Professional Documents

Culture Documents

Psychological Levels

Uploaded by

joshua oderindeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Psychological Levels

Uploaded by

joshua oderindeCopyright:

Available Formats

babypips

Elementary Support and Resistance …

Psychological Levels

In technical analysis, Partner Center

a psychological Find a Broker

level is a price level

that is perceived as

significant by

traders, often due to

its round number or because it has

previously acted as a support or

resistance level.

These levels are not based on any

inherent fundamental value, but rather

on the collective perception and

behavior of market participants.

These levels, often referred to as

“invisible lines” often influence both

individual and institutional traders’

actions, leading to predictable

patterns in price movements.

What are

psychological levels?

Psychological levels are price points

in financial markets that hold

significant meaning for traders and

investors, mainly due to their

simplicity and ease of remembrance.

Typically, these levels are round

numbers, ending in “00” or halfway

points like “50“.

With currency pairs, the exchange

rate of “1.00” or “parity” is also a big

deal.

Traders tend to anchor their decisions

around these levels, leading to

increased buying and selling pressure

when prices approach or surpass

them.

A nice way to think about

psychological levels is that traders

become psychos when prices near

them.

For example, if USDJPY is

approaching a round number like 100,

traders may be more likely to buy or

sell at that level, as they may feel that

it represents an important milestone.

Similarly, if USD/JPY has previously

bounced off a certain price level,

traders may see that level as a key

support or resistance level, and may

adjust their trading accordingly.

Why do psychological

levels matter?

Psychological levels are important in

technical analysis because they can

influence the behavior of traders.

The human brain is naturally inclined

to seek simplicity and order. In

trading, this tendency results in a

preference for round numbers and

other easily recognizable patterns.

As more market participants focus on

these levels, they can become self-

fulfilling prophecies, with prices

reacting predictably as they approach,

hit, or break through psychological

barriers.

For example, a significant

psychological level like 1.0000 in the

EUR/USD currency pair may attract a

substantial amount of attention from

traders.

As the price nears this level, some

traders may place buy orders in

anticipation of a bounce, while others

may place sell orders, expecting a

reversal.

This increased activity can result in

price fluctuations around the

psychological level, leading to trading

opportunities for yourself.

What are examples

of psychological

levels?

Here are some examples of

psychological levels:

Round numbers: These are

price levels that end in zero or

five, such as 100 or 1.50. These

levels are often seen as

psychologically significant, as

they represent round numbers

and are easy to remember.

Previous highs or lows: If an

asset has previously reached a

certain high or low price, traders

may see that level as a key

support or resistance level, and

may expect the price to bounce

off that level again in the future.

These could be daily, weekly,

yearly, or all-time highs (or lows).

Moving averages: Moving

averages, which will be discussed

later in the School of Pipsology,

are commonly used in technical

analysis to identify trends and

potential support or resistance

levels. Traders may see a moving

average as a psychological level

if it has previously acted as a

support or resistance level.

How to Trade

Psychological Levels

1. Identify Key Levels: The first

step in incorporating

psychological levels into your

trading is to identify the key

levels relevant to the financial

instrument (e.g. currency pair)

you are trading. This can be

done by observing historical

price action and noting round

numbers where the price has

previously shown significant

reactions.

2. Monitor Price Action: Keep a

close eye on how the price

behaves as it approaches a

psychological level. Look for

signs of increased price

volatility, as this can indicate

heightened interest from

market participants.

3. Set Entry and Exit Points:

Once you have identified a

psychological level and

observed price action around

it, use this information to set

entry and exit points for your

trades. For example, if the

price has bounced off a

psychological support level,

you might enter a long position

just above the level and set a

stop loss slightly below it.

Summary

In summary, a psychological level in

technical analysis is a price level that

is perceived as significant by traders

and investors, often due to its round

number or because it has previously

acted as a support or resistance level.

Advertisement

These levels gain significance simply

due to the attention traders pay to

them.

