Professional Documents

Culture Documents

Assignment 2 - Financials of Boru Vaahana (PVT) LTD.: Current Assets

Uploaded by

Rukshani RefaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2 - Financials of Boru Vaahana (PVT) LTD.: Current Assets

Uploaded by

Rukshani RefaiCopyright:

Available Formats

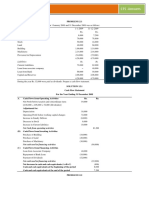

Assignment 2 - Financials of Boru Vaahana (Pvt) Ltd.

Boru Vaahana (Pvt) Ltd.

Statement of Profit or Loss and Other Comprehensive Income

st

for the year ended 31 March 2020

Turnover 7,000,000

Cost of Sales (2,850,000)

Gross Profit 4,150,000

Selling & distribution expenses (700,000)

Administration expenses (400,000)

Operating Profit 3,050,000

Interest expenses (200,000)

Profit before tax 2,850,000

Corporation tax (200,000)

Profit after tax 2,650,000

Boru Vaahana (Pvt) Ltd.

Statement of Financial Position

as at 31st March 2020

Non-current Assets 4,000,000

Current Assets

Inventory 450,000

Trade Debtors 725,000

Other Debtors 150,000

Prepayments & advances 125,000

Short term Investments 50,000

Cash at Bank 175,000

Cash in Hand 1,750,000

75,000

Current Liabilities

Trade Creditors 350,000

Bank Overdraft 250,000

Accrued expenses 75,000

Dividends payable 50,000

Corporation tax payable 25,000 750,000

Working Capital 1,000,000

5,000,000

Shareholders’ Equity

Stated capital 2,000,000

Reserves 2,000,000

4,000,000

Non-current Liabilities

Bank Loan 750,000

Debentures 250,000 1,000,000

5,000,000

Additional Information

1. A detailed analysis of the cost of sales revealed the following:

All sales and purchases have been made purely on credit

The Cost of sales figure was made up as follows:

Opening inventory 800,000

Purchases 2,500,000

Closing inventory (450,000)

Cost of Sales 2,850,000

2. The ordinary share capital consists of 200,000 ordinary shares with a nominal value of Rs. 10 each. The

latest available market price of this share is Rs. 50.00 st

3. The trade debtors and trade creditors balances as at 31 March 2019 had been Rs. 600,000 and Rs.

400,000 respectively

Required

Calculate each of the following financial ratios and comment on what each of those ratios generally

communicate about Boru Vaahana (Pvt) Ltd.’s financial performance and financial position:

i. Net Profit Margin

ii. Return on Capital Employed

iii. Current Ratio

iv. Inventory Residence Period (Inventory Turnover Days)

v. Debtors turnover (Average Collection Period)

vi. Creditors Turnover (Average Payment Period)

vii. Debt to Total Assets (Gearing) ratio

You might also like

- Ratio Analysis QuestionDocument3 pagesRatio Analysis QuestionPraween BimsaraNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Alfa Limited trial balance, adjusting entries, financial statementsDocument9 pagesAlfa Limited trial balance, adjusting entries, financial statementsRaffayNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- Sample Question MCom 2019 PatternDocument6 pagesSample Question MCom 2019 PatternPRATIKSHA CHAUDHARINo ratings yet

- 8-2 at 8-3Document6 pages8-2 at 8-3danmatthew265No ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- ROCE, profit margin and financial analysis of Enn LtdDocument7 pagesROCE, profit margin and financial analysis of Enn LtdKccc siniNo ratings yet

- Attempt All Questions: Summer Exam-2015Document25 pagesAttempt All Questions: Summer Exam-2015ag swlNo ratings yet

- Bengal Financial Statements AnalysisDocument1 pageBengal Financial Statements AnalysisTenghour LyNo ratings yet

- ACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONDocument2 pagesACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONPravallika RavikumarNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- National Law Institute University: BhopalDocument3 pagesNational Law Institute University: BhopalMranal MeshramNo ratings yet

- Fa3 PDF LongDocument1 pageFa3 PDF LongAmir LMNo ratings yet

- Generate Funds StatementDocument9 pagesGenerate Funds Statementjaydeep kriplaniNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Activity 01 PDFDocument5 pagesActivity 01 PDFJennifer AdvientoNo ratings yet

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- Subsidiary and Sub SubsidiaryDocument3 pagesSubsidiary and Sub SubsidiaryNipun Chandula WijayanayakaNo ratings yet

- Cash Flow Statement TestDocument2 pagesCash Flow Statement TestHitesh SemwalNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- SLLC - 2021 - Acc - C - Review Question 2 - Ratio AnalysisDocument3 pagesSLLC - 2021 - Acc - C - Review Question 2 - Ratio AnalysisChamela MahiepalaNo ratings yet

- COMPARATIVE INCOME STATEMENTDocument12 pagesCOMPARATIVE INCOME STATEMENTBISHAL ROYNo ratings yet

