs) and its Implications for Economic Growth in Indonesia

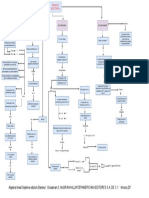

Figure 1. Path Analysis

Hypothesis testing results show that tax policies have a significant and beneficial influence on investment decisions (t=3.170>1.96),

business development (t=5.302>1.96), and economic growth (t=2.369>1.96). In addition, investment decisions (t=4.123>1.96) and

business development (t=6.105>1.96) impact positively on economic growth. Furthermore, investment decisions (t=2.248>1.96)

and business development (t=4.930>1.96) mediates the link between tax policies and economic growth. As a result of the statistical

analysis, all hypotheses, from H1 to H7, are supported and accepted (see Table 2).

Table 2. Path Coefficient Result

Hypothesis Construct T P Values Result

Statistics

H1 Tax Policies -> Investment Decisions 3.170 0.002 Accepted

H2 Tax Policies -> Business Development 5.302 0.000 Accepted

H3 Tax Policies -> Economic Growth 2.369 0.018 Accepted

H4 Investment Decisions -> Economic Growth 4.123 0.000 Accepted

H5 Business Development -> Economic Growth 6.105 0.000 Accepted

H6 Tax Policies -> Investment Decisions -> Economic Growth 2.248 0.025 Accepted

H7 Tax Policies -> Business Development -> Economic 4.930 0.000 Accepted

Growth

The impact of tax policies on investment decisions is that tax policies have a considerable influence on corporate investment

decisions. Advantageous tax policies, such as the provision of tax incentives or lower tax rates, can encourage businesses to invest

in a variety of activities, such as expanding operations, acquiring new assets, or performing R&D. Favorable tax laws create an

environment that encourages investment and fosters economic growth by lowering the tax burden and raising the possible return

on investment. On the other hand, unfavorable tax policies, such as high tax rates or complicated compliance requirements, deter

enterprises from making major investments. Burdensome tax laws may reduce the potential profitability of investments and

provide disincentives for enterprises to dedicate resources to expansion or innovation. Businesses may be more likely to delay

investments or seek alternative investment possibilities in jurisdictions with more favorable tax policies in such instances. In

general, the effect of tax policy on investment decisions is critical for determining the investment environment. Governments can

impact the level and direction of investment flows by establishing and implementing tax policies that are favorable and conducive

to investment, which in turn contributes to economic growth, job creation, and greater productivity.

JEFMS, Volume 06 Issue 07 July 2023 www.ijefm.co.in Page 3293

The Influence of Tax Policies on Investment Decisions and Business Development of Micro, Small, and Medium-

Sized Enterprises (MSMEs) and its Implications for Economic Growth in Indonesia

The impact of tax policies on business development is that tax policies can substantially impact corporate growth and development.

When tax policies are favorable, such as tax incentives or exemptions, they can provide financial relief to businesses while creating

a favorable atmosphere for their expansion and development. These favorable tax regulations can free up financial resources for

enterprises to invest in R&D, marketing, hiring, and other business development initiatives. In contrast, negative tax policies, such

as high tax rates or onerous compliance requirements, can constrain businesses, reducing their capacity for growth. Too onerous

taxation may drain resources away from business development efforts, limiting a company's ability to thrive. Tax regulations have

an impact on business development that goes beyond financial considerations. Tax policies can also impact the general business

climate, regulatory environment, and market competitiveness. Governments can encourage entrepreneurship, innovation, and

market expansion by enacting tax laws that encourage business development. It, in turn, contributes to employment creation,

higher productivity, and overall economic growth. Policymakers must carefully assess the impact of tax policies on business

development and find a balance between revenue generation and encouraging corporate growth and sustainability. Governments

may create an environment that supports business development, stimulates economic growth, and improves firm competitiveness

in domestic and worldwide markets by establishing and implementing advantageous tax laws.

