Professional Documents

Culture Documents

5110WA7 Financials

Uploaded by

Ahmed Ezz0 ratings0% found this document useful (0 votes)

22 views1 pageOriginal Title

5110WA7-Financials

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views1 page5110WA7 Financials

Uploaded by

Ahmed EzzCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

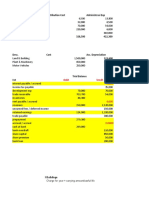

BUS 5110 Written Assignment 7 Financials

Income Statements Balance Sheets

Fashion Forward Dream Designs Fashion Forward Fashion Forward Dream Designs Dream Designs

12/31/2018 12/31/2018 12/31/2018 12/31/2017 12/31/2018 12/31/2017

Revenue Current Assets

Credit Sales 2,000,000 4,320,000 Cash and Cash Equivalents 950,000 980,000 1,710,000 1,705,000

Non-Credit Sales 500,000 1,080,000 Accounts Receivable 200,000 150,000 250,000 275,000

Total Revenue 2,500,000 5,400,000 Inventory 112,000 105,000 200,000 215,000

Other Current Assets 35,000 50,000 120,500 100,000

Cost of Sales 1,400,000 3,250,000 Total Current Assets 1,297,000 1,285,000 2,280,500 2,295,000

Gross Profit 1,100,000 2,150,000 Property, Plant and Equipment 635,000 700,000 850,000 900,000

Goodwill 750,000 750,000 1,150,000 1,150,000

Operating Expenses Other Long-Term Assets 65,000 70,000 100,750 105,000

Research and Development 50,000 200,000 Total Assets 2,747,000 2,805,000 4,381,250 4,450,000

Selling, General, and Administrative 750,000 1,600,000

Total Operating Expenses 800,000 1,800,000 Current Liabilities

Accounts Payable 545,000 535,000 845,750 875,000

Earnings Before Interest and Taxes 300,000 350,000 Short-Term Debt 25,000 - 50,000 60,000

Other Current Liabilities 600,000 510,000 730,000 740,000

Interest Expense (18,000) (50,000) Total Current Liabilities 1,170,000 1,045,000 1,625,750 1,675,000

Income Before Tax 282,000 300,000 Long-Term Debt 75,000 - 120,500 130,000

Income Tax Expense (145,500) (87,500) Other Long-Term Liabilities 100,000 75,000 155,000 165,000

Net Income 136,500 212,500 Total Liabilities 1,345,000 1,120,000 1,901,250 1,970,000

Profit Margin Ratio 5.46% 3.94% Stockholders Equity

Return on Assets 4.92% 4.81% Common Stock 500,000 775,000 749,500 942,750

Current ratio 111% 140% Preferred Stock 150,000 294,500 390,000 409,250

Quick ratio 98% 121% Retained Earnings 752,000 615,500 1,340,500 1,128,000

Receivables turnover ratio 11.43 16.46 Total Stockholders Equity 1,402,000 1,685,000 2,480,000 2,480,000

average collection period 31.94 22.18

Inventory turnover ratio 12.90 15.66 Total Liabilities and Stockholders Equity 2,747,000 2,805,000 4,381,250 4,450,000

Average sale period 28 23 - - - -

Debt to Equity Ratio 96% 77%

3.72

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Advanced Accounting 4Document2 pagesAdvanced Accounting 4Tax TrainingNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument8 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualChelseaPowelljscna100% (17)

- Latihan UTS AKUNDocument32 pagesLatihan UTS AKUNchittamahayantiNo ratings yet

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Ratio Analysis QuestionDocument3 pagesRatio Analysis QuestionPraween BimsaraNo ratings yet

- Er Cla 2Document2 pagesEr Cla 2Sakshi ManotNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument36 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions Manualandrewnealobrayfksqe100% (23)

- McPhee Distillers Statements v03 CPDocument13 pagesMcPhee Distillers Statements v03 CPcmag10No ratings yet

- CH02 ProblemDocument3 pagesCH02 ProblemTuyền Võ ThanhNo ratings yet

- Financial Position and Income Statement Analysis of Simple CompanyDocument2 pagesFinancial Position and Income Statement Analysis of Simple CompanyAndrea Monique AlejagaNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- FSA Financial StatementsDocument4 pagesFSA Financial StatementsabidjaysNo ratings yet

- FM Model - Coffee ParlorDocument11 pagesFM Model - Coffee ParlorPRITESH PATILNo ratings yet

- Group 6 05 Quiz 1Document4 pagesGroup 6 05 Quiz 1Angela Fye LlagasNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- Issued & Paid Up Capital StatementDocument6 pagesIssued & Paid Up Capital StatementShoukat KhaliqNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- CAD Schedule Consolidated Income ReportDocument5 pagesCAD Schedule Consolidated Income Reportm habiburrahman55No ratings yet

