Professional Documents

Culture Documents

ADVANCED ACADEM9 BK Avi

Uploaded by

Advanced Academy0 ratings0% found this document useful (0 votes)

15 views2 pagesOriginal Title

ADVANCED ACADEM9 bk avi

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesADVANCED ACADEM9 BK Avi

Uploaded by

Advanced AcademyCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

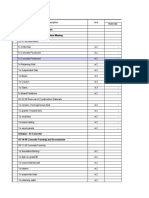

ADVANCED ACADEMY 3.

Old ratio – New ratio = ____

4. The Partner who died.

Date : 25/01/23 BK Marks:80 5. Money value of business reputation earned by the firm over a number of years.

STD : 12 Comth

Time:1:15Hrs 6. Debit balance of Revaluation Account

Q.1. BK Objectives 7. A Person who represents the deceased partner on the death of the Partner.

A. Select the correct option and rewrite the sentence : (10m) 8. Excess of credit side over debit side of profit and loss adjustment account.

1. A _____ is an Intangible Asset . 9. An account opened to find out the Profit or Loss on realisation of Assets and

a. Goodwill b. stock c. Cash d. Furniture settlement of Liabilities.

2. Not for Profit Concern renders ______ services to public at large . 10. The part of subscribed capital which is not called-up by the company.

a. Commercial b. Social c. Individual d. Group C. State true or false: (7M)

3. Anuj and Eeshan are two partners sharing profits and losses in the ratio of 3 :2 , 1. Adjustments are recorded in Partners Current Account in Fixed Capital Method.

They decided to admit Aaroh for 1/5 th share , the new profit sharing ratio will be 2. Super profit method , Valuation method , Average profit method , Fluctuating

________. capital method

a. 12 : 8.5 b. 4 : 3 :1 c. 12 : 8 :1 d. 12 : 3 : 1 3. A bill of exchange must be presented to the acceptor on the due date.

4. When goodwill is withdrawn by the partners , ______ account is credited. 4. Sweat shares are issued to public .

a. Revaluation b. Cash / Bank c. Current d. Profit and Loss 5. The Authorised capital is also known as Normal Capital .

Adjustment 6. Retiring partners share in Profit up to the date of his retirement will be debited

5. New Ratio = Old Ratio + ______ ratio . to Profit and Loss Suspense Account

a. Gain b. Capital c. Sacrifice d. Current 7 . After the death of partner, entire amount due to deceased partner is paid to

6. Profit and Loss Suspense Account is shown in the new Balance Sheet on ____ legal representative of the deceased partner.

side. D. Find the odd one : (8M)

a. Debit b. Credit c. Asset d. Liabilities 1. Capital , Bills Receivable , Reserve Fund , Bank overdraft

7. If asset is taken over by the partner .......................account is debited. 2. Machinery , Furniture , Computers , Salaries.

(a) Revaluation (b) Capital (c) Asset (d) Balance Sheet 3. Surplus, Deficit , Net Profit , Capital fund .

8. Decrease in the value of assets should be ................. to Profit and Loss 4. Notary Public , Drawer , Drawee , Payee

Adjustment Account. 5. General reserve, Creditors, Machinery, Capital

a) Debited b) Credited c) Added d) Equal 6. Retaining , Noting , Discounting , Endorsing

9. The balance of the capital account of retired partner is transferred to 7. Trade bill ,Accommodation bill , After date bill ,Demand bill.

his ................. account if it is not paid. 8. Discounting charges , Rebate , Bank charges , Noting charges

a) Loan b) Personal c) Current d) Son’s 9. Stamp , Acceptance ,Draft , Amount.

10. Decrease in Furniture, Patents written off, Increase in Bills Payable, RDD

10. Death is a compulsory ..............................

written off

a) Dissolution b) Admission c) Retirement d) Winding up E. Complete the sentence : (8M)

1. Partners share profit and losses in _____ ratio in the absence of partnership

B. Give one word / Phrase / term : (10M) deed.

1. Act under which partnership firms are regulated. 2. Not for Profit organisation is called _____ organisation .

2. The Credit balance of Income and Expenditure Account .

Total Profit 9. Insolvent partners capital A/c Debit side is Rs.15,000 & insolvent partner

3. _________ =

Number of years brought cash Rs 6,000. Calculate the amount of Insolvency Loss to be distributed

NRR among the solvent partners.