The effect of tax policies on economic development is that tax policies significantly influence a nation's economic

performance as a whole. Economic growth can be affected both directly and indirectly by fiscal policy. Directly, tax policies affect

government revenue, which can impact public expenditure on infrastructure, education, healthcare, and other sectors vital to

long-term economic growth. Lower tax rates or concessions encourage investor confidence, promote entrepreneurship, and entice

foreign investment, contributing to economic growth. Indirectly, tax policies affect the conduct of individuals and businesses,

impacting economic growth. By favorable tax policies, businesses can be incentivized to invest in R&D, innovation, and expansion,

resulting in increased productivity and competitiveness. In addition, tax policies can influence consumer behavior by affecting

disposable income, purchasing power, and savings rates, impacting consumption patterns and aggregate demand. However, it is

essential to note that the impact of tax policies on economic growth is complex and can vary depending on the particular context

and design of the tax system. Factors such as the aggregate tax burden, tax structure, progressivity, and tax administration efficiency

also play a role in determining the overall impact of tax policies on economic growth. Therefore, policymakers must carefully

consider the design and implementation of tax policies to balance economic growth and revenue generation. Tax policies that

foster investment, innovation, and entrepreneurship while ensuring fairness and efficiency can contribute to the growth and

development of the economy over the long term.

Investment is essential for economic growth and expansion because it fuels economic expansion. The economy benefits

from investment decisions such as designating funds for expenditures on capital, research and development, and business

expansion. It involves raised output and manufacturing, the creation of jobs, generating income, and increasing consumer

expenditure. Investment also encourages innovation, technological advancement, and industry development. Investment's

multiplier effect increases demand, production, and revenue throughout the supply chain. Nonetheless, investment climate,

financing accessibility, regulatory frameworks, and macroeconomic stability can influence the impact of investment decisions on

economic growth. Governments and policymakers play a crucial role in fostering investment through favorable policies, access to

capital, and a stable economic environment. Investment decisions contribute substantially to long-term economic growth and

development.

Investment decisions in MSMEs are important in mediating the relationship between tax policies and economic growth. Tax

policies, whether through incentives or reductions, directly impact the financial resources readily accessible to enterprises.

However, the actual effect on economic growth is mediated by MSMEs' investment decisions. Favorable tax rules enable businesses

to direct resources towards productive activities such as growing their operations or pursuing R&D. These investments boost

productivity and competitiveness, resulting in economic growth. Unfavorable tax policies discourage investment and restrict

economic growth potential. Investment decisions operate as a bridge builder, deciding how tax policies transform into actual

expenditures and their impact on economic growth. When creating tax policies to reward MSMEs and foster economic growth,

policymakers should examine the role of investment decisions.

Business development acts as a bridge in the interaction between tax policy and economic growth in MSMEs. Tax laws

directly impact the financial resources available to enterprises, but MSMEs' business development efforts mediate their impact on

economic growth. Favorable tax rules foster business development by allowing MSMEs to invest in expanding operations,

upgrading products or services, and implementing innovative techniques. These efforts at business development contribute to

higher productivity and competitiveness, which drives economic growth. Unfavorable tax laws, conversely, can stifle business

growth by limiting financial resources and hampering expenditures in innovation and expansion. Business development is a bridge

builder by determining how tax policies translate into substantial business growth, influencing economic growth. When creating

JEFMS, Volume 06 Issue 07 July 2023 www.ijefm.co.in Page 3294

The Influence of Tax Policies on Investment Decisions and Business Development of Micro, Small, and Medium-

Sized Enterprises (MSMEs) and its Implications for Economic Growth in Indonesia

tax policies to incentivize MSMEs and promote general economic growth, policymakers should examine the importance of business

development.

CONCLUSION

The study's findings emphasize the critical significance of tax policy in affecting investment decisions, business development, and

economic growth in the context of MSMEs. According to the findings, favorable tax policies positively impact investment decisions

and healthy development, both of which contribute to economic growth. The importance of providing an appropriate tax

environment that promotes MSMEs' growth and development is highlighted by the mediating role of investment decisions and

company development.

IMPLICATION

The study findings have several consequences for policymakers, SMEs, and other stakeholders. First, policymakers should consider

developing tax policies that give incentives and support for investment and business development, as they are important drivers

of economic growth. Second, MSMEs should be aware of the potential benefits of favorable tax policies and strategically use them

to drive their growth and competitiveness. Finally, other players, such as industry groups and financial institutions, can assist

MSMEs in negotiating tax rules and reaping the greatest benefits.

LIMITATIONS

While this study provided significant insights, numerous limitations should be noted. First, the study focused on the specific

context of MSMEs in a specific region, which may restrict the findings' generalizability. Second, the study relied on self-reported

data, which respondents could bias. Furthermore, the cross-sectional methodology of the study provides a snapshot of the

interactions. However, longitudinal studies may provide a full knowledge of the dynamics between tax policy, investment

decisions, business development, and economic growth.

