Professional Documents

Culture Documents

Bafin 1-4

Uploaded by

Miranda, Aliana Jasmine M.0 ratings0% found this document useful (0 votes)

9 views8 pagesOriginal Title

BAFIN 1-4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views8 pagesBafin 1-4

Uploaded by

Miranda, Aliana Jasmine M.Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

BAFIN MODULE 1: INTRODUCTION TO Shareholder’s wealth maximization takes into company to bankruptcy risk.

Also, too much

FINANCIAL MANAGEMENT account the risk return trade off of focus on profits may force management to

management decisions and the prospects of a consider inferior raw materials for production.

Financial management starts with a plan. This company. For closely held corporations, the While this may improve profits in the short run,

applies to both individuals and companies. It is concept of shareholder’s wealth maximization this may have adverse repercussions in the

not enough to have cash and other resources maybe more difficult to apply as there is no long run. Management may also defer

today. Such resources if not managed market price of the stock to look at. important repairs and maintenance just to

properly can be wiped out. Hence financial Nevertheless, the management show better profits in the current accounting

management is a must. should still be aware of the variables that period. Again, deferring such repairs and

From the perspective of a corporation, influence the price of the stock because new maintenance may impair the efficiency of the

financial management deals with investors may join the company or the production facilities in the long run.

decisions that are supposed to maximize the controlling stockholders may decide to list the Maximizing shareholder’s wealth

value of shareholders wealth. This means shares in the Philippine stock exchange in the motivates members of top management to

maximizing the market value of the shares of future. When these opportunities come, the develop a longer perspective for the company

stocks represent the form of ownership in a factors which are considered relevant in that they manage. With this objective in mind,

corporation. appropriately valuing a stock will be applied. management will try to make their customers

happy by providing good products and

The changes in the price of a stock can be SHAREHOLDER’S WEALTH MAXIMIZATION services at reasonable prices. To achieve this,

a confluence of many factors: Maximizing shareholder’s wealth management may have to innovate, invest in

Profitable operation through maximization of stock price should be technology and be more efficient in their

Nature of the business the overriding objective of management as it production and operation. Management may

Prospects of the business covers the different facets of operating a also need to consider setting aside a certain

Projected earnings company and it considers the different percentage of income to research and

Timeframe for the realization of such stakeholders in the organization. Stakeholders development to further improve, and possibly

projected earnings are not limited to the stockholders of the expand the company’s existing product and

company. Stakeholders also include service offerings.

Ability to meet maturing obligations

management employees, suppliers, The interest of the employees has to

Appropriate capital structure

customers, creditors, regulatory agencies, and be considered in managing a company.

Dividend policies the community where the company operates. Chances are happy employees mean more

Investing decisions For a longer and sustainable operations, the productive employees. If employees are

Management and market sentiment interest of these different stakeholders has to happy in the workplace and they have sense

be borne in mind. of belonging in the company, they will protect

While profits significantly affect the price of The stock holders have to be happy the interest of the company. In Filipino culture,

stock, finance literature states that profit with their investments in the company so that it is called malasakit. A close translation to

maximization should not be the overriding they will be encouraged to invest more. More English will probably be solicitude or empathy.

objective of company’s management, but investments mean more jobs can be created. Unhappy employees can damage the

shareholder’s wealth maximization. Profits can While profitability is a major drive for reputation of the company or they may do

be maximized by taking more risks, for increasing the value of stock, there are other something that will taint the image of the

example borrowing more to finance expansion factors that influence share prices. There are company.

and generate more revenues. While more many reasons why profit maximization should Paying suppliers and creditors on time

borrowings can increase profitability, it can not be the overriding objective of a company. is a good business practice that will improve

also expose the company to more risks and One reason as cited previously is that the relationships with these parties. It is important

may even result in operating losses if some company may need to borrow more just so it that management take care of suppliers to

external shocks occur and adversely affect the can increase sales or augment production ensure good quality of materials at reasonable

company’s operations. capacity. While borrowing is not necessarily prices. Good relationships with creditors

bad, too much too much of it exposes the enhance the probability of getting credit facilities

especially during times of emergencies.

Compliance with the requirements of FINANCIAL INTERMEDIARIES The same entities can be savers and users of

regulatory agencies also ensures more a. Banks funds. One entity may have

smooth operations. Noncompliance may result b. Insurance companies savings today but may be needing funds in the

in suspension of operations or unnecessary c. Stock exchange future, for example for

penalties. Disruption in operation as a result of d. Stock brokerage firm expansion.

noncompliance with regulatory requirements e. Mutual funds

may also taint the image of the company f. Other financial institutions BANKS

which may have adverse effect effects not just Banks provide mechanism where savers can

on the operations but also on the cost of USERS OF FUNDS put their excess funds through deposits.

financing as well. (BORROWERS.INVESTORS) Banks give the depositors interest on the

a. Households money deposited to them. To cover for the

Supporting the community where the company b. Individuals interest given to depositors, banks lend the

operates, its whatever capacity it can, c. Corporations/companies money to borrowers after performing a credit

increases the company’s chances of d. Government agencies investigation. Some of the deposits can be

continuous operations in the area. Hiring invested in some financial instruments like

employees from the community promotes Savings can come from households, government securities and corporate bonds.

employees support for the company. The individuals, companies, government Banks can also serve as conduits of investors

company can also help in some civic oriented agencies, or any other entity whose cash in buying and selling both government

activities like planting trees in the area. Philex inflows are greater than them cash outflows. securities and corporate bonds. Banks have to

mining corporation is an example of a The financial system through financial be regulated by the Bangko Sentral ng

company which has reforested more than intermediaries provides a mechanism by Pilipinas because they take deposits, and

2,500 hectares of land across ITOGON and which these savings can be channeled to there is public interest involved.

TUBA, BENGUET. For this, the company has users of funds, borrowers and investors.

won several awards, some of which were INSURANCE COMPANIES

given by the Philippine Mine Safety and Some of the financial instruments issued by Insurance companies offer different products.

