Professional Documents

Culture Documents

AIT Matrix Expanded Withholding Tax

Uploaded by

Sherleen Gallardo0 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageAIT Matrix Expanded Withholding Tax

Uploaded by

Sherleen GallardoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

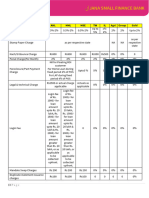

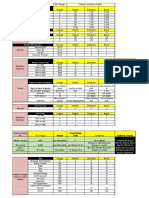

ASIAN INSTITUTE OF TAXATION

EXPANDED WITHHOLDING TAX (CREDITABLE)

RR2-98 RR14-02 RR17-03 RR30-03 RR 8-05 RR2-09 RR6-09 RR10-09 RR 14-12 RR10-13 RR11-14 Current

Jan '98 Oct '02 Jun '03 Jan '04 Feb '05 Feb '09 Jun '09 Dec '09 Nov 7 '12 1-Jun-13 Dec5 '14

A Professional fees, talent fees, etc for services rendered by individuals 10% 10/15% 10/15%

Real Estate Service Practitioners who passed PRC licensure 10/15% 10/15%

B Professional fees, talent fees, etc for services rendered by juridical persons 5% 10/15% 10/15%

C Rentals

Real Property 5% 5% 5%

Personal Property (P10,000 threshold) 5% 5% 5%

D Cinematographic film rentals and other payments 5% 5%

E Income payments to certain Contractors 1% 2% 2% 2% 2%

F Income Distribution to the Beneficiaries 15% 15%

G Income payments to Brokers and agents of professional entertainers 5% 10% 10% 10%

Real Estate Service Practitioners who did not pass PRC licensure 10% 10

H Income payments to Partners of General Professional Partnership 10% 10/15% 10/15%

I Professional Fees paid to Medical Practitioners 10% 10% 10% 10/15% 10/15%

J Sale, exchange or transfer of real property other than capital assets

Exempt under SEC 2.57.5 of RR2-98 Exempt Exempt

Gross Selling Price of P500,000 or less 1.5% 1.5%

Gross Selling Price of more than P500,000 but not more than P2M 3% 3%

Gross Selling Price of more than P2M 5% 5%

Gross Selling Price of not habitually engaged in real estate business 6% 6%

K Additional income payments to government personnel from importers,

shipping and airline companies, or their agents 15% 15%

L Certain income payments made by Credit Card Companies 0.5% 0.50%

M Income payments made by the top 5,000 corps (now top 20,000 corps RR 14-08)

to local supplier of goods 1% 1%

to local suppliers of services 2% 2%

N Income payments by government

to local supplier of goods 1% 2% 2% 1% 1%

to local supplier of services 2% 2% 2%

O Commissions of exclusive distributor, medical/technical/sales reps/agents of

multi-level marketing companies 10% 10% 10%

P Tolling fees paid to refineries 5% 5%

Q Payments made by pre-need companies to funeral parlor 1% 1%

R Payments made to embalmers 1% 1%

S Sale of suppliers of agricultural products (deferred by RR3-04; >300,000 by RR6-09) 1% 1% 1% 1%

T Income payments on purchases of minerals, mineral products/quarry resources 1% 1%

U Meralco Refund : Active contracts/Terminated Contracts 25/32% 25/32%

Meralco Refund on interest on meter deposit: residential/non-residential 10/10% 10/10%

V Meralco interest income on the refund paid: residential/non-residential 10/20% 10/20%

W Income payments made by the top 5,000 individuals

to local supplier of goods 1% 1%

to local suppliers of services 2% 2%

X Income Payment to Political Parties 5% 5%

Y Interest Income derived from any other instruments not within the coverage of deposit substitute 20% 20%

Z Income payments to Real Estate Investment Trust (REIT) 1% 1%

AA Income payments on locally produced raw sugar 1% 1%

Asian Institute of Taxation Updated June 2013 by ECA

You might also like

- Income Payment Subject To Creditable Withholding TaxDocument2 pagesIncome Payment Subject To Creditable Withholding TaxChelsea Anne VidalloNo ratings yet

- Withholding Taxes Learning ObjectivesDocument8 pagesWithholding Taxes Learning ObjectivesAce AlquinNo ratings yet

- Current Botswana Personal Income Tax Calculations (2020)Document4 pagesCurrent Botswana Personal Income Tax Calculations (2020)Eunice AdjeiNo ratings yet

- Financial Model TemplateDocument42 pagesFinancial Model TemplatekissiNo ratings yet