FUTURE RESEARCH RECOMMENDATIONS

In expanding on the current work, future research can look into the following areas of exploration. To begin, broadening the scope

to encompass a broader range of industries and geographic regions might improve the findings' generalizability. Second,

undertaking long-term studies that examine the influence of tax policies on investment decisions, business development, and

economic growth would provide insight into the long-term implications. Furthermore, investigating the mechanisms and channels

by which tax laws influence investment decisions and business development may provide a better understanding of the underlying

processes. Finally, looking at the influence of other contextual factors, such as regulatory frameworks and access to funding, in

conjunction with tax policies, could provide a more comprehensive picture of the factors influencing MSME growth and economic

development.

REFERENCES

1) Al-Qudah, A. A., Al-Okaily, M., & Alqudah, H. (2022). The relationship between social entrepreneurship and sustainable

development from economic growth perspective: 15 ‘RCEP’countries. Journal of Sustainable Finance & Investment, 12(1),

44–61.

2) Annisa, L. H., & Mahendrawathi, E. R. (2019). Impact of alignment between social media and business processes on SMEs’

business process performance: A conceptual model. Procedia Computer Science, 161, 1106–1113.

3) Bialowolski, P., & Weziak-Bialowolska, D. (2014). External factors affecting investment decisions of companies.

Economics, 8(1), 20140011.

4) Chen, Y., Kumara, E. K., & Sivakumar, V. (2021). Investigation of finance industry on risk awareness model and digital

economic growth. Annals of Operations Research, 1–22.

5) Chijioke, A. K., & Amadi, A. I. (2019). Human capital investment as a catalyst for sustainable economic development in

Nigeria. International Journal of Management Science and Business Administration, 5(5), 13–22.

6) Evers, L., Miller, H., & Spengel, C. (2015). Intellectual property box regimes: effective tax rates and tax policy

considerations. International Tax and Public Finance, 22, 502–530.

7) Hidayati, R., & Rachman, N. M. (2021). Indonesian Government Policy and SMEs business strategy during the Covid-19

pandemic. Niagawan, 10(1), 1–9.

8) Islam, A., & Wahab, S. A. (2021). The intervention of strategic innovation practices in between regulations and sustainable

JEFMS, Volume 06 Issue 07 July 2023 www.ijefm.co.in Page 3295

The Influence of Tax Policies on Investment Decisions and Business Development of Micro, Small, and Medium-

Sized Enterprises (MSMEs) and its Implications for Economic Growth in Indonesia

business growth: a holistic perspective for Malaysian SMEs. World Journal of Entrepreneurship, Management and

Sustainable Development, 17(3), 396–421.

9) Kim, J., McGuire, S., Savoy, S., & Wilson, R. (2022). Expected economic growth and investment in corporate tax planning.

Review of Accounting Studies, 1–34.

10) Lawless, M. (2013). Do complicated tax systems prevent foreign direct investment? Economica, 80(317), 1–22.

11) Mazzola, S. X. R. (2021). The Role of Tax Incentives on Business Location and Economic Growth.

12) Mdanat, M. F., Shotar, M., Samawi, G., Mulot, J., Arabiyat, T. S., & Alzyadat, M. A. (2018). Tax structure and economic

growth in Jordan, 1980-2015. EuroMed Journal of Business, 13(1), 102–127.

13) Prasetyo, P. E. (2020). The role of government expenditure and investment for MSME growth: Empirical study in

Indonesia. The Journal of Asian Finance, Economics and Business (JAFEB), 7(10), 471–480.

14) Prasetyo, P. E., & Kistanti, N. R. (2020). Human capital, institutional economics and entrepreneurship as a driver for quality

& sustainable economic growth. Entrepreneurship and Sustainability Issues, 7(4), 2575.

15) Raihan, A., Muhtasim, D. A., Farhana, S., Pavel, M. I., Faruk, O., Rahman, M., & Mahmood, A. (2022). Nexus between

carbon emissions, economic growth, renewable energy use, urbanization, industrialization, technological innovation, and

forest area towards achieving environmental sustainability in Bangladesh. Energy and Climate Change, 3, 100080.

16) Ribeiro-Soriano, D. (2017). Small business and entrepreneurship: their role in economic and social development. In

Entrepreneurship & Regional Development (Vol. 29, Issues 1–2, pp. 1–3). Taylor & Francis.

