Professional Documents

Culture Documents

Non-Profit Making Organization

Uploaded by

JingyiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Non-Profit Making Organization

Uploaded by

JingyiCopyright:

Available Formats

Non-profit Making Organization

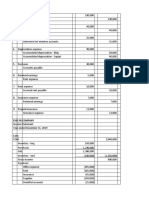

The following Trial Balance was extracted from the books of Broom Golf Club on 31 July 2009:

£ £

Subscriptions 96,250

Catering inventory at 1 August 2008 14,250

Catering staff wages 8,000

Catering purchases 52,000

Catering sales 110,340

Rent and rates 6,500

Golf club secretary's salary 21,250

Lighting and heating 8,120

Insurance 17,160

General expenses 24,750

Cash at bank 40,995

Cash in hand 125

Accumulated fund 37,310

Equipment (at cost) 30,750

Fixtures and fittings (at cost) 85,000

Accumulated depreciation on golf equipment 15,000

Accumulated depreciation on fixtures and fittings 50,000

308,900 308,900

Additional information:

(1) Depreciation is to be provided for the year ended 31 July 2009 as follows

Equipment - 10% reducing balance

Fixtures and fittings - 25% straight line.

(2) No subscriptions were prepaid or accrued at 1 August 2008.

(3) At 31 July 2009:

General expenses included a prepayment of £1,000

Rent and rates were accrued £930

Subscriptions in arrears amounted to £1,500

Subscriptions prepaid totalled £1,200

Catering inventory was valued at £16,000 at cost.

REQUIRED

Prepare for Broom Golf Club the:

(a) Catering Trading account, showing the profit for the year ended 31 July 2009.

(b) Income and Expenditure account for the year ended 31 July 2009

(c) Statement of Financial Position at 31 July 2009.

Answer Guide: (a) Catering Profit £52,090 (b) Surplus £48,105 (c) £87,545

You might also like

- Chords BeginnerDocument53 pagesChords BeginnerRoche Victor100% (3)

- Chapter 6 Pre OperatingDocument5 pagesChapter 6 Pre OperatingEthan Nolasco100% (3)

- Bretts Developmentally Appropriate EducationDocument31 pagesBretts Developmentally Appropriate Educationapi-457699298100% (1)

- Paneer Tikka Masala RecipeDocument41 pagesPaneer Tikka Masala Recipeimemyself009No ratings yet

- Latin Eglogas Todas 900pags.Document942 pagesLatin Eglogas Todas 900pags.Mecha Mechosa100% (1)

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- Anatmical TermsDocument40 pagesAnatmical TermsMRS DR NIDHI SHARMA VISHWAKARMANo ratings yet

- Bild Raths Mercantile PricelistDocument13 pagesBild Raths Mercantile PricelistLibedrat0 EarlNo ratings yet

- Risk & InsuranceDocument8 pagesRisk & InsuranceAlan100% (2)

- Moya PDFDocument2 pagesMoya PDFVincent TanNo ratings yet

- 2008 LCCI Level1 Book-Keeping (1517-4)Document13 pages2008 LCCI Level1 Book-Keeping (1517-4)JessieChuk100% (2)

- Binani Cement Research ReportDocument11 pagesBinani Cement Research ReportRinkesh25No ratings yet

- Non Profit Making OrganizationsDocument6 pagesNon Profit Making OrganizationsangaNo ratings yet

- Practice Questions-Accounts For Mon Profit Making-1Document4 pagesPractice Questions-Accounts For Mon Profit Making-1Letsah Bright100% (1)

- Accounting For A Service CompanyDocument9 pagesAccounting For A Service CompanyAnnie RapanutNo ratings yet

- FA 2 - Essay QuestionDocument4 pagesFA 2 - Essay QuestioncalebNo ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- Accounts Revision QuestionDocument1 pageAccounts Revision QuestionZaara AshfaqNo ratings yet

- PARTNERSHIPDocument2 pagesPARTNERSHIPMaryanne0% (1)

- Chap13 Non-Profit Making OrganisationsDocument7 pagesChap13 Non-Profit Making OrganisationsSaiful AliNo ratings yet

- Examples Topic 2. Af 121Document3 pagesExamples Topic 2. Af 121Adorf JamesNo ratings yet

- Exercise 6-23 Upeng VeggiesDocument18 pagesExercise 6-23 Upeng VeggiesjunjunNo ratings yet

