Professional Documents

Culture Documents

Consolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000

Uploaded by

.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000

Uploaded by

.Copyright:

Available Formats

PRACTICE KIT

CFAP 1: ADVANCED ACCOUNTING AND FINANCIAL REPORTING

CHAPTER 20: CONSOLIDATION CASH FLOWS

Exchange gain 700 700 175 875

–––––– –––––– –––––– –––––– –––––– –––––– ––––––

C/fwd 31 Dec 11,000 401 2,800 5,674 19,875 2,800 22,675

–––––– –––––– –––––– –––––– –––––– –––––– ––––––

Notes: NCI = non-controlling interest

Exchange gain = exchange gain on translation of subsidiary

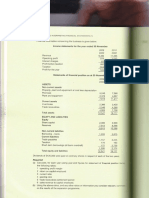

Consolidated statement of financial position as at 31 December 20X2

20X2 20X1

Rs.000 Rs.000

Tangible assets 11,720 7,520

Investments 3,000 2,700

Current assets

Inventories 6,135 5,740

Receivables 5,720 4,380

Cash at bank and in hand 820 169

27,395 20,509

Equity and liabilities

Ordinary share capital 11,000 7,500

Share premium 401 77

Foreign currency translation 2,800 2,100

Retained earnings 5,674 4,905

Equity attributable to owners of parent 19,875 14,582

Non-controlling interest 2,800 2,500

Total equity 22,675 17,082

Current liabilities

Payables 1,420 1,760

Tax 700 167

Obligations under finance leases 110 50

Non- current liabilities

Loans 1,200 800

Obligations under finance leases 740 250

Provisions for liabilities and charges

Deferred tax 550 400

27,395 20,509

Notes to the accounts

(1) Operating profit is stated after charging Rs.000 Rs.000

Depreciation: Owned assets 960 840

Assets held under finance leases 240 120

1,200 960

(2) Finance costs Rs.000 Rs.000

Loan interest 120 80

Finance charge on finance leases 205 132

Exchange rate losses on long-term loans 25 18

350 230

From the desk of Hassnain R. Badami, ACA

TSB Education-Premium Accountancy Courses P a g e 64 of 318

You might also like

- Rivera and Santos PartnershipDocument31 pagesRivera and Santos PartnershipDaneca GallardoNo ratings yet

- FINANCIAL ACCOUNTING FUNDAMENTALSDocument7 pagesFINANCIAL ACCOUNTING FUNDAMENTALSabhaymvyas1144No ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Brianne Kylle Dela Cruz FSA3 111Document29 pagesBrianne Kylle Dela Cruz FSA3 111Kathlene JaoNo ratings yet

- Brianne Kylle Dela Cruz FSA3 10 20 21Document35 pagesBrianne Kylle Dela Cruz FSA3 10 20 21Kathlene JaoNo ratings yet

- Financial Statement AnalysisDocument2 pagesFinancial Statement Analysissmallvin62No ratings yet

- ADVANCED ACCOUNTING 2BDocument4 pagesADVANCED ACCOUNTING 2BHarusiNo ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- Zakat ExercisesDocument5 pagesZakat Exercisesnor saidahNo ratings yet

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- Trial Balance Adjustments FinancialsDocument2 pagesTrial Balance Adjustments FinancialsMichelle BabaNo ratings yet

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRNo ratings yet

- Class Discussion On Ratios 28022023Document2 pagesClass Discussion On Ratios 28022023lil telNo ratings yet

- Fund Flow Statement: by Dr. Aleem AnsariDocument18 pagesFund Flow Statement: by Dr. Aleem AnsariPRIYAL GUPTANo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- 1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 EpsDocument3 pages1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 Epsarmaan ryanNo ratings yet

- OLC Chap 5Document6 pagesOLC Chap 5Isha SinghNo ratings yet

- Class Problem: 2Document7 pagesClass Problem: 2Riad FaisalNo ratings yet

- Cashflow Statement Problems & SolutionsDocument2 pagesCashflow Statement Problems & SolutionsHaidee Flavier Sabido100% (1)

- Unit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsDocument9 pagesUnit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsKirti RawatNo ratings yet

- Accounting 621Document2 pagesAccounting 621Sarah Precious NkoanaNo ratings yet

- WE NEVER KNOW Inc. trial balance audit issuesDocument1 pageWE NEVER KNOW Inc. trial balance audit issuesJastine Rose CañeteNo ratings yet