Environmental association. In 2014, PHILEX the users of funds such as the Insurance products can be broadly

also joined forces with the National Power shares of stocks and corporate bonds of categorized into life insurance products and

Corporation to reforest about 500 hectares of publicly listed companies and the non-life insurance products. Life insurance

land around San Roque dam’s critical debt securities issued by the national products protect the insured from loss of life

watershed area. Philex has also established government can be traded. The while non-life insurance products protect the

Adopt a School Program where the company financial market provides a system for the insured from the loss of or damage to

helps in the renovation of schools in their host trading of these securities. The properties. In exchange for the protection, the

and neighboring communities. In its mining Philippine Stock Exchange (PSE) offers insured pays premium to the insurance

area, the company also provides free private facilities for the trading of shares companies. These premiums are used to fund

elementary education through Philex Mines of publicly listed companies. claims. Generally, the cash collected from the

Elementary School. It has also awarded premiums may cover more than claims for

several scholarships to students in their host A company can become publicly listed through most periods. Hence, the excess cash can be

communities. an initial public offering invested by insurance companies. There are

(IPO) where shares will be offered to many guidelines in investing that insurance

BAFIN MODULE 2: OVERVIEW OF investors. The offering of the companies have to follow to ensure that they

FINANCIAL SYSTEM shares will be coursed through an investment have enough cash when claims are made.

The financial system makes the savers and bank which will underwrite Insurance companies are regulated by the

users of funds. the offering of the shares. Corporate bonds insurance commission.

SAVERS and government debt securities can be traded

A. Households B. Individuals through the Philippine Dealing and Exchange

C. Corporations D. Government agencies Corporation (PDEX).

STOCK EXCHANGE With mutual funds, investments are pooled COMMON STOCK AND PREFERRED

The Philippine Stock Exchange (PSE) and the funds are invested by professional STOCK

provides a system for the trading of managers for a fee. The fees are a small Most company have only common stocks in

equity securities of publicly listed companies. percentage of the funds invested. their stockholder’s equity but some companies

These equity securities are have both common stocks and preferred

common stocks and preferred stocks. An Mutual cater to different investment objectives. stocks. PLDT and GLOBE have both common

individual who wants to invest There are mutual funds stocks and preferred stocks in their

and trade in the stock market cannot go which are limited only to stocks while others stockholders’ equity.

directly to PSE to buy and sell are restricted to fixed income instruments like A preferred stock has priority over

stocks. He has to open an account with an bonds and treasury notes. Others provide a common stocks in terms of claim over the

accredited stock brokerage firm where he can combination of both stocks and fixed income assets of the company. This means that if a

channel his buy and sell orders of equity instruments. company is to be liquidated and its assets

securities. have to be distributed, no asset will be

It must be noted that when one invests in distributed to common stockholders unless all

STOCK BROKERAGE FIRMS mutual fund, he becomes a part owner of that the claims of the preferred stockholders have

Investing in the stock market has to be fund. To invest in a mutual fund, he has to buy been given.

coursed through stock brokerage shares of the mutual fund and the buying Preferred stockholders also have

firms. At present, there are on line brokers and shares depend on the net assets value (NAV) priority over common stockholders in cash

live brokers. With on line of that fund when the purchase is made. Note dividend declaration. No cash dividends will

brokers, one can trade in the stock market that the net asset value of a mutual fund be given to common stockholders unless all

through the internet. COL changes every day as the value of the the dividends due to preferred are paid first.

Financial and BPI Trade are two of the o line financial instruments where the funds are If the preferred stockholders have

brokers in the Philippines. To trade on line, invested also changes. preference over common stockholders in

one must have an account and deposit with terms of claims over the assets of the

the on line Because NAV changes, an investor in mutual company and in cash dividend declaration,

broker. fund can also lose as the NAV can fall before why would an investor be willing to become a

With live brokers, one needs a the NAV when the investment was made. common stockholder?

telephone to call brokers and place orders. However, because the fund is managed by There are benefits in being a common

Settlement of the transaction can be arranged professionals, positive returns are expected stockholder. Common stockholders are the

with the broker. Live brokers normally have over time. How much one gains from investing real owners of the company. Being residual

their messengers who deliver confirmation in mutual funds may also depend on the owners, the growth potential of their

receipts as well as collect and deliver checks. investment horizon of the investor. investment is unlimited. If an investor has

Confirmation receipts are forms of evidence identified a good common stock, its value can

regarding the executed buy or sell transaction OTHER FINANCIAL INSTITUTIONS multiply overtime.

that a client placed with his broker. Other financial institutions include pension Unlike preferred stocks, the dividend per

funds like Government service insurance share for common stocks is not fixed. A common

MUTUAL FUNDS system (GSIS) and social security system stock investor can receive more cash dividends

Mutual funds provide opportunities for big and (SSS), investment banks and credit unions during period of unusual profitability. But during

small investors to invest in financial among others. periods of unprofitable operations, both preferred

instruments which they would not have stockholders and common stockholders may not

considered on their own, or they may have FINANCIAL INSTRUMENTS receive dividends. The company is not obligated

considered but do not have the time or the Financial instruments are generally classified to pay dividends if it

is not in a position to do so. For cumulative

expertise to do it. These include investments into two major categories:

preferred stockholders, unpaid dividends can

in the stock market, bonds, treasury notes and a. Equity securities – include common accumulate and no cash dividends will be paid to

other money market instruments like treasury stocks and preferred stocks common stockholders unless all dividends in

bills. b. Debt securities arrears for prepaid stockholders are paid.

