Professional Documents

Culture Documents

Benefit Illustration: UIN: 104N076V17 Page 1 of 3

Uploaded by

vipin jainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benefit Illustration: UIN: 104N076V17 Page 1 of 3

Uploaded by

vipin jainCopyright:

Available Formats

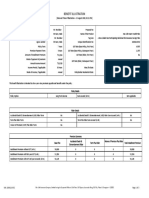

BENEFIT ILLUSTRATION

Name of the First Annuitant: Mr. Proposal No:

Age & Gender: 65 Years, Male Name of the Product: Max Life Guaranteed Lifetime Income Plan

Name of the Second Annuitant, if any: Not Applicable Tag Line: A Non-Linked Non Participating Individual General Annuity Savings Plan

Age & Gender: 59 Years, Female Unique Identification No: 104N076V17

Policy Term: Not Applicable

Premium Payment Mode: Single

Premium Payment Term: 1 Max Life State: Rajasthan

Amount of Installment Premium (excl. taxes): `15,00,000 Policyholder Residential State: Rajasthan

Amount allocated for Investment (First Year): `14,33,250 GST Rate: 18%*

Amount allocated for Investment (Second Year onwards): `0

Amount of Installment Premium (First Year incl. taxes): `15,12,015

Annuity Payment Frequency: Monthly Issue Date of Quote: 21 September 2023

Annuity Purchased From: Agent Assisted Annuity Start Date: 21 October 2023

Monthly Income Amount Starting On 21-Oct-2023

`8,028

(Guaranteed)

*0% if qualifies as zero-rated supply under GST law

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

Policy Details

Policy Option Immediate Annuity - Joint Life Sum Assured (in Rs.) Not Applicable

Deferment Period, if applicable Not Applicable Sum Assured on Death (at inception of the policy) (in Rs.) `15,00,000

Death Benefit Opted Yes Payment Option Single Pay

Premium Summary

Base Plan Riders Total Installment Premium

Installment Premium without GST (in Rs.) 15,00,000 NA 15,00,000

Installment Premium with first year GST (in Rs.) 15,12,015 NA 15,12,015

Installment Premium with GST 2nd year onwards (in Rs.) NA NA NA

UIN: 104N076V17 Page 1 of 3

(Amount in Rupees)

Guaranteed Non Guaranteed

Single/ Annualized

Policy Year

Premium ~Acrued Guranteed Additions Min Guaranteed Surrender Value Special Surrender Value

Annuity Amount Maturity Benefit Death Benefit

1 15,00,000 96,336 0 0 15,00,000 10,28,664 11,73,098

2 0 96,336 0 0 15,00,000 9,32,328 11,76,181

3 0 96,336 0 0 15,00,000 8,35,992 11,79,455

4 0 96,336 0 0 15,00,000 9,64,656 11,82,982

5 0 96,336 0 0 15,00,000 8,68,320 11,86,856

6 0 96,336 0 0 15,00,000 7,71,984 11,91,015

7 0 96,336 0 0 15,00,000 6,75,648 11,95,406

8 0 96,336 0 0 15,00,000 5,79,312 11,99,974

9 0 96,336 0 0 15,00,000 4,82,976 12,04,646

10 0 96,336 0 0 15,00,000 3,86,640 12,09,519

11 0 96,336 0 0 15,00,000 2,90,304 12,14,521

12 0 96,336 0 0 15,00,000 1,93,968 12,19,736

13 0 96,336 0 0 15,00,000 97,632 12,24,925

14 0 96,336 0 0 15,00,000 1,296 12,30,313

15 0 96,336 0 0 15,00,000 0 12,35,648

16 0 96,336 0 0 15,00,000 0 12,41,159

17 0 96,336 0 0 15,00,000 0 12,46,582

18 0 96,336 0 0 15,00,000 0 12,51,948

19 0 96,336 0 0 15,00,000 0 12,57,464

20 0 96,336 0 0 15,00,000 0 12,62,839

21 0 96,336 0 0 15,00,000 0 12,68,253

22 0 96,336 0 0 15,00,000 0 12,73,716

23 0 96,336 0 0 15,00,000 0 12,79,216

24 0 96,336 0 0 15,00,000 0 12,84,586

25 0 96,336 0 0 15,00,000 0 12,89,966

26 0 96,336 0 0 15,00,000 0 12,95,307

27 0 96,336 0 0 15,00,000 0 13,00,842

28 0 96,336 0 0 15,00,000 0 13,06,325

29 0 96,336 0 0 15,00,000 0 13,11,949

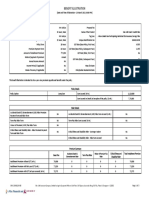

UIN: 104N076V17 Page 2 of 3

Guaranteed Non Guaranteed

Single/ Annualized

Policy Year

Premium ~Acrued Guranteed Additions Min Guaranteed Surrender Value Special Surrender Value

Annuity Amount Maturity Benefit Death Benefit

30 0 96,336 0 0 15,00,000 0 13,17,692

31 0 96,336 0 0 15,00,000 0 13,23,641

32 0 96,336 0 0 15,00,000 0 13,29,808

33 0 96,336 0 0 15,00,000 0 13,36,426

34 0 96,336 0 0 15,00,000 0 13,43,435

35 0 96,336 0 0 15,00,000 0 13,51,369

Notes:

1.Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods and Service Tax.