17) Rizos, V., Behrens, A., Van der Gaast, W., Hofman, E., Ioannou, A., Kafyeke, T., Flamos, A., Rinaldi, R., Papadelis, S.,

Hirschnitz-Garbers, M., & Topi, C. (2016). Implementation of Circular Economy Business Models by Small and Medium-

Sized Enterprises (SMEs): Barriers and Enablers. In Sustainability (Vol. 8, Issue 11). https://doi.org/10.3390/su8111212

18) Shahbaz, M., Mallick, H., Mahalik, M. K., & Sadorsky, P. (2016). The role of globalization on the recent evolution of energy

demand in India: Implications for sustainable development. Energy Economics, 55, 52–68.

19) Surya, B., Menne, F., Sabhan, H., Suriani, S., Abubakar, H., & Idris, M. (2021). Economic Growth, Increasing Productivity

of SMEs, and Open Innovation. In Journal of Open Innovation: Technology, Market, and Complexity (Vol. 7, Issue 1).

https://doi.org/10.3390/joitmc7010020

20) Susan, M. (2020). Financial literacy and growth of micro, small, and medium enterprises in west java, indonesia. In

Advanced issues in the economics of emerging markets (pp. 39–48). Emerald Publishing Limited.

21) Vedia-Jerez, D. H., & Chasco, C. (2016). Long-run determinants of economic growth in South America. Journal of Applied

Economics, 19(1), 169–192.

22) Werekoh, E. A. (2022). The effects of taxation on economic development: the moderating role of tax compliance among

SMEs.

23) Zahra, S. A., & Wright, M. (2016). Understanding the social role of entrepreneurship. Journal of Management Studies,

53(4), 610–629.

There is an Open Access article, distributed under the term of the Creative Commons

Attribution – Non Commercial 4.0 International (CC BY-NC 4.0

(https://creativecommons.or/licenses/by-nc/4.0/), which permits remixing, adapting and

building upon the work for non-commercial use, provided the original work is properly cited.

JEFMS, Volume 06 Issue 07 July 2023 www.ijefm.co.in Page 3296

You might also like

- The Impact of Government Policies and Small Scale Enterprise Development Activities On Economic Growth Evidence From NigeriaDocument28 pagesThe Impact of Government Policies and Small Scale Enterprise Development Activities On Economic Growth Evidence From NigeriaTemitope AkesireNo ratings yet

- PPP Proceding ScopusDocument6 pagesPPP Proceding ScopusadindanellaNo ratings yet

- The Effect of Tax Training and Tax UnderDocument12 pagesThe Effect of Tax Training and Tax UnderAlexander Durante IINo ratings yet

- Effect of Fiscal Policy On Growth of Small - Medium Scale Enterprises in NigeriaDocument22 pagesEffect of Fiscal Policy On Growth of Small - Medium Scale Enterprises in NigeriaLaura StefaniaNo ratings yet

- Chapter 1 Triple IDocument7 pagesChapter 1 Triple IAaron Alexander Salbino SantosNo ratings yet

- Formal Finance Usage and Innovative Smes: Evidence From Asean CountriesDocument19 pagesFormal Finance Usage and Innovative Smes: Evidence From Asean Countriesmenchong 123No ratings yet

- Tommy RRLDocument16 pagesTommy RRLJam DomingoNo ratings yet

- Assessment of SMESDocument25 pagesAssessment of SMESPelumi AdebayoNo ratings yet

- Does Government Support Policy Moderate The Relationship - GovernmentSupportPolicyforIJBEMSDocument24 pagesDoes Government Support Policy Moderate The Relationship - GovernmentSupportPolicyforIJBEMSMai Thanh NghịNo ratings yet

- Innovation Case StudyDocument7 pagesInnovation Case Studybilhar keruboNo ratings yet

- Research PaperDocument8 pagesResearch PaperGunay ChandawatNo ratings yet

- Concept Paper TRAIN Law FinalDocument4 pagesConcept Paper TRAIN Law FinalRenaliza TalagtagNo ratings yet

- Running Head: Effects of Tax Policies On Smes: January 2022Document11 pagesRunning Head: Effects of Tax Policies On Smes: January 2022georgeNo ratings yet

- Capital Budgeting Analysis in Digital Marketing Activities at Yes Cake & BakeryDocument8 pagesCapital Budgeting Analysis in Digital Marketing Activities at Yes Cake & BakeryTJPRC Publications100% (1)