- Investment Analysis1Document9 pagesInvestment Analysis1Kanchanit BangthamaiNo ratings yet

- Asm ACCOUNTINGDocument16 pagesAsm ACCOUNTINGVũ Khánh HuyềnNo ratings yet

- MadindigwaDocument7 pagesMadindigwaRay MondNo ratings yet

- Exercise Question - Accounting Non-Profit OrganizationDocument1 pageExercise Question - Accounting Non-Profit OrganizationMoriatyNo ratings yet

- Jawaban UTS Genap 2007 AkunDocument8 pagesJawaban UTS Genap 2007 Akunapi-3862199No ratings yet

- Drill Fs and Closing Entries 2Document2 pagesDrill Fs and Closing Entries 2Kuroko TetsuyaNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Accounting: Pearson Edexcel (Modular Syllabus)Document16 pagesAccounting: Pearson Edexcel (Modular Syllabus)Ammar SohailNo ratings yet

- Accounting: Pearson Edexcel (Modular Syllabus)Document16 pagesAccounting: Pearson Edexcel (Modular Syllabus)rahat879No ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Acctg 303 Midterm Quiz 1 With Solution at 2 Ma T1 Ma Addtnl TTHDocument4 pagesAcctg 303 Midterm Quiz 1 With Solution at 2 Ma T1 Ma Addtnl TTHOly VieenaNo ratings yet

- Solution Additional Exercise 1 Chapter 6 7Document3 pagesSolution Additional Exercise 1 Chapter 6 7Doreen OngNo ratings yet

- Assignment II, CorrectedDocument1 pageAssignment II, Correctedbelete ephremNo ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- Abay General TRDocument2 pagesAbay General TRbereketNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Adjusting and Summarising Data II (Workshop Question) - 2Document1 pageAdjusting and Summarising Data II (Workshop Question) - 2PRERNA JAINNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Sue Feria Travel AgencyDocument5 pagesSue Feria Travel AgencyMa Sophia Mikaela Erece100% (1)

- Cash Flow Excercise Questions-Set-2Document2 pagesCash Flow Excercise Questions-Set-2AgANo ratings yet

- Week 4 5 ULOb Lets Analyze Activity 1 SolutionDocument2 pagesWeek 4 5 ULOb Lets Analyze Activity 1 Solutionemem resuentoNo ratings yet

- SOAL Test Magang OnlineDocument6 pagesSOAL Test Magang OnlineFajar SaputraNo ratings yet

- Items Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairaDocument4 pagesItems Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairababatundeNo ratings yet

- AE121-PPE Lecture Prob SolDocument7 pagesAE121-PPE Lecture Prob SolGero MarinasNo ratings yet

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNo ratings yet

- Balance Sheets 2nd YearDocument38 pagesBalance Sheets 2nd YearEva WaminalNo ratings yet

- Seatwork No. 2 (Sanguine) AnswerDocument1 pageSeatwork No. 2 (Sanguine) AnswerJohn Paul Cristobal0% (1)

- Brisbane Profit and Loss BrisbaneDocument2 pagesBrisbane Profit and Loss BrisbaneTania SNo ratings yet

- Master of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Document6 pagesMaster of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Namrata RamgadeNo ratings yet

- Excercise ProblemsDocument7 pagesExcercise ProblemsKatherine EderosasNo ratings yet

- Training CasesDocument5 pagesTraining CasesIvan KralchevNo ratings yet

- Symphony Theatre Financial StatementsDocument3 pagesSymphony Theatre Financial StatementsSakshi kumarNo ratings yet

- TUTORIAL 1 (Clubs and Societies)Document5 pagesTUTORIAL 1 (Clubs and Societies)Wen Xin GanNo ratings yet

- Assignment Farm AccountsDocument6 pagesAssignment Farm AccountsCharles ChikumbiNo ratings yet

- MAPEL104 Lesson 7 - Final Accounts and Financial Statements - 10062021Document59 pagesMAPEL104 Lesson 7 - Final Accounts and Financial Statements - 10062021Maria Jeannie CurayNo ratings yet

- Income Statement P2 JayatamaDocument1 pageIncome Statement P2 JayatamaShula KinantiNo ratings yet

- RestaurantDocument1 pageRestaurantkgbakilobaNo ratings yet

- Financials FY2019-20Document3 pagesFinancials FY2019-20Umesh Kumar PatelNo ratings yet

