Professional Documents

Culture Documents

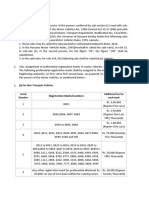

Strategic Cost Multiple Choice

Uploaded by

Christian ZanoriaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Cost Multiple Choice

Uploaded by

Christian ZanoriaCopyright:

Available Formats

lOMoARcPSD|19100787

Chapter 8 and 9

BS Accountancy (University of Baguio)

Studocu is not sponsored or endorsed by any college or university

Downloaded by ZANORIA, CHRISTIAN JOSEPH PAUL T. (christianzanoria8146@gmail.com)

lOMoARcPSD|19100787

MA Chapter 1 c. A budget may be used as a planning tool, but not as a

control tool.

1. Which of the following statements is true?

d. Management accountants often are simultaneously

a. Management accounting information focuses on

doing problem-solving, scorekeeping, and attention-

external reporting.

directing activities.

b. The statement of financial position, income

6. Management accounting

statement and statement of cash flows are used for

financial accounting but not for management a. focuses on estimating future revenues, costs, and

accounting. other measures to forecast activities and their results.

c. Financial accounting is broader in scope than b. provides information about the company as a whole.

management accounting.

c. provides information that has occurred in the past

d. Modern cost accounting plays a significant role in and that is verifiable and reliable.

management decision making.

d. provides information that is generally available only

2. Which of the following statements is false? on a quarterly or annual basis.

a. Cost accounting measures and reports short-term, 7. Financial accounting

long-term financial, and nonfinancial information.

a. focuses on the future and includes activities such as

b. Cost management provides information that helps preparing next year’s operating budget.

increase value for customers.

b. must comply with PFRS ( Philippine Financial

c. All strategies should be evaluated regarding the Reporting Standards).

resources and capabilities of the company.

c. reports include detailed information on the various

d. A good cost accounting system is narrowly focused operating segments of the business such as product

on continuous reduction of costs. lines or departments.

3. Which of the following statements is correct? d. is prepared for the use of department heads and

other employees.

a. The best-designed strategies are valuable whether or

not they are effectively implemented. 8. The person MOST likely to use management

accounting information is a(n)

b. To take advantage of changing market opportunities,

the annual budget should be strictly enforced. a. banker evaluating a credit application.

c. Linking rewards to performance is a major deterrent b. shareholder evaluating a stock investment.

to good management performance.

c. governmental taxing authority.

d. An important strategic decision is making the correct

d. assembly department supervisor.

investments in productive assets.

4. All of the following statements are true except 9. Which of the following descriptions refers to

management accounting information?

a. A budget is a tool used to plan and express strategy.

b. Financial accounting reports financial and a. It is verifiable and reliable.

nonfinancial information that helps managers

implement company strategies. b. It is driven by rules.

c. Feedback links planning and control. c. It is prepared for shareholders.

d. Control includes deciding what feedback to provide

d. It provides reasonable and timely estimates.

that will help with future decision making.

5. All of the following statements are false except 10. Which of the following groups would be LEAST likely

to receive detailed management accounting reports?

a. Attention-directing activities should focus on cost-

reduction opportunities, and not on value-adding a. Stockholders

opportunities.

b. Sales representatives

b. For strategic decisions, scorekeeping is the most

prominent role played by management accounting.

Downloaded by ZANORIA, CHRISTIAN JOSEPH PAUL T. (christianzanoria8146@gmail.com)

lOMoARcPSD|19100787

c. Production supervisors 16. Strategy specifies

d. Managers a. how an organization matches its own capabilities

with the opportunities in the marketplace

11. Management accounting information includes

b. standard procedures to ensure quality products

a. tabulated results of customer satisfaction surveys

c. incremental changes for improved performance

b.the cost of producing a product

d. the demand created for products and services

c. the percentage of units produced that are defective

17. Control includes

d. all of the above a. implementing planning decisions

12. Which of the following types of information are b. evaluating performance

used in management accounting? c. providing feedback to help with future decision

making

a. Financial information

d. all of the above

b. Nonfinancial information

18. Linking rewards to performance

c. Information focused on long term a. helps to motivate managers

d. All of the above b. allows companies to charge premium prices

c. should only be based on financial information

13. Management accounting includes

d. does all of the above

a. implementing strategies

19. Control measures should

b. developing budgets a. be set and not changed until the nest budget cycle.

c. preparing special studies and forecasts b. be flexible to allow for employees who are slackers.

c. be kept confidential from employees so that

d. all of the above

competitors do have an opportunity to gain a

competitive advantage

14. Financial accounting is concerned PRIMARILY with

d. be linked by feedback to planning

a. external reporting to investors, creditors, and

20. For control decisions, emphasis is placed on the

government authorities

_________ role(s) of management accounting.

b. cost planning and cost controls a. problem-solving

c. profitability and analysis b. score-keeping

c. attention-directing

d. providing information for strategic and tactical

decisions d. both (b) and (c)

21. ________ means reporting and interpreting

15. Financial accounting provides a historical

information that helps managers to focus on operating

perspective, whereas management accouting

problems, imperfections, inefficiencies, and

emphasizes

opportunities.

a. the future a. Scorekeeping

b. past transactions b. Attention directing

c. Problem solving

c. a current perspective

d. None of the above.

d. reports to shareholders

Downloaded by ZANORIA, CHRISTIAN JOSEPH PAUL T. (christianzanoria8146@gmail.com)

lOMoARcPSD|19100787

22. Management accounting is considered successful b. Whether to report unfavorable department

when it information that may result in unfavorable

consequences for a friend.

a. helps creditors evaluate the company’s performance.

c. Whether to file a tax return this year.

b. helps managers improve their decisions

d. Both (a) and (b).

c. is accurate

29. If a financial manager/management accountant has

d. is relevant and reported annually.

a problem in identifying unethical behavior or resolving

23. The Institute of Management Accountants (IMA) an ethical concept, the first action (s)he should normally

take is to

a. is a professional organization of management

accountants a. Consult the board of directors.

b. is a professional organization of financial accountants b. Discuss the problem with his/her immediate superior.

c. issues standards for management accounting c. Notify the appropriate law enforcement.

d. issues standards financial accounting d. Resign from the company.

24. Line management includes 30. Katrina is a financial manager who has discovered

that her company is violating environmental

a. manufacturing managers

regulations. If her immediate superior is involved, her

b. human-resource managers appropriate action is to

c. information-technology managers a. Do nothing since she has a duty of loyalty to the

organization.

d. management-accounting managers

b. Consult the audit committee.

25. Staff management includes

c. Present the matter to the next higher managerial

a. Manufacturing managers.

level.

b. Human-resource managers.

d. Confront her immediate superior.

c. Purchasing managers.

31. If financial manager/management accountant

d. Distribution managers. discovers unethical conduct in his/her organization and

fails to act, (s)he will be in violation of which ethical

26. Responsibility of a CFO include all EXCEPT

standard(s)?

a. Providing financial reports to shareholders.

a. “Actively or passively subvert the attainment of the

b. Managing short-term and long-term financing. organization’s legitimate and ethical objectives.”

c. Investing in new equipment. b. “Communicate unfavorable as well as favorable

information.”

d. Preparing tax returns.

c. “Condone the commission of such acts by others

27. The Standards of Ethical Conduct for management within their organizations.”

accountants include concepts related to

d. All of the answers are correct.

a. Competence, performance, integrity, and reporting.

32. Corporate social responsibility is

b. Competence, confidentiality, integrity, and

objectivity. a. Effectively enforced through the controls envisioned

by classical economics.

c. Experience, integrity, reporting, and objectivity.

b. The obligation to shareholders to earn a profit.

d. None of the above as ethical issues do not affect

management accountants. c. The duty to embrace service to the public interest.

28. Ethical challenges for management accountants d. The obligation to serve long-term, organizational

include interests.

a. Whether to accept gifts from suppliers, knowing it is 33. A common argument against corporate involvement

an effort to indirectly influence decisions. in socially responsible behavior is that

Downloaded by ZANORIA, CHRISTIAN JOSEPH PAUL T. (christianzanoria8146@gmail.com)

lOMoARcPSD|19100787

a. it encourages government intrusion in decision 37. Which ethical standard is most clearly violated if a

making. financial manager/management accountant knows of a

problem that could mislead users but does has

b. as a legal person, a corporation, is accountable for its

requested information

conduct.

a. Competence

c. it creates goodwill.

b. Legality

d. in a competitive market, such behavior incurs costs

that place the company at a disadvantage. c. Objectivity

34. Integrity is an ethical requirement for all financial d. Confidentiality

managers/management accountants. One aspect of

38. ___________ produces information that helps

integrity requires

workers, managers and executives in organizations

a. performance of professional duties in accordance make better decisions.

with applicable laws.

a. Governmental Accounting

b. avoidance of conflict of interest.

b. Management Accounting

c. refraining from improper use of inside information.

c. Auditing

d. maintenance of an appropriate level of professional

d. Financial Accounting

competence.

39. ___________ is the recognition and evaluation of

35. A financial manager/management accountant

business transactions and other economic events for

discovers a problem that could mislead users of the

appropriate accounting action.

firm’s financial data and has informed his/her

immediate superior. (S)he should report the a. Identification

circumstances to the audit committee and/or the board

b. Analysis

of directors only if

c. Communication

a. the immediate superior, who reports to the chief

executive officer, knows about the situation but refuses d. Evaluating

to correct it.

40. ___________is the quantification of business

b. the immediate superior assures the financial transactions or other economic events that have

manager/management accountant that the problem occurred or forecasts of those that may occur.

will be resolved.

a. Accumulation

c. the immediate superior reports the situation to

b. External reporting

his/her superior.

c. Measurement

d. the immediate superior, the firm’s chief executive

officer, knows about the situation but refuses to correct d. Internal reporting

it.

41. ___________ is a determination of the reasons for

36. In which situation a financial manager/management the reported activity and its relationship with other

accountant permitted to communicate confidential economic events and circumstances.

information to individuals or authorities outside the

a. Analysis

firm?

b. Measurement

a. There is an ethical conflict and the board refused to

take action. c. Evaluation

b. Such communication is legally prescribed. d. Accumulation

c. The financial manager/management accountant 42. ___________ includes strategic, tactical and

knowingly communicates the information indirectly operating aspects.

through a subordinate.

a. Controlling

d. An officer at financial manager/management

accountant’s bank has requested information on a b. Communication

transaction that could influence the firm’s stock price. c. Planning

Downloaded by ZANORIA, CHRISTIAN JOSEPH PAUL T. (christianzanoria8146@gmail.com)

lOMoARcPSD|19100787

d. Evaluating 49. Which of the following groups would be LEAST likely

to receive detailed management accounting reports?

43. ___________ judges implications of historical and

expected events and helps to choose the optimum a. management accountants

course of action.

b. scientists and engineers

a. Controlling

c. stockholders

b. Communication

d. managers

c. Planning

50.________________indicate whether the organization

d. Evaluating is creating long-term value and profitability.

44. Which of the following is a basic feature of a a. Strategic information

financial accounting system?

b. ROI

a. Internal audience

c. Net income

b. Historical data

d. Critical success factors

c. Subjective information

51. ________________ is when a firm compares itself

d. Disaggregate information with the best practice of competitors or other

comparable organizations.

