Professional Documents

Culture Documents

Behavioral Finance - Brochure (June 13, 2020 - 9am)

Uploaded by

Via Commerce Sdn BhdOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Behavioral Finance - Brochure (June 13, 2020 - 9am)

Uploaded by

Via Commerce Sdn BhdCopyright:

Available Formats

Behavioral Finance – Impact

Analysis on Investment

Decisions

DATE:

June 13, 2020 (Saturday)

5

TIME:

9.00 a.m. to 11.30 a.m.

▪ Describe commonalities and differences in investor behaviors.

▪ Describe individual investor behaviors to cycles in financial markets.

▪ Describe how the recent financial crisis might modify behaviors.

COURSE ▪ Construct a grid to analyze investor behavior and spot psychological

OBJECTIVES biases.

▪ Apply tools to correct or adapt to psychological biases.

▪ Apply finding for the marketing and sale of financial products.

▪ Describe insight for implementing behavioral investment strategies.

▪ Financial Advisors

▪ Private Wealth Planner

TARGET

▪ Private Bankers

AUDIENCE ▪ Relationship Managers

▪ Personal Financial Consultants

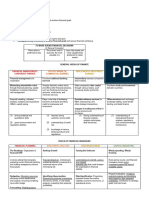

Session 1: Behavioral Financial Principles

▪ Key behavioral aspects: heuristics, mental accounting, mental bias.

▪ Beyond Risk Aversion: why risk aversion is insufficient to evaluate

tolerance to risk.

▪ Risk perception and informal risk management: how investors

misperceive risk and fail to manage it properly.

Session 2: Applied Behavioral Finance

COURSE ▪ Behavioral biases: the various pitfalls in investors psychology.

▪ Behavior and expertise: how financial professionals’ behavioral

OUTLINE

biases differ from those of individual investors.

Session 3: Linkage Behavioral Finance to Financial Products

▪ Various types of conflicts and potential exploitative practices.

▪ Behavioral profiling: finding the appropriate dimensions to evaluate

the behavioral profile of a client.

▪ Behavioral therapy: how to assess, improve and adapt to different

behaviors.

Trainer Profile

Mr. David Meow

• Chartered Financial Analyst (CFA)

• Master of Laws (University of London)

• Financial Risk Manager (FRM)

• Chartered Accountant (M)

• Master of Business Administration

(Heriot-Watt University)

• Certificate of Data Science

(John Hopkins University)

David has more than 20 years of experience in areas including business valuation,

financial markets and risks, and financial reporting. His exposures in diverse areas in

the capital markets as well as being a Chartered Financial Analyst (CFA) holder and

qualified as a Chartered Accountant (Malaysia), allow him to offer training and

consultancy services in areas including investment management and company

valuation.

For the studies of behavioural finance, he was awarded a Verified Certificate by the

Higher School of Economics (with Distinction) on Neuroeconomics and attained a

Statement of Accomplishment for “A Beginner's Guide to Irrational Behavior” course

by Duke University. He is also a member of the Neuromarketing Science and

Business Association (NMSBA).

He is currently associated with Securities Commission for several development

projects and in several programmes initiated by Permodalan Nasional Berhad

Institute. He is also the Lead Moderator for the Capital Markets with the Financial

Accreditation Agency (FAA).

Ms Shanny Lim & Mr Jason Chang

013-868 1346 / 017-234 6100

info@viacommerce.com.my

You might also like

- BF IntroDocument5 pagesBF IntroNidhi SatvekarNo ratings yet

- Find Your Dream Finance Job: Explore The Best Opportunities On Our Finance Jobs PortalDocument11 pagesFind Your Dream Finance Job: Explore The Best Opportunities On Our Finance Jobs PortalMaryNo ratings yet

- 1 NoteDocument21 pages1 Notesumit vishwakarmaNo ratings yet

- Business Management For Head of Investments - Free Guide #005Document9 pagesBusiness Management For Head of Investments - Free Guide #005RublesNo ratings yet

- Faculty of Business and Economics Business and AdministrationDocument3 pagesFaculty of Business and Economics Business and Administrationbahya mostafaNo ratings yet

- Black Book Ashish ChanchalaniDocument19 pagesBlack Book Ashish ChanchalaniAshish SinghNo ratings yet

- Portfolio Management - Advanced (May 21, 2020)Document2 pagesPortfolio Management - Advanced (May 21, 2020)Via Commerce Sdn BhdNo ratings yet

- 4.de Citit Decision Making in The Stock Market - Incorporating Psychology With FinanceDocument29 pages4.de Citit Decision Making in The Stock Market - Incorporating Psychology With FinanceMihai PetraNo ratings yet

- Comparative Study of Various Alternatives Available in The Market For Wealth Management PDFDocument68 pagesComparative Study of Various Alternatives Available in The Market For Wealth Management PDFHenal Jhaveri100% (1)

- Finance Elective Briefing: DR Sharon K JoseDocument26 pagesFinance Elective Briefing: DR Sharon K Josebhagyesh taleleNo ratings yet

- Intro To FinanceDocument4 pagesIntro To Financezeus manNo ratings yet

- UBS-Behavioral-Finance 1Document60 pagesUBS-Behavioral-Finance 1Ivan Mezhuev100% (2)

- Standard Chartered BankDocument102 pagesStandard Chartered Bankmaverick987100% (1)

- Using Behavioral Investor TypesDocument8 pagesUsing Behavioral Investor TypesVidushi Bonomaully100% (1)

- Behavioural Finance: A guide for financial advisersFrom EverandBehavioural Finance: A guide for financial advisersRating: 5 out of 5 stars5/5 (1)

- Detecting Creative Accounting and Fraud (June 6, 2020 - 9am)Document2 pagesDetecting Creative Accounting and Fraud (June 6, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Q1 LAS Business Finance 12 Week 1 Comp1Document8 pagesQ1 LAS Business Finance 12 Week 1 Comp1AsiNo ratings yet

- Investment Analysis and Portfolio Management Course ObjectiveDocument5 pagesInvestment Analysis and Portfolio Management Course ObjectiveNishantNo ratings yet

- Overview of Private Wealth ManagementDocument7 pagesOverview of Private Wealth ManagementSewale AbateNo ratings yet

- Finance101 ReviewerDocument2 pagesFinance101 Reviewerzenyasula13No ratings yet

- Conclusion and SuggestionsDocument5 pagesConclusion and SuggestionsAnkit PashteNo ratings yet

- Introduction To Behavioral FinanceDocument4 pagesIntroduction To Behavioral FinanceKimberly Serafica FeleoNo ratings yet

- Why Is Investment Analysis ImportantDocument2 pagesWhy Is Investment Analysis Importantxxtha999No ratings yet

- Study Session 3: Behavioral Finance: Shahzaib Masud Khan, CFA, ACA, CMADocument67 pagesStudy Session 3: Behavioral Finance: Shahzaib Masud Khan, CFA, ACA, CMAHasan_Shah_538No ratings yet

- Chapter 3 - Incorporating Investor Behavior PDFDocument9 pagesChapter 3 - Incorporating Investor Behavior PDFassem mohamedNo ratings yet

- Career Guides - Leveraged Finance & Credit Risk Management Free GuideDocument9 pagesCareer Guides - Leveraged Finance & Credit Risk Management Free GuideRublesNo ratings yet

- Portfolio Management Opportunities and ChallengesDocument18 pagesPortfolio Management Opportunities and ChallengesPrat91No ratings yet

- Intro To AMDocument70 pagesIntro To AMzongweiterngNo ratings yet

- Career As Finance Manager: Job ProfileDocument5 pagesCareer As Finance Manager: Job ProfileSneha KumarNo ratings yet

- Analysis of The Rudy Wong Case-Raquel SanchezDocument7 pagesAnalysis of The Rudy Wong Case-Raquel SanchezJuan Camilo Ninco CardenasNo ratings yet

- Internal Audit FileDocument6 pagesInternal Audit FileAsherah SedilloNo ratings yet

- Deutsche Bank AG-2Document3 pagesDeutsche Bank AG-2avijeetboparaiNo ratings yet

- Functional Areas of ManagementDocument16 pagesFunctional Areas of Managementbaby winette vicerraNo ratings yet

- Brochure - Mergers & Acquisitions - Imperial Executive Education.Document14 pagesBrochure - Mergers & Acquisitions - Imperial Executive Education.Daniel Pories SitinjakNo ratings yet

- A Study of Behavioral Finance Biases and Its Impact On Investment Decisions of Individual InvestorsDocument64 pagesA Study of Behavioral Finance Biases and Its Impact On Investment Decisions of Individual InvestorsSHUKLA YOGESHNo ratings yet

- 5 PsiFinance Behavioral Finance Course Mitroi 2015Document11 pages5 PsiFinance Behavioral Finance Course Mitroi 2015Iulia BalaceanuNo ratings yet

- Investment Policy Statement Individual InvestorsDocument26 pagesInvestment Policy Statement Individual InvestorsEduardo Luis LemusNo ratings yet

- M1 Foundation in Financial Planning and Tax Planning Syllabus FinalDocument10 pagesM1 Foundation in Financial Planning and Tax Planning Syllabus FinalCalvin YeohNo ratings yet

- Forex 3Document56 pagesForex 3pardeep singhNo ratings yet

- SapmDocument21 pagesSapmPankaj ChaudhariNo ratings yet

- Behavioral Finance IntroductionDocument20 pagesBehavioral Finance IntroductionNikhilSharma100% (2)

- SPECIALIZATIONSDocument36 pagesSPECIALIZATIONSNishant ShekharNo ratings yet

- Decision-Making in The Stock Market: Incorporating Psychology With FinanceDocument28 pagesDecision-Making in The Stock Market: Incorporating Psychology With FinanceEmiliyana SoejitnoNo ratings yet

- Finance ProfilesDocument24 pagesFinance ProfilesHarveyNo ratings yet

- Financial Planning M4Document51 pagesFinancial Planning M4aashish kumarNo ratings yet

- What Is An Investment Policy Statement (IPS) ?Document3 pagesWhat Is An Investment Policy Statement (IPS) ?Helen TuberaNo ratings yet

- Asset Management Perspectives Encompass A Broad Range of ConsiderationsDocument5 pagesAsset Management Perspectives Encompass A Broad Range of Considerationssashanaumova672No ratings yet

- лекция 2Document21 pagesлекция 2dNo ratings yet

- Unit 1Document21 pagesUnit 1ranaparth189No ratings yet

- MBA 1.5 Outlines PDFDocument148 pagesMBA 1.5 Outlines PDFMaQsud AhMad SaNdhuNo ratings yet

- A Major Project Report On A Study of Awareness and Knowledge About Wealth Management Among IndividualsDocument51 pagesA Major Project Report On A Study of Awareness and Knowledge About Wealth Management Among IndividualsGaurav Solanki50% (2)

- Group 6 Report Wealth ManagementDocument14 pagesGroup 6 Report Wealth ManagementAngelo MedinaNo ratings yet

- Business Finance ABM StrandDocument107 pagesBusiness Finance ABM StrandMiss Anonymous23No ratings yet

- Introduction To Investment Analysis & Portfolio ManagementDocument4 pagesIntroduction To Investment Analysis & Portfolio Managementgaurav parekhNo ratings yet

- Behavioural Finance: The Role of PsychologyDocument15 pagesBehavioural Finance: The Role of PsychologyDiwakar SharmaNo ratings yet

- Behavioral Finance Introduction ChapterDocument11 pagesBehavioral Finance Introduction Chapterkhush preetNo ratings yet

- Goals-Based Investing: A Visionary Framework for Wealth ManagementFrom EverandGoals-Based Investing: A Visionary Framework for Wealth ManagementNo ratings yet

- CFA Brochure (2021 & 2022)Document8 pagesCFA Brochure (2021 & 2022)Via Commerce Sdn Bhd100% (1)

- MSYA Series 1 - Personal Financial Management (Final, Distribution, Grey)Document53 pagesMSYA Series 1 - Personal Financial Management (Final, Distribution, Grey)Via Commerce Sdn BhdNo ratings yet

- LMS System Guidelines (FIRIX) - CFA Program ME & VideosDocument7 pagesLMS System Guidelines (FIRIX) - CFA Program ME & VideosVia Commerce Sdn BhdNo ratings yet

- VCSB - Financial Modelling Series (Apr & May 2021)Document9 pagesVCSB - Financial Modelling Series (Apr & May 2021)Via Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Level III - IRC (May 2021 Exam)Document1 pageFIRIX - CFA Level III - IRC (May 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- VCSB LMS Access Guidelines - PNB CFA L2 IRC ProgramDocument13 pagesVCSB LMS Access Guidelines - PNB CFA L2 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- VCSB - LMS Access Guidelines - PNB CFA L3 IRC ProgramDocument13 pagesVCSB - LMS Access Guidelines - PNB CFA L3 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- VCSB LMS Access Guidelines - PNB CFA L1 IRC ProgramDocument13 pagesVCSB LMS Access Guidelines - PNB CFA L1 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Level II - IRC (May 2021 Exam)Document1 pageFIRIX - CFA Level II - IRC (May 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- LMS System Access Guidelines (VCSB) - CFA Program ME & VideosDocument7 pagesLMS System Access Guidelines (VCSB) - CFA Program ME & VideosVia Commerce Sdn BhdNo ratings yet

- FIRIX - LMS Access Guidelines - CFA ProgramDocument13 pagesFIRIX - LMS Access Guidelines - CFA ProgramVia Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Brochure (2021)Document8 pagesFIRIX - CFA Brochure (2021)Via Commerce Sdn Bhd100% (1)

- FIRIX - LMS Access Guidelines - FRM ProgramDocument12 pagesFIRIX - LMS Access Guidelines - FRM ProgramVia Commerce Sdn BhdNo ratings yet

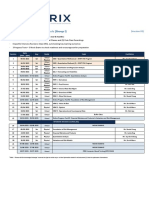

- FRM PI (Group I & II) - Timetable (July 2021 Exam) (V2)Document2 pagesFRM PI (Group I & II) - Timetable (July 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- FIRIX - FRM Brochure (2021)Document8 pagesFIRIX - FRM Brochure (2021)Via Commerce Sdn BhdNo ratings yet

- CFA Level I - Timetable (August 2021 Exam) (V2)Document1 pageCFA Level I - Timetable (August 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- FRM PI (G1&G2) - Timetable (July 2021 Exam)Document2 pagesFRM PI (G1&G2) - Timetable (July 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- CFA Level I - Timetable (August 2021 Exam)Document1 pageCFA Level I - Timetable (August 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- FIRIX - FRM Brochure (2021)Document8 pagesFIRIX - FRM Brochure (2021)Via Commerce Sdn BhdNo ratings yet

- LMS Enrollment Guidelines (FIRIX) - CFA & FRM ProgramDocument16 pagesLMS Enrollment Guidelines (FIRIX) - CFA & FRM ProgramVia Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Brochure (2021)Document8 pagesFIRIX - CFA Brochure (2021)Via Commerce Sdn Bhd100% (1)

- Behavioral Finance - Brochure (June 13, 2020 - 9am)Document2 pagesBehavioral Finance - Brochure (June 13, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Portfolio Management - Advanced (May 21, 2020)Document2 pagesPortfolio Management - Advanced (May 21, 2020)Via Commerce Sdn BhdNo ratings yet

- Detecting Creative Accounting and Fraud (June 6, 2020 - 9am)Document2 pagesDetecting Creative Accounting and Fraud (June 6, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Anti-Money Laundering (AML) - Cases Involving Capital Market ParticipantsDocument3 pagesAnti-Money Laundering (AML) - Cases Involving Capital Market ParticipantsVia Commerce Sdn BhdNo ratings yet

- Risk Management in Indian Banking IndustryDocument5 pagesRisk Management in Indian Banking Industryarpit55No ratings yet

- Risk Management PolicyDocument13 pagesRisk Management PolicychhotelalNo ratings yet

- BSBINN601-Task 2Document11 pagesBSBINN601-Task 2Ali Butt50% (2)

- The "Riskification" of European Data Protection Law Through A Two-Fold ShiftDocument23 pagesThe "Riskification" of European Data Protection Law Through A Two-Fold ShiftFalalaNo ratings yet