- Unit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsDocument9 pagesUnit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsKirti RawatNo ratings yet

- Indirect Method Cash Flow Statement for Hill CompanyDocument6 pagesIndirect Method Cash Flow Statement for Hill CompanyJessbel MahilumNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocument6 pagesHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- Issued & Paid Up Capital StatementDocument6 pagesIssued & Paid Up Capital StatementShoukat KhaliqNo ratings yet

- Financial Statement Analysis for Entity Providing Trial BalanceDocument3 pagesFinancial Statement Analysis for Entity Providing Trial BalanceMansour HamjaNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Comprehensive SOCF ProblemDocument1 pageComprehensive SOCF ProblemAbdullah alhamaadNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- Group 6 05 Quiz 1Document4 pagesGroup 6 05 Quiz 1Angela Fye LlagasNo ratings yet

- Updates in Philippine Accounting and Financial Reporting StandardsDocument4 pagesUpdates in Philippine Accounting and Financial Reporting StandardsWindie SisodNo ratings yet

- Activity Part 1 Prepartion of Financial StatementsDocument4 pagesActivity Part 1 Prepartion of Financial Statementsjrmsu-3No ratings yet

- OLC Chap 5Document6 pagesOLC Chap 5Isha SinghNo ratings yet

- 5110WA7 FinancialsDocument1 page5110WA7 FinancialsAhmed EzzNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- Techniques of Financial Analysis by ERICH A HELFERTDocument62 pagesTechniques of Financial Analysis by ERICH A HELFERTRupee Rudolf Lucy Ha100% (3)

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- Redeemable Preferred Stock Long-Term Loans Liabilities Against Asset Subject To Financial Lease Deferred Tax Liabilities Warranty ObligationsDocument2 pagesRedeemable Preferred Stock Long-Term Loans Liabilities Against Asset Subject To Financial Lease Deferred Tax Liabilities Warranty Obligationsnida vardakNo ratings yet

- HD Book 5Document4 pagesHD Book 5humphrey daimonNo ratings yet

- Module-2 Equity Valuation Numerical For StudentsDocument11 pagesModule-2 Equity Valuation Numerical For Studentsgaurav supadeNo ratings yet

- Quiz 1 - Statement of Financial PositionDocument9 pagesQuiz 1 - Statement of Financial PositionJonathan SolerNo ratings yet

- 3 Ratios FormulaeDocument2 pages3 Ratios FormulaeRukshani RefaiNo ratings yet

- Begam Rukshani: I RUKSHANI Characterize Myself in Being Honest and TrustworthyDocument3 pagesBegam Rukshani: I RUKSHANI Characterize Myself in Being Honest and TrustworthyRukshani RefaiNo ratings yet

- CCM - AE 1 - Reflective StatementDocument2 pagesCCM - AE 1 - Reflective StatementRukshani RefaiNo ratings yet

- 3 Interpretation of Financial StatementsDocument87 pages3 Interpretation of Financial StatementsRukshani RefaiNo ratings yet

- ACC314 Revision Ratio Questions - SolutionsDocument8 pagesACC314 Revision Ratio Questions - SolutionsRukshani RefaiNo ratings yet

- Seminar 2 - Investment AppraisalDocument3 pagesSeminar 2 - Investment AppraisalRukshani RefaiNo ratings yet

- ACC314 Revision CIA QuestionsDocument3 pagesACC314 Revision CIA QuestionsRukshani RefaiNo ratings yet

- ARR & Payback Investment AnalysisDocument1 pageARR & Payback Investment AnalysisRukshani RefaiNo ratings yet

- Week 8 The Equality Act, Diversity and Inclusion 20200213Document32 pagesWeek 8 The Equality Act, Diversity and Inclusion 20200213Rukshani RefaiNo ratings yet

- Managing Ethnic Diversity in OrganisationsDocument14 pagesManaging Ethnic Diversity in OrganisationsRukshani RefaiNo ratings yet

- ACC314 Business Finance Management Resit Answers (SEPT) R 19-20Document8 pagesACC314 Business Finance Management Resit Answers (SEPT) R 19-20Rukshani RefaiNo ratings yet

- BCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMEDocument5 pagesBCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMERukshani RefaiNo ratings yet

- ACC314 Practise Paper SolutionsDocument7 pagesACC314 Practise Paper SolutionsRukshani RefaiNo ratings yet

- BSc Business Finance Exam QuestionsDocument9 pagesBSc Business Finance Exam QuestionsRukshani RefaiNo ratings yet

- BSc (HONS) BUSINESS ADMINISTRATION (TOP UP) LEVEL 6 MODULE ACC314 EXAMDocument8 pagesBSc (HONS) BUSINESS ADMINISTRATION (TOP UP) LEVEL 6 MODULE ACC314 EXAMRukshani RefaiNo ratings yet

