Professional Documents

Culture Documents

Flow Chart IAS 32

Uploaded by

Hameed Ullah Khan0 ratings0% found this document useful (0 votes)

56 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

56 views1 pageFlow Chart IAS 32

Uploaded by

Hameed Ullah KhanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

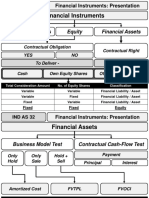

IAS 32 – Financial Instruments

Contract

Financial Asset Financial Liability Equity Instrument

Investment in Contractual right to Settlement in entity’s Contractual Settlement in entity’s own

Cash Equity = Assets - Liabilities

shares receive own equity instruments obligation to deliver equity instruments

· Cash Variable number · Cash

Variable number of

· Another Financial Asset of equity · Another Financial Asset

equity instruments

· Potentially Favorable Derivative instruments · Potentially Unfavorable Derivative

PRESENTATION COMPOUND FINANCIAL INSTRUMENT

Financial Liability Based on substance Financial liability Equity instrument

Equity Instrument

and definition

Exception – Puttable

Settlement Treasury Share shown as FV by discounting using By deducting FV of FL

Instrument (Features)

deduction from equity market interest rate from FV of CFI

Prorate share in net Subordinate to all

Option to settle in Contingent 1. Interest, dividend, losses and gains

assets other classes

either cash or shares Provisions related to Financial liabilities At maturity

recognized as an expense in P&L 1. Conversion

No other obligation 2. Repurchase

Identical features to deliver cash than 2. Dividend related to equity

redemption instrument recognized in equity

Before maturity

Expected cash flows from P&L, change in Net Offsetting only 1. Conversion

assets and fair value change in net assets only 1. legally enforceable right to set-off 2. Repurchase

2. intends either to settle on net basis or

Reclassification to realize asset and settle the liability

simultaneously Induced conversion

Additional payment recognize as a loss in P&L

Difference between CA of Equity instrument to Financial liability to

No gain / loss

EI and FV of FL in equity financial liability equity instrument

You might also like

- Ind AS 109Document47 pagesInd AS 109Savin Avaran SajanNo ratings yet

- F7 - C8 Financial Instrument FullDocument60 pagesF7 - C8 Financial Instrument FullK59 Vo Doan Hoang AnhNo ratings yet

- Pas 32Document1 pagePas 32Patrick AlcoberNo ratings yet

- 2.2 Audit of InvestmentsDocument1 page2.2 Audit of Investmentsantonette seradNo ratings yet

- CHAPTER 22 Theory Financial Assets at Fair ValueDocument3 pagesCHAPTER 22 Theory Financial Assets at Fair ValueRomel BucaloyNo ratings yet

- Accounting EquationDocument2 pagesAccounting EquationHannie CaratNo ratings yet

- FAR14 Financial Liabilities - With AnsDocument9 pagesFAR14 Financial Liabilities - With AnsAJ CresmundoNo ratings yet

- Investment in Equity SecuritiesDocument42 pagesInvestment in Equity SecuritiesJhay AbabonNo ratings yet

- IND AS 109 v12 050516Document70 pagesIND AS 109 v12 050516Ashish.kaklotar7No ratings yet

- Ia InvestmentsDocument11 pagesIa InvestmentsJhunnie LoriaNo ratings yet

- Concept Map-Investments (Singson, DM)Document11 pagesConcept Map-Investments (Singson, DM)Donna Mae SingsonNo ratings yet

- Pfrs For Smes Full PFRS: Same Same Same SameDocument14 pagesPfrs For Smes Full PFRS: Same Same Same SameAnthon GarciaNo ratings yet

- Afar.02 Corporate LiquidationDocument3 pagesAfar.02 Corporate LiquidationRhea Royce CabuhatNo ratings yet

- Ifrs at A Glance: IAS 32 Financial InstrumentsDocument4 pagesIfrs at A Glance: IAS 32 Financial InstrumentsCindy YinNo ratings yet

- Sme VS PFRSDocument17 pagesSme VS PFRSDesai SarvidaNo ratings yet

- CFAS Chapter 5-8 PDFDocument25 pagesCFAS Chapter 5-8 PDFKenneth PimentelNo ratings yet

- CFAS PAS 32 Financial Instruments and PFRS 9 Measurement of F Asset Topic 5Document3 pagesCFAS PAS 32 Financial Instruments and PFRS 9 Measurement of F Asset Topic 5Erica mae BodosoNo ratings yet

- Far 06-05 Investments PDFDocument8 pagesFar 06-05 Investments PDFZee MarvsNo ratings yet

- Financial Instruments PDFDocument133 pagesFinancial Instruments PDFHimanshu Gaur100% (1)

- IFRS 9 Part 1Document49 pagesIFRS 9 Part 1ErslanNo ratings yet

- Ifrs at A Glance: IAS 21 The Effects of Changes in ForeignDocument4 pagesIfrs at A Glance: IAS 21 The Effects of Changes in ForeignEric SampongNo ratings yet