2.Refer Sales literature for explanation of terms used in this illustration.

3.~ Accrued Guaranteed Additions refers to the Guaranteed Additions which accrue during deferment period in respect of inforce premium paying and fully paid policies. Amount illustrated in this column is already factored in

within “Death Benefit” section and is payable in case of Death only.

*GST of 18% is applied only on premium amount derived as per Rule 32(4) of CGST Rule (i.e. the non-investable component of premium amount).

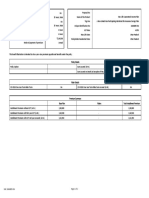

I, ……………………………………………. (name),have explained the premiums, and benefits I, ……………………………………………. (name), having received the information with respect

under the product fully to the prospect / policyholder to the above, have understood the above statement before entering into the contract.

Place:

Date: 9/21/23 Signature / OTP Confirmation Date / Thumb Impression / Date:9/21/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104N076V17 Page 3 of 3

You might also like

- Benefit Illustration: Of2 UIN: 104N076V11Document2 pagesBenefit Illustration: Of2 UIN: 104N076V11Vir ShahNo ratings yet

- Benefit Illustration: UIN: 104N076V16 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N076V16 Page 1 of 3Viju KNo ratings yet

- Benefit Illustration: UIN: 104N076V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N076V11 Page 1 of 2Vir ShahNo ratings yet

- Benefit Illustration: Tata AIA Life Insurance Smart Value Income PlanDocument3 pagesBenefit Illustration: Tata AIA Life Insurance Smart Value Income PlanPrakash SinghNo ratings yet

- Benefit Illustration: UIN: 104N137V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N137V02 Page 1 of 4bhavnapal74No ratings yet

- Benefit Illustration: Of2 UIN: 104N076V11Document2 pagesBenefit Illustration: Of2 UIN: 104N076V11Vir ShahNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Benefit Illustration: UIN: 104N116V02 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V02 Page 1 of 3Ravindar aNo ratings yet

- Page 1 of 9: Policy DetailsDocument9 pagesPage 1 of 9: Policy Detailsrajesh nagarajNo ratings yet

- Benefit Illustration: UIN: 104N137V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N137V02 Page 1 of 4bhavnapal74No ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusScribbydooNo ratings yet

- Benefit IllustrationDocument2 pagesBenefit IllustrationusefulNo ratings yet

- 70015063229Document4 pages70015063229Manish YadavNo ratings yet

- IllustrationDocument2 pagesIllustrationRajnandan shindeNo ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001722290821Document5 pagesE SymbiosysFiles Generated OutputSIPDF 10200001722290821Sankalp SrivastavaNo ratings yet

- 70014913388Document4 pages70014913388Manish YadavNo ratings yet

- IllustrationDocument3 pagesIllustrationTarush RastogiNo ratings yet

- IllustrationDocument3 pagesIllustrationHar DonNo ratings yet

- ILLUSTRATION OF BENEFITS FOR Bharti AXA Life Guaranteed Wealth ProDocument4 pagesILLUSTRATION OF BENEFITS FOR Bharti AXA Life Guaranteed Wealth ProThe Why MindNo ratings yet

- IllustrationDocument3 pagesIllustrationlosssssssssNo ratings yet

- Sampoorna Raksha Supreme - 2023-09-15T150349.974Document4 pagesSampoorna Raksha Supreme - 2023-09-15T150349.974Karthikeyan SakthivelNo ratings yet

- Mon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueDocument3 pagesMon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueRamesh SharmaNo ratings yet

- 70012752332Document5 pages70012752332Hitesh KumarNo ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Page 1 of 6: Policy DetailsDocument6 pagesPage 1 of 6: Policy DetailsSANIDHYA SHETTYNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001876111021Document4 pagesE SymbiosysFiles Generated OutputSIPDF 10200001876111021Sankalp SrivastavaNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusĄńıkęť MâhîñďNo ratings yet

- Illustration Qbh72erqqhuwfDocument3 pagesIllustration Qbh72erqqhuwfNagendra Kumar VNo ratings yet

- Bi 937976Document10 pagesBi 937976Sankalp SrivastavaNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- HDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Document3 pagesHDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Teja Reddy Telugu YuvathaNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- IllustrationDocument2 pagesIllustrationNeerja M GuhathakurtaNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- 70014883867Document4 pages70014883867Manish YadavNo ratings yet

- UIN: 104N113V02 Page 1 of 4Document4 pagesUIN: 104N113V02 Page 1 of 4NagarjunaNo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Sanchay Plus Policy DocumentDocument2 pagesSanchay Plus Policy DocumentM V N V PrasadNo ratings yet

