Professional Documents

Culture Documents

Portfolio Management - Advanced (June 13, 2020 - 2pm)

Uploaded by

Via Commerce Sdn BhdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Management - Advanced (June 13, 2020 - 2pm)

Uploaded by

Via Commerce Sdn BhdCopyright:

Available Formats

Portfolio Management

(Advanced)

DATE: 5

June 13, 2020 (Saturday) TIME:

2.00 p.m. to 4.30 p.m.

▪ Explain the underlying concepts and theories of portfolio management.

▪ Construct a model portfolio for clients based on pre-determined return

and risk objectives

▪ Discuss the major asset allocation strategies – strategic, tactical and

COURSE OBJECTIVES dynamic.

▪ Discuss the monitoring of investor circumstances, market/economic

conditions, and portfolio holdings and explain the effects that changes

in each of these areas can have on the investor’s portfolio.

▪ Research Analyst

▪ Equity Analyst

TARGET AUDIENCE ▪ Investment Banking Personnel

▪ Institutional Investors Representatives

▪ Relationship Manager

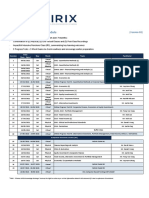

Session 1: Key Concepts of An Efficient Portfolio and Asset

Allocation Strategies

▪ Measures of returns and risks, covariances and correlations

▪ Modern Portfolio Theory and the optimal level of diversification.

▪ Portfolio Building

▪ Strategic Asset Allocation – the rationale for passive investments

▪ Tactical Asset Allocation – the construction of a portfolio seeking active

returns

COURSE OUTLINE ▪ Investment styles – Value, Growth, Market, and Small-cap

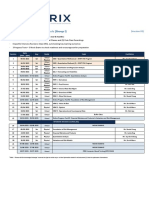

Session 2: Rebalancing Strategies

▪ Dynamic Asset Allocation

▪ Calendar rebalancing to percentage-of-portfolio rebalancing

▪ The key determinants of the optimal corridor width of an asset class in

a percentage-of-portfolio rebalancing program

▪ The benefits of rebalancing an asset class to its target portfolio weight

versus rebalancing the asset class to stay within its allowed range

Trainer Profile

Mr. David Meow

• Chartered Financial Analyst (CFA)

• Master of Laws (University of London)

• Financial Risk Manager (FRM)

• Chartered Accountant (M)

• Master of Business Administration

(Heriot-Watt University)

• Certificate of Data Science

(John Hopkins University)

David has more than 26 years of experience in areas including financial risk

management, business valuation, financial markets, and financial reporting. His

exposures in diverse areas in the capital markets as well as being a Financial Risk

Manager (FRM) holder, Chartered Financial Analyst (CFA) holder and qualified as a

Chartered Accountant (Malaysia), allow him to offer training and consultancy services

in areas including risk management, investment management and securities

valuation. During the past years, he has received increasing engagement in relation

to capital markets projects using data science applications.

He has provided training and consultancy services to government-related regulatory

bodies including Bank Negara Malaysia, Permodalan Nasional Berhad, Securities

Commission, Kumpulan Wang Simpanan Pekerja, Jabatan Perdana Menteri, as well

as financial institutions, including Maybank, CIMB, OCBC and RHB.

He is currently associated with Securities Commission for several development

projects and in several programmes initiated by Permodalan Nasional Berhad

Institute. He is also the Lead Moderator for the Capital Markets with the Financial

Accreditation Agency (FAA).

Ms Shanny Lim & Mr Jason Chang

013-868 1346 / 017-234 6100

info@viacommerce.com.my

You might also like

- CFA Brochure (2021 & 2022)Document8 pagesCFA Brochure (2021 & 2022)Via Commerce Sdn Bhd100% (1)

- VCSB - LMS Access Guidelines - PNB CFA L3 IRC ProgramDocument13 pagesVCSB - LMS Access Guidelines - PNB CFA L3 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- LMS System Guidelines (FIRIX) - CFA Program ME & VideosDocument7 pagesLMS System Guidelines (FIRIX) - CFA Program ME & VideosVia Commerce Sdn BhdNo ratings yet

