Professional Documents

Culture Documents

Merak Fiscal Model Library for Colombia

Uploaded by

Libya TripoliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Merak Fiscal Model Library for Colombia

Uploaded by

Libya TripoliCopyright:

Available Formats

Merak Fiscal Model Library

A world-class collection of standardized fiscal models

Colombia Association (2002)

Fiscal Term Description

The latest Association Contracts for new fields include sliding scale Royalty, R-Factor Production

Fiscal Regime Type Sharing, Income Tax, and NOC participation.

Governing Legislation Model Association Contract for new fields.

• At declaration of commerciality, Ecopetrol participates with 30% of the development

investment and operational costs.

• Ecopetrol also reimburses the contractor 30% of its prior direct successful exploration costs

NOC Participation (plus inflation) out of 50% its share of production net of royalty for liquid fields (100% for gas

fields). Inflation effect has not been modeled. Ecopetrol reimburse the carried costs to the

Contractor as a Net After Tax payment.

• Ecopetrol participates in operating costs in the same proportion as its share of production

(per R-Factor).

Signature Bonus None.

Fees Various small entered as surface rental and training fees ( $ 40,000 / year ).

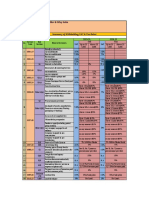

Sliding scale royalty based on the field’s BOE production rate.

Average Daily

Royalty Rate (%)

Production (MBOED)

0–5 8%

8% increasing

5 – 125

linearly to 20%

125 – 400 20%

Royalty 20% increasing

400 – 600

linearly to 25%

> 600 25%

Other rates % of above

1000 feet deep onshore 80%

1000 feet deep offshore 60%

API < 15 75%

Production Sharing, after royalties have been deducted, is 30% for Ecopetrol and 70% for the

contractor, for the first 60 millions cum barrels. When the production exceeds 60 million cum

barrels, the distribution is based on R-Factor (accumulated income/expenses ratio) as follows:

Production Sharing R-Factor Contractor (%) Ecopetrol (%)

< 1.5 70 30

1.5 – 2.5 70 / (R -0.5) 100 - Contractor

> 2.5 35 65

June 2007 Page 1 of 2

Colombia Association (2002)

Fiscal Term Description

Where; R-Factor = Cum Contractor Prod Share Revenue after Royalty (in constant dollars)

Cum Contractor Costs – any carry payback

The factors in the above table are negotiable and ring fenced by contract area.

For Gas only fields after the first 900 giga cubic feet:

R-Factor Contractor (%) Ecopetrol (%)

0 to 2 70 30

2 to 3 70 / (R –1.0) 100 - Contractor

>3 35 65

• Tax rate was originally 35%, going to 38.5% in 2003, and to 36.75% in 2004, 34% in 2007,

and 33% in 2008 an after.

• Municipal tax is a deduction for CIT.

• Depreciation of capital costs to calculate Taxable Income for Income Tax:

o Wells and facilities (drilling & completion, locations and roads, gathering lines, power

lines, power generation, disposal pits, injection facilities, treatment plants, on-shore/off-

shore facilities): 5-year Straight Line

o Pipelines and buildings (transportation pipelines, camps, offices): 7.5% annual. (5%

annual based on 8 hours/day of work. Additional 1.25% per each additional 8 hours work

shift. Thus, for a 24 hours/day operation, 7.5%/year). Modeled as 13-year Straight Line.

Income Tax

o Platforms: costs related to the construction of offshore platforms: 10-year Straight Line

o Successful exploration drilling; costs related to successful exploration efforts: 5-year

Straight Line

o G&A and G&G capital depreciated 5-year Straight Line (Other Cost Group)

o Operating costs are expensed

• Local VAT and 1.2% import duty are considered part of costs.

• For income tax purposes there is no ring fence.

• There is an Income Tax Allowance that is applicable on new investments [Development

Drilling Success and Facilities Capital]. The Income Tax Allowance Rate is set to 30 % before

2007 and 40 % in 2007 and after.

• The current year’s tax liability is paid in two pieces an “advance payment” in the current year

and the balance the following year. The amount of the advance payment depends on the

Income Tax Payment prior two years taxes. When tax liabilities are rising year to year, the advance payment is

75% of the average of the prior two years. When tax liabilities are declining, the advance

payment is 75% of the prior year’s taxes.

Municipal tax Typically 0.4% of the field’s gross revenue after royalty.

