Professional Documents

Culture Documents

Bos 59410

Uploaded by

Bharath Krishna MVOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bos 59410

Uploaded by

Bharath Krishna MVCopyright:

Available Formats

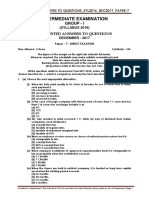

MULTIPLE CHOICE QUESTIONS

1. X & Co., a supplier registered under GST in Meghalaya, wants to opt for

composition levy. The aggregate turnover limit for composition levy is-

(a) ` 50 lakh

(b) ` 75 lakh

(c) ` 1.5 crore

(d) none of the above

2. The person making inter-State supply of goods from Madhya Pradesh is

compulsorily required to get registered under GST, provided

such goods are not notified handicraft goods nor predominantly hand-

made notified products .

(a) if his aggregate turnover exceeds ` 20 lakh in a financial year

(b) if his aggregate turnover exceeds ` 10 lakh in a financial year

(c) if his aggregate turnover exceeds ` 40 lakh in a financial year

(d) irrespective of the amount of aggregate turnover in a financial

year since he is making inter-State supply of taxable goods.

3. Which of the following supply of services are exempt under GST?

(i) testing of agricultural produce

(ii) supply of farm labour

(iii) warehousing of agricultural produce

(a) (i)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

4. Input tax credit is not available in respect of .

(i) services on which tax has been paid under composition levy

(ii) goods given as free samples

© The Institute of Chartered Accountants of India

132 INDIRECT TAXES

(iii) goods used for personal consumption

(a) (i)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

5. Subhas & Co., a registered person, supplies taxable goods to

unregistered persons. It need not issue tax invoice, if the value of supply

of goods to such persons is and the recipient does not require

such invoice.

(a) ` 1,200

(b) ` 600

(c) ` 150

(d) ` 200

6. Various taxes have been subsumed in GST to make one nation one tax

one market for consumers. Out of the following, determine which taxes

have been subsumed in GST.

(i) Basic customs duty levied under Customs Act, 1962

(ii) Taxes on lotteries

(iii) Environment tax

(a) (ii)

(b) (ii) and (iii)

(c) (iii)

(d) (i), (ii) and (iii)

7. Services by way of transportation of by rail from Chennai to

Gujarat is exempt from GST.

(i) pulses

(ii) military equipments

(iii) electric equipments

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 133

(iv) jaggery

(a) (i) & (ii)

(b) (i) & (iii)

(c) (ii) & (iv)

(d) (i), (ii), (iii) & (iv)

8. GST is not payable by recipient of services in the following cases:-

(i) Services provided by way of sponsorship to ABC Ltd. located in

India.

(ii) Services supplied by a director (registered under GST) of Galaxy

Ltd. to Mr. Krishna

(iii) Services by Department of Posts by way of speed post to MNO

Ltd. located in India.

(iv) Services supplied by a recovering agent to SNSP Bank located in

India.

(a) (i) & (iii)

(b) (i) & (iv)

(c) (ii) & (iii)

(d) (ii) & (iv)

9. Mr. X, a casual taxable person, is not involved in making taxable supplies

of notified handicraft goods or predominantly hand-made notified

products. Which of the following statements is true for Mr. X - a casual

taxable person?

(a) Mr. X is not required to take registration under GST under any

circumstances.

(b) Mr. X is required to get registration under GST if the aggregate

turnover in a financial year exceeds ` 20 lakh.

(c) Mr. X is required to get registration under GST if the aggregate

turnover in a financial year exceeds ` 40 lakh.

© The Institute of Chartered Accountants of India

134 INDIRECT TAXES

(d) Mr. X has to compulsorily get registered under GST irrespective

of the threshold limit.

10. The registration certificate granted to non-resident taxable person is

valid for _____days from the effective date of registration or period

specified in registration application, whichever is earlier.

(a) 30

(b) 60

(c) 90

(d) 120

11. Which of the following activities shall be treated neither as supply of

goods nor as supply of services?

(i) Permanent transfer of business assets where input tax credit has

been availed on such assets

(ii) Temporary transfer of intellectual property right

(iii) Transportation of the deceased

(iv) Services provided by an employee to the employer in the course

of employment

(a) (i) & (iii)

(b) (ii) & (iv)

(c) (i) & (ii)

(d) (iii) & (iv)

12. Balance in electronic credit ledger can be utilized against payment of

________________.

(a) output tax

(b) interest

(c) penalty

(d) late fees

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 135

13. How is the aggregate turnover calculated for determining threshold limit

for registration?

(a) Aggregate value of all taxable supplies (excluding the value of

inward supplies on which tax is payable by a person on reverse

charge basis and inter-State supplies), exempt supplies and

export of goods/services.