Traders will often react and make

trading decisions around these levels

even though there may not be any

logical importance of that specific

number.

Traders often set their orders around

these levels. So when a price

approaches these levels, it can

trigger a cluster of buy or sell

orders that causes the price to stall

or reverse.

Breaking through a psychological

level can signal a further move in that

direction as it suggests traders’

attitudes or psychology around that

stock or market are changing.

For example, EUR/USD breaking

through 1.00 to the upside could

signal bullish momentum.

Markets will often test these levels to

see if they still hold before continuing

a trend. For example, a market may

rally up to but not quite reach a round

number before pulling back again.

Then make another run at that level.

Did this content help you?

Please consider

supporting BabyPips.com.

Your contribution will enable us to continue

providing quality content and tools, for free, to

you and others.

Next Lesson

Summary: Trading Support and

Resistance

Online Bachelor's in Marketing

LSDM - London School Open

What to Read Next...

Play of the Day Recaps: Sept. 4 – 7, 2023

3 hours ago

" Either write

something

worth reading

or do

something

worth writing."

- Benjamin Franklin

LEARN FOREX COMPANY

How to Trade Forex About

Forex Quizzes Contact

Forex Forums Advertise

Forex Glossary Newsletter

Forex Margin 101 Testimonials

Technical Analysis 101 FAQ

Risk Management 101 Contribute

FOREX TOOLS

MarketMilk™

Economic Calendar

Risk-On / Risk-Off Meter

Position Size Calculator

"Back to Breakeven" Calculator

Pip Value Calculator

Pivot Point Calculator

babypips

BabyPips helps new traders learn about the forex

and crypto markets without falling asleep.

We introduce people to the world of trading

currencies, both fiat and crypto, through our non-

drowsy educational content and tools. We're also

a community of traders that support each other

on our daily trading journey.

Copyright © 2023 BabyPips.com LLC. All rights reserved.

Privacy Risk Terms of Do Not Sell My Personal Change

Trade Share CFDs

Policy Disclosure Use information Consent

with as little as $50 START TRADING

Losses can exceed deposits

You might also like

- Learn to Become Profitable Trader Using Smart Money Concept: Complete Guide to Trading Cryptocurrencies, Stocks Trading, and Forex TradingFrom EverandLearn to Become Profitable Trader Using Smart Money Concept: Complete Guide to Trading Cryptocurrencies, Stocks Trading, and Forex TradingNo ratings yet

- PsychologyDocument9 pagesPsychologymikoNo ratings yet

- Hidden Secrets of EOD SR Trading SystemsDocument8 pagesHidden Secrets of EOD SR Trading SystemsNguyễn Hoàng PhongNo ratings yet

- Two Wheels for Heaven: God is real and He is still in the business of doing God thingsFrom EverandTwo Wheels for Heaven: God is real and He is still in the business of doing God thingsNo ratings yet

- FXTM Ebook 50succesful en 0Document53 pagesFXTM Ebook 50succesful en 0Joel ChikomaNo ratings yet

- How To Draw Supply Demand LevelDocument1 pageHow To Draw Supply Demand LevelRodriguez MichaelNo ratings yet

- 4 5863814219530505354Document31 pages4 5863814219530505354DansnipesNo ratings yet

- MG Swing Trading Profits Ebook PDFDocument36 pagesMG Swing Trading Profits Ebook PDFMostNo ratings yet

- 5 Key Factors that Move Forex MarketsDocument12 pages5 Key Factors that Move Forex MarketsGuna KananNo ratings yet

- The Magic of ZonesDocument7 pagesThe Magic of ZonesAmilcar RivasNo ratings yet

- Technical AnalysisDocument69 pagesTechnical AnalysisNikhil KhandelwalNo ratings yet

- Forex Calendar at Forex FactoryDocument2 pagesForex Calendar at Forex FactoryMuhamad SochabasNo ratings yet

- Entry Time: Entries 101Document5 pagesEntry Time: Entries 101Eric Woon Kim ThakNo ratings yet