- Fmci Vat RatesDocument19 pagesFmci Vat RatesFahim YusufNo ratings yet

- Withholding TaxDocument20 pagesWithholding TaxAngela CanayaNo ratings yet

- List of Income Payments Subject To EWTDocument4 pagesList of Income Payments Subject To EWTYuri SheenNo ratings yet

- FTX (LSO) Examinable Documents 2019Document2 pagesFTX (LSO) Examinable Documents 2019Mokoena RalesupiNo ratings yet

- Taxation (Botswana) : Tuesday 12 June 2012Document11 pagesTaxation (Botswana) : Tuesday 12 June 2012true100% (1)

- Franchise - ModelDocument4 pagesFranchise - ModelLokesh JainNo ratings yet

- W14 Module 12withholding TaxesDocument7 pagesW14 Module 12withholding Taxescamille ducutNo ratings yet

- TY-2015 TY-2016 and TY-2017 13%: Subject: Tax Rates TY-2017 (FY 2016-17)Document1 pageTY-2015 TY-2016 and TY-2017 13%: Subject: Tax Rates TY-2017 (FY 2016-17)m arshadNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- Topic 2 Expanded Withholding TaxesDocument26 pagesTopic 2 Expanded Withholding TaxesTeresa AlbertoNo ratings yet

- Yield/monetary Benefit From Deposit Substitutes Yield/monetary Benefit From Trust Funds and Similar ArrangementsDocument1 pageYield/monetary Benefit From Deposit Substitutes Yield/monetary Benefit From Trust Funds and Similar ArrangementsChimmy ParkNo ratings yet

- Financial Statment Model-CompleteDocument27 pagesFinancial Statment Model-CompleteSalman AhmadNo ratings yet

- Taxation (Botswana) : Thursday 7 June 2018Document12 pagesTaxation (Botswana) : Thursday 7 June 2018gajendra.naiduNo ratings yet

- RateDocument3 pagesRatemikamiiNo ratings yet

- Taxation - Botswana (TX - Bwa) : Applied SkillsDocument20 pagesTaxation - Botswana (TX - Bwa) : Applied Skillsgajendra.naiduNo ratings yet

- WithholdingRatesCards 2022-2023Document17 pagesWithholdingRatesCards 2022-2023ausafhaider5345No ratings yet

- Txbwa 2018 Dec Q PDFDocument19 pagesTxbwa 2018 Dec Q PDFgajendra.naiduNo ratings yet

- Regular Business/Corporate Tax: DC RFC NRFCDocument2 pagesRegular Business/Corporate Tax: DC RFC NRFCGrace Angelie C. Asio-SalihNo ratings yet

- f6chn 2018 Jun QDocument11 pagesf6chn 2018 Jun QALEX TRANNo ratings yet

- Revised TDS TCS Rate ChartDocument3 pagesRevised TDS TCS Rate ChartMandar KadamNo ratings yet

- Summary of Final Tax Under The Nirc, As Amended Individual Citizen AlienDocument16 pagesSummary of Final Tax Under The Nirc, As Amended Individual Citizen AlienXiaoyu KensameNo ratings yet

- Table of Creditable Withholding Tax RatesDocument4 pagesTable of Creditable Withholding Tax RatesZandra Mari Dela PenaNo ratings yet

- Commission Structure - May 2019Document16 pagesCommission Structure - May 2019Sabuj MollaNo ratings yet

- Name: Ray Adrian P. Ditona Subject: Taxation 1Document1 pageName: Ray Adrian P. Ditona Subject: Taxation 1Ray Adrian P. DitonaNo ratings yet

- Sierra Leone Fiscal Guide 2020 PDFDocument10 pagesSierra Leone Fiscal Guide 2020 PDFMAlek AMARANo ratings yet

- Ghana Fiscal Guide 2015 2016Document10 pagesGhana Fiscal Guide 2015 2016batuchemNo ratings yet

- Final TDS and Tax ExemptionsDocument4 pagesFinal TDS and Tax Exemptionsdpak bhusalNo ratings yet

- Survey of Metro Manila RPT RatesDocument6 pagesSurvey of Metro Manila RPT RatesMarcus DoroteoNo ratings yet

- Set Up A Car Showroom: Requirements Estimate of BusinessDocument4 pagesSet Up A Car Showroom: Requirements Estimate of Businessraviharsha19884495No ratings yet

- WHT-Card - (TY 2024)Document1 pageWHT-Card - (TY 2024)yahya zafarNo ratings yet

- Budget Synopsis Fy 2078-79 - TDSDocument1 pageBudget Synopsis Fy 2078-79 - TDSSahu BhaiNo ratings yet

- WHT Tax Card - 2024Document1 pageWHT Tax Card - 2024shahid100% (1)