Being the residual owners of the company, BAFIN MODULE 3.1 1. Overseeing the operations of a company

common stockholders have voting rights, a and ensuring that the strategies as

privilege generally not available to preferred ORGANIZATIONAL CHART AND THE approved by the board are implemented

stockholders. This means that if one has ROLES OF THE VP FOR FINANCE as planned

enough common shares in a company, he can 2. Performing all areas of management

nominate a director in the board of directors. If BOARD OF DIRECTORS planning, organizing, staffing, directing

this happens, then he can influence the major The Board of directors is the highest policy and controlling

decisions made by a company as such major making body in a corporation. The boards 3. Representing the company in

decisions are approved by the board. primary responsibility is to ensure that professional, social and civic activities

corporation is operating to serve the best

DEBT SECURITIES interest of the stockholders. The members of The president cannot manage the company

The treasury bonds and treasury bills issued the board who are called directors are elected on his own , especially when the corporation

by the national treasury are of forms of by the stockholders. The ability to elect a has become too big. To assist him are the vice

indebtedness of the national government. The director in the board is contingent on the presidents of different functional areas :

treasury bills which are in the tenors of 91 number of shares owned and the number of finance, sales and marketing production and

days, 182 days, and 360 days are auctioned directors in the board. administration .

at the national treasury every Monday to To illustrate assume that there are ten

accredited dealers. These are eventually directors in the board. If a stockholder owns VP FOR SALES AND MARKETING

formed out to both institutional investors on 10% of the voting shares of the company then The following are among the responsibilities of

Wednesdays. this stockholder can elect one director in the VP for Sales and Marketing

Occasionally, the national treasury also board. This is the reason why some investors 1. Formulating marketing strategies and

issues retail treasury bonds. A small investor can want to own the majority shares of a company plans

participate in these retail treasury bonds. These if they want control over that company. 2. Directing and coordinating company sales

are normally in multiples of 5,000. Coupon Owning majority of the shares means having 3. Performing market and competitor

interest on these retail treasury the right to elect majority of the directors in the analysis

bonds are paid quarterly for treasury bonds, board. 4. Analyzing and evaluating the

coupon interest is paid semi The following are among the effectiveness and cost of marketing

annually. responsibilities of the board of directors: methods applied

Some publicly listed companies have 1. Setting policies on investments , capital 5. Conducting or directing research that will

also started issuing corporate bonds. The structure and dividends allow the company to identify new

tenors are usually 5 years, 7 years and 10 2. Approving company’s strategies , goals marketing opportunities , for example

years. and budgets variants of the existing products /services

PLDT and MERALCO are the other 3. Appointing and removing members of the already offered in the market

big publicly listed companies which issued top management including the president 6. Promoting good relationships with

corporate bonds recently. Corporate bonds 4. Determining top management’s customers and distributors

offer slightly higher interest rates than compensation

government securities. 5. Approving the information and other VP FOR PRODUCTION

Interest on investment to debt disclosures reported in the financial The following are among the responsibilities of

securities is subject to 20% final tax. For statements VP for Production:

bank deposits with tenors of at least 5 years 1. Ensuring production meets customer

tax rate is zero percent. PRESIDENT demands

In terms of claims over the assets of a The roles of a president in a corporation may 2. Identifying production technology /process

company, bondholders have preference over vary from one company to another . Among that minimizes production cost and makes

preferred stocks and common stocks. Also the responsibilities of a president are the the company cost competitive

interest due to them, just like bank creditors, following :

has to be paid first before dividends are

given to preferred and common stockholders.

3. Coming up with a production plan that Capital structure decisions vary from one OPERATING DECISIONS

maximizes the utilization of the company’s company to another. It is affected by the Operating decisions deal with the daily

production facilities stability of cash flows , extent of fixed operations of the company . The role of the

4. Identifying adequate and competitively operating expenses and variable expenses. VP for finance is determining how to finance

priced raw materials suppliers Companies which are capital intensive and working capital such as accounts receivable

are characterized by high fixed operating and inventories . Should the company finance

VP FOR ADMINSITRATION expenses such as utility and mining these two accounts substantially by short term

The following are among the responsibilities of companies are supposedly more sources of financing or through long term

VP for Administration conservatively financed. This means, these sources of financing .

1. Coordinating the functions of companies have to be financed more by The decision regarding the financing

administration , finance and sales and equity. These companies have to generate of these working capital accounts depends on

marketing departments high levels of revenues before they can cover the appetite of top management for risk. If the

2. Assisting other departments in hiring their expenses. If these companies are heavily company is more aggressive , then these

employees financed by debt, then interest expense adds accounts receivable and inventories can be

3. Providing assistance in payroll up to the already high fixed operating substantially financed by short term sources.

preparation expenses. This would mean higher revenues Short term sources of funds are

4. Determining the location and the for profits to be made . cheaper . interest on short term loans is

maximum amount of office space needed generally lower than the interest on long term

by the company INVESTING DECISIONS loans. Using short term loans can boost the

5. Identifying means, processes or systems profitability of a company.

that will minimize the operating costs of To minimize the probability of failure , long While financing through short term

the company term investments have to be supported by a sources of financing may minimize the

capital budgeting analysis which is among the financing cost of the company , this has a

VP FOR FINANCE responsibilities of a finance manager. Capital trade off . financing working capital accounts

Functions of VP for FINANCE budgeting analysis is a technique used to mostly through short term sources may

FINANCING determine the financial viability of a long term expose the company to a liquidity problem

INVESTING investment. This requires forecasting the cost where obligations are already due but the

OPERATING of investment and the streams of cash flow company does not have sufficient cash to pay

DIVIDEND POLICIES expected to be generated from the for the obligations.

investment. The investment can only be A more conservative management will

FINANCING DECISIONS considered if it satisfies certain financial opt to finance working capital accounts mostly

Financing decisions include making decisions parameters that are to the top management. through long term sources.

as to how to finance long term investments

and working capital which deals with the day This function of a finance manager is crucial. DIVIDEND POLICIES

to day operations of the company. Many companies which suffered financial Some investors buy stocks because of the

