Professional Documents

Culture Documents

Carol Majestica-01012190047-PR Pertemuan 04

Uploaded by

nadila ika sefiraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carol Majestica-01012190047-PR Pertemuan 04

Uploaded by

nadila ika sefiraCopyright:

Available Formats

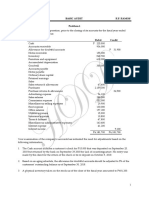

Mortoson plc

Statement of Cash Flows

For the Year Ended December 31, 2019

Cash flows from operating activities

Cash received from customers 3,520 *

Less: Cash Payments

Purchase for merchandise 1,270 *

Salaries and benefits 725

Heat, light and power 75

Property taxes 80

Miscellaneous expense 10

Interest 30

Income taxes 808 * 2,937

Net cash provided by operating activities 583

Cash flows from investing activities

Sale of non-trading equity investment 40

Purchase of land -80

Purchase of buildings and equipment -310

Net cash used by financing activities -350

Net increase in cash 233

Cash at beginning period 100

Cash at end of period 333

Computations

Sales revenue 3,800

Deduct ending account receivable 780

Add beginning account receivable 500

Cash receipts from collecting customers 3,520

Cost of goods sold 1,200

Add ending inventory 720

Goods available for sale 1,920

Deduct beginning inventory 560

Purchases 1,360

Deduct ending account payable 420

Add beginning account payable 330

Cash purchases 1,270

Income taxes expense 818

Deduct ending income taxes payable 40

Add beginning income taxes payable 30

Income taxes 808

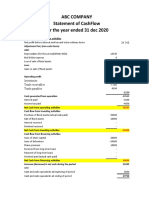

Michaels Ltd

Statement of Cash Flows

For the Year Ended December 31, 2019

Cash flows from operating activities

Cash received from customers 1,152,450

Dividend received 2,400 1,154,850

Less: Cash payments

To suppliers 765,000

For operating expenses 226,350

For taxes 38,400

For interest 57,300

Net cash provided by operating activities 67,800

Cash flows from investing activities

Sale of short-term equity investment 12,000

(8.000+4.000)

Sale of land 58,000

(175.000-125.000 + 8.000)