• There is also a remittance tax of 7% of repatriated dividends. The withholding tax rate is no

Withholding Tax

longer valid starting in 2007.

Schlumberger Information Solutions

Merak Fiscal Model Library is licensed and supported by Schlumberger Information Solutions (SIS). SIS is an operating unit of Schlumberger that

provides consulting, software, information management and IT infrastructure services to support the core operational processes of the oil and gas

industry. SIS enables oil and gas companies to drive their business performance and realize the potential of the digital oilfield. SIS is on the Internet at

www.sis.slb.com 04-IS-171

June 2007 Page 2 of 2

You might also like

- Building Inspection Service Revenues World Summary: Market Values & Financials by CountryFrom EverandBuilding Inspection Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Merak Fiscal Model Library: Algeria R/T (2005)Document3 pagesMerak Fiscal Model Library: Algeria R/T (2005)Libya TripoliNo ratings yet

- Merak Fiscal Model Library - Cameroon Rente Miniere (1995Document2 pagesMerak Fiscal Model Library - Cameroon Rente Miniere (1995Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Colombia RT 2004 Fiscal RegimeDocument4 pagesMerak Fiscal Model Library: Colombia RT 2004 Fiscal RegimeLibya TripoliNo ratings yet

- Merak Fiscal Model Library: Algeria PSC (2001)Document3 pagesMerak Fiscal Model Library: Algeria PSC (2001)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Libya PSC (2006)Document3 pagesMerak Fiscal Model Library: Libya PSC (2006)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Madagascar PSC (2006)Document2 pagesMerak Fiscal Model Library: Madagascar PSC (2006)Tripoli ManoNo ratings yet

- Petroleum Economics 1Document78 pagesPetroleum Economics 1Eya HentatiNo ratings yet

- Merak Fiscal Model Library: Brunei PSC (2001)Document2 pagesMerak Fiscal Model Library: Brunei PSC (2001)Libya TripoliNo ratings yet

- Chapter 4 CB Problems - IDocument11 pagesChapter 4 CB Problems - IRoy YadavNo ratings yet

- Chapter 4 CB Problems - FDocument11 pagesChapter 4 CB Problems - FAkshat SinghNo ratings yet

- Merak Fiscal Model Library: Cambodia PSC (1996)Document2 pagesMerak Fiscal Model Library: Cambodia PSC (1996)Libya TripoliNo ratings yet

- Standardized Libya PSC Fiscal ModelDocument2 pagesStandardized Libya PSC Fiscal ModelLibya TripoliNo ratings yet

- Merak Fiscal Model Library Namibia R/TDocument2 pagesMerak Fiscal Model Library Namibia R/TTripoli ManoNo ratings yet

- Merak Fiscal Model Library: Trinidad PSC Fiscal TermsDocument6 pagesMerak Fiscal Model Library: Trinidad PSC Fiscal TermsLibya TripoliNo ratings yet

- Peep Training Day 1-3 Fiscal Regime OverviewDocument26 pagesPeep Training Day 1-3 Fiscal Regime Overviewwarrior_2008No ratings yet

- Rooftop PV Financial ModelDocument14 pagesRooftop PV Financial ModelXplore EnggNo ratings yet

- Merak Fiscal Model Library: Bangladesh PSC (1993)Document2 pagesMerak Fiscal Model Library: Bangladesh PSC (1993)Tripoli ManoNo ratings yet

- Merak Fiscal Model Library: Italy R/T (2000)Document2 pagesMerak Fiscal Model Library: Italy R/T (2000)Tripoli ManoNo ratings yet

- Merak Fiscal Model Library: Brunei R/T (2000)Document2 pagesMerak Fiscal Model Library: Brunei R/T (2000)Libya TripoliNo ratings yet

- Maharashtra EB Sale No Yes Mar No: Wind Power Project - Financial StatementDocument5 pagesMaharashtra EB Sale No Yes Mar No: Wind Power Project - Financial Statementaby_000No ratings yet

- Merak Fiscal Model Library: Egypt PSC (1998)Document3 pagesMerak Fiscal Model Library: Egypt PSC (1998)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Trinidad PSC (2005)Document3 pagesMerak Fiscal Model Library: Trinidad PSC (2005)Libya TripoliNo ratings yet

- Withholding VAT & Tax Rates Summary for FY 2019-20 and 2018-19Document3 pagesWithholding VAT & Tax Rates Summary for FY 2019-20 and 2018-19Tanvir TanmoyNo ratings yet

