Professional Documents

Culture Documents

(ACCTG) Classifying&Recording Transactions

Uploaded by

Miranda, Aliana Jasmine M.0 ratings0% found this document useful (0 votes)

71 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

71 views3 pages(ACCTG) Classifying&Recording Transactions

Uploaded by

Miranda, Aliana Jasmine M.Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

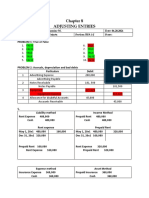

Classifying and Recording Transactions

For the given transactions below, indicate whether it is a Source of Asset (SA), Use of Asset (UA),

Exchange of Asset (EA) or Exchange of Claims (EC). On the succeeding columns, indicate the effects of

the transactions to the Assets, Liabilities and Equity by putting (+) if it will increase or (-) if it will

decrease. If the transaction doesn’t need to be recorded, simply write “N/E” for every column.

Transactions A L Eq ToT Debit Credit

The owner, Mr. Sicat received N/E N/E

P1.5M from his employer when

he retired from his job.

Mr. Sicat invested half of his + + Cash Sicat,

retirement pay into his own

Capital

business named Sicat Cleaning

Services.

Mr. Sicat also invested his + + Building Sicat,

building to be used for his

Capital

business

Acquired Computer Equipment + + Computer Account

worth P50, 000 on account.

Equipment Payable

Purchased Furniture and + + Furniture and Account

Fixtures amounting to P25,000 Fixtures

Payable

on credit

Loaned a Delivery Vehicle from + + Delivery Vehicle Accounts Payable

PS Bank worth P500, 000

payable every end of the year.

Issued a promissory note for + + Office Supplies Notes Payable

the purchase of office supplies

worth P7, 500.

Bought a desktop computer for + + Desktop Notes Payable

P40, 000; paid 50% down and Computer

issued a promissory note for

N/E N/E

the balance due in 60 days.

Acquired a personal copier for Equipment Accounts Payable

P39, 500 on credit; paid P9, 500 + +

Cash

cash, balance in due in 30 days.

Bought office furniture for P50, + Furniture Cash

000 in cash. +

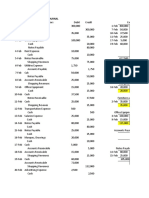

Interviewed and hired the N/E N/E

office staff that he needs in

running his business

Rendered services and received + + Cash Service Revenue

P12, 0000 cash.

Performed services and + + Notes Service Revenue

received a note from his client Receivable

amounting to P15, 000.

Performed services for P27, + + Accounts Service Revenue

750 on credit. Receivable

Services worth P10, 000 was + + Account Service Revenue

earned on account by cleaning receivable

OYG Bldg. in the CSF.

Received P7, 000 from the + + Cash Notes Receivable

client who issued the

promissory note.

Bought additional office chairs + + Furniture Account Payable

for P8, 000 on credit

Issued a check for P32, 500 to + + Salaries Payable Cash

pay for salaries.

Performed services for P10, + + Cash Service Revenue

250 cash

Performed services for P11, + + Accounts Service Revenue

500 on credit. Receivable

Collected P6, 000 on accounts + + Cash Accounts

receivable. Receivable

Issued a check for P4, 000 in + + Utilities Payable Cash

partial payment of the amount

owed for office computer

equipment.

Received the Electric bill + + Notes Utilities Payable

amounting to P2, 250 to be Receivable

paid next month.

Billed by TFX Advertising N/E N/E

Company for the advertisement

of Sicat Cleaning Services

Paid P2, 500 for the repair of N/E N/E

his personal car usually used by

his son.

Mr Sicat withdrew P50, 000 in + + Cash Sicat, Capital

cash from the business for

personal use.

Collected P10, 000 from his + + Cash Accounts Receivable

previously billed clients.

You might also like

- Crush It With Iron Condors 1Document61 pagesCrush It With Iron Condors 1danNo ratings yet

- NPO Financial Policies TemplateDocument13 pagesNPO Financial Policies TemplateNyril Tamayo0% (1)

- Alano V Planter's Development BankDocument1 pageAlano V Planter's Development BankKC NicolasNo ratings yet

- Chapter 2 Basic Financial StatementsDocument34 pagesChapter 2 Basic Financial StatementsZemene HailuNo ratings yet

- Fabm 1 Reviewer Q1Document8 pagesFabm 1 Reviewer Q1raydel dimaanoNo ratings yet

- Memorandum On Carnapping by Shai Clemino-AbeloDocument9 pagesMemorandum On Carnapping by Shai Clemino-AbeloShyrell Clemino100% (3)

- Praktiswan Complete WorksheetDocument12 pagesPraktiswan Complete WorksheetMiranda, Aliana Jasmine M.No ratings yet

- IAS 7 Statement of Cash Flow QuizDocument5 pagesIAS 7 Statement of Cash Flow QuizRocel Vasaya PacresNo ratings yet

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- DILG Resources 2011216 85e96b8954Document402 pagesDILG Resources 2011216 85e96b8954jennifertong82No ratings yet

- Statement of Purpose - University of HohenheimDocument1 pageStatement of Purpose - University of HohenheimZUBAIRNo ratings yet

- Management Science - HomeworkDocument15 pagesManagement Science - HomeworkVinaNo ratings yet

- Cbmec 1 New Module 1Document22 pagesCbmec 1 New Module 1Calabia, Angelica MerelosNo ratings yet

- Morales Vin Allen A. BSE-1A Activity#1Document4 pagesMorales Vin Allen A. BSE-1A Activity#1Renz MoralesNo ratings yet

- CHAPTER 2 Pama Carullo RondinaDocument17 pagesCHAPTER 2 Pama Carullo RondinaRaffy Rodriguez100% (2)

- A. Journal Entries Accounts Debit CreditDocument3 pagesA. Journal Entries Accounts Debit CreditAnne AlagNo ratings yet

- POWS02 - CelyKalaw (VCM, 2021, p58) Soln 1Document30 pagesPOWS02 - CelyKalaw (VCM, 2021, p58) Soln 1Phaelyn YambaoNo ratings yet

- Module 5 - Adjusting AccountsDocument16 pagesModule 5 - Adjusting AccountsMJ San PedroNo ratings yet

- EXERCISE/ ACTIVITIES 1.1 - Yung Dora Catan: Transactions Debit Credit A B C D e F G H I JDocument8 pagesEXERCISE/ ACTIVITIES 1.1 - Yung Dora Catan: Transactions Debit Credit A B C D e F G H I JCharrie Faye Magbitang HernandezNo ratings yet

- Activity 7 Motivation-GomezDocument12 pagesActivity 7 Motivation-GomezANGELICA FRANSCINE GOMEZ100% (1)

- ACCOUNTING IDENTITY-means That TheDocument23 pagesACCOUNTING IDENTITY-means That TheHel LoNo ratings yet

- Unadjusted Trial BalanceDocument4 pagesUnadjusted Trial BalanceJemma Rose BagalacsaNo ratings yet

- Well" - A New Way of Saying - "Do Well by Doing Good."Document3 pagesWell" - A New Way of Saying - "Do Well by Doing Good."Rinna Lynn FraniNo ratings yet

- EXERCISES 1-Introduction To AccountingDocument4 pagesEXERCISES 1-Introduction To AccountingAnna Jeramos100% (1)

- Accounting 1Document16 pagesAccounting 1Rommel Angelo AgacitaNo ratings yet

- Managerial Economics ReviewerDocument26 pagesManagerial Economics ReviewerAlyssa Faith NiangarNo ratings yet

- Trucking and StorageDocument2 pagesTrucking and StorageMichael San Luis100% (1)

- Exercise 4Document17 pagesExercise 4LoyalNamanAko LLNo ratings yet

- MultimodalityDocument19 pagesMultimodalityRenan EnggayNo ratings yet

- PT BaDocument18 pagesPT BaJasmine Merthel Masmila ObstaculoNo ratings yet

- Diaz - Journal EntriesDocument4 pagesDiaz - Journal EntriesPangitkaNo ratings yet

- Business Math Q1 M8Document12 pagesBusiness Math Q1 M8Fraeyo Barcoma DanceQ100% (1)

- Special Journal ExercisesDocument1 pageSpecial Journal ExercisesRolly Baroy67% (3)

- FundAcc Exercise WorkbookDocument33 pagesFundAcc Exercise WorkbookJosef SamoranosNo ratings yet

- Statement of Financial Position (SFP)Document11 pagesStatement of Financial Position (SFP)jocenee atupNo ratings yet

- Practice Set 1 (Basic Accounting)Document3 pagesPractice Set 1 (Basic Accounting)Maica LagareNo ratings yet

- 2 CHAPTER Lesson 2 1 AssetsDocument6 pages2 CHAPTER Lesson 2 1 AssetsRegine BaterisnaNo ratings yet

- Exercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotDocument15 pagesExercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotCherry Doong CuantiosoNo ratings yet

- Enclosure 1. Teacher-Made Learner's Home Task (Week 3)Document7 pagesEnclosure 1. Teacher-Made Learner's Home Task (Week 3)Kim FloresNo ratings yet

- Problem 15Document1 pageProblem 15Alyssa Jane G. AlvarezNo ratings yet

- Southwestern Institute of Business and TechnologyDocument2 pagesSouthwestern Institute of Business and TechnologyBeomiNo ratings yet

- Fabm2 Q2 M4 - 4 CsefDocument20 pagesFabm2 Q2 M4 - 4 CsefZeus MalicdemNo ratings yet

- Financial Statements AnalysisDocument35 pagesFinancial Statements AnalysisKiarra Nicel De TorresNo ratings yet

- Chapter 10Document16 pagesChapter 10Charlene LeynesNo ratings yet

- Integrated Accounting Learning Module Attachment (Do Not Copy)Document15 pagesIntegrated Accounting Learning Module Attachment (Do Not Copy)Jasper PelicanoNo ratings yet

- Account Titles and Its ElementsDocument3 pagesAccount Titles and Its ElementsJeb PampliegaNo ratings yet

- Video ReflectionDocument4 pagesVideo ReflectionXuan LimNo ratings yet

- AccountingDocument6 pagesAccountingIshiangreatNo ratings yet

- FABM ActivityDocument3 pagesFABM ActivityRey VillaNo ratings yet

- Fabm Nites PrintDocument3 pagesFabm Nites Printwiz wizNo ratings yet

- S. Roces (Closing)Document11 pagesS. Roces (Closing)Jesseric RomeroNo ratings yet

- Group Activity 1Document10 pagesGroup Activity 1Winshei Cagulada0% (1)

- ACFAR ReviewDocument39 pagesACFAR ReviewYza IgartaNo ratings yet

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Negros Occidental (ACCOUNTING1)Document7 pagesNegros Occidental (ACCOUNTING1)Maxine Ceballos Glodove100% (1)

- Canvas Activity - Journalizing - Oct - 29 PDFDocument2 pagesCanvas Activity - Journalizing - Oct - 29 PDFJian Francisco100% (2)

- Financial Planning Tools and Concepts pt.1: Learning ModuleDocument33 pagesFinancial Planning Tools and Concepts pt.1: Learning Moduledaphne ramosNo ratings yet

- FAR Chapter4 FinalDocument43 pagesFAR Chapter4 FinalPATRICIA COLINANo ratings yet

- Balance Sheet Bella EnterprisesDocument2 pagesBalance Sheet Bella EnterprisesmarivicNo ratings yet

- Accounting 101Document17 pagesAccounting 101Jenne Santiago BabantoNo ratings yet

- Business Finance: Mrs. Leah O. RualesDocument28 pagesBusiness Finance: Mrs. Leah O. RualesCleofe Sobiaco100% (1)

- Week-1-7 CM MDL 3q EthicsDocument20 pagesWeek-1-7 CM MDL 3q EthicsCharls Jose100% (1)

- Medium Term Youth Development Plan 2005-2010 KRJDocument42 pagesMedium Term Youth Development Plan 2005-2010 KRJVhen Payo-osNo ratings yet

- Sol. Man. - Chapter 3 - The Accounting EquationDocument8 pagesSol. Man. - Chapter 3 - The Accounting EquationMae Ann Tomimbang MaglinteNo ratings yet

- Exercises Short ProblemsDocument6 pagesExercises Short ProblemsKlaire SwswswsNo ratings yet

- Preparation of Financial StatementsDocument13 pagesPreparation of Financial StatementsSharina Mhyca SamonteNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015 PDFDocument91 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015 PDFGarp BarrocaNo ratings yet

- Bhulero Merchandise Periodic 11 25Document10 pagesBhulero Merchandise Periodic 11 25Mary Jane PalermoNo ratings yet

- What Did You Discover About Your Whole Self After Taking The Course Understanding The Self?Document2 pagesWhat Did You Discover About Your Whole Self After Taking The Course Understanding The Self?Miranda, Aliana Jasmine M.No ratings yet

- Antonio Pigafetta's First Voyage Around The World: A TravelogueDocument2 pagesAntonio Pigafetta's First Voyage Around The World: A TravelogueMiranda, Aliana Jasmine M.No ratings yet

- Answer SheetDocument4 pagesAnswer SheetMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda - Sample Problem ACCTGDocument3 pagesAliana Miranda - Sample Problem ACCTGMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda Activity Cavite MutinyDocument5 pagesAliana Miranda Activity Cavite MutinyMiranda, Aliana Jasmine M.No ratings yet

- Answer SheetDocument4 pagesAnswer SheetMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda Activity Cavite MutinyDocument5 pagesAliana Miranda Activity Cavite MutinyMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda - Easy Inc. Final ExaminationDocument7 pagesAliana Miranda - Easy Inc. Final ExaminationMiranda, Aliana Jasmine M.No ratings yet

- (Contempo) GROUP 9 (PhotoEssay)Document3 pages(Contempo) GROUP 9 (PhotoEssay)Miranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda - Sample Problem ACCTGDocument3 pagesAliana Miranda - Sample Problem ACCTGMiranda, Aliana Jasmine M.No ratings yet

- (Contempo) References (PhotoEssay)Document2 pages(Contempo) References (PhotoEssay)Miranda, Aliana Jasmine M.No ratings yet

- Don Honorio Ventura State University: Generation Z As VUCA (And How They Define GlobalizationDocument1 pageDon Honorio Ventura State University: Generation Z As VUCA (And How They Define GlobalizationMiranda, Aliana Jasmine M.No ratings yet

- (ACCTG) Classifying&Recording TransactionsDocument3 pages(ACCTG) Classifying&Recording TransactionsMiranda, Aliana Jasmine M.No ratings yet

- Books of Accounts and Double-Entry System: Problem 7: Multiple ChoiceDocument5 pagesBooks of Accounts and Double-Entry System: Problem 7: Multiple ChoiceMiranda, Aliana Jasmine M.No ratings yet

- Books of Accounts and Double-Entry System: Problem 7: Multiple ChoiceDocument5 pagesBooks of Accounts and Double-Entry System: Problem 7: Multiple ChoiceMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda - Quiz 2 - The Economics of Effective ManagementDocument3 pagesAliana Miranda - Quiz 2 - The Economics of Effective ManagementMiranda, Aliana Jasmine M.No ratings yet

- (ACCTG) Classifying&Recording TransactionsDocument3 pages(ACCTG) Classifying&Recording TransactionsMiranda, Aliana Jasmine M.No ratings yet

- Books of Accounts and Double-Entry System: Problem 7: Multiple ChoiceDocument5 pagesBooks of Accounts and Double-Entry System: Problem 7: Multiple ChoiceMiranda, Aliana Jasmine M.No ratings yet

- Aliana Miranda - Quiz 2 - The Economics of Effective ManagementDocument3 pagesAliana Miranda - Quiz 2 - The Economics of Effective ManagementMiranda, Aliana Jasmine M.No ratings yet

- Quiz On Partnership Operations - Final Term Period (1) (Repaired)Document3 pagesQuiz On Partnership Operations - Final Term Period (1) (Repaired)Ceejay MancillaNo ratings yet

- M 02Document27 pagesM 02Praneil DahyaNo ratings yet

- PAY+SLIP+LATESTDocument2 pagesPAY+SLIP+LATESTAhmed AnsariNo ratings yet

- EU DirectivesDocument67 pagesEU DirectivesNazneen SabinaNo ratings yet

- Rural BankingDocument3 pagesRural BankingRanjeet SinghNo ratings yet

- Managerial Accounting Exam 2 With SolutionsDocument13 pagesManagerial Accounting Exam 2 With Solutionskwathom1No ratings yet

- Chain Restaurant QuestionnaireDocument15 pagesChain Restaurant QuestionnairemirwaseemNo ratings yet

- Chapter 2 - Budgeting and Finance SolutionsDocument5 pagesChapter 2 - Budgeting and Finance SolutionsSuhasini PadmanabanNo ratings yet

- 04 - Chapter 2Document33 pages04 - Chapter 2baby0310No ratings yet

- Detailed StatementDocument5 pagesDetailed StatementSantosh Kumar GuptaNo ratings yet

- Econ 100.1 - Problem Set 2 - Answer KeyDocument4 pagesEcon 100.1 - Problem Set 2 - Answer KeyjevieNo ratings yet

- Business Combination AssignmentDocument4 pagesBusiness Combination AssignmentRica Joy RuzgalNo ratings yet

- Sample Work PlanDocument5 pagesSample Work PlanVJ GeoNo ratings yet

- The Power Tends To Corrupt, Absolute Powers Corrupts AbsolutelyDocument3 pagesThe Power Tends To Corrupt, Absolute Powers Corrupts AbsolutelySuci SabillyNo ratings yet

- Fiscal Aspects of Aviation Management: Robert W.KapsDocument5 pagesFiscal Aspects of Aviation Management: Robert W.KapsAbcdefNo ratings yet

- Mridul Tiwari - Mridul Tiwari - PGPGM03 - 13 - IE - FMDocument4 pagesMridul Tiwari - Mridul Tiwari - PGPGM03 - 13 - IE - FMekta agarwalNo ratings yet

- Corporate Governance: The International Journal of Business in SocietyDocument15 pagesCorporate Governance: The International Journal of Business in Societyfahad khakanNo ratings yet

- Performance EvaluationDocument5 pagesPerformance Evaluationrinto OdegawaNo ratings yet

- Exercise 8 - 1: Tugas Analisis Laporan Keuangan (Alk) Chapter 8 Dosen Pengampu: Dr. Aprilia Beta Suandi, SE., M. SCDocument3 pagesExercise 8 - 1: Tugas Analisis Laporan Keuangan (Alk) Chapter 8 Dosen Pengampu: Dr. Aprilia Beta Suandi, SE., M. SCArdilla Noor Paramashanti Wirahadikusuma100% (5)

- 1.FIN508 Global Trends and Developments in International BankingDocument183 pages1.FIN508 Global Trends and Developments in International BankingDhawal RajNo ratings yet

- IM Academy WelcomeDocument1 pageIM Academy Welcomepaola perezNo ratings yet

- Orgniziation Study of Sri Sai Rice Mill Bba Project ReportDocument71 pagesOrgniziation Study of Sri Sai Rice Mill Bba Project ReportBabasab Patil (Karrisatte)100% (3)