Professional Documents

Culture Documents

Ass 18

Uploaded by

Manish Mehta (Kapoor)0 ratings0% found this document useful (0 votes)

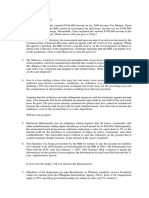

10 views1 pageThe document is a GST transaction log for BEN10 PVT. LTD. for the month of April 2021. It lists various purchase and sale transactions along with other expenses like salary, electricity, and depreciation. Key transactions include purchases of goods from Supplier A, B, and C amounting to over 1 lakh and sales of goods to Customer A and B amounting to over 1 lakh as well. It also records cash withdrawals, bank transfers, and payments. The GST rate on all purchases and sales is assumed to be 28% and all dealers are located in Delhi.

Original Description:

Original Title

Ass-18

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is a GST transaction log for BEN10 PVT. LTD. for the month of April 2021. It lists various purchase and sale transactions along with other expenses like salary, electricity, and depreciation. Key transactions include purchases of goods from Supplier A, B, and C amounting to over 1 lakh and sales of goods to Customer A and B amounting to over 1 lakh as well. It also records cash withdrawals, bank transfers, and payments. The GST rate on all purchases and sales is assumed to be 28% and all dealers are located in Delhi.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageAss 18

Uploaded by

Manish Mehta (Kapoor)The document is a GST transaction log for BEN10 PVT. LTD. for the month of April 2021. It lists various purchase and sale transactions along with other expenses like salary, electricity, and depreciation. Key transactions include purchases of goods from Supplier A, B, and C amounting to over 1 lakh and sales of goods to Customer A and B amounting to over 1 lakh as well. It also records cash withdrawals, bank transfers, and payments. The GST rate on all purchases and sales is assumed to be 28% and all dealers are located in Delhi.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

`

Tally Prime with GST

ASSIGNMENT # 18

Name BEN10 PVT. LTD.

Address H-18 Mayur Vihar Phase-3, Delhi-110096

GST no. 07APVKP1451H1Z5

Phone 9876543210

ASS-18 GST-Multiple Rate

Date Transaction Amount Party Name Mode

1.4.21 CASH INTRODUCED 500000

3.4.21 T/F TO SBI BANK 270000

5.4.21 PURCHASE 31000 LAPTOP DIGITAL PVT. LTD.

6.4.21 PURCHASE 14500 GOODS SUPPLIER A

6.4.21 PURCHASE 18500 FURNITURE WOODEN TRADERS

8.4.21 WITHDRAW FOR PERSONAL 12000 SBI

9.4.21 PURCHASE 7700 GOODS SUPPLIER A

12.4.21 PURCHASE 8900 GOODS SUPPLIER A

15.4.21 PAID TO 26000 SBI DIGITAL PVT. LTD.

15.4.21 PURCHASE 42000 GOODS SUPPLIER B

20.4.21 PURCHASE 30000 GOODS SUPPLIER B

20.4.21 SALE 50000 GOODS CUSTOMER A

20.4.21 SALE 22000 GOODS CUSTOMER A

20.4.21 PURCHASE 8800 GOODS SUPPLIER A

21.4.21 SALE 16800 GOODS CUSTOMER B

23.4.21 WITHDRAW FROM SBI 60000

23.4.21 SALE 25600 GOODS CUSTOMER B

23.4.21 SALE 24000 GOODS CUSTOMER B

26.4.21 SALARY 20000 CHEQUE

26.4.21 PRINTING & STATIONERY 2560 CASH

28.4.21 PAID TO 50000 SBI SUPPLIER B

12.4.21 RECEIVED FROM 75000 SBI CUSTOMER A

13.4.21 ELECTRICTY 1850 CASH

15.4.21 SUNDARY EXPENSE 1200 CASH

16.4.21 RECEIVED FROM FULL SBI CUSTOMER B

20.4.21 DEPRICIATION ON ALL FIXED ASSET @10%

Assume GST rate is 28% on all Sale and Purchase (including purchase of fixed assets)

Assume all dealers are from Delhi

1

You might also like

- Hello, Here's Your: Energy BillDocument4 pagesHello, Here's Your: Energy BillJN Adingra60% (5)

- Projections - Civil Contractor Material SupplierDocument16 pagesProjections - Civil Contractor Material SupplierRahul LipareNo ratings yet

- All Tally TheoryDocument21 pagesAll Tally Theoryvijay024088% (17)

- Day Spa Business PlanDocument33 pagesDay Spa Business Planbrokencyder100% (2)

- Ralph Kennedy I. Tong Assignment Quiz No 2Document11 pagesRalph Kennedy I. Tong Assignment Quiz No 2Tong KennedyNo ratings yet

- Pay Slip Aug 2018Document1 pagePay Slip Aug 2018manionchennaiNo ratings yet

- MISys - Guide - Level 1 ADocument63 pagesMISys - Guide - Level 1 AcaplusincNo ratings yet

- CIR V SONY Case DigestDocument2 pagesCIR V SONY Case DigestAndrea TiuNo ratings yet