- 1012 3187 1 PBDocument10 pages1012 3187 1 PBA. Isma NursyamsuNo ratings yet

- The Determinants of Micro, Small and Medium Enterpeises (Msmes) Financial Performance: A Literature ReviewDocument5 pagesThe Determinants of Micro, Small and Medium Enterpeises (Msmes) Financial Performance: A Literature ReviewMarie Irish HuligangaNo ratings yet

- Micro, Small and Medium Enterprises Survey in Nigeria by SmedanDocument182 pagesMicro, Small and Medium Enterprises Survey in Nigeria by Smedanleye02100% (2)

- Abdelwahed 2021 E1 RDocument16 pagesAbdelwahed 2021 E1 RUsama SarwarNo ratings yet

- The Impact of Cashless Policy On Small Scale Businesses in Ogoni Land of Rivers State, NigeriaDocument6 pagesThe Impact of Cashless Policy On Small Scale Businesses in Ogoni Land of Rivers State, NigeriaIOSRjournalNo ratings yet

- The Influence of Financial Literacy On Smes Performance Through Access 1528 2635 24-5-595Document17 pagesThe Influence of Financial Literacy On Smes Performance Through Access 1528 2635 24-5-595rexNo ratings yet

- Determinants of Investment Intention in Micro and Small - Etc EthiopiaDocument11 pagesDeterminants of Investment Intention in Micro and Small - Etc EthiopiaEko GaniartoNo ratings yet

- The Impact of Financing On The Growth ofDocument15 pagesThe Impact of Financing On The Growth ofAshimolowo BabatundeNo ratings yet

- Abstract 3Document2 pagesAbstract 3Surajit RoyNo ratings yet

- Taxes ProjectDocument56 pagesTaxes ProjectMikel KingNo ratings yet

- (EJAVEC) Modelling Micro Enterprises' Behavioral Intention To Adopt Integrated Islamic Crowdfunding-Micro Enterprise (IICME) Model As A Source of Financing in East Java, IndDocument20 pages(EJAVEC) Modelling Micro Enterprises' Behavioral Intention To Adopt Integrated Islamic Crowdfunding-Micro Enterprise (IICME) Model As A Source of Financing in East Java, IndchintiaarchivesNo ratings yet

- 135-Article Text-875-1-10-20220509Document14 pages135-Article Text-875-1-10-20220509Samelyn SabadoNo ratings yet

- Artikel UTSDocument6 pagesArtikel UTSmarinahamapdsd77No ratings yet

- Menike LMCS - 2018 - Effect of Financial Literacy On Firm Performance of Small and Medium Enterprises in Sri LankaDocument25 pagesMenike LMCS - 2018 - Effect of Financial Literacy On Firm Performance of Small and Medium Enterprises in Sri Lankayuta nakamotoNo ratings yet

- Digital - 121296 D 00939 Praktik Penghindaran AbstrakDocument7 pagesDigital - 121296 D 00939 Praktik Penghindaran AbstrakevelynNo ratings yet

- The Impact of Corporate Governance On Tax Aggressiveness: Evidence On Consumer Goods Sector in IndonesiaDocument18 pagesThe Impact of Corporate Governance On Tax Aggressiveness: Evidence On Consumer Goods Sector in Indonesiaindex PubNo ratings yet

- Research TitlesDocument3 pagesResearch Titleszee abadillaNo ratings yet

- 2237-Article Text-4218-1-10-20210409Document8 pages2237-Article Text-4218-1-10-20210409Diễm Quỳnh NguyễnNo ratings yet

- Document 1Document17 pagesDocument 1Pamela R. ArevaloNo ratings yet

- Journal 5Document8 pagesJournal 5tesoriosachiNo ratings yet

- Project ProposalDocument17 pagesProject ProposalAmit MirjiNo ratings yet

- SSRN Id3697494Document14 pagesSSRN Id3697494Laura StefaniaNo ratings yet

- 925-Article Text-4638-1-10-20220701Document11 pages925-Article Text-4638-1-10-20220701Yobi NagoyaNo ratings yet

- Gla Pro WorkDocument26 pagesGla Pro WorkEric AddoNo ratings yet

- The Influence of Capital Intensity, Sales GrowthDocument11 pagesThe Influence of Capital Intensity, Sales GrowthAmberly QueenNo ratings yet