(b) Aggregate value of all taxable supplies (excluding the value of

inward supplies on which tax is payable by a person on reverse

charge basis), exempt supplies, export of goods/services and

inter-State supplies of a person computed for each State

separately.

(c) Aggregate value of all taxable intra-State supplies, export of

goods/services and exempt supplies of a person having same

PAN computed for each State separately.

(d) Aggregate value of all taxable supplies (excluding the value of

inward supplies on which tax is payable by a person on reverse

charge basis), exempt supplies, export of goods/services and

inter-State supplies of a person having same PAN computed on

all India basis and excluding taxes if any charged under CGST

Act, SGST Act and IGST Act.

14. Within how many days a person should apply for registration under GST,

apart from provisions of voluntary registration?

(a) Within 60 days from the date he becomes liable for registration.

(b) Within 30 days from the date he becomes liable for registration.

(c) No time limit

(d) Within 90 days from the date he becomes liable for registration.

15. Kalim & Associates made an application for cancellation of GST

registration in the month of March due to closure of its business. Its

application for cancellation of GST registration was approved w.e.f.

4th September by the proper officer by passing an order for the same on

14th September. In the given case, Kalim & Associates is:

(a) required to file Final Return on or before 4th December

© The Institute of Chartered Accountants of India

136 INDIRECT TAXES

(b) not required to file Final Return

(c) required to file Final Return on or before 30 th September

(d) required to file Final Return on or before 14 th December

16. Xylo & Co. has three branches, in Jalandhar, Amritsar and Ludhiana, in

the State of Punjab. Amritsar and Ludhiana branches are engaged in

supply of garments and Jalandhar branch engaged in supply of shoes.

Which of the following options is/are legally available for registration to

Xylo & Co.?

(i) Xylo & Co. can obtain single registration for Punjab State

declaring any one of the branches as principal place of business

and other two branches as additional place of business.

(ii) Xylo & Co. can obtain separate GST registration for each of the

three branches - Amristar, Jalandhar and Ludhiana.

(iii) Xylo & Co. can obtain one GST registration for shoe business

(Jalandhar branch) and another GST registration which is

common for garments business (Amritsar and Ludhiana).

(a) (ii)

(b) Either (i), (ii) or (iii)

(c) Either (i) or (ii)

(d) Either (ii) or (iii)

17. What is the validity of the registration certificate granted under GST for

a normal tax payer?

(a) One year

(b) Two years

(c) Valid till it is cancelled

(d) Five years.

18. Within how many days an application for revocation of cancellation of

registration can be made provided no extension to said time-limit has

been granted?

(a) Within 7 days from the date of service of the cancellation order.

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 137

(b) Within 15 days from the date of the cancellation order.

(c) Within 45 days from the date of the cancellation order.

(d) Within 30 days from the date of service of the cancellation order.

19. Can a registered person under composition scheme collect GST on his

outward supplies from recipients?

(a) Yes, in all cases

(b) Yes, only on such goods as may be notified by the Central

Government

(c) Yes, only on such services as may be notified by the Central

Government

(d) No

20. Which of the following activities is a supply of services?

(i) Transfer of right in goods/ undivided share in goods without

transfer of title in goods

(ii) Transfer of title in goods

(iii) Transfer of title in goods under an agreement which stipulates

that property shall pass at a future date upon payment of full

consideration as agreed.

(a) (i)

(b) (iii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

21. ‘P’ Ltd. has its registered office, under the Companies Act, 2013, in the

State of Maharashtra from where it ordinarily carries on its business of

taxable goods. It also has a warehouse in the State of Telangana for

storing said goods. What will be the place of business of ‘P’ Ltd. under

the GST law?

(a) Telangana

(b) Maharashtra

© The Institute of Chartered Accountants of India

138 INDIRECT TAXES

(c) Both (a) and (b)

(d) Neither (a) nor (b)

22. An exempt supply includes-

(i) Supply of goods or services or both which attracts Nil rate of tax

(ii) Non-taxable supply

(iii) Supply of goods or services or both which are wholly exempt

from tax under section 11 of the CGST Act or under section 6 of

IGST Act

(a) (i)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

23. Which of the following services are exempt from GST?

(a) Services by an artist by way of a performance in classical art

forms of painting/sculpture making etc. with consideration

thereof not exceeding ` 1.5 lakh.

(b) Services by an artist by way of a performance in modern art

forms of music/ dance/ theatre with consideration thereof not

exceeding ` 1.5 lakh.

(c) Services by an artist by way of a performance in folk or classical

art forms of music/ dance/theatre with consideration thereof

exceeding ` 1.5 lakh.

(d) Services by an artist by way of a performance in folk or classical

art forms of music/ dance / theatre with consideration thereof

not exceeding ` 1.5 lakh.

