Professional Documents

Culture Documents

Intangible Asset

Uploaded by

Nath Bongalon0 ratings0% found this document useful (0 votes)

23 views2 pagesThis document defines and discusses intangible assets according to PAS 38. It outlines three key criteria for an intangible asset: identifiability, control, and future economic benefits. It also discusses the initial measurement of intangible assets at cost, and the two conditions for recognition: it is probable future economic benefits will flow to the entity, and cost can be reliably measured. Judgment is exercised in assessing the certainty of future benefits based on external evidence.

Original Description:

Original Title

INTANGIBLE ASSET

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines and discusses intangible assets according to PAS 38. It outlines three key criteria for an intangible asset: identifiability, control, and future economic benefits. It also discusses the initial measurement of intangible assets at cost, and the two conditions for recognition: it is probable future economic benefits will flow to the entity, and cost can be reliably measured. Judgment is exercised in assessing the certainty of future benefits based on external evidence.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views2 pagesIntangible Asset

Uploaded by

Nath BongalonThis document defines and discusses intangible assets according to PAS 38. It outlines three key criteria for an intangible asset: identifiability, control, and future economic benefits. It also discusses the initial measurement of intangible assets at cost, and the two conditions for recognition: it is probable future economic benefits will flow to the entity, and cost can be reliably measured. Judgment is exercised in assessing the certainty of future benefits based on external evidence.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

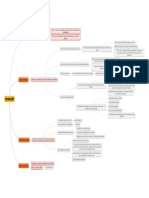

INTANGIBLE ASSET

PAS 38 An indentifiable nonmonetary asset without physical substance

DEFINITION

to distinguish from goodwill capable og being

separable separated from the

Identifiability entity

Identifiable when:

INTANGIBLE ASSETS

regardless whether the

arise from contractual/

it must be under control of rights are transferable

legal rights

the entity as a result of past or separable

Essential

Criteria event

Control

stem out of legal rights but

is not always necessary

includes revenue from the

Future Economic

sale, cost savings, other

Benefits

benefits

Identifiability – intangible asset must be identifiable in order to distinguish

clearly from goodwill

Control – is the power of the entity to obtain the future economic benefits INITIAL MEASUREMENT

flowing from the itangible asset and restrict the access of others to those

PAS 38 paragraph 24, intangible asset shall be measured initially at COST.

benefits.

Future economic benefits – may include revenue from the sale of products or

service, cost savings or other benefits resulting from the use of the asset by

the entity.

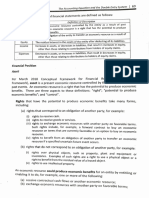

Acquired separately

Separate acquisition

INTANGIBLE ASSET

It is probable that future Payment is deffered beyong

Acquisition as a part of a normal credit terms

economic benefits business combination

attributable to the asset will

Recognize if two flow to the entity COST

Depending Acquisition by way of a

conditions are on government grant

met:

the cost of the intangible

asset can be measured Acquisition by exchange

reliably

Acquisition by self-

creation or internal

generation

RECOGNITION

Judgment is usually exercised in assessing the degree of certainty of the future

economic benefits.

Judgment is based on external evidence

You might also like

- ADVACC NOTES - Business CombinationDocument5 pagesADVACC NOTES - Business CombinationAlyaNo ratings yet

- Prepared by Nitin S PoojaryDocument36 pagesPrepared by Nitin S PoojaryAmit GoyalNo ratings yet

- Chapter 2-Conceptual Framework of Financial ReportingDocument2 pagesChapter 2-Conceptual Framework of Financial Reportingagm25No ratings yet

- BUS 310 Lecture 4 OnlineDocument17 pagesBUS 310 Lecture 4 OnlinefungilismNo ratings yet

- Account Initial Measurement Subsequent Measurement Recognition DerecognitionDocument3 pagesAccount Initial Measurement Subsequent Measurement Recognition DerecognitionMixxEn TeaNo ratings yet