- Rayner Teo - Stock Trading Secrets 24.12.21Document1 pageRayner Teo - Stock Trading Secrets 24.12.21Joy CheungNo ratings yet

- (My Secret Trading Weapon) - The Most Important Ingredient To Trading SuccessDocument29 pages(My Secret Trading Weapon) - The Most Important Ingredient To Trading SuccessJoshua Danquah100% (1)

- How to Trade Against the Herd Using FXSSI IndicatorsDocument46 pagesHow to Trade Against the Herd Using FXSSI IndicatorsstowfankNo ratings yet

- If C Markets BookDocument12 pagesIf C Markets BookRahul SingrolyNo ratings yet

- Pin Bar and Inside Bar Combo Trading StrategyDocument5 pagesPin Bar and Inside Bar Combo Trading StrategyDoug TrudellNo ratings yet

- Compounding SheetDocument4 pagesCompounding SheetMouzam AliNo ratings yet

- Forex For Beginners: "Rapid Quick Start Manual" by Brian CampbellDocument10 pagesForex For Beginners: "Rapid Quick Start Manual" by Brian CampbellBudi MulyonoNo ratings yet

- Bollinger Band Divergence Strategy - 2-8-2017 PDFDocument3 pagesBollinger Band Divergence Strategy - 2-8-2017 PDFMohd Zohardi Mohd ZainNo ratings yet

- Find and Trade Low Risk SetupsDocument6 pagesFind and Trade Low Risk SetupsHaichuNo ratings yet

- CCFp&XM7 EA (Pent56)Document14 pagesCCFp&XM7 EA (Pent56)Hai To ThanhNo ratings yet

- Fundamental Factors That Impact Currency ValuesDocument3 pagesFundamental Factors That Impact Currency ValuesVishvesh SinghNo ratings yet

- FXST Business ManualDocument25 pagesFXST Business ManualPDDY20002981100% (2)

- USD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James FournierDocument5 pagesUSD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James Fournierapi-100874888No ratings yet

- Forex Intelligence Guide)Document61 pagesForex Intelligence Guide)Romeo RofhiwaNo ratings yet

- This Study Resource Was: Amazing Scalping Strategy Using Pin Bar in The 15 Minute Time FrameDocument2 pagesThis Study Resource Was: Amazing Scalping Strategy Using Pin Bar in The 15 Minute Time Framequentin oliverNo ratings yet

- Trade the DAX with the 7am-9am Breakfast StrategyDocument1 pageTrade the DAX with the 7am-9am Breakfast StrategyAKSHAYA AKSHAYANo ratings yet

- 21 Candlesticks Every Trader Should Know (Melvin Pasternak) (Z-Library)Document83 pages21 Candlesticks Every Trader Should Know (Melvin Pasternak) (Z-Library)Free WillNo ratings yet

- An Approach To How To Trade in Commodities Market 13052013Document6 pagesAn Approach To How To Trade in Commodities Market 13052013sskr1307No ratings yet

- Buyers Sellers VolumeDocument8 pagesBuyers Sellers Volumesandip_exlNo ratings yet

- Market Trending: Forex Lesson 3Document43 pagesMarket Trending: Forex Lesson 3angkiongbohNo ratings yet

- Keys To Trading Gold USDocument15 pagesKeys To Trading Gold USBaris100% (1)

- Myths of The MarketsDocument22 pagesMyths of The MarketsMark OatesNo ratings yet

- Acegazettepriceaction Supplyanddemand 140117194309 Phpapp01Document41 pagesAcegazettepriceaction Supplyanddemand 140117194309 Phpapp01Panneer Selvam Easwaran100% (1)

- Forex CourseDocument188 pagesForex CourseIbrahim MazumderNo ratings yet

- ReportBreakout Triangle StrategyDocument20 pagesReportBreakout Triangle StrategyAnkush VashishtNo ratings yet

