Professional Documents

Culture Documents

How Much Does Registering A Franchise Business Cost

Uploaded by

Tma FrxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How Much Does Registering A Franchise Business Cost

Uploaded by

Tma FrxCopyright:

Available Formats

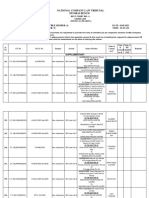

How Much Does Registering a Franchise Business Cost?

1. For DTI Registration

It depends on the territorial scope you chose for your franchise:

● Barangay: PHP 230

● City/Municipality: PHP 530

● Regional: PHP 1,030

● National: PHP 2,030

2. For SEC Registration

It depends on the type of business structure.

a. For partnerships, the articles of partnership costs 1/5 of 1% of the partnership’s

capital but not less than PHP 2,000.

b. For corporations, the articles of incorporation costs:

● Stock corporation with par value: 1/5 of 1% of the authorized capital stock but

not less than PHP 2,000, or the subscription price of the subscribed capital

stock, whichever is higher.

● Stock corporation without par value: 1/5 of 1% of the authorized capital stock

computed at PHP 100 per share but not less than PHP 2,000, or the issue

value of the subscribed capital stock, whichever is higher.

● Non-stock corporation: PHP 1,000.

It’s recommended to use the SEC’s registration fee calculator here.

For corporations, you also need to pay for the by-laws, which cost PHP 1,000.

You also need to pay a legal research fee (1% of the filing fee), a documentary stamp

tax of PHP 30, and a name registration fee of PHP 100.

3. For BIR Registration

The total cost is PHP 1,360 inclusive of the annual registration fee, documentary stamp

tax, registration of book of accounts, and sales invoice.

4. For Business/Mayor’s Permit

The costs depend on the LGU. It can be anywhere from PHP 300 to PHP 5,000. Larger

cities typically charge higher than small municipalities. Note that you might need to

register both your franchise’s head office and physical store’s location if they are

different.

Tips & Warnings

● The timing of your registration is important, so don’t register too early.

As a beginner franchisee, it might be tempting to get the time-consuming

business registrations out of the way. However, if you register too early, you

might be taking on a burden that you don’t even need yet.

● Once you have your store set up, display the documents required for

compliance. These include the BIR certificate of registration, business permit,

and plate. Choose a visible location in your store where they won’t be

damaged.

● You might want to consider hiring a professional accountant who can

complete the government requirements for you. They can also help you with

the monthly, quarterly, and annual compliance documents. That way, you’ll be

able to save time and use that time to focus on growing your franchise

instead.

You might also like

- Individual - Sole Proprietorship - Corporation/PartnershipDocument3 pagesIndividual - Sole Proprietorship - Corporation/PartnershipAliyaaaahNo ratings yet

- Important Information - Foreign Business in PHDocument4 pagesImportant Information - Foreign Business in PHGraze IsidroNo ratings yet

- How To Register A Sole Proprietor Business in The Philippines?Document23 pagesHow To Register A Sole Proprietor Business in The Philippines?Lei Anne MirandaNo ratings yet

- BMA 1 HW#8.1 GUERRERO, RonneLouiseDocument8 pagesBMA 1 HW#8.1 GUERRERO, RonneLouiseLoisaDu RLGNo ratings yet

- Awareness On Business Registration, Invoicing and BookkeepingDocument70 pagesAwareness On Business Registration, Invoicing and BookkeepingRonald Allan Valdez Miranda Jr.No ratings yet

- Legal Documents You Need To Run A Business in Philippines SEC Registration DTI Registration Mayor's Business PermitDocument2 pagesLegal Documents You Need To Run A Business in Philippines SEC Registration DTI Registration Mayor's Business PermitblessingNo ratings yet

- Requirements and Fees - Dti Bir Fda SecDocument25 pagesRequirements and Fees - Dti Bir Fda SecHiraeth WeltschmerzNo ratings yet

- ARCH591 - 3. Where Do I Get Licenses and PermitsDocument27 pagesARCH591 - 3. Where Do I Get Licenses and PermitsJahzeel CubillaNo ratings yet

- Step-By-Step Sole Proprietor Business RegistrationDocument4 pagesStep-By-Step Sole Proprietor Business Registrationjen mikeNo ratings yet

- The Insider Secret of Business: Growing Successful Financially and ProductivelyFrom EverandThe Insider Secret of Business: Growing Successful Financially and ProductivelyNo ratings yet

- Business in The PhilippinesDocument6 pagesBusiness in The PhilippinesNitz GallevoNo ratings yet

- How To Close BusinessDocument5 pagesHow To Close BusinessJose Gabriel PesebreNo ratings yet

- Summary - Permits, Registrations & CompliancesDocument2 pagesSummary - Permits, Registrations & ComplianceschaitanyakorannechaitanyaNo ratings yet