- Policy Details: Page 1 of 5Document5 pagesPolicy Details: Page 1 of 5SANIDHYA SHETTYNo ratings yet

- Fortune Guarantee PlusDocument3 pagesFortune Guarantee PlusbabukcdNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Sanchay Par 75Document3 pagesSanchay Par 75Soumen BeraNo ratings yet

- Illustration PDFDocument2 pagesIllustration PDFArvind HarikrishnanNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- Illustration - 2023-09-16T115558.673Document3 pagesIllustration - 2023-09-16T115558.673LogeshParthasarathyNo ratings yet

- Class NotesDocument3 pagesClass NotesMUKESH MEHTANo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Page 1 of 2Document2 pagesPage 1 of 2harish babu kolliNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- ChristyDocument6 pagesChristyKrishna JeyakumarNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- Illustration - 2022-12-21T143227.841Document2 pagesIllustration - 2022-12-21T143227.841Ashher UsmaniNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Y2YSA5NeVVTIVEUe 9071693721735435Document25 pagesY2YSA5NeVVTIVEUe 9071693721735435kuldeep kumarNo ratings yet

- Delhi To Rudrapur: Abhibus TicketDocument2 pagesDelhi To Rudrapur: Abhibus TicketKrishan SharmaNo ratings yet

- 1 Working CapitalDocument63 pages1 Working CapitalDeepika Mittal50% (2)

- Solved Rollo and Andrea Are Equal Owners of Gosney Company DuringDocument1 pageSolved Rollo and Andrea Are Equal Owners of Gosney Company DuringAnbu jaromiaNo ratings yet

- Bajaj Allianz InsuranceDocument93 pagesBajaj Allianz InsuranceswatiNo ratings yet

- Merger Arbitrage Strategy and Its RiskDocument3 pagesMerger Arbitrage Strategy and Its RiskKeval ShahNo ratings yet

- 0450 m18 in 22Document4 pages0450 m18 in 22yoshNo ratings yet

- Etf Playbook 1Document12 pagesEtf Playbook 1langlinglung1985No ratings yet

- Unit Test 5Document6 pagesUnit Test 5Madalina Fira0% (1)

- 7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Document5 pages7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Heidee ManliclicNo ratings yet

- Welcome To Momentum Trading SetupDocument12 pagesWelcome To Momentum Trading SetupSunny Deshmukh0% (1)

- In The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Document67 pagesIn The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Chapter 11 DocketsNo ratings yet

- Jean Keating and Jack SmithDocument10 pagesJean Keating and Jack SmithStephen Monaghan100% (2)

- Payment 4310725205Document1 pagePayment 4310725205Radoslav TsvetkovNo ratings yet

- Central Banking and Financial RegulationsDocument9 pagesCentral Banking and Financial RegulationsHasibul IslamNo ratings yet

- Case 1 - Argon BankDocument5 pagesCase 1 - Argon BankLiyana IzyanNo ratings yet

- A Study On Claims ManagementDocument77 pagesA Study On Claims Managementarjunmba119624100% (2)

- Summer Traning Report of Working Capital Manegment (CCBL)Document62 pagesSummer Traning Report of Working Capital Manegment (CCBL)PrabhatNo ratings yet

- I-Byte Business Services July 2021Document64 pagesI-Byte Business Services July 2021IT ShadesNo ratings yet

- BIR Ruling No. 317-18 (BVI Law)Document3 pagesBIR Ruling No. 317-18 (BVI Law)Liz100% (1)

- Far270 July2022Document8 pagesFar270 July2022Nur Fatin AmirahNo ratings yet

- T Vijaya Kumar - Accounting For Management-Tata McGraw Hill Education Private Limited (2010)Document842 pagesT Vijaya Kumar - Accounting For Management-Tata McGraw Hill Education Private Limited (2010)2073 - Ajay Pratap Singh Bhati100% (1)

- Sample Contract To SellDocument3 pagesSample Contract To SellCandice Tongco-Cruz100% (4)

- Partnership Deed Bareilly Gorakhpur Liquor CompanyDocument8 pagesPartnership Deed Bareilly Gorakhpur Liquor CompanyDeepkamal JaiswalNo ratings yet

- Mirae Factsheet April2017Document16 pagesMirae Factsheet April2017Dashang G. MakwanaNo ratings yet

- Country Wide Litigation Database 01072007Document15 pagesCountry Wide Litigation Database 01072007Carrieonic100% (1)

- HDFC Amc PDFDocument8 pagesHDFC Amc PDFRahul JaiswalNo ratings yet

- The Foreign-Exchange Market-Structure & Case StudyDocument7 pagesThe Foreign-Exchange Market-Structure & Case StudyAnuranjanSinha80% (5)

- 2012a Buyback NoticeDocument4 pages2012a Buyback Noticekv chandrasekerNo ratings yet

- 0304 Boudreau Beyond HRDocument17 pages0304 Boudreau Beyond HRasha_tatapudiNo ratings yet

- Golf Course Business Plan - Union College 2009Document48 pagesGolf Course Business Plan - Union College 2009flippinamsterdam100% (2)