Professional Documents

Culture Documents

IAS 38 Intangibles Summary Final

IAS 38 Intangibles Summary Final

Uploaded by

Saqib IqbalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 38 Intangibles Summary Final

IAS 38 Intangibles Summary Final

Uploaded by

Saqib IqbalCopyright:

Available Formats

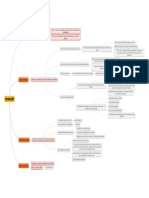

IAS 38 – Intangibles Summary

Prepared by Akash Mukesh Kumar - AMK

❹ Recognition Criteria

IAS 38 Intangibles Summary

❶

The expected inflow of Cost must be

Intangible Future economic benefits And reliably measurable

from the asset must be

probable;

Identifiable Non- Monetary Asset Without Physical ❸

Substance

Two Stages for Capitalization

- A resource

We control the asset controlled by the Research Development

Separable Arises from

entity

Contractual or Legal - As a result of past Treatment

3. Capable of being: If we can

Rights events

Separated - From which an Expense Out

6 Conditions Met “N1”

Restrict access to the

Sold, These rights must be

FEB; and

inflow of Future

considered even if they are: economic benefits Reasons

Transferred,

not transferrable or are expected

licensed or separable Yes

Have the power to No

exchanged from the entity or Research is merely a project to investigate if

from other rights and obtain the FEB. there are possible future economic benefits.

Either

obligations There is therefore no guarantee at this stage Capitalize Expense Out

individually or that the future economic benefits are:

together with 1. Expected (thus the definition is not met);

N1: Conditions for capitalization:

other contract or

4. Regardless of whether The technical feasibility of completing the asset;

the entity intends to do ❷ 2. Probable (thus the recognition criteria

The intention to complete the asset and to either use or

are not met).

so or not. ❺ sell it;

The ability to use or sell the asset;

How the asset will generate future economic benefits,

Internally Generated Items Concept of in-process Research and through, for instance, demonstrating that there is a

market to sell to, or if the asset is to be used internally,

Development Purchased then its usefulness;

The adequate availability of necessary resources

Internally generated Goodwill Internally generated items other than Goodwill (technical, financial or otherwise) to complete the

Initially Subsequently development and to sell or use the asset; and

the ability to reliably measure the cost of the

development of the asset

IA Asset Definition & criteria= Not Met IA Definition and IA Definition and

Measured at fair value (Includes

criteria = met criteria = not met both research and Costs that relate to Costs that relate to

development) research must be

Expense Out expensed

development:

Internally generated Expense

Just For Ratafication:

intangible asset Expense out if 6 Capitalize if 6

conditions are not conditions are met. ❻

If following internally generated met

items appear in paper are never ❼ Amortization Amount to be amortized is = Cost (or fair value) of the asset – Residual value

capitalized (always ignore): The reason that the internal generation of these

items results in them being expensed is because

the nature of the costs incurred in the process Ceases

Goodwill of creating them are very similar to the costs Period

that are related to simply operating a business. Begins At earlier of: Shorter of:

Brands In other words, it is impossible to separate the

The residual value should always be zero unless:

one from the other and reliably measure the When an asset becomes

Mastheads costs to be capitalized. available for use – same

i. De-recognition of the asset i. Economic Life

1. third party has committed to purchasing the asset at the end of its useful life

ii. Re-classification of the asset to ii. Legal Life (unless legal

Publishing Titles On the other hand, had they been purchased, as PPE (IAS 16). the classification of ‘non- rights are renewable & 2. there is an active market (as defined in IRFS 13) for that asset and

there would be a reliable measure – the purchase

Customer List price! current asset held for sale’. evidence suggests renewal it is possible to measure the residual value using such market and

will occur at insignificant it is probable that the market will still exist at the end of the asset’s useful life

Other similar items cost.