The VP for Finance is also distress went through an aggressive dividends they expect to receive from the

responsible for determining the appropriate expansion heavily financed by debt. Among company. Non declaration of dividends may

capital structure of the company, that is how the local companies which suffered a major disappoint these investors. PLDT and Globe

much of the total assets should be financed by setback because of aggressive expansion are are two of the Philippine listed companies

debt and equity. This responsibility is crucial Metro Pacific Corporation with respect to their which have generously distributed cash

because if the company is aggressively Fort Bonifacio Global City development project dividends for the last five years.

financed, that is , it is heavily financed by debt, and Belle Resources as regards their initial Two conditions must exist before a

the company becomes vulnerable to adverse venture in the casino business. Both company can declare cash dividends. First,

economic conditions which may result in companies implemented these expansions the company must have enough retained

higher volatility in earnings. The company can right after the 1997 Asian financial crisis. earnings to support cash dividend declaration.

get bankrupt because of too much debt. When cash dividends are declared , the

retained earnings of a company go down to 3. STATEMENT OF CASH FLOWS STATEMENT OF CHANGES IN

the extent of such declaration . second the The statement of cash flows provides an STOCKHOLDER’s EQUITY

company must have cash. How much cash explanation regarding the change in cash This financial statement provides information that

dividend a company declares is within the balance from one accounting period to explains the changes in the stockholder’s equity

another. The cash flow are also classified from one accounting period to another.

purview of the VP for Finance? The changes may be due to the following.

There are several factors considered in into three main categories : operating ,

investing and financing 1. Profit or loss for the accounting period

declaring cash dividends. 2. Cash dividend declaration

1. Availability of investment opportunities The statement of cash flows is very

3. Issuance of new shares of stocks

2. Access to long term sources of funds important financial statement because it 4. Other transactions that affect the stockholders

provides information regarding the quality of

3. Capital structure equity such as other comprehensive income,

earnings of a company as shown in the cash treasury stocks and revaluation of assets.

flows from operating activities. In this section

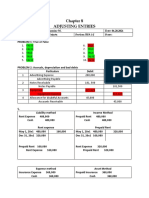

BAFIN MODULE 3.2 , the income reported from statement of

REVIEW OF FS PREPARATION, ANALYSIS NOTES TO FINANCIAL STATEMENTS

profit or loss which is based on accrual The notes to financial statements are integral part

AND INTERPRETATION principle is converted to cash. This is very of the financial statements. Among the additional

BASIC FINANCIAL STATEMENTS important piece of information found in this information that the notes to financial statements

1. STATEMENT OF FINANCIAL POSITION financial report because a company may provide are the following:

The statement of financial position

have so much reported net income , but if 1. Brief description of the company. Information

provides information regarding the liquidity position

such income is not translated into cash , may include the nature of business of the

and capital structure of a company as of a given

then that income is useless. One cannot use company and the owners behind the company

date. Liquidity – refers to the ability of a company

net income to pay debt or to pay the salaries 2. Summary of significant accounting policies .

to pay maturing obligations. The current assets of a

of the employees. Cash is needed. this I very important because the existing

company are compared with its current liabilities to

The cash flows from investing activities generally accepted accounting principles

determine its paying capacity. Generally assets

provide information regarding the future provide alternative accounting policies to

which are expected to be converted to cash within

companies . it is therefore important to find out

one year such as accounts receivable and directions of the company. This section

what specific accounting policies are used by

inventories are classified as current assets. shows how much investment the company is

the company.

Liabilities which are expected to be settled or paid making a given accounting period. 3. Breakdown of amounts found in the financial

within one year are classified as current liabilities. Expansions allow companies to grow. statements. The company’s property, plant and

However, that expansion or investment are equipment account may have too many

2. INCOME STATEMENT not always good especially when components. Putting all the details on the face

The income statement provides information management has undertaken them too of the balance sheet may make the balance

regarding the revenues or sales , expenses aggressively and are also financed sheet long . an alternative presentation is to

and net income of a company over a given aggressively. provide a single amount on the face of the

accounting period. The accounting period To find out if a company, which is balance sheet for PPE for the breakdown of

maybe for a month , a quarter, or a year. The PPE can be presented in the notes to financial

undergoing expansion, will potentially

income reported by a company is not that statements .

encounter liquidity problems in the future, an

useful if the accounting period is not stated . In

analyzing earnings performance , a examination of the third section of the

statement of cash flows has to be made. PROCESS TAKEN IN PREPARING FINANCIAL

comparison with the previous periods and with STATEMENTS

other companies , especially those coming The cash flow from financing activities

provide information whether there is a 1. Analyzing business transactions

from the same industry is a must. Such 2. Recording in the journals

comparison will not be made possible without proper matching of investing and financing

3. Posting to ledger accounts

knowing the accounting periods covered in the activities. An expansion which will take a

4. Preparing the unadjusted trial balance

statement of profit or loss. longer period of time to realize the benefits

5. Making the adjusting entries

In analyzing statement of profit or loss ,it is warrants a more patient source of financing 6. Preparing the adjusted trial balance

important to identify how much of the income such as equity. 7. Preparing the financial statements

comes from core business and how much 8. Making the closing entries

comes from the non core business. Core 9. Post closing trial balance

business refers to the main business of a

company.

