Professional Documents

Culture Documents

Seminar Solutions Consolidations 3 Question 2

Uploaded by

张紫翠Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Seminar Solutions Consolidations 3 Question 2

Uploaded by

张紫翠Copyright:

Available Formats

Question 2 Helter and Skelter

On 1st October 20X2 Helter plc acquired 140,000 of the 200,000 £1 ordinary shares in Skelter ltd, paying £4

per share in cash. On 1st October 20X2 the reserves of Skelter Ltd were £390,000.

Helter plc Skelter Ltd

£'000 £'000

Revenue 980 590

Cost of sales (660) (395)

Gross profit 320 195

Other income - investment income 25

Operating expenses (118) (92)

Profit before tax 227 103

Taxation (70) (25)

Profit after tax 157 78

Statement of Changes in Equity - Extract

Retained Retained

earnings earnings

£'000 £'000

Profit after tax 157 78

Dividends paid (48) (20)

Retained profit for the year 109 58

Retained profit brought forward 508 475

Retained profit carried forward 617 533

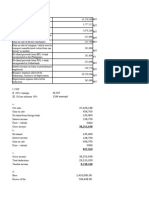

ANSWER Helter Skelter Ltd Total Cancel Helter plc

Parent % Sub Consol

£'000 £'000 £'000 £'000 £'000

Revenue 980 590 1570 -360 1210 1.0 Working 1

Cost of sales -660 -395 -1055 315 -740 1.5 Working 1

Gross profit 320 195 515 -45 470

Other income - investment income 25 25 -14 11 1.0 Working 2

Sellind and Distribution expenses -78 -70 -148 -148 0.5

Administrative expenses -40 -22 -62 -27 -89 1.0

Profit before tax 227 103 330 -86 244

Taxation -70 -25 -95 -95 0.5

Profit after tax 157 78 235 -86 149

Attributable to Non-Controlling Interests -9.9 Working 3

Attributable to equity holders of the group 139.1 1.0

Helter plc - Statement of Changes in Equity - Extract Retained

earnings

Profit attributable to ordinary shareholders 139.1

Dividends paid - Parent company only -48 1.0

Retained profit for the year 91.1

Retained profit brought forward 567.5 Working 4

Retained profit carried forward 658.6

Working 1

Eliminate intercompany sales £360,000

The goods were invoiced at cost plus 1/3.

Half of these goods remained in stock of Helter PLC at the year-end.

profit on stock £'000

360,000 x 1/4 = 90

unrealised 1/2 45

Working 2 Dividends received by H from S

£'000 % £'000

Ordinary 20 70% 14

14

Working 3 Non-controlling interest £'000 £'000

Profit after tax of Skelter Ltd 78

Less unrealised profit 45

Profits attributable to minority 33 30% 9.9 2.0

Working 4 Retained profit brought forward £'000

Parent Company H plc 508

Share of S Ltd's post-acquistion reserves

(475,000-390,000) x 70% 59.5

567.5 2.0

11.5

Part b) Goodwill

Consideration (140,000 x4) 560

NCI at acqn (30%*590) 177

737

Assets acquired

Share capital 200

Revenue Reserve 390

590

147

Less impairment -27

120 3.5

Discussion 5.5

Positive goodwill should be recognised as an asset in the consolidated Statement of Financial Position

and should be reviewed annually for impairment.

If the calculation of goodwill gives a negative balance The view of the IASB is that where an acquisition

appears to create negative goodwill, a careful check of the assets acquired and whether any liabilities have been omitted

is required. Any remaining negative goodwill after this reassessment should be recognised immediately in the income

statement and increase the group’s reserves.

Part c

Goodwill would increase because the NCI at acqn would be valued at fair value instead of the NCI's share of

net assets of the subsidiary.

Assuming that the fair value of the NCI holding is £4 per share, then the NCI at acquisition would be

£4*60,000 shares = £240,000

Goodwill on the fair value basis would become

Consideration (140,000 x4) 560

NCI at acqn (60,000*£4) 240

800

Assets acquired

Share capital 200

Revenue Reserve 390

590

210

Less impairment -27

183

Increasing goodwill by £63,000

You might also like

- Akuntansi Tugas 4Document2 pagesAkuntansi Tugas 4Biyan ArdanaNo ratings yet

- CR Inter QuestionsDocument22 pagesCR Inter QuestionsRichie BoomaNo ratings yet

- Larsen & Toubro Infotech Ltd Income Statement AnalysisDocument140 pagesLarsen & Toubro Infotech Ltd Income Statement AnalysisNishant SharmaNo ratings yet

- Income Statements For The Year Ended 30 JuneDocument3 pagesIncome Statements For The Year Ended 30 JuneMercy AnaneNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- Playtime Excel PeruDocument4 pagesPlaytime Excel PeruPatrick Rock RamirezNo ratings yet

- Engineering Management 3000/5039: Tutorial Set 5Document5 pagesEngineering Management 3000/5039: Tutorial Set 5SahanNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- 2021 Seminar Paper Marking SchemeDocument12 pages2021 Seminar Paper Marking Schemesayuru423geenethNo ratings yet