- 2015 CRMA® Certification in Risk Management Assurance - Exam Practice QuestionsDocument195 pages2015 CRMA® Certification in Risk Management Assurance - Exam Practice QuestionsOrlando Pineda Vallar100% (1)

- BRC Global Standard For Consumer Products PCH Issue 4Document89 pagesBRC Global Standard For Consumer Products PCH Issue 4DavidHernandez50% (2)

- Bb-Cissp Isc 2 Certification Practice PDFDocument593 pagesBb-Cissp Isc 2 Certification Practice PDFmukul1saxena6364100% (1)

- Template Sidang Proposal Tesis BINUSDocument32 pagesTemplate Sidang Proposal Tesis BINUSFaizal abidNo ratings yet

- Public Open SpacesDocument96 pagesPublic Open Spacesjai digheNo ratings yet

- BECG AssignmentsDocument18 pagesBECG AssignmentsMoh'ed A. KhalafNo ratings yet

- Operations Management - Quality Improvement and Productivity 1Document12 pagesOperations Management - Quality Improvement and Productivity 1Ashish KumarNo ratings yet

- Oisd RP 233 DraftDocument66 pagesOisd RP 233 DraftvijaygalaxyNo ratings yet

- Tools To Manage EHS RiskDocument2 pagesTools To Manage EHS RiskJamsari SulaimanNo ratings yet

- Project Perspectives 2010Document60 pagesProject Perspectives 2010adrianregisterNo ratings yet

- Winter 22Document25 pagesWinter 22rohitmhaske0208No ratings yet

- Manual: Revised VersionDocument27 pagesManual: Revised Versionmohamed sobhyNo ratings yet

- Implementation of Risk Management in Malaysian ConDocument6 pagesImplementation of Risk Management in Malaysian ConFizz FirdausNo ratings yet

- Oil Gas Offshore Safety Case (Risk Assessment) : August 2016Document44 pagesOil Gas Offshore Safety Case (Risk Assessment) : August 2016Andi SuntoroNo ratings yet

- Aragaw W. Assignment 2Document24 pagesAragaw W. Assignment 2amanualNo ratings yet

- Software Project Management: Submitted To: Mrs. Kavita Aggarwal Submitted By: Nikhlesh Partap Singh Mba 1 SemDocument40 pagesSoftware Project Management: Submitted To: Mrs. Kavita Aggarwal Submitted By: Nikhlesh Partap Singh Mba 1 SemVidyut VatsNo ratings yet

- Roger - E - Hales - ICS (Current) - 1Document6 pagesRoger - E - Hales - ICS (Current) - 1Ashwani kumarNo ratings yet

- A Survey of AI Risk Assessment Methodologies Full ReportDocument47 pagesA Survey of AI Risk Assessment Methodologies Full ReportJessareth Atilano CapacioNo ratings yet

- Notes On Project ManagementDocument45 pagesNotes On Project ManagementHamza JuniorNo ratings yet

- BSBPMG632 Risk Management Plan - UpdatedDocument6 pagesBSBPMG632 Risk Management Plan - UpdatedHardik PandyaNo ratings yet

- RA 002 - HFO Line Pressure TestDocument4 pagesRA 002 - HFO Line Pressure Testdassi99100% (1)

- Risk Management in IoT ImplementationDocument4 pagesRisk Management in IoT ImplementationvsureshaNo ratings yet

- Topic 3 - Internal Control System - Part 2-StudentDocument9 pagesTopic 3 - Internal Control System - Part 2-Studentnnmnghi1409No ratings yet

- ANG-RGN-OP-PRO-0014 Rev A1 BP Angola Procedure Lifting Operation and Lifting Equipment ManagementDocument103 pagesANG-RGN-OP-PRO-0014 Rev A1 BP Angola Procedure Lifting Operation and Lifting Equipment ManagementPaul100% (1)

- Anza-Borrego Desert Integrated Regional Water Management Planning GuidelinesDocument12 pagesAnza-Borrego Desert Integrated Regional Water Management Planning GuidelineslbrechtNo ratings yet

- ISPE Good Practice Guide: Applied Risk Management For Commissioning and QualificationDocument2 pagesISPE Good Practice Guide: Applied Risk Management For Commissioning and QualificationLuis Gerardo Rendón BeltránNo ratings yet