Professional Documents

Culture Documents

Project Shield Financial Management EWT Guide

Uploaded by

Surani shaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Shield Financial Management EWT Guide

Uploaded by

Surani shaiCopyright:

Available Formats

PROJECT SHIELD

BUSINESS BLUEPRINT DOCUMENT

Financial Management

EXTENDED WITHHOLDING TAX (TDS / FBT)

Version: 02

Date: 31 Aug 2007

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 1 of 12

Document Information

Document Name Business Blueprint

Title Financial Management

Document Purpose To account for EWT/FBT requirements

Key Words EWT, FBT

Document Status In Progress

Contact for Enquiries Saikumar

Document Change Control :

Release Description Created Date Reviewed Date Approv Date

by by ed by

00 Extended Jagadish 16/08/2007

Withholding

Tax

00 Extended Saikumar 20/08/2007 KPMG 31/08/2007

Withholding

Tax

00 Extended Saikumar 31/08/2007 KPMG 03/09/2007

Withholding

Tax

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 2 of 12

CI Number

Process

EXTENDED WITHHOLDING TAX (TDS / FBT)

Applicable Sectors

ALL SECTORS

TABLE OF CONTENT

1. Requirements/Expectations...................................................................................4

2. General Explanations (For Masters and Enterprise structure include Naming

Convention) .................................................................................................................5

3. Explanations of Functions and Events .................................................................6

4. Organizational Considerations ..............................................................................6

5. Process Diagrams...................................................................................................7

6. Changes to Existing Organization processes ......................................................7

7. Description of Improvements ................................................................................7

8. Solution in SAP. ......................................................................................................8

9. Description of Functional Deficits.......................................................................11

10. Approaches to Covering Functional Deficits ...................................................11

11. Integration considerations.................................................................................11

12. Reporting Requirements ....................................................................................11

13. Authorization Requirements ..............................................................................12

14. File Conversion / Interface Considerations ......................................................12

15. Workflow Requirement.......................................................................................12

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 3 of 12

1. Requirements/Expectations

A brief / bulleted list of requirements and expectations

A. Fringe Benefit tax: [Solution # A & Functional deficit]

As per Section 115WB of the Income Tax Act, 1961, it is required to calculate Fringe Benefit Tax on any

privilege, service, facility or amenity, directly or indirectly, provided by an employer, whether by way of

reimbursement or otherwise, to his employees, any free or concessional ticket provided by the employer for

private journeys of his employees or their family members, any contribution by the employer to an approved

superannuation fund for employees, any specified security or sweat equity shares allotted or transferred,

directly or indirectly, by the employer free of cost or at concessional rate to his employees - Act

Calculation of FBT will be done on the basis of data directly obtained from the system based on the

percentages specified in the Income Tax Act, 1961 including surcharge and education cess.

System to give alerts when the due date for payment approaches.

System to give the Advance Fringe Benefit tax computation in specified format. System should estimate the

expenses for the balance period based on data available in the system for the full financial year.

System should facilitate to store information relating to remittance of tax amount to bank with the bank

challan number (External Challan Number), Name & Branch of the Bank, BSR code, date of cheque deposit,

etc

System should provide facility for automatic printing of annual return in specified format.

B. Tax deduction at Source:

Permanent Account Number should be mandatory while creating vendor Master based on Vendor Groups.

(Typically for Service Vendors). [Solution #B6]

TDS is to be calculated and deducted as per the provisions of Section 192, 193, 194, 194A, 194C, 194H,

194I, 194J & 195 of the Income Tax Act, 1961 read with rules, circulars or any notifications. [Solution #B2]

As per Section 192, 193, 194, 194A, 194C, 194H, 194I, 194J & 195 of the Income Tax Act, 1961, system has

to calculate TDS either at the time of Invoice Posting or payment posting whichever is earlier. [Solution

#B2/11/12]

System should take care of the minimum amount specified under the above sections for calculation of TDS.

[Solution #B2]

System should facilitate to manually enter the taxable amount. [Solution #B8]

Once the tax is calculated, it should be posted to the respective account TDS payable a/c automatically.

