Professional Documents

Culture Documents

Ass 16

Ass 16

Uploaded by

Manish Mehta (Kapoor)0 ratings0% found this document useful (0 votes)

8 views1 pageMalhotra Associates, a firm located in Delhi, recorded various business transactions in April 2021 including purchases, sales, expenses, and receipts. The transactions involved multiple goods taxable at different GST rates of 12% and 5%. The document provides a detailed listing of the date, transaction details, amounts, supplier/customer names, and payment modes for each transaction recorded by Malhotra Associates for the month.

Original Description:

Original Title

Ass-16

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMalhotra Associates, a firm located in Delhi, recorded various business transactions in April 2021 including purchases, sales, expenses, and receipts. The transactions involved multiple goods taxable at different GST rates of 12% and 5%. The document provides a detailed listing of the date, transaction details, amounts, supplier/customer names, and payment modes for each transaction recorded by Malhotra Associates for the month.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageAss 16

Ass 16

Uploaded by

Manish Mehta (Kapoor)Malhotra Associates, a firm located in Delhi, recorded various business transactions in April 2021 including purchases, sales, expenses, and receipts. The transactions involved multiple goods taxable at different GST rates of 12% and 5%. The document provides a detailed listing of the date, transaction details, amounts, supplier/customer names, and payment modes for each transaction recorded by Malhotra Associates for the month.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

`

Tally Prime with GST

ASSIGNMENT-16

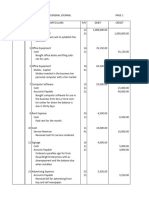

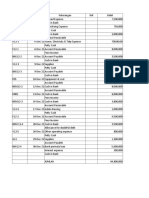

Name MALHOTRA ASSOCIATES

Address C-20, Laxmi Nagar, Delhi-110092

GST no. 07APVKP1451H1Z5

Phone 9876543210

ASS-16 GST-Multiple Rate

Date Transaction Amount Party Name Mode

1.4.21 CAPITAL INTRODUCED 200000

2.4.21 BOUGHT FURNITURE 16000 WOODY CO. DELHI CREDIT

2.4.21 HALF CASH DEPOSITE IN PNB BANK

3.4.21 BOUGHT LAPTOP FOR OFFICE USE 42000 REMO TECH. DELHI CASH

5.4.21 BOUGHT GOODS SUPPLIER A DELHI CREDIT

RAJMA 40

ALMOND 25

UDAD 80

CHHOLE 25

6.4.21 BOUGHT GOODS SUPPLIER B UP CREDIT

MUSTERED 12

OLIVE 18

MOONG 40

6.4.21 PAID SALARY 12000

6.4.21 PAID TELEPHONE BILLS 2000 PNB

8.4.21 PAID ELECTRICITY 1500 CASH

9.4.21 SALE GOODS CUSTOMER A UP CREDIT

ALMOND 18

UDAD 25

OLIVE 15

CASH WITHDRAW FOR PERSONAL USE 6000

15.4.21 SALE GOODS CUSTOMER B DELHI CREDIT

RAJMA 30

MOONG 35

CHHOLE 20

20.4.21 RECEIVED FROM CUSTOMER B 2500 PNB

20.4.21 RECEIVED FROM CUSTOMER A 1500 CASH

20.4.21 PAID TO WOODY CO. 60% PNB

20.4.21 PAID TO SUPPLIER B HALF PNB

21.4.21 PAID TO SUPPLIER A 1/4TH CASH

23.4.21 RECEIVED FROM CUSTOMER B 1500 CASH

Assume GST on goods @12% and 5%

(Fixed Assets is taxable @ 12% GST)

Use Round Off ledger for invoice (if required)

You might also like

- Lloyds Bank StatementDocument2 pagesLloyds Bank StatementWadie NsiriNo ratings yet

- Ralph Kennedy I. Tong Assignment No 5Document2 pagesRalph Kennedy I. Tong Assignment No 5Tong KennedyNo ratings yet