45. Which of the following is NOT a basic feature of

financial accounting system? a. Process improvement

a. objective information b. Benchmarking

b. reports on past performance c. Employee empowerment

c. future oriented reports d. Total quality philosophy

d. highly aggregated data 52. Which of the following is NOT a function of a

management accounting system?

46. Which of the following is a basic feature of

managerial accounting system? a. operating control

a. external audience b. product and customer costing

b. reports are current and future oriented c. management control

c. objective data only d. financial reporting

d. reports on the entire organization 53. Which of the following functions provides feedback

information about the efficiency of tasks performed?

47. Which of the following is NOT a basic feature of

managerial accounting system? a. operating control

a. financial measures only b. product and customer costing

b. subjective information c. management control

c. internal audience d. financial reporting

d. informs local decision and actions 54. Which of the following functions provides

information on the performance of managers and

48. Which of the following is a basic feature of

operating units?

managerial accounting system?

a. operating control

a. The scope tends to be highly aggregate.

b. product and customer costing

b. There are no regulations governing the reports.

c. management control

c. The reports are generally delayed and historical.

d. financial reporting

d. The audience tends to be stockholders, creditors, and

tax authorities. 55. Which of the following is NOT a role of management

accounting information in operating control?

Downloaded by ZANORIA, CHRISTIAN JOSEPH PAUL T. (christianzanoria8146@gmail.com)

lOMoARcPSD|19100787

a. to provide feedback information about quality 60. Certified Management Accountants are required to

adhere to the following ethical standards, EXCEPT

b. to provide feedback information about timeliness

a. competence

c. to provide feedback information about the efficiency

of tasks performed b. ingenuity

d. to provide performance measures for decentralized c. integrity

organizational units

d. objectivity

56. Which of the following is NOT a role of management

61. A study of organization that are among the best in

accounting information in product and customer

the world at performing a particular task

costing?

a. Business process

a. to measure the cost of resources used to provide a

service b. Benchmarking

b. to assess the profitability of the organization’s services c. Control

by linking resources generated

d. Feedback

c. to provide feedback information about the quality,

62. An activity that consumes resources or takes time

timeliness, and efficiency of tasks performed

out that does not add value for which costumers are

d. to assess customer profitability for a particular willing to pay

segment

a. Non-value added activity

57. An organization develops a code of ethics because

b. Value-added activity

a. it is required by law.

c. Process reengineering

b. the Chief Executive Officer demands it.

d. Total quality management

c. it wishes to reduce ethical conflicts by avoiding

63. Accounting and other reports that help managers

ambiguity or misunderstandings

monitor performance and focus on problems and/or

d. it wishes to punish those who ethical standards are opportunities that might otherwise go unnoticed

different from its own.

a. Feedback

58. If an individual faces a conflict between the

b. Performance report

organization’s stated and practiced values experts

recommend that c. Financial accounting

a. the individual resign immediately and call the media. d. Managerial accounting

b. the individual call the media.

c. delay action and work with the respected leaders in

the organization

d. delay action and hope the problem goes away.

59. The elements of an ethical control system include

the following EXCEPT

a. a reward system for turning in those who violate the

ethical code.

b. a statement of the organization’s value and code of

ethics.

c. an ongoing internal audit of the ethical control

system

d. a statement of the employee’s ethical

responsibilities.

Downloaded by ZANORIA, CHRISTIAN JOSEPH PAUL T. (christianzanoria8146@gmail.com)

You might also like

- SCM Strategic Cost Management Cabrera 2021 Edition Multiple Choice Questions With - Compress PDFDocument119 pagesSCM Strategic Cost Management Cabrera 2021 Edition Multiple Choice Questions With - Compress PDFMark Vincent Estanislao100% (3)

- Proforma Balance Sheet with Financing OptionsDocument6 pagesProforma Balance Sheet with Financing OptionsJohn Richard Bonilla100% (4)

- Management Accounting Test BankDocument5 pagesManagement Accounting Test Bank수지No ratings yet

- Bobadilla BudgetingDocument20 pagesBobadilla BudgetingJenelyn Ubanan100% (1)

- Nature of ConsultancyDocument8 pagesNature of ConsultancyNalyanya50% (2)

- Lloyds Banking Group PLCDocument20 pagesLloyds Banking Group PLCImran HussainNo ratings yet

- Chapter1 ReviewerDocument6 pagesChapter1 Reviewerdaniellejueco1228No ratings yet

- Strat Chap 1Document5 pagesStrat Chap 1Allaisa Joyce DuenasNo ratings yet

- Managerial Advisory ServicesOverviewwoanswersDocument3 pagesManagerial Advisory ServicesOverviewwoanswersJhuneth DominguezNo ratings yet

- 1Document67 pages1Kim Flores0% (1)

- MAS MCQs All Topics 2019Document71 pagesMAS MCQs All Topics 2019Justine TadeoNo ratings yet

- FORBES COLLEGE - Docx - 2ndprelimDocument3 pagesFORBES COLLEGE - Docx - 2ndprelimLea Moureen KaibiganNo ratings yet

- Strategic Cost Managemen TDocument4 pagesStrategic Cost Managemen TApril Joy Padua SimonNo ratings yet

- Quiz 1: Basic ConsiderationsDocument4 pagesQuiz 1: Basic ConsiderationsMarriah Izzabelle Suarez RamadaNo ratings yet

- MAS ADVISORY SERVICES GUIDEDocument3 pagesMAS ADVISORY SERVICES GUIDEchowchow123No ratings yet

- MidtermExam Strategic Cost 002Document8 pagesMidtermExam Strategic Cost 002Christine RepuldaNo ratings yet

- Test Bank Mas 1 Test BankDocument72 pagesTest Bank Mas 1 Test Bank20-52775No ratings yet

- Basic Concepts in Management AccountingDocument10 pagesBasic Concepts in Management AccountingJohayra AbbasNo ratings yet

- Mas Mcqs All Topics 20 1 9Document72 pagesMas Mcqs All Topics 20 1 9Princess Diane RamirezNo ratings yet

- MS.101 Scope Concepts Objectives Role Environment of MA Students Copy Answer KeyDocument8 pagesMS.101 Scope Concepts Objectives Role Environment of MA Students Copy Answer KeyBridget Zoe Lopez BatoonNo ratings yet

- Management Advisory Services OverviewDocument5 pagesManagement Advisory Services OverviewJymldy EnclnNo ratings yet

- Test Bank Mas 1 Test BankDocument72 pagesTest Bank Mas 1 Test BankDave Clark de LaraNo ratings yet

- Chapter 1 StudentsDocument7 pagesChapter 1 StudentsArah Opalec0% (1)

- SCMactivity 1Document8 pagesSCMactivity 1Jasmin NoblezaNo ratings yet

- Midterms Se11 Answer KeyDocument5 pagesMidterms Se11 Answer KeyALYZA ANGELA ORNEDONo ratings yet

- Midterms Se11 Answer KeyDocument5 pagesMidterms Se11 Answer KeyALYZA ANGELA ORNEDO100% (1)

- MAS Review QuestionnairesDocument13 pagesMAS Review QuestionnairesLye Loren MarceloNo ratings yet

- Introduction to Cost AccountingDocument10 pagesIntroduction to Cost AccountingaiswiftNo ratings yet

- Homework NoDocument3 pagesHomework NoPrinceMontalanNo ratings yet

- CPA REVIEW SCHOOL OF THE PHILIPPINESDocument7 pagesCPA REVIEW SCHOOL OF THE PHILIPPINESRick Marl PadenNo ratings yet

- zMSQ-04 - Responsibility Acctg, Transfer Pricing - GP AnalysisDocument11 pageszMSQ-04 - Responsibility Acctg, Transfer Pricing - GP AnalysisJenica SaludesNo ratings yet