24. Services by way of admission to ______________ is not exempt from

GST.

(a) Museum

(b) National park

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 139

(c) Tiger reserve

(d) Recognised sporting event where the admission ticket costs

` 600 per person.

25. Discount given after the supply has been effected is deducted from the

value of taxable supply, if –

(i) such discount is given as per the agreement entered into at/or

before the time of such supply

(ii) such discount is linked to the relevant invoices

(iii) proportionate input tax credit is reversed by the recipient of

supply

(a) (i)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

26. Which of the following statements are correct?

(i) Revocation of cancellation of registration under SGST/UTGST Act

shall be deemed to be a revocation of cancellation of registration

under CGST Act.

(ii) Cancellation of registration under SGST/UTGST Act shall be

deemed to be a cancellation of registration under CGST Act.

(iii) Revocation of cancellation of registration under SGST/UTGST Act

shall not be deemed to be a revocation of cancellation of

registration under CGST Act.

(iv) Cancellation of registration under SGST/UTGST Act shall not be

deemed to be a cancellation of registration under CGST Act.

(a) (i) and (ii)

(b) (i) and (iv)

(c) (ii) and (iii)

(d) (iii) and (iv)

© The Institute of Chartered Accountants of India

140 INDIRECT TAXES

27. If the goods are received in lots/instalment, _________________

(a) 50% ITC can be taken on receipt of 1st lot and balance 50% on

receipt of last lot.

(b) ITC can be availed upon receipt of last lot.

(c) 100% ITC can be taken on receipt of 1st lot.

(d) Proportionate ITC can be availed on receipt of each

lot/instalment.

28. For banking companies using inputs and input services partly for taxable

supplies and partly for exempt supplies, which of the following

statement is true?

(a) ITC shall be compulsorily restricted to credit attributable to

taxable supplies including zero rated supplies

(b) 50% of eligible ITC on inputs, capital goods, and input services

shall be mandatorily taken in a month and the rest shall lapse.

(c) Banking company can choose to exercise either option (a) or

option (b)

(d) ITC shall be compulsorily restricted to credit attributable to

taxable supplies excluding zero rated supplies.

29. A supplier takes deduction of depreciation on the GST component of the

cost of capital goods as per Income- tax Act, 1961. The supplier can-

(a) avail only 50% of the said tax component as ITC

(b) not avail ITC on the said tax component

(c) avail 100% ITC of the said tax component

(d) avail only 25% of the said tax component as ITC

30. Warehousing services of is exempt from GST.

(i) Wheat

(ii) Apples

(iii) Pulses

(iv) Potato

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 141

(a) i, ii, iii and iv

(b) i and iii

(c) ii, iii and iv

(d) iii

31. Which of the following services received, in the course or furtherance of

business, without consideration amount to supply?

(i) Import of services by a person in India from his son well-settled

in USA

(ii) Import of services by a person in India from his brother well-

settled in Germany

(iii) Import of services by a person in India from his brother (wholly

dependent on such person in India) in France

(iv) Import of services by a person in India from his daughter (wholly

dependent on such person in India) in Russia

(a) i, iii and iv

(b) ii, iii and iv

(c) ii and iii

(d) i and ii

32. Which of the following persons engaged in making intra-state supplies

from Uttar Pradesh, as prescribed below, is not eligible for composition

levy under sub-sections (1) and (2) of the CGST Act, 2017 even though

their aggregate turnover does not exceed ` 1.5 crore in preceding FY?

(a) A person supplying restaurant services

(b) A person supplying restaurant services and earning bank interest

(c) A person trading in ice cream

(d) A person supplying service of repairing of electronic items

33. The time of supply of service in case of reverse charge mechanism is:

(a) Date on which payment is entered in the books of account of the

recipient

© The Institute of Chartered Accountants of India

142 INDIRECT TAXES

(b) Date immediately following 60 days from the date of issue of

invoice

(c) Date on which the payment is debited in the bank account of

recipient

(d) Earlier of (a), (b) or (c)

34. Which of the following services does not fall under reverse charge

provisions as contained under section 9(3) of the CGST Act?

(a) Services supplied by arbitral tribunal to business entity located in

Ladakh

(b) Sponsorship services provided to a partnership firm located in

Jammu & Kashmir

(c) Sponsorship services provided to a body corporate located in

Kerala

(d) Service of renting of motor vehicle for passengers provided to a

recipient other than body corporate.