4. Normal Profit = _________ x 10. When the issued price of share is Rs.12 and face value is Rs.10, the share is

100

5. Revaluation A /c is also know as _____ account . said to be issued at premium.

6. Benefit ratio = New Ratio - _____ . H. Give Specimen of Bill of Exchange : (15M)

7.A bill whose due date is calculated from the date of acceptance is known 1. From the following details prepare a format of bill of exchange.

as ..................... 1. Drawer : Mr. Mukund Desai, No.14, Heritage Heights, Nagpur.

8. Person whose liabilities are more than his assets and is not in position to pay 2. Drawee : Mr. Yogesh Tilak, Narayan Peth, Pune.

off his liabilities is .................. . 3. Amount Rs.30,000.

F. Do you agree or disagree with the following statements : (8M) 4. Tenure or term :90 days

1. It is compulsory to have a partnership agreement in writing . 5. Date of Bill : 16th July, 2019.

2. Gross profit is an operation profit. 6. Date of acceptance : 20th July, 2019.

3.Usually current ratio should be 3 :1 7. Payee : Shravan Dave, Panvel.

4. Current Ratio measures the liquidity of the business.

5. In Tally , F6 funcation key is for payment voucher . 2. Prepare a format bill of exchange from the following details. Mr. Amol Sane,

6. Salary Account comes under indirect expenses. 42, Gangadham, M. G. Road, Ratnagiri draws a 45 days bill on Mrs. Sagarika

7. In case of bill drawn payable ‘on demand’ no grace days are allowed. Mane, 345, Kumthekar Road, Pune, for ` 18,750 on 1st March, 2020 which was

8. Renewal is request by Drawee to extend the credit period of the bill. accepted on 4th March, 2020 for ` 15,000 only, by Mrs. Sagarika Mane.

9. A bill before acceptance is called Promissory Note.

10. Public limited company can issue its share without issuing its prospectus. 3. Prepare a format of bill of exchange from the following details.

G. Calculate the following : (8M) 1. Drawer : Kedar Pandit, 22/1, Kalpataru Estate, Pirangut, Pune.

1. Insurance Premium paid for the year ending 1 st September , 2019 amounted to 2. Drawee : Gauri Mulay, Vashi, Navi Mumbai.

Rs. 1,500. Calculate prepaid insurance assuming that the year ending is 31 st March 3. Date of Bill : 14th August, 2019.

,2019. 4. Date of acceptance : 17th August, 2019.

2. 10% p.a. Depreciation on Furniture Rs.50,000 (for three months ) 5. Amount ` 38,740

3. Library Book Rs ______ ? Less 10 % Depreciation Rs 5,000 = Rs 45,000 I . Complete the following : (6M)

4. Ganesh draws a bill for Rs 40,260 on 15 th Jan . 2020 for 50 days . He discounted 1. When face value of the share is Rs.100 and issued price is `120, then it is said

the bill with Bank of India @ 15 % p.a. on the same day. Calculate the amount of that the shares are issued at ...................... .

discount. 2. ...................... Capital is the part of issued capital which is subscribed by the

5. 10,000 equity shares of Rs 10 each issued at 10% premium . Calculate the total public.

amount of share premium . 3. ...................... share holders get fixed rate of dividend.

6. Anika and Radhika are partners sharing profits in the ratio of 5:1. They decide 4. ...................... share holders are the real owners of the company

to admit Sanika in the firm for 1/5th share. calculate the sacrifice ratio of Anika 5. The difference between Called-up Capital and Paid-up Capital is known as __

and Radhika

7. Pramod and Vinod are partners sharing profits and losses in the ratio 3:2. After 6. ...................... Capital is the Capital which a company is authorised to issue by

admission of Ramesh the new ratio of Pramod, Vinod and Ramesh is 4:3:2. Find its Memorandum of Association.

out the sacrifice ratio.