- Pas 36Document38 pagesPas 36iyahvrezNo ratings yet

- SBR (1) MergedDocument36 pagesSBR (1) Mergedrosh.motwani19No ratings yet

- Buscom ReviewerDocument16 pagesBuscom ReviewereysiNo ratings yet

- Chapter 21Document25 pagesChapter 21Charissa Cecile HaberNo ratings yet

- Government GrantDocument4 pagesGovernment GrantMary Jescho Vidal AmpilNo ratings yet

- Assets: Assets Defined Asset RecognitionDocument1 pageAssets: Assets Defined Asset Recognitionnaega nuguNo ratings yet

- Annual Report of IOCL 95Document1 pageAnnual Report of IOCL 95Nikunj ParmarNo ratings yet

- Business Combinations Notes: Topic OutlineDocument4 pagesBusiness Combinations Notes: Topic OutlineMary Jescho Vidal AmpilNo ratings yet

- Intangible Assets - Mary and AllyDocument4 pagesIntangible Assets - Mary and AllyMary Ann B. GabucanNo ratings yet

- Chart On IFRIC 4Document4 pagesChart On IFRIC 4shahrajeev50% (1)

- Revision - Summary of IFRS - SBRDocument40 pagesRevision - Summary of IFRS - SBRPhạm Thu HuyềnNo ratings yet

- Ifrs 3 AagDocument5 pagesIfrs 3 AagMoses TNo ratings yet

- Financial Instruments: Recognition and MeasurementDocument14 pagesFinancial Instruments: Recognition and MeasurementEmily MauricioNo ratings yet

- Recasting FSDocument1 pageRecasting FSCapung SolehNo ratings yet

- Flow Chart IAS 32Document1 pageFlow Chart IAS 32Hameed Ullah KhanNo ratings yet

- Business Combinations: Advantages Disadvantages T Y E PDocument1 pageBusiness Combinations: Advantages Disadvantages T Y E PPrincessNo ratings yet

- Ia 2 - NotesDocument14 pagesIa 2 - NotesuradorajasmineNo ratings yet

- 66705studentjournal-Oct2021a (1) - Removed MadarDocument20 pages66705studentjournal-Oct2021a (1) - Removed MadarTimepass MungfuliNo ratings yet

- CFAS Millan CHAPTERS 20-22Document16 pagesCFAS Millan CHAPTERS 20-22Maria Mikaela ReyesNo ratings yet

- Chapter 11Document3 pagesChapter 11Kristine TiuNo ratings yet

- Comprender Textos en Inglés en Forma Escrita y AuditivaDocument4 pagesComprender Textos en Inglés en Forma Escrita y Auditivanohora pulidoNo ratings yet

- This Study Resource Was: Philippine School of Business AdministrationDocument6 pagesThis Study Resource Was: Philippine School of Business AdministrationGab IgnacioNo ratings yet

- Acc203 - Cfas - 08.19.23Document15 pagesAcc203 - Cfas - 08.19.23Hailsey WinterNo ratings yet

- Abusama Impairment of AssetsDocument1 pageAbusama Impairment of AssetsGarp BarrocaNo ratings yet

- Necessary Condition For Control.: PAS 38 Intangible AssetsDocument2 pagesNecessary Condition For Control.: PAS 38 Intangible AssetsEmma Mariz GarciaNo ratings yet

- Intermediate Accounting - Intangible Assets (Pas 38)Document5 pagesIntermediate Accounting - Intangible Assets (Pas 38)22100629No ratings yet

- Ifrs at A Glance: IAS 32 Financial InstrumentsDocument4 pagesIfrs at A Glance: IAS 32 Financial InstrumentsCindy YinNo ratings yet

- Ind-AS 103Document69 pagesInd-AS 103amarNo ratings yet

- Ifrs at A Glance IFRS 3 Business CombinationsDocument5 pagesIfrs at A Glance IFRS 3 Business CombinationsNoor Ul Hussain MirzaNo ratings yet

- Intacc1A - M4 Map - SantosDocument3 pagesIntacc1A - M4 Map - SantosRosette SANTOSNo ratings yet

- SMEs ALE PDFDocument13 pagesSMEs ALE PDFFranchNo ratings yet

- Secl - Evidencia 1 - Act - 3iiDocument3 pagesSecl - Evidencia 1 - Act - 3iisofia castilloNo ratings yet