35. Which of the following services are exempt from GST?

(a) Admission to a circus where entry ticket costs ` 550 per person

(b) Interest charged on outstanding credit card balances

(c) Services by an organiser to any person in respect of a business

exhibition held in India

(d) Services by a foreign diplomatic mission located in India

36. ITC of motor vehicles used for making is allowed.

(i) Transportation of goods

(ii) Taxable supplies of transportation of passengers

(iii) Taxable supplies of imparting training on driving

(a) (i)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 143

37. A non-resident taxable person is required to apply for registration:

(a) within 30 days from the date on which he becomes liable to

registration

(b) within 60 days from the date on which he becomes liable to

registration

(c) at least 5 days prior to the commencement of business

(d) within 180 days from the date on which he becomes liable to

registration

38. Registration certificate granted to casual taxable person or non-resident

taxable person will be valid for:

(a) Period specified in the registration application

(b) 90 days from the effective date of registration

(c) Earlier of (a) or (b)

(d) Later of (a) or (b)

39. In case of taxable supply of services by a non-banking financial company

(NBFC) to, other than a distinct person, invoice shall be issued within a

period of from the date of supply of service.

(a) 30 days

(b) 45 days

(c) 60 days

(d) 90 days

40. Where the goods being sent or taken on approval for sale or return are

removed before the supply takes place, the invoice shall be issued:

(a) before/at the time of supply

(b) 6 months from the date of removal

(c) Earlier of (a) or (b)

(d) Later of (a) or (b)

© The Institute of Chartered Accountants of India

144 INDIRECT TAXES

41. Invoice shall be prepared in ___________ in case of taxable supply of

goods and in _____________ in case of taxable supply of services.

(a) Triplicate, Duplicate

(b) Duplicate, Triplicate

(c) Duplicate, Duplicate

(d) Triplicate, Triplicate

42. Which of the following shall be discharged first, while discharging

liability of a taxable person?

(a) All dues related to previous tax period

(b) All dues related to current tax period

(c) Demand raised under section 73 and 74

(d) No such condition is mandatory.

43. The due date of filing Final Return is .

(a) 20th of the next month

(b) 18th of the month succeeding the quarter

(c) within 3 months of the date of cancellation or date of order of

cancellation, whichever is later

(d) 31st December of next financial year

44. Which of the following statements is true under GST law?

(a) Grand-parents are never considered as related persons to their

grand-son/grand-daughter

(b) Grand-parents are always considered as related persons to their

grand-son/grand-daughter

(c) Grand-parents are considered as related persons to their grand-

son/grand-daughter only if they are wholly dependent on their

grand-son/grand-daughter

(d) Grand-parents are considered as related persons to their grand-

son/grand-daughter only if they are not dependent on their

grand-son/grand-daughter

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 145

45. Alcoholic liquor for human consumption is subjected to

(a) State excise duty

(b) Central Sales Tax/Value Added Tax

(c) Both (a) and (b)

(d) GST

46. Input tax credit shall not be available in respect of:

(i) Goods used for personal consumption

(ii) Membership of a club provided by the employer to its employees

as per company’s internal policy.

(iii) Travel benefits extended to employees on vacation such as leave

or home travel concession as per company’s internal policy.

(a) (i)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

47. Which of the following is not considered as ‘goods’ under the CGST Act,

2017?

(i) Ten-paisa coin having sale value of ` 100.

(ii) Shares of unlisted company

(iii) Lottery tickets

(a) (i)

(b) (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

48. Mr Ram, a jeweller registered under GST in Mumbai, wants to sell his

jewellery in a Trade Expo held in Delhi. Which of the following

statements is false in his case?

(a) He needs to get registration in Delhi as casual taxable person.

© The Institute of Chartered Accountants of India

146 INDIRECT TAXES

(b) He needs to pay advance tax on estimated tax liability.

(c) He needs to mandatorily have a place of business in Delhi.

(d) He needs to file GSTR-1/ IFF and GSTR-3B for Delhi GSTIN for

the month or quarter, as the case may be, when he gets

registered in Delhi.

49. Which of the following is treated as exempt supply under the CGST Act,

2017?

(i) Sale of liquor

(ii) Supply of health care services by a hospital

(iii) Transmission of electricity by an electricity transmission utility

(a) (i)

(b) (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

50. Which of the following is a recognised system of medicine for the

purpose of exemption for health care services?

(i) Allopathy

(ii) Unani

(iii) Siddha

(a) (i)

(b) (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

51. Which of the following services is exempt under health care services

provided by clinical establishments?

(a) Chemist shop in the hospital selling medicines to public at large.

(b) Food supplied by canteen run by the Hospital to in-patients as

per diet prescribed by the hospital’s dietician.

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 147

(c) Food supplied to the visitors or attendants of the patients in the

hospital by canteen run by the Hospital.

(d) Advertisement services provided by the hospital to a

pharmaceutical company for their asthma pump by displaying it

prominently in the hospital building

52. In case of supply of goods for ` 5,00,000, following information is

provided-

Advance received on 1st April

Invoice issued on 15th April

Goods removed on 25th April

What is the time of supply of goods, where tax is payable under forward

charge?