- CERC Tariff Framework 2004 & 2009Document11 pagesCERC Tariff Framework 2004 & 2009Upendra SachanNo ratings yet

- Standardized Peru License Production Fiscal ModelDocument2 pagesStandardized Peru License Production Fiscal ModelLibya TripoliNo ratings yet

- Merak Fiscal Model Library: Bahrain PSC (1998)Document2 pagesMerak Fiscal Model Library: Bahrain PSC (1998)Libya TripoliNo ratings yet

- Capital AllowancesDocument22 pagesCapital AllowancesAmogelangNo ratings yet

- Merak Fiscal Model Library: Azerbaijan PSC ROR (1994)Document2 pagesMerak Fiscal Model Library: Azerbaijan PSC ROR (1994)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Kurdistan PSC (2006)Document2 pagesMerak Fiscal Model Library: Kurdistan PSC (2006)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Congo PSC (1994)Document1 pageMerak Fiscal Model Library: Congo PSC (1994)Tripoli ManoNo ratings yet

- Merak Fiscal Model Library: Thailand R/T (1991)Document3 pagesMerak Fiscal Model Library: Thailand R/T (1991)Libya TripoliNo ratings yet

- Engineering Economics and Project AppraisalDocument29 pagesEngineering Economics and Project AppraisalGOATNo ratings yet

- Details of Rooftop Solar - Dec'20Document3 pagesDetails of Rooftop Solar - Dec'20shahnawaz1709No ratings yet

- Principles of TaxationDocument74 pagesPrinciples of Taxationmutuamutisya306No ratings yet

- ProformaDocument43 pagesProformaSaad Hassan0% (1)

- Chapter 8 ed 18Document27 pagesChapter 8 ed 18Audi WibisonoNo ratings yet

- CGE 660 March - June 2018 ProjectDocument2 pagesCGE 660 March - June 2018 ProjectPejal SahakNo ratings yet

- Victoria Chemicals Merseyside Project Boosts EPSDocument24 pagesVictoria Chemicals Merseyside Project Boosts EPSAde AdeNo ratings yet

- Cost of ProductionDocument27 pagesCost of Productionfaisal197No ratings yet

- Case Apparisal 2Document8 pagesCase Apparisal 2Tharanga RNo ratings yet

- Operational solar plant financial modelDocument81 pagesOperational solar plant financial modelSaurabh SharmaNo ratings yet

- Sterlite Technologies: Ambitious Target To Double Revenues in Three Years!Document8 pagesSterlite Technologies: Ambitious Target To Double Revenues in Three Years!Guarachandar ChandNo ratings yet

- Worldwide Petroleum Fiscal Regimes Development: Observations and TrendsDocument63 pagesWorldwide Petroleum Fiscal Regimes Development: Observations and TrendsBenny Lubiantara100% (7)

- JSERC Tariff Regulations 2010 - Tarun NegiDocument19 pagesJSERC Tariff Regulations 2010 - Tarun NegiManoj UpadhyayNo ratings yet

- Regulation Amendment Notification 15 August 2019Document3 pagesRegulation Amendment Notification 15 August 2019Shiran MahadeoNo ratings yet

- Slow and Stead Group's Investment Plan for Mr. Alok KumarDocument25 pagesSlow and Stead Group's Investment Plan for Mr. Alok KumaralamnurshidNo ratings yet

- Merak Fiscal Model Library: Chile RSC (1996)Document2 pagesMerak Fiscal Model Library: Chile RSC (1996)Libya TripoliNo ratings yet

- Case StudyDocument17 pagesCase StudyMukesh LakhotiaNo ratings yet

- Kso TugasDocument7 pagesKso TugasRahmat Ramadhan RahmatNo ratings yet

- Wind Power Valuation ModelDocument9 pagesWind Power Valuation ModelManoj AswaniNo ratings yet

- Albemarle Benchmark Minerals Presentation Dec. 10 V - ApprovedDocument16 pagesAlbemarle Benchmark Minerals Presentation Dec. 10 V - ApprovedLuis Rolando SirpaNo ratings yet