- Ias 103Document150 pagesIas 103Avani KatheNo ratings yet

- Scholarship Application FormDocument6 pagesScholarship Application FormJeromyNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 5 - NotesDocument4 pagesConceptual Framework and Accounting Standards - Chapter 5 - NotesKhey KheyNo ratings yet

- AFAR 8918. Business Combination-Date of AcquisitionDocument4 pagesAFAR 8918. Business Combination-Date of AcquisitionTineNo ratings yet

- IAS 36 Impairment of Assets: ScopeDocument2 pagesIAS 36 Impairment of Assets: ScopeKazi MahbubNo ratings yet

- Ande - Financing OptionsDocument3 pagesAnde - Financing OptionsVipul RastogiNo ratings yet

- IndAS 103 AmalgamationDocument98 pagesIndAS 103 AmalgamationadityaNo ratings yet

- Business Combination and Corporate Restructuring: After Studying This Chapter, You Would Be Able ToDocument98 pagesBusiness Combination and Corporate Restructuring: After Studying This Chapter, You Would Be Able ToYUUSDHNo ratings yet

- 74524bos60448 Indas38Document5 pages74524bos60448 Indas38pave.scgroupNo ratings yet

- Republic of The Philippines, Represented by The Philippine Reclamation Authority (PRA), Petitioner, vs. CITY OF PARAÑAQUE, RespondentDocument14 pagesRepublic of The Philippines, Represented by The Philippine Reclamation Authority (PRA), Petitioner, vs. CITY OF PARAÑAQUE, RespondentZymon Andrew MaquintoNo ratings yet

- Income From Business & ProfessionDocument14 pagesIncome From Business & ProfessionSneha PotekarNo ratings yet

- SUMMARY - Intangible AssetsDocument12 pagesSUMMARY - Intangible AssetsKRESLEY LAUDEEN ORTEGANo ratings yet

- Snapshot - IFRS 9 - Financial Instruments (Excluding Hedge Accounting)Document1 pageSnapshot - IFRS 9 - Financial Instruments (Excluding Hedge Accounting)angaNo ratings yet

- FAR11 Intangibles - With AnsDocument18 pagesFAR11 Intangibles - With AnsAJ Cresmundo100% (1)

- Business LawDocument11 pagesBusiness LawsimrnNo ratings yet

- Ey Ifrs 10 Consolidation For Fund Managers PDFDocument32 pagesEy Ifrs 10 Consolidation For Fund Managers PDFCindy Yin100% (2)

- LegwailaT 2019 452IncomeVersusCapita TaxLawAnIntroductionDocument2 pagesLegwailaT 2019 452IncomeVersusCapita TaxLawAnIntroductionsnembalindlovuNo ratings yet

- AssetDocument1 pageAssetShoyo HinataNo ratings yet

- Intacc 2 NotesDocument25 pagesIntacc 2 Notescoco credoNo ratings yet

- Forms of Business AssociationsDocument4 pagesForms of Business Associationsnamratha minupuri100% (1)

- Comparitive Analysis of Certain Sections of Companies Act, 1956 & Companies Act, 2013Document11 pagesComparitive Analysis of Certain Sections of Companies Act, 1956 & Companies Act, 2013MOUSOM ROYNo ratings yet

- ACCA - Chapter 5-6 (A5)Document6 pagesACCA - Chapter 5-6 (A5)Bianca Alexa SacabonNo ratings yet

- The LLC Launchpad: Navigate Your Business Journey with ConfidenceFrom EverandThe LLC Launchpad: Navigate Your Business Journey with ConfidenceNo ratings yet

- (Ex. Liquors) (Ex. Grape Wine) (Ex. Beer) (Ex. Chewing Tobacco)Document1 page(Ex. Liquors) (Ex. Grape Wine) (Ex. Beer) (Ex. Chewing Tobacco)Nath BongalonNo ratings yet

- TiuaonsgtdnDocument2 pagesTiuaonsgtdnNath BongalonNo ratings yet

- Relevant Costing For Non Routine Decision Making - Managment ScienceDocument1 pageRelevant Costing For Non Routine Decision Making - Managment ScienceNath BongalonNo ratings yet