- Mathematics of Finance - Rupinder Sekhon and Roberta BloomDocument45 pagesMathematics of Finance - Rupinder Sekhon and Roberta BloomYeong Zi YingNo ratings yet

- Assignment 1 Compulsory JuneDocument2 pagesAssignment 1 Compulsory JuneJubair Al AmeenNo ratings yet

- Ass 19Document2 pagesAss 19Manish Mehta (Kapoor)No ratings yet

- Ass 22Document1 pageAss 22Manish Mehta (Kapoor)No ratings yet

- Ass 17Document2 pagesAss 17Manish Mehta (Kapoor)No ratings yet

- Ass 20Document1 pageAss 20Manish Mehta (Kapoor)No ratings yet

- Ass 18Document1 pageAss 18Manish Mehta (Kapoor)No ratings yet

- Ass-24 TESTDocument2 pagesAss-24 TESTManish Mehta (Kapoor)No ratings yet

- Ass 13Document1 pageAss 13Manish Mehta (Kapoor)No ratings yet

- Acctg Seatwork 1Document6 pagesAcctg Seatwork 1Janine KateNo ratings yet

- Ralph Kennedy I. Tong Assignment Quiz No 2Document11 pagesRalph Kennedy I. Tong Assignment Quiz No 2Tong KennedyNo ratings yet

- DRAFT 6-3-19 ATM FY20 Booklet Summary 06-18-19Document67 pagesDRAFT 6-3-19 ATM FY20 Booklet Summary 06-18-19Andrew GolasNo ratings yet

- MERCHANDISINGDocument30 pagesMERCHANDISINGJerlyn SaynoNo ratings yet

- CCP102Document15 pagesCCP102api-3849444No ratings yet

- Ledger Creation AssignmentDocument1 pageLedger Creation AssignmentRajeswari SathishkumarNo ratings yet

- Answer Key Activity 39Document15 pagesAnswer Key Activity 39MAXINE CLAIRE CUTINGNo ratings yet

- Lembar Jawaban Tahap 1Document25 pagesLembar Jawaban Tahap 1aida anumNo ratings yet

- Bill To: Ship To:: Terms Due Date Salesperson Customer Contact Contact Phone Contact FaxDocument1 pageBill To: Ship To:: Terms Due Date Salesperson Customer Contact Contact Phone Contact Faxshifanas15No ratings yet

- DK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash BookDocument51 pagesDK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash Bookjigyasu100% (1)

- April Day BookDocument1 pageApril Day Bookvishal kushwahaNo ratings yet

- CusdecPreSAD 5Z3A1900083 PDFDocument4 pagesCusdecPreSAD 5Z3A1900083 PDFKiko KokiNo ratings yet

- Monthly Return For Value Added Tax: Form Vat 200Document17 pagesMonthly Return For Value Added Tax: Form Vat 200Christopher CarrNo ratings yet

- Special JournalDocument38 pagesSpecial JournalSally Ubando Delos Reyes100% (1)

- Week 8 EXAMPLESDocument2 pagesWeek 8 EXAMPLESKaye VillaflorNo ratings yet

- Date Accounts Title and Explanation PR# CR: Boo Goo Kho DecipuloDocument17 pagesDate Accounts Title and Explanation PR# CR: Boo Goo Kho DecipuloJenefer BabantoNo ratings yet

- Bill of Entry / Export A Office of Destination: ProducedDocument6 pagesBill of Entry / Export A Office of Destination: ProducedMd. Jonirul Islam100% (1)

- Ulidsonlen5Document11 pagesUlidsonlen5devora aveNo ratings yet

- Hssreporter Xi Acc Afs Anskey Ramesh VP 2023 March UnofficialDocument5 pagesHssreporter Xi Acc Afs Anskey Ramesh VP 2023 March Unofficialmuhammedmuhtharmuhthar52No ratings yet

- Aqua Post Meridian Company: General Journal Entry For The Year Ended December 31, 2018Document9 pagesAqua Post Meridian Company: General Journal Entry For The Year Ended December 31, 2018grace villamorNo ratings yet

