0% found this document useful (0 votes)

401 views3 pagesMortgage Process Map - Model Answer

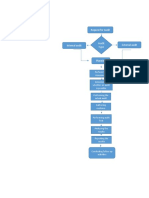

The document summarizes the simple mortgage origination process. It includes an as-is process map showing the steps from a borrower filling out an application to closing being scheduled if approved. There are opportunities to improve the process such as using alternative data sources and AI to manage underwriting risk, automating steps like pre-qualification, and receiving documents digitally to streamline the process.

Uploaded by

sdsCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

401 views3 pagesMortgage Process Map - Model Answer

The document summarizes the simple mortgage origination process. It includes an as-is process map showing the steps from a borrower filling out an application to closing being scheduled if approved. There are opportunities to improve the process such as using alternative data sources and AI to manage underwriting risk, automating steps like pre-qualification, and receiving documents digitally to streamline the process.

Uploaded by

sdsCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Title Slide: Introduces the document with a focus on process mapping for the simple mortgage origination process.

- As-is Process Map: Presents a flowchart detailing the steps involved in the simple mortgage origination process from application to closing.

- Process Improvement Opportunities: Outlines opportunities for improving the mortgage origination process through technology and improved customer interactions.