- Law On Sales ReviewerDocument1 pageLaw On Sales ReviewerNath BongalonNo ratings yet

- Sample ProblemDocument5 pagesSample ProblemNath BongalonNo ratings yet

- Dalton's Atomic TheoryDocument2 pagesDalton's Atomic TheoryNath BongalonNo ratings yet

- Introduction To Bank ReconciliationDocument8 pagesIntroduction To Bank ReconciliationNath Bongalon100% (1)

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- Recognizing Expenses When Incurred Rather Than When PaidDocument2 pagesRecognizing Expenses When Incurred Rather Than When PaidNath BongalonNo ratings yet

- A Case Study On The Effects of Bullying To Teenagers With Broken FamilyDocument5 pagesA Case Study On The Effects of Bullying To Teenagers With Broken FamilyNath BongalonNo ratings yet

- The LithosphereDocument8 pagesThe LithosphereNath Bongalon100% (1)

- Learning or Not: Active and Passive ClassesDocument6 pagesLearning or Not: Active and Passive ClassesNath Bongalon60% (5)

- 1st PPT GEO3Document17 pages1st PPT GEO3Nath BongalonNo ratings yet

- 08 Acctg Ed 1 - Bank Reconciliation PDFDocument3 pages08 Acctg Ed 1 - Bank Reconciliation PDFNath BongalonNo ratings yet

- Classification of TrianglesDocument4 pagesClassification of TrianglesNath BongalonNo ratings yet

- 14 Acctg Ed 1 - Receivable FinancingDocument19 pages14 Acctg Ed 1 - Receivable FinancingNath BongalonNo ratings yet

- 15 Acctg Ed 1 - Receivable Financing 2Document10 pages15 Acctg Ed 1 - Receivable Financing 2Nath BongalonNo ratings yet

- 11 Acctg Ed 1 - Estimation of Doubtful Accounts PDFDocument12 pages11 Acctg Ed 1 - Estimation of Doubtful Accounts PDFNath BongalonNo ratings yet

- George Polya: December 1887 - September 1985Document1 pageGeorge Polya: December 1887 - September 1985Nath BongalonNo ratings yet

- 12 Acctg Ed 1 - Notes Receivable PDFDocument17 pages12 Acctg Ed 1 - Notes Receivable PDFNath BongalonNo ratings yet

- Taxation New Topics Cpa Borad Exam As of October 2017Document2 pagesTaxation New Topics Cpa Borad Exam As of October 2017Nath BongalonNo ratings yet

- Accounting FOR Partnership SDocument3 pagesAccounting FOR Partnership SNath BongalonNo ratings yet

- Auditing Theory - Day 04Document2 pagesAuditing Theory - Day 04Nath BongalonNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsNath BongalonNo ratings yet

- Triangle Classification: Sides AnglesDocument2 pagesTriangle Classification: Sides AnglesNath BongalonNo ratings yet

- RECEIVABLESDocument12 pagesRECEIVABLESNath BongalonNo ratings yet

- Charles DarwinDocument4 pagesCharles DarwinNath BongalonNo ratings yet

- 03 Acctg Ed 1 - Conceptual Framework 2 PDFDocument5 pages03 Acctg Ed 1 - Conceptual Framework 2 PDFNath BongalonNo ratings yet

- Whodoyousayiam? Who Said It?: Chapter/Ve RseDocument3 pagesWhodoyousayiam? Who Said It?: Chapter/Ve RseNath BongalonNo ratings yet

- Dynamics: Vector Mechanics For EngineersDocument62 pagesDynamics: Vector Mechanics For EngineersAkatew Haile MebrahtuNo ratings yet

- PCAB CFY 2014 2015 List of ContractorsDocument570 pagesPCAB CFY 2014 2015 List of ContractorsRobert Ramirez100% (4)

- Code of Ethics in Philippine Real Estate ServiceDocument9 pagesCode of Ethics in Philippine Real Estate ServiceHib Atty Tala100% (3)

- Land LawDocument25 pagesLand LawPiyush Nikam MishraNo ratings yet

- Legal Framework For MRO Setup in PakistanDocument18 pagesLegal Framework For MRO Setup in Pakistanhassan wastiNo ratings yet

- Shayara Bano v. Union of India: The Triple Talaq CaseDocument34 pagesShayara Bano v. Union of India: The Triple Talaq CaseUnnatiNo ratings yet

- San Miguel Corp Employees Union V BersamiraDocument1 pageSan Miguel Corp Employees Union V BersamiraGlenda OzaetaNo ratings yet

- Title IX ComplaintDocument34 pagesTitle IX ComplaintClickon DetroitNo ratings yet

- Digest PNB V RitrattoDocument1 pageDigest PNB V RitrattoGRNo ratings yet

- Banking and Insurance Law Assignment by Anubhav SinghDocument5 pagesBanking and Insurance Law Assignment by Anubhav Singhrieya dadhichiNo ratings yet

- STS Transfer Operations PlanDocument183 pagesSTS Transfer Operations Planyuniariwibowo100% (3)

- Dean Navarro Lecture NotesDocument91 pagesDean Navarro Lecture NotesmayaNo ratings yet

- 1) Oca - v. - Custodio20180319-6791-1pqfdoaDocument27 pages1) Oca - v. - Custodio20180319-6791-1pqfdoaVictoria EscobalNo ratings yet

- Risk Assessment and Management in Chemical Industry in Vietnam - SINHDocument24 pagesRisk Assessment and Management in Chemical Industry in Vietnam - SINHMinh Hoàng Nguyễn HữuNo ratings yet

- G.R. No. 162230 Isabelita Vinuya, Et Al. vs. Executive Secretary Alberto G. Romulo, Et Al. by Justice Lucas BersaminDocument11 pagesG.R. No. 162230 Isabelita Vinuya, Et Al. vs. Executive Secretary Alberto G. Romulo, Et Al. by Justice Lucas BersaminHornbook Rule100% (1)

- Co Kim Cham Vs Valdez Tan KehDocument9 pagesCo Kim Cham Vs Valdez Tan KehKenny CastañedaNo ratings yet

- Masbud, Faraida P. (Legal Writing)Document3 pagesMasbud, Faraida P. (Legal Writing)Faraida MasbudNo ratings yet

- Ayers Alliance Quantum Fund Offering MemorandumDocument78 pagesAyers Alliance Quantum Fund Offering MemorandumJon SolakianNo ratings yet

- Bank of America Credit Committee CharterDocument1 pageBank of America Credit Committee CharterSebastian PaulNo ratings yet

- Cicl 2Document34 pagesCicl 2Val Justin DeatrasNo ratings yet

- QCDD BP GuidelinesDocument6 pagesQCDD BP Guidelines남광연0% (1)

- Msds UMBDocument9 pagesMsds UMBDwi April YantoNo ratings yet

- Barangay Seal OrdinanceDocument8 pagesBarangay Seal OrdinanceKenoys Gales89% (37)

- Criminology - Topic 1: Crime StatisticsDocument12 pagesCriminology - Topic 1: Crime StatisticsravkoonerNo ratings yet

- The Tax Law of Private Foundations 2022 Cumulative Supplement (Bruce R. Hopkins, Shane T. Hamilton) (Z-Library)Document305 pagesThe Tax Law of Private Foundations 2022 Cumulative Supplement (Bruce R. Hopkins, Shane T. Hamilton) (Z-Library)juridico.tributarioNo ratings yet

- RMO No.26-2016 - Policies and Guidelines in Handling Disputed AssessmentsDocument2 pagesRMO No.26-2016 - Policies and Guidelines in Handling Disputed AssessmentsMichelle VelascoNo ratings yet

- Assured Shorthold Tenancy Agreement: CBBJJFGJJJHHHGGDocument5 pagesAssured Shorthold Tenancy Agreement: CBBJJFGJJJHHHGGJan TanaseNo ratings yet

- US V SerapioDocument19 pagesUS V SerapioJoy NavalesNo ratings yet

- Shobert v. Benefits USEC, 4th Cir. (2005)Document4 pagesShobert v. Benefits USEC, 4th Cir. (2005)Scribd Government DocsNo ratings yet

- Internal Auditing BanksDocument88 pagesInternal Auditing BanksMitesh MehtaNo ratings yet