- ESBM Speaker NotesDocument67 pagesESBM Speaker NotesRukshani RefaiNo ratings yet

- OPMDocument118 pagesOPMRukshani RefaiNo ratings yet

- 0580 m16 QP 42Document16 pages0580 m16 QP 42Paul TurnerNo ratings yet

- MAC Assigment 1Document44 pagesMAC Assigment 1Rukshani RefaiNo ratings yet

- ESBM Begum Rukshani Mohamed Refai Batch 42Document21 pagesESBM Begum Rukshani Mohamed Refai Batch 42Rukshani RefaiNo ratings yet

- Begum Rukshani Mohamed Refai Batch 42Document24 pagesBegum Rukshani Mohamed Refai Batch 42Rukshani RefaiNo ratings yet

- Hospital Management System Synopsis and Project ReportDocument152 pagesHospital Management System Synopsis and Project ReportKapil Vermani100% (1)

- Basf TapesDocument3 pagesBasf TapesZoran TevdovskiNo ratings yet

- Turbo Plus PDFDocument27 pagesTurbo Plus PDFAnonymous iDJw3bDEW2No ratings yet

- PSC Vacancy Government SpokespersonDocument3 pagesPSC Vacancy Government SpokespersonMoreen WachukaNo ratings yet

- Tech Note FormatDocument2 pagesTech Note FormatUgonna OhiriNo ratings yet

- Senate Bill 365Document5 pagesSenate Bill 365samtlevinNo ratings yet

- Get started with Power BI DesktopDocument34 pagesGet started with Power BI Desktopbhargavc7No ratings yet

- Sources of Finance ExplainedDocument114 pagesSources of Finance Explained7229 VivekNo ratings yet

- 2020 Ifs InsuranceDocument262 pages2020 Ifs InsuranceSensi CTPrima100% (1)

- 03board of Directors Resolution For AGRONetBIZ ENGLISHDocument1 page03board of Directors Resolution For AGRONetBIZ ENGLISHyuswirdaNo ratings yet

- Apollo Experience Report Lunar Module Landing Gear SubsystemDocument60 pagesApollo Experience Report Lunar Module Landing Gear SubsystemBob Andrepont100% (3)

- Enclosure No. 6: Election Application PacketDocument8 pagesEnclosure No. 6: Election Application PacketLen LegaspiNo ratings yet

- EY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Document35 pagesEY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Tejas JosephNo ratings yet

- Principles of Marketing Handout 4: Marketing Opportunity and Consumer AnalysisDocument19 pagesPrinciples of Marketing Handout 4: Marketing Opportunity and Consumer AnalysisAsset Dy100% (1)

- CIO Executive SummaryDocument8 pagesCIO Executive SummaryResumeBearNo ratings yet

- Air ConditionDocument4 pagesAir ConditionTaller Energy EnergyNo ratings yet

- Lesson 3.3: The Third Wave: The Information/Knowledge AgeDocument3 pagesLesson 3.3: The Third Wave: The Information/Knowledge AgeFaith PrachayaNo ratings yet

- S Sss 001Document4 pagesS Sss 001andy175No ratings yet

- Agfa CR 10 X User ManualDocument4 pagesAgfa CR 10 X User ManualpietrokoNo ratings yet

- Contradictions That Drive Toyota's SuccessDocument7 pagesContradictions That Drive Toyota's SuccesskidurexNo ratings yet

- LuisRFlores (lf6225) UTRESUMEDocument3 pagesLuisRFlores (lf6225) UTRESUMELuis Rene FloresNo ratings yet

- KEDIT User's GuideDocument294 pagesKEDIT User's GuidezamNo ratings yet

- Agreement: /ECE/324/Rev.2/Add.127 /ECE/TRANS/505/Rev.2/Add.127Document29 pagesAgreement: /ECE/324/Rev.2/Add.127 /ECE/TRANS/505/Rev.2/Add.127Mina RemonNo ratings yet

- Manual ZappyDocument9 pagesManual Zappyapi-45129352No ratings yet

- List of Company Name EtymologiesDocument9 pagesList of Company Name EtymologiesElizabeth ArosteguiNo ratings yet

- Electricity Began With Man's Curiosity On The Peculiar Ability of Amber and Lodestone To Attract Other Material.Document2 pagesElectricity Began With Man's Curiosity On The Peculiar Ability of Amber and Lodestone To Attract Other Material.Axle Rose CastroNo ratings yet

- Nitro - Quiz 3 Ged102-A13Document3 pagesNitro - Quiz 3 Ged102-A13Eliezer NitroNo ratings yet

- Written Report Maneco FinalDocument31 pagesWritten Report Maneco FinalKymicah DesiertoNo ratings yet

- Wedding Planning GuideDocument159 pagesWedding Planning GuideRituparna Majumder0% (1)

- Mechatronic Project Progress Report W3Document5 pagesMechatronic Project Progress Report W3Hariz IzzuddinNo ratings yet