[Solution #B9]

System should calculate on the basis of the base percentage specified under the respective section of the

Income Tax Act, 1961 together with the surcharge, education cess and Secondary higher education

thereon. [Solution #B5]

Exemptions as applicable in certain scenarios should be taken into consideration in deducting tax to Vendors.

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 4 of 12

[Solution #B10]

System should facilitate in preparation of duly filled in TDS remittance Challan (ITNS-281) for different

sections and further under different section for corporate and non corporate parties separately. [Solution

#B13]

System should facilitate to store information relating to remittance of tax amount to bank with the bank

challan number (External Challan Number), Name and Branch of Bank, BSR code, date of Cheque deposit,

etc. [Solution #B14]

System should provide Form 16A in case of tax deducted at source / 27D in case of tax collection tax at

Source from suppliers, contractors etc. Certificate numbers should be internally managed by the system.

However, system should facilitate to print certificates not only for section wise but also for vendor wise,

posting date wise, bank challan date wise etc. [Solution #B15/18]

System should facilitate Form 26Q / 27Q / 27EQ – Quarterly (e-filing) on TDS with respect to each section,

and recipient type. [Solution #B16]

System should facilitate reports by way of Tax deduction Number, Section as well as consolidated statement

with respect to remittance to challans, certificates issued etc [Solution thru reporting requirements]

Dividend Distribution Tax (Sec.115O) [Solution #B19]

2. General Explanations (For Masters and Enterprise structure include Naming Convention)

Describe the business process in detail. This typically does not include any SAP specific terms, it should relate purely

to the business rules.

Describe the naming and numbering convention in case of masters and enterprise structure

A. Fringe Benefit tax:

Advance Fringe Benefit is payable in the following installments:

Due date of installment Amount payable

On or before June 15 Not less than 15% of FBT.

On or before September 15 Not less than 45% of FBT. [Inclusive of first installment]

On or before December 15 Not less than 75% of FBT. [Inclusive of earlier two installments]

On or before March 15 the whole amount of FBT. [Inclusive of earlier installment(s)]

Accounting process - Advance Fringe Benefit tax account is debited and bank account is credited.

B. Tax deduction at Source:-

TDS deducted under various sections during the month is to be remitted to the government account on or

before the 7 of the following month. Rates of taxes and sur-charges as applicable will be provided.

Dividend - 14 days from the date of declaration or date of disbursement whichever is earlier

th st

In case of TDS for March, , and others – TDS deducted – 7 of next month, and for TDS provided for 31

st

March will be on or before – 31 of May will be last date.

In case of deduction for Non-Residents, payment has to be made within 7 days from date of deduction.

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 5 of 12

3. Explanations of Functions and Events

Explain what events and processes trigger this process

A. Fringe Benefit Tax:-

When any privilege, service, facility or amenity, directly or indirectly, provided by an employer, whether by

way of reimbursement or otherwise, to his employees, any free or concessional ticket provided by the

employer for private journeys of his employees or their family members, any contribution by the employer to

an approved superannuation fund for employees, any specified security or sweat equity shares allotted or

transferred, directly or indirectly, by the employer free of cost or at concessional rate to his employees.

B. Tax deduction at Source:-

When any credit or payment is made to vendor towards Salary, dividend, interest, Contract, Advertisement,

Commission, Rent, Technical / Professional fees, foreign remittance and any other such payments / credit

which attract the provision of Tax deduction at Source.

Tax can be deducted either at the time of invoicing or at the time of payment. Rates of tax will be based on

nature of service rendered by the Vendor. Surcharge and cess as applicable will be deducted. Tax need to be

deducted at the time of advance payment also.

4. Organizational Considerations

Address any issues agreed in the workshop concerning the SAP organizational structure and this process.

Applicable for all Company Codes

Company Code

Business Place / Section Codes (TAN No.)

Vendor Master Data

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 6 of 12

5. Process Diagrams

Provide all related process maps or diagrams

6. Changes to Existing Organization processes

Change management issues as appropriate.

No refund is entertained with respect to vendors on wrong deduction cases if physical payment is already

made to the Government.

