Professional Documents

Culture Documents

Detecting Creative Accounting and Fraud (June 6, 2020 - 9am)

Uploaded by

Via Commerce Sdn BhdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Detecting Creative Accounting and Fraud (June 6, 2020 - 9am)

Uploaded by

Via Commerce Sdn BhdCopyright:

Available Formats

Detecting Creative Accounting

and Fraud

DATE:

June 6, 2020 (Saturday)

5

TIME:

9.00 a.m. to 11.30 a.m.

▪ Explain, as part of fundamental analysis, the importance of

relying on accurate and truthful financial reports.

▪ Examine key creative accounting techniques commonly

perpetrated by reporting entities.

COURSE OBJECTIVES ▪ Identify the red flags for potential financial reporting fraud or

misstatement from external sources, namely the financial

reports, that affects the valuation on intrinsic values.

▪ Conduct analysis on the quantitative and qualitative data to

select relevant data that detects creating accounting.

▪ Prospective investors in equity markets

▪ Financial and research analysts in asset management

TARGET AUDIENCE companies

▪ Financial planning and investment advisory firms

▪ Corporate and bank treasuries

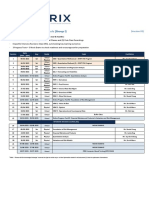

Session 1: Red Flags in Financial Reporting Fraud

▪ Scope of financial reporting misstatement and fraud.

▪ Identifying the major types of financial statement fraud.

▪ Case discussions.

COURSE OUTLINE

Session 2: Contemporary Techniques in Fraud Detection

▪ Common financial reporting fraud detection methods

▪ Application of data science in detecting financial reporting fraud

Trainer Profile

Mr. David Meow

• Chartered Financial Analyst (CFA)

• Master of Laws (University of London)

• Financial Risk Manager (FRM)

• Chartered Accountant (M)

• Master of Business Administration

(Heriot-Watt University)

• Certificate of Data Science

(John Hopkins University)

David Meow is the Managing Director of Via Commerce Sdn. Bhd. The company,

incorporated in 2002 by a group of professionals from various backgrounds in investment

and finance. Via Commerce is involved in training and consultancy in areas including fraud

examination, fraud prevention programmes and forensic accounting.

He has obtained the Certified Fraud Examiner qualification from the Association of Certified

Fraud Examiner. He has obtained the Post-Graduate Diploma in Laws from the University of

London, and has also received a Certificate in Forensic Accounting and Fraud Examination

from the West Virginia University, USA (via Coursera) and A Certificate in The Psychology of

Criminal Justice, offered by UQx, an initiative of The University of Queensland through edX.

He has trained and consulted in 7 countries within the region. He was involved in providing

advisory and training courses for government–related regulatory bodies including Bank

Negara Malaysia (BNM), Permodalan Nasional Berhad (PNB) and Securities Commission,

Jabatan Perdana Menteri (ILKAP), Khazanah Berhad, Employees Provident Fund (EPF),

Central Provident Fund (CPF) of Singapore, financial institutions and corporations.

Besides training and consultancy, he is also involved as a facilitator for the Chartered

Normal

Financial Analysts (CFA) and the Financial Risk Manager (FRM) programmes in Kuala Lumpur,

Singapore, Hong Kong and Vietnam.

Ms Shanny Lim & Mr Jason Chang

013-868 1346 / 017-234 6100

info@viacommerce.com.my

You might also like

- Low-Rank Models in Visual Analysis: Theories, Algorithms, and ApplicationsFrom EverandLow-Rank Models in Visual Analysis: Theories, Algorithms, and ApplicationsNo ratings yet

- The Ultimate Guide To Digital Marketing: Strategies and Tactics for SuccessFrom EverandThe Ultimate Guide To Digital Marketing: Strategies and Tactics for SuccessNo ratings yet

- E&Y Re Imagining Indias Media Sector March 2018Document270 pagesE&Y Re Imagining Indias Media Sector March 2018Siddharth SanapathiNo ratings yet

- Reimagining IndiaDocument4 pagesReimagining IndiaKushal BathijaNo ratings yet

- Journal of Cleaner Production: Huanhuan Feng, Xiang Wang, Yanqing Duan, Jian Zhang, Xiaoshuan ZhangDocument15 pagesJournal of Cleaner Production: Huanhuan Feng, Xiang Wang, Yanqing Duan, Jian Zhang, Xiaoshuan ZhangPham Cong MinhNo ratings yet

- Electron Spin and Its History - Eugene D. ComminsDocument27 pagesElectron Spin and Its History - Eugene D. Comminssanjeevsoni64No ratings yet

- Letter: Real-Time Dynamics of Lattice Gauge Theories With A Few-Qubit Quantum ComputerDocument10 pagesLetter: Real-Time Dynamics of Lattice Gauge Theories With A Few-Qubit Quantum ComputerCristianRiveraNo ratings yet

- Making Sense of The Legendre TransformDocument10 pagesMaking Sense of The Legendre TransformFaisal AmirNo ratings yet

- Fundamental Nature of The Fine-Structure ConstantDocument12 pagesFundamental Nature of The Fine-Structure ConstantMichael A. SherbonNo ratings yet

- Evening Talks With Sri Aurobindo PDFDocument2 pagesEvening Talks With Sri Aurobindo PDFShannonNo ratings yet

- Forensic AccountingDocument6 pagesForensic AccountingAlif Anas RNo ratings yet

- Dmitri Sorokin - Introduction To The Classical Theory of Higher SpinsDocument33 pagesDmitri Sorokin - Introduction To The Classical Theory of Higher SpinsKlim00No ratings yet

- Efficient P-N Junction-Based ThermoelectricDocument9 pagesEfficient P-N Junction-Based ThermoelectricKeshav DabralNo ratings yet

- No One Has To Die Alone by Lani Leary - CH 1Document26 pagesNo One Has To Die Alone by Lani Leary - CH 1Beyond Words Publishing100% (1)

- Quantum Gravity LecturesDocument222 pagesQuantum Gravity Lecturessidhartha samtaniNo ratings yet

- IL Digital June2018Document116 pagesIL Digital June2018AndresMartinez28No ratings yet

- Gilead Sciences, Inc. (GILD) Equity Research ReportDocument6 pagesGilead Sciences, Inc. (GILD) Equity Research ReportAnant VijayNo ratings yet

- Fundamentals of PhotonicsDocument13 pagesFundamentals of PhotonicsMelvin LopezNo ratings yet

- The Black Hole Information ParadoxDocument45 pagesThe Black Hole Information Paradoxursml12No ratings yet

- Don Locke. Memory-Macmillan Education. 1971Document151 pagesDon Locke. Memory-Macmillan Education. 1971Dafny C. AroneNo ratings yet

- Assessing Blockchain Opportunities - Blockchain OpportunitiesDocument22 pagesAssessing Blockchain Opportunities - Blockchain OpportunitiesAakash MalhotraNo ratings yet

- ACCA Exam Tips For PaperDocument4 pagesACCA Exam Tips For PaperRiz WanNo ratings yet

- List of Unsolved Problems in PhysicsDocument9 pagesList of Unsolved Problems in Physicslev76No ratings yet

- Under Our Noses: Existing Theories of EverythingDocument46 pagesUnder Our Noses: Existing Theories of EverythingTrevor PittsNo ratings yet

- Digital Evidence, Digital Investigations and E-Disclosure:: Third EditionDocument115 pagesDigital Evidence, Digital Investigations and E-Disclosure:: Third EditionToma XtraNo ratings yet

- Questions and Answers 1950-1951 by Holy MotherDocument432 pagesQuestions and Answers 1950-1951 by Holy Motherapi-3719687No ratings yet

- Aspects of Quantum Field Theory - PadmanabhanDocument96 pagesAspects of Quantum Field Theory - PadmanabhanSupritsingh100% (1)

- Blockchain Based Freight Management Solution ThesisDocument81 pagesBlockchain Based Freight Management Solution ThesisFarwa WaqarNo ratings yet

- Deloitte's Global Blockchain SurveyDocument44 pagesDeloitte's Global Blockchain SurveyForkLogNo ratings yet

- Unsolved Problems in Mainly AstrophysicsDocument19 pagesUnsolved Problems in Mainly AstrophysicsgooliNo ratings yet

- Shiller BubblesDocument17 pagesShiller BubblesLolo Set100% (1)

- Java Programming Assignment: Designing a Restaurant Ordering AppDocument38 pagesJava Programming Assignment: Designing a Restaurant Ordering AppTran Hung Minh (FGW HCM)No ratings yet

- Is There A Role For Blockchain in Responsible Supply ChainsDocument28 pagesIs There A Role For Blockchain in Responsible Supply ChainsasdNo ratings yet

- Why Do People Use Log Returns of Stock Prices For Auto-Regression - QuoraDocument3 pagesWhy Do People Use Log Returns of Stock Prices For Auto-Regression - QuorapedrodotnetNo ratings yet

- Draft: Introductory Computational Physics Using PythonDocument103 pagesDraft: Introductory Computational Physics Using PythonSushovan MondalNo ratings yet

- Book - The Future of MoneyDocument20 pagesBook - The Future of MoneySamuel S. KamelNo ratings yet

- Novelty, Information, and SurpriseDocument259 pagesNovelty, Information, and SurpriseAbram DemskiNo ratings yet

- +learn Thai PodcastDocument30 pages+learn Thai Podcasttony musanteNo ratings yet

- Accelerated Learning Techniques Index PDFDocument2 pagesAccelerated Learning Techniques Index PDFAruneyGiseLe100% (1)

- Quantum Computing BrochureDocument2 pagesQuantum Computing BrochureSorinel BalanNo ratings yet

- Stochastic Search OptimizationDocument317 pagesStochastic Search OptimizationAugusto RibeiroNo ratings yet

- This Posting Is Based Upon A Conference Presentation at The Society For Clinical and Experimental Hypnosis, EntitledDocument15 pagesThis Posting Is Based Upon A Conference Presentation at The Society For Clinical and Experimental Hypnosis, EntitledOVVCMOULI100% (1)

- 1.2 Basic Economic ConceptsDocument22 pages1.2 Basic Economic ConceptsMissDangNo ratings yet

- Intro To Modern Cryptography - PrefaceDocument2 pagesIntro To Modern Cryptography - Prefacearmughal70No ratings yet

- Financial Management Course Book BibliographyDocument2 pagesFinancial Management Course Book BibliographyaluiscgNo ratings yet

- Currency Competition and Foreign Exchange Markets - Hartmann, P (1998)Document211 pagesCurrency Competition and Foreign Exchange Markets - Hartmann, P (1998)ererereretrterNo ratings yet

- Financial Engineering Lecture NotesDocument12 pagesFinancial Engineering Lecture NotesMehmet ZirekNo ratings yet

- Rajarama M. Jena, Subrat K. Jena, Snehashish Chakraverty - Computational Fractional Dynamical Systems - Fractional Differential Equations and Applications-Wiley (2022)Document268 pagesRajarama M. Jena, Subrat K. Jena, Snehashish Chakraverty - Computational Fractional Dynamical Systems - Fractional Differential Equations and Applications-Wiley (2022)Rafael GuzmanNo ratings yet

- Dynamics of Financial Markets - Mandlebrot & Beyond Bouchard and BorlandDocument11 pagesDynamics of Financial Markets - Mandlebrot & Beyond Bouchard and BorlandGreg McKennaNo ratings yet

- Stock Market Trend Analysis Using Hidden Markov ModelsDocument8 pagesStock Market Trend Analysis Using Hidden Markov ModelsAileenJessicaNo ratings yet

- Deep Learning in FinanceDocument38 pagesDeep Learning in FinanceAyush SagarNo ratings yet

- Pairs Trading (Copulas)Document20 pagesPairs Trading (Copulas)alexa_sherpyNo ratings yet

- Artificial IntelligenceDocument422 pagesArtificial IntelligenceAamir Karmali100% (1)

- House Prices, Money, Credit and The Macroeconomy.Document45 pagesHouse Prices, Money, Credit and The Macroeconomy.alphathesisNo ratings yet

- A Review On Emotion and Sentiment Analysis Using Learning TechniquesDocument13 pagesA Review On Emotion and Sentiment Analysis Using Learning TechniquesIJRASETPublicationsNo ratings yet

- Fraudulent Financial Reporting Fresh ThinkingDocument15 pagesFraudulent Financial Reporting Fresh ThinkingLoo Bee YeokNo ratings yet

- IITM Placement Guide 2015-16 PDFDocument352 pagesIITM Placement Guide 2015-16 PDFSudesh ChaudharyNo ratings yet

- Effective Compliance in Anti-Money Laundering in MalaysiaDocument4 pagesEffective Compliance in Anti-Money Laundering in MalaysiaCFE International Consultancy GroupNo ratings yet

- Financial, Treasury and Forex ManagementDocument542 pagesFinancial, Treasury and Forex ManagementPraveen100% (1)

- VCSB - LMS Access Guidelines - PNB CFA L3 IRC ProgramDocument13 pagesVCSB - LMS Access Guidelines - PNB CFA L3 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- MSYA Series 1 - Personal Financial Management (Final, Distribution, Grey)Document53 pagesMSYA Series 1 - Personal Financial Management (Final, Distribution, Grey)Via Commerce Sdn BhdNo ratings yet

- (Important Updates For All May 2021 Cfa Exam Candidates Who Will Sit For Their Exams On 1 June 2021Document4 pages(Important Updates For All May 2021 Cfa Exam Candidates Who Will Sit For Their Exams On 1 June 2021Via Commerce Sdn BhdNo ratings yet

- CFA Brochure (2021 & 2022)Document8 pagesCFA Brochure (2021 & 2022)Via Commerce Sdn Bhd100% (1)

- FRM PI (Group II) - Timetable (July 2021 Exam) (V3)Document1 pageFRM PI (Group II) - Timetable (July 2021 Exam) (V3)Via Commerce Sdn BhdNo ratings yet

- FRM PI (Group II) - Timetable (July 2021 Exam) (V3)Document1 pageFRM PI (Group II) - Timetable (July 2021 Exam) (V3)Via Commerce Sdn BhdNo ratings yet

- FRM PI (Group II) - Timetable (July 2021 Exam) (V3)Document1 pageFRM PI (Group II) - Timetable (July 2021 Exam) (V3)Via Commerce Sdn BhdNo ratings yet

- VCSB - Financial Modelling Series (Apr & May 2021)Document9 pagesVCSB - Financial Modelling Series (Apr & May 2021)Via Commerce Sdn BhdNo ratings yet

- VCSB - Financial Modelling Series (Apr & May 2021)Document9 pagesVCSB - Financial Modelling Series (Apr & May 2021)Via Commerce Sdn BhdNo ratings yet

- VCSB LMS Access Guidelines - PNB CFA L1 IRC ProgramDocument13 pagesVCSB LMS Access Guidelines - PNB CFA L1 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- CFA Level I - Timetable (August 2021 Exam) (V2)Document1 pageCFA Level I - Timetable (August 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- VCSB LMS Access Guidelines - PNB CFA L2 IRC ProgramDocument13 pagesVCSB LMS Access Guidelines - PNB CFA L2 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- LMS System Guidelines (FIRIX) - CFA Program ME & VideosDocument7 pagesLMS System Guidelines (FIRIX) - CFA Program ME & VideosVia Commerce Sdn BhdNo ratings yet

- FRM PI (Group II) - Timetable (July 2021 Exam) (V3)Document1 pageFRM PI (Group II) - Timetable (July 2021 Exam) (V3)Via Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Level II - IRC (May 2021 Exam)Document1 pageFIRIX - CFA Level II - IRC (May 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- FIRIX - LMS Access Guidelines - FRM ProgramDocument12 pagesFIRIX - LMS Access Guidelines - FRM ProgramVia Commerce Sdn BhdNo ratings yet

- LMS Enrollment Guidelines (FIRIX) - CFA & FRM ProgramDocument16 pagesLMS Enrollment Guidelines (FIRIX) - CFA & FRM ProgramVia Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Level III - IRC (May 2021 Exam)Document1 pageFIRIX - CFA Level III - IRC (May 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- FIRIX - LMS Access Guidelines - CFA ProgramDocument13 pagesFIRIX - LMS Access Guidelines - CFA ProgramVia Commerce Sdn BhdNo ratings yet

- FIRIX - FRM Brochure (2021)Document8 pagesFIRIX - FRM Brochure (2021)Via Commerce Sdn BhdNo ratings yet

- LMS System Access Guidelines (VCSB) - CFA Program ME & VideosDocument7 pagesLMS System Access Guidelines (VCSB) - CFA Program ME & VideosVia Commerce Sdn BhdNo ratings yet

- CFA Level I - Timetable (August 2021 Exam)Document1 pageCFA Level I - Timetable (August 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- FRM PI (Group I & II) - Timetable (July 2021 Exam) (V2)Document2 pagesFRM PI (Group I & II) - Timetable (July 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- FRM PI (G1&G2) - Timetable (July 2021 Exam)Document2 pagesFRM PI (G1&G2) - Timetable (July 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- Behavioral Finance - Brochure (June 13, 2020 - 9am)Document2 pagesBehavioral Finance - Brochure (June 13, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- CFA Level I - Timetable (August 2021 Exam) (V2)Document1 pageCFA Level I - Timetable (August 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Brochure (2021)Document8 pagesFIRIX - CFA Brochure (2021)Via Commerce Sdn Bhd100% (1)

- FIRIX - FRM Brochure (2021)Document8 pagesFIRIX - FRM Brochure (2021)Via Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Brochure (2021)Document8 pagesFIRIX - CFA Brochure (2021)Via Commerce Sdn Bhd100% (1)

- Portfolio Management - Advanced (June 13, 2020 - 2pm)Document2 pagesPortfolio Management - Advanced (June 13, 2020 - 2pm)Via Commerce Sdn BhdNo ratings yet

- Lecture Guide 15 - KeyDocument5 pagesLecture Guide 15 - KeyFrancis VirayNo ratings yet

- Fabm1 Module 5Document16 pagesFabm1 Module 5Randy Magbudhi50% (4)

- Paytm Wallet TXN HistoryJul2019 8433939758Document17 pagesPaytm Wallet TXN HistoryJul2019 8433939758Udayraj VarmaNo ratings yet

- Mergers and Acquisitions and Multinational Companies: A Review and Research AgendaDocument15 pagesMergers and Acquisitions and Multinational Companies: A Review and Research AgendaVikas SinghNo ratings yet

- Partnership Acctg Course Outline (CUP)Document1 pagePartnership Acctg Course Outline (CUP)Baron AJNo ratings yet

- Satyam CaseDocument9 pagesSatyam CaseGaurav Agarwal0% (1)

- FM11 CH 01 Test BankDocument33 pagesFM11 CH 01 Test Banksarah_200285No ratings yet

- IBA Karachi Course Outlines PDFDocument38 pagesIBA Karachi Course Outlines PDFDr. Abdullah0% (1)

- Thesis-1 13Document29 pagesThesis-1 13Beige TanNo ratings yet

- Case Study - Manufacturing Accounting - 10Document2 pagesCase Study - Manufacturing Accounting - 10nadwa dariah50% (2)

- The value of B if interest is compounded semi-annually is 1,260,875.183Document58 pagesThe value of B if interest is compounded semi-annually is 1,260,875.183nonononowayNo ratings yet

- F3FFA Chapter 13 PROVISION AND CONTINGENCYDocument8 pagesF3FFA Chapter 13 PROVISION AND CONTINGENCYMd Enayetur RahmanNo ratings yet

- Taxation - Quick Notes - FinalsDocument17 pagesTaxation - Quick Notes - FinalsRoseanneNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- Truist Bank Powerpoint ActivityDocument12 pagesTruist Bank Powerpoint Activityapi-688079199No ratings yet

- Brilliant Charts User ManualDocument27 pagesBrilliant Charts User ManualKuru Govind0% (1)

- Federal Deposit Insurance Corporation, A United States Corporation, Plaintiff v. Bank of Boulder, A Colorado Corporation, 865 F.2d 1134, 10th Cir. (1988)Document24 pagesFederal Deposit Insurance Corporation, A United States Corporation, Plaintiff v. Bank of Boulder, A Colorado Corporation, 865 F.2d 1134, 10th Cir. (1988)Scribd Government DocsNo ratings yet

- Anjanadri Granite Stone Project ReportDocument35 pagesAnjanadri Granite Stone Project ReportKanaka Raja CNo ratings yet

- Bank Reconciliation MethodsDocument12 pagesBank Reconciliation MethodsKalven Perry Agustin80% (5)

- CITECH SImple InterestDocument27 pagesCITECH SImple InterestJoseph QuizanaNo ratings yet

- Laundry InvoiceDocument1 pageLaundry InvoiceprashantkgargNo ratings yet

- Value Added StatementDocument6 pagesValue Added StatementPooja SheoranNo ratings yet

- Basic Accounting Notes (Finale)Document33 pagesBasic Accounting Notes (Finale)Chreann Rachel100% (3)

- Ajanta PharmaDocument18 pagesAjanta Pharmaumesh.raoNo ratings yet

- Drawings 4,500: Financial AccountiDocument3 pagesDrawings 4,500: Financial AccountiShamNo ratings yet

- Engineering Economy: Interest and Money-Time RelationshipsDocument21 pagesEngineering Economy: Interest and Money-Time RelationshipsanonNo ratings yet

- Stock Markiet.Document87 pagesStock Markiet.deepti singhalNo ratings yet

- IPO Prospectus Explained: Key Details and Importance for InvestorsDocument3 pagesIPO Prospectus Explained: Key Details and Importance for InvestorshrikilNo ratings yet

- May 2022 PayslipDocument1 pageMay 2022 PayslipJustice Agbeko100% (1)

- Afm ProjectDocument11 pagesAfm ProjectAnshul MishraNo ratings yet