Professional Documents

Culture Documents

Corporate Accounting

Uploaded by

ilakkya sumathy070 ratings0% found this document useful (0 votes)

1 views1 pageCorporate accounting

Original Title

Corporate accounting

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorporate accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views1 pageCorporate Accounting

Uploaded by

ilakkya sumathy07Corporate accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Bank Accounts 1260

Preparation of Profit and Loss Account and Balance Sheet

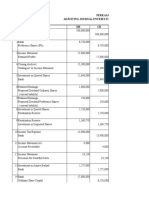

Illustration 17

The following isthe Trial

Balance extracted from the books ofTown Bank Ltd.

Debit balances Rs. Credit Balances Rs.

Balances with banks

46350 Share capital

Investment in Govemment bonds 1.94370 3,00,000

Security deposit of

Other investments employees 15,000

Gold Bullion 1,55,630 SB Accounts 7,420

Interest accrued on investments 15,130Current accounts 97,000

Silver 24,620|Fixed deposits 1,13,050

2,000 Reserve fund 140,000

Constituent's liability for Borrowings from banks TI230

acceptances, etc. 56,500|Profit and Loss Alc 6,500

Building

Furniture 65,000 Bills for collection 43,500 )x

5,000| Acceptances and

endorsements 56,500

Money at call 26,000 Interest T2,000

Loans

Bills Discounted

2,00,000| Commission 25,300

12,500|Discounts 42,000

Interest 7,950 Rent 600

Bills for collection 43,500| Profit on Bullion 1,200

Audit fees 5,000|Miscellaneous income 2,700

Loss on sale of furniture 1,000 Accumulated depreciation

Directors' fees 1,200 on building 20,000

Salaries 21,200

Postage 50

Managing director's remuneration 12,000

Loss on sale of investments 30,000|

Cash in hend 25,000

Cash with RBI 50,000|

Branch adjustment A/c 20,000

10,20,000 10,20,000

You are required to prepare the Profit and Loss Account and Balance Sheet

after taking into consideration the following

) Bad debts Rs. 500

( Rebate on bills 1,000

() Current year's depreciation on building Rs. 2,000

and total of

(1V) Some current accounts are over drawn to the extent of Rs. 25,000

credit balances is Rs. 1.22,000.

[Bangalore, B.Com, Nov. 1988 adapted]

You might also like

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- Bank AccountingDocument8 pagesBank Accountinggordonomond2022No ratings yet

- Trial Balance Adjustments FinancialsDocument2 pagesTrial Balance Adjustments FinancialsMichelle BabaNo ratings yet

- Practice MathDocument1 pagePractice MathDibyo Joy Saha DipNo ratings yet

- Answer Sheet Mock Test 23-2Document5 pagesAnswer Sheet Mock Test 23-2Nam Nguyễn HoàngNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- Rivera and Santos PartnershipDocument31 pagesRivera and Santos PartnershipDaneca GallardoNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Unit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsDocument9 pagesUnit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsKirti RawatNo ratings yet

- Bnaking Profit and Loss Account 1Document12 pagesBnaking Profit and Loss Account 1madhumathi100% (1)

- Consolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000Document1 pageConsolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000.No ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Additional Questions AcctsDocument3 pagesAdditional Questions AcctsDEV NANKANINo ratings yet

- Issued & Paid Up Capital StatementDocument6 pagesIssued & Paid Up Capital StatementShoukat KhaliqNo ratings yet

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- Prepare financial statements and cash flow statementDocument4 pagesPrepare financial statements and cash flow statementrishi dhungel100% (1)

- Lesson34 2Document10 pagesLesson34 2Sami UllahNo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedDocument6 pagesAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedMehul Gupta100% (1)

- Grade 11 Test On AdjustmentsDocument6 pagesGrade 11 Test On AdjustmentsENKK 25No ratings yet

- Banking Company Final Accounts QuestionsDocument8 pagesBanking Company Final Accounts QuestionsPradeepaa BalajiNo ratings yet

- ABC MIDTERMS PROJECT Sene Di Pa TaposDocument11 pagesABC MIDTERMS PROJECT Sene Di Pa TaposJanesene SolNo ratings yet

- CFS Income Statement ReceiptsDocument2 pagesCFS Income Statement ReceiptsRamana DvNo ratings yet

- Fa3 PDF LongDocument1 pageFa3 PDF LongAmir LMNo ratings yet

- Worksheet Quiz ExampleDocument5 pagesWorksheet Quiz ExampleFrenzearl ArmadaNo ratings yet

- Amanda D - Excel 2Document3 pagesAmanda D - Excel 2api-643373008No ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- Joyk-Excel 2 3 1Document4 pagesJoyk-Excel 2 3 1api-664350584No ratings yet

- Teresita Buenaflor Shoes Financial Statement AnalysisDocument25 pagesTeresita Buenaflor Shoes Financial Statement AnalysisMary Ingrid Arellano RabulanNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- PT Sejahtera Neraca Saldo Per 31 Desember 2018 No Akun Nama Akun D KDocument15 pagesPT Sejahtera Neraca Saldo Per 31 Desember 2018 No Akun Nama Akun D Kdanie RidwanNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- IAS 7 Cash Flow StatementDocument5 pagesIAS 7 Cash Flow Statementchalah DeriNo ratings yet

- 4.6 Final AcoountsDocument2 pages4.6 Final AcoountsSarath kumar CNo ratings yet

- Performa of Balance SheetDocument2 pagesPerforma of Balance SheetAman hingoraniNo ratings yet

- Prepare Trading, P&L and Balance SheetDocument4 pagesPrepare Trading, P&L and Balance SheetShreya ShrivastavaNo ratings yet