(a) 1st April

(b) 15th April

(c) 25th April

(d) 30th April

53. Sham Ltd., located in Mumbai, is receiving legal services from a lawyer

Mr. Gyan, registered under GST. The aggregate turnover of Sham Ltd.

in the preceding financial year is ` 42 lakh. The information regarding

date of payment, invoice etc. is as follows-

Invoice issued by Mr. Gyan on 15th April

Payment debited in the bank account of Sham Ltd. on 5th May

Date of payment entered in books of accounts of Sham Ltd.: 1st May

What is time of supply of services?

(a) 1st May

(b) 5th May

(c) 15th June

(d) 15th April

© The Institute of Chartered Accountants of India

148 INDIRECT TAXES

54. Which of the following is not eligible for opting composition scheme

under sub-sections (1) and (2) of section 10 of the CGST Act, 2017?

(a) M/s ABC, a firm selling garments solely in Ahmedabad, having

aggregate turnover of ` 78 lakh in the preceding F.Y.

(b) A start up company exclusively operating a restaurant in Delhi,

having aggregate turnover of ` 98 lakh in the preceding F.Y.

(c) A courier service company operating solely in Mumbai having

aggregate turnover of ` 90 lakh in the preceding F.Y.

(d) A trader selling grocery items solely in Orissa having an

aggregate turnover of ` 95 lakh in the preceding F.Y.

55. Assuming that all the activities given below are undertaken for a

consideration, state which of the following is not a supply of service ?

(a) Renting of commercial office complex

(b) An employee agreeing to not work for the competitor

organization after leaving the current employment

(c) Repairing of mobile phone

(d) Provision of services by an employee to the employer in the

course of employment

56. During the month of May, Z Ltd. sold goods to Y Ltd. for ` 2,55,000 and

charged GST @ 18%. However, owing to some defect in the goods, Y

Ltd. returned some of the goods by issuing debit note of

` 40,000 in the same month. Z Ltd. records the return of goods by

issuing a credit note of ` 40,000 plus GST in the same month. In this

situation, GST liability of Z Ltd. for the month of May will be-

(a) ` 45,900

(b) ` 38,700

(c) ` 53,100

(d) ` 40,000

57. Goods as per section 2(52) of the CGST Act, 2017 includes:

(i) Actionable claims

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 149

(ii) Growing crops attached to the land agreed to be severed before

supply.

(iii) Money

(iv) Securities

(a) (i) and (iii)

(b) (iii) and (iv)

(c) (i) and (ii)

(d) (ii) and (iii)

58. Which of the following statements is/are incorrect under GST law:-

(i) If the supplier has erroneously declared a value which is more

than the actual value of goods or services provided, then he can

issue credit note for the same.

(ii) If the supplier declared some special discount which is offered

after the supply is over, then he cannot issue credit note under

GST law for the discount offer.

(iii) If quantity received by the recipient is more than what has been

declared in the tax invoice, then supplier can issue debit note for

the same.

(iv) There is no time limit to declare the details of debit note in the

return.

(a) (i),(ii) and (iv)

(b) (i) and (iv)

(c) (iv)

(d) (i) and (iii)

59. ABC Ltd. generated e-way bill on 12th February at 14.00 hrs. It

transported over-dimensional cargo for a distance of 100 km. The

validity period of the e-way bill will expire on ________ if there is no

extension of the same.

(a) Midnight of 13 th-14th February

© The Institute of Chartered Accountants of India

150 INDIRECT TAXES

(b) Midnight of 17th-18th February

(c) At 14.00 hrs. of 13th February

(d) At 14.00 hrs. of 14th February

60. Ram, an individual, based in Gujarat, is in employment and earning

` 10 lakh as salary. He is also providing intra-State consultancy services

to different organizations on growth and expansion of business. His

turnover from the supply of such services is ` 12 lakh. Determine

whether Ram is liable for taking registration as per provisions of the

Act?

(a) Yes, as his aggregate turnover is more than ` 20 lakh.

(b) No, as his aggregate turnover is less than ` 40 lakh.

(c) No, as services in the course of employment does not constitute

supply and therefore, aggregate turnover is less than ` 20 lakh.

(d) Yes, since he is engaged in taxable supply of services.

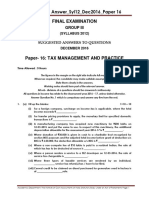

Answer keys

Question Answer

No.

1 (b) ` 75 lakh

2 (d) irrespective of the amount of aggregate turnover in

a financial year since he is making inter-State supply

of taxable goods.