- poa_2012_Jan_p.2.q.1_1Document4 pagespoa_2012_Jan_p.2.q.1_1RealGenius (Carl)No ratings yet

- Bank AccountingDocument8 pagesBank Accountinggordonomond2022No ratings yet

- Cash Flow Statement PT - NandiDocument1 pageCash Flow Statement PT - NandiHelena KambongelaNo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- WE NEVER KNOW audit issuesDocument1 pageWE NEVER KNOW audit issuesNana CatNo ratings yet

- Problem 1: Partially Secured UnsecuredDocument2 pagesProblem 1: Partially Secured UnsecuredYahlianah LeeNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Corporate AccountingDocument1 pageCorporate Accountingilakkya sumathy07No ratings yet

- The Grape Group (Acquisition) : Cfap 1: A A F RDocument1 pageThe Grape Group (Acquisition) : Cfap 1: A A F R.No ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- M4 - Problem Exercises - Statement of Financial Position PDFDocument7 pagesM4 - Problem Exercises - Statement of Financial Position PDFCamille CastroNo ratings yet

- Bengal Financial Statements AnalysisDocument1 pageBengal Financial Statements AnalysisTenghour LyNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- CHAPTER 15 17 InvestmentsDocument38 pagesCHAPTER 15 17 InvestmentsJinkyNo ratings yet

- Eloiza Heart Trading Company Financial StatementsDocument2 pagesEloiza Heart Trading Company Financial StatementsAr JayNo ratings yet

- SFP ACT 2021 Answer SheetDocument1 pageSFP ACT 2021 Answer SheetmoreNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- Packages Annualreport2002Document66 pagesPackages Annualreport2002omairNo ratings yet

- Assignment 2 - Financials of Boru Vaahana (PVT) LTD.: Current AssetsDocument2 pagesAssignment 2 - Financials of Boru Vaahana (PVT) LTD.: Current AssetsRukshani RefaiNo ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- Trade Receivables Control AccountDocument3 pagesTrade Receivables Control AccountChen Shu YingNo ratings yet

- CA FINAL (May 2019 - New Course) Paper - 1 (Financial Reporting)Document32 pagesCA FINAL (May 2019 - New Course) Paper - 1 (Financial Reporting)Upasana NimjeNo ratings yet

- Cash Flow ProblemsDocument2 pagesCash Flow ProblemsMeiMisakiNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Study Hub SECTION CDocument10 pagesStudy Hub SECTION Cgetcultured69No ratings yet

- Chap3_Buying Net AssetsDocument7 pagesChap3_Buying Net AssetsThanh PhuongNo ratings yet

- Ratio Analysis WorksheetDocument5 pagesRatio Analysis WorksheetAnish AroraNo ratings yet

- Exercise 8 13 TemplateDocument4 pagesExercise 8 13 TemplateashibhallauNo ratings yet

- Studying The Financial Statements of A Bank: Balance Sheet of ICICI Bank LTD As On 31.03.2003. (Figures in Rs'000)Document10 pagesStudying The Financial Statements of A Bank: Balance Sheet of ICICI Bank LTD As On 31.03.2003. (Figures in Rs'000)Anand KumarNo ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Interpretation of Financial StatementsDocument2 pagesInterpretation of Financial StatementsTimilehin OgundareNo ratings yet

- Topic No. 1 - Statement of Financial Position PDFDocument4 pagesTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESNo ratings yet

- 8-2 at 8-3Document6 pages8-2 at 8-3danmatthew265No ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial Positionbobo tangaNo ratings yet

- Al Noor 2021Document1 pageAl Noor 2021Afan QayumNo ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Dear Shareholders,: Future OutlookDocument1 pageDear Shareholders,: Future Outlook.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Major Gen Naseer Ali Khan: ST SC HR EC SIC ACDocument1 pageMajor Gen Naseer Ali Khan: ST SC HR EC SIC AC.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- 2022 Performance Highlights: People Planet ProsperityDocument1 page2022 Performance Highlights: People Planet Prosperity.No ratings yet

- Profile of The Board: Syed Bakhtiyar KazmiDocument1 pageProfile of The Board: Syed Bakhtiyar Kazmi.No ratings yet

- Workings Rs.000Document1 pageWorkings Rs.000.No ratings yet

- Financial CapitalDocument1 pageFinancial Capital.No ratings yet

- The Grape Group (Acquisition) : Cfap 1: A A F RDocument1 pageThe Grape Group (Acquisition) : Cfap 1: A A F R.No ratings yet

