Professional Documents

Culture Documents

NON-SUBMISSION WAIVER-converted-signed

NON-SUBMISSION WAIVER-converted-signed

Uploaded by

ガンボア ジョン・アーウィンOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NON-SUBMISSION WAIVER-converted-signed

NON-SUBMISSION WAIVER-converted-signed

Uploaded by

ガンボア ジョン・アーウィンCopyright:

Available Formats

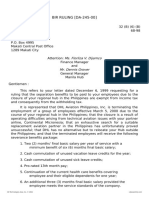

TDCX (Philippines) Inc.

21st to 26th floor Robinsons Cyberscape Gamma

Topaz & Ruby Roads|Ortigas Center, Pasig City Philippines 1605

www.tdcx.com

CERTIFICATION OF NON-SUBMISSION OF 2022 BIR FORM 2316

I,Jon Irvin M. Gamboa an employee of TDCX Philippines Inc. with employee number

45515 as of December 31, 2022 hereby certify that I did not furnish TDCX a copy of my 2022

Certificate of Income Tax Withheld on Compensation(BIR Form 2316) from my previous employer

due to.

Please choose only one and write your Tax Identification number on left side:

1) I have no previous employer for 2022.

347-209-423-000 2) My 2316 is not yet available from my previous company.

**For 2022 Tax Annualization purposes, Z -zero exemption will automatically apply to employees

with previous employer but did not submit the BIR form 2316.

In light of this, my current employer, TDCX has no basis of combining my other income from

previous employer for the taxable year 2022.

I shall be responsible in computing / filing and paying the appropriate tax to BIR after I combine

my income earned from my previous company,Teletech Cainta , and my income from

TDCX Philippines Inc. on or before April 15, 2023.

I hereby release TDCX Philippines Inc. for any obligations, costs, and other expenses that may

arise from above action.

Jon Irvin M. Gamboa

Signature over Printed Name

Employee / Taxpayer

This is to acknowledge receipt of the above form.

Date Signature over Printed Name

HR- Compensation and Benefits Specialist

You might also like

- Instructions For Form 941: (Rev. March 2021)Document20 pagesInstructions For Form 941: (Rev. March 2021)Btakeshi1No ratings yet

- Investment Declaration For Income Tax Calculation For The Financial Year 2023-24Document2 pagesInvestment Declaration For Income Tax Calculation For The Financial Year 2023-24Bheemineni ChandrikaNo ratings yet

- 2022 Non-Submission WaiverDocument1 page2022 Non-Submission WaiverZarah BernabeNo ratings yet

- Bir 2316 Submission Waiver 2022Document1 pageBir 2316 Submission Waiver 2022John Jason Narsico AlbrechtNo ratings yet

- Employee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezDocument2 pagesEmployee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezLaurence Erex GomezNo ratings yet

- GauriDocument12 pagesGauriRahul MittalNo ratings yet

- O o o o o o oDocument1 pageO o o o o o oashaNo ratings yet

- Waiver For Non SubmissionDocument1 pageWaiver For Non SubmissionJayson BongulanNo ratings yet

- b616c - MR Zamir Haider Shah Satr 2021-2022 SignedDocument14 pagesb616c - MR Zamir Haider Shah Satr 2021-2022 SignedJaved ShahNo ratings yet

- What Is Incorporation of A CompanyDocument4 pagesWhat Is Incorporation of A CompanyAnshika GuptaNo ratings yet

- Analysis of Section 43B (H)Document21 pagesAnalysis of Section 43B (H)gavandarpita02No ratings yet

- GST ChecklistDocument19 pagesGST ChecklistAakash BamniyaNo ratings yet

- Interim-Dividen-2021-22 - TDS-on-dividend-CommunicationDocument4 pagesInterim-Dividen-2021-22 - TDS-on-dividend-CommunicationNimesh PatelNo ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- Income Taxation ReportingDocument24 pagesIncome Taxation Reportingandresjovito14No ratings yet

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- 02 Rule 37BA Credit For TDSDocument3 pages02 Rule 37BA Credit For TDSAwanish SrivastavaNo ratings yet

- PGDTP ParnaDocument73 pagesPGDTP ParnaRi ChNo ratings yet

- INC-22A: On Companies Incorporated On or Before 31 December 2017Document6 pagesINC-22A: On Companies Incorporated On or Before 31 December 2017MrityunjayNo ratings yet

- Income Tax Amendments For May-2023Document12 pagesIncome Tax Amendments For May-2023Shubham krNo ratings yet

- 337060-2022-ABC Educational Development Center Inc.20221006-11-1574647Document4 pages337060-2022-ABC Educational Development Center Inc.20221006-11-1574647Ren Mar CruzNo ratings yet