8. Insolvent Partners Capital A/c debit side total is Rs 10,000 & Credit side total is

Rs.6,000 Calculate deficiency

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Banking Finance Tax Test SK2019 - 1Document4 pagesBanking Finance Tax Test SK2019 - 1Vishwas JNo ratings yet

- HSC Accounts Model Question Paper For Board ExamDocument6 pagesHSC Accounts Model Question Paper For Board ExamAMIN BUHARI ABDUL KHADERNo ratings yet

- Sebenta Inglês AplicadoDocument30 pagesSebenta Inglês AplicadoJoana PimentelNo ratings yet

- S Y J C Accounts Model Question Paper For Board Exam No 4 2009 - 2010Document6 pagesS Y J C Accounts Model Question Paper For Board Exam No 4 2009 - 2010AMIN BUHARI ABDUL KHADER100% (1)

- Xii Mcqs CH - 8 Dissolution of Partnership FirmDocument4 pagesXii Mcqs CH - 8 Dissolution of Partnership FirmJoanna GarciaNo ratings yet

- Intermediate Acctg 1 - Receivables2Document3 pagesIntermediate Acctg 1 - Receivables2GraceNo ratings yet

- TEST YOUR BUSINESS ENGLISH: ACCOUNTING - Part OneDocument2 pagesTEST YOUR BUSINESS ENGLISH: ACCOUNTING - Part Onenorica_feliciaNo ratings yet

- HSC Accounts Model Question Paper For Board ExamDocument7 pagesHSC Accounts Model Question Paper For Board ExamAMIN BUHARI ABDUL KHADER100% (2)

- F Acadl 01Document12 pagesF Acadl 01Illion IllionNo ratings yet

- Quiz 4 Types of Major Accounts Without AnswerDocument5 pagesQuiz 4 Types of Major Accounts Without AnswerHello KittyNo ratings yet

- Assignment No. 2 PDFDocument3 pagesAssignment No. 2 PDFHarvey MarquezNo ratings yet

- Weekly Test of Accounts 2Document4 pagesWeekly Test of Accounts 2AMIN BUHARI ABDUL KHADERNo ratings yet

- ACCT105 Accounting For Non Accounting MajorsDocument31 pagesACCT105 Accounting For Non Accounting MajorsG JhaNo ratings yet

- Model Accounts Question PaperDocument4 pagesModel Accounts Question PaperAMIN BUHARI ABDUL KHADERNo ratings yet

- Revision - Final Test. 1. Types of BusinessesDocument4 pagesRevision - Final Test. 1. Types of BusinessesAnna Musińska100% (1)

- Aklan State University School of Management Sciences Banga, Aklan Final Examination in BEC 1/ BCC 2 Name: Course: DateDocument4 pagesAklan State University School of Management Sciences Banga, Aklan Final Examination in BEC 1/ BCC 2 Name: Course: DateArjay Datoon VillanuevaNo ratings yet

- nullDocument2 pagesnullAymen GaouasNo ratings yet

- CH 8Document1 pageCH 8Binat SanghaniNo ratings yet

- Acconts Preliminary Paper 2Document4 pagesAcconts Preliminary Paper 2AMIN BUHARI ABDUL KHADERNo ratings yet

- 3 - Activities For ULO 7, 8, 9, 10 & 11Document8 pages3 - Activities For ULO 7, 8, 9, 10 & 11RJ 1No ratings yet

- Acc. P 2 2021 RevisionDocument8 pagesAcc. P 2 2021 RevisionSowda AhmedNo ratings yet

- Assessment in Acc204Document2 pagesAssessment in Acc204Quincy Lawrence DimaanoNo ratings yet

- Final Exam - FA2 (Shareholders Equity) With QuestionsDocument10 pagesFinal Exam - FA2 (Shareholders Equity) With Questionsjanus lopezNo ratings yet

- ACCTG. 101 End - Term ExaminationDocument9 pagesACCTG. 101 End - Term ExaminationZAIL JEFF ALDEA DALENo ratings yet

- Third - Quarter Sum. Exam in Business FinanceDocument3 pagesThird - Quarter Sum. Exam in Business FinanceRaul Soriano Cabanting75% (4)

- Fundamental of ABM1Document4 pagesFundamental of ABM1Raul Soriano Cabanting100% (1)

- University of Cebu Accounting 2 Prelim ExamDocument3 pagesUniversity of Cebu Accounting 2 Prelim ExamJM Singco Canoy100% (1)

- Corporate Law MCQsDocument33 pagesCorporate Law MCQsSalman AliNo ratings yet

- ED213 - INDIVIDUAL PROJECT - Student Completed AnswerDocument6 pagesED213 - INDIVIDUAL PROJECT - Student Completed AnswerAfifi Iskandar MohamadNo ratings yet