- Lesson 12Document10 pagesLesson 12shadowlord468No ratings yet

- Financial InstrumentsDocument21 pagesFinancial InstrumentsTommaso SpositoNo ratings yet

- Lesson 12Document6 pagesLesson 12Jamaica bunielNo ratings yet

- FabmDocument5 pagesFabmJihane TanogNo ratings yet

- Fundamentos de La Contabilidad de Coberturas: (Hedge Accounting)Document78 pagesFundamentos de La Contabilidad de Coberturas: (Hedge Accounting)doiNo ratings yet

- ICare PFRS For Banks Financial InstrumentsDocument45 pagesICare PFRS For Banks Financial InstrumentsMark Gelo WinchesterNo ratings yet

- Ifrs 9Document42 pagesIfrs 9tariqNo ratings yet

- LiabilitiesDocument4 pagesLiabilitiessafe.skies00No ratings yet

- FINACC1 - Investment in Equity and Debt Instruments PDFDocument4 pagesFINACC1 - Investment in Equity and Debt Instruments PDFJerico DungcaNo ratings yet

- Presentation5.1 - Audit of Investments (Part 2)Document29 pagesPresentation5.1 - Audit of Investments (Part 2)Roseanne Dela CruzNo ratings yet

- 2Q - Fabm 2Document7 pages2Q - Fabm 2Alexandra Norin RodriguezNo ratings yet

- FR Concept Book Jai ChawlaDocument280 pagesFR Concept Book Jai ChawlatharishbabubNo ratings yet

- IFRS at A Glance - IAS 7 PDFDocument4 pagesIFRS at A Glance - IAS 7 PDFRachel Mae FajardoNo ratings yet

- Financial Instrument NotesDocument3 pagesFinancial Instrument NotesKrishna AdhikariNo ratings yet

- IFRS 9 and ECL Modeling Free ClassDocument43 pagesIFRS 9 and ECL Modeling Free ClassAbdallah Abdul JalilNo ratings yet

- Financial Statements: General Purpose FS: For Users Not in The Position ToDocument3 pagesFinancial Statements: General Purpose FS: For Users Not in The Position ToRoyce DenolanNo ratings yet

- AK2 Pertemuan 1 - Financial Instrument OKDocument48 pagesAK2 Pertemuan 1 - Financial Instrument OKhaccp bkipmNo ratings yet

- Accounting BasicsDocument10 pagesAccounting BasicsMitanshi ShahNo ratings yet

- Philippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Document13 pagesPhilippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Thalia UyNo ratings yet

- Summary of Capital Market Instruments in IndonesiaDocument6 pagesSummary of Capital Market Instruments in IndonesiaAyesha MaroofNo ratings yet

- IFRS 2e Slides 15Document43 pagesIFRS 2e Slides 15Piertotum LocomotorNo ratings yet

- 2022 PDPA Lecture 7 HKAS32 HKFRS 9Document46 pages2022 PDPA Lecture 7 HKAS32 HKFRS 9clancychengNo ratings yet

- Snapshot - IFRS 9 - Financial Instruments (Excluding Hedge Accounting)Document1 pageSnapshot - IFRS 9 - Financial Instruments (Excluding Hedge Accounting)angaNo ratings yet

- Advanced Financial Accounting and Reporting (Afar) Accounting For Joint ArrangementsDocument4 pagesAdvanced Financial Accounting and Reporting (Afar) Accounting For Joint ArrangementsJasmine Marie Ng CheongNo ratings yet

- Intermediate Accounting 2Document10 pagesIntermediate Accounting 2Sean ThyrdeeNo ratings yet

- Porperty Plant and EquipmentDocument280 pagesPorperty Plant and EquipmentchingNo ratings yet

- Module 4 - Financial Instruments (Assets)Document9 pagesModule 4 - Financial Instruments (Assets)Luisito CorreaNo ratings yet

- FAR 04 Investment in Debt Instruments LectureDocument4 pagesFAR 04 Investment in Debt Instruments Lecturebyunb3617No ratings yet

- Ind AS 32 - Financial InstrumentsDocument2 pagesInd AS 32 - Financial InstrumentsJAINAM SHETHNo ratings yet

- Bdo - Ifrs 9Document8 pagesBdo - Ifrs 9fildzah dessyanaNo ratings yet

- Annual Report of IOCL 91Document1 pageAnnual Report of IOCL 91Nikunj ParmarNo ratings yet

- Financial Asset at Fair ValueDocument4 pagesFinancial Asset at Fair ValueDaren Dame Jodi RentasidaNo ratings yet

- Ifrs at A Glance IFRS 9 Financial InstrumentsDocument13 pagesIfrs at A Glance IFRS 9 Financial InstrumentsNoor Ul Hussain MirzaNo ratings yet

- Document From Adhu-2 PDFDocument26 pagesDocument From Adhu-2 PDFBasavaraj S PNo ratings yet

- Ifrs at A Glance IAS 21 The Effects of Changes In: Foreign Exchange RatesDocument4 pagesIfrs at A Glance IAS 21 The Effects of Changes In: Foreign Exchange Ratesمعن الفاعوريNo ratings yet