Purchase of equipment -125,000

Net cash used by investing activities -55,000

Cash flows from financing activities

Issuance of ordinary shares 27,500

Payment of long term debt -10,000

Dividens paid -24,300

Net cash used by financing activities -6,800

Net increase in cash 6,000

Cash at beginning period 4,000

Cash at end of period 10,000

Sales revenue 1,160,000

Deduct ending account receivable 20,500

Add beginning account receivable 12,950

Cash receipts from collecting customers 1,152,450

Cost of goods sold 748,000

Add ending inventory 42,000

Goods available for sale 790,000

Deduct beginning inventory 35,000

Purchases 755,000

Deduct ending account payable 22,000

Add beginning account payable 32,000

Cash to suppliers 765,000

Operating expenses 276,400

Depreciation expense -40,500

Decrease in prepaid rent -9,000

Increase in prepaid insurance 1,200

Increase in office supplies 250

Increase in salaries and wages payable -2,000

Cash Payments for operating expenses 226,350

Income taxes expense 39,400

Deduct ending income taxes payable 5,000

Add beginning income taxes payable 4,000

Income taxes 38,400

Interest expense 51,750

Amortization bonds premium 5,550

Interest 57,300

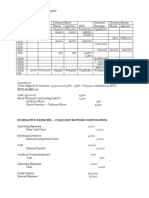

Net cash flow from operating activities

Cash received from customers 524,850

Less: Cash payments

To suppliers 375,750

For operating expenses 105,675 481,425

Net cash provided by operating activities 43,425

Sales revenue 540,000

Deduct ending account receivable 70,500

Add beginning account receivable 60,000

Writeoff of accounts receivable (1.500+5.400-2.250) 4,650

Cash receipts from collecting customers 524,850

Cost of goods sold 380,000

Add ending inventory 30,000

Goods available for sale 410,000

Deduct beginning inventory 24,000

Purchases 386,000

Deduct ending account payable 35,000

Add beginning account payable 24,750

Cash to suppliers 375,750

Operating expenses 120,450

Depreciation expense -8,625

Increase in accrued payable -750

Bad debt expense -5,400

Cash Payments for operating expenses 105,675

Marcus AG

Statement of Cash Flows

For the Year Ended December 31, 2019

Cash flows from operating activities

Net income 42,500

Adjustments to reconcile net income

to net cash provided by operating activities

Depreciation expense 8,625

Gain on sale of investments -3,750

Loss on sale of machinery 800

Increase in account receivable -9,750

Increase in inventory -6,000

Increase in account payable 10,250

Increase in accrued payable 750 925

Net cash provided by operating activities 43,425

Cash flows from investing activities

Purchase of non-trading equity investment -8,750

(22.250-(38.500-25.000))

Purchase of machinery -15,000

(30.000-(18.750-3.750))

Sale of investments 28,750

Sale of machinery 2,200

Addition of building -11,250

Net cash used by investing activities -4,050

Cash flows from financing activities

Reduction long-term notes payable -10,000

Cash dividends -21,125

Net cash used by financing activities -31,125

Net increase in cash 8,250

Cash at beginning period 33,750

Cash at end of period 42,000

Champan Company

Statement of Cash Flows

For the Year Ended May 31, 2019

Cash flows from operating activities

Cash received from customers 1,238,250

Less: Cash payments

To suppliers 684,000

To employees 276,850

For other expense 10,150

For interest 73,000

For income taxes 43,000 1,087,000

Net cash provided by operating activities 151,250

Cash flows from investing activities

Purchase of plant asset -28,000

Cash flows from financing activities

Issuance of ordinary shares 20,000

Cash dividends -105,000

Retire bonds payable -30,000

Net cash used by financing activities -115,000

Net increase in cash 8,250

Cash at beginning period 20,000

Cash at end of period 28,250

Note : Non-cash investing and financing activities

Issuance of ordinary shares for plant asset 70.000

Computations:

Sales revenue 1,255,250

Increase in accounts receivable 17,000

Cash received from customers 1,238,250

Cost of goods sold 722,000

Decrease in inventory -30,000

Increase in accounts payable -8,000

Cash to suppliers 684,000

Salaries and wages expense 252,100

Decrease salaries and wages payable 24,750

Cash to employees 276,850

Other expense 8,150

Increase in prepaid expense 2,000

Cash for other expense 10,150

Interest expense 75,000

Increase in interest payable -2,000

Cash for interest 73,000

Champan Company

Statement of Cash Flow

For the Year Ended May 31, 2019

Cash flows from operating activities

Net income 130,000

Adjustments to reconcile net income

to net cash provided by operating activities

Depreciation expense 25,000

Decrease in inventory 30,000

Increase in prepaid expense -2,000

Increase in accounts receivable -17,000

Increase in accounts payable 8,000

Decrease in salaries and wages payable -24,750

Increase in interest payable 2,000 21,250

Net cash provided by operating activities 151,250

You might also like

- Massey Ferguson MF7600 Technician Workshop ManualDocument798 pagesMassey Ferguson MF7600 Technician Workshop Manualgavcin100% (5)

- Working: Lunch Dinner Sales Units 7800 20280 Sales Price 12 25 93600 507000Document8 pagesWorking: Lunch Dinner Sales Units 7800 20280 Sales Price 12 25 93600 507000kudkhanNo ratings yet

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Cash Flow Statement StudentDocument60 pagesCash Flow Statement StudentJanine MosatallaNo ratings yet

- Hilti TE 804 and 905avr PartsDocument13 pagesHilti TE 804 and 905avr PartsAqui Solo100% (1)

- UntitledDocument17 pagesUntitledSedat100% (1)

- 01 eLMS Activity 3 - ARGDocument2 pages01 eLMS Activity 3 - ARGJilliane MaineNo ratings yet

- ACT320 Assignment ProjectDocument11 pagesACT320 Assignment ProjectMd. Shakil Ahmed 1620890630No ratings yet

- Soal Cash FlowDocument6 pagesSoal Cash FlowSantiNo ratings yet

- Cashflow A. Indirect Method: KM Manufacturing CompanyDocument2 pagesCashflow A. Indirect Method: KM Manufacturing CompanyArnold AdanoNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- Tugas PAKDocument4 pagesTugas PAKTedo Arsa NanditamaNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- CashFlow Smart CompanyDocument1 pageCashFlow Smart CompanyCheyenne CariasNo ratings yet

- Adhila Sandra Devy - LF53 - Cash in FlowsDocument4 pagesAdhila Sandra Devy - LF53 - Cash in FlowsLydia limNo ratings yet

- BDFA1103Document5 pagesBDFA1103Yukie LimNo ratings yet

- Cash FlowDocument13 pagesCash FlowAbdul Hadi SheikhNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- Merchant Center Income Statement For The Year Ended, DECEMBER 31, 2018Document7 pagesMerchant Center Income Statement For The Year Ended, DECEMBER 31, 2018Melissa RaboNo ratings yet

- The Statement of Cash Flows Problems 5-1. (Currency Company)Document7 pagesThe Statement of Cash Flows Problems 5-1. (Currency Company)Marcos DmitriNo ratings yet

- Prepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceDocument4 pagesPrepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceEntertainment StatusNo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- g1 Final Written Answers Bkal1013Document13 pagesg1 Final Written Answers Bkal1013tasya zakariaNo ratings yet

- Chapter 3. Exercises Income StatementDocument6 pagesChapter 3. Exercises Income StatementHECTOR ORTEGANo ratings yet

- Reconciliation Statement MathDocument6 pagesReconciliation Statement MathRajibNo ratings yet

- The Deluxe Store Income Statement For The Year Ended November 30, 2020Document2 pagesThe Deluxe Store Income Statement For The Year Ended November 30, 2020Charisa BenjaminNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Far (Semestral Project)Document5 pagesFar (Semestral Project)Diana Rose RioNo ratings yet

- Bkal1013 Business Accounting (Group Project)Document19 pagesBkal1013 Business Accounting (Group Project)Chin EnNo ratings yet

- OLC Chap 5Document6 pagesOLC Chap 5Isha SinghNo ratings yet

- Cashflow (Direct Method)Document7 pagesCashflow (Direct Method)Umair ShahzadNo ratings yet

- Afe 3582Document6 pagesAfe 3582sarah josephNo ratings yet

- Llagas 01 eLMS Activity 3Document3 pagesLlagas 01 eLMS Activity 3Angela Fye LlagasNo ratings yet

- Tugas Cash Flow (Kel 4)Document22 pagesTugas Cash Flow (Kel 4)RamaNo ratings yet

- Cash Flow Statement-ShortDocument27 pagesCash Flow Statement-ShortLaurene Delos ReyesNo ratings yet

- TP 2 Acct For BusinessDocument5 pagesTP 2 Acct For BusinessLuna AnggrainiNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- Statement of Cash Flows: Jeffrey I. OrfrectoDocument5 pagesStatement of Cash Flows: Jeffrey I. OrfrectoDanhilson VivoNo ratings yet

- Q No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditDocument4 pagesQ No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditNAFEES NASRUDDIN PATEL0% (1)

- Chapter 23Document59 pagesChapter 23boboandiandiNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- Chapter 3. Solution Exercises Income StatementDocument13 pagesChapter 3. Solution Exercises Income StatementHECTOR ORTEGANo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- Chapter 2 - Statement of Cash FlowsDocument23 pagesChapter 2 - Statement of Cash FlowsCholophrex SamilinNo ratings yet

- SituationsDocument8 pagesSituationsAn Trần Thị HảiNo ratings yet

- Ex 09 Electro ProductsDocument6 pagesEx 09 Electro ProductsRiznel Anthony CapaladNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Cash Flow StatementDocument5 pagesCash Flow Statementl201046No ratings yet

- Solution Chapter 6 Financial Statements Pre Adjustments 1Document8 pagesSolution Chapter 6 Financial Statements Pre Adjustments 1IsmahNo ratings yet

- Fabm Performance Task PDFDocument7 pagesFabm Performance Task PDFAlyssa NadaNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- ACTIVITY 1 BSA4A AutosavedDocument6 pagesACTIVITY 1 BSA4A AutosavedJonathan BausingNo ratings yet

- TK Intro No 3Document1 pageTK Intro No 3Nur Febriana ArumNo ratings yet

- Equity Method VS Cost MethodDocument14 pagesEquity Method VS Cost MethodMerliza JusayanNo ratings yet

- Problem 23 2Document5 pagesProblem 23 2Muhammad SyahbinNo ratings yet

- FS-Practice QuestionDocument2 pagesFS-Practice QuestionNinh Thị Ánh NgọcNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 1 StandardReportDocument44 pages1 StandardReportnadila ika sefiraNo ratings yet

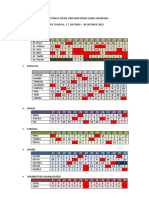

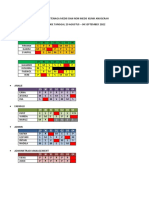

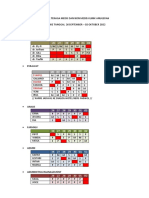

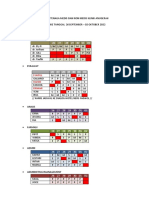

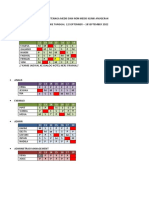

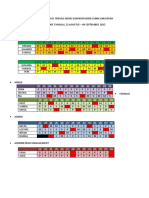

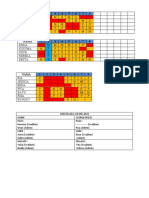

- Jadwaljadwal Tenaga Medis Dan Non Medis Klinik Anugerah Periode 10 - 16 Oktober 2o22Document1 pageJadwaljadwal Tenaga Medis Dan Non Medis Klinik Anugerah Periode 10 - 16 Oktober 2o22nadila ika sefiraNo ratings yet

- JADWALDocument1 pageJADWALnadila ika sefiraNo ratings yet

- JADWALDocument1 pageJADWALnadila ika sefiraNo ratings yet

- Jadwal Tenaga Medis Dan Non Medis Klinik Anugerah Periode 17 - 30 Oktober 2o22Document1 pageJadwal Tenaga Medis Dan Non Medis Klinik Anugerah Periode 17 - 30 Oktober 2o22nadila ika sefiraNo ratings yet

- PDF Uraian Tugas Marketing - CompressDocument2 pagesPDF Uraian Tugas Marketing - Compressnadila ika sefiraNo ratings yet

- Revisi Jadwal 29 Ags - 04 SeptDocument1 pageRevisi Jadwal 29 Ags - 04 Septnadila ika sefiraNo ratings yet

- Revisi Jadwal 29 Ags - 04 SeptDocument1 pageRevisi Jadwal 29 Ags - 04 Septnadila ika sefiraNo ratings yet

- Jadwal Tenaga Medis Non Medis 26 Sept - 02 OctDocument1 pageJadwal Tenaga Medis Non Medis 26 Sept - 02 Octnadila ika sefiraNo ratings yet

- Jadwal Tenaga Medis Non Medis 26 Sept - 02 OcttDocument1 pageJadwal Tenaga Medis Non Medis 26 Sept - 02 Octtnadila ika sefiraNo ratings yet

- Jadwal 19-25Document1 pageJadwal 19-25nadila ika sefiraNo ratings yet

- Jadwal Tenaga Medis Non Medis 12 Sept - 18 SeptDocument1 pageJadwal Tenaga Medis Non Medis 12 Sept - 18 Septnadila ika sefiraNo ratings yet

- PDF Laporan Studi Banding Unit Rekam Medis CompressDocument6 pagesPDF Laporan Studi Banding Unit Rekam Medis Compressnadila ika sefiraNo ratings yet

- Revisi Jadwal 29 Ags - 04 SeptDocument1 pageRevisi Jadwal 29 Ags - 04 Septnadila ika sefiraNo ratings yet

- Jadwal Tenaga Medis Dan Non Medis Ka 5 Sept - 11 Sept 2022Document1 pageJadwal Tenaga Medis Dan Non Medis Ka 5 Sept - 11 Sept 2022nadila ika sefiraNo ratings yet

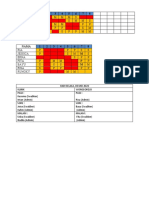

- 09 - 15 Mei RapidDocument3 pages09 - 15 Mei Rapidnadila ika sefiraNo ratings yet

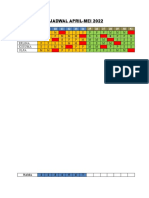

- Jadwal April-Mei 2022: Nama S SDocument3 pagesJadwal April-Mei 2022: Nama S Snadila ika sefiraNo ratings yet

- Jadwal LebaranDocument3 pagesJadwal Lebarannadila ika sefiraNo ratings yet

- Jadwal MsiDocument1 pageJadwal Msinadila ika sefiraNo ratings yet

- Jadwal April-Mei 2022: Nama S SDocument3 pagesJadwal April-Mei 2022: Nama S Snadila ika sefiraNo ratings yet

- 09 - 15 Mei RapidDocument3 pages09 - 15 Mei Rapidnadila ika sefiraNo ratings yet

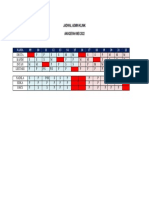

- Jadwal Tenaga Medis Dan Non Medis Klinik AnugerahDocument2 pagesJadwal Tenaga Medis Dan Non Medis Klinik Anugerahnadila ika sefiraNo ratings yet

- NamaDocument1 pageNamanadila ika sefiraNo ratings yet

- Jadwal Klinik Trial Fix-1Document1 pageJadwal Klinik Trial Fix-1nadila ika sefiraNo ratings yet

- Jadwal Tenaga Medis Dan Non Medis Ka 8-21 AgsDocument1 pageJadwal Tenaga Medis Dan Non Medis Ka 8-21 Agsnadila ika sefiraNo ratings yet

- 09 - 22 Mei Admin FODocument1 page09 - 22 Mei Admin FOnadila ika sefiraNo ratings yet

- Makro CarolDocument4 pagesMakro Carolnadila ika sefiraNo ratings yet

- Jadwal Tenaga Medis Dan Non Medis Ka 22 Ags-4 SeptDocument1 pageJadwal Tenaga Medis Dan Non Medis Ka 22 Ags-4 Septnadila ika sefiraNo ratings yet

- Jadwal LebaranDocument3 pagesJadwal Lebarannadila ika sefiraNo ratings yet

- Carol Majestica-01012190047-PR Pertemuan 01Document13 pagesCarol Majestica-01012190047-PR Pertemuan 01nadila ika sefiraNo ratings yet

- Titus Selection of DiffuserDocument14 pagesTitus Selection of DiffuserhanyassawyNo ratings yet

- p1632 eDocument4 pagesp1632 ejohn saenzNo ratings yet

- 7 ApportionmentDocument46 pages7 Apportionmentsass sofNo ratings yet

- Proposed 4way D54 Proposed 2way D56: Issue Date DescriptionDocument3 pagesProposed 4way D54 Proposed 2way D56: Issue Date DescriptionADIL BASHIRNo ratings yet

- In Other Words RE Increased by P250,000 (Income Less Dividends)Document6 pagesIn Other Words RE Increased by P250,000 (Income Less Dividends)Agatha de CastroNo ratings yet

- E Commerce and Its Influence in Changing in Purchasing Behavior of Modern ConsumersDocument13 pagesE Commerce and Its Influence in Changing in Purchasing Behavior of Modern ConsumersRichard VillanuevaNo ratings yet

- Education Programme: The School of Concrete TechnologyDocument28 pagesEducation Programme: The School of Concrete TechnologyThabiso Jacob MokwenaNo ratings yet

- Definition Nature and Scope of Urban GeographyDocument4 pagesDefinition Nature and Scope of Urban Geographysamim akhtarNo ratings yet

- Bell Single-Sleeve Shrug Crochet PatternDocument2 pagesBell Single-Sleeve Shrug Crochet PatternsicksoxNo ratings yet

- KPI's Troubleshooting GuideDocument27 pagesKPI's Troubleshooting GuideMohamed SayedNo ratings yet

- General Information Exhibition Guide Lines - 3P 2022Document6 pagesGeneral Information Exhibition Guide Lines - 3P 2022muhammad khanNo ratings yet

- Srinivasa Ramanujan - Britannica Online EncyclopediaDocument2 pagesSrinivasa Ramanujan - Britannica Online EncyclopediaEvariste MigaboNo ratings yet

- NUFLO Low Power Pre-Amplifier: SpecificationsDocument2 pagesNUFLO Low Power Pre-Amplifier: SpecificationsJorge ParraNo ratings yet

- Buy Wholesale China Popular Outdoor Football Boot For Teenagers Casual High Quality Soccer Shoes FG Ag Graffiti Style & FootballDocument1 pageBuy Wholesale China Popular Outdoor Football Boot For Teenagers Casual High Quality Soccer Shoes FG Ag Graffiti Style & Footballjcdc9chh8dNo ratings yet

- Nokia 3g Full Ip CommissioningDocument30 pagesNokia 3g Full Ip CommissioningMehul JoshiNo ratings yet

- Bank OD Account in Tally 1Document3 pagesBank OD Account in Tally 1yashusahu180No ratings yet

- RSM222.f22.CourseOutline v3 2022-09-05Document9 pagesRSM222.f22.CourseOutline v3 2022-09-05Kirsten WangNo ratings yet

- Intermediate Programming (Java) 1: Course Title: Getting Started With Java LanguageDocument11 pagesIntermediate Programming (Java) 1: Course Title: Getting Started With Java LanguageRickCy Perucho PccbsitNo ratings yet

- Reaction Paper DementiaDocument1 pageReaction Paper DementiaElla MejiaNo ratings yet

- H I Ôn Thi Aptis & Vstep - Tài Liệu - Anna MaiDocument4 pagesH I Ôn Thi Aptis & Vstep - Tài Liệu - Anna Maihanh.mt2022No ratings yet

- Sorting Algorithms in Fortran: Dr. Ugur GUVENDocument10 pagesSorting Algorithms in Fortran: Dr. Ugur GUVENDHWANIT MISENo ratings yet

- CfoDocument13 pagesCfocarmen pirvanNo ratings yet

- Esp8285 Datasheet enDocument29 pagesEsp8285 Datasheet enJohn GreenNo ratings yet

- Lesson Plan Defining and Non Relative Clauses XII (I)Document3 pagesLesson Plan Defining and Non Relative Clauses XII (I)mariaalexeli0% (1)

- Castle CrashesDocument21 pagesCastle Crasheswicked wolfNo ratings yet

- Evolution of Strategic HRM As Seen Through Two Founding Books A 30TH Anniversary Perspective On Development of The FieldDocument20 pagesEvolution of Strategic HRM As Seen Through Two Founding Books A 30TH Anniversary Perspective On Development of The FieldJhon Alex ValenciaNo ratings yet

- Rise of Al JazeeraDocument1 pageRise of Al Jazeeraইlish ProductionsNo ratings yet