- Subsidiary Books - DPP 03 - (Aarambh 2024)Document3 pagesSubsidiary Books - DPP 03 - (Aarambh 2024)Shubh KhandelwalNo ratings yet

- A EnumerationDocument5 pagesA EnumerationMyrna AlcantaraNo ratings yet

- Accounting For IT Mid-Term ExamDocument2 pagesAccounting For IT Mid-Term ExamCarlo AguilarNo ratings yet

- CusdecFinalSAD TQSB2400004Document5 pagesCusdecFinalSAD TQSB2400004BSCA DepartmentNo ratings yet

- DownloadDocument1 pageDownloadDisebo Mama-DintleNo ratings yet

- Accounting PracticeDocument9 pagesAccounting PracticeWinz QuitasolNo ratings yet

- Balance Sheet ExerciseDocument4 pagesBalance Sheet ExercisevijayjhingaNo ratings yet

- Comp 2 Activity 5Document13 pagesComp 2 Activity 5Jhon Lester MagarsoNo ratings yet

- Practice Problem 7.0Document4 pagesPractice Problem 7.0Paw VerdilloNo ratings yet

- Latihan UjikomDocument3 pagesLatihan UjikomSitaNo ratings yet

- Peter Pan Accounting Firm General JournalDocument7 pagesPeter Pan Accounting Firm General JournalMarites AmorsoloNo ratings yet

- FA ProjectDocument16 pagesFA ProjectMomin AhsanNo ratings yet

- BukuDocument2 pagesBukuSitaNo ratings yet

- Accounting For Warranties and PremiumsDocument8 pagesAccounting For Warranties and Premiumsalcazar rtuNo ratings yet

- Activity 2:: Date Account Titles and Explanation P.R. Debit CreditDocument2 pagesActivity 2:: Date Account Titles and Explanation P.R. Debit Creditemem resuentoNo ratings yet

- Salon CantikDocument22 pagesSalon Cantikfniii ftriaNo ratings yet

- Pre Sad 234059446Document4 pagesPre Sad 234059446BSCA DepartmentNo ratings yet

- Accounting 101Document17 pagesAccounting 101Jenne Santiago BabantoNo ratings yet

- Omar Muhktar Abusama Nov 19Document34 pagesOmar Muhktar Abusama Nov 19Garpt Kudasai100% (1)

- Accountancy DK Goel 2019 For Class 11 Commerce Accountancy Chapter 7 - LedgerDocument74 pagesAccountancy DK Goel 2019 For Class 11 Commerce Accountancy Chapter 7 - LedgerPri296No ratings yet

- RKG Accounts (XI) CH 9 To 16 SolDocument3 pagesRKG Accounts (XI) CH 9 To 16 SolJohn WickNo ratings yet

- SFP ACT 2021 Answer SheetDocument1 pageSFP ACT 2021 Answer SheetmoreNo ratings yet

- Audit of Liabilities Problem No. 1: Auditing ProblemsDocument8 pagesAudit of Liabilities Problem No. 1: Auditing ProblemsSailah DimakutaNo ratings yet

- Date Entry Per Client Correct Entry A. 2020 No Entry (Failed To Record)Document22 pagesDate Entry Per Client Correct Entry A. 2020 No Entry (Failed To Record)Scarlet DragonNo ratings yet

- Sad (1X20) PDFDocument3 pagesSad (1X20) PDFHarrenNo ratings yet

- FOA - General Journal - Discussion - 21 - 03 - 2023 - GENERAL JOURNALDocument1 pageFOA - General Journal - Discussion - 21 - 03 - 2023 - GENERAL JOURNALSteven Lawrence ManiponNo ratings yet

- Daily Report - 2019: Cash: ChequeDocument2 pagesDaily Report - 2019: Cash: ChequemanotgNo ratings yet

- Account Summary: Credit Card NumberDocument6 pagesAccount Summary: Credit Card Numberanilvishaka7621No ratings yet