- How To Register Your Online Business in BIR and DTI: By: Kenneth MedinaDocument8 pagesHow To Register Your Online Business in BIR and DTI: By: Kenneth MedinaCandice BoiserNo ratings yet

- How to Start Your Own Cleaning Business: Low Start up Cost, Fast Growing and ProfitableFrom EverandHow to Start Your Own Cleaning Business: Low Start up Cost, Fast Growing and ProfitableNo ratings yet

- Closing A Business in The PhilippinesDocument7 pagesClosing A Business in The PhilippinesWen ChiNo ratings yet

- Singapore Branch Office RegistrationDocument5 pagesSingapore Branch Office RegistrationTarun VBRSITNo ratings yet

- Company Formation and Legal AspectsDocument3 pagesCompany Formation and Legal AspectsJayan PrajapatiNo ratings yet

- How To Register in DTI and BIRDocument6 pagesHow To Register in DTI and BIRLuanne dela CruzNo ratings yet

- The Seriously Lighthearted Guide to Basic Compliance for Small Businesses!: The Seriously Lighthearted Guide Series, #2From EverandThe Seriously Lighthearted Guide to Basic Compliance for Small Businesses!: The Seriously Lighthearted Guide Series, #2No ratings yet

- Setting Up or Registering A Company in GhanaDocument4 pagesSetting Up or Registering A Company in GhanaNii ArmahNo ratings yet

- What This Is For:: BIR Form 1905Document7 pagesWhat This Is For:: BIR Form 1905shfskjdgbNo ratings yet

- Permit ProcessDocument9 pagesPermit ProcessBiz MakerNo ratings yet

- Chapter 7: Forms of Small Business Ownership, Registering and OrganizingDocument77 pagesChapter 7: Forms of Small Business Ownership, Registering and OrganizingEmerson CruzNo ratings yet

- Opening New Office WhitepaperDocument8 pagesOpening New Office WhitepaperJúlio SantosNo ratings yet

- Faqs Regarding SFM Offshore Company FormationDocument10 pagesFaqs Regarding SFM Offshore Company FormationInition TechnologyNo ratings yet

- Guide To Starting A Goudou Kaisha in JapanDocument4 pagesGuide To Starting A Goudou Kaisha in JapanTeam NurosoftNo ratings yet

- How To Register A Partnership Company in The PhilippinesDocument2 pagesHow To Register A Partnership Company in The PhilippinesAdrimar AquinoNo ratings yet

- 3 Kinds of Taxes For Pinoy FreelancersDocument28 pages3 Kinds of Taxes For Pinoy Freelancersjedcee21No ratings yet

- Zanzibar RegistrationDocument8 pagesZanzibar RegistrationNuswaibahNo ratings yet

- Everything An F&O Trader Should Know About Return FilingDocument8 pagesEverything An F&O Trader Should Know About Return FilingTrading CuesNo ratings yet

- Steps in Closing SPDocument2 pagesSteps in Closing SPphilip william altaresNo ratings yet

- Module 1 Sole Proprietorship BusinessDocument18 pagesModule 1 Sole Proprietorship BusinessJam HailNo ratings yet

- Tax Guide For Professionals BIRDocument8 pagesTax Guide For Professionals BIRPY CaunanNo ratings yet

- Activity 02Document4 pagesActivity 02HaruNo ratings yet

- J.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedFrom EverandJ.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedNo ratings yet

- One Person CompanyDocument10 pagesOne Person CompanyThakreNo ratings yet

- How To Register A Sole Proprietor Business in The PhilippinesDocument2 pagesHow To Register A Sole Proprietor Business in The PhilippinesAngellaine BulanadiNo ratings yet

- Sales Tax RegistrationDocument11 pagesSales Tax RegistrationLegalRaastaNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Compliance SDocument2 pagesCompliance SJaya JamdhadeNo ratings yet

- Business Registration For Sole ProprietorshipDocument2 pagesBusiness Registration For Sole ProprietorshipErielle Sta. AnaNo ratings yet

- Investment Requirements For A Food Truck BusinessDocument10 pagesInvestment Requirements For A Food Truck BusinessYna Paulite100% (1)

- The SolopreneurDocument6 pagesThe Solopreneurjun junNo ratings yet

- ONE-ON-ONE MARKETING GUIDE: Every Tax Business Secrets To Success!From EverandONE-ON-ONE MARKETING GUIDE: Every Tax Business Secrets To Success!No ratings yet

- Establishing An EntityDocument32 pagesEstablishing An EntityAbhishek RaiNo ratings yet

- PDF of Private Limited CompanyDocument2 pagesPDF of Private Limited Companyfiling expertNo ratings yet

- Business RegistrationDocument5 pagesBusiness RegistrationgithireNo ratings yet

- Lyceum of The Philippines University Cavite Legal and Taxation Aspects 1.1 Legal AspectsDocument14 pagesLyceum of The Philippines University Cavite Legal and Taxation Aspects 1.1 Legal AspectsYolly DiazNo ratings yet