You might also like

- ZIPCAR Case AnalysisDocument1 pageZIPCAR Case AnalysisVarun LoyalkaNo ratings yet

- Chart of Accounts For Petroleum Exploration Company - Accounting-Financial-TDocument6 pagesChart of Accounts For Petroleum Exploration Company - Accounting-Financial-TJohnLAsia100% (1)

- Zacks Rank Guide: Harnessing The Power of Earnings Estimate RevisionsDocument25 pagesZacks Rank Guide: Harnessing The Power of Earnings Estimate RevisionsAl AlamNo ratings yet

- Chapter 1 Introduction: Multiple-Choice QuestionsDocument192 pagesChapter 1 Introduction: Multiple-Choice QuestionsSZANo ratings yet

- Case Analysis II - SomPackDocument2 pagesCase Analysis II - SomPackAllan Gunawan0% (1)

- Price Elasticity of DemandDocument23 pagesPrice Elasticity of Demandwikeeshah100% (3)

- Chapter 4 Concept MapDocument1 pageChapter 4 Concept MapClyde SaladagaNo ratings yet

- IntacDocument1 pageIntac2022301307No ratings yet

- Pas 38Document1 pagePas 38Patrick AlcoberNo ratings yet

- Unit 3 - Financial Statements Assets and LiabilitiesDocument4 pagesUnit 3 - Financial Statements Assets and LiabilitiesSean Michael TanChuaNo ratings yet

- PPIRPDocument8 pagesPPIRPShyam Shankar VNo ratings yet

- CH 1 2 Company LawDocument22 pagesCH 1 2 Company Lawrishita mittalNo ratings yet

- AFM Unit 2 (Problems Only)Document17 pagesAFM Unit 2 (Problems Only)Goutham GnNo ratings yet

- Recasting FSDocument1 pageRecasting FSCapung SolehNo ratings yet

- BDC224 FD ADV Financial Statement A4Document1 pageBDC224 FD ADV Financial Statement A4bscjjwNo ratings yet

- Grap 17 (IAS 16) - Layout 1Document1 pageGrap 17 (IAS 16) - Layout 1gvmgNo ratings yet

- All 1Document1 pageAll 1Prashant ThamanNo ratings yet

- PDIC ActDocument41 pagesPDIC ActJornel MandiaNo ratings yet

- Non-Current Assets Current AssetDocument9 pagesNon-Current Assets Current AssetZOZONo ratings yet

- Chapter 1 - Accounting in BusinessDocument1 pageChapter 1 - Accounting in BusinessLê Nguyễn Anh ThưNo ratings yet

- Intangible AssetDocument2 pagesIntangible AssetNath BongalonNo ratings yet

- Income From Business & ProfessionDocument14 pagesIncome From Business & ProfessionSneha PotekarNo ratings yet

- Reading 23 - Long-Lived AssetsDocument7 pagesReading 23 - Long-Lived AssetsLuis Henrique N. SpínolaNo ratings yet

- 13 Psu Audit HandwrittenDocument12 pages13 Psu Audit HandwrittenDhanalakshmi BoorlagaddaNo ratings yet

- Assets: Assets Defined Asset RecognitionDocument1 pageAssets: Assets Defined Asset Recognitionnaega nuguNo ratings yet

- Fianace WK 1 PDFDocument7 pagesFianace WK 1 PDFAJ MalakoffNo ratings yet

- Pa 2Document8 pagesPa 2Trần Ngọc NhưNo ratings yet

- Mind Map of Accounting ElementsDocument4 pagesMind Map of Accounting ElementsSapphire Au MartinNo ratings yet

- Organization Level - Internal & External Issues& Requirements of Interested Parties-New 11-11-17Document3 pagesOrganization Level - Internal & External Issues& Requirements of Interested Parties-New 11-11-17Ramdas PaithankarNo ratings yet

- IBC ChartsDocument16 pagesIBC ChartsSouravNo ratings yet

- InventoryControl ForecastingDocument7 pagesInventoryControl ForecastingME20BTECH11058No ratings yet

- Audit of CFS Mind MapDocument1 pageAudit of CFS Mind Mapgovarthan1976No ratings yet