- Exercises 270919Document3 pagesExercises 270919Kim AnhNo ratings yet

- Fmci Vat RatesDocument19 pagesFmci Vat RatesFahim YusufNo ratings yet

- Acca 08Document11 pagesAcca 08anon-854895No ratings yet

- Micro 4Document33 pagesMicro 4gauravpalgarimapalNo ratings yet

- Chapter 6 Capital AllowanceDocument59 pagesChapter 6 Capital AllowanceKailing KhowNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Orient Electric Report - Aazeb A. ParbataniDocument7 pagesOrient Electric Report - Aazeb A. ParbataniPreet JainNo ratings yet

- Quiz Ing ProcesosDocument4 pagesQuiz Ing Procesos0231810003 ROSAIRA LÒPEZ ROMERO ESTUDIANTE ACTIVONo ratings yet

- Decl Ine Curve Analysis Using Type CurvesDocument28 pagesDecl Ine Curve Analysis Using Type CurvesLibya TripoliNo ratings yet

- Estimating PVT Properties of Crude Oil Systems Based On A Boosted Decision Tree Regression Modelling Scheme With K-Means ClusteringDocument15 pagesEstimating PVT Properties of Crude Oil Systems Based On A Boosted Decision Tree Regression Modelling Scheme With K-Means ClusteringLibya TripoliNo ratings yet

- Merak Fiscal Model Library: Egypt PSC (1998)Document3 pagesMerak Fiscal Model Library: Egypt PSC (1998)Libya TripoliNo ratings yet

- PVTi - Mode حسن قهني lDocument91 pagesPVTi - Mode حسن قهني lLibya TripoliNo ratings yet

- Standardized Libya PSC Fiscal ModelDocument2 pagesStandardized Libya PSC Fiscal ModelLibya TripoliNo ratings yet

- Merak Fiscal Model Library: Bahrain PSC (1998)Document2 pagesMerak Fiscal Model Library: Bahrain PSC (1998)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Egypt PSC (1998)Document3 pagesMerak Fiscal Model Library: Egypt PSC (1998)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: June 2007Document7 pagesMerak Fiscal Model Library: June 2007Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Kurdistan PSC (2006)Document2 pagesMerak Fiscal Model Library: Kurdistan PSC (2006)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Brunei R/T (2000)Document2 pagesMerak Fiscal Model Library: Brunei R/T (2000)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Chad R/T (1999)Document2 pagesMerak Fiscal Model Library: Chad R/T (1999)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Country Regime RegionDocument3 pagesMerak Fiscal Model Library: Country Regime RegionLibya TripoliNo ratings yet

- Merak Fiscal Model Library: Azerbaijan PSC ROR (1994)Document2 pagesMerak Fiscal Model Library: Azerbaijan PSC ROR (1994)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Brunei R/T (2000)Document2 pagesMerak Fiscal Model Library: Brunei R/T (2000)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Cambodia PSC (1996)Document2 pagesMerak Fiscal Model Library: Cambodia PSC (1996)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Cambodia PSC (1996)Document2 pagesMerak Fiscal Model Library: Cambodia PSC (1996)Libya TripoliNo ratings yet

- Merak Dbtools Help: December, 2006Document16 pagesMerak Dbtools Help: December, 2006Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Trinidad PSC (1996)Document3 pagesMerak Fiscal Model Library: Trinidad PSC (1996)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Thailand R/T (1991)Document3 pagesMerak Fiscal Model Library: Thailand R/T (1991)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Chile RSC (1996)Document2 pagesMerak Fiscal Model Library: Chile RSC (1996)Libya TripoliNo ratings yet

- Merak Fiscal Model Library: Trinidad PSC Fiscal TermsDocument6 pagesMerak Fiscal Model Library: Trinidad PSC Fiscal TermsLibya TripoliNo ratings yet

- Merak Fiscal Model Library: Brunei PSC (2001)Document2 pagesMerak Fiscal Model Library: Brunei PSC (2001)Libya TripoliNo ratings yet

- Standardized Peru License Production Fiscal ModelDocument2 pagesStandardized Peru License Production Fiscal ModelLibya TripoliNo ratings yet

- Merak Fiscal Model Library: Trinidad PSC (2005)Document3 pagesMerak Fiscal Model Library: Trinidad PSC (2005)Libya TripoliNo ratings yet

- Merak Fiscal Model Library for ColombiaDocument2 pagesMerak Fiscal Model Library for ColombiaLibya TripoliNo ratings yet

- Merak Fiscal Model Library: Brazil R/T (2004)Document3 pagesMerak Fiscal Model Library: Brazil R/T (2004)Libya TripoliNo ratings yet