3 (d) (i), (ii) and (iii)

4 (d) (i), (ii) and (iii)

5 (c) ` 150

6 (a) Basic customs duty levied under Customs Act, 1962

7 (a) (i) & (ii)

8 (c) (ii) & (iii)

9 (d) Mr. X has to compulsorily get registered under

GST irrespective of the threshold limit.

10 (c) 90

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 151

11 (d) (iii) & (iv)

12 (a) output tax

13 (d) Aggregate value of all taxable supplies (excluding

the value of inward supplies on which tax is payable

by a person on reverse charge basis), exempt

supplies, export of goods/services and inter-State

supplies of a person having same PAN computed on

all India basis and excluding taxes if any charged

under CGST Act, SGST Act and IGST Act.

14 (b) Within 30 days from the date he becomes liable for

registration.

15 (d) required to file Final Return on or before 14 th

December

16 (b) Either (i), (ii) or (iii)

17 (c) Valid till it is cancelled

18 (d) Within 30 days from the date of service of the

cancellation order.

19 (d) No

20 (a) (i)

21 (c) Both (a) and (b)

22 (d) (i), (ii) and (iii)

23 (d) Services by an artist by way of a performance in

folk or classical art forms of music/ dance / theatre

with consideration thereof not exceeding ` 1.5

lakh.

24 (d) Recognised sporting event where the admission

ticket costs ` 600 per person.

25 (d) (i), (ii) and (iii)

26 (a) (i) and (ii)

27 (b) ITC can be availed upon receipt of last lot.

28 (c) Banking company can choose to exercise either

option (a) or option (b)

29 (b) not avail ITC on the said tax component

© The Institute of Chartered Accountants of India

152 INDIRECT TAXES

30 (a) i, ii, iii and iv

31 (a) i, iii and iv

32 (d) A person supplying service of repairing of electronic

items

33 (d) Earlier of (a), (b) and (c)

34 (d) Service of renting of motor vehicle for passengers

provided to a recipient other than body corporate.

35 (d) Services by a foreign diplomatic mission located in

India

36 (d) (i), (ii) and (iii)

37 (c) at least 5 days prior to the commencement of

business

38 (c) Earlier of (a) or (b)

39 (b) 45 days

40 (c) Earlier of (a) or (b)

41 (a) Triplicate, Duplicate

42 (a) All dues related to previous tax period

43 (c) within 3 months of the date of cancellation or date

of order of cancellation, whichever is later

44 (c) Grand-parents are considered as related persons to

their grand-son/grand-daughter only if they are

wholly dependent on their grand-son/grand-

daughter

45 (c) Both (a) and (b)

46 (d) (i), (ii) and (iii)

47 (b) (ii)

48 (c) He needs to mandatorily have a place of business in

Delhi.

49 (d) (i), (ii) and (iii)

50 (d) (i), (ii) and (iii)

51 (b) Food supplied by canteen run by the Hospital to in-

patients as per diet prescribed by the hospital’s

dietician.

© The Institute of Chartered Accountants of India

MCQs & CASE SCENARIOS 153

52 (b) 15th April

53 (a) 1st May

54 (c) A courier service company operating solely in

Mumbai having aggregate turnover of ` 90 lakh in

the preceding F.Y.

55 (d) Provision of services by an employee to the

employer in the course of employment

56 (b) ` 38,700

57 (c) (i) and (ii)

58 (c) (iv)

59 (b) Midnight of 17th-18th February

60 (c) No, as services in the course of employment does

not constitute supply and therefore, aggregate

turnover is less than ` 20 lakh.

© The Institute of Chartered Accountants of India

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Full Syllabus GST Test - 1 Without AnswersDocument19 pagesFull Syllabus GST Test - 1 Without Answersrajbhanushali3981No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Tax MCQ 5Document17 pagesTax MCQ 5siddhant.gupta.delhiNo ratings yet

- GST MCQ 1Document7 pagesGST MCQ 1avinashNo ratings yet

- 23 Tax JuneDocument16 pages23 Tax JunemistryankusNo ratings yet

- IcstDocument5 pagesIcstMukeshbhai ShahNo ratings yet

- CS EXECUTIVE GST MOCK TEST PAPER 6 WITH ANSWER by CA VIVEK GABA PDFDocument5 pagesCS EXECUTIVE GST MOCK TEST PAPER 6 WITH ANSWER by CA VIVEK GABA PDFRadhika ChopraNo ratings yet

- Intermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)Document12 pagesIntermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)AnjaliNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- Paper7 Set2 AnsDocument21 pagesPaper7 Set2 Ansmonukroy1234No ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- Mock Test Cma June 20 Set 2 PDFDocument7 pagesMock Test Cma June 20 Set 2 PDFamit jangraNo ratings yet