- Ifrs at A Glance: IAS 39 Financial InstrumentsDocument8 pagesIfrs at A Glance: IAS 39 Financial InstrumentsSamNo ratings yet

- Financial Instruments: An IntroductionDocument20 pagesFinancial Instruments: An Introductionlaksana45No ratings yet

- Pkp-08-Instrumen Keuangan-Psak 55 (Revisi 2014) - Pengakuan Dan PengukuranDocument139 pagesPkp-08-Instrumen Keuangan-Psak 55 (Revisi 2014) - Pengakuan Dan PengukuranGugat jelang romadhonNo ratings yet

- Weekly Quiz 2Document30 pagesWeekly Quiz 2Emmmanuel ArthurNo ratings yet

- 2020-21 G12 Mock AA-HL Calculator Practice Questions ANSWERSDocument23 pages2020-21 G12 Mock AA-HL Calculator Practice Questions ANSWERS0010048No ratings yet

- 8.managing Risk - Off The Balance Sheet With Loan Sales and SecuritizationDocument38 pages8.managing Risk - Off The Balance Sheet With Loan Sales and SecuritizationChristine Joy AguilaNo ratings yet

- Mid 1 Questions (Except 405)Document4 pagesMid 1 Questions (Except 405)Raisha LionelNo ratings yet

- End Term ACF 2021 Set 2Document2 pagesEnd Term ACF 2021 Set 2pranita mundraNo ratings yet

- Class 10th - Money and Credit - Exam Pack - Most Important Questions Exam PackDocument19 pagesClass 10th - Money and Credit - Exam Pack - Most Important Questions Exam PackLalit KumarNo ratings yet

- AcFn 611 CH 02Document78 pagesAcFn 611 CH 02embiale ayaluNo ratings yet

- Paper12 SolutionDocument15 pagesPaper12 SolutionTarunSainiNo ratings yet

- SWAP Cocept Construction & ValuationDocument71 pagesSWAP Cocept Construction & ValuationKaushik BhattacharjeeNo ratings yet

- # Solution: 900,000/100,000 9:. 9 16 144Document5 pages# Solution: 900,000/100,000 9:. 9 16 144Joel Christian MascariñaNo ratings yet

- Obsolescence 2. Book Value 3. Depreciation 4. Depletion EtcDocument9 pagesObsolescence 2. Book Value 3. Depreciation 4. Depletion EtcKHAN AQSANo ratings yet

- Chapter 3 - Concept Questions and Exercises StudentDocument4 pagesChapter 3 - Concept Questions and Exercises StudentTuấn Vũ MạnhNo ratings yet

- Macroeconomics Principles and Practice Australian 2nd Edition Littleboy Test Bank Full Chapter PDFDocument51 pagesMacroeconomics Principles and Practice Australian 2nd Edition Littleboy Test Bank Full Chapter PDFStevenCookexjrp100% (10)

- FIN222 Autumn2016 Tutorials Tutorial 8Document8 pagesFIN222 Autumn2016 Tutorials Tutorial 8HELENANo ratings yet

- CF2 - Chapter 1 Cost of Capital - SVDocument58 pagesCF2 - Chapter 1 Cost of Capital - SVleducNo ratings yet

- CF Week9 Seminar3Document4 pagesCF Week9 Seminar3KesyadwikaNo ratings yet

- Liabilities by Valix: Intermediate Accounting 2Document34 pagesLiabilities by Valix: Intermediate Accounting 2Trisha Mae AlburoNo ratings yet

- 2022 - Business Plan - SEC Fom BP FCLCDocument7 pages2022 - Business Plan - SEC Fom BP FCLCkenNo ratings yet

- Assured ReturnsDocument11 pagesAssured ReturnsTheMoneyMitraNo ratings yet

- Problem Set 3Document2 pagesProblem Set 3Omar SrourNo ratings yet

- LACTU2170Document389 pagesLACTU2170GemnNo ratings yet

- Assignment 3 20042023 103711pmDocument5 pagesAssignment 3 20042023 103711pmahmed aliNo ratings yet

- Loan Receivable NotesDocument8 pagesLoan Receivable NotesPearl May DignosNo ratings yet

- International Financial MarketsDocument42 pagesInternational Financial MarketsVamsi Kumar0% (1)

- Capital Markets Fundamentals - Ethiopian ContextDocument50 pagesCapital Markets Fundamentals - Ethiopian ContextHub TechnologyNo ratings yet

- Studies 2016 May P1 MSDocument35 pagesStudies 2016 May P1 MSnathan.kimNo ratings yet

- IFM 04 Parity RelationshipsDocument24 pagesIFM 04 Parity RelationshipsTanu GuptaNo ratings yet

- Module10 1Document22 pagesModule10 1Colleen Mae San DiegoNo ratings yet

- Unit 2 Quantitaive MethodsDocument36 pagesUnit 2 Quantitaive MethodsLuis PaulinoNo ratings yet

- TVM - QuestionsDocument2 pagesTVM - QuestionsUdittiNo ratings yet