- Passive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCDocument10 pagesPassive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCBARBEKS 202021No ratings yet

- Tax Rates For Individuals: Fast Moving Consumer GoodsDocument1 pageTax Rates For Individuals: Fast Moving Consumer GoodsHakim JanNo ratings yet

- Income Taxation PDFDocument103 pagesIncome Taxation PDFjanus lopezNo ratings yet

- Reduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)Document6 pagesReduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)Kranthi Kumar KatamreddyNo ratings yet

- SOC AssetsDocument2 pagesSOC AssetsptsmithrafoundationNo ratings yet

- Taxation: RC NRC RA Nraeb Nraneb SA On Taxable Income On Passive IncomeDocument1 pageTaxation: RC NRC RA Nraeb Nraneb SA On Taxable Income On Passive IncomeCyangenNo ratings yet

- Case StudyDocument17 pagesCase StudyMukesh LakhotiaNo ratings yet

- Town of West Hartford Suspension of Revaluation Phase-In: Robert Sisk June 9, 2009Document7 pagesTown of West Hartford Suspension of Revaluation Phase-In: Robert Sisk June 9, 2009whtalk100% (2)

- F CarsDocument31 pagesF Carsuttam kotwalNo ratings yet

- F6PKN QPDocument14 pagesF6PKN QPمحمد شمائل چیمہNo ratings yet

- Withholding Tax Deduction Chart: Dividend (In Cash or in Specie)Document6 pagesWithholding Tax Deduction Chart: Dividend (In Cash or in Specie)Ahmed BilalNo ratings yet

- Pe-Wallet PDF Magin List PDFDocument1 pagePe-Wallet PDF Magin List PDFSITARAM JAISWAL100% (1)

- Schedules of Alphanumeric Tax CodesDocument2 pagesSchedules of Alphanumeric Tax CodesJon0% (1)

- Merak Fiscal Model Library: Colombia Association (2002)Document2 pagesMerak Fiscal Model Library: Colombia Association (2002)Libya TripoliNo ratings yet

- Final Tax Lecture PDFDocument7 pagesFinal Tax Lecture PDFMarlo Caluya ManuelNo ratings yet

- Set Up A Car Showroom: Requirements Estimate of BusinessDocument4 pagesSet Up A Car Showroom: Requirements Estimate of BusinessAnonymous SQSsuAE3No ratings yet

- Sales Tax WH Rules and RatesDocument4 pagesSales Tax WH Rules and RatesAnushka SNo ratings yet

- Soc CFDDocument6 pagesSoc CFDindbatch2022No ratings yet

- Tax Card For Tax Year 2020Document1 pageTax Card For Tax Year 2020zohaib shahNo ratings yet

- Theories and Concepts: Creditworthiness Rating System: Bureau of Local Government FinanceDocument25 pagesTheories and Concepts: Creditworthiness Rating System: Bureau of Local Government FinanceAttyGalva22No ratings yet

- Value Added Tax Deducted at Source (VDS) Rate For The Financial Year 2019-20Document5 pagesValue Added Tax Deducted at Source (VDS) Rate For The Financial Year 2019-20Asif Assistant ManagerNo ratings yet

- Preliminary FS - SELOG ESTATEDocument20 pagesPreliminary FS - SELOG ESTATEbob.muttaharaNo ratings yet

- Important Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesDocument1 pageImportant Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesDaljeet SinghNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Bigwash - Equipment Price List - 20191028 - NOVEMBER 2019Document2 pagesBigwash - Equipment Price List - 20191028 - NOVEMBER 2019Sherleen GallardoNo ratings yet

- 6 - Intro To Pivot TablesDocument10 pages6 - Intro To Pivot TablesSherleen GallardoNo ratings yet

- 7 - Doing More With Pivot TablesDocument7 pages7 - Doing More With Pivot TablesSherleen GallardoNo ratings yet

- ERC Regulatory Updates Rates & Other Related ECs ConcernDocument12 pagesERC Regulatory Updates Rates & Other Related ECs ConcernSherleen GallardoNo ratings yet

- Rbi A ManualDocument182 pagesRbi A ManualSids ShenviNo ratings yet

- How To Conduct A Financial AuditDocument4 pagesHow To Conduct A Financial AuditSherleen GallardoNo ratings yet

- 3 - ChartsDocument16 pages3 - ChartsSherleen GallardoNo ratings yet

- Model Management Control PolicyDocument1 pageModel Management Control PolicySherleen GallardoNo ratings yet

- Risk Management Cheat Sheet Risk Management Cheat SheetDocument4 pagesRisk Management Cheat Sheet Risk Management Cheat SheetEdithNo ratings yet