- 2 Numericals of Schedule 3 For PracticeDocument3 pages2 Numericals of Schedule 3 For PracticeAchyut AwasthiNo ratings yet

- WorkDocument8 pagesWorkshifaanjum7172No ratings yet

- Trial Balance@ Akshita BhattDocument1 pageTrial Balance@ Akshita BhattAkshita BhattNo ratings yet

- CFAB Chapter12 Full GuidanceDocument74 pagesCFAB Chapter12 Full GuidanceNgân Lê Trần BảoNo ratings yet

- Far110 Group Assignment 2Document7 pagesFar110 Group Assignment 21ANurul AnisNo ratings yet

- Delos Santos - John Marquin - Prefinal-Ia3Document18 pagesDelos Santos - John Marquin - Prefinal-Ia3Delos Santos, John Marquin S.No ratings yet

- #Chapter 4 Asignación (Recovered)Document22 pages#Chapter 4 Asignación (Recovered)adrianasofiagomez14No ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Cash Flow NewDocument4 pagesCash Flow NewAnkur GoyalNo ratings yet

- Assignment: Unit Vi: Trial BalanceDocument3 pagesAssignment: Unit Vi: Trial BalanceGautami Patil100% (1)

- LembarDocument26 pagesLembarIbnu Kamajaya75% (4)

- Acc hw2Document5 pagesAcc hw2pujaadiNo ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Kunci JawabanDocument31 pagesKunci JawabanDeni HudayaNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- JournalDocument7 pagesJournalathierahNo ratings yet

- Accounting Principles AbDocument36 pagesAccounting Principles Absamson mutukuNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Marketing Plan CDocument5 pagesMarketing Plan CAsep KurniaNo ratings yet

- Consumption Function and Investment Function Chap 2 160218025106 PDFDocument39 pagesConsumption Function and Investment Function Chap 2 160218025106 PDFlizakhanamNo ratings yet

- G9 Banana Economics: Prepared: Sunil Kumar M K, (Fresh2kichen)Document5 pagesG9 Banana Economics: Prepared: Sunil Kumar M K, (Fresh2kichen)mksunilNo ratings yet

- Accounting For Business Combinations Second Grading ExaminationDocument21 pagesAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- Eimco Elecon Equity Research Report July 2016Document19 pagesEimco Elecon Equity Research Report July 2016sriramrangaNo ratings yet

- Blackbook Project On Insurance PDFDocument77 pagesBlackbook Project On Insurance PDFMayuri L100% (1)

- CH 03Document56 pagesCH 03Zelalem GirmaNo ratings yet

- Stock Screener Investing Undervalued StocksDocument12 pagesStock Screener Investing Undervalued StocksAchint KumarNo ratings yet

- Principles of Taxation: Nature, Scope, Classification, and Essential CharacteristicsDocument14 pagesPrinciples of Taxation: Nature, Scope, Classification, and Essential CharacteristicsClariña VirataNo ratings yet

- Starwood Hotel 2007Document31 pagesStarwood Hotel 2007Mohd Bunyamin Abd Rahman100% (8)

- Spin-Offs: Unlocking Hidden ValueDocument8 pagesSpin-Offs: Unlocking Hidden ValueSangram PandaNo ratings yet

- Marketing Strategy Models Chapter Reviews Gaps and SolutionsDocument54 pagesMarketing Strategy Models Chapter Reviews Gaps and SolutionsHamis Rabiam MagundaNo ratings yet

- Child Day Care Services Business PlanDocument19 pagesChild Day Care Services Business PlanSarfraz Ali0% (2)

- Pidilite Industries Profile and Fevicol Brand AnalysisDocument25 pagesPidilite Industries Profile and Fevicol Brand AnalysisAbhishek GoswamiNo ratings yet

- KAMM Notes Taxation Bar 2021Document115 pagesKAMM Notes Taxation Bar 2021Bai MonadinNo ratings yet

- Goods and Services Tax Media and Entertainment SectorDocument28 pagesGoods and Services Tax Media and Entertainment SectorSanjog100% (1)

- Finance and AccountingDocument143 pagesFinance and Accountingrt222250% (2)

- Governmental & Non Profit Accounting: TEST BANK Spring 2007Document43 pagesGovernmental & Non Profit Accounting: TEST BANK Spring 2007irish570No ratings yet

- PiramalDocument411 pagesPiramalswarnaNo ratings yet

- Labor Organization Rights and RequirementsDocument6 pagesLabor Organization Rights and RequirementskNo ratings yet

- CFO Chief Financial Officer in Southern CA Resume Richard DrinkwardDocument3 pagesCFO Chief Financial Officer in Southern CA Resume Richard DrinkwardRichardDrinkwardNo ratings yet

- Sap DBMDocument4 pagesSap DBMamitsj100% (1)

- 2016-17 Governor's Executive BudgetDocument976 pages2016-17 Governor's Executive BudgetGovernor Tom WolfNo ratings yet

- 006 Fundamental AnalysisDocument8 pages006 Fundamental AnalysisDavid RiveraNo ratings yet

- Start-up Pitch Deck for Experiential Gardening BusinessDocument33 pagesStart-up Pitch Deck for Experiential Gardening BusinessVarshith SaiNo ratings yet

- BPI Vs SarabiaDocument15 pagesBPI Vs Sarabiapau.au mendozaNo ratings yet

- Financial Supplement: January - MarchDocument9 pagesFinancial Supplement: January - MarchSanjeev ThadaniNo ratings yet

- Accounting Notes PDFDocument67 pagesAccounting Notes PDFEjazAhmadNo ratings yet

- Methods of CostingDocument21 pagesMethods of CostingsweetashusNo ratings yet

- Financial Accounting Review on Bonds and SecuritiesDocument9 pagesFinancial Accounting Review on Bonds and SecuritiesljaneNo ratings yet