- Harman Connected Services Corporation India Private LimitedDocument1 pageHarman Connected Services Corporation India Private LimitedManjunath ReddyNo ratings yet

- 1-27-23 BTF & Buffalo School Fact-Finding ReportDocument22 pages1-27-23 BTF & Buffalo School Fact-Finding ReportWGRZ-TVNo ratings yet

- Income Tax BasicsDocument20 pagesIncome Tax BasicsShivajee SNo ratings yet

- Calculate Proportional Vacation Pay (PVPDocument10 pagesCalculate Proportional Vacation Pay (PVPlevi adunaNo ratings yet

- CSTC College of Sciences Technology and Communication, IncDocument35 pagesCSTC College of Sciences Technology and Communication, IncJohn Patrick MercurioNo ratings yet

- What Is Employee Separation and Its Two Types? Also Explain That What Actions Can Be Taken by An Organization To Fire The Unwanted Staff? Employee SeparationDocument2 pagesWhat Is Employee Separation and Its Two Types? Also Explain That What Actions Can Be Taken by An Organization To Fire The Unwanted Staff? Employee SeparationFakhira ShehzadiNo ratings yet

- Introduction to Taxation and Income Tax PrinciplesDocument11 pagesIntroduction to Taxation and Income Tax Principlesjulius art maputiNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAkhila ChinniNo ratings yet

- The Cry of Balintawak or Pugad LawinDocument6 pagesThe Cry of Balintawak or Pugad LawinMiguel VienesNo ratings yet

- A2 Remittance - Request LetterDocument9 pagesA2 Remittance - Request Letterpkar81No ratings yet

- Consolidated/Classified Abstract Report: (Actuals)Document17 pagesConsolidated/Classified Abstract Report: (Actuals)Ashish Singh NegiNo ratings yet

- Cash Advance Form - NewDocument1 pageCash Advance Form - NewBENAZIR BORRERONo ratings yet

- Bowles Sporting Inc Is Prepared To Report The Following IncomeDocument1 pageBowles Sporting Inc Is Prepared To Report The Following IncomeAmit PandeyNo ratings yet

- Form No. 16 Tax DetailsDocument3 pagesForm No. 16 Tax DetailsYashika ChoudharyNo ratings yet

- Gratuity Trust - BenefitsDocument10 pagesGratuity Trust - BenefitsManoj Kumar KoyalkarNo ratings yet

- EOT MaterialDocument21 pagesEOT Materialpavan bNo ratings yet

- Direct and Indirect Tax CourseDocument10 pagesDirect and Indirect Tax CourseKASHISH GUPTANo ratings yet

- Know Your PensionerDocument1 pageKnow Your Pensioneraparna tiwariNo ratings yet

- ACCT 4410 Taxation Salaries tax (Part II) Key areasDocument40 pagesACCT 4410 Taxation Salaries tax (Part II) Key areasElaine LingxNo ratings yet

- Factors Influencing Job Satisfaction of Bank Employees in NepalDocument18 pagesFactors Influencing Job Satisfaction of Bank Employees in NepalVaibhav SreekumarNo ratings yet

- Tax Laws Direct Tax Suppliment June2023Document77 pagesTax Laws Direct Tax Suppliment June2023Disha GuptaNo ratings yet

- Capex vs Opex ExplainedDocument10 pagesCapex vs Opex ExplainedJannatan Sang AdjiNo ratings yet

- Taxes - Timor Leste Guide (2014)Document72 pagesTaxes - Timor Leste Guide (2014)Luiz EduardoNo ratings yet

- 7 P's of Insurance IndustryDocument13 pages7 P's of Insurance IndustryFazlur RahmanNo ratings yet

- Types of InsuranceDocument47 pagesTypes of InsuranceBRYNA BHAVESH 2011346No ratings yet

- A Project Report HDFC Standard Life InsuDocument68 pagesA Project Report HDFC Standard Life InsuSneha PandeyNo ratings yet

- Print Application FormDocument8 pagesPrint Application FormbonfaceNo ratings yet

- DOPW OM Dated 11.06.2020Document4 pagesDOPW OM Dated 11.06.2020Project Manager IIT Kanpur CPWDNo ratings yet

- Toeic Gold KrubirdDocument206 pagesToeic Gold KrubirdChayanit100% (1)

- Chapter 1: Introduction To AuditingDocument3 pagesChapter 1: Introduction To AuditingSaroar HossainNo ratings yet