- Literasi Keuangan Dan Pertumbuhan UMKMDocument11 pagesLiterasi Keuangan Dan Pertumbuhan UMKMghofur maNo ratings yet

- SMEs in GhanaDocument5 pagesSMEs in GhanaOwusuasare ChrispakNo ratings yet

- The Impact of Strategic Planning On Small Business Growth in KosovoDocument7 pagesThe Impact of Strategic Planning On Small Business Growth in KosovoFilipe AmorimNo ratings yet

- Entrepreneur Word FileDocument6 pagesEntrepreneur Word Fileshivamkarir03No ratings yet

- 10556-Article Text-31892-1-10-20210130Document4 pages10556-Article Text-31892-1-10-20210130cabdijibaar barreNo ratings yet

- How Do Trading, Service, and Investment Sector Companies Make Transfer Pricing Decisions?Document12 pagesHow Do Trading, Service, and Investment Sector Companies Make Transfer Pricing Decisions?Lukmanul HakimNo ratings yet

- 48 (Artikel 5)Document10 pages48 (Artikel 5)Yolan kartikaNo ratings yet

- Strategic Assessment of Indonesian E-Commerce Fashion BusinessDocument35 pagesStrategic Assessment of Indonesian E-Commerce Fashion BusinessfreteerNo ratings yet

- Research PaperDocument22 pagesResearch PaperNain TechnicalNo ratings yet

- Determinants The of Micro and Small Enterprises Performance in Karat Town, Konso, EthiopaDocument10 pagesDeterminants The of Micro and Small Enterprises Performance in Karat Town, Konso, EthiopaKanbiro OrkaidoNo ratings yet

- Small and Medium EnterprisesDocument6 pagesSmall and Medium EnterprisesSarva ShivaNo ratings yet

- P4: Good Practice Techniques To Monitor The Delivery of Customer Service Against Organizational StandardsDocument11 pagesP4: Good Practice Techniques To Monitor The Delivery of Customer Service Against Organizational StandardsWallaceAceyClarkNo ratings yet

- Peer Reviewed - International Journal Vol-4, Issue-2, 2020 (IJEBAR)Document14 pagesPeer Reviewed - International Journal Vol-4, Issue-2, 2020 (IJEBAR)Nurlita Puji AnggraeniNo ratings yet

- Impact of Tax Policy ChangesDocument19 pagesImpact of Tax Policy Changesadesybatty01No ratings yet

- Monetary Policy Final Manuscript With Author DetailDocument19 pagesMonetary Policy Final Manuscript With Author DetailHufzi KhanNo ratings yet

- Significance of The StudyDocument2 pagesSignificance of The Studymamamo ghorlNo ratings yet

- 468-Article Text-539-1-10-20231216Document12 pages468-Article Text-539-1-10-20231216nhuphan31221021135No ratings yet

- The Relevance of Working Capital, Financial Literacy and Financial Inclusion On Financial Performance and Sustainability of Micro, Small and Medium-Sized Enterprises (MSMEs)Document14 pagesThe Relevance of Working Capital, Financial Literacy and Financial Inclusion On Financial Performance and Sustainability of Micro, Small and Medium-Sized Enterprises (MSMEs)AJHSSR JournalNo ratings yet

- Mnyazi Lydiaand Makhamara Felistus PublicationDocument19 pagesMnyazi Lydiaand Makhamara Felistus PublicationAnıl ÖztürkNo ratings yet

- Research Title: Challengs and Prospects of Private Business Investment (In Case of Arbaminch Town)Document5 pagesResearch Title: Challengs and Prospects of Private Business Investment (In Case of Arbaminch Town)Mebratu MazeNo ratings yet

- CHP 11: Setting Goals and Managing The Sales Force's PerformanceDocument2 pagesCHP 11: Setting Goals and Managing The Sales Force's PerformanceHEM BANSALNo ratings yet

- Temple ManualDocument21 pagesTemple Manualapi-298785516No ratings yet

- Nota 4to Parcial ADocument8 pagesNota 4to Parcial AJenni Andrino VeNo ratings yet

- BIM 360-Training Manual - MEP ConsultantDocument23 pagesBIM 360-Training Manual - MEP ConsultantAakaara 3DNo ratings yet

- 211-05 Steering Column SwitchesDocument13 pages211-05 Steering Column SwitchesMiguel AngelNo ratings yet

- Why Should I Hire You - Interview QuestionsDocument12 pagesWhy Should I Hire You - Interview QuestionsMadhu Mahesh Raj100% (1)