- Paper 18Document5 pagesPaper 18VijayaNo ratings yet

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Document21 pagesPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNo ratings yet

- Set 17 WADocument18 pagesSet 17 WAIS WING APNo ratings yet

- MCQs of GST Book 1Document136 pagesMCQs of GST Book 1AnjuRoseNo ratings yet

- CS Tax Question CsDocument16 pagesCS Tax Question Csgopika mundraNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationvijaykumartaxNo ratings yet

- GSTDocument13 pagesGSTpriyababu4701No ratings yet

- 1idt PDFDocument19 pages1idt PDFShantanuNo ratings yet

- CA Final IDT RTP For May 2023Document19 pagesCA Final IDT RTP For May 2023Nick VincikNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationDocument6 pagesMTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationvijaykumartaxNo ratings yet

- MCQ's IDTDocument45 pagesMCQ's IDTangadsharmaNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- Paper7 Set1Document9 pagesPaper7 Set1meswetashaw96No ratings yet

- Multiple Choice QuestionsDocument25 pagesMultiple Choice Questionsqwerty qwertNo ratings yet

- MCQ On TDS, TCS & Advance TaxDocument15 pagesMCQ On TDS, TCS & Advance TaxPrakhar GuptaNo ratings yet

- GST PRACTICE SETs - SET 7 (9th Edition)Document6 pagesGST PRACTICE SETs - SET 7 (9th Edition)Ismail RizwanNo ratings yet

- Paper11 Set1Document8 pagesPaper11 Set1mvsvvksNo ratings yet

- Paper7 Set2Document7 pagesPaper7 Set2ashrant69No ratings yet

- Itctp 2022Document4 pagesItctp 2022Muskaan ShawNo ratings yet

- Chapter 4Document26 pagesChapter 4Kritika JainNo ratings yet

- TYBCom-Sem-VI-Indirect Taxes-GST MCQsDocument10 pagesTYBCom-Sem-VI-Indirect Taxes-GST MCQsMâyúř PäťîĺNo ratings yet

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument15 pagesIntermediate Examination: Suggested Answers To QuestionsSairaj MudhirajNo ratings yet

- Final Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDocument13 pagesFinal Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDiwakar GiriNo ratings yet

- Paper7 Set2 SolutionDocument17 pagesPaper7 Set2 SolutionMayuri KolheNo ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument5 pages© The Institute of Chartered Accountants of IndiaRahul ToshanNo ratings yet

- GST PRACTICE SET - 6th EDITION - SET JDocument6 pagesGST PRACTICE SET - 6th EDITION - SET JGANESH KUNJAPPA POOJARINo ratings yet

- 52593bos42131 Finalold p8Document13 pages52593bos42131 Finalold p8Rakesh MauryaNo ratings yet

- Sy Idt Obj U-3&4Document16 pagesSy Idt Obj U-3&4SNEH MEHTANo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument18 pagesIntermediate Examination: Suggested Answers To QuestionsSannu VijayeendraNo ratings yet

- P11 QpmaDocument7 pagesP11 QpmaRehan RahmanNo ratings yet

- P16 - Syl2012 CostDocument16 pagesP16 - Syl2012 CostheerunheroNo ratings yet

- Indirect Tax-Sample QuestionDocument8 pagesIndirect Tax-Sample Questionantonyashin007No ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument20 pagesIntermediate Examination: Suggested Answers To QuestionsVVR &CoNo ratings yet

- Paper7 Syl22 Dec23 Set1Document6 pagesPaper7 Syl22 Dec23 Set1rishabhrai676No ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- Taxation - DPP 9.1 - (CDS - 2 Viraat 2023)Document4 pagesTaxation - DPP 9.1 - (CDS - 2 Viraat 2023)tanwar9780No ratings yet

- Paper 7 CmaDocument16 pagesPaper 7 CmaRama KrishnaNo ratings yet

- Exemptions From GSTDocument7 pagesExemptions From GSTpujitha vegesnaNo ratings yet

- 58794bos47893finalnew p8 PDFDocument21 pages58794bos47893finalnew p8 PDFANIL JARWALNo ratings yet

- Inu 2216 Idt - Question PaperDocument5 pagesInu 2216 Idt - Question PaperVinil JainNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAida AmalNo ratings yet

- Charge of GSTDocument4 pagesCharge of GSTpujitha vegesnaNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument13 pagesIntermediate Examination: Suggested Answers To QuestionsmistryankusNo ratings yet

- Cma RTP Dec 18Document34 pagesCma RTP Dec 18amit jangraNo ratings yet

- SJ Shikha Jaiswal: Shikha Jaiswal M 302 Monsoon Breeze Sector 78, Gurgaon Near Rampura Chowk Gurgaon, Haryana, 122051Document8 pagesSJ Shikha Jaiswal: Shikha Jaiswal M 302 Monsoon Breeze Sector 78, Gurgaon Near Rampura Chowk Gurgaon, Haryana, 122051Saini HarikeshNo ratings yet