- General Workflow Inside YardDocument1 pageGeneral Workflow Inside YardKenginNo ratings yet

- Cfa TopicsDocument1 pageCfa Topicshanzenda2511No ratings yet

- MBP InsuranceDocument22 pagesMBP InsuranceMurtuza SadikotNo ratings yet

- Securities Regulation CodeDocument3 pagesSecurities Regulation CodeDanica ZamoraNo ratings yet

- 2022 Yamana Gold ESTMA ReportDocument5 pages2022 Yamana Gold ESTMA ReportIsabella PinaNo ratings yet

- Insurance Regulations ParaguayDocument1 pageInsurance Regulations ParaguayMaria Esther PadovanNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument15 pagesInvesting and Financing Decisions and The Balance SheetgeorgeredaNo ratings yet

- 06 Intangible AssetsDocument57 pages06 Intangible Assets林義哲No ratings yet

- Financial Accounting & Decision Making NotesDocument27 pagesFinancial Accounting & Decision Making Notessuhanibhatt90No ratings yet

- Fa RevisionDocument25 pagesFa RevisionMohammad Ameen DanishNo ratings yet

- Ifrs 3 Business Combinations: Identifying The AcquirerDocument3 pagesIfrs 3 Business Combinations: Identifying The AcquirerRen NolascoNo ratings yet

- Práticas FinancialDocument22 pagesPráticas FinancialmariamaiafelnerNo ratings yet

- 7 Scramble: Cost of UpgradingDocument4 pages7 Scramble: Cost of UpgradingMubashar HussainNo ratings yet

- Financial Product Prototype: Asset ClassDocument1 pageFinancial Product Prototype: Asset ClassRuwan WijemanneNo ratings yet

- 13 Short Term FinancingDocument3 pages13 Short Term FinancingIrene LimpinNo ratings yet

- OE - ODR - Cat 994 Presentation - 041111Document45 pagesOE - ODR - Cat 994 Presentation - 041111Antony Armando Huaylla Quispe100% (1)

- Flexi Cap Fund - Leaflet 1 0Document2 pagesFlexi Cap Fund - Leaflet 1 0shubhamchavan8411No ratings yet

- Strategic Marketing NoteDocument10 pagesStrategic Marketing Notefaisa.qanitakikaNo ratings yet

- Ias 21Document13 pagesIas 21f9vertexlearningsolutionsNo ratings yet

- Chapter4.3 - NEU 2020 - IFRS. Part 1 - NCADocument18 pagesChapter4.3 - NEU 2020 - IFRS. Part 1 - NCAPhương NhungNo ratings yet

- Classification Of: AuditDocument15 pagesClassification Of: Audit224 G.RiteshNo ratings yet

- (AEco) Cidam Chapter 2Document6 pages(AEco) Cidam Chapter 2angel dinglasaNo ratings yet

- Income Taxation Chapter 9Document11 pagesIncome Taxation Chapter 9Kim Patrice NavarraNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement Analysiswookie monsterrNo ratings yet

- Strategic Planning 6aDocument1 pageStrategic Planning 6aBaher WilliamNo ratings yet

- Topic 2,5,4 - IAS 16,38,40 (28.2.23) .SVDocument15 pagesTopic 2,5,4 - IAS 16,38,40 (28.2.23) .SVanhnguyen.88231020192No ratings yet

- FIN - Chap 3 - Financial Statement, Cash Flows, and TaxesDocument1 pageFIN - Chap 3 - Financial Statement, Cash Flows, and Taxesduyennthds170525No ratings yet

- Ia Vol 3 Valix 2019 SolmanDocument118 pagesIa Vol 3 Valix 2019 SolmanElaiza SanicoNo ratings yet

- AP 9502 - LiabilitiesDocument12 pagesAP 9502 - Liabilitiesrandel10caneteNo ratings yet

- Abusama Impairment of AssetsDocument1 pageAbusama Impairment of AssetsGarp BarrocaNo ratings yet