- Fsa Questions and SolutionsDocument11 pagesFsa Questions and SolutionsAnjali Betala KothariNo ratings yet

- Fin Mid Fall 2020Document2 pagesFin Mid Fall 2020Shafiqul Islam Sowrov 1921344630No ratings yet

- National Law Institute University: BhopalDocument3 pagesNational Law Institute University: BhopalMranal MeshramNo ratings yet

- Financial Statement Analysis of Everest EmporiumDocument8 pagesFinancial Statement Analysis of Everest EmporiumArthur Richard SumaldeNo ratings yet

- Attachment AccountingDocument6 pagesAttachment Accountingtaylor swiftyyyNo ratings yet

- Sharon PLC (Long Question)Document4 pagesSharon PLC (Long Question)Jimmy LimNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- Cash Flow Pr. 16-1ADocument1 pageCash Flow Pr. 16-1AKearrion BryantNo ratings yet

- Advanced Financial Accounting Assignment: QuestionDocument2 pagesAdvanced Financial Accounting Assignment: QuestionAyyan AzeemNo ratings yet

- Quiz 1 - Statement of Financial PositionDocument9 pagesQuiz 1 - Statement of Financial PositionJonathan SolerNo ratings yet

- P&L Statement for 1999 FinancialsDocument5 pagesP&L Statement for 1999 FinancialsambitiousfirkinNo ratings yet

- Subsidiary and Sub SubsidiaryDocument3 pagesSubsidiary and Sub SubsidiaryNipun Chandula WijayanayakaNo ratings yet

- YVONNE MerchandisingDocument1 pageYVONNE Merchandisingart50% (2)

- Chapter 1 Case 1 Net Asset AcquisitionDocument4 pagesChapter 1 Case 1 Net Asset AcquisitionANGELI GRACE GALVANNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- Task Performance I. Horizontal AnalysisDocument3 pagesTask Performance I. Horizontal AnalysisarisuNo ratings yet

- Assignment 2 - Financials of Boru Vaahana (PVT) LTD.: Current AssetsDocument2 pagesAssignment 2 - Financials of Boru Vaahana (PVT) LTD.: Current AssetsRukshani RefaiNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Forever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecemberDocument4 pagesForever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecembermwauracoletNo ratings yet

- De Jesus, Zephaniah - (Finals)Document4 pagesDe Jesus, Zephaniah - (Finals)Zephaniah De JesusNo ratings yet

- 201B 201A Peso Change % ChangeDocument4 pages201B 201A Peso Change % ChangeNin JahNo ratings yet

- Unit 3Document13 pagesUnit 3hassan19951996hNo ratings yet

- Part 4 exercisesDocument6 pagesPart 4 exercisesrbaalsdy530No ratings yet

- Partnership LiquidationDocument8 pagesPartnership LiquidationJhane XiNo ratings yet

- Stock Acquisition Quiz 100% AnswerDocument2 pagesStock Acquisition Quiz 100% AnswerJohn BalanquitNo ratings yet

- TF 00000053Document2 pagesTF 00000053api-355983822No ratings yet

- DVM Enterprises Financial Statements AnalysisDocument6 pagesDVM Enterprises Financial Statements AnalysisNicole AlexandraNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Horizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BDocument10 pagesHorizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BKarysse Arielle Noel JalaoNo ratings yet

- Trial Balance Adjustments FinancialsDocument2 pagesTrial Balance Adjustments FinancialsMichelle BabaNo ratings yet

- Joyk-Excel 2 3 1Document4 pagesJoyk-Excel 2 3 1api-664350584No ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Consolidated financial statements worksheetDocument38 pagesConsolidated financial statements worksheetJeane Mae BooNo ratings yet

- Comprehensive SOCF ProblemDocument1 pageComprehensive SOCF ProblemAbdullah alhamaadNo ratings yet

- IT Customer Service Handbook-SOPDocument36 pagesIT Customer Service Handbook-SOPAhmed Ezz100% (2)

- WA CalculationsDocument3 pagesWA CalculationsAhmed EzzNo ratings yet

- Student Grade Tracking TableDocument2 pagesStudent Grade Tracking TableAhmed Ezz0% (1)

- Crocs Form 10-KDocument99 pagesCrocs Form 10-KAhmed EzzNo ratings yet

- ManpowerGroup From C-Suite To Digital Suite White PaperDocument12 pagesManpowerGroup From C-Suite To Digital Suite White PaperAhmed EzzNo ratings yet

- Crocs Financial Analysis 2016-2019Document9 pagesCrocs Financial Analysis 2016-2019Ahmed EzzNo ratings yet