- Triumph Spitfire MK4 - 1500Document108 pagesTriumph Spitfire MK4 - 1500Ricardo100% (1)

- TABS 6SellSheetDocument4 pagesTABS 6SellSheetHernando MontenegroNo ratings yet

- Subhasis Patra CV V3Document5 pagesSubhasis Patra CV V3Shubh SahooNo ratings yet

- Government of West Bengal Ration Card DetailsDocument1 pageGovernment of West Bengal Ration Card DetailsGopal SarkarNo ratings yet

- Equalization of Lithium-Ion Battery Pack Based On Fuzzy Logic Control in Electric VehicleDocument10 pagesEqualization of Lithium-Ion Battery Pack Based On Fuzzy Logic Control in Electric VehicleSureshNo ratings yet

- PSC Vacancy Government SpokespersonDocument3 pagesPSC Vacancy Government SpokespersonMoreen WachukaNo ratings yet

- BS 3892-1 1997 - Pulverized-Fuel AshDocument22 pagesBS 3892-1 1997 - Pulverized-Fuel Ashmykel_dp100% (1)

- Theory of Planned Behaviour (TPB)Document18 pagesTheory of Planned Behaviour (TPB)Afiq Wahyu AjiNo ratings yet

- Supreme Court: Arsenio C. Villalon, Jr. For Petitioner. Labaguis, Loyola, Angara & Associates For Private RespondentDocument43 pagesSupreme Court: Arsenio C. Villalon, Jr. For Petitioner. Labaguis, Loyola, Angara & Associates For Private RespondentpiaNo ratings yet

- Rotating EquipmentDocument3 pagesRotating EquipmentSathish DesignNo ratings yet

- 11 Core CompetenciesDocument11 pages11 Core CompetenciesrlinaoNo ratings yet

- Differendial Pressure Flow MetersDocument1 pageDifferendial Pressure Flow Metersborn2engineerNo ratings yet

- Manual ZappyDocument9 pagesManual Zappyapi-45129352No ratings yet

- How To Install Blue PrismDocument2 pagesHow To Install Blue PrismRanjith NarayanNo ratings yet

- International Journal of Plasticity: Dong Phill Jang, Piemaan Fazily, Jeong Whan YoonDocument17 pagesInternational Journal of Plasticity: Dong Phill Jang, Piemaan Fazily, Jeong Whan YoonGURUDAS KARNo ratings yet

- Serena Berman PW Res - 2020Document2 pagesSerena Berman PW Res - 2020Serena BermanNo ratings yet

- Nursing Grand Rounds Reviewer PDFDocument17 pagesNursing Grand Rounds Reviewer PDFAlyssa Jade GolezNo ratings yet

- CV (Muhammad Irfan Khan)Document3 pagesCV (Muhammad Irfan Khan)Niazi_sabNo ratings yet

- Philips LCD Monitor 220EW9FB Service ManualDocument10 pagesPhilips LCD Monitor 220EW9FB Service Manualpagy snvNo ratings yet

- Data Protection Act (DPA)Document14 pagesData Protection Act (DPA)Crypto SavageNo ratings yet

- Un Authorised Sites Regularisation Within Sept 2009Document2 pagesUn Authorised Sites Regularisation Within Sept 2009Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- HQ 170aDocument82 pagesHQ 170aTony WellsNo ratings yet

- SDA HLD Template v1.3Document49 pagesSDA HLD Template v1.3Samuel TesfayeNo ratings yet

- Director Infrastructure Technology Data Center in Atlanta GA Resume Thiron BarrDocument4 pagesDirector Infrastructure Technology Data Center in Atlanta GA Resume Thiron BarrThironBarrNo ratings yet

- Ram SAP MM Class StatuscssDocument15 pagesRam SAP MM Class StatuscssAll rounderzNo ratings yet

- Design of Anchor Bolts Embedded in MasonryDocument6 pagesDesign of Anchor Bolts Embedded in MasonryAnonymous DJrec2No ratings yet

- Acute AppendicitisDocument51 pagesAcute AppendicitisPauloCostaNo ratings yet

- W3. The Relational ModelDocument21 pagesW3. The Relational ModelSABOOR UR RAHMANNo ratings yet

- Wedding Planning GuideDocument159 pagesWedding Planning GuideRituparna Majumder0% (1)

- EE370 L1 IntroductionDocument38 pagesEE370 L1 IntroductionAnshul GoelNo ratings yet