- Class 12 Term 1 AccountancyDocument7 pagesClass 12 Term 1 AccountancyTûshar ThakúrNo ratings yet

- General Instructions: Read Carefully All The Instructions. Write All Your Answers in CAPITAL LETTERS OnlyDocument2 pagesGeneral Instructions: Read Carefully All The Instructions. Write All Your Answers in CAPITAL LETTERS OnlyRegine BaterisnaNo ratings yet

- QP Xii Accs PB 1Document7 pagesQP Xii Accs PB 1ansabroxx02No ratings yet

- Accounts 1Document4 pagesAccounts 1AMIN BUHARI ABDUL KHADERNo ratings yet

- Paper2 SolutionDocument10 pagesPaper2 Solutionadityatiwari122006No ratings yet

- Chap 01 - Introduction To Financial Statements (ICA)Document8 pagesChap 01 - Introduction To Financial Statements (ICA)Wayne Andrea TualaNo ratings yet

- Philippine High School Financial ReportDocument5 pagesPhilippine High School Financial ReportMitchelle DumlaoNo ratings yet

- Answer Key Summative Exam 1 & 2 Business FinanceDocument5 pagesAnswer Key Summative Exam 1 & 2 Business Financejelay agresorNo ratings yet

- Chapter 8 Liabilities Exercises T3AY2021Document6 pagesChapter 8 Liabilities Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- EconoDocument4 pagesEcononguyen an quynhNo ratings yet

- Ae 13 Midterm ExamDocument2 pagesAe 13 Midterm ExamRizz Aigel OrillosNo ratings yet

- Types of Major Accounts QuizDocument6 pagesTypes of Major Accounts Quizbbrightvc 一ไบร์ทNo ratings yet

- 3rd LONG TEST IN ENTREPDocument2 pages3rd LONG TEST IN ENTREPRedchest Manalang - YumolNo ratings yet

- Midterm - Advance Accounting 1Document6 pagesMidterm - Advance Accounting 1randyblanza2014No ratings yet

- Business FinanceDocument3 pagesBusiness FinanceRaul Soriano Cabanting100% (2)

- Business Finance - Final ExamDocument3 pagesBusiness Finance - Final ExamRain VicenteNo ratings yet

- Business Finance 1st Quarter Examination 22-23Document3 pagesBusiness Finance 1st Quarter Examination 22-23Phegiel Honculada MagamayNo ratings yet

- ShareDocument20 pagesShareSaroj MeherNo ratings yet

- Quiz 1 20.06.17 Q& ADocument11 pagesQuiz 1 20.06.17 Q& ADeependra NigamNo ratings yet

- Question Bank of Financial and Management Accounting - 2 MarkDocument28 pagesQuestion Bank of Financial and Management Accounting - 2 MarklakkuMS100% (1)

- Chapter 19 Accounting and Financial StatementsDocument6 pagesChapter 19 Accounting and Financial Statementssekeresova.nikolaNo ratings yet

- Mileydis Pérez - Performance Test Part IDocument7 pagesMileydis Pérez - Performance Test Part ILeisy M. SolísNo ratings yet

- Quiz 4 - Accounts Receivable & Notes ReceivableDocument4 pagesQuiz 4 - Accounts Receivable & Notes ReceivableCaila Nicole ReyesNo ratings yet

- PartnershipDocument5 pagesPartnershipjohnNo ratings yet

- 2nd Quarter Final Exam Oct. 2019Document3 pages2nd Quarter Final Exam Oct. 2019awdasdNo ratings yet

- 23 PartnershiptheoryDocument10 pages23 PartnershiptheorySanjeev MiglaniNo ratings yet

- Chapter 10 Objective QuestionsDocument7 pagesChapter 10 Objective QuestionsjhouvanNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Alcohol Phenol Ether OldDocument1 pageAlcohol Phenol Ether OldAdvanced AcademyNo ratings yet

- 12 C BK Mock Board PraveenaDocument4 pages12 C BK Mock Board PraveenaAdvanced AcademyNo ratings yet

- 9th Sci ..CHP No 16.. 27-01-23Document1 page9th Sci ..CHP No 16.. 27-01-23Advanced AcademyNo ratings yet

- LogarithmicTables 11009163Document160 pagesLogarithmicTables 11009163Vijay HuseNo ratings yet

- Batt ChargerDocument2 pagesBatt Chargerdjoko witjaksonoNo ratings yet

- M.Com Second Semester – Advanced Cost Accounting MCQDocument11 pagesM.Com Second Semester – Advanced Cost Accounting MCQSagar BangreNo ratings yet

- Armv8-A Instruction Set ArchitectureDocument39 pagesArmv8-A Instruction Set ArchitectureraygarnerNo ratings yet

- Basic Facts in EventDocument1 pageBasic Facts in EventAllan AgpaloNo ratings yet

- Material Safety Data Sheet Surfacecool© Roof CoatingDocument3 pagesMaterial Safety Data Sheet Surfacecool© Roof CoatingPremfeb27No ratings yet

- Temenos Brochure - FormpipeDocument5 pagesTemenos Brochure - FormpipeDanial OngNo ratings yet

- Engr2227 Apr03Document10 pagesEngr2227 Apr03Mohamed AlqaisiNo ratings yet

- Hunk 150Document2 pagesHunk 150Brayan Torres04No ratings yet

- 21st Century Literary GenresDocument2 pages21st Century Literary GenresGO2. Aldovino Princess G.No ratings yet

- NST 021 Orientation SASDocument5 pagesNST 021 Orientation SASLady Mae AguilarNo ratings yet

- Engagement LetterDocument1 pageEngagement LetterCrystal Jenn Balaba100% (1)

- Design and Analysis of Buck ConverterDocument18 pagesDesign and Analysis of Buck Converterk rajendraNo ratings yet

- Community HelpersDocument3 pagesCommunity Helpersapi-252790280100% (1)

- IBM TS2900 Tape Autoloader RBDocument11 pagesIBM TS2900 Tape Autoloader RBLeonNo ratings yet

- READMEDocument3 pagesREADMERadu TimisNo ratings yet

- ForwardMails PDFDocument7 pagesForwardMails PDFJesús Ramón Romero EusebioNo ratings yet

- Radio Drama (Rubric)Document1 pageRadio Drama (Rubric)Queenie BalitaanNo ratings yet

- SolidWorks2018 PDFDocument1 pageSolidWorks2018 PDFAwan D'almightyNo ratings yet

- Clock Al Ghadeer Setup GuideDocument4 pagesClock Al Ghadeer Setup Guideakberbinshowkat100% (2)

- UnitTest D10 Feb 2024Document26 pagesUnitTest D10 Feb 2024dev.shah8038No ratings yet

- Mark Wildon - Representation Theory of The Symmetric Group (Lecture Notes) (2015)Document34 pagesMark Wildon - Representation Theory of The Symmetric Group (Lecture Notes) (2015)Satyam Agrahari0% (1)

- DOJ OIG Issues 'Fast and Furious' ReportDocument512 pagesDOJ OIG Issues 'Fast and Furious' ReportFoxNewsInsiderNo ratings yet

- Unit Rates and Cost Per ItemDocument213 pagesUnit Rates and Cost Per ItemDesiree Vera GrauelNo ratings yet

- LESSON 9 Steam Generators 2Document12 pagesLESSON 9 Steam Generators 2Salt PapiNo ratings yet

- CHM131 Presentation - Oxidation of MetalsDocument11 pagesCHM131 Presentation - Oxidation of MetalsNazrul ShahNo ratings yet

- COR2-03 Admist The Mists and Coldest Frost PDFDocument16 pagesCOR2-03 Admist The Mists and Coldest Frost PDFLouis BachNo ratings yet

- Nelson Climate Change Plan UpdateDocument37 pagesNelson Climate Change Plan UpdateBillMetcalfeNo ratings yet

- G7-UNIT - I. (Module - 1 (Week 1 - 3 (Microscopy & Levels of Org.)Document8 pagesG7-UNIT - I. (Module - 1 (Week 1 - 3 (Microscopy & Levels of Org.)Margie Gabo Janoras - DaitolNo ratings yet

- Wolfgang KohlerDocument16 pagesWolfgang KohlerMaureen JavierNo ratings yet

- Nigeria Emergency Plan NemanigeriaDocument47 pagesNigeria Emergency Plan NemanigeriaJasmine Daisy100% (1)