- Direct Tax Mcq'sDocument44 pagesDirect Tax Mcq'sSuraj PawarNo ratings yet

- Activity 11Document7 pagesActivity 11MaryNo ratings yet

- Letters of CreditDocument1 pageLetters of CreditElaine ChescaNo ratings yet

- MESFINMENAMOFINALPAPERMBA2018Document82 pagesMESFINMENAMOFINALPAPERMBA2018Sew 23No ratings yet

- FD 2Document5 pagesFD 2Nikita Shekhawat100% (1)

- Pine LabsDocument11 pagesPine LabsSandeep NashikarNo ratings yet

- Origin of The Word:: Banca, From Old High German Banc, Bank "Bench, Counter". Benches Were Used As Desks orDocument13 pagesOrigin of The Word:: Banca, From Old High German Banc, Bank "Bench, Counter". Benches Were Used As Desks orJaved KhanNo ratings yet

- 500 BonnieDocument17 pages500 BonnieMurilo Oliveira50% (2)

- Ecash: What Is E-Cash?Document6 pagesEcash: What Is E-Cash?Aarchi MaheshwariNo ratings yet

- Time Value of Money: - Presented byDocument18 pagesTime Value of Money: - Presented byMayuresh GanuNo ratings yet

- Presidential Decree No. 2035Document2 pagesPresidential Decree No. 2035caster troyNo ratings yet

- Topic 2 Interest Rates & The Role of A Central BankDocument26 pagesTopic 2 Interest Rates & The Role of A Central BankSarifah SaidsaripudinNo ratings yet

- AccountStatement 06 NOV 2023 To 06 DEC 2023Document5 pagesAccountStatement 06 NOV 2023 To 06 DEC 2023thejakickNo ratings yet

- MCB Can Be Divided Into Three Phases: University of Central PunjabDocument39 pagesMCB Can Be Divided Into Three Phases: University of Central PunjabAhmed RiiazNo ratings yet

- Ethical Practice in Correspondent BankingDocument35 pagesEthical Practice in Correspondent Bankingmahesh ojhaNo ratings yet

- AP.2904 - Cash and Cash Equivalents - YTDocument3 pagesAP.2904 - Cash and Cash Equivalents - YTRosevilla AbneNo ratings yet

- Internship Report On "General Banking Activities &HR Practices of Southeast Bank Limited, Agargaon Branch"Document46 pagesInternship Report On "General Banking Activities &HR Practices of Southeast Bank Limited, Agargaon Branch"Tasmia MarufaNo ratings yet

- FA2-Pre Exam (R)Document3 pagesFA2-Pre Exam (R)BRos THivNo ratings yet

- Structure and Mechanism of Corporate Governance in The Indian Banking SectorDocument7 pagesStructure and Mechanism of Corporate Governance in The Indian Banking SectorIJAR JOURNALNo ratings yet

- Commercial Banks in India..Document21 pagesCommercial Banks in India..Dakshata GadiyaNo ratings yet

- Circular No 1353 - Accts Dated 03.10.2023 - Eng-1Document5 pagesCircular No 1353 - Accts Dated 03.10.2023 - Eng-1piyush jainNo ratings yet

- A50 6g PDFDocument1 pageA50 6g PDFAashish Kumar VardhaniyaNo ratings yet

- ZVR Iban enDocument2 pagesZVR Iban enLUL MIAUNo ratings yet

- Excel 19Document6 pagesExcel 19debojyotiNo ratings yet

- Hong Kong and Shanghai Banking Corp. LTD., V Commissioner of Internal Revenue PDFDocument8 pagesHong Kong and Shanghai Banking Corp. LTD., V Commissioner of Internal Revenue PDFMykaNo ratings yet

- Welcome To The MachineDocument26 pagesWelcome To The MachineDee RossNo ratings yet

- Nabil Bank Limited: Tribhuvan UniversityDocument7 pagesNabil Bank Limited: Tribhuvan UniversityBijaya DhakalNo ratings yet

- Research Nepal BankDocument61 pagesResearch Nepal Bankbadaladhikari12345No ratings yet

- All Banks and Bank Branches in India IFSC Code ListDocument4 pagesAll Banks and Bank Branches in India IFSC Code ListsraguNo ratings yet