- f3 AssignmentDocument6 pagesf3 Assignmentnoumanchaudhary902No ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Assignment 7 SolutionsDocument10 pagesAssignment 7 SolutionsjoanNo ratings yet

- Question 2 (30 Marks) : Sales 8000 Cost of Sales (6000)Document4 pagesQuestion 2 (30 Marks) : Sales 8000 Cost of Sales (6000)Chitradevi RamooNo ratings yet

- Rit Rit Rit Rit Rit Rit FT Rit Rit Rit RitDocument4 pagesRit Rit Rit Rit Rit Rit FT Rit Rit Rit RitCJAY SOTELONo ratings yet

- CORPORATE REPORTING Icag PDFDocument31 pagesCORPORATE REPORTING Icag PDFmohedNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- PNX Income Statement AnalysisDocument12 pagesPNX Income Statement AnalysisDave Emmanuel SadunanNo ratings yet

- Financial Statement ACIFL 31 March 2015 ConsolidatedDocument16 pagesFinancial Statement ACIFL 31 March 2015 ConsolidatedNurhan JaigirdarNo ratings yet

- MMZ ACCOUNTANCY SCHOOL: 15 Mark Questions on Preparing Simple Consolidated Financial StatementsDocument7 pagesMMZ ACCOUNTANCY SCHOOL: 15 Mark Questions on Preparing Simple Consolidated Financial StatementsSerena100% (1)

- Exercises of Session 8Document4 pagesExercises of Session 8tranhlthNo ratings yet

- GROUP QUARTERLY RESULTS SNAPSHOTDocument6 pagesGROUP QUARTERLY RESULTS SNAPSHOTDivya MukherjeeNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Corporate Financial Reporting PDFDocument3 pagesCorporate Financial Reporting PDFIshan SharmaNo ratings yet

- Income Statement PSODocument4 pagesIncome Statement PSOMaaz HanifNo ratings yet

- Tutorial SolutionsDocument31 pagesTutorial SolutionsBukhari HarNo ratings yet

- Alpha + Subs OnlyDocument8 pagesAlpha + Subs OnlyPrabavathi KarunanithiNo ratings yet

- Cognovi Labs FinancialsDocument52 pagesCognovi Labs FinancialsShukran AlakbarovNo ratings yet

- SQA Accounting Assignment 1 02000759Document4 pagesSQA Accounting Assignment 1 02000759SENITH J100% (1)

- Acct 401 Tutorial Set FiveDocument13 pagesAcct 401 Tutorial Set FiveStudy GirlNo ratings yet

- Revenue and earnings analysis of public company from 2005 to 2008Document8 pagesRevenue and earnings analysis of public company from 2005 to 2008Marc StephanickNo ratings yet

- Tutorial 2 AnswerDocument2 pagesTutorial 2 AnswerDiana TuckerNo ratings yet

- Chapter 5 Solution To Problems and CasesDocument22 pagesChapter 5 Solution To Problems and Caseschandel08No ratings yet

- Tesco 2023 Ar Primary Statements Updated 230623Document5 pagesTesco 2023 Ar Primary Statements Updated 230623Ñízãr ÑzrNo ratings yet

- FR Kit 333Document5 pagesFR Kit 333Khin Lapyae TunNo ratings yet

- HI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsDocument24 pagesHI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsFeku RamNo ratings yet

- Tesco PLC LSE TSCO Financials Income StatementDocument6 pagesTesco PLC LSE TSCO Financials Income StatementYA JiaoNo ratings yet

- 06 Excelfiles Student Text Assignments 2010Document4 pages06 Excelfiles Student Text Assignments 2010leuleuNo ratings yet

- Confusion Plcs SolutionsDocument8 pagesConfusion Plcs SolutionsJen Hang WongNo ratings yet

- Acquire AirThread to Expand Wireless InfrastructureDocument31 pagesAcquire AirThread to Expand Wireless InfrastructurenidhidNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Apple financial report 2013-2017Document19 pagesApple financial report 2013-2017Jims Leñar CezarNo ratings yet

- Income Stat 09Document2 pagesIncome Stat 09KashifntcNo ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- Mock Exam FRPM SolutionDocument45 pagesMock Exam FRPM SolutionangelitayosecasetiawanNo ratings yet

- Business Valuation ExercisesDocument12 pagesBusiness Valuation Exercisesanamul haqueNo ratings yet

- Statement of Profit and LossDocument2 pagesStatement of Profit and Lossradhika100% (1)

- Hindustanprofit LossDocument2 pagesHindustanprofit LossPradeep WaghNo ratings yet

- Statement of Profit and LossDocument2 pagesStatement of Profit and LossradhikaNo ratings yet

- MR D.I.Y. Group's Q3 2020 financial reportDocument15 pagesMR D.I.Y. Group's Q3 2020 financial reportMzm Zahir MzmNo ratings yet