Interface is being used to generate data from Tally to generate Form 16A and Annual Returns where such

requirements are not necessary in SAP

TDS deducted will be calculated and posted automatically to the respective TDS Payable A/c

7. Description of Improvements

Describe improvements which will result from implementation of the SAP System. Be sure to include any impact on

business drivers.

The tax amounts will be calculated by the system on the execution of the transaction in respective modules.

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 7 of 12

Separate accounting entries for Taxes are not required to be passed.

System will deduct and propose the amount of TDS to be deducted from vendors at the time of invoice and

advance.

TDS Return shall be generated by the system.

8. Solution in SAP.

Describe how this process will be addressed in the product.

(A) Fringe Benefit Tax (FBT)

FBT is applicable for certain expenses incurred by the company as prescribed in Income Tax Act. FBT calculation

has to be done out of the SAP system, by extracting the required data from SAP.

Separate GL accounts will be used for capturing the data which is liable to FBT. At the time of depositing the FBT,

report shall be generated from system for calculation of FBT amount to be deposited.

(B) Tax Deducted at Source :

TDS will be covered as :

TDS on salary of employees

TDS on others

1. TDS on salary to employees will be covered in HR payroll and deduction will be done at the end of

each month. TDS on salary will be posted to a separate GL account as required. Payment to Government

will be made by Finance deptt. Every month on the due date.

Accounting entry on the payroll run:

Dr. Employee vendor a/c

Cr. TDS on Salary payable

Deposit of TDS:

Dr TDS on Salary payable

Cr Bank account

Form 16 for tax deducted from salary of employees shall be generated from HR. Similarly Tax return for

Salary will also be generated from HR.

Other TDS will be categorized as per the following sections under Income Tax Act.

2. Official Withholding tax key :

The deduction of TDS takes place under various sections of the Income Tax Act. These sections are defined as

Withholding Tax keys in the system and mapped to the sections of the Income Tax Act under which TDS is to be

deducted. Based on the above the following official Withholding Tax codes shall be created in the system:

Section-193 TDS on Interest on Securities

Section-194 TDS on Dividends

Section-194A TDS on Interest other than Interest on securities

Section-194C TDS on payment to Contractors and sub contractors

Section-194H TDS on Commission and Brokerage

Section-194I TDS on Rent

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 8 of 12

Section-194J TDS for Professional and Technical services

Section-195 TDS on payments for Foreign services

3. Recipient type:

The vendors from whom TDS is deducted need to be classified as Company and Others.

Recipient type enables categorization of the vendors. This categorization is required for creation of

separate challans and printing the TDS certificates

4. Withholding Tax types:

Withholding tax types are defined at client level to represent the various types of withholding taxes

for eg 194C, 194D etc. Withholding tax types are also used to determine whether the deduction of

TDS will take place at the time of invoice verification or at the time of payment. These withholding tax

types can be used once these are linked to the Company codes. Withholding tax types shall be

configured as per GMR requirement. For each withholding tax type minimum and maximum

amounts shall be maintained.

5. Withholding Tax Codes:

The various sections of the Income tax Act prescribe the rate at which the Tax is to be deducted.

Withholding tax codes are used to define the rate at which tax is to be deducted and the base amount

on which the tax is to be calculated. The rate will also include rate of surcharge and Education Cess if

any is applicable. SAP suggests to go with one tax code which is inclusive of basic tax rate,

surcharge and Education cess.Surcharge and Education cess rates shall be maintained separately in

tables and printed on the Vendor TDS certificate. In system we can have 99 inherent tax codes only

due to this we should not go for exclusive method. For each withholding taxcode, minimum and

maximum amounts shall be maintained.

6. Vendor master:

WHT type /codes shall be maintained in the Vendor master as applicable to the vendor. Tax

computation will be done by the system based on the WHT type/code maintained in the vendor

master at the time of invoice entry and also advance payments. Withholding Tax Type and

Withholding Tax code are maintained at the Invoice Entry level and

PAN# will be made as a part of Vendor Master.

Only tax type is maintained at the Payment level. This will ensure tax will not be deducted both at

the time of invoice and payment. In the case of Advance payment, tax type will be maintained and

user need to select the tax code. If multiple TDS sections are applicable to a particular vendor, then

all the tax types and tax codes for invoice s applicable for those TDS sections must be maintained in

the vendor master. However at the time of invoice entry the user has to select the correct tax type

and code and exclude those which are not applicable.

7. SAP suggested to go for one withholding tax code which is inclusive of basic rate, surcharge

and education cess. Surcharge and Education cess rates shall be maintained in separate table and

printed on Vendor TDS certificate. In system we can have 99 inherent tax codes only due to this we

should not go for exclusive method

8. System should facilitate manually enter the taxable amount :- At the time of posting

user shall amend the base amount.

9. Once the tax is calculated, it should be posted to the respective account Tax Payable

A/c automatically is a standard functionality. TDS Payable Account will be maintained section wise.

10. Exemptions rates will be maintained at the Vendor Master level for deducting tax to

vendors.

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 9 of 12

11. Accounting entry at the time of Invoice entry:

Dr Expense a/c

Cr Vendor

Cr TDS Payable

Separate GL accounts shall be created section wise like

TDS payable - Contractors

TDS payable - Professional fee. etc.

12. Accounting entry for advance payment to vendors:

Dr. Vendor Advance a/c

Cr. Bank a/c

Cr. TDS Payable

13. TDS remittance: Remittance will be made through the system by standard T-code

J1INCHLN. Challans will be updated for each section wise, corporate and Non

corporate separately. Due dates will be defined in the configuration for each section

wise.

Dr TDS Payable

Cr Bank a/c

14. Bank Challan updation: Bank challan number will be updated in the system through

standard T code – J1INBANK. This will link the remittance challans with the external

bank scroll number. No accounting entry will be generated.

15. TDS certificate: Certificates for the vendors can be generated by T Code- J1INCERT

Certificates can not be generated more than once. However duplicate certificate can be issued.

16. Quarterly E-Returns: E-Returns for TDS shall be generated from the system by T code –

J1INQEFILE. The return shall be converted into required excel file and can be

validated for filing.

17. TDS deducted by Customers:

A separate set of WT tax code & tax type shall have to be created for customers. Following

accounting entry shall be generated at the time of receiving the payment:

Dr. Bank a/c

Dr. TDS deducted by customer a/c

Cr. Customer a/c

The system will propose the TDS amount and the user can overwrite the amount, if required.

After receiving the TDS certificate from the customer, J1INCUST transaction shall be run and

following accounting entry shall be generated:

Dr. Advance Tax Paid A/c

Cr. TDS deducted by customer a/c

18. Tax Collected at source (TCS)

TCS is applicable on sale of Scrap to customers. Tax has to be collected at the time of billing to

customers and to be grossed up.

TCS will be covered by creating a separate condition type in Sales and Distribution module and

system will calculate TCS at the time of sale of scrap. TCS amount will be posted to TCS payable

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 10 of 12

GL account in FI. Payment for the same will be from FI by T-Code F-07.

Accounting entry on billing:

Dr. Customer

Cr. Revenue a/c

Cr. TCS Payable

Cr. Other taxes

Deposit of TCS into Govt.:

Dr. TCS payable

Cr. Bank a/c

System should facilitate reports by way of Tax Deduction No, Section, Consolidated statement:- A

standard functionality in SAP.

19. Dividend Distribution Taxes (Sec.115O): This has to be manually calculated and

entered in the system by passing JV (Txn.FB50 or F-02).

9. Description of Functional Deficits

Where appropriate, identify any gaps. This section is important when assessing risk, as well as estimating the need

for ABAP (or similar) resources.

Computation of Fringe Benefits Tax (FBT)

TCS certificate has to be issued to the customers from whom Tax has been collected.

10. Approaches to Covering Functional Deficits

Documentation of any work-arounds or assumptions that have been made when outlining functional deficits.

Workaround suggested for FBT by identifying the accounts for FBT and tax calculation out of SAP.

11. Integration considerations

Specify what integration you need with other modules / sub modules

MM Module: TDS,

HR Module: TDS on salary

SD Module: TCS

12. Reporting Requirements

Document the various reports that you would require.

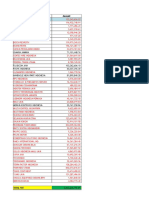

A. Fringe Benefit Tax:-

Computation of Advance Fringe Benefit tax for the 1, 2, 3 and Final instalment.(format attached)

Quarter wise & consolidated computation of FBT

Fringe Benefit tax return. (format attached)

FBT-Format for FY 2007-08.xls

FBT Return.xlsx

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 11 of 12

B. Tax deduction at Source:-

Report to generated in Form No.26Q / 27Q / 27EQ – Quarterly ETDS returns.(format attached)

TDS remittance sections wise, TAN No wise, quarter wise, etc (format attached)

challanitns-281.pdf (T.Code J1INQEFILE ) gives the Quarterly ETDS returns.

eTDSRPUForm26Q_ver3.21.xls

eTDSRPUForm27Q_ver3.22.xls

eTDSRPUForm27EQ_ver3.22.xls

Reports are Standard.

13. Authorization Requirements

Document the level of authorizations that you need for each process in the system

Authorization to be given to Direct taxation department for all sector for Internal audit

Authorization to be given to Direct taxation department to view taxation accounts

Authorization to be given to generate all Tax reports, Tax returns etc.,

14. File Conversion / Interface Considerations

Document file conversion / interface requirements. Where the information is to come from, what data is to be

converted manually/automatically and at what point in time. This is critical information that is used later.

NIL

15. Workflow Requirement

Document workflow requirement in this process including the levels of approval required. Mention who will initiate the

workflow and who all will be the recipients of the work item

Refer Process Diagram above.

FIN_GL_BBP_005 Extended Withholding Tax(TDS,FBT) Page 12 of 12

You might also like

- Fica ExcelDocument171 pagesFica ExcelYash GuptaNo ratings yet

- J58 S4hana2020 BPD en RoDocument144 pagesJ58 S4hana2020 BPD en RoSutaNo ratings yet

- Drive Sales of Brands & Categories at NykaaDocument1 pageDrive Sales of Brands & Categories at NykaaBhavya S. LadhaniNo ratings yet

- Sap Fi CrossDocument261 pagesSap Fi CrossTchordach2020No ratings yet

- GAL Data & Insights Requirement Specification Document (FinanceDocument332 pagesGAL Data & Insights Requirement Specification Document (FinanceAditTya RaparlaNo ratings yet

- Relnote Erpehp7 enDocument128 pagesRelnote Erpehp7 enHanif AbdurrahmanNo ratings yet

- Blueprint MODECORDocument70 pagesBlueprint MODECORsrinivasNo ratings yet

- Sap Fico ClassDocument113 pagesSap Fico ClassSidharth MansinghNo ratings yet

- Z Option Inc Glsu ManualDocument124 pagesZ Option Inc Glsu ManualnstomarNo ratings yet

- SAP FICO Consultant ResumeDocument5 pagesSAP FICO Consultant ResumeVijaybhaskar ReddyNo ratings yet

- Virutal GRDocument142 pagesVirutal GRajithno1No ratings yet

- 2020.03.04 SAP Bw4HANA Business ContentDocument44 pages2020.03.04 SAP Bw4HANA Business ContentdoudouNo ratings yet

- GST India - TDS Solution - SAP - SD - FIDocument13 pagesGST India - TDS Solution - SAP - SD - FISachin BhalekarNo ratings yet

- SC320 Umoja Inbound Goods Process ILT PDF v29 PDFDocument144 pagesSC320 Umoja Inbound Goods Process ILT PDF v29 PDFhemantkinoniNo ratings yet

- Blue Print - FI - BEARINGSDocument110 pagesBlue Print - FI - BEARINGSnagasuresh nNo ratings yet

- BP Op Entpr S4hana2022 09 Prerequisites Matrix en AeDocument122 pagesBP Op Entpr S4hana2022 09 Prerequisites Matrix en AeVinay KumarNo ratings yet

- Project Sunrise: Molson Coors International, India SAP Implementation - Project Sunrise Module: ControllingDocument43 pagesProject Sunrise: Molson Coors International, India SAP Implementation - Project Sunrise Module: ControllingKaveri BangarNo ratings yet

- What's New in Sap S4hana 2020 Sps04Document114 pagesWhat's New in Sap S4hana 2020 Sps04Sushant TyagiNo ratings yet

- User ID RolesDocument50 pagesUser ID Rolesrohan_juanNo ratings yet

- ERP Integration (U of Warwick)Document273 pagesERP Integration (U of Warwick)Tushar SakhalkarNo ratings yet

- S4Hana - SD Integration With FICODocument74 pagesS4Hana - SD Integration With FICOBhargav ReddyNo ratings yet

- SAP CCTR Advanced Training Configuration Part 1Document146 pagesSAP CCTR Advanced Training Configuration Part 1HuseyinNo ratings yet

- S. No. Page NoDocument363 pagesS. No. Page NorekhagoleyNo ratings yet

- 55856fi NotesDocument268 pages55856fi NotesMilind JoshiNo ratings yet

- 997 Functional Acknowledgment 5010Document25 pages997 Functional Acknowledgment 5010Lakshmi KanthNo ratings yet

- S4Hana - New Asset Accounting in 2020 VersionDocument104 pagesS4Hana - New Asset Accounting in 2020 VersionBhargav ReddyNo ratings yet

- Sap Tcodes: Logistics ExecutionDocument53 pagesSap Tcodes: Logistics ExecutionGabrielNo ratings yet

- SAP Budget Reports Training Manual: TopicDocument18 pagesSAP Budget Reports Training Manual: TopicMarco RicoNo ratings yet

- Business Partner For SAP FSCMDocument172 pagesBusiness Partner For SAP FSCMYinka FaluaNo ratings yet

- Financial Statements Based On Philippine Accounting Standards (PAS) #1Document17 pagesFinancial Statements Based On Philippine Accounting Standards (PAS) #1Corpuz TyroneNo ratings yet

- FSD OP2021 LatestDocument718 pagesFSD OP2021 Latestkarelin velazquezNo ratings yet

- 3102 SAP Support For GS1 Standards PDFDocument186 pages3102 SAP Support For GS1 Standards PDFJohn NederpelNo ratings yet

- FS Enhancement Template04-167MM - Marchon AMSDocument20 pagesFS Enhancement Template04-167MM - Marchon AMSashishsapmmNo ratings yet

- SAP Solutions For The: Dairy, Meat & Fish IndustryDocument29 pagesSAP Solutions For The: Dairy, Meat & Fish IndustryAlexey MalakhovNo ratings yet

- SAP NetWeaver Process Integration - Handbook PDFDocument123 pagesSAP NetWeaver Process Integration - Handbook PDFMatheus OliveiraNo ratings yet

- Material ManagementDocument369 pagesMaterial ManagementAndrewNo ratings yet

- S4HANA CompatibilityScopeMatrix DETAILSDocument8 pagesS4HANA CompatibilityScopeMatrix DETAILSNavinn SomaalNo ratings yet

- Cost and Management Accounting-I - Honours First Paper (CC 2.1 CH) Full Marks: 80Document12 pagesCost and Management Accounting-I - Honours First Paper (CC 2.1 CH) Full Marks: 80Anshul BajajNo ratings yet

- SAP Simple LogisticsDocument2 pagesSAP Simple LogisticspraveennbsNo ratings yet

- Ytach MahindaraDocument241 pagesYtach MahindaraAswin AswinNo ratings yet

- SAMConfiguration_2005Document160 pagesSAMConfiguration_2005franubiedaNo ratings yet

- Activity Managers Reporting GuideDocument144 pagesActivity Managers Reporting GuideRoberto De FlumeriNo ratings yet

- Authorisation Object ListDocument70 pagesAuthorisation Object Listsamirjoshi73No ratings yet

- Consolidated TPM Configuration BI-BPSDocument111 pagesConsolidated TPM Configuration BI-BPSSuresh Reddy100% (2)

- NTPC ERP-in-NTPCDocument144 pagesNTPC ERP-in-NTPCGautamNo ratings yet

- Sap CloudDocument29 pagesSap CloudjagankilariNo ratings yet

- Basic Processes in Finance Procurement and Sales 1659849966Document36 pagesBasic Processes in Finance Procurement and Sales 1659849966Pradeesh dhanapalNo ratings yet

- Release5 ReplicatingPricingDatafromtheSAPBackEnd 270116 1913 41114Document2 pagesRelease5 ReplicatingPricingDatafromtheSAPBackEnd 270116 1913 41114ahoilNo ratings yet

- LP SA Combine Deliveries Into Shipment - E1Q-100Document116 pagesLP SA Combine Deliveries Into Shipment - E1Q-100DamianSpagnulNo ratings yet

- 1eg S4hana2022 BPD en AeDocument33 pages1eg S4hana2022 BPD en AeVinay KumarNo ratings yet

- 2tt S4hana2021 BPD en de Sales CommissionsDocument69 pages2tt S4hana2021 BPD en de Sales CommissionsLarisa SchiopuNo ratings yet

- Sap Hana Platform Sps 08 Sap Hana DeveloDocument800 pagesSap Hana Platform Sps 08 Sap Hana Develosantosh tripathiNo ratings yet

- SAP S4HANA Central Finance 1709788975Document137 pagesSAP S4HANA Central Finance 1709788975opj.peppyleafNo ratings yet

- FI-CO End User Training ModuleDocument6 pagesFI-CO End User Training Moduledevanshugaur5No ratings yet

- SAMConfiguration 2105Document248 pagesSAMConfiguration 2105syedwahab.wahab93No ratings yet

- SAP Road Map For RetailDocument106 pagesSAP Road Map For RetailA HNo ratings yet

- SAP Upgrade From SAP R - 3 To ECC 6.0 With EHPDocument33 pagesSAP Upgrade From SAP R - 3 To ECC 6.0 With EHPPrasad PenkeNo ratings yet

- What is SAP ERPDocument34 pagesWhat is SAP ERPKyla Caryll De VillaNo ratings yet

- TDS AND TCS PROVISIONSDocument55 pagesTDS AND TCS PROVISIONSBeing HumaneNo ratings yet

- Tax Deducted at Source ExplainedDocument31 pagesTax Deducted at Source ExplainedShaleenPatniNo ratings yet

- S - 4 HANA Credit CardDocument14 pagesS - 4 HANA Credit CardSurani shaiNo ratings yet

- SAP Biller Direct Step by Step ConfiguraDocument16 pagesSAP Biller Direct Step by Step ConfiguraSurani shaiNo ratings yet

- SAP S4HANA FI MonitoringDocument45 pagesSAP S4HANA FI MonitoringSurani shaiNo ratings yet

- Sap S4hana FicaDocument23 pagesSap S4hana FicaSurani shaiNo ratings yet

- SAP S4 HANA Finance Associate Exam PrepDocument50 pagesSAP S4 HANA Finance Associate Exam PrepSurani shai100% (2)

- Bank Account ManagmeDocument54 pagesBank Account ManagmeSurani shai100% (1)

- What Is Planning Level in SAP Cash ManagementDocument2 pagesWhat Is Planning Level in SAP Cash ManagementSurani shaiNo ratings yet

- (PDF) FIN - GL - BBP - 005 Extended Withholding Tax (TDS, FBT - BVR Rao1 - Academia - EduDocument15 pages(PDF) FIN - GL - BBP - 005 Extended Withholding Tax (TDS, FBT - BVR Rao1 - Academia - EduSurani shaiNo ratings yet

- END-USER GUIDES (Finance) SAP S/4 HANA Finance, Localization Extension For The Republic of Belarus by EPAMDocument50 pagesEND-USER GUIDES (Finance) SAP S/4 HANA Finance, Localization Extension For The Republic of Belarus by EPAMMaxwell DeafeamekporNo ratings yet

- DAY258403358 Auth LetterDocument3 pagesDAY258403358 Auth LetterDanish InamNo ratings yet

- Merchant Rates 2019 2020 Oct 2019Document11 pagesMerchant Rates 2019 2020 Oct 2019rh007No ratings yet

- User Guide On Paying MCA21 Fees Via NEFT: BanksDocument4 pagesUser Guide On Paying MCA21 Fees Via NEFT: BanksRajesh KumarNo ratings yet

- Your Personal Bank Chequing Account Statement: Toronto, ON M5W 1L5Document2 pagesYour Personal Bank Chequing Account Statement: Toronto, ON M5W 1L5John BarrNo ratings yet

- Candor Cash Flow ExerciseDocument3 pagesCandor Cash Flow ExerciseMohammed100% (1)

- Discount (October 1)Document9 pagesDiscount (October 1)Shiela Marie FranciscoNo ratings yet

- Idt - GSTDocument35 pagesIdt - GSTArush KothariNo ratings yet

- NEGODocument24 pagesNEGOTj AllasNo ratings yet

- Bill No:: Billing Month:: TariffDocument1 pageBill No:: Billing Month:: TariffSozib HosenNo ratings yet

- SMS ATM Technical Specifications,: V.I.P. SystemDocument230 pagesSMS ATM Technical Specifications,: V.I.P. Systemkandukuri3456No ratings yet

- LNG Competitors Wages - Aug 2015Document11 pagesLNG Competitors Wages - Aug 2015OctavianNo ratings yet

- Electronic Filing and Payment SystemDocument33 pagesElectronic Filing and Payment SystemJeannie de leonNo ratings yet

- 160 Scra 560 (GR L-66838) Cir vs. Procter and GambleDocument37 pages160 Scra 560 (GR L-66838) Cir vs. Procter and GambleRuel FernandezNo ratings yet

- "Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Document3 pages"Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Christopher Vinoth0% (2)

- Classification of Taxes: A. Domestic CorporationDocument5 pagesClassification of Taxes: A. Domestic CorporationWenjunNo ratings yet

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- Computerised Accounting With MYOB 2Document126 pagesComputerised Accounting With MYOB 2AzwirNo ratings yet

- Inclusivebankingsuite User Guide: Parameters, Head Teller and TellerDocument123 pagesInclusivebankingsuite User Guide: Parameters, Head Teller and TellerMark MahuaNo ratings yet

- Iesco Online BilllDocument2 pagesIesco Online BilllMohammad NaveedNo ratings yet

- Guanlao Post Test ReviewsDocument2 pagesGuanlao Post Test Reviewslena cpaNo ratings yet

- 1450 BTDocument1 page1450 BTShahjada ShekhNo ratings yet

- GST - Textile IndustryDocument16 pagesGST - Textile IndustrykaranNo ratings yet

- Purchase Unit 116 Tierra Verde TownhomeDocument2 pagesPurchase Unit 116 Tierra Verde Townhomeshrine obenietaNo ratings yet

- Menu Finacle 10xDocument63 pagesMenu Finacle 10xInfotomathiNo ratings yet

- PH Taxes Guide: National & Local TaxesDocument2 pagesPH Taxes Guide: National & Local TaxesYzah CariagaNo ratings yet

- California Adjustments to Federal Taxable IncomeDocument1 pageCalifornia Adjustments to Federal Taxable Incomep001No ratings yet

- Channel Access Request Form for Individual and Non-Individual AccountsDocument3 pagesChannel Access Request Form for Individual and Non-Individual AccountsRavi RamrakhaniNo ratings yet

- Payment IDR - Mega - Januari 2009 - UPdatedDocument115 pagesPayment IDR - Mega - Januari 2009 - UPdatedirfanafiffudinNo ratings yet

- Rhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestDocument2 pagesRhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestEmir MendozaNo ratings yet

- Account Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSuryakiran kallaNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Hidden Wealth Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth Nations: The Scourge of Tax HavensRating: 4.5 out of 5 stars4.5/5 (40)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)