- MAS - 1 - Basic Concepts and Recent Developments - TBPDocument5 pagesMAS - 1 - Basic Concepts and Recent Developments - TBPFederico Angoluan Socia Jr.No ratings yet

- Revision Module 1 - 2Document3 pagesRevision Module 1 - 2avineshNo ratings yet

- MAS Concepts AnswerDocument6 pagesMAS Concepts AnswerRehanne M. MarohomNo ratings yet

- zMSQ-06 - Master BudgetDocument10 pageszMSQ-06 - Master BudgetKekenn Escabas100% (1)

- A Posteriori A Priori Ad HocDocument10 pagesA Posteriori A Priori Ad HocAila Jean PascualNo ratings yet

- Q1 Strat-Mgt 2023 2024Document4 pagesQ1 Strat-Mgt 2023 2024Christian ZanoriaNo ratings yet

- MSQ-06 - Master BudgetDocument11 pagesMSQ-06 - Master Budgetralphalonzo50% (2)

- MSQ-06 - Master BudgetDocument11 pagesMSQ-06 - Master BudgetElin SaldañaNo ratings yet

- HO1 - INTRODUCTION To MAS PDFDocument8 pagesHO1 - INTRODUCTION To MAS PDFPATRICIA PEREZNo ratings yet

- Acc 223 1ST ExamDocument3 pagesAcc 223 1ST ExamKate FernandezNo ratings yet

- MANAGEMENT SERVICES MAY 2018 PREWEEK LECTUREDocument38 pagesMANAGEMENT SERVICES MAY 2018 PREWEEK LECTURELara FloresNo ratings yet

- NNDC - Ican Kaduna Study Centre: Practice Questions On Introduction To Management Accounting A. Multiple Choice QuestionsDocument8 pagesNNDC - Ican Kaduna Study Centre: Practice Questions On Introduction To Management Accounting A. Multiple Choice QuestionsAbdulkadir KayodeNo ratings yet

- Exercises Management Accounting With AnswersDocument3 pagesExercises Management Accounting With AnswersNor Alem SampornaNo ratings yet

- 10 X08 BudgetingDocument13 pages10 X08 Budgetingjenna hannahNo ratings yet

- Budgeting: Key Concepts and ApproachesDocument20 pagesBudgeting: Key Concepts and ApproachesMJ YaconNo ratings yet

- 10 X08 BudgetingDocument13 pages10 X08 BudgetingJohn Bryan100% (2)

- Basic ConceptDocument5 pagesBasic ConceptHillary CanlasNo ratings yet

- Theories: Basic ConceptsDocument20 pagesTheories: Basic ConceptsJude VeanNo ratings yet

- At - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Document85 pagesAt - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Waleed MustafaNo ratings yet

- CPA Review School of the Philippines Final Pre-board ExaminationDocument67 pagesCPA Review School of the Philippines Final Pre-board ExaminationCykee Hanna Quizo Lumongsod100% (1)

- 2nd FM Master BudgetDocument18 pages2nd FM Master BudgetIzzy DiegoNo ratings yet

- Philippine MysteriesDocument41 pagesPhilippine MysteriesYes ChannelNo ratings yet

- 05 x05 Standard Costing & Variance AnalysisDocument19 pages05 x05 Standard Costing & Variance AnalysisKatherine Cabading InocandoNo ratings yet

- At - Prelim Rev (875 MCQS) Red Sirug ofDocument100 pagesAt - Prelim Rev (875 MCQS) Red Sirug ofNicole Kyle AsisNo ratings yet

- Preliminary Exam Reviewer1Document100 pagesPreliminary Exam Reviewer1Racel DelacruzNo ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesFrom EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNo ratings yet

- IT GOVERNANCE APPROACHES FOR AGILE SOFTWARE DEVELOPMENT INVESTMENTSFrom EverandIT GOVERNANCE APPROACHES FOR AGILE SOFTWARE DEVELOPMENT INVESTMENTSRating: 4 out of 5 stars4/5 (1)