- Jan 18 ExerciseDocument4 pagesJan 18 ExercisekrisNo ratings yet

- Committed Vs Aspirational OKRs The Idea OKRE V1 0Document3 pagesCommitted Vs Aspirational OKRs The Idea OKRE V1 0baohan dinhNo ratings yet

- Ul AppletonDocument2 pagesUl AppletonDIEGO SANCHEZ100% (1)

- Brosur & Harga Perumahan Lavon Swan City 2020Document32 pagesBrosur & Harga Perumahan Lavon Swan City 2020Wahyudi PurnamaNo ratings yet

- Dream Beyond Training AcademyDocument20 pagesDream Beyond Training AcademyssabdullssNo ratings yet

- 3.1 Plan Business Analysis ApproachDocument4 pages3.1 Plan Business Analysis ApproachSushmita RoyNo ratings yet

- Raheem - Big Data - A Tutorial-Based ApproachDocument203 pagesRaheem - Big Data - A Tutorial-Based ApproachStan LaurelNo ratings yet

- SF LRN Impl InstructorsDocument64 pagesSF LRN Impl InstructorsThuyết Mai VănNo ratings yet

- Enterprenuership Course Outline - HIUDocument4 pagesEnterprenuership Course Outline - HIUAbdinasir Mohamed AddowNo ratings yet

- 1 Macro-Perspective-Of-Tourism-And-Hospitality-PrelimDocument23 pages1 Macro-Perspective-Of-Tourism-And-Hospitality-Prelimbarbara palaganasNo ratings yet

- Contractual Agreements in Ghana's OilDocument23 pagesContractual Agreements in Ghana's OilAaron Gbogbo MorthyNo ratings yet

- Chipotle UIBM ProjectDocument10 pagesChipotle UIBM ProjectAlan FernandesNo ratings yet

- A Study On Consumer Preference Towards Red Label Tea Powder With Reference To Samrat Chowk, SolapurDocument10 pagesA Study On Consumer Preference Towards Red Label Tea Powder With Reference To Samrat Chowk, SolapurVasu ChenniappanNo ratings yet

- Court of Tax Appeals: Republic of The Philippines Quezon CityDocument3 pagesCourt of Tax Appeals: Republic of The Philippines Quezon CityDyrene Rosario UngsodNo ratings yet

- 14.1.1.1 UL Product 4004R DescargaDocument1 page14.1.1.1 UL Product 4004R DescargaPablo AmpueroNo ratings yet

- Cworld Midterm Paper (FINAL)Document6 pagesCworld Midterm Paper (FINAL)Shaun LeeNo ratings yet

- FINAL-thesis-writing SampleDocument48 pagesFINAL-thesis-writing SampleGwen-Evelyn GallosaNo ratings yet

- Advanced Financial AccountingDocument102 pagesAdvanced Financial AccountingYash WanthNo ratings yet

- Rev 2 - Change of Details EmailedDocument5 pagesRev 2 - Change of Details EmailedMunodawafa ChimhamhiwaNo ratings yet

- Labor Canonical DoctrinesDocument17 pagesLabor Canonical DoctrinesJake MendozaNo ratings yet

- F.C. Fisher v. Yangco Steamship Co. G.R. No. L-8095 FactsDocument2 pagesF.C. Fisher v. Yangco Steamship Co. G.R. No. L-8095 Factsamado espejoNo ratings yet

- AX 2012 - ENUS - SMA - 01 - Service ManagementDocument6 pagesAX 2012 - ENUS - SMA - 01 - Service ManagementSubbu_kalNo ratings yet

- 20-Article Text-286-1-10-20201231Document16 pages20-Article Text-286-1-10-20201231Andi Fitrah AulyahNo ratings yet

- WCM VbeDocument59 pagesWCM VbeMohmmedKhayyumNo ratings yet

- Busines Plan On Poultry Farming PDFDocument54 pagesBusines Plan On Poultry Farming PDFDeep & Minimal Tech House Music UnionHouseMusicNo ratings yet

- Tax SOLVINGDocument3 pagesTax SOLVINGjr centenoNo ratings yet

- Aircraft IT MRO V10.1 FinalDocument70 pagesAircraft IT MRO V10.1 FinalEmNo ratings yet

- BMA Bulletin 23 Int Audit WindowDocument5 pagesBMA Bulletin 23 Int Audit WindowcaptaksahNo ratings yet

- Mil Quarter 1 Module 3Document5 pagesMil Quarter 1 Module 3Catherine SarrosaNo ratings yet

- Cause List 18.09.2023 Court 5-Mumbai BenchDocument40 pagesCause List 18.09.2023 Court 5-Mumbai BenchSavinder Singh GulairNo ratings yet