- Gross Income: Quit CourseDocument45 pagesGross Income: Quit CourseFranklin Fronek Jr50% (2)

- AS Business Paper October 2019Document4 pagesAS Business Paper October 2019Ved “Veko” KodothNo ratings yet

- Nism X A - Investment Adviser Level 1 - Last Day Revision Test 1 PDFDocument42 pagesNism X A - Investment Adviser Level 1 - Last Day Revision Test 1 PDFavik bose25% (4)

- Pharmacy Management Leadership Marketing and Finance Book Only 2nd Edition Ebook PDFDocument62 pagesPharmacy Management Leadership Marketing and Finance Book Only 2nd Edition Ebook PDFrosanne.hahn846100% (40)

- MGMT2023 Lecture 7 BOND VALUATION - Parts I IIDocument66 pagesMGMT2023 Lecture 7 BOND VALUATION - Parts I IIIsmadth2918388No ratings yet

- HbsDocument45 pagesHbsClaudia Ladolcevita JohnsonNo ratings yet

- Van Attack Kills 13 in Barcelona: at Cisco, A Feud Turns Personal-And CostlyDocument30 pagesVan Attack Kills 13 in Barcelona: at Cisco, A Feud Turns Personal-And CostlystefanoNo ratings yet

- Computerized Accounting SystemsDocument5 pagesComputerized Accounting SystemsRaghu Ck100% (1)

- Heck 1984Document3 pagesHeck 1984Agumasie BantieNo ratings yet

- The Power Tends To Corrupt, Absolute Powers Corrupts AbsolutelyDocument3 pagesThe Power Tends To Corrupt, Absolute Powers Corrupts AbsolutelySuci SabillyNo ratings yet

- Merger Management - 1Document26 pagesMerger Management - 1boka987No ratings yet

- Uppar Ext Solutions PVT LTD: Nevy KukrejaDocument4 pagesUppar Ext Solutions PVT LTD: Nevy KukrejaSanjana GuptaNo ratings yet

- Trading The Elliott Wave Indicator. Winning Strategies For Timing Entry & Exit Moves. R. Prechter. EWI - mp4Document2 pagesTrading The Elliott Wave Indicator. Winning Strategies For Timing Entry & Exit Moves. R. Prechter. EWI - mp4laxmicc33% (3)

- Accounting For Installment SalesDocument16 pagesAccounting For Installment SalesLeimonadeNo ratings yet

- Managerial Accounting Exam 2 With SolutionsDocument13 pagesManagerial Accounting Exam 2 With Solutionskwathom1No ratings yet

- Abm 3 Exam ReviewerDocument7 pagesAbm 3 Exam Reviewerjoshua korylle mahinayNo ratings yet

- Revised Market Making Agreement 31.03Document13 pagesRevised Market Making Agreement 31.03Bhavin SagarNo ratings yet

- New Oltc Enrolment Form: TitleDocument14 pagesNew Oltc Enrolment Form: TitleHari PrasadNo ratings yet

- Fuqua 2014Document248 pagesFuqua 2014Andrew100% (1)

- CHAPTER 26 Statement of Comprehensive Income (Concept Map)Document1 pageCHAPTER 26 Statement of Comprehensive Income (Concept Map)kateyy99100% (1)

- 21 09 21 Tastytrade ResearchDocument5 pages21 09 21 Tastytrade ResearchtrungNo ratings yet

- Sure IpadalaDocument1 pageSure IpadalaChristine LogdatNo ratings yet

- Negotiable Instrument Act 1881Document22 pagesNegotiable Instrument Act 1881Akash saxenaNo ratings yet

- A Study of Credit Analysis in Husky Injection Molding System India Private Limited With Special Focus On Their CustomersDocument54 pagesA Study of Credit Analysis in Husky Injection Molding System India Private Limited With Special Focus On Their CustomersInternational Journal of Innovative Science and Research Technology100% (1)

- HEB LawsuitDocument43 pagesHEB LawsuitMaritza NunezNo ratings yet

- On December 31 2011 Information Inc Completed Its Third YearDocument1 pageOn December 31 2011 Information Inc Completed Its Third YearFreelance WorkerNo ratings yet

- E-Payment Details Report: Rwanda Revenue AuthorityDocument1 pageE-Payment Details Report: Rwanda Revenue AuthorityGilbert KamanziNo ratings yet

- IM Academy WelcomeDocument1 pageIM Academy Welcomepaola perezNo ratings yet

- MFRS108 & MFRS110 - in Class ExerciseDocument2 pagesMFRS108 & MFRS110 - in Class ExerciseRubiatul AdawiyahNo ratings yet