- Other Percentage TaxesDocument5 pagesOther Percentage TaxesAlexandra Nicole IsaacNo ratings yet

- Comprehensive Problem For Fundamentals of AccountingDocument19 pagesComprehensive Problem For Fundamentals of Accountingjojie dador100% (3)

- 2011 r083020t Toverengwa Chigweremba's Industrial Attachment ReportDocument93 pages2011 r083020t Toverengwa Chigweremba's Industrial Attachment ReportPaul Chibange69% (26)

- JOURNALIZINGDocument2 pagesJOURNALIZINGArneld SantiagoNo ratings yet

- North Indian Institut-Inv1904549mailDocument1 pageNorth Indian Institut-Inv1904549mailkanwarNo ratings yet

- Teresita Buenaflor Shoes Worksheet 1 RegineDocument24 pagesTeresita Buenaflor Shoes Worksheet 1 RegineBaby Babe100% (1)

- OECD - Building Tax Culture Compliance and CitizenshipDocument150 pagesOECD - Building Tax Culture Compliance and CitizenshipjiaNo ratings yet

- Ass 17Document2 pagesAss 17Manish Mehta (Kapoor)No ratings yet

- Ass 13Document1 pageAss 13Manish Mehta (Kapoor)No ratings yet

- Ass 22Document1 pageAss 22Manish Mehta (Kapoor)No ratings yet

- Ass 19Document2 pagesAss 19Manish Mehta (Kapoor)No ratings yet

- Ass 16Document1 pageAss 16Manish Mehta (Kapoor)No ratings yet

- Ass 20Document1 pageAss 20Manish Mehta (Kapoor)No ratings yet

- A Square Media Hou Se: Thank You For Your Business!Document2 pagesA Square Media Hou Se: Thank You For Your Business!Akshit AroraNo ratings yet

- MERCHANDISINGDocument30 pagesMERCHANDISINGJerlyn SaynoNo ratings yet

- Cashbook Questions For PractiseDocument21 pagesCashbook Questions For Practisedona100% (1)

- Account FINAL Project With FRNT PageDocument25 pagesAccount FINAL Project With FRNT PageMovies downloadNo ratings yet

- Accounting Practice For Cash BookDocument15 pagesAccounting Practice For Cash BookPrakriti Ram100% (1)

- (Please Read This Before Answering The Given Problem) : (I.e. Enriquez/A/Practice Set)Document5 pages(Please Read This Before Answering The Given Problem) : (I.e. Enriquez/A/Practice Set)Felicitte Mae Guico LabarosaNo ratings yet

- A EnumerationDocument5 pagesA EnumerationMyrna AlcantaraNo ratings yet

- Subsidiary Books - DPP 03 - (Aarambh 2024)Document3 pagesSubsidiary Books - DPP 03 - (Aarambh 2024)Shubh KhandelwalNo ratings yet

- Assignment 4 FARDocument24 pagesAssignment 4 FARAlonah Grace LucaserNo ratings yet

- DK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash BookDocument51 pagesDK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash BookjigyasuNo ratings yet

- Accountancy Project LedgerDocument31 pagesAccountancy Project LedgerJeevan BobyNo ratings yet

- Bba Bcom Ll.b-I-Fincncial Accounting CC01Document2 pagesBba Bcom Ll.b-I-Fincncial Accounting CC01vijay.s12usNo ratings yet

- ACCOUNTSDocument9 pagesACCOUNTSrakciyaNo ratings yet

- Acc PrintingDocument26 pagesAcc PrintingLIZ HELENA A/P SUBRAMANIAM MoeNo ratings yet

- Subsidiary Books - DPP 02 - (Aarambh 2024)Document3 pagesSubsidiary Books - DPP 02 - (Aarambh 2024)Shubh KhandelwalNo ratings yet

- Comp BKKPNGDocument4 pagesComp BKKPNGXyron D. HuangNo ratings yet

- Css Accountancy2 2018 PDFDocument2 pagesCss Accountancy2 2018 PDFMaria NazNo ratings yet

- Accounts Class 11 SQPDocument7 pagesAccounts Class 11 SQPDSNo ratings yet

- Assignment 2023 For BPOI-102 (002) (DBPOFA Prog)Document2 pagesAssignment 2023 For BPOI-102 (002) (DBPOFA Prog)Pawar ComputerNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Sunrise Pvt. LTDDocument1 pageSunrise Pvt. LTDYashi GuptaNo ratings yet

- Class 7 On 27.7.18Document22 pagesClass 7 On 27.7.18Akshay SinghNo ratings yet

- Acctg 123 Merchandising Operations WorksheetDocument18 pagesAcctg 123 Merchandising Operations WorksheetCyruz Jared RamosNo ratings yet

- General Journal (June) Date Transactions Account No. DebitDocument34 pagesGeneral Journal (June) Date Transactions Account No. DebitHa TranNo ratings yet

- B.SC & Bca Degree Examination: Fourth SemesterDocument11 pagesB.SC & Bca Degree Examination: Fourth SemesterStudents Xerox ChidambaramNo ratings yet