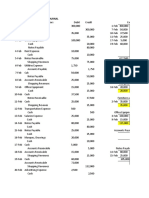

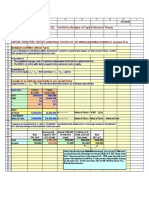

ACTIVITY : what the Energy Regulatory Commission does to companies who offer their products at

Prepare the income statement for 2021` and for power distribution companies and other cheaper prices.

statement of financial position as of December 31, energy companies. The second approach which is to

2021 of XYZ Company. •Financial statement analysis is definitely used bring down production costs may not also be

The following transactions were incurred by XYZ

Company

by management for monitoring performance easy to achieve because this may require

January 2021 and for identifying strategies to further improve investment in technology. It may also require

a. Incorporators invested 12.5 million cash in a newly the company’s operations. identifying cheaper sources of raw materials.

organized corporation., XYZ Company . the par Trying to make the production more efficient

value of the share is 1 FINANCIAL RATIOS can also help.

b. XYZ Company bought land and building for 6 A. PROFITABILITY RATIOS

million cash. The value of the building which has a The following ratios are used to measure the OPERATING PROFIT MARGIN

remaining useful life of 20 years is 4 million. A full profitability of a company Operating profit margin measures the amount

year depreciation for the building can be 1. Return on equity (ROE) of income generated from the core business of

recognized in 2021.

c. XYZ company bought fixtures to be used in the

ROE is a profitability measure that should be a company. It is computed as the difference

operation of the business for 600,000. These are of interest to stock market investors. It between revenues and the sum of cost of

depreciable over 10 years. measures the amount of net income earned in revenues or sales and operating expenses.

d. XYZ company bought office equipment for relation to stockholder’s equity. ROE is The formula for computing profit margin ratio

500,000. These are depreciated over five years. computed as follows: is Operating profit margin = (Operating income

e. XYZ Company bought two transportation vehicle for ROE = NET INCOME/STOCKHOLDER’s EQUITY /sales) x 100%

1.1.million. These are depreciated over five years. 2. Return on assets (ROA )

Transactions for 2021 Return on assets measures the ability of a NET PROFIT MARGIN

a. Bought merchandise worth 18 million , 1.5 million of company to generate income out of its Net profit margin measures how much net

which remained unpaid in December 31, 2021. resources. The formula is

b. Sold merchandise for 20 million . The average cost

profit a company generates for every peso of

ROA = (Operating income /total assets ) x 100% sales or revenues that it generates. The

of the merchandise sold is 75 % of the sales.

Twenty percent of the sales remained uncollected

3. Gross profit margin formula for computing net profit margin is

as of December 31, 2021. The formula for computing gross profit margin Net profit margin = (Net income /Sales) x 100%

c. Paid salaries of employees amounting to 1.25 is Gross profit margin = (Gross profit /sales) x

million . 100% LIQUIDITY RATIOS

d. Total utilities incurred for the year is 280,000. Liquidity ratios measures the ability of a

250,000 of which was paid during the year. Gross profit margin is a profitability ratio company to pay maturing obligations from its

e. Other operating expenses which were paid in cash that measures the ability of the company current assets. Two commonly used liquidity

amounted to 350,000. to cover its cost of goods sold from its ratios are the current ratio and the acid test

f. Tax rate is 30 %. Seventy percent of the tax due for sales .

the year was paid in 2021. The balance was paid in

ratio or sometimes called quick assets ratio.

the first quarter of 2022. If the manager of a company wants to

improve its gross profit margin, two things CURRENT RATIO

can be done: 1. Raise prices 2.Find ways The formula for computing current ratio is

BAFIN MODULE 4: FINANCIAL to bring down production costs. Current ratio = Current assets / current liabilities

STATEMENT ANALYSIS For trading or merchandising

•There are different users of financial companies, find a supplier which can sell ACID TEST OR QUICK ASSET RATIO

statements. Financial statement analysis can finished goods to the company at low prices. The formula is Quick asset ratio = (Cash t

be used by managers, equity investors, Both approaches are not easy to do . current accounts receivable t short term

creditors, regulators, labor unions , Raising prices is possible if your company is marketable securities) / current liabilities

employees, the public and potential investors the only seller or provider of this product in the The quick asset ratio is a stricter measure of a

and creditors. Financial statement analysis is area. If there are may sellers, however raising company’s liquidity position. Common to both

used for investment and credit decisions. It is prices can make your products appear current ratio and the quick asset ratio is the

also used for regulating companies such as relatively more expensive and buyers may go accounts receivable. The real test of a

company’s ability to meet its maturing

obligations largely depends on the quality of 3. INTEREST COVERAGE RATIO with highly perishable products and those that

its receivables. Even if a company has a high Interest coverage ratio provides information if are prone to technological obsolescence must

quick asset ratio, a company is not assured a company has enough operating income to pay close attention to this ratio to minimize

that no liquidity problems will arise if the cover interest expense. The formula is losses. The formula is Inventory turnover

collection of accounts receivable takes too Interest coverage ratio = Earnings before ratio = Cost of sales /inventories

long. interest and taxes / Interest expense

4. ACCOUNTS PAYABLE TURNOVER

LEVERAGE RATIOS EFFICIENCY RATIOS OR TURNOVER RATIOS RATIO

Leverage ratios shows the capital structure of Efficiency ratios . otherwise known as turnover The accounts payable turnover ratio provides

a company, that is how much of the total ratios are called as such because they information regarding the rate by which trade

assets of a company is financed by debt and measure the management’s efficiency in payables are paid. Any operating company will

how much is financed by stockholder’s equity. utilizing the assets of the company . The prefer to have a longer payment period for its

Leverage ratios can also be used to measure following are the efficiency ratios : accounts payable but this should be done only

the company’s ability to meet long term Total assets turnover ratio measures the with the concurrence of the supplier.

obligations. company’s ability to generate revenues for The formula is as follows: Accounts payable

A question may be raised as to what every peso of asset invested . It is an indicator turnover ratio = Cost of sales /trade

an appropriate capital structure is, that is a of how productive the company is in utilizing accounts payable

combination of debt and equity for a company. its resources. The formula is Asset turnover

The capital structure of a company is ratio = Sales / Total Assets 5. OPERATING CYCLE AND CASH

influenced by the following factors; CONVERSION CYCLE

Nature of business 1. FIXED ASSET TURNOVER RATIO By adding the average collection period and

Stage of business development If a company is heavily invested in property , days inventories, the operating cycle can be

Macroeconomic conditions plant and equipment or fixed assets, it pays to computed. This operating cycle covers the

Prospects of the industry and expected know how efficient the management of these period from the time the merchandise is

growth rates assets is. This can be applied to companies bought to the time the proceeds from the sale

Bond and stock market conditions which are characterized by high PPE such as are collected. Managers of companies will

Financial flexibility utility companies like telecom companies, prefer to have a short operating cycle as

power generation , distribution companies and compared to long one.