- Manuel Vs AlfecheDocument2 pagesManuel Vs AlfecheGrace0% (1)

- Fire Safety Management - Traditional Building Part#2Document194 pagesFire Safety Management - Traditional Building Part#2Yoyon Haryono100% (1)

- Windows Kernel Exploitation Tutorial Part 5: NULL Pointer DereferenceDocument7 pagesWindows Kernel Exploitation Tutorial Part 5: NULL Pointer DereferenceRonaldMartinezNo ratings yet

- MTE Radionuclear THYROID FK UnandDocument44 pagesMTE Radionuclear THYROID FK UnandAmriyani OFFICIALNo ratings yet

- All-India rWnMYexDocument89 pagesAll-India rWnMYexketan kanameNo ratings yet

- Tropical Design Reviewer (With Answers)Document2 pagesTropical Design Reviewer (With Answers)Sheena Lou Sangalang100% (4)

- Reflexive PronounsDocument2 pagesReflexive Pronounsquely8343% (7)

- United States Court of Appeals Fifth CircuitDocument4 pagesUnited States Court of Appeals Fifth CircuitScribd Government DocsNo ratings yet

- FINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedDocument7 pagesFINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedYou VeeNo ratings yet

- ACA 122-My Academic Plan (MAP) Assignment: InstructionsDocument5 pagesACA 122-My Academic Plan (MAP) Assignment: Instructionsapi-557842510No ratings yet

- Summer Anniversary: by Chas AdlardDocument3 pagesSummer Anniversary: by Chas AdlardAntonette LavisoresNo ratings yet

- Waa Sik Arene & Few Feast Wis (FHT CHT Ste1) - Tifa AieaDocument62 pagesWaa Sik Arene & Few Feast Wis (FHT CHT Ste1) - Tifa AieaSrujhana RaoNo ratings yet

- PMP Chapter-12 P. Procurement ManagementDocument30 pagesPMP Chapter-12 P. Procurement Managementashkar299No ratings yet

- RMC No. 23-2007-Government Payments WithholdingDocument7 pagesRMC No. 23-2007-Government Payments WithholdingWizardche_13No ratings yet

- Methods in Enzymology - Recombinant DNADocument565 pagesMethods in Enzymology - Recombinant DNALathifa Aisyah AnisNo ratings yet

- Ppivspiandpi G.R. No. 167715 November 17, 2010 Petitioner Respondents: Pfizer, Inc. and Pfizer (Phil.) Inc., TopicDocument26 pagesPpivspiandpi G.R. No. 167715 November 17, 2010 Petitioner Respondents: Pfizer, Inc. and Pfizer (Phil.) Inc., TopicMc Whin CobainNo ratings yet

- Algebra Lineal Septima Edicion Stanley I. Grossman S. Mcgraw-Hilliinteramericana Editores S.A. de C.V Mexico, DFDocument1 pageAlgebra Lineal Septima Edicion Stanley I. Grossman S. Mcgraw-Hilliinteramericana Editores S.A. de C.V Mexico, DFJOSE JULIAN RAMIREZ ROJASNo ratings yet

- Eva Karene Romero (Auth.) - Film and Democracy in Paraguay-Palgrave Macmillan (2016)Document178 pagesEva Karene Romero (Auth.) - Film and Democracy in Paraguay-Palgrave Macmillan (2016)Gabriel O'HaraNo ratings yet

- 3RD Last RPHDocument5 pages3RD Last RPHAdil Mohamad KadriNo ratings yet

- Financial Accounting Theory Craig Deegan Chapter 7Document9 pagesFinancial Accounting Theory Craig Deegan Chapter 7Sylvia Al-a'maNo ratings yet

- Khenpo Tsultrim Gyamtso Rinpoche - Meditation On EmptinessDocument206 pagesKhenpo Tsultrim Gyamtso Rinpoche - Meditation On Emptinessdorje@blueyonder.co.uk100% (1)

- Tiananmen1989(六四事件)Document55 pagesTiananmen1989(六四事件)qianzhonghua100% (3)

- 215 Final Exam Formula SheetDocument2 pages215 Final Exam Formula SheetH.C. Z.No ratings yet

- Comparative Study of The Prison System in India, UK and USADocument12 pagesComparative Study of The Prison System in India, UK and USAHarneet Kaur100% (1)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)