- Comprehensive Problem For Merchandising OperationsDocument8 pagesComprehensive Problem For Merchandising OperationsSam Rae LimNo ratings yet

- Tally Practical (B) - 1Document3 pagesTally Practical (B) - 1Bhaavya GuptaNo ratings yet

- Journal Part 1Document1 pageJournal Part 1Chaudhry M. BurairNo ratings yet

- Financial Accounting Unit 1Document7 pagesFinancial Accounting Unit 1MOAAZ AHMEDNo ratings yet

- CH 9Document28 pagesCH 9scoutxrdxNo ratings yet

- C ChanalDocument2 pagesC ChanalRj TechNo ratings yet

- Accounting PracticeDocument9 pagesAccounting PracticeWinz QuitasolNo ratings yet

- TallyDocument1 pageTallyIsha PatelNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- Journal-Service Mr. BooDocument4 pagesJournal-Service Mr. BooJasmine ActaNo ratings yet

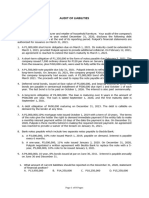

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesMenacexgNo ratings yet

- ZR Ics Oray WFF 4 o YVGRi 7Document46 pagesZR Ics Oray WFF 4 o YVGRi 7RahulNo ratings yet

- (Module 3) ProblemsDocument17 pages(Module 3) ProblemsArriane Dela CruzNo ratings yet

- Special JournalDocument38 pagesSpecial JournalSally Ubando Delos Reyes100% (1)

- Tutorial AdjustmentDocument13 pagesTutorial AdjustmentnoorhanaNo ratings yet

- Activity 11Document7 pagesActivity 11MaryNo ratings yet

- Accounting For Mgt.Document3 pagesAccounting For Mgt.RNo ratings yet

- Solution Laubausa CateringDocument10 pagesSolution Laubausa CateringMoises Macaranas JrNo ratings yet

- Part and Corporation Formation 1Document17 pagesPart and Corporation Formation 1Maila LoquincioNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- Peta in Fabm Letter D Fixed VersionDocument3 pagesPeta in Fabm Letter D Fixed VersionearldennyvillasisNo ratings yet

- Rights and Remedies of The Government Under The Tax CodeDocument12 pagesRights and Remedies of The Government Under The Tax CodeAnisah AquilaNo ratings yet

- RFP Instructions To BiddersDocument6 pagesRFP Instructions To BiddersPrawin AntonyNo ratings yet

- Advances and Deposits - RMC No 89-12Document8 pagesAdvances and Deposits - RMC No 89-12美流No ratings yet

- Final Thesis of Samrawit Shume After PresentationDocument66 pagesFinal Thesis of Samrawit Shume After Presentationbereket nigussieNo ratings yet

- Folai Bundi 2.technical - Docs PDFDocument540 pagesFolai Bundi 2.technical - Docs PDFnc mathurNo ratings yet

- RMC No. 23-2007-Government Payments WithholdingDocument7 pagesRMC No. 23-2007-Government Payments WithholdingWizardche_13No ratings yet

- Real P & TCCDocument9 pagesReal P & TCCCloieRjNo ratings yet

- IESA FS Report Indian ESDM MarketDocument172 pagesIESA FS Report Indian ESDM MarketVishnu ReddyNo ratings yet

- TAX - LEAD BATCH 3 - Preweek 1 PDFDocument28 pagesTAX - LEAD BATCH 3 - Preweek 1 PDFMay Litt0% (1)

- International Marketing MRM402Document258 pagesInternational Marketing MRM402yared1995203No ratings yet

- NAEG10063768466 InvoiceDocument1 pageNAEG10063768466 InvoiceAlaaNo ratings yet

- Taxes To Be Subsumed Under GSTDocument3 pagesTaxes To Be Subsumed Under GSTShreyaNo ratings yet

- Business Plan Towing CompanyDocument25 pagesBusiness Plan Towing Companymudinda malabiNo ratings yet

- Creation of Purchase Sales Ledger With GST in TallyDocument11 pagesCreation of Purchase Sales Ledger With GST in TallysuhailfaaqirNo ratings yet

- Lembar JawabanDocument26 pagesLembar JawabanFajar SepdiantoNo ratings yet

- ReceiptDocument1 pageReceiptRubi KumariNo ratings yet

- Taxation Law II Prelim Exam 2021Document2 pagesTaxation Law II Prelim Exam 2021Aure ReidNo ratings yet

- Guide+to+Importing+and+Exporting +Breaking+Down+the+BarriersDocument77 pagesGuide+to+Importing+and+Exporting +Breaking+Down+the+BarriersGrand-Master-FlashNo ratings yet

- Julians Park. Rushden, HertfordshireDocument20 pagesJulians Park. Rushden, HertfordshiremicromacromarketNo ratings yet

- Non Refundable VAT On Lease Payments IFRS 16 1664730536Document17 pagesNon Refundable VAT On Lease Payments IFRS 16 1664730536Mohammad Monir uz ZamanNo ratings yet