- From Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1From EverandFrom Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1No ratings yet

- Creating Strategic Advantages for NespressoDocument14 pagesCreating Strategic Advantages for NespressoAnkitpandya23No ratings yet

- Dr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeDocument12 pagesDr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- Capital Allowances1Document23 pagesCapital Allowances1Yoven VeerasamyNo ratings yet

- August Dialy Walkin ReportDocument23 pagesAugust Dialy Walkin Reportcheater1111No ratings yet

- PWC AlertDocument5 pagesPWC AlertAli AyubNo ratings yet

- Monginis PDF BBMDocument16 pagesMonginis PDF BBMFurkan AhmedNo ratings yet

- A Simple 8-Step Social Media Content Creation ProcessDocument2 pagesA Simple 8-Step Social Media Content Creation ProcessDaveNo ratings yet

- Yacapin Legal Services Adjusted Trial BalanceDocument3 pagesYacapin Legal Services Adjusted Trial BalanceCleah WaskinNo ratings yet

- Cadbury BournvitaDocument11 pagesCadbury Bournvitadiptibhoi0% (1)

- HRmanualDocument6 pagesHRmanualNaman KediaNo ratings yet

- SKAND Business and Management Paper 2 HL MarkschemeDocument3 pagesSKAND Business and Management Paper 2 HL MarkschemeSesión Plenaria Asamblea GeneralNo ratings yet

- Vardhman Textiles LTD - 22Document280 pagesVardhman Textiles LTD - 22Mrigank Mahajan (IN)No ratings yet

- Service Department and Joint Cost Allocation: True / False QuestionsDocument246 pagesService Department and Joint Cost Allocation: True / False QuestionsElaine GimarinoNo ratings yet

- Commercial Bid Sheet - PPMSDocument41 pagesCommercial Bid Sheet - PPMSpt.cahayamaju indonesiaNo ratings yet

- Group Assignment OshmsDocument16 pagesGroup Assignment OshmsimanNo ratings yet

- Business Ethics and Social Responsibility: The Core Principles of Good Corporate GovernanceDocument16 pagesBusiness Ethics and Social Responsibility: The Core Principles of Good Corporate GovernanceRecy Beth EscopelNo ratings yet

- Strategic Human Resource ManagementDocument59 pagesStrategic Human Resource ManagementFrancisquete BNo ratings yet

- Case 3 SolutionsDocument4 pagesCase 3 SolutionsNishtha Raheja100% (1)

- SEC Type Test Report 2021Document25 pagesSEC Type Test Report 2021engr.mehran93No ratings yet

- Southwest Airlines Success: A Case Study Analysis: January 2011Document6 pagesSouthwest Airlines Success: A Case Study Analysis: January 2011Fabián RosalesNo ratings yet

- GTPPL Company Profile and CertificationsDocument12 pagesGTPPL Company Profile and CertificationsGtppl Green Thermo PowerNo ratings yet

- Branding and Promotion: Learning ObjectiveDocument20 pagesBranding and Promotion: Learning Objectivesk001No ratings yet

- 6.3.21 Draft RFP-RFQ 115NFedHwy For BRD MTG AttachmentDocument24 pages6.3.21 Draft RFP-RFQ 115NFedHwy For BRD MTG AttachmentMatt PapaycikNo ratings yet

- Costing FM Mock Test May 2019Document20 pagesCosting FM Mock Test May 2019Roshinisai VuppalaNo ratings yet

- DropboxDocument3 pagesDropboxmeriemNo ratings yet

- Official Accounting Procedures Manual.....Document8 pagesOfficial Accounting Procedures Manual.....ALBERT ATUMANo ratings yet

- Pricing Strategies - FinalDocument4 pagesPricing Strategies - FinalSirJason AnaloNo ratings yet