- Notice of RetrenchmentDocument1 pageNotice of RetrenchmentJeliza ManaligodNo ratings yet

- New Hire Package BC - Hourly - FY2022-02-PADocument14 pagesNew Hire Package BC - Hourly - FY2022-02-PARuben 24 :DNo ratings yet

- BIR Ruling DA-245-00Document2 pagesBIR Ruling DA-245-00Em EmNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- CA3538Document1 pageCA3538Mark Joseph RespicioNo ratings yet

- CTPM Mid 2Document4 pagesCTPM Mid 2Abl SasankNo ratings yet

- Tax Proof Forms PDFDocument1 pageTax Proof Forms PDFAnushyantan NicholasNo ratings yet

- 5.BIR Form 2316 (CertificationWaiver)Document1 page5.BIR Form 2316 (CertificationWaiver)MARKOI SHOWNo ratings yet

- Week - 2 Assignment BDocument3 pagesWeek - 2 Assignment BJulan Calo CredoNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- EDit 2Document2 pagesEDit 2Nrs KhalidNo ratings yet

- DPT-3 FilingDocument4 pagesDPT-3 FilingSadvisree dpt 3 filingNo ratings yet

- Module 1-Business RenewalDocument4 pagesModule 1-Business RenewalKhitz CryztyNo ratings yet

- TDS - TCSDocument55 pagesTDS - TCSBeing HumaneNo ratings yet

- TDS Under Sec 194A EtcDocument26 pagesTDS Under Sec 194A EtcDivyaNo ratings yet

- PDR Tax Forum 2016 Recent Court Decisions On Tax - FinalDocument144 pagesPDR Tax Forum 2016 Recent Court Decisions On Tax - FinalFender Boyang100% (1)

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- AINO Communique 105th Edition - July 2022Document13 pagesAINO Communique 105th Edition - July 2022Swathi JainNo ratings yet

- Tax - Nature of BusinessDocument69 pagesTax - Nature of BusinessDhiraj MAkwanaNo ratings yet

- Section 192 Relatin Gto TDS On Salary - Section 192 Says That Every Person Who Is Responsible For Paying Any Income Chargeable Under The HeadDocument46 pagesSection 192 Relatin Gto TDS On Salary - Section 192 Says That Every Person Who Is Responsible For Paying Any Income Chargeable Under The HeadAtul SharmaNo ratings yet

- Circular 10 - 2022 - 194Q FunctionalityDocument3 pagesCircular 10 - 2022 - 194Q Functionalitylegendry007No ratings yet

- Circular No 10 2022Document4 pagesCircular No 10 2022Shobhit ShuklaNo ratings yet

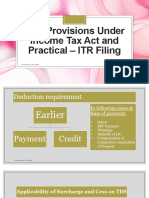

- TDS Provisions Under Income Tax Act and PracticalDocument42 pagesTDS Provisions Under Income Tax Act and PracticalTax NatureNo ratings yet

- FIN GL BBP 005 Extended Withholding TaxDocument12 pagesFIN GL BBP 005 Extended Withholding TaxSurani shaiNo ratings yet

- Declaration - For - Due Date After Cut Off DateDocument1 pageDeclaration - For - Due Date After Cut Off DateJitender MadanNo ratings yet

- Ditc CTE RQST To BIR 2Document2 pagesDitc CTE RQST To BIR 2reyna cruzadaNo ratings yet

- Role of PAODocument29 pagesRole of PAOAjay DhokeNo ratings yet

- Erd 4 F 003Document3 pagesErd 4 F 003GCLT Logistics and Transport and Trucking ServicesNo ratings yet

- Cma Final DT AmendmentsDocument40 pagesCma Final DT AmendmentsRaj KumarNo ratings yet

- Circular-No-10-2022 Income Tax ActDocument4 pagesCircular-No-10-2022 Income Tax Actsaurabh14014No ratings yet

- Cambodian Taxation Reviewers 5Document25 pagesCambodian Taxation Reviewers 5Ken JomelNo ratings yet

- Income-Tax Circular 2021-22Document1 pageIncome-Tax Circular 2021-22Aishwarya TripathiNo ratings yet

- Last Minute Notes in Tax RemediesDocument10 pagesLast Minute Notes in Tax RemediesJake MendozaNo ratings yet

- Unit IIDocument14 pagesUnit IICaddy BitchNo ratings yet

- SEC - 2020 AFS Deadline PDFDocument3 pagesSEC - 2020 AFS Deadline PDFRoy RitagaNo ratings yet

- Form E InformationDocument2 pagesForm E Informationmels.meltonNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet