Professional Documents

Culture Documents

Practice Exercise - Ship Shape Retail - Solution

Uploaded by

155- Salsabila GadingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Exercise - Ship Shape Retail - Solution

Uploaded by

155- Salsabila GadingCopyright:

Available Formats

Practice Exercise - Ship Shape Retail Strictly Confidential

Table of Contents

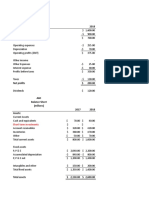

Ship Shape Cash Flow Statement

© 2015 to 2023 CFI Education Inc.

This Excel model is for educational purposes only and should not be used for any other reason. All content is Copyright material of CFI Education Inc.

All rights reserved. The contents of this publication, including but not limited to all written material, content layout, images, formulas, and code, are protected

under international copyright and trademark laws. No part of this publication may be modified, manipulated, reproduced, distributed, or transmitted in any

form by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission of the publisher,

except in the case of certain noncommercial uses permitted by copyright law.

https://corporatefinanceinstitute.com/

Construct Direct and Indirect Cash Flow Statements for Ship Shape Retail Inc. - Year 1

You have…

1 Cash purchases 250

2 Cash sales 370

3 Cash expenses 40

4 Depreciation 55

There was no inventory at the year end.

Income Statement Cash Flow Direct Cash Flow Indirect

Revenue 370 Cash from sales 370 Net income 25

Purchases (250) Cash on purchases (250)

Expenses (40) Cash expenses (40)

Depreciation (55) Depreciation 55

Net income 25 Change in cash 80 Change in cash 80

Year 2

You have…

1 Cash purchases 280

2 Cash sales 300

3 Sales on credit 170

4 Cash expenses 50

5 Receipts from receivables 140

6 Depreciation 55

Again, there was no inventory at the year end.

Income Statement Cash Flow Direct Cash Flow Indirect

Revenue 470 Cash from sales 440 Net income 85

Purchases (280) Cash on purchases (280) Increase in A/R (30)

Expenses (50) Cash expenses (50)

Depreciation (55) Depreciation 55

Net income 85 Change in cash 110 Change in cash 110

Practice Exercise - Ship Shape Retail Page 3 of 4

Year 3

You have…

1 Cash purchases 150

2 Cash sales 320

3 Sales on credit 310

4 Purchases on credit 180

5 Receipts from receivables 260

6 Payments to payables 140

7 Cash expenses 70

8 Depreciation 55

Again, there was no inventory at the year end.

Income Statement Cash Flow Direct Cash Flow Indirect

Revenue 630 Cash from sales 580 Net income 175

Purchases (330) Cash on purchases (290) Increase in A/R (50)

Expenses (70) Cash expenses (70) Increase in A/P 40

Depreciation (55) Depreciation 55

Net income 175 Change in cash 220 Change in cash 220

Year 4

You have…

1 Cash purchases 200

2 Cash sales 400

3 Sales on credit 410

4 Purchases on credit 380

5 Receipts from receivables 390

6 Payments to payables 360

7 Cash expenses 100

8 Depreciation 55

There was closing inventory of 35.

Income Statement Cash Flow Direct Cash Flow Indirect

Revenue 810 Cash from sales 790 Net income 110

Opening inventory – Cash on purchases (560) Increase in A/R (20)

Purchases (580) Cash expenses (100) Increase in A/P 20

Closing Inventory 35 Increase in inventory (35)

Cost of sales (545)

Expenses (100)

Depreciation (55) Depreciation 55

Net income 110 Change in cash 130 Change in cash 130

Practice Exercise - Ship Shape Retail Page 4 of 4

You might also like

- Johannes 1 To 3 Solution Period 1: © Corporate Finance InstituteDocument4 pagesJohannes 1 To 3 Solution Period 1: © Corporate Finance InstitutePirvuNo ratings yet

- Johannes 1 To 3 Solution: Strictly ConfidentialDocument5 pagesJohannes 1 To 3 Solution: Strictly ConfidentialDavid JohnNo ratings yet

- CFI - Accounting - Fundementals - Johannes Period 1 To 3 SolutionDocument5 pagesCFI - Accounting - Fundementals - Johannes Period 1 To 3 SolutionsovalaxNo ratings yet

- Johannes Period 1 To 3 SolutionDocument5 pagesJohannes Period 1 To 3 SolutionHue PhamNo ratings yet

- Johannes 1 To 3 Solution: Strictly ConfidentialDocument5 pagesJohannes 1 To 3 Solution: Strictly ConfidentialVibhuti BatraNo ratings yet

- Johannes 1 To 3 Solution: Strictly ConfidentialDocument5 pagesJohannes 1 To 3 Solution: Strictly ConfidentialLeon WilsonNo ratings yet

- Cash FlowsDocument12 pagesCash FlowsEjaz AhmadNo ratings yet

- JohannesPeriod4Exercise 1522272899898Document2 pagesJohannesPeriod4Exercise 1522272899898Manoj Dasari100% (1)

- Johannes Period 4 ExerciseDocument3 pagesJohannes Period 4 ExerciseHue PhamNo ratings yet

- Johannes Period 4 SolutionDocument3 pagesJohannes Period 4 SolutionHue PhamNo ratings yet

- Johannes Period 4 Solution: Strictly ConfidentialDocument3 pagesJohannes Period 4 Solution: Strictly ConfidentialDavid John100% (1)

- CFI Accounting Fundamentals Johannes Period 4 SolutionDocument3 pagesCFI Accounting Fundamentals Johannes Period 4 SolutionsovalaxNo ratings yet

- Income Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Document3 pagesIncome Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Sathyanarayana GNo ratings yet

- JohannesPeriod1to3Exercise 200115 104430Document5 pagesJohannesPeriod1to3Exercise 200115 104430indahpsNo ratings yet

- Analysis of Financial StatementDocument10 pagesAnalysis of Financial StatementAli QasimNo ratings yet

- SESSION 3 Practice TemplateDocument7 pagesSESSION 3 Practice Templateyimin liuNo ratings yet

- Cash Flow Statement-ShortDocument27 pagesCash Flow Statement-ShortLaurene Delos ReyesNo ratings yet

- Problem 7-5Document2 pagesProblem 7-5Irfan ghaniNo ratings yet

- Cashflow ActivityDocument2 pagesCashflow ActivityHannie CaratNo ratings yet

- 89 F 4 EfsaDocument3 pages89 F 4 EfsaabhimussoorieNo ratings yet

- Cash FlowDocument12 pagesCash FlowalguienNo ratings yet

- Math Solution - Session 11Document8 pagesMath Solution - Session 11Saoda Feel IslamNo ratings yet

- Statement of Kamran Establishment C o DFDocument4 pagesStatement of Kamran Establishment C o DFRazaAmin100% (1)

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- BE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnDocument10 pagesBE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnNguyễn Linh NhiNo ratings yet

- Solved Problem 3.1 Profit & Loss Account For Year Ending 31st MarchDocument65 pagesSolved Problem 3.1 Profit & Loss Account For Year Ending 31st MarchChaitanyaNo ratings yet

- Management Accounting - I: - Dr. Sandeep GoelDocument109 pagesManagement Accounting - I: - Dr. Sandeep GoelRajat Jawa100% (1)

- Analysis of Financial StatementDocument8 pagesAnalysis of Financial StatementMuhammad IrfanNo ratings yet

- Exercise ProfitabilityDocument2 pagesExercise ProfitabilityPhong Nghiêm TấnNo ratings yet

- ABC Income Statement (Millons) 2018: Short Term InvestmentsDocument20 pagesABC Income Statement (Millons) 2018: Short Term InvestmentsAlejo valenzuelaNo ratings yet

- DW CorpDocument20 pagesDW CorpAlejo valenzuelaNo ratings yet

- Ratio AnlysDocument5 pagesRatio AnlysVi PhuongNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Column3 Column4 Column5 Day 1 Day 2 Day 3 Sales Gross ProfitDocument10 pagesColumn3 Column4 Column5 Day 1 Day 2 Day 3 Sales Gross ProfitMelodias BartlomeoNo ratings yet

- Carol Majestica-01012190047-PR Pertemuan 04Document7 pagesCarol Majestica-01012190047-PR Pertemuan 04nadila ika sefiraNo ratings yet

- Bookkeeping Practice SetDocument31 pagesBookkeeping Practice SetSittie Norhanizah100% (1)

- BFN202 Seminar Questions SET1Document3 pagesBFN202 Seminar Questions SET1baba cacaNo ratings yet

- 4excels On Solved ProblemsDocument2 pages4excels On Solved ProblemsAtushNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- FCFF 1 Aayush ParasharDocument7 pagesFCFF 1 Aayush Parasharaayush.5.parasharNo ratings yet

- Module 5 Lecture WorksheetDocument6 pagesModule 5 Lecture WorksheetcccNo ratings yet

- BOOKKEEPPING EQA CorporationDocument21 pagesBOOKKEEPPING EQA CorporationLovely Rose GuinilingNo ratings yet

- IFS - Sales Model - Blank - Extended VersionDocument6 pagesIFS - Sales Model - Blank - Extended VersionGaurav MishraNo ratings yet

- Jenga Inc ExerciseDocument3 pagesJenga Inc ExerciseHue PhamNo ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Lecture 2 Answer1 1564205815261Document18 pagesLecture 2 Answer1 1564205815261Trinesh BhargavaNo ratings yet

- Assignment: Financial Ratios: Submitted byDocument4 pagesAssignment: Financial Ratios: Submitted byHarshit DalmiaNo ratings yet

- Assignment 1 - 2021 - 2022Document4 pagesAssignment 1 - 2021 - 2022Assya El MoukademNo ratings yet

- Interpreting Financial StatementsDocument2 pagesInterpreting Financial StatementsSharen HariNo ratings yet

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocument18 pages2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNo ratings yet

- Step 1 - Statement of Cash FlowsDocument4 pagesStep 1 - Statement of Cash Flowshusse fokNo ratings yet

- Model Policies and Procedures for Not-for-Profit OrganizationsFrom EverandModel Policies and Procedures for Not-for-Profit OrganizationsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- J.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessFrom EverandJ.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessNo ratings yet

- The Wall Street MBA: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA: Your Personal Crash Course in Corporate FinanceNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- IFpaper 2020Document25 pagesIFpaper 2020155- Salsabila GadingNo ratings yet

- 11.1. Practice Exercise - Cumberland Inc - BlankDocument5 pages11.1. Practice Exercise - Cumberland Inc - Blank155- Salsabila GadingNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- Practice Exercise - Ravensburger - BlankDocument3 pagesPractice Exercise - Ravensburger - Blank155- Salsabila GadingNo ratings yet

- Working Capital Management andDocument15 pagesWorking Capital Management and155- Salsabila GadingNo ratings yet

- Practice Exercise - Springbok - BlankDocument3 pagesPractice Exercise - Springbok - Blank155- Salsabila GadingNo ratings yet

- Literature Review of The ImpacDocument23 pagesLiterature Review of The Impac155- Salsabila GadingNo ratings yet

- Murataj, Marsida - 508493 - Senior Project ThesisDocument55 pagesMurataj, Marsida - 508493 - Senior Project Thesis155- Salsabila GadingNo ratings yet

- Pengaruh Motivasi Terhadap Kinerja Pegawai Badan Kepegawaian Dan Diklat Daerah Kabupaten Mamuju UtaraDocument12 pagesPengaruh Motivasi Terhadap Kinerja Pegawai Badan Kepegawaian Dan Diklat Daerah Kabupaten Mamuju Utara155- Salsabila GadingNo ratings yet

- NirvanaDocument8 pagesNirvanaSanj RNo ratings yet

- Chapter 2 Qualities of Accounting Information: Financial Accounting: A Business Process Approach, 3e (Reimers)Document18 pagesChapter 2 Qualities of Accounting Information: Financial Accounting: A Business Process Approach, 3e (Reimers)PeterNo ratings yet

- 2017 PRS For Music Annual Transparency ReportDocument46 pages2017 PRS For Music Annual Transparency ReportJah-Son Shamma Shamma DennisNo ratings yet

- Acct 557Document10 pagesAcct 557kihumbaeNo ratings yet

- Master Template v1Document79 pagesMaster Template v1KiranNo ratings yet

- Kamus AkuntansiDocument9 pagesKamus Akuntansiardityo uriyaniNo ratings yet

- Morning Star BakeryDocument24 pagesMorning Star BakeryKelvin WidjajaNo ratings yet

- Globalization of UnileverDocument5 pagesGlobalization of UnileverRihan H Rahman100% (3)

- Lakeland Corporation Year 5 Year 4 Assets: Chapter One - Overview of Financial Statement AnalysisDocument4 pagesLakeland Corporation Year 5 Year 4 Assets: Chapter One - Overview of Financial Statement AnalysisKHOO TAT SHERN DEXTONNo ratings yet

- Toa 1404Document9 pagesToa 1404chowchow123No ratings yet

- Hailan Holdings Limited 海 藍 控 股 有 限 公 司: Announcement Of Interim Results For The Six Months Ended 30 June 2020Document40 pagesHailan Holdings Limited 海 藍 控 股 有 限 公 司: Announcement Of Interim Results For The Six Months Ended 30 June 2020in resNo ratings yet

- Multiplan FR Shopping Jundiai 20080909 EngDocument1 pageMultiplan FR Shopping Jundiai 20080909 EngMultiplan RINo ratings yet

- 13-Theory (85-89)Document12 pages13-Theory (85-89)Sameer HussainNo ratings yet

- Chapter 9-10 QuestionsDocument10 pagesChapter 9-10 QuestionsMya B. WalkerNo ratings yet

- Chapter 12 PDFDocument11 pagesChapter 12 PDFgerNo ratings yet

- Bacc 404 Ass 1Document6 pagesBacc 404 Ass 1Denny ChakauyaNo ratings yet

- Entrepreneurship: Quarter 2 - Module 7 Forecasting Revenues and CostsDocument27 pagesEntrepreneurship: Quarter 2 - Module 7 Forecasting Revenues and CostsIra Jane CaballeroNo ratings yet

- Notes in Taxation Law by Atty Vic MamalateoDocument99 pagesNotes in Taxation Law by Atty Vic Mamalateorossfrancisco_l8835100% (2)

- VII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909Document11 pagesVII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909Stef OcsalevNo ratings yet

- C4 W1 Final AssessmentDocument14 pagesC4 W1 Final Assessmentdiktat86No ratings yet

- Metrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMetrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Reza CahyaNo ratings yet

- Original Presentation by Hamza ShahDocument56 pagesOriginal Presentation by Hamza ShahHamza BukhariNo ratings yet

- Annual AccountsDocument63 pagesAnnual Accountsherrera.angelaNo ratings yet

- Relevant Costs & BenefitsDocument12 pagesRelevant Costs & BenefitsshampamgmtNo ratings yet

- Intermediate Accounting Canadian Canadian 6Th Edition Beechy Solutions Manual Full Chapter PDFDocument68 pagesIntermediate Accounting Canadian Canadian 6Th Edition Beechy Solutions Manual Full Chapter PDFchanelleeymanvip100% (11)

- RR 16 2008Document8 pagesRR 16 2008Ruby ReyesNo ratings yet

- Assertion and Reasoning (A-R) Based Questions: Name of The Chapter:-Ratio AnalysisDocument6 pagesAssertion and Reasoning (A-R) Based Questions: Name of The Chapter:-Ratio AnalysisSiddhi Jain100% (1)

- Berjaya Financial Report PDFDocument108 pagesBerjaya Financial Report PDFRubanNo ratings yet

- Basic AccountingDocument107 pagesBasic AccountingApril Justine Fuentebella DacalosNo ratings yet

- Form Annual Report (Feb 29 2008)Document329 pagesForm Annual Report (Feb 29 2008)serpepeNo ratings yet