- VCSB - Financial Modelling Series (Apr & May 2021)Document9 pagesVCSB - Financial Modelling Series (Apr & May 2021)Via Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Level III - IRC (May 2021 Exam)Document1 pageFIRIX - CFA Level III - IRC (May 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- VCSB LMS Access Guidelines - PNB CFA L2 IRC ProgramDocument13 pagesVCSB LMS Access Guidelines - PNB CFA L2 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- MSYA Series 1 - Personal Financial Management (Final, Distribution, Grey)Document53 pagesMSYA Series 1 - Personal Financial Management (Final, Distribution, Grey)Via Commerce Sdn BhdNo ratings yet

- VCSB LMS Access Guidelines - PNB CFA L1 IRC ProgramDocument13 pagesVCSB LMS Access Guidelines - PNB CFA L1 IRC ProgramVia Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Level II - IRC (May 2021 Exam)Document1 pageFIRIX - CFA Level II - IRC (May 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- LMS System Access Guidelines (VCSB) - CFA Program ME & VideosDocument7 pagesLMS System Access Guidelines (VCSB) - CFA Program ME & VideosVia Commerce Sdn BhdNo ratings yet

- FIRIX - LMS Access Guidelines - CFA ProgramDocument13 pagesFIRIX - LMS Access Guidelines - CFA ProgramVia Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Brochure (2021)Document8 pagesFIRIX - CFA Brochure (2021)Via Commerce Sdn Bhd100% (1)

- FIRIX - FRM Brochure (2021)Document8 pagesFIRIX - FRM Brochure (2021)Via Commerce Sdn BhdNo ratings yet

- FIRIX - LMS Access Guidelines - FRM ProgramDocument12 pagesFIRIX - LMS Access Guidelines - FRM ProgramVia Commerce Sdn BhdNo ratings yet

- CFA Level I - Timetable (August 2021 Exam) (V2)Document1 pageCFA Level I - Timetable (August 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- FRM PI (Group I & II) - Timetable (July 2021 Exam) (V2)Document2 pagesFRM PI (Group I & II) - Timetable (July 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- FRM PI (G1&G2) - Timetable (July 2021 Exam)Document2 pagesFRM PI (G1&G2) - Timetable (July 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- CFA Level I - Timetable (August 2021 Exam)Document1 pageCFA Level I - Timetable (August 2021 Exam)Via Commerce Sdn BhdNo ratings yet

- FIRIX - FRM Brochure (2021)Document8 pagesFIRIX - FRM Brochure (2021)Via Commerce Sdn BhdNo ratings yet

- LMS Enrollment Guidelines (FIRIX) - CFA & FRM ProgramDocument16 pagesLMS Enrollment Guidelines (FIRIX) - CFA & FRM ProgramVia Commerce Sdn BhdNo ratings yet

- FIRIX - CFA Brochure (2021)Document8 pagesFIRIX - CFA Brochure (2021)Via Commerce Sdn Bhd100% (1)

- Behavioral Finance - Brochure (June 13, 2020 - 9am)Document2 pagesBehavioral Finance - Brochure (June 13, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Behavioral Finance - Brochure (June 13, 2020 - 9am)Document2 pagesBehavioral Finance - Brochure (June 13, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Detecting Creative Accounting and Fraud (June 6, 2020 - 9am)Document2 pagesDetecting Creative Accounting and Fraud (June 6, 2020 - 9am)Via Commerce Sdn BhdNo ratings yet

- Portfolio Management - Advanced (May 21, 2020)Document2 pagesPortfolio Management - Advanced (May 21, 2020)Via Commerce Sdn BhdNo ratings yet

- Anti-Money Laundering (AML) - Cases Involving Capital Market ParticipantsDocument3 pagesAnti-Money Laundering (AML) - Cases Involving Capital Market ParticipantsVia Commerce Sdn BhdNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Homework Week7Document3 pagesHomework Week7Arista Yuliana SariNo ratings yet

- Appendix 2 - CRJDocument1 pageAppendix 2 - CRJJohn Hendrix RegulacionNo ratings yet

- 8.0money Demand & Money MKT EquilibriumDocument16 pages8.0money Demand & Money MKT EquilibriumJacquelyn ChungNo ratings yet

- Comprehensive Review SolutionsDocument20 pagesComprehensive Review SolutionsJane Ruby JennieferNo ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- Answers To Exercises: ExerciseuDocument69 pagesAnswers To Exercises: ExerciseuGunjan GaganNo ratings yet

- Chapter 1 The Portifolio Management Process Chapte 1Document9 pagesChapter 1 The Portifolio Management Process Chapte 1Panashe MachekepfuNo ratings yet

- Session 1Document19 pagesSession 1Madhav AgarwalNo ratings yet

- Life Insurance Underwriting IC 22 Ebook - Flip PDF - FlipBuilderDocument122 pagesLife Insurance Underwriting IC 22 Ebook - Flip PDF - FlipBuilderYashovant PatelNo ratings yet

- Advanced Audit and Assurance (International) : Tuesday 3 June 2008Document8 pagesAdvanced Audit and Assurance (International) : Tuesday 3 June 2008usamaNo ratings yet

- G Chart of AccountsDocument2 pagesG Chart of AccountsMubashar HussainNo ratings yet

- Fake by Robert Kiyosaki PDFDocument31 pagesFake by Robert Kiyosaki PDFLimJohnvyn50% (4)

- Financial Statements of Non-Profit OrganisationsDocument6 pagesFinancial Statements of Non-Profit OrganisationsPetrinaNo ratings yet

- Future Generali India Insurance Company LTD PAYSLIP For The MONTHDocument1 pageFuture Generali India Insurance Company LTD PAYSLIP For The MONTHJoseph MooreNo ratings yet

- Customer Loyalty Awards: Chapter 1 - Provisions, Contingencies and Other LiabilitiesDocument2 pagesCustomer Loyalty Awards: Chapter 1 - Provisions, Contingencies and Other Liabilitiesimsana minatozakiNo ratings yet

- Application Form For Loan Under Pradhan Mantri Mudra Yojana (PMMY) (For Loan Upto Rs. 50,000/-Under Shishu)Document2 pagesApplication Form For Loan Under Pradhan Mantri Mudra Yojana (PMMY) (For Loan Upto Rs. 50,000/-Under Shishu)PradeepMathadNo ratings yet

- Acctstmt DDocument4 pagesAcctstmt Dmaakabhawan26No ratings yet

- Bank - Wise Appropriation of Profit of Scbs (Strbi - b08)Document78 pagesBank - Wise Appropriation of Profit of Scbs (Strbi - b08)ahujavivekNo ratings yet

- Chapter 4 - Financial InstrumentsDocument17 pagesChapter 4 - Financial InstrumentsMerge MergeNo ratings yet

- Investment Is Defined As The Employment of Funds, With The Aim of Achieving Additional Income or Some Growth in Its ValueDocument5 pagesInvestment Is Defined As The Employment of Funds, With The Aim of Achieving Additional Income or Some Growth in Its ValuePera AnandNo ratings yet

- Business Loan Keyword ListDocument19 pagesBusiness Loan Keyword Listcorporatecredit20140% (1)

- Trainee Evaluation FormDocument6 pagesTrainee Evaluation FormIndranilGhoshNo ratings yet

- POSB Payroll Account-9Document5 pagesPOSB Payroll Account-9Krishna Chaitanya KolluNo ratings yet

- Chapter 6 BFMDocument59 pagesChapter 6 BFMrifat AlamNo ratings yet

- Account Statement 301018 300119Document18 pagesAccount Statement 301018 300119cuttack cscndlmNo ratings yet

- Real Estate MortgageDocument3 pagesReal Estate MortgageJuven MoradaNo ratings yet

- Vijayalaxmi Engineers & ContractorsDocument2 pagesVijayalaxmi Engineers & ContractorsDivya DhumalNo ratings yet

- 3-9 FINANCIAL STATEMENTS The Davidson CorporationDocument3 pages3-9 FINANCIAL STATEMENTS The Davidson Corporationlai vivianNo ratings yet

- Deposit Challan PDFDocument1 pageDeposit Challan PDFAbhishek KumarNo ratings yet

- SA2 SolvencyII 2016Document16 pagesSA2 SolvencyII 2016ChidoNo ratings yet