- Trading Forex With Confluence and Price Action SignalsDocument6 pagesTrading Forex With Confluence and Price Action Signalsnrepramita100% (1)

- Lesson 3 - Impulse & CorrectionsDocument25 pagesLesson 3 - Impulse & CorrectionsrontechtipsNo ratings yet

- Forex & IntuitionDocument0 pagesForex & Intuitionagus purnomoNo ratings yet

- Secrets For Profiting in Bull and Bear Markets - enDocument11 pagesSecrets For Profiting in Bull and Bear Markets - enKelvin KwanNo ratings yet

- QUICK GUIDE TO TRADER DALE’S VOLUME PROFILE PACKDocument14 pagesQUICK GUIDE TO TRADER DALE’S VOLUME PROFILE PACKRui LopesNo ratings yet

- Lower risk, stress free TDI trading systemDocument15 pagesLower risk, stress free TDI trading systemsilvofNo ratings yet

- NASDAQDocument10 pagesNASDAQVìkhíl VíçkyNo ratings yet

- Average True Range (ATR) Formula, What It Means, and How To Use ItDocument10 pagesAverage True Range (ATR) Formula, What It Means, and How To Use ItAbdulaziz AlshakraNo ratings yet

- Short Term Trading Strategy Based On Chart Pattern Recognition and Trend Trading in Nasdaq Biotechnology Stock MarketDocument7 pagesShort Term Trading Strategy Based On Chart Pattern Recognition and Trend Trading in Nasdaq Biotechnology Stock MarketAman KNo ratings yet

- The Braveheart Report #Issue002Document21 pagesThe Braveheart Report #Issue002dogajunk100% (1)

- Not An Oracle 1Document7 pagesNot An Oracle 1abanceritNo ratings yet

- Trade Details: Half-Position of GBPDocument4 pagesTrade Details: Half-Position of GBPImre GamsNo ratings yet

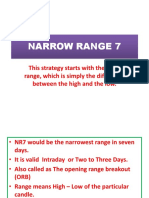

- NR7Document18 pagesNR7RAGHU S100% (1)

- "Face The Trader Within" by Chris Lori CTA: Equity ManagementDocument23 pages"Face The Trader Within" by Chris Lori CTA: Equity ManagementBen WillmottNo ratings yet

- 3 New Books:: Trading Price Action Trading Price Action Trading Price ActionDocument53 pages3 New Books:: Trading Price Action Trading Price Action Trading Price ActionLeszekNo ratings yet

- How To Read The Forex Charts and How To Deal With ItDocument4 pagesHow To Read The Forex Charts and How To Deal With ItCMS Prime100% (1)

- Top Reasons Forex Traders Fail Due to Lack of Discipline and Proper Risk ManagementDocument16 pagesTop Reasons Forex Traders Fail Due to Lack of Discipline and Proper Risk Managementkapoor_mukesh4u100% (1)

- Bilal - Forex - Daily Bias Using The 3 Candle FractalDocument17 pagesBilal - Forex - Daily Bias Using The 3 Candle Fractalrex anthony100% (1)

- Top 7 Reasons Why Forex Traders Fail and Lose MoneyDocument9 pagesTop 7 Reasons Why Forex Traders Fail and Lose Moneyrobert.d.lopezNo ratings yet

- How To Use IG Client SentimentDocument7 pagesHow To Use IG Client SentimentRJ Zeshan AwanNo ratings yet

- For Ex ToolkitDocument11 pagesFor Ex ToolkitEdison Queiroz VillelaNo ratings yet

- MACD DivergenceDocument4 pagesMACD DivergenceBiantoroKunartoNo ratings yet

- Bushman and Smith 2001Document97 pagesBushman and Smith 2001Rajesh VijayaraghavanNo ratings yet

- Introductory MacroeconomicsDocument106 pagesIntroductory MacroeconomicsHardik Gupta50% (4)