- Creative Chips Case StudyDocument6 pagesCreative Chips Case StudyDhruvi GandhiNo ratings yet

- ReviewDocument8 pagesReviewMaya BangunNo ratings yet

- Module 5 - Far - Activity-Answer KEYDocument2 pagesModule 5 - Far - Activity-Answer KEYRhadzmae OmalNo ratings yet

- Manufacturing AccountDocument1 pageManufacturing AccountJingyiNo ratings yet

- Accounting Ratio 2Document1 pageAccounting Ratio 2JingyiNo ratings yet

- End-of-Period AdjustmentDocument1 pageEnd-of-Period AdjustmentJingyiNo ratings yet

- Control AccountDocument1 pageControl AccountJingyiNo ratings yet

- Partnership AccountDocument1 pagePartnership AccountJingyiNo ratings yet

- TerminDocument5 pagesTerminAnonymous DA8iQzNo ratings yet

- MCQ For AminDocument21 pagesMCQ For AminKailali Polytechnic Institute100% (2)

- IV. Data Presentation, Interpretation and AnalysisDocument43 pagesIV. Data Presentation, Interpretation and AnalysisMaykel JekNo ratings yet

- Gideon Hatsu Cv...Document4 pagesGideon Hatsu Cv...Gideon HatsuNo ratings yet

- Policies of Modi Government and Their Effect On EconomyDocument11 pagesPolicies of Modi Government and Their Effect On EconomyAditi BanerjeeNo ratings yet

- Module 3 - Philippine LiteratureDocument9 pagesModule 3 - Philippine LiteratureLyn PalmianoNo ratings yet

- Exp. 6 Laws of Lenses and Optical InstrumentsDocument6 pagesExp. 6 Laws of Lenses and Optical Instrumentsglasswing7No ratings yet

- Star CaseDocument1 pageStar CaseRazvan GhitaNo ratings yet

- Tennis Unit Plan: 11 and 12 Grade Matthew CummiskeyDocument15 pagesTennis Unit Plan: 11 and 12 Grade Matthew CummiskeyRafael Javier Bernabe MartinNo ratings yet

- City College of Science and Commerce Test No:9 Subject: Computer Science Class: ICS 1 Year Student Name: - Roll NoDocument4 pagesCity College of Science and Commerce Test No:9 Subject: Computer Science Class: ICS 1 Year Student Name: - Roll NoMalik KashifNo ratings yet

- An Exploratory Study of Gendered Di!erences in Young Tourists Perception of Danger Within LondonDocument6 pagesAn Exploratory Study of Gendered Di!erences in Young Tourists Perception of Danger Within LondonLilyNo ratings yet

- Social AuditDocument2 pagesSocial Auditमन्नू लाइसेंसीNo ratings yet

- Dairy ProductsDocument2 pagesDairy ProductsnigelNo ratings yet

- Chapter 4Document15 pagesChapter 4Nicole TamangNo ratings yet

- Wyndham Lewis-Count Your DeadDocument183 pagesWyndham Lewis-Count Your DeadVictoria GrantNo ratings yet

- FIFA World Cup 2010Document3 pagesFIFA World Cup 2010rizwan akhtarNo ratings yet

- Social Science MS - 2017Document56 pagesSocial Science MS - 2017dashrathrai17No ratings yet

- Thomas Hobbes: Thomas Hobbes: From Classical Natural Law To Modern Natural RightsDocument3 pagesThomas Hobbes: Thomas Hobbes: From Classical Natural Law To Modern Natural RightsGerard Anthony Teves RosalesNo ratings yet

- Linux MCQ Fot InterviewDocument2 pagesLinux MCQ Fot InterviewHromit ProdigyNo ratings yet

- Why The Eversion of The Endophallus of Honey Bee Drone Stops at The Partly Everted Stage and Significance of ThisDocument11 pagesWhy The Eversion of The Endophallus of Honey Bee Drone Stops at The Partly Everted Stage and Significance of Thisbalteanu_alinaNo ratings yet

- The Detail of Compiling, Linking, Assembling and Loading The C Program Image of Process (Binary - Executable) Into MemoryDocument7 pagesThe Detail of Compiling, Linking, Assembling and Loading The C Program Image of Process (Binary - Executable) Into MemorySathya Sathya100% (1)