Regulatory environment

water distribution companies. It can also be OPERATING CYCLE = Day’s inventories

Taxes

applied to manufacturing companies. The plus days receivables

Management style formula is Fixed asset turnover ratio = Sales

/PPE

The following are the leverage ratios:

1. DEBT RATIO 2. ACCOUNTS RECEIVABLE TURNOVER

Debt ratio measures how much of the total RATIO

assets are financed by liabilities. The formula Accounts receivable turnover ratio measures

is DEBT RATIO = Total liabilities/ Total the efficiency by which accounts receivable

assets are managed. A high accounts receivable

turnover ratio means efficient management of

2. DEBT TO EQUITY RATIO receivables. Accounts receivable turnover

Debt to equity ratio is a variation of the debt ratio = Sales / Accounts receivable

ratio. A debt to equity ratio of more than one

means that a company has more liabilities as 3. INVENTORY TURNOVER RATIO

compared to stockholder’s equity. The formula Inventory turnover ratio measures the

is Debt to equity ratio = Total liabilities company’s efficiency in managing its

/total stockholder’s equity inventories. Trading and manufacturing

companies and companies that are dealing

You might also like

- Solution Manual For Managerial Economics 6th Edition Paul KeatDocument3 pagesSolution Manual For Managerial Economics 6th Edition Paul Keatalifertekin45% (11)

- Fundamentals of Corporate Finance Canadian 5th Edition Brealey Solutions ManualDocument11 pagesFundamentals of Corporate Finance Canadian 5th Edition Brealey Solutions ManualEricBergermfcrd100% (16)

- UNIT-IV-Financing of ProjectsDocument13 pagesUNIT-IV-Financing of ProjectsDivya ChilakapatiNo ratings yet

- Business Risk Factors: Evaluation and Guidelines for EntrepreneursFrom EverandBusiness Risk Factors: Evaluation and Guidelines for EntrepreneursNo ratings yet

- Modigliani & Miller Capital Structure TheoryDocument2 pagesModigliani & Miller Capital Structure TheoryJoao Mariares de VasconcelosNo ratings yet

- The Handbook of Financing GrowthDocument6 pagesThe Handbook of Financing GrowthJeahMaureenDominguezNo ratings yet

- Agency Theory AssignmentDocument6 pagesAgency Theory AssignmentProcurement PractitionersNo ratings yet

- FM59 New GuideDocument190 pagesFM59 New GuideDr. Naeem MustafaNo ratings yet

- Corporate Finance Self-Learning ManualDocument219 pagesCorporate Finance Self-Learning ManualMohit AroraNo ratings yet

- Corp Fin Test 2 PDFDocument9 pagesCorp Fin Test 2 PDFT Surya Kandhaswamy100% (2)

- Group 10 - Case 1 - Gainesboro Machine Tools CorporationDocument4 pagesGroup 10 - Case 1 - Gainesboro Machine Tools CorporationYubaraj AdhikariNo ratings yet

- Ltcma Full ReportDocument136 pagesLtcma Full ReportGUILHERME ORSATTO DE AZEVEDONo ratings yet

- Chapter 2 - AnswerDocument4 pagesChapter 2 - Answerwynellamae80% (5)

- Assignment 2 LuceroDocument3 pagesAssignment 2 LuceroJessa100% (1)

- Financial ManagementDocument393 pagesFinancial ManagementSM Friend100% (1)

- A Study On Capital Structure in Sri Pathi Paper and Boards Pvt. LTD., SivakasiDocument69 pagesA Study On Capital Structure in Sri Pathi Paper and Boards Pvt. LTD., SivakasiGold Gold50% (4)

- Strategic Financial ManagementDocument213 pagesStrategic Financial ManagementShubha Subramanian100% (5)

- Praktiswan Complete WorksheetDocument12 pagesPraktiswan Complete WorksheetMiranda, Aliana Jasmine M.No ratings yet

- Sources and Uses of Short-Term and Long-Term FundsDocument7 pagesSources and Uses of Short-Term and Long-Term FundsSyrill Cayetano0% (1)

- Financial Management: Business FinanceDocument7 pagesFinancial Management: Business Financeazileinra OhNo ratings yet

- Solutions To Chapter 1 The Firm and The Financial ManagerDocument10 pagesSolutions To Chapter 1 The Firm and The Financial Managermehvinessp_811845301No ratings yet

- Solutions To Chapter 1 The Firm and The Financial ManagerDocument10 pagesSolutions To Chapter 1 The Firm and The Financial Managermehvinessp_811845301No ratings yet

- Chapter 1 - Intro To FMDocument62 pagesChapter 1 - Intro To FMJessa RosalesNo ratings yet

- Solved Past Papers AS LevelDocument20 pagesSolved Past Papers AS LevelUzair siddiquiNo ratings yet

- Role of A Financial ManagerDocument15 pagesRole of A Financial ManagerAadi Jain -No ratings yet

- Admi 4005 Lectura Finanzas PDFDocument20 pagesAdmi 4005 Lectura Finanzas PDFLORRAINE A ECHEVARRIA-VERANo ratings yet

- Financial Management Guide: Investment, Financing and Dividend DecisionsDocument34 pagesFinancial Management Guide: Investment, Financing and Dividend DecisionsLatha VarugheseNo ratings yet

- Downloadable Solution Manual For Managerial Economics 6th Edition Paul Keat Ch02 Keat6e 1Document3 pagesDownloadable Solution Manual For Managerial Economics 6th Edition Paul Keat Ch02 Keat6e 1Ana Krann0% (1)