- The Relationship Between Saving and Investment in MalaysiaDocument24 pagesThe Relationship Between Saving and Investment in MalaysiaAzri AlimorNo ratings yet

- Introduction to Financial Institutions: An OverviewDocument16 pagesIntroduction to Financial Institutions: An OverviewsleshiNo ratings yet

- Financial Performance of SamsungDocument43 pagesFinancial Performance of SamsungGunjan ChoureNo ratings yet

- Rahman.S, Askari.H: An Economic Islamicity IndexDocument39 pagesRahman.S, Askari.H: An Economic Islamicity IndexShahzeb AtiqNo ratings yet

- Director Structured Finance Credit in NYC Resume Mark DouglassDocument3 pagesDirector Structured Finance Credit in NYC Resume Mark DouglassMarkDouglassNo ratings yet

- CH06 Correcting Behavioral BiasesDocument70 pagesCH06 Correcting Behavioral BiasesFatima Zahra ElhaddekNo ratings yet

- Fabm2: Quarter 1 Week 6 Module 6Document17 pagesFabm2: Quarter 1 Week 6 Module 6Jose John Vocal90% (10)

- 2.4 Ishares Product List PDFDocument12 pages2.4 Ishares Product List PDFVijay YadavNo ratings yet

- Tensor Charts ScalpingDocument10 pagesTensor Charts Scalpingpotfictio100% (1)

- Put-Call Ratio Volume vs. OpenDocument11 pagesPut-Call Ratio Volume vs. OpenPraveen RangarajanNo ratings yet

- Apple Stock BuybackDocument2 pagesApple Stock BuybackalimithaNo ratings yet

- Accumulation-Sec17-Transfer of PropertyDocument18 pagesAccumulation-Sec17-Transfer of PropertyArunaML71% (7)

- Canara Robeco AMC TeamDocument29 pagesCanara Robeco AMC TeamSarfarazzKhanNo ratings yet

- Accountancy Notes PDF Class 12 Chapter 2Document4 pagesAccountancy Notes PDF Class 12 Chapter 2Miss Palak.kNo ratings yet

- BIBLIOGRAPHY RESEARCH SOURCESDocument9 pagesBIBLIOGRAPHY RESEARCH SOURCESyezdiarwNo ratings yet

- Muthoot Finance as India's Largest Gold Loan NBFCDocument22 pagesMuthoot Finance as India's Largest Gold Loan NBFCLove IcanBeur'heroNo ratings yet

- Exness SC Client AgreementDocument69 pagesExness SC Client AgreementErhijivwo EnorNo ratings yet

- 12 - Q. Paper - Exam Code FTEE-2005 - 22 - Class - K8 - AccountancyDocument14 pages12 - Q. Paper - Exam Code FTEE-2005 - 22 - Class - K8 - AccountancyShafali Aggarwal TanejaNo ratings yet

- Real Estate Investing 101Document21 pagesReal Estate Investing 101Ronald CagapeNo ratings yet

- The Knowledge ToolboxDocument13 pagesThe Knowledge ToolboxJoham GutierrezNo ratings yet

- Mock Exam 4 - AnswersDocument78 pagesMock Exam 4 - AnswersAditya MuchhalaNo ratings yet

- Roi Ri EvaDocument14 pagesRoi Ri EvaAhalik HamzahNo ratings yet

- Finance Management 6th Edition Timothy Gallagher FullDocument640 pagesFinance Management 6th Edition Timothy Gallagher FullPhương Linh NguyễnNo ratings yet

- Financial Ratios MGT657Document8 pagesFinancial Ratios MGT657Iman NadzirahNo ratings yet

- Cost of CapitalDocument49 pagesCost of CapitalSatyam JadonNo ratings yet

- MCXAX Presentation - 2015 Q3Document22 pagesMCXAX Presentation - 2015 Q3ZerohedgeNo ratings yet

- SEBI Grade A Mock QuestionsDocument5 pagesSEBI Grade A Mock QuestionsSivaramakrishna SobhaNo ratings yet