Professional Documents

Culture Documents

2022 Non-Submission Waiver

2022 Non-Submission Waiver

Uploaded by

Zarah BernabeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2022 Non-Submission Waiver

2022 Non-Submission Waiver

Uploaded by

Zarah BernabeCopyright:

Available Formats

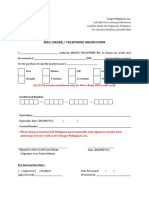

TDCX (Philippines) Inc.

21st to 26th floor Robinsons Cyberscape Gamma

Topaz & Ruby Roads|Ortigas Center, Pasig City Philippines 1605

www.tdcx.com

CERTIFICATION OF NON-SUBMISSION OF 2022 BIR FORM 2316

Zarah I Bernabe

I,_______________________________, an employee of TDCX Philippines Inc. with employee number

_____________

51049 as of December 31, 2022 hereby certify that I did not furnish TDCX a copy of my 2022

Certificate of Income Tax Withheld on Compensation(BIR Form 2316) from my previous employer

due to.

Please choose only one and write your Tax Identification number on left side:

_________________________ 1) I have no previous employer for 2022.

_________________________ 2) My 2316 is not yet available from my previous company.

**For 2022 Tax Annualization purposes, Z -zero exemption will automatically apply to employees

with previous employer but did not submit the BIR form 2316.

In light of this, my current employer, TDCX has no basis of combining my other income from

previous employer for the taxable year 2022.

I shall be responsible in computing / filing and paying the appropriate tax to BIR after I combine

my income earned from my previous company, _______________________, and my income from

TDCX Philippines Inc. on or before April 15, 2023.

I hereby release TDCX Philippines Inc. for any obligations, costs, and other expenses that may

arise from above action.

Zarah Bernabe

_____________________________

Signature over Printed Name

Employee / Taxpayer

This is to acknowledge receipt of the above form.

______________________________ ______________________________________

Date Signature over Printed Name

HR- Compensation and Benefits Specialist

You might also like

- Transfer Commitment FormDocument1 pageTransfer Commitment Formromarcambri100% (6)

- SWP Application PacketDocument7 pagesSWP Application PacketGemma RetubaNo ratings yet

- Form CPFLMDocument4 pagesForm CPFLMKrishnan JayaramanNo ratings yet

- Bir 2316 Submission Waiver 2022Document1 pageBir 2316 Submission Waiver 2022John Jason Narsico AlbrechtNo ratings yet

- NON-SUBMISSION WAIVER-converted-signedDocument1 pageNON-SUBMISSION WAIVER-converted-signedガンボア ジョン・アーウィンNo ratings yet

- BIR Form No. 2316 - Certificate of Compensation Payment / Tax Withheld From Previous EmployerDocument1 pageBIR Form No. 2316 - Certificate of Compensation Payment / Tax Withheld From Previous EmployerAriel Grajera (Consultant)No ratings yet

- Clearance With Quit Claim - EmpireDocument2 pagesClearance With Quit Claim - EmpireCareer at Prime Tigers Tech IncNo ratings yet

- 2020form - MC28s2020-Annex D SGDDocument1 page2020form - MC28s2020-Annex D SGDJenel ChuNo ratings yet

- 01.latest New FORM 19-InfocommDocument3 pages01.latest New FORM 19-InfocommABHISHEK JURIANI100% (1)

- Waiver For Non SubmissionDocument1 pageWaiver For Non SubmissionJayson BongulanNo ratings yet

- Pre-Qualification QuestionnaireDocument6 pagesPre-Qualification Questionnairemarsel.dcoiNo ratings yet

- DEMPCC Loan FormDocument2 pagesDEMPCC Loan FormMikko RamiraNo ratings yet

- Certificate of Clearance: Pro Pack Manufacturing & Marketing CorporationDocument3 pagesCertificate of Clearance: Pro Pack Manufacturing & Marketing CorporationShobee LengNo ratings yet

- DBSL FORM PFNomination2Document2 pagesDBSL FORM PFNomination2Shreya AgarwalNo ratings yet

- Annex D - Affidavit On Inability To Pay Assessed DelinquenciesDocument1 pageAnnex D - Affidavit On Inability To Pay Assessed DelinquenciesAtty TanglaoNo ratings yet

- Quitclaim - Docx 2024Document1 pageQuitclaim - Docx 2024Nellow M. TaberaraNo ratings yet

- Extension of StayDocument1 pageExtension of StayAlex GatsulaoNo ratings yet

- Approved/Disapproved:: DCIR-OG If Amount Payable Is Over P500,000 Up To P10.0M orDocument2 pagesApproved/Disapproved:: DCIR-OG If Amount Payable Is Over P500,000 Up To P10.0M orElaine DGNo ratings yet

- Freelancing Contract Form-2Document4 pagesFreelancing Contract Form-2Zanele DlaminiNo ratings yet