- IT CertificateDocument2 pagesIT CertificatePrashant TiwariNo ratings yet

- Gasbill 6191371000 202310 20231102185048Document1 pageGasbill 6191371000 202310 20231102185048kamran.mhrbprNo ratings yet

- CIR Vs Isabela Cultural Corporation (ICC)Document11 pagesCIR Vs Isabela Cultural Corporation (ICC)Victor LimNo ratings yet

- Ola - Tata Station To Adityapur - 110320Document3 pagesOla - Tata Station To Adityapur - 110320Bhanu Pratap ChoudhuryNo ratings yet

- Xiaomi Pad 6 DetailsDocument2 pagesXiaomi Pad 6 DetailswattefunNo ratings yet

- Filipinas Life Assurance Company v. Court of Tax Appeals GR No. L-21258Document27 pagesFilipinas Life Assurance Company v. Court of Tax Appeals GR No. L-21258rowela jane paanoNo ratings yet

- Ordinance Resolution 2024Document2 pagesOrdinance Resolution 2024Weng KayNo ratings yet

- 272 M S Q MDocument2 pages272 M S Q MAdnan AzizNo ratings yet

- VAT Syllabus - BaniquedDocument5 pagesVAT Syllabus - BaniquedJN CENo ratings yet

- OFAAL Application Form 2024Document1 pageOFAAL Application Form 2024sinnathambysharon11No ratings yet

- 2017-18 Tax Case DigestDocument2 pages2017-18 Tax Case DigestRay Marvin Anor Palma100% (1)

- Certification: Cupido Gerry D. AsuncionDocument26 pagesCertification: Cupido Gerry D. AsuncionMark Anthony De GuzmanNo ratings yet

- TAX Lecture 0 - Exam TechniqueDocument12 pagesTAX Lecture 0 - Exam TechniqueHuma BashirNo ratings yet

- AssignmentDocument5 pagesAssignmentkannadhassNo ratings yet

- Nilson Pos ReportDocument11 pagesNilson Pos ReportNaila AzizNo ratings yet

- KQTT455449KQDocument1 pageKQTT455449KQVirat PandeyNo ratings yet

- Indian Oil Corporation - Bitumen PricesDocument10 pagesIndian Oil Corporation - Bitumen PricesSanjib Mazumder69% (39)

- Checks Issued by The City of Boise Idaho - 4Document52 pagesChecks Issued by The City of Boise Idaho - 4Mark ReinhardtNo ratings yet

- Lbhyd00002731694 IciciDocument1 pageLbhyd00002731694 IciciSurya GoudNo ratings yet

- gst523 1 Fill 15eDocument3 pagesgst523 1 Fill 15eJeff MNo ratings yet

- BIDC Registration Form 2011 p1Document1 pageBIDC Registration Form 2011 p1andre_duvenhageNo ratings yet

- Yes Bank2Document8 pagesYes Bank2Hafidz MozillaNo ratings yet

- MCQ Donorx27s TaxesDocument6 pagesMCQ Donorx27s TaxesMary Joyce GarciaNo ratings yet

- TATA 1MG Healthcare Solutions Private LimitedDocument1 pageTATA 1MG Healthcare Solutions Private LimitedAmish JhaNo ratings yet

- AdvanceDocument32 pagesAdvancemuse tamiruNo ratings yet

- Group-I and Group-II Categories For PG StudentsDocument12 pagesGroup-I and Group-II Categories For PG Studentsjefeena saliNo ratings yet

- Summary Philippine Income Tax FormulaDocument25 pagesSummary Philippine Income Tax FormulaDonvidachiye Liwag CenaNo ratings yet

- Orient Cables (India) Pvt. LTD: Party DetailsDocument1 pageOrient Cables (India) Pvt. LTD: Party DetailsShashank SaxenaNo ratings yet

- Basic Concepts of VATDocument20 pagesBasic Concepts of VATspchheda4996No ratings yet

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (89)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouFrom EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouRating: 4 out of 5 stars4/5 (2)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestFrom EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestRating: 5 out of 5 stars5/5 (1)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherFrom EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherRating: 5 out of 5 stars5/5 (14)

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomFrom EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomRating: 4.5 out of 5 stars4.5/5 (2)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitFrom EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNo ratings yet

- Buy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeFrom EverandBuy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeNo ratings yet

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- The Ultimate 7 Day Financial Fitness ChallengeFrom EverandThe Ultimate 7 Day Financial Fitness ChallengeRating: 5 out of 5 stars5/5 (1)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)