Professional Documents

Culture Documents

BSA 2 Activity 1

BSA 2 Activity 1

Uploaded by

Melrose Eugenio Erasga0 ratings0% found this document useful (0 votes)

6 views2 pagesFor practice

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFor practice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesBSA 2 Activity 1

BSA 2 Activity 1

Uploaded by

Melrose Eugenio ErasgaFor practice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

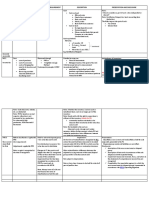

QUESTIONS

1. Define property,

2. What are ¢]

plent and

Plant and equipment.

he major characteristics in defining property,

‘equipment?

. Give examples of Property, plant and equipment.

Explain the recognition of property, plant and equipment.

5. Explain the ¢

; reatment of spare parts and servicing

equipment.

. Explain the measurement of

e property, plant and equipment

at recognition and after recognition.

What are the elements of cost of property, plant and

equipment?

8. Give examples of directly attributable costs.

o Give examples of costs which are expensed rather than

capitalized as property, plant and equipment.

10. What does the cost of the asset acquired on a cash basis

include?

11. What is the cost of an asset acquired on account subject to a

cash discount?

12, If an asset is acquired on the installment basis, the asset is

recorded at what amount?

13, Discuss the accounting procedure when an asset is acquired

through the issuance of share capital

14, Discuss the accounting procdure when an asset is acquired

by issuing bonds payable.

15. Discuss the accounting procedure for the recording of an

exchange.

647

Problem 1:0n January 1, 2022, Hydrogen-H Company purchased several Machineries that will be

Used in the production of goods at @ purchase price of P1,000,000. Hydrogen-H Company paid import

duties of P10,000 and non-refundable purchase taxes of P5,000. Hydrogen-H Company also incurred

£230,000 installation and assembly cost. Hydrogen-H Company expects that it wil incur dismantling

Cost émounting to P132,275 at the end of its S-year useful Ife. The prevailing market interest rate

during the transaction date was 12%.

‘The present value factor of P1 at 12% for 5 periods is at 0.567

‘The present value factor of ordinary annuity at 12% for 5 periods is at 3.6048

1. How much should the Machineries be initially recognized?

a. 1,045,000 b. 1,177,275 c. 1,120,000 d. 1,521,825

Problem 2: On March 1, 2022, Helium-He Company purchased an equipment from a local dealer

under the terms 3/15, n/30 for P3,000,000. Helium-He Company paid installation costs of P14,000.

In addition, Helium-He Company paid advertising and promotion amounting to P 20,000 and incurred

initial operating losses of P 12,000. Helium-He Company settled the account on March 16, 2022.

2. How much is the cost of Equipment to be recorded on the date of acquisition?

‘a. 2,924,000 b. 3,015,000 c. 2,925,000 4. 3,014,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BSA2 - AIS2 Quiz No. 2Document8 pagesBSA2 - AIS2 Quiz No. 2Melrose Eugenio ErasgaNo ratings yet

- Governance, Business Ethics, Risk Management and Internal Control-1st Sem 2022-2023 - M T W TH 10300-12Document1 pageGovernance, Business Ethics, Risk Management and Internal Control-1st Sem 2022-2023 - M T W TH 10300-12Melrose Eugenio ErasgaNo ratings yet

- Acctg 25 DepartmentalDocument11 pagesAcctg 25 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- BSA 2 GG QuizDocument5 pagesBSA 2 GG QuizMelrose Eugenio ErasgaNo ratings yet

- Acctg 41 DepartmentalDocument12 pagesAcctg 41 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- ACCTG 22 DepartmentalDocument12 pagesACCTG 22 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- 05 s2 Prospectus SMC 2012Document674 pages05 s2 Prospectus SMC 2012Melrose Eugenio ErasgaNo ratings yet

- Illustrative Examples - Notes and Loans ReceivableDocument4 pagesIllustrative Examples - Notes and Loans ReceivableMelrose Eugenio ErasgaNo ratings yet

- Name of Form Bir Form Filing and Payment DescriptionDocument4 pagesName of Form Bir Form Filing and Payment DescriptionMelrose Eugenio ErasgaNo ratings yet

- Summary of Measurement, Presentation and DisclosureDocument17 pagesSummary of Measurement, Presentation and DisclosureMelrose Eugenio ErasgaNo ratings yet

- Japanese LangDocument7 pagesJapanese LangMelrose Eugenio ErasgaNo ratings yet