- 23 Winning Job DescriptionsDocument23 pages23 Winning Job DescriptionsAhmed EzzNo ratings yet

- Entrepreneurship F CDocument433 pagesEntrepreneurship F CLalitkumar BholeNo ratings yet

- Kunci Jawaban Soal UKK 2016/2017Document42 pagesKunci Jawaban Soal UKK 2016/2017Nur hayatiNo ratings yet

- Class 8 Ch-10 Law and Social Justice Notes Political ScienceDocument6 pagesClass 8 Ch-10 Law and Social Justice Notes Political Sciencedungarsingh2530No ratings yet

- Corporate Social Responsibility A New Way of Doing Business..FINALDocument21 pagesCorporate Social Responsibility A New Way of Doing Business..FINALRavi Gupta100% (1)

- Sony and Zee Ink Merger DealDocument2 pagesSony and Zee Ink Merger DealMr PicaedNo ratings yet

- Long-Term Construction Contracts & FranchiseDocument6 pagesLong-Term Construction Contracts & FranchiseBryan ReyesNo ratings yet

- MBM Issue 5 - Ethos Magazine PDFDocument28 pagesMBM Issue 5 - Ethos Magazine PDFPAPALÓ ARSNo ratings yet

- (Ec) No. (Reach) Article 33 ("Candidate List") : Regul Tion 1907/2006Document2 pages(Ec) No. (Reach) Article 33 ("Candidate List") : Regul Tion 1907/2006TVE AcademyNo ratings yet

- MKT 222222222Document21 pagesMKT 222222222Faisal AhmedNo ratings yet

- Balaji Company ProfileDocument14 pagesBalaji Company ProfileBalaji DefenceNo ratings yet

- Financial Analysis of HDFC BankDocument58 pagesFinancial Analysis of HDFC BankInderdeepSingh50% (2)

- 2011 - Shell - DEP - INSTRUMENTATION FOR EQUIPMENT PACKAGES PDFDocument19 pages2011 - Shell - DEP - INSTRUMENTATION FOR EQUIPMENT PACKAGES PDFHH Kevin100% (1)

- Analysis of JackWills' Marketing StrategiesDocument24 pagesAnalysis of JackWills' Marketing StrategiesAmanda Wong78% (9)

- RPADocument3 pagesRPAAnju C MohanNo ratings yet

- Philippine Christian University: 1648 Taft Avenue Corner Pedro Gil ST., ManilaDocument4 pagesPhilippine Christian University: 1648 Taft Avenue Corner Pedro Gil ST., ManilaKatrizia FauniNo ratings yet

- Rewards credit card statement detailsDocument3 pagesRewards credit card statement detailsVvNo ratings yet

- Masters Management AnalyticsDocument12 pagesMasters Management AnalyticsRonNo ratings yet

- BIR Ruling 415-93Document2 pagesBIR Ruling 415-93Russell PageNo ratings yet

- Ansys ACT API Reference GuideDocument4,876 pagesAnsys ACT API Reference GuideajkNo ratings yet

- United Bank of India: Application Form For Internet Banking (United Online) - CorporateDocument4 pagesUnited Bank of India: Application Form For Internet Banking (United Online) - CorporateSourav NandiNo ratings yet

- Fa-Q by Lolits Dos - 2 PDFDocument35 pagesFa-Q by Lolits Dos - 2 PDFMark Jovin RomNo ratings yet

- Corporate Governance Models ExplainedDocument34 pagesCorporate Governance Models ExplainedAprajita Sharma0% (1)

- Bobble.AI Internship Offer LetterDocument3 pagesBobble.AI Internship Offer LetterNilesh Sukhdeve IINo ratings yet

- Ogl 260 Module 5 Paper FubuDocument4 pagesOgl 260 Module 5 Paper Fubuapi-650422817No ratings yet

- Role Soft Switch in NGNDocument6 pagesRole Soft Switch in NGNHung Nguyen HuyNo ratings yet

- Session 6 - Conflicts of Interest in Business - The Accounting ProfessionDocument27 pagesSession 6 - Conflicts of Interest in Business - The Accounting Profession20201211053 NUR AZIZAHNo ratings yet

- S. Venkatesan: ProfileDocument2 pagesS. Venkatesan: ProfileSudu SalianNo ratings yet

- Legal Business Global 100 - Issue 317Document126 pagesLegal Business Global 100 - Issue 317Vivian Luiz CocoNo ratings yet

- User Guide Inquiry - Velocity V2 (English Version) - 090317Document10 pagesUser Guide Inquiry - Velocity V2 (English Version) - 090317herwongNo ratings yet

- MDSAP Medical Device Single Audit Program OverviewDocument31 pagesMDSAP Medical Device Single Audit Program OverviewAditya C KNo ratings yet