- SF-INFRA-11 Key Personnel's Certificate of EmploymentDocument2 pagesSF-INFRA-11 Key Personnel's Certificate of EmploymentPatrick SarmientoNo ratings yet

- Background Check FormDocument6 pagesBackground Check FormRam RamNo ratings yet

- BGC1Document1 pageBGC1pratiksha babannavarNo ratings yet

- Republic of The Philippines) S.SDocument1 pageRepublic of The Philippines) S.SLoraine MandapNo ratings yet

- Form F - ODocument10 pagesForm F - ORobin RubinaNo ratings yet

- POLICY SERVICING REQUEST 2 - With StandardDocument3 pagesPOLICY SERVICING REQUEST 2 - With Standardsarwar shamsNo ratings yet

- Employee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezDocument2 pagesEmployee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezLaurence Erex GomezNo ratings yet

- 47a 2 APPLICATION FORMDocument8 pages47a 2 APPLICATION FORMJohn Lawrence de lunaNo ratings yet

- Vul ApplicationDocument4 pagesVul ApplicationJoseph ZafraNo ratings yet

- Vul ApplicationDocument4 pagesVul ApplicationJoseph ZafraNo ratings yet

- FRANCHISE Application Form 2023Document1 pageFRANCHISE Application Form 2023bibiboy1218No ratings yet

- Salary Deduction FormDocument1 pageSalary Deduction Formkrishneil kiritNo ratings yet

- Artifact 5 PF Withdrawal Form PDFDocument1 pageArtifact 5 PF Withdrawal Form PDFSuraj BaugNo ratings yet

- HDFCLife Mandate Deactivation FormDocument1 pageHDFCLife Mandate Deactivation FormAbh ParNo ratings yet

- Bonus Loan FormDocument2 pagesBonus Loan FormPATCOMC CooperativeNo ratings yet

- Mail Order / Telephone Order Form: (3/12/24 Months Installment Only For Metro Bank, BDO Credit Card)Document1 pageMail Order / Telephone Order Form: (3/12/24 Months Installment Only For Metro Bank, BDO Credit Card)Mark Angielo TrillanaNo ratings yet

- Pcab PDFDocument11 pagesPcab PDFArlyn JarabeNo ratings yet

- Park Generations Application Form PDFDocument20 pagesPark Generations Application Form PDFbhim singh pundirNo ratings yet

- Acknowledgement: Pre-Employment Requirements ChecklistDocument6 pagesAcknowledgement: Pre-Employment Requirements ChecklistTamis Anghang KetchupNo ratings yet

- Director Certificate SampleDocument3 pagesDirector Certificate SampleEkie GonzagaNo ratings yet

- PFN MLO Onboarding Package&Agreement-Contreras, Adriell - EncryptedDocument73 pagesPFN MLO Onboarding Package&Agreement-Contreras, Adriell - EncryptedVanessa GuardadoNo ratings yet

- Annexures CADocument21 pagesAnnexures CADeepankar SinghNo ratings yet

- STEP GRANT SelfCertificationForm EligibilityCriteria DCDocument1 pageSTEP GRANT SelfCertificationForm EligibilityCriteria DCbizDCNo ratings yet

- Thomson East Coast Line, Work Injury Compensation FormDocument3 pagesThomson East Coast Line, Work Injury Compensation FormbankerjudisNo ratings yet

- Certificate of AppearanceDocument2 pagesCertificate of AppearanceConselvien Juno Limson AsoyNo ratings yet

- LBTI W2 Waiver - 2015 - Option2Document1 pageLBTI W2 Waiver - 2015 - Option2Ryan Caezar LaspiñasNo ratings yet

- Non-Disclosure Agreement "Company Name": Doc. No. - Page No. - Book No. - Series of 2023Document1 pageNon-Disclosure Agreement "Company Name": Doc. No. - Page No. - Book No. - Series of 2023shendelier17No ratings yet

- Unitech Letter of ApplicationDocument3 pagesUnitech Letter of ApplicationJulius ErlanoNo ratings yet

- Cancellation FormDocument2 pagesCancellation FormAkash TebaliyaNo ratings yet

- Employer Undertaking (Seal Stamp) May 2018Document1 pageEmployer Undertaking (Seal Stamp) May 2018adetounadefalujoNo ratings yet

- Mumbai DivisionDocument3 pagesMumbai DivisionJuzz BujjiNo ratings yet

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018Yreced Gabison ResmaNo ratings yet

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018Yreced Gabison ResmaNo ratings yet

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018zetajrrogelioNo ratings yet

- Form-Loan Express March 2015 PDFDocument3 pagesForm-Loan Express March 2015 PDFJesse Carredo0% (1)

- Authorization LetterDocument1 pageAuthorization LetterLhien OmbaoNo ratings yet

- Authorization LetterDocument1 pageAuthorization LetterReem MagpantayNo ratings yet

- Authorization LetterDocument1 pageAuthorization Lettergludolovelymae5No ratings yet