- Pas 40 Concept MapDocument1 pagePas 40 Concept MapJohn Steve VasalloNo ratings yet

- Cost Recovery: Turning Your Accounts Payable Department into a Profit CenterFrom EverandCost Recovery: Turning Your Accounts Payable Department into a Profit CenterNo ratings yet

- Philippines Land Ownership and AcquisitionDocument5 pagesPhilippines Land Ownership and AcquisitionLRMNo ratings yet

- MMTP Sales Brochure PRINT - 2016 V1 - tcm47-27548Document5 pagesMMTP Sales Brochure PRINT - 2016 V1 - tcm47-27548Vaibhav DeshmukhNo ratings yet

- Profit and Loss AND DISCOUNT 20221123101605Document182 pagesProfit and Loss AND DISCOUNT 20221123101605vaibhav singhNo ratings yet

- Process Costing: © 2016 Pearson Education LTDDocument47 pagesProcess Costing: © 2016 Pearson Education LTDAshish ShresthaNo ratings yet

- Hybrid and Derivative SecuritiesDocument23 pagesHybrid and Derivative SecuritiesMd Rasel Uddin ACMANo ratings yet

- Adapon Ia1 Posttest3 InventoriesDocument8 pagesAdapon Ia1 Posttest3 InventoriesJOSCEL SYJONGTIANNo ratings yet

- Cost Planning: Elektif:BJTC3023 Pengukuran & Taksiran (Measurement & Estimation)Document5 pagesCost Planning: Elektif:BJTC3023 Pengukuran & Taksiran (Measurement & Estimation)880618No ratings yet

- Project MaDocument18 pagesProject MaBhuvneshwari RathoreNo ratings yet

- MasterCard Initiating CoverageDocument13 pagesMasterCard Initiating CoverageNate ENo ratings yet

- Inflation in Theory Practice: George L. Perry Brookings InstitutionDocument53 pagesInflation in Theory Practice: George L. Perry Brookings InstitutionblackmanNo ratings yet

- 51 - Internal Control QuestionnaireDocument13 pages51 - Internal Control QuestionnaireAkhil RokzNo ratings yet

- 3Document10 pages3Cherie DiazNo ratings yet

- Tarraco XCELLENCE First Edition PlusDocument4 pagesTarraco XCELLENCE First Edition Plusmaterials5380100% (1)

- Netflix Case Study AbstractDocument2 pagesNetflix Case Study Abstractmae tuazonNo ratings yet

- Trend AnalysisDocument28 pagesTrend Analysisdiwakar0000000No ratings yet

- 04 Overheads DistributionDocument15 pages04 Overheads DistributionDevesh BahetyNo ratings yet

- 19 - Revaluation and ImpairmentDocument3 pages19 - Revaluation and Impairmentjaymark canayaNo ratings yet

- Formatted IBPS RRB PO Prelims Previous Year Mock 2017 Que.Document20 pagesFormatted IBPS RRB PO Prelims Previous Year Mock 2017 Que.SahithyaNo ratings yet

- The Relationship Between Inflation, Employment and Economic Growth in NigeriaDocument91 pagesThe Relationship Between Inflation, Employment and Economic Growth in NigeriaDaniel ObasiNo ratings yet

- Arbitrage in India: Past, Present and FutureDocument22 pagesArbitrage in India: Past, Present and FuturetushartutuNo ratings yet

- Vail and Ski IndustryDocument7 pagesVail and Ski IndustryChen WenboNo ratings yet

- Decision MakingDocument17 pagesDecision MakingPankaj SahaniNo ratings yet

- II Annex B Form of ContractDocument6 pagesII Annex B Form of ContractSandeep JoshiNo ratings yet

- Bond Valuation 1Document37 pagesBond Valuation 1Nitesh SolankiNo ratings yet

- Unions Da: J /F 2015 D (I)Document8 pagesUnions Da: J /F 2015 D (I)Cedric ZhouNo ratings yet