- Assignment: Strategic Financial ManagementDocument7 pagesAssignment: Strategic Financial ManagementVinod BhaskarNo ratings yet

- Business Finance Module 1Document7 pagesBusiness Finance Module 1John Calvin GerolaoNo ratings yet

- Financial ManagmentDocument34 pagesFinancial ManagmentDarsh AroraNo ratings yet

- Wealth MaximizationDocument6 pagesWealth MaximizationPeter KinyanjuiNo ratings yet

- Financial MGMT - Fin 1aDocument8 pagesFinancial MGMT - Fin 1arossNo ratings yet

- Manajemen Keuangan Lanjutan - Tugas Minggu 1Document7 pagesManajemen Keuangan Lanjutan - Tugas Minggu 1NadiaNo ratings yet

- Answers To Questions Chapter 1Document5 pagesAnswers To Questions Chapter 1samah.fathi3No ratings yet

- Factors Determining Optimal Capital StructureDocument8 pagesFactors Determining Optimal Capital StructureArindam Mitra100% (8)

- Optimal Capital Structure Decisions for Maximizing Firm ValueDocument29 pagesOptimal Capital Structure Decisions for Maximizing Firm ValuesaravmbaNo ratings yet

- Case1 Mama BearDocument9 pagesCase1 Mama BearAngelo FerrerNo ratings yet

- Agency TheoryDocument17 pagesAgency TheoryLegend GameNo ratings yet

- Business Finance NotesDocument42 pagesBusiness Finance Noteskaiephrahim663No ratings yet

- Brealey 6CE Solutions To Chapter 1Document12 pagesBrealey 6CE Solutions To Chapter 1Mtl AndyNo ratings yet

- The Battle For Endesa - Case AnalysisDocument3 pagesThe Battle For Endesa - Case Analysislorren4jeanNo ratings yet

- Maximizing Wealth & Functions of Finance AssignmentDocument6 pagesMaximizing Wealth & Functions of Finance AssignmentAjay BakshiNo ratings yet

- Group Report Financial ManagementDocument21 pagesGroup Report Financial ManagementNur Nabilah NoranizamNo ratings yet

- FM Mod 4Document12 pagesFM Mod 4Supriya CSNo ratings yet

- Chapter 1 An Overview of FinanceDocument6 pagesChapter 1 An Overview of FinanceSyrill CayetanoNo ratings yet

- MB0029: Financial Management: (Assignment - SET1 & SET2)Document15 pagesMB0029: Financial Management: (Assignment - SET1 & SET2)syed_akmalNo ratings yet

- Bbmf2093 Corporate FinanceDocument9 pagesBbmf2093 Corporate FinanceXUE WEI KONGNo ratings yet

- FM - Introduction To FMDocument23 pagesFM - Introduction To FMSHANMUGHA SHETTY S SNo ratings yet

- Assignment 1 MBA G3 MPCF7113 Question 5mar 2023 - 1Document16 pagesAssignment 1 MBA G3 MPCF7113 Question 5mar 2023 - 1Nabila Abu BakarNo ratings yet

- BBMF 2013 Tutorial 1Document5 pagesBBMF 2013 Tutorial 1BPLim94No ratings yet

- Ge Entrep Activity 2 (Sayre)Document4 pagesGe Entrep Activity 2 (Sayre)Cyrell Malmis SayreNo ratings yet

- Business FinanceDocument91 pagesBusiness FinanceIStienei B. EdNo ratings yet

- Topic OneDocument15 pagesTopic OnechelseaNo ratings yet

- According To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions ThatDocument26 pagesAccording To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions Thataneesh arvindhanNo ratings yet

- Question 4 AssignmentDocument2 pagesQuestion 4 Assignmentnurin afiqah muhammadNo ratings yet

- The Other Questions 22052023Document33 pagesThe Other Questions 22052023Anjanee PersadNo ratings yet

- DIVESTURESDocument2 pagesDIVESTURESAngela DucusinNo ratings yet

- Anderson On Executive Pay - Why Investors Are Right and Wrong - ICGN 2009 Yearbook (Oct 2009)Document4 pagesAnderson On Executive Pay - Why Investors Are Right and Wrong - ICGN 2009 Yearbook (Oct 2009)David W. AndersonNo ratings yet

- MB0029 - P.Srinath - Completely SolvedDocument18 pagesMB0029 - P.Srinath - Completely SolvedSrinathNo ratings yet

- M.C. Jensen FA AssignmentDocument8 pagesM.C. Jensen FA AssignmentHarsh MaheshwariNo ratings yet

- Terricina Jackson Fundamentals of FinancialManagementAug31st2009Document6 pagesTerricina Jackson Fundamentals of FinancialManagementAug31st2009terraj1979No ratings yet

- Aliana Miranda - Sample Problem ACCTGDocument3 pagesAliana Miranda - Sample Problem ACCTGMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda Activity Cavite MutinyDocument5 pagesAliana Miranda Activity Cavite MutinyMiranda, Aliana Jasmine M.No ratings yet

- What Did You Discover About Your Whole Self After Taking The Course Understanding The Self?Document2 pagesWhat Did You Discover About Your Whole Self After Taking The Course Understanding The Self?Miranda, Aliana Jasmine M.No ratings yet

- Antonio Pigafetta's First Voyage Around The World: A TravelogueDocument2 pagesAntonio Pigafetta's First Voyage Around The World: A TravelogueMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda - Easy Inc. Final ExaminationDocument7 pagesAliana Miranda - Easy Inc. Final ExaminationMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda Activity Cavite MutinyDocument5 pagesAliana Miranda Activity Cavite MutinyMiranda, Aliana Jasmine M.No ratings yet

- Answer SheetDocument4 pagesAnswer SheetMiranda, Aliana Jasmine M.No ratings yet

- Answer SheetDocument4 pagesAnswer SheetMiranda, Aliana Jasmine M.No ratings yet

- (Contempo) References (PhotoEssay)Document2 pages(Contempo) References (PhotoEssay)Miranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda - Sample Problem ACCTGDocument3 pagesAliana Miranda - Sample Problem ACCTGMiranda, Aliana Jasmine M.No ratings yet

- (Contempo) GROUP 9 (PhotoEssay)Document3 pages(Contempo) GROUP 9 (PhotoEssay)Miranda, Aliana Jasmine M.No ratings yet

- Don Honorio Ventura State University: Generation Z As VUCA (And How They Define GlobalizationDocument1 pageDon Honorio Ventura State University: Generation Z As VUCA (And How They Define GlobalizationMiranda, Aliana Jasmine M.No ratings yet

- (ACCTG) Classifying&Recording TransactionsDocument3 pages(ACCTG) Classifying&Recording TransactionsMiranda, Aliana Jasmine M.No ratings yet

- Books of Accounts and Double-Entry System: Problem 7: Multiple ChoiceDocument5 pagesBooks of Accounts and Double-Entry System: Problem 7: Multiple ChoiceMiranda, Aliana Jasmine M.No ratings yet

- Books of Accounts and Double-Entry System: Problem 7: Multiple ChoiceDocument5 pagesBooks of Accounts and Double-Entry System: Problem 7: Multiple ChoiceMiranda, Aliana Jasmine M.No ratings yet

- (ACCTG) Classifying&Recording TransactionsDocument3 pages(ACCTG) Classifying&Recording TransactionsMiranda, Aliana Jasmine M.No ratings yet

- Books of Accounts and Double-Entry System: Problem 7: Multiple ChoiceDocument5 pagesBooks of Accounts and Double-Entry System: Problem 7: Multiple ChoiceMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda - Quiz 2 - The Economics of Effective ManagementDocument3 pagesAliana Miranda - Quiz 2 - The Economics of Effective ManagementMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda - Quiz 2 - The Economics of Effective ManagementDocument3 pagesAliana Miranda - Quiz 2 - The Economics of Effective ManagementMiranda, Aliana Jasmine M.No ratings yet

- (ACCTG) Classifying&Recording TransactionsDocument3 pages(ACCTG) Classifying&Recording TransactionsMiranda, Aliana Jasmine M.No ratings yet

- BBA2030493Document14 pagesBBA2030493Saad AhmedNo ratings yet

- Cost of CapitalDocument68 pagesCost of CapitalJohn Ervin TalagaNo ratings yet

- Entrepreneurship Development Chapter 1: Qualities of Entrepreneurs and Their Role in the EconomyDocument84 pagesEntrepreneurship Development Chapter 1: Qualities of Entrepreneurs and Their Role in the EconomyDeepthi Gowda100% (3)

- UT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)Document5 pagesUT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)UT Dallas Provost's Technology GroupNo ratings yet

- Theories of Capital Structure 1. Net Income ApproachDocument33 pagesTheories of Capital Structure 1. Net Income ApproachAhmad NaseerNo ratings yet

- Corporate Social Responsibility and Cost of Equity Capital The Moderating Role of Capital StructureDocument8 pagesCorporate Social Responsibility and Cost of Equity Capital The Moderating Role of Capital StructureInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 1227-Article Text-1721-1-10-20210720Document10 pages1227-Article Text-1721-1-10-20210720vera maulithaNo ratings yet

- Capital Structure of Tata MotorsDocument7 pagesCapital Structure of Tata Motorssaurabhrawal10033% (3)

- Indian Rayon's Supply Chain ManagementDocument86 pagesIndian Rayon's Supply Chain ManagementNikunj GevariyaNo ratings yet

- Fnce 726 - Advanced Corporate Finance: FALL 2013Document12 pagesFnce 726 - Advanced Corporate Finance: FALL 2013kathiepengNo ratings yet

- Company Structure. Q1) A Company S Balance Sheet Shows The Following Capital StructureDocument6 pagesCompany Structure. Q1) A Company S Balance Sheet Shows The Following Capital StructureDullah AllyNo ratings yet

- Jurnal Artikel Wan Nurul Fatin Annisa - NoDocument10 pagesJurnal Artikel Wan Nurul Fatin Annisa - NoShikamaru NaraNo ratings yet

- B Com Hons Sem 2 EditedDocument22 pagesB Com Hons Sem 2 EditedShikha GoyalNo ratings yet

- F9) QuestionsDocument15 pagesF9) Questionspavishne0% (1)

- Articile Write UpDocument7 pagesArticile Write UpKeehara ParkNo ratings yet

- FM Assignment AnanduDocument23 pagesFM Assignment AnanduAmrutha P RNo ratings yet

- Traditional ApproachDocument10 pagesTraditional ApproachRevati Shinde100% (1)

- S7 Capital Structure Online VersionDocument34 pagesS7 Capital Structure Online Versionconstruction omanNo ratings yet

- Al Afif Mursalin (C1B018133) Kelas D (MKU2)Document101 pagesAl Afif Mursalin (C1B018133) Kelas D (MKU2)Algeus FelomeNo ratings yet

- Capital Structure Theory: MM Models Analyze Effects of LeverageDocument11 pagesCapital Structure Theory: MM Models Analyze Effects of LeverageJITIN ARORANo ratings yet

- Answers To Problem Sets: Does Debt Policy Matter?Document14 pagesAnswers To Problem Sets: Does Debt Policy Matter?mandy YiuNo ratings yet

- CH 7 Cost of CapitalDocument59 pagesCH 7 Cost of CapitalAsmi SinglaNo ratings yet

- Cost of Capital QuestionsDocument18 pagesCost of Capital QuestionsRonmaty VixNo ratings yet

- MAF603 COC - StudentsDocument12 pagesMAF603 COC - StudentsZoe McKenzieNo ratings yet