- Ceci TEAMWORK HW - Case - New and Repaired FurnaceDocument14 pagesCeci TEAMWORK HW - Case - New and Repaired FurnaceMarcela GzaNo ratings yet

- X82 - Threads LTD v01Document4 pagesX82 - Threads LTD v01Udaya Makineni33% (3)

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- RatiosDocument6 pagesRatiosNicat QuliyevNo ratings yet

- Top Star Polymer (PVT) Ltd. Final ReportDocument2 pagesTop Star Polymer (PVT) Ltd. Final ReportMuhammad Amin Muhammad AminNo ratings yet

- Ifrs Feb 2019 KeyDocument4 pagesIfrs Feb 2019 Keyjad NasserNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Module 5Document22 pagesModule 5AliceJohnNo ratings yet

- Wksheet 05Document18 pagesWksheet 05venkeeeeeNo ratings yet

- 558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaDocument2 pages558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaPankaj GuptaNo ratings yet

- Review of Accounting: Irwin/Mcgraw-HillDocument20 pagesReview of Accounting: Irwin/Mcgraw-HillJefferson EncaladaNo ratings yet

- SFD NotesDocument125 pagesSFD NotesPampana Sainikhitha9997100% (1)

- Free Cash Flow Calculation and Valuation ExampleDocument11 pagesFree Cash Flow Calculation and Valuation ExamplealliahnahNo ratings yet

- EPIC - THE EPIC PATH Book-MinDocument29 pagesEPIC - THE EPIC PATH Book-MinAhmed MohamedNo ratings yet

- Detecting Creative Accounting and Fraud (June 6, 2020 - 9am)Document2 pagesDetecting Creative Accounting and Fraud (June 6, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Basic Concepts in Forest Valuation and Investment Analysis - EditiDocument336 pagesBasic Concepts in Forest Valuation and Investment Analysis - EditiAsfaw GelanNo ratings yet

- SFM Suggested N08-N18 (OLD Syll) PDFDocument420 pagesSFM Suggested N08-N18 (OLD Syll) PDFVANDANA GOYALNo ratings yet

- Issue of SharesDocument3 pagesIssue of SharesPratiksha PatelNo ratings yet

- Balaji TelefilmsDocument23 pagesBalaji TelefilmsShraddha TiwariNo ratings yet

- CFA L1: SCF Analysis and ValuationDocument27 pagesCFA L1: SCF Analysis and ValuationtamannaakterNo ratings yet

- Topic 1 - Understanding Investments & Investment Alternatives (STU) - Đã G PDocument280 pagesTopic 1 - Understanding Investments & Investment Alternatives (STU) - Đã G PThanh XuânNo ratings yet

- Financial Statement AnalysisDocument26 pagesFinancial Statement Analysissagar7No ratings yet

- OZ Funds Real Estate EbookDocument29 pagesOZ Funds Real Estate EbookMark PolitiNo ratings yet

- SJVN Letter of OfferDocument48 pagesSJVN Letter of Offerveenu68No ratings yet

- AB Co. Ltd. Trial Balance StatementDocument10 pagesAB Co. Ltd. Trial Balance StatementMd. Iqbal Hasan0% (1)

- 10 Day Trading Strategies For BeginnersDocument18 pages10 Day Trading Strategies For Beginnersthebrahyz100% (1)

- The Global Financial System Has Seven Basic Economic FunctionsDocument5 pagesThe Global Financial System Has Seven Basic Economic FunctionsArpitaNo ratings yet

- Financial Management (FM) Solution Pack: S. No ACCA Exam Paper Topics CoveredDocument64 pagesFinancial Management (FM) Solution Pack: S. No ACCA Exam Paper Topics CoveredKoketso MogweNo ratings yet

- Scottish English Limited PartnershipsDocument2 pagesScottish English Limited Partnershipsalex_hmspNo ratings yet

- Lesson 05 - Fiscal Policy and StabilizationDocument48 pagesLesson 05 - Fiscal Policy and StabilizationMetoo ChyNo ratings yet

- Unit 5 Topic 1 Intro of Financial AnalysisDocument4 pagesUnit 5 Topic 1 Intro of Financial AnalysisYash goyalNo ratings yet

- Chapter 2Document19 pagesChapter 2Mahi MaheshNo ratings yet

- Team Project 2: Chapter 8: Investment Decision Rules Fundamentals of Capital BudgetingDocument61 pagesTeam Project 2: Chapter 8: Investment Decision Rules Fundamentals of Capital BudgetingБекФорд ЗакNo ratings yet

- A Clever Move by Porsche On VWDocument3 pagesA Clever Move by Porsche On VWBrandon Parra FuentesNo ratings yet

- MFRS 132 Financial InstrumentDocument3 pagesMFRS 132 Financial InstrumentThineswaran David BillaNo ratings yet

- Business Finance 1Document24 pagesBusiness Finance 1Stevo papaNo ratings yet

- IIFL - Capital Goods - Union Budget 2022 - 20220202Document10 pagesIIFL - Capital Goods - Union Budget 